- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Apple Is Organized for Innovation

- Joel M. Podolny

- Morten T. Hansen

When Steve Jobs returned to Apple, in 1997, it had a conventional structure for a company of its size and scope. It was divided into business units, each with its own P&L responsibilities. Believing that conventional management had stifled innovation, Jobs laid off the general managers of all the business units (in a single day), put the entire company under one P&L, and combined the disparate functional departments of the business units into one functional organization. Although such a structure is common for small entrepreneurial firms, Apple—remarkably—retains it today, even though the company is nearly 40 times as large in terms of revenue and far more complex than it was in 1997. In this article the authors discuss the innovation benefits and leadership challenges of Apple’s distinctive and ever-evolving organizational model in the belief that it may be useful for other companies competing in rapidly changing environments.

It’s about experts leading experts.

Idea in Brief

The challenge.

Major companies competing in many industries struggle to stay abreast of rapidly changing technologies.

One Major Cause

They are typically organized into business units, each with its own set of functions. Thus the key decision makers—the unit leaders—lack a deep understanding of all the domains that answer to them.

The Apple Model

The company is organized around functions, and expertise aligns with decision rights. Leaders are cross-functionally collaborative and deeply knowledgeable about details.

Apple is well-known for its innovations in hardware, software, and services. Thanks to them, it grew from some 8,000 employees and $7 billion in revenue in 1997, the year Steve Jobs returned, to 137,000 employees and $260 billion in revenue in 2019. Much less well-known are the organizational design and the associated leadership model that have played a crucial role in the company’s innovation success.

- Joel M. Podolny is the dean and vice president of Apple University in Cupertino, California. The former dean of the Yale School of Management, Podolny was a professor at Harvard Business School and the Stanford Graduate School of Business.

- MH Morten T. Hansen is a professor at the University of California, Berkeley, and a faculty member at Apple University, Apple. He is the author of Great at Work and Collaboration and coauthor of Great by Choice . He was named one of the top management thinkers in the world by the Thinkers50 in 2019. MortentHansen

Partner Center

Apple Business Strategy: Plans that made it a Multi-Trillion dollar Company

The study was first published on September 27, 2021, and then updated on September 18, 2023.

This strategy teardown compiles the ideas, innovations, technological research, partnerships, and, most importantly, the strategies responsible for Apple’s growth to such heights.

However, before we move forward, here is a small intro about Apple.

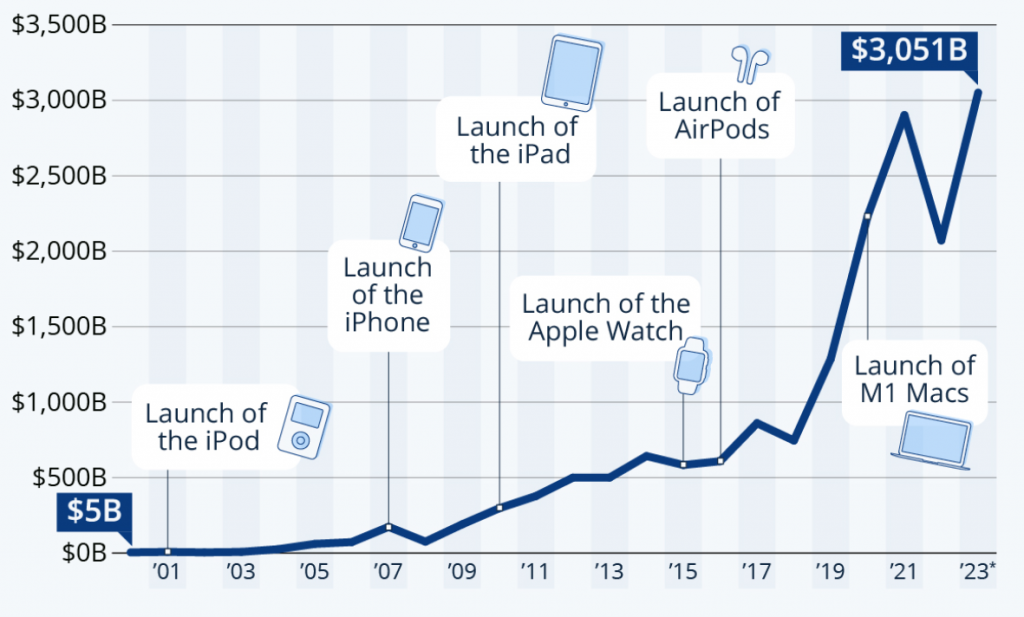

On Friday, June 30, 2023, Apple became the first company in history to reach a $3 trillion market valuation. It stays ahead by half a trillion dollars from the second most-valued company on the planet- Microsoft. Apple is now the most profitable technology corporation in the world.

Steve Jobs, Steve Wozniak, and Ronald Wayne founded Apple on the 1st of April 1976, bringing creativity to the table through their rendition of a personal computer. Apple is one of the world’s most popular and recognized labels. The company has experienced unparalleled revenue growth, from just $8 billion in 2004 to over $274B last year . This is more when compared to other technology giants out there today, such as Google ($181B) and Microsoft ($143B).

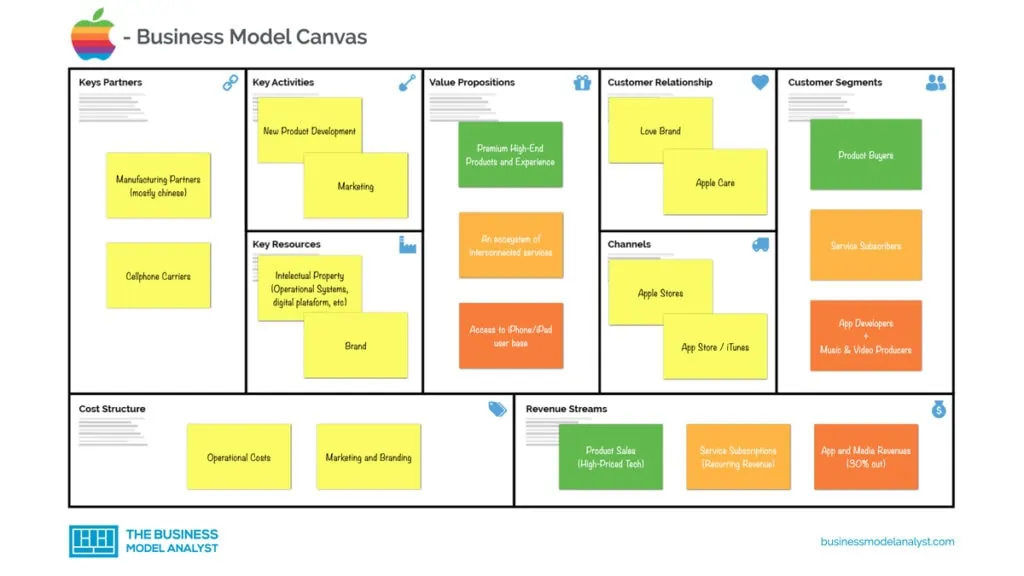

Apple’s growth could primarily be attributed to its business strategy. By combining its designing capabilities, hardware expertise, software prowess, and strategic acquisitions , the company has built an ecosystem that a user doesn’t want to leave.

Vertical integration is another main reason that distinguishes Apple from the competition. It has reaped enormous benefits from the vertical model. It has always built, controlled, and manufactured all of its hardware and software. This inherent benefit assists the corporation in achieving a higher degree of synergy between its hardware and applications. Even the apps are tightly controlled to follow Apple policies. The company also increased its spending on the cost of sales and product R&D to $26,251 billion, which was less than 18% of its total expenditure.

“We have fierce competition at the developer side and the customer side. It’s so competitive, I would describe it as a street fight for market share in the smartphone business.” – Tim Cook, CEO of Apple Inc.

Apple’s business strategy consists of the following four elements:

- Focus on product design and functionality

- Strengthening Apple’s ecosystem

- Improving consumer service experience

- Reducing the business’s reliance on iPhone sales

As for the product and service categories, Apple Inc. includes iPhone, Mac, iPad, Wearables, Home and Accessories, and Services like iMessage, FaceTime, Apple Maps, etc.

This study explores Apple’s business strategy that will help you acquire some basic principles that could be applied to any kind of business, even yours. So, if you’d like the entire analysis in PDF form that you can download and save for later reading (or sharing with your friends), just fill out the form below, and we’ll deliver it right to your inbox.

Now, let’s dive deep into the reasons behind Apple’s success.

Table of Contents

History of Apple

These products and strategies helped apple win before the launch of the iphone..

While the iMac sparked Apple’s rebirth in 1998, the introduction of the iPod in Oct 2001 sent the company to the top of the world’s most valuable companies list.

“With the iPod, Apple has invented a whole new category of digital music player that lets you put your entire music collection in your pocket and listen to it wherever you go,” said Steve Jobs, Apple’s CEO. “With iPod, listening to music will never be the same again.” We all know digital music players used to exist before the iPod, but as we know, Apple’s marketing is phenomenal at positioning its products.

The iPod was introduced as a part of Apple’s digital hub strategy . The iPod had unparalleled marketing and promotional exposure. Apple introduced a new kind of digital music player with the iPod, allowing users to carry their complete music library in their pocket and listen to it on the move.

The device’s original edition was released with 5GB and 10GB capacities , beginning at just under £300. The iPod was a spectacular success, increasing Apple’s overall revenue from $1.9 billion in Q1 of 2000 to $3.2 billion in the same quarter of 2001.

After dropping the price of the 5GB iPod to $299 in July 2002 and expanding compatibility to Windows, the iPod became the best-selling digital music player in history until smartphones came along.

By 2004, it had established a strong market leadership position in the worldwide digital music player sector. Apple spent a lot of money advertising the iPod . The advertising, which featured shadows dancing to the rhythms of their iPods, could be found in print, on television, and on billboards. In a relatively short period, Apple established an iconic image for the iPod that drew both young and old people. The iPod period, which began in 2001, ended in 2014.

With the introduction of iTunes in 2001, Apple opened up a vast new market sector in digital music, which it has now controlled for more than a decade. Customers worldwide flocked to iTunes because of the incredible value it provided, and music companies and artists benefited as well. Furthermore, Apple safeguarded recording companies by developing copyright protection that was not inconvenient for customers. While the company has dominated this blue ocean for more than a decade, as new online businesses entered the market, the issue for Apple has been to maintain its sights on the expanding mainstream market rather than competitive benchmarking or high-end niche marketing.

As iTunes’ success developed, so did its content offerings – one of the most important aspects of Apple’s digital domination was how it adapted what it learned from selling music to TV shows, movies, and, eventually, applications. The company created and employed a distribution strategy as well as a usage model to continue adding media to the three prongs of its ecosystem.

Steve Jobs introduced the initial 15-inch MacBook Pro , Apple’s thinnest, quickest, and lightest notebook to date, in 2006. The MacBook was a tremendous hit with buyers, and it was one of the reasons that Mac sales were rising three times faster than PC sales.

The Apple TV , which debuted in March 2007, was praised for its attractive interface, painless setup, and overall ease of use – all of which marked a significant shift from prior network-based home entertainment systems. Almost a year later, the hardware remained the same, but a free software upgrade essentially gave the device a makeover. Apple subsequently reduced the price of the 40GB model to $229, while the 160GB model was reduced to $329.

Apple’s award-winning computers, OS X operating system, and iLife, and professional apps continued to set the industry standard for innovation. It was also at the forefront of the digital media revolution with its iPod portable music and video players and iTunes online store, as well as its innovative iPhone entry into the mobile phone industry.

In 2007, Apple entered the mobile market with the iPhone , which was widely praised for its unique design, touch-screen capabilities, and lack of a conventional keyboard.

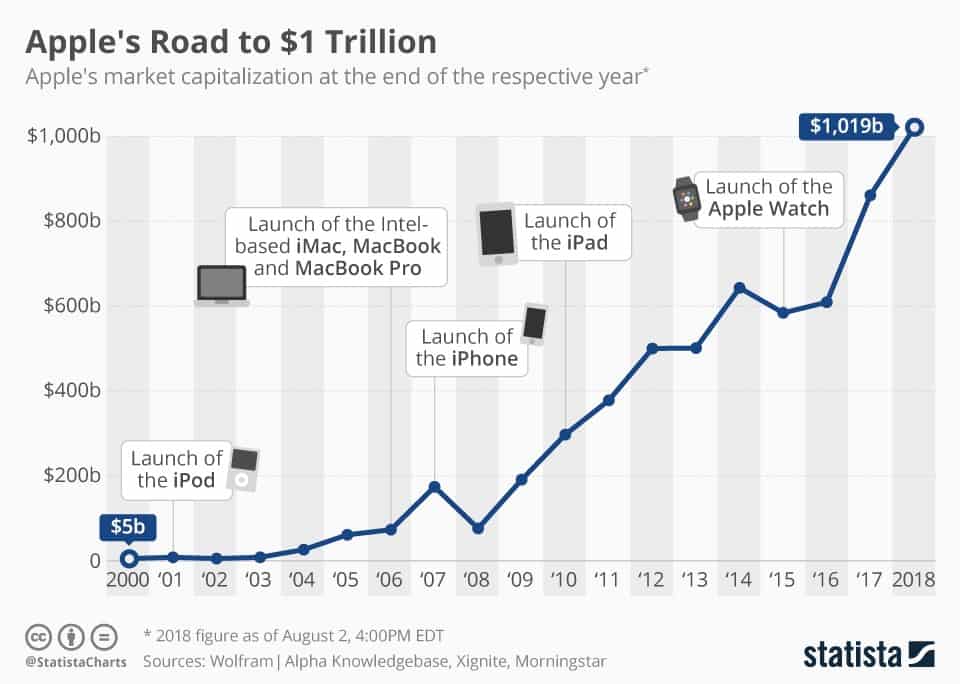

Apple Market Cap as of June 2023 – source

Apple’s Product Strategies After the Launch of the iPhone

After the launch of the first-generation iPhone, the company’s product strategy was very clear, i.e., ‘ Design a high-end smartphone in which the user experience is more important than making a slew of features available.’

The iPhone was not the first smartphone to have a mobile Web, email, and touch-screen user interface, but it was intended to have a better experience than most smartphones. Another strategy was to have superior technology, which included the mobile operating system and the thousands of mobile applications available via the App Store.

Before the launch of the iPhone, the annual revenue of Apple — in the year 2006 — was $19.3 billion, which increased to $24.4 billion in 2007 and $37.4 billion in 2008. And since 2008, iPhones have been Apple’s main source of revenue.

The launch became one of the most anticipated technological product launches in Apple’s history, owing to the company’s masterful media build-up. After the launch of the iPhone on January 9, 2007, the share price of Apple’s stock boosted and doubled to a value of $179.40 on January 9, 2008. The iPhone was described as a mix between its iconic iPod music player and a mobile phone programmed to browse the Internet.

Apple Inc. used the strong reputation of the Apple brand and the success of the iPod to penetrate the competitive cell phone market, a move that may have posed a possible challenge to the company as other firms launched smartphones with strong music storage and playback capabilities.

During the iPhone’s two-year growth phase, Jobs launched a campaign to secure a wireless company as the iPhone’s exclusive carrier. Customers who purchased an iPhone were forced to sign a two-year wireless deal with AT&T Inc. to make calls or access the phone’s other capabilities. Apple had even struck agreements with Viacom, Disney, Google, and Yahoo, all of which were carefully chosen to add internet applications to the iPhone.

Apple chose a promotion and delivery policy in European countries that were similar to its strategy in the United States. In France, it offered France Telecom’s smartphone affiliate, Orange, to be the sole carrier. Even in the United Kingdom, Telefonica’s telecom division, O2, was chosen as the sole cellular provider for iPhone customers with a two-year contract.

Apple developed a clear overall marketing strategy for the iPhone and successfully managed every aspect of the iPhone’s launch. Despite some shortcomings and pitfalls, the company was able to create a one-of-a-kind package for tech-savvy buyers interested in a hybrid mobile phone-music player and make those customers aware of the device through well-managed marketing campaigns and positive advertising. Both of these efforts significantly increased Apple’s stock price and solidified its status as a pioneer in consumer electronic gadgetry.

After the launch of the iPhone, the company adopted the strategy of patenting everything it does. The vigorous patenting helped shield Apple from competitors working on related technologies. It also provided Apple with a legal arm for the future.

One of Apple’s attorneys explained, “We basically tried to patent everything … And we tried to patent it as many different ways as we could, even the stuff we weren’t 100% sure would go in a product.”

Apple, too, has been chasing and implementing its design patents, endangering the whole technology industry. It has adopted a policy of patenting any tiny recognizable bit of its merchandise, including design patents, which protect a product’s ornamental appearance rather than its usable components.

Presently, out of the total revenue of Apple Inc., the maximum revenue is generated from the sales of the iPhone. The iPhone sales continue to be the most significant contributor to their total revenue, routinely averaging over 50%! We’ll discuss their annual revenue breakdown further down in this article.

Now that we have covered the strategic aspects, let’s examine the company’s financial information, growth and revenue numbers for the last few years, and projected growth going forward.

What does Apple’s Financial Growth look like?

Growth projection and market-related factors.

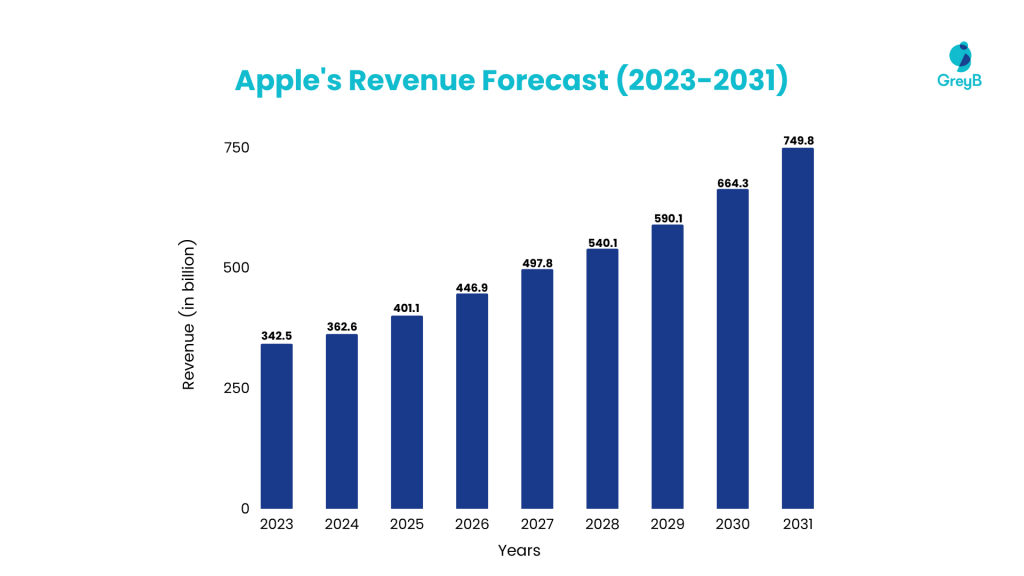

Under a realistic growth profile, Apple’s revenue is expected to grow by 9.66% over 10 years. Capital expenditures are estimated to be valued at $11 billion from 2024 to 2026 and $9 billion from 2027 to 2031. Also, over the 10-year forecast period, Apple’s earnings per share (EPS) are expected to increase by 10.68% .

Apple’s growth would continue over the next 10 years, and while substantial risks do exist, early warnings and evaluations may efficiently monitor them.

The following are some of the market-related factors that influence Apple’s growth projections:

- Due to increased demand, the Mac and iPad will flourish in the coming decade.

- High customer satisfaction scores with Apple’s products, 82/100 (2020 survey by MBLM).

- The App Store gives several benefits to users, such as privacy, curated quality applications, protection from malware and malicious scams, etc.

- Home and Accessories, Wearables, and Services provide opportunities for several decades.

- The future launch of new products, namely the Apple Car, AR/VR headset, and AR smart glasses.

- Increased anticipation for future iPhone models.

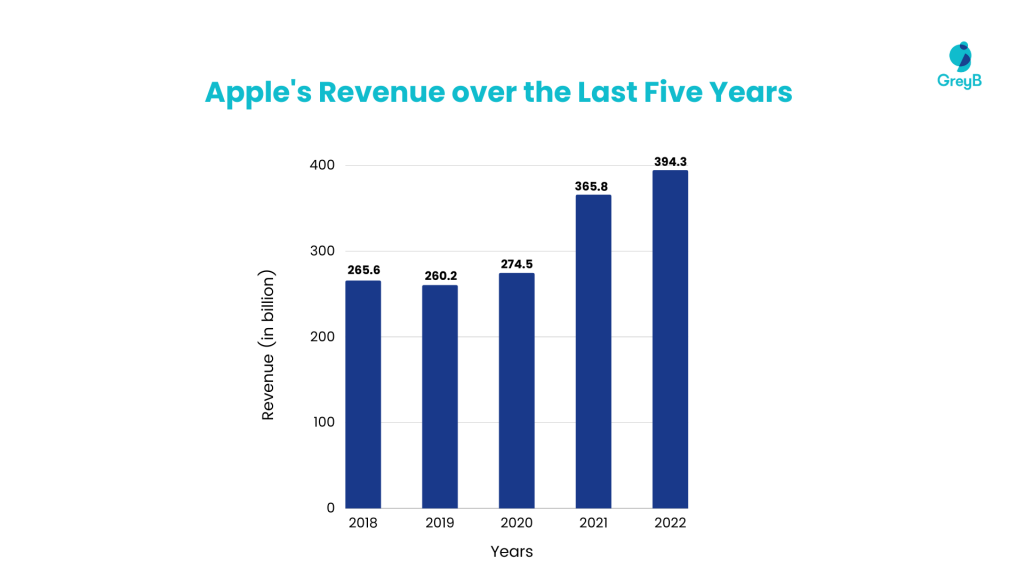

Revenue of the Last 5 Years (in $ Billion)

Apple’s annual revenue in fiscal year 2022 was $394.32 Billion, an 8% growth over the previous year. It’s less impressive than the 33% jump from 2020 to 2021, but it’s a positive trend nonetheless. Here’s the breakdown of Apple’s revenue in the last five years across its most notable business lines.

Apple’s iPhone sales revenue grew by 7% from 2021 and approximately 40% compared to 2020. Mac and services, like Apple Music and Apple TV, saw higher growth in 2021-2022, up nearly 14% year-over-year.

Between September 2021 and 2022, iPhone sales accounted for 52% of the company’s total revenue! The 3-year revenue breakdown below provides more details .

Revenue Breakdown (Section-Wise) of the Last 3 Years

The last three annual reports of Apple suggest that the iPhone category had the highest revenue amongst all the categories of Apple. The breakdown of revenue for the last 3 years is listed below:

| 205,489 | 7% | 191,973 | 39% | 137,781 | |

| 40,177 | 14% | 35,190 | 23% | 28,622 | |

| 29,292 | (8)% | 31,862 | 34% | 23,724 | |

| 41,241 | 7% | 38,367 | 25% | 30,620 | |

| 78,129 | 14% | 68,425 | 27% | 53,768 | |

- Apple currently has 2 billion active devices globally.

- Apple’s net expenditures in 2022 were $295.5 billion, leaving them a hefty $99.8 billion profit.

- The company’s new iPhone models released during the fourth quarter of 2021 were a massive success.

- Mac sales netted approximately $5 billion more than fiscal year 2021. Their new Mac Studio with the Apple M1 Max chip may have attracted people looking for powerful desk workstation upgrades.

- iPad Pro sales decreased from 2021 to 2022, leading to a relatively small reduction in revenue. This is likely because no other iPad lineup was noticeably refreshed during this period with notable features, except for integrating the M1 chip. In addition, Apple had said during this period that it had faced supply issues with the iPad, which may have impacted sales.

The corporation has been vigorously investing in research and development to ensure an increased revenue stream. Let’s now look at Apple’s R&D strategy and the tech areas in which the company is increasingly investing.

What does Apple’s R&D investment strategy look like?

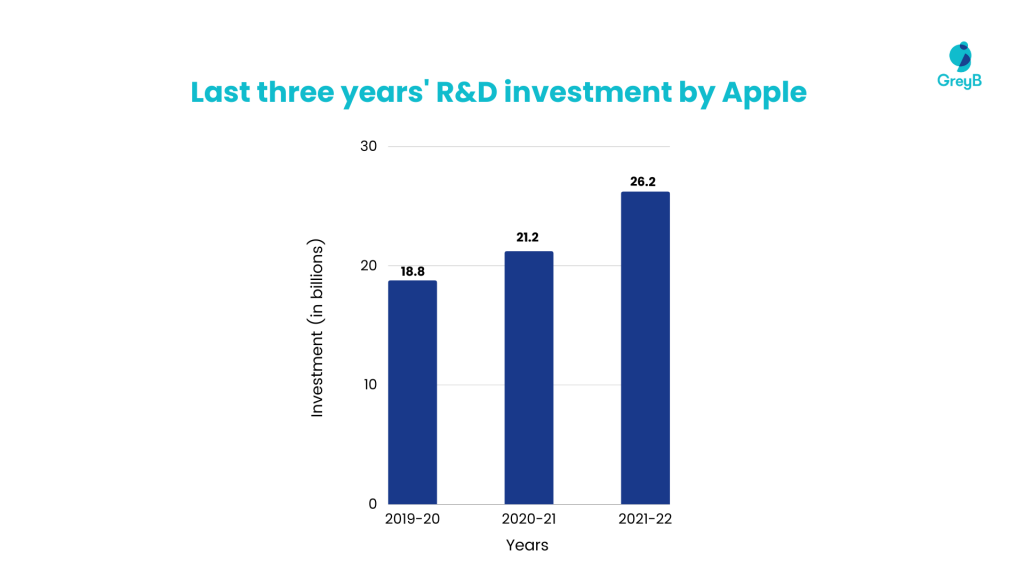

The tech giant has vigorously invested in research and development to ensure an increased revenue stream. We observed that Apple continuously increases its R&D budget each year, with 2022 closing in at $26.2 billion, increasing by about $4 billion from 2021.

How much has Apple invested in R&D in the Past 3 Years (in $ Billion)?

- In 2020, several patents revealed that Apple focuses on wearables, fitness, and health innovations. Various wearable patents indicated that the company could target AirPods with biometric sensors, Apple Watch with UV tracking, motion recognition for AR/VR applications, machine learning experiments to allow autonomous driving, and incorporation of various existing devices with a vehicle.

- In 2021, they launched several noteworthy products. Perhaps the most disruptive of them was AirTag. These item trackers have quickly become so popular that Apple sold 20 million units within eight months of launch! Now, analysts claim Apple is projected to sell 55 million AirTags by the end of this year.

- In 2022, they introduced the Apple Watch Ultra to their product line. It’s their flagship wearable device with several top-tier features like a titanium build, two times brighter display, and a dual-frequency GPS system, among other things. Driven by this model, the Apple Watch accounted for 34.1% of total smartwatch shipments in 2022 and 60% of the revenue for the global market.

Which Tech Areas is Apple focusing its R&D on?

Apple Inc. had invested in further expanding its research and development centers globally. The company had invested over half a billion dollars in research development centers in China alone. The company also concentrated on R&D centers in the United Kingdom, owing to their increasing emphasis on creating unique innovations to underpin its product designs, including A-series processors, W-series wireless chips, unique manufacturing, materials experience, speech recognition, machine intelligence, and many more.

These are the key areas where the company focuses its innovation efforts the most.

Apple invests heavily in developing new hardware for its products. Their most recent and notable advancement has been with their M-series processors for computers to supplement their excellent A-series mobile chips. These have smashed benchmarks worldwide, delivering chart-topping performance and power efficiencies never seen before. They make some of the best pro-grade displays , too.

Apple’s software development efforts include creating new operating systems for their products, new applications, and services. All their software products are designed and optimized for their ecosystem, allowing seamless inter-device connectivity. This interconnected approach to innovation can be seen throughout their designs, like on this expansive 358-page patent they filed for the first iPhone’s multi-touch capability .

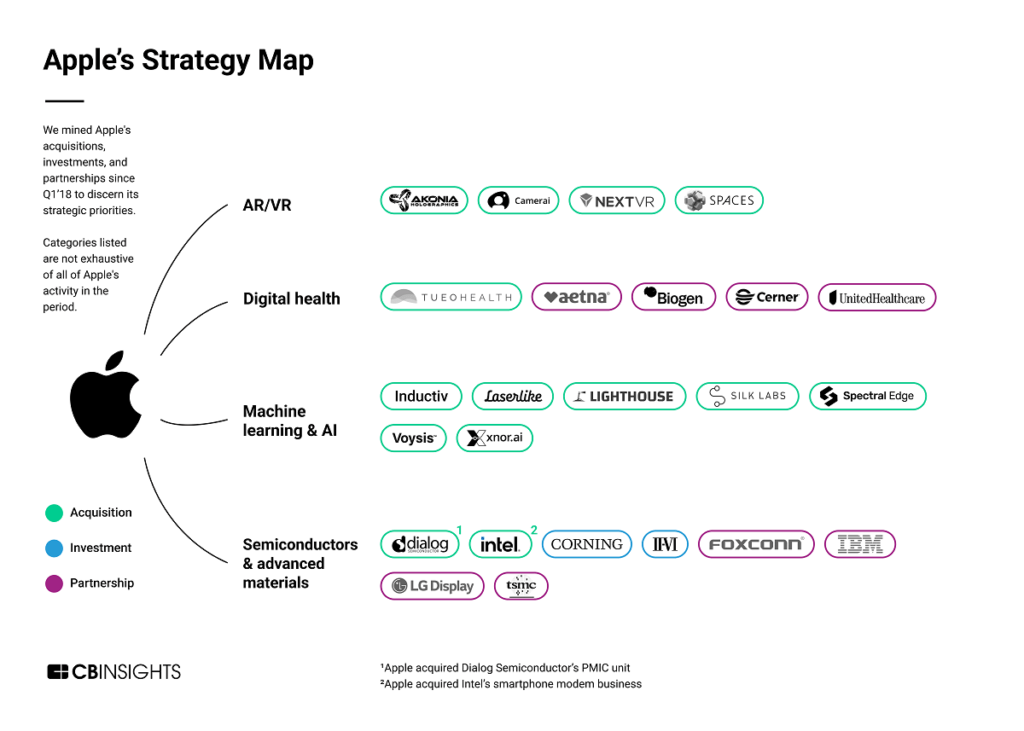

Artificial Intelligence

Apple also invests in artificial intelligence and machine learning to improve its products and services. They’ve made numerous acquisitions to enhance their in-house AI capabilities, which we will discuss further in this article. Their advanced machine learning algorithms enable many features, ranging from FaceID’s fundamental security to fun AR Animojis on Facetime calls.

Healthcare Technology

Apple has been expanding its focus on healthcare , developing health-related features for its devices, such as the Apple Watch. Alongside regular customers, Apple wishes to be the go-to choice among doctors and healthcare professionals as well. They’ve partnered with healthcare providers like Geisinger and Ochsner to provide a seamless way for doctors and patients to connect. Their CEO, Tim Cook, has often made it clear that healthcare is one of Apple’s top priorities as a business sector.

Augmented/Virtual Reality

Spatial computing is one of Apple’s lesser-known yet rapidly developing departments. Our research suggests that Apple has been working on an AR and VR-capable wearable device for nearly 16 years!

“The products that are in R&D, there is quite a bit of investment in there for products and services that are not currently shipping or derivations of what is currently shipping…You can look at the growth rate and conclude that there’s a lot of stuff that we’re doing beyond the current products.” – Tim Cook, CEO of Apple Inc.

Which Core Innovation Areas Is Apple Majorly Focusing on?

For the tenth year in a row, Forbes magazine ranked the company as the most valuable brand in the world in 2020. Apple took second place in 2023, around $2 billion shy of Amazon in brand value. Nonetheless, Apple has risen to become the world’s largest company by market capitalization, not by attempting to become the largest smartphone provider but by becoming the most beloved. Apple, more than any other tech company, has always prioritized the end-user experience over anything else, not just the speed, storage capacity, or other technical specifications of its products.

Apple’s innovations are often incremental, with the company adapting its design expertise to the most recent consumer tech trends. Apple did not invent the MP3 player or the smartphone, but it went on to dominate both devices by emphasizing design, user experience, and brand cachet. The company has aggressively increased the domains where the Apple experience is part of daily life during the last ten years.

Apple guarantees that the universe of Apple-mediated behaviors continues to grow by encouraging app developers while strictly enforcing rules. By reinventing product form factor and function, from computing in a user’s pocket to managing home electronics to reminding the calorie count or parking spot — all of these experiences are connected, integrated, and packaged in a single accessible ecosystem of complimentary items.

Moreover, Apple has focused on innovation outside the core by developing the infrastructure required to support this ecosystem safely and frictionlessly (Apple Pay secure payments or biometric facial recognition since the iPhone X).

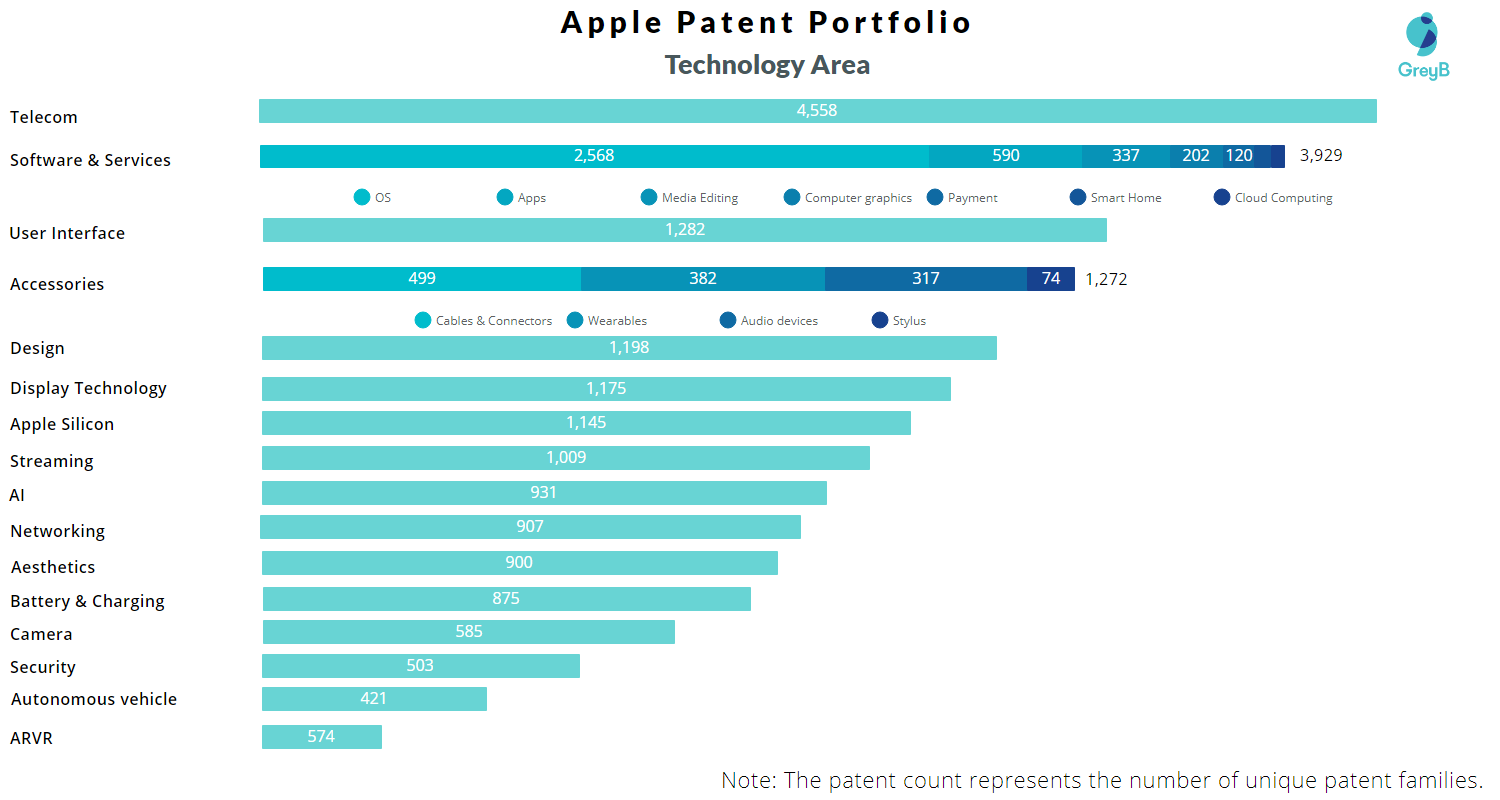

We have mentioned before that Apple vigorously patented everything it did. After looking at the wide array of domains on which Apple works, it becomes important to examine the kind of patent portfolio Apple has accumulated over the years.

What does Apple Patent Portfolio look like?

A company’s patent portfolio provides us with another set of lenses to find the core areas it has been focusing on for quite some time and what it plans to launch next. Let’s take a deep dive.

Source: Insights;Gate by GreyB

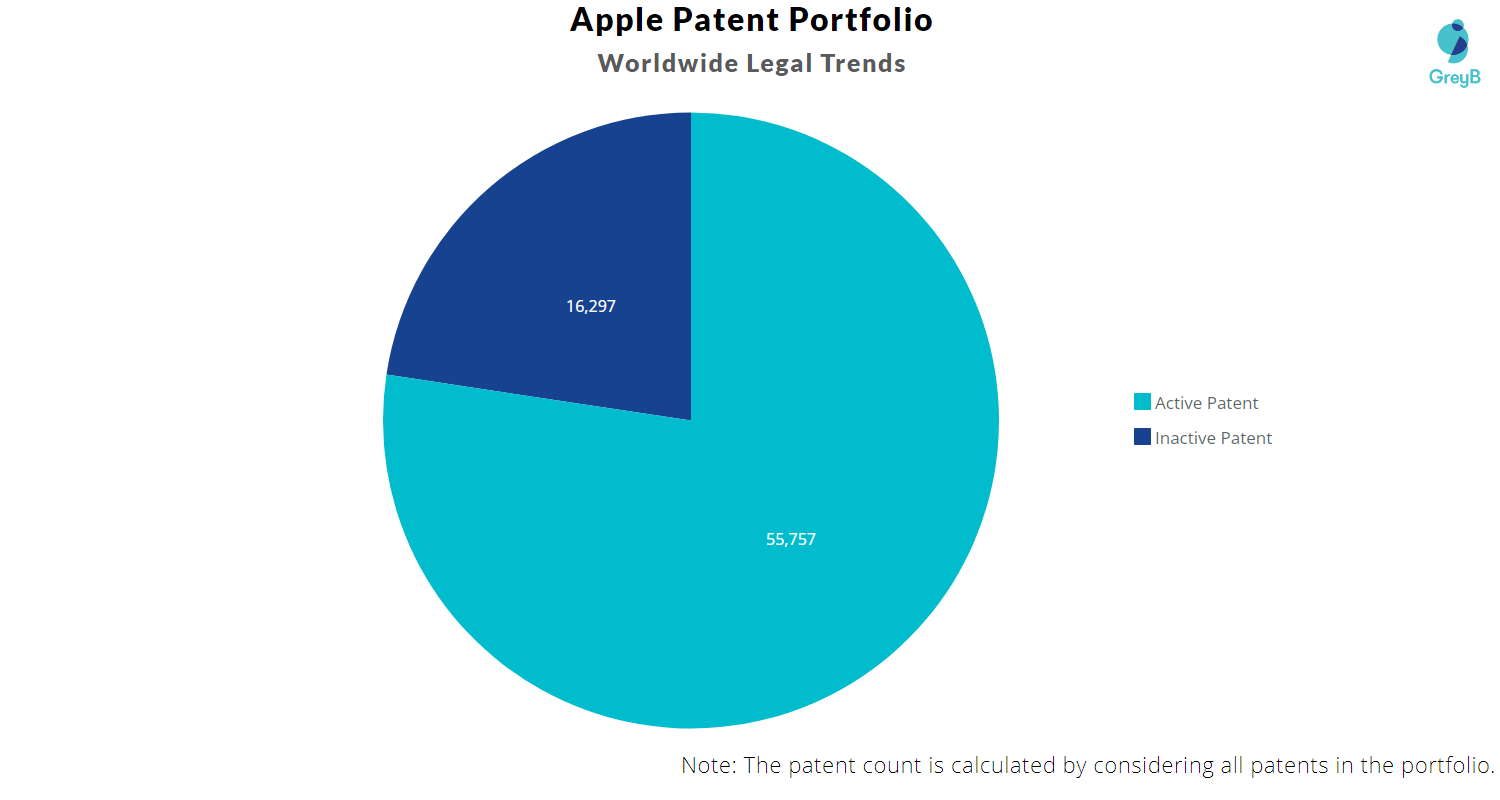

With 72000+ patents (24000+ patent families) in its entire portfolio, Apple is one of the top patent filing companies in the world. It has more than 55000 patents that are still active.

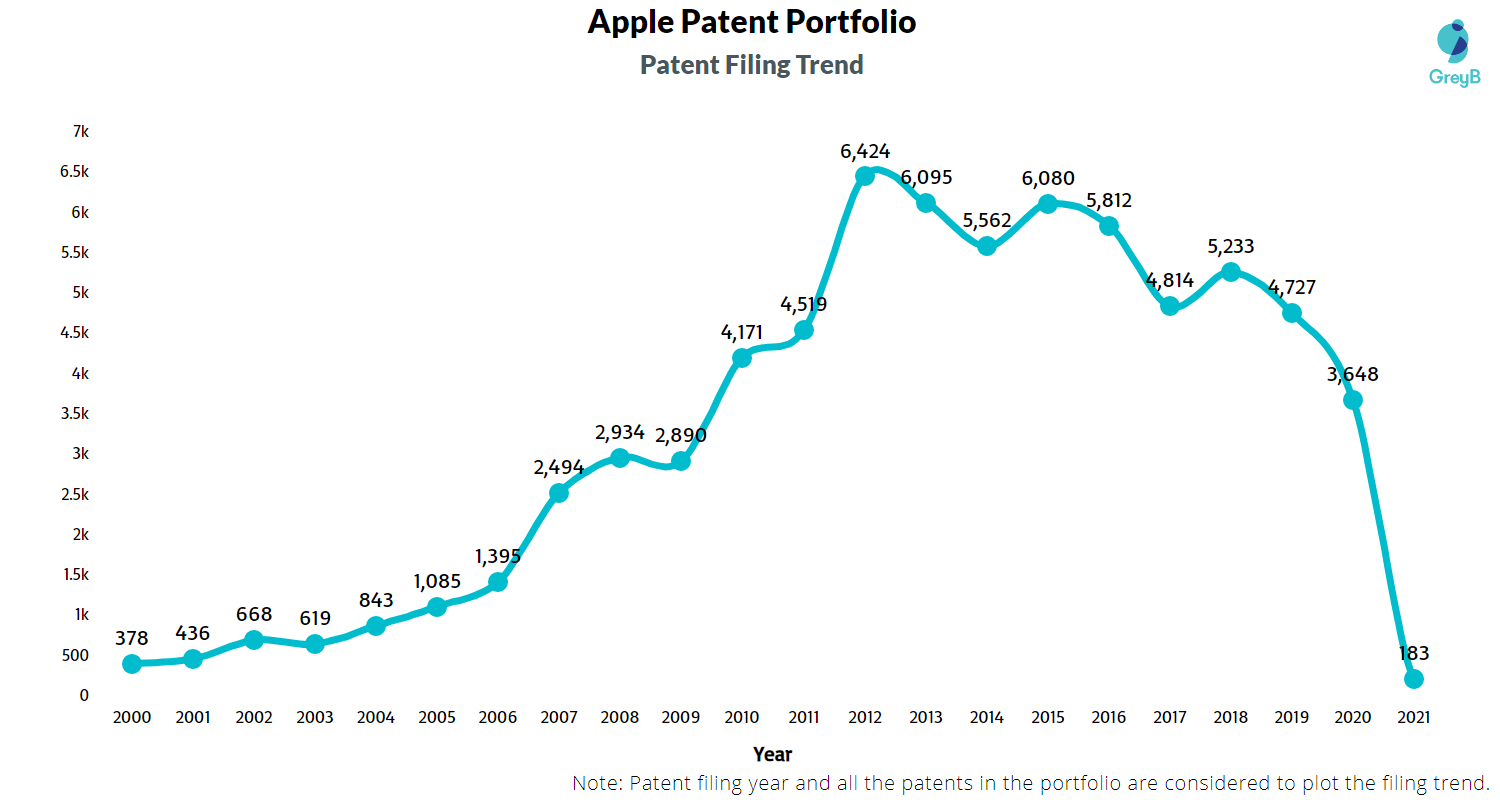

Looking at the filing trend, you can see the year 2007 saw a sharp increase. It was the same year they launched the iPhone. One can conclude that the iPhone is one of the reasons Apple invested heavily in securing its technologies.

The Apple vs Samsung lawsuit is still one of the largest patent infringement lawsuits that happened in the tech industry. And that further pushed the consumer electronic gadgetry pioneer to invest more in patents. (See the growth in 2012)

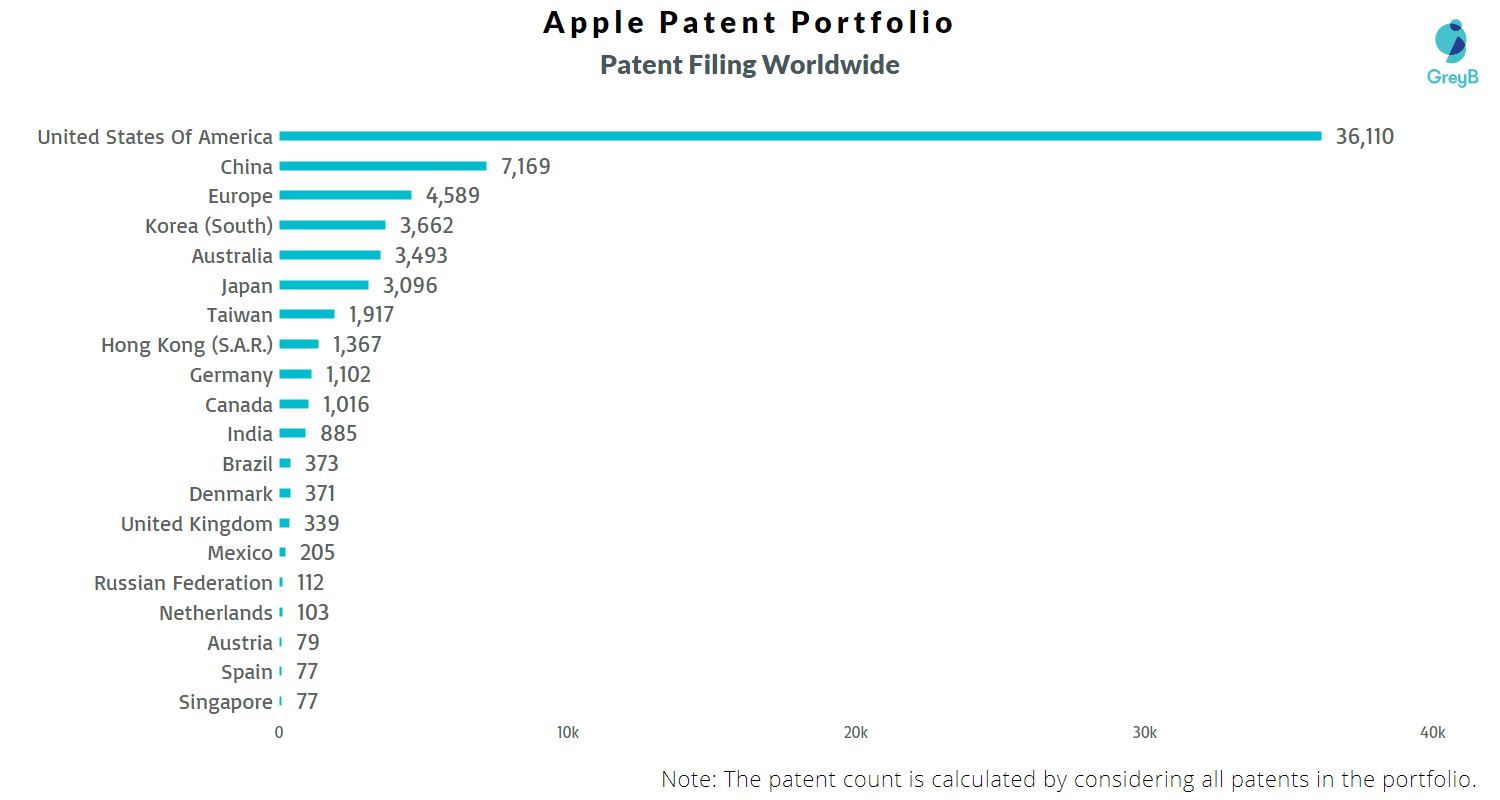

One of the reasons for this growth is Apple’s consideration to secure its tech in more countries. As Apple is gaining more and more global markets, it is securing its patents in more and more jurisdictions.

The US is the home market for Apple, so, naturally, the company has the most patents in the US. China is a crucial market for smartphone makers now more than ever. China has become more patent aware thus most of the big companies are trying to secure more and more technologies/patents in the country. Apple being one of the biggest technology companies, it makes sense that it has secured thousands of patents in China.

The huge portfolio of Apple is categorized into 16 different technologies that the company uses for its products/services or future products.

Being a smartphone manufacturer makes Apple research heavily in the Telecom sector, which is also crucial for companies, especially when 5G is on the doorstep.

Another interesting figure is of Apple’s design patents. The company focuses greatly on the design part, and the patent count is proof of how valuable product designs are for Apple.

Apple hasn’t made any public announcements yet on their Autonomous Vehicle front, but the AR/VR space is where we had a long-awaited announcement in June 2023 – their Vision Pro headset. We’ll discuss this in more detail in the upcoming sections.

Moving forward, let’s go through Apple’s expertise in various sections.

What are the products and services responsible for Apple’s growth?

Design and functionality.

Apple’s competitive advantages include software control, hardware control, retail strategy, product differentiation, and, most importantly, Steve Jobs’ strategic decision-making. Since its foundation, the company has introduced simple-to-use computers to the market so that people would not face any issues while using Apple goods. Apple used both horizontal and vertical integration. It depended on its designs and refused to let third-party access to its hardware. Apple employed superior software, which aided it in increasing its market share. The company also provided a comprehensive desktop solution with hardware, software, and other components. Apple has always used typical designs for its products.

Apple has over 4,000 design patents in its portfolio, which is a big number.

Consumer Electronics

Apple Inc., a computing and consumer electronics giant, is one of the world’s most recognizable and famous brands, with hundreds of its retail shops. A globally leading consumer electronics developer with key products including the iPhone, which runs Apple’s IOS operating system, personal computers (Macs), and tablet computers (iPads), all of which utilize Apple’s exclusive operating systems. Other notable products include the Apple Watch, AirPod, Homepod smart speakers, Apple TV streaming device, Beats headphones, and iPod Touch music player.

The company’s product strategy results in extremely high-quality products. It’s known as the “great product” strategy.

Apple refuses to join the bandwagon other gadget makers employ by maintaining high-quality standards. The “great product” strategy emphasizes quality over quantity as well.

While other manufacturers’ strategies include releasing items one after the other quickly and having such a diverse product mix, Apple opted to stick to what it does well.

Smartphones (iPhones)

Since 2008, the iPhone has been Apple’s most valuable product and its primary source of income. Although Apple has expanded its product range with the Watch, AirPods, and services, the iPhone still accounts for 50% of its income. The company’s extensive relations with China, particularly in the manufacturing sector, are one of the key bear arguments.

Most of Apple’s products are manufactured in China. While Apple has been expanding production into other countries, recent estimates suggest that 95% of the total iPhone supply still comes from China. Apple also has manufacturing facilities and assembly lines in other countries, such as the United States, Ireland, and Brazil.

Three of the company’s aforementioned contract partners, all of whom are situated in Taiwan, made relocation news in the summer of 2020:

- Foxconn began producing the iPhone 11 in India in July 2020 and had invested $1 billion in the nation.

- Pegatron established a subsidiary in India.

The demographic of iPhone users changes a little each year. Here are some of the latest statistics on iPhone users:

- 51% of iPhone users are female, while males make up the remaining 49%

- The 16 – 34 age group has the highest number of iPhone users

- 35% of iPhone owners also have an Apple Watch

- The average income of iPhone users in the US is 85,000 USD

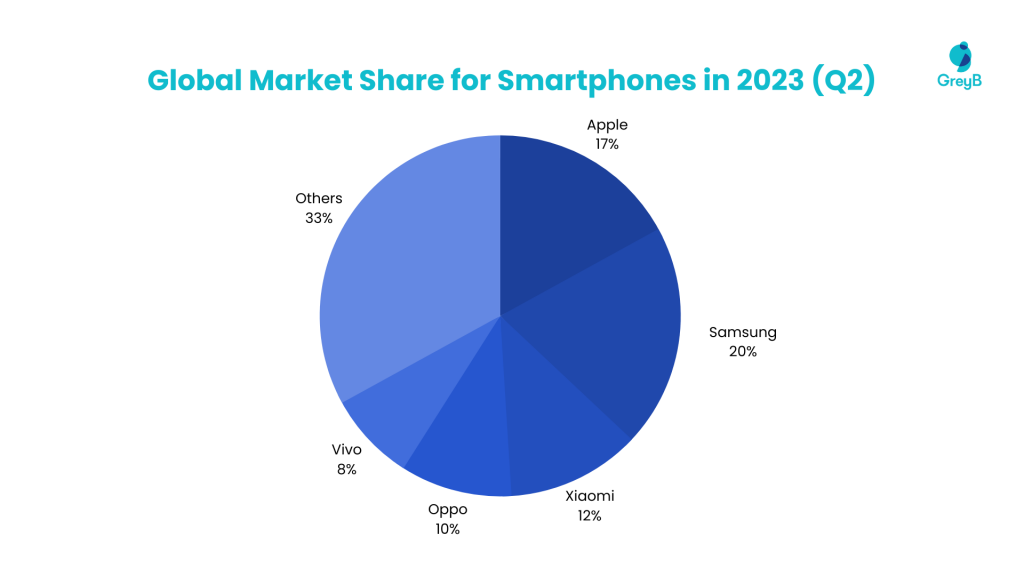

Its main competitors in the worldwide smartphone industry are Samsung and Huawei, with the business following the other two with a share of 13.5 % in the most recent quarter.

In the second quarter of 2023, Apple’s global market share for the iPhone was 17%, while Samsung’s, Xiaomi’s, and Oppo’s market shares were 20%, 12%, and 10%, respectively. The company sold 845.3 million smartphones in the second quarter of 2023, while Samsung sold 53.5 million handsets. Xiaomi and Oppo, respectively, sold 33.2 million and 28 million units.

Apple’s iPhone is the market leader due to excellent hardware and software integration and control over both sides of the equation. Any Android app will lag in terms of speed and performance when compared to an iPhone app.

In 2021, Apple spent an additional $45 million on Corning, which manufactures the glass used in the iPhone, Apple Watch, and iPad. In May 2021, the company announced a $410 million grant to II-VI, which develops the technology for the iPhone’s Face ID and Portrait mode.

With over 1 billion iPhones in use, Apple is the doorway to the most valuable clients in the mobile industry. In 2021, Apple has updated its iPhone software and allows consumers to choose whether they want to be followed for targeted adverts.

Even though both iOS and Android have millions of apps in their app stores, developers still prefer the iPhone as the launch platform of choice for the latest new apps. Mario Run, for example, was released for iOS in December 2016 and Android in March 2017. Instagram for Android was released two years later for the iPhone.

The iPhone 15 lineup in 2023 builds upon the foundations set by the 14 series with additional features like USB-C replacing the lightning port, the dynamic island-inspired design on the 15 and 15 Plus, and the newer A17 Pro chip on the “Pro” models. Apple says the A17 Pro is the industry’s first chip to feature a 3-nanometer fabrication process.

And thankfully, the rumors about the USB ports being locked behind the MFi authentication layer were false.

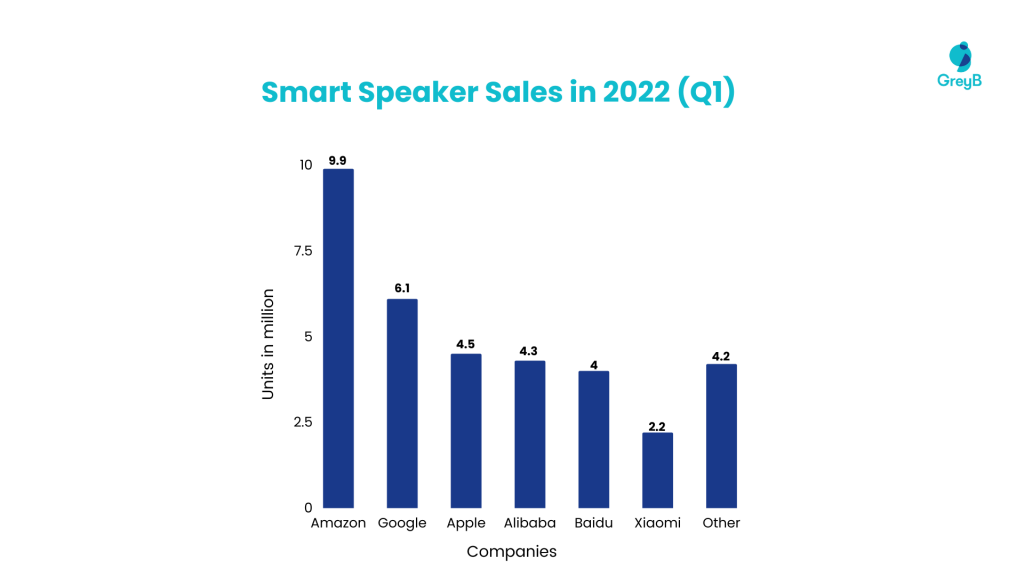

Smart Speakers (HomePod)

HomePod has experienced limited success in the Smart Speakers market. Apple trailed Amazon and Google in terms of unit sales . However , the release of the HomePod Mini has made significant advances, enabling Apple to double its share in the smart speaker market in 2021. According to survey results from Statista Consumer Insights, Amazon remains the clear market leader in the smart speaker segment in the United States. Apple took third place among the global smart speaker sellers as of Q1 2022.

Apple’s HomePod is the best-sounding wireless smart speaker today, and it can be operated by speech using the in-house virtual assistant, Siri. However, the HomePod is only worth considering if the owner possesses an iPhone and subscribes to Apple Music. In March 2021, Apple announced the discontinuation of the original Homepod after 4 years and indicated its focus on the mini Homepod it released last year.

Laptop & PC (MacBook and Mac)

Despite Apple’s shift in priority from PC to mobile, the Mac has remained a key component of the company’s product lineup. The company has maintained a core group of devices throughout the decade: the MacBook Air, MacBook Pro, Mac Pro, and iMac. Even after modifications and new models, its core has remained popular among many professional clients.

In 2022, Apple had a 9.8% market share, following market leaders Lenovo, which had a 24.1% market share, HP Inc., which had a 19.4% market share, and Dell, which had a 17.5% market share.

When a customer purchases a Mac, that purchase is a philosophy as much as it is a piece of computer technology. The hardware and software are produced by the same corporation, and the laptops share an aesthetic sensibility with Apple phones and tablets.

Macs are popular among music producers due to Apple’s high-end Logic Pro software and the user-friendly GarageBand program, both of which are free. Apple acquired Emagic, a music production software, on July 1, 2002, for $30 million as the foundation for these two apps.

In addition, other Apple-exclusive media software like Final Cut Pro and Pixelmator could convince photo and video editors to switch to Mac OS.

Apple Watch

Since its debut in 2015, Apple Watch has dominated the smartwatch industry, with a market share of 40% in Q4 2020 .

According to Counterpoint Research, Apple Watch shipments increased by 19% between 2019 and 2020, reaching 33.9 million units in 2020. In Q4 2020, Apple Watch Series 6 and SE delivered 12.9 million devices. Further, markets such as India saw strong demand for Apple Watch Series 3 and 6 in 2020, with a growth of 144.3% in overall Apple wearable devices shipments.

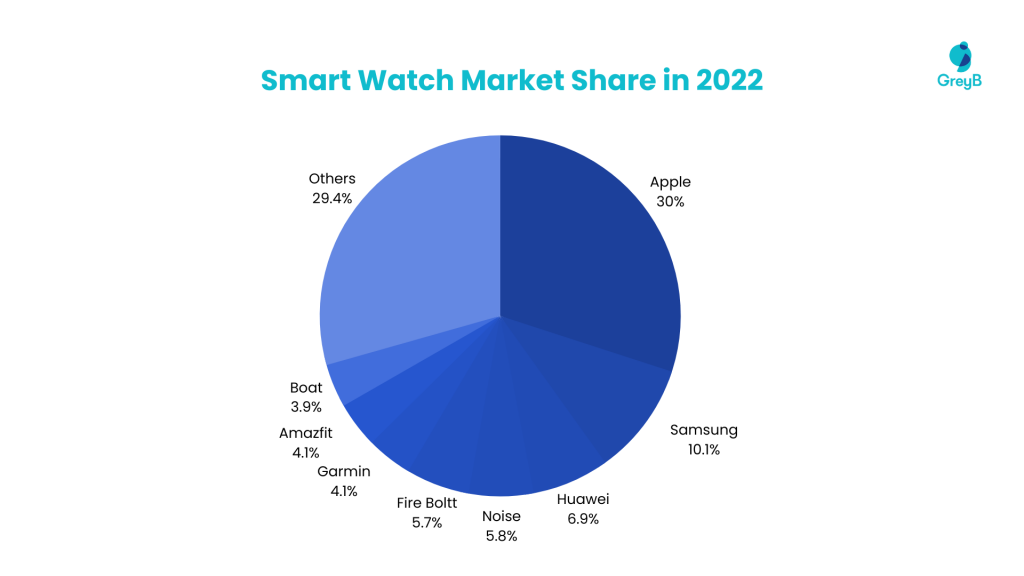

Apple dominated the market in 2022 with a 30% share, followed by Samsung at 10.1% and Huawei at 6.9%, among others.

The same trends are also reflected in Q1 of 2023 , where Apple is leading the market with a 26% share and Samsung at 9%.

The Apple Watch is the greatest smartwatch on any platform in terms of appearance, message handling, activity tracking, app choices, and battery life. The Apple Watch is water resistant to 50 meters, making it ideal for swimming and surfing. The Sleep app monitors the user’s sleeping habits and assists in creating a plan and bedtime routine to accomplish sleep goals. Apple is, in fact, making strides in the Healthcare sector with its Apple watch.

Read Now: Apple in Healthcare: Top MedTech Acquisitions and How Can You Gain an Edge over it?

AirPod and AirPod Max

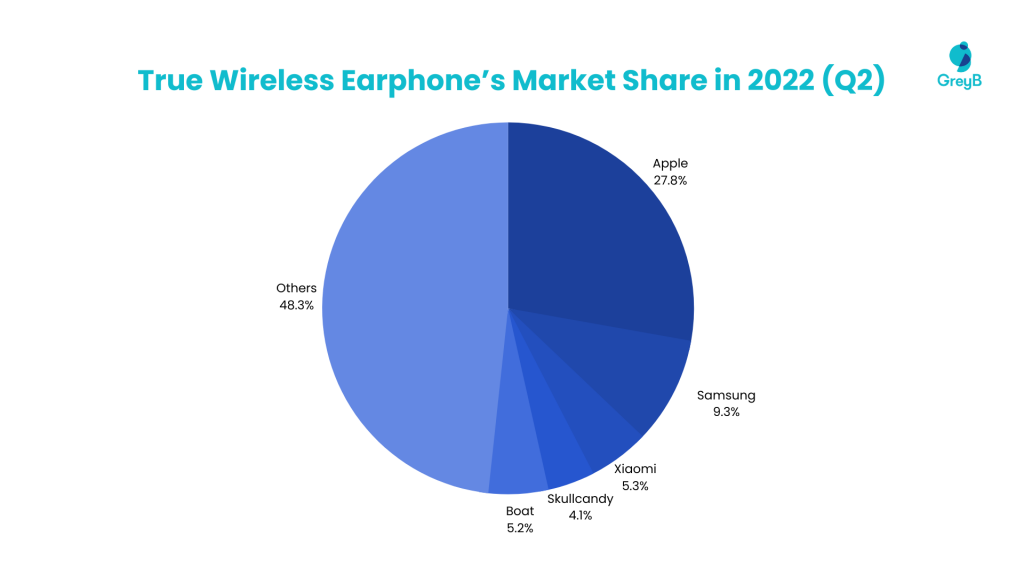

Apple’s AirPods have grown into a significant business for the company, with 114 million sold by 2020. A commodity that many saw as an expensive accessory has become common, with nearly every phone maker selling their own ‘hearable’ to compete with Apple. Apple was ahead of the pack in Q2 of 2022, holding 27.8% of the total market share. Samsung and Xiaomi followed up with 9.3% and 5.3% respectively.

Further, Apple released AirPod Max, Bluetooth over-ear headphones, in Dec 2020 with a price tag of $549. While Analysts estimated that AirPod Max won’t boost Apple sales because of a niche market, some expect that it could boost AirPod sales because of Apple’s Goldilocks strategy.

Cybart forecasts that Apple’s wearables segment will generate $30 billion in revenue by 2021, including the Watch, AirPods, and select Beats headphones.

The five reasons why Apple built a strong wearables business are mentioned below:

- Early adopter: One of Apple’s guiding principles is to make technology more personal, and it began investing in wearables, including its silicon processors, in the early 2010s.

- Other corporations gambled on voice: Because few Large Tech businesses had Apple’s hardware competence, they bet big on voice (example: Amazon’s Echo) as the future computing paradigm. It appeared to be a bad gamble.

- Design expertise: People must desire to wear wearables, which requires design skills. Apple has a track record (and aptitude) for designing devices that consumers want to show off as much for its aesthetic as it does for its computational capabilities.

- Advantage of the supply chain: Wearable technology is built on top of smartphone components. Apple has been able to capitalize on lessons learned and partnerships formed through the iPhone production process.

- Advantage of the ecosystem: Apple’s entry-level AirPods and Watch were around $200. Because the wearables effectively share computational power with the iPhone, it achieved these pricing thresholds.

According to Cybart, Apple’s wearables segment will likely reach $50 billion in the following year if present trends continue.

Apple Silicon (Chipsets, Processors)

Apple announced that it would switch from Intel chipsets to its own Apple Silicon processors based on ARM in 2020. In keeping with this, the business released a new M1 processor as well as three products powered by it — the MacBook Air, MacBook Pro, and Mac Mini. A survey from market analysis firm TrendForce suggested that M1-powered Mac machines represented around 0.8% of overall laptop sales in 2020, months after the products became available for purchase.

In terms of operating systems, Windows was the global leader in the laptop industry. However, due to the strong expansion of Chromebooks in 2020, Windows’ market share would fall below 80% for the first time in history. Windows is unlikely to regain lost market share immediately since its fall is predicted to continue. TrendForce predicts that the market shares of Windows, Chrome OS, and macOS will each settle at around 70-75%, 20-15%, and less than 10%, respectively.

In 2020, Apple is anticipated to launch the first MacBook to utilize its silicon processor rather than Intel’s, allowing all its key product lines to run on the same architecture.

When considering Apple’s most notable purchases, two stand out:

- In 1997, NeXT Software was purchased for $404 million. The acquisition of Steve Jobs’ post-Apple venture, which featured the forerunner to iOS, returned Jobs to the firm he created.

- Beats for $3 billion in 2014: Apple’s largest acquisition was Dr. Dre and Jimmy Iovine’s headphone firm, which laid the framework for Apple Music.

- However, a third (and extremely significant) transaction set Apple’s mobile product roadmap: the $278 million acquisition of P.A. Semi in 2008.

According to tech analyst Ben Thompson, P.A., Semi gained the expertise and intellectual property (IP) “that would underpin (Apple’s) A-series of processors, which have powered every iPad and iPhone since 2010.”

Apple introduced the Apple TV in March 2007. And much to everyone’s surprise, it was not an actual TV set but rather a box to offer services using the software. It was praised for its attractive interface, painless setup, and overall ease of use – all of which marked a significant shift from prior network-based home entertainment systems.

The hardware remained the same almost a year later, but a free software upgrade essentially gave the device a makeover. Apple subsequently reduced the price of the 40GB model to $229, while the 160GB model was reduced to $329.

People still wonder why Apple never made an actual TV like Samsung or Sony. There are multiple reasons why Apple didn’t enter the TV manufacturing business even with enough expertise.

First, this industry’s margin is very thin, and Apple always focuses on making profits. Second, unlike smartphones or other consumer electronics, there isn’t much design to make it unique. You can find many identical TV designs from different companies. Third, Apple can provide a good user experience through its software, so it went for a box to provide better UX in any TV.

Source: Apple

The box design remained the same throughout the years, but they made multiple changes to its remote.

The iPod was one of the most successful products ever created by Apple. It was a little device that let users listen to music on the go. However, it is now 2021, and despite having Apple Music on iPhones and even being accessible on Android and even smart TVs, Apple continues to offer the iPod Touch . One of the main reasons is that it is not an iPhone and is suitable for children.

Further, iPod Touch uses iOS with the same inbuilt software. It’s basically an iPhone without cellular network connectivity. The user can play games, surf the internet using Wi-Fi, and can send messages using a web browser.

It is Apple’s tactic to prime the iPod users to turn into iPhone users when they choose to buy a smartphone. By using the iPod for 2 or 3 years, most users would want to choose an iPhone over other smartphone brands.

As the iPod is a part of the Apple ecosystem, it helps users remain in it even when they want to upgrade a device.

AirTag, a compact and elegantly designed device that helps keep track of and find the stuff that matters most with Apple’s Find My app, was announced in April 2021 . AirTag, whether connected to a handbag, keys, backpack, or other objects, connects to the enormous, worldwide Find My network and can assist in recovering a misplaced item, keeping location data private and anonymous using end-to-end encryption.

“We’re excited to bring this incredible new capability to iPhone users with the introduction of AirTag, leveraging the vast Find My network, to help them keep track of and find the important items in their lives.” – Kaiann Drance, Vice President of Worldwide iPhone Product Marketing of Apple

Dongles link headphones to charging connections, computers to TVs or card readers, etc. Dongles are a major business nowadays since it’s difficult to conduct many routine computer chores without them. This is owing, in large part, to Apple, which, in 2016, eliminated the headphone jack from the iPhone range and shifted nearly completely to USB-C connectors on its Macs. The newest iPhone isn’t the only Apple gadget that requires an array of dongles to function properly.

A dongle is necessary to connect a MacBook Air to an Ethernet wire. A dongle is also required if the user wants to add a second screen to the computer or import images from an SD card. A USB to USB-C adaptor is required even if users put a flash drive directly into the MacBook.

This causes users to accept the dongle as an integral part of their lives, allowing Apple to establish a sizable market for dongles. Apple, Belkin, and other accessory firms have established a massive market for these dongles, which Facts and Factors estimates will be worth more than $25 billion by 2027.

It is unknown how much Apple’s revenue is from Dongles, but considering the user base’s preferences and Apple’s dongle prices, it could be more than a billion dollars.

Now, let’s move on to the core of all these products- Software.

For over four decades, Apple has been a Silicon Valley trendsetter. Apple’s competitors have widely imitated the Apple II, Macintosh, iPod, iPhone, and iPad. Apple’s success may be attributed in large part to the company’s obsessive attention to the user experience. The iPod first debuted in 2001, followed by the iPhone in 2007, and the iPad in 2010. Consequently, Apple earned about $40 billion in earnings in its fiscal year 2014. Apple is a design-focused corporation that prefers to create all aspects of a product — hardware, software, and internet services — in-house.

Apple II computers were sold until 1993, when they were phased out in favor of Macintosh computers. Around 5 million Apple II computers were sold in total. The first Macintosh had significant limits. However, later versions were more powerful. In 1987, Apple introduced color to the Macintosh with the Macintosh II. The groundbreaking graphical interface of the Mac immediately drew several imitators. Apple debuted the iPod music player in 2001. More crucially, the iPod was compatible with iTunes, Apple’s jukebox software for the Mac, making it simple for users to transfer music from CDs to their iPods. Apple, too, capitalized on the iPhone’s popularity in 2010 by releasing the iPad, a tablet computer built on the same software.

Operating Systems

Both Mac OS X and iOS originated from Darwin, an older Apple operating system based on BSD UNIX. iOS is a proprietary mobile operating system owned by Apple that can only be loaded on Apple devices.

Apple’s iOS is a closed ecosystem, which implies that Apple creates both the operating system and the hardware, and no other corporation utilizes either of them to integrate with their services. It gives Apple an advantage over Android regarding hardware and software synchronization. In the case of Android, however, the hardware is manufactured by companies like Qualcomm and MediaTek (rather than Google), and the manufacturers create their own flavor that runs on top of Android. In addition, Apple allows users to offer 3D touch inputs with mini menu selections. The iOS devices are set up to detect pressure sensitivity on the screen and allow various input choices based on it.

As of July 2023, Android occupies 70.9% of the mobile OS market, followed by Apple’s iOS at 28.36%.

The Mac OS was released in 1984 to power Apple’s Macintosh series of personal computers (PCs). The Macintosh heralded the age of graphical user interface (GUI) systems, inspiring Microsoft Corporation to create its own GUI, the Windows operating system.

The interface is the most noticeable variation between Windows and Mac operating systems. macOS is perceived to be more basic, streamlined, and elegant, but Windows is considered to be more sophisticated and feature-rich, with more customization choices.

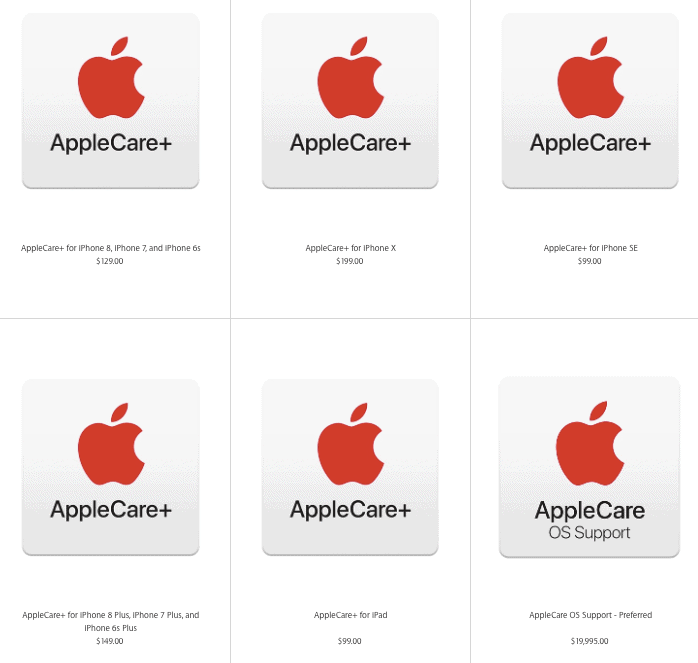

The design styles for Mac and PC are vastly different. Whereas macOS has smooth edges and a consistent application across all apps, Windows has jagged edges and a UI that frequently changes across programs. As Apple has complete control over hardware and software, new security enhancements can be implemented on macOS. Similarly, Apple has a simple and comprehensive AppleCare service in place to assist consumers with any hardware issues. Newer Apple products have Touch ID functionality by default for system access, further protecting devices from fraudulent logins.

Microsoft Windows has a 77.74% market share for desktop operating systems (OS) as of July 2020. Apple’s macOS has grown in popularity over the years but is still a minor player in the desktop OS industry. Linux, the third most popular desktop operating system, has a tiny but constant market share. As of May 2021, OS X had a market share of 15.87% , while Windows had a market share of 73.54%, and Linux had a market share of 2.38%.

The WatchOS app experience differs from app experiences on other platforms in several ways. For example, because the Apple Watch is meant to be worn, the UI is tailored to wearers and provides a lightweight, responsive, and highly personalized experience. People commonly utilize the related experiences of a WatchOS app such as Apple complications, notifications, and Siri interactions — more than they use the app itself.

The latest WatchOS 9 update reflects Apple’s goals in healthcare and personalization. Users can now see more information about their workouts on the screen. Turning the Digital Crown reveals metrics like Activity rings, Heart Rate Zones, Power, and Elevation.

In healthcare, Apple has been at work for years, acquiring medtech startups and using its patented technology to strengthen its WatchOS ecosystem. For instance, most of the sleep-tracking technology on Apple Watch likely came from startups like Beddit, which Apple acquired in 2017. Through the acquisition, Apple also got rights to Beddit’s patents on crucial health features, such as a system for determining sleep quality and applying a pressure sensor .

Read More Here: Apple in Healthcare: top MedTech acquisitions and how can you gain an edge over it?

Apple devices are well-known for linking users to content. This sense of connection is anticipated from Apple TV, although it is not a product that the user can physically grasp or touch. Apple TV is a one-of-a-kind platform with unique specifications . TvOS apps can provide incredible experiences with great visual quality thanks to 4K resolution, Dolby Vision, and HDR10, as well as immersive sound thanks to Dolby Atmos. Furthermore, the Siri Remote provides access to three-axis gyro data, allowing users to build even more immersive gaming and interactive experiences.

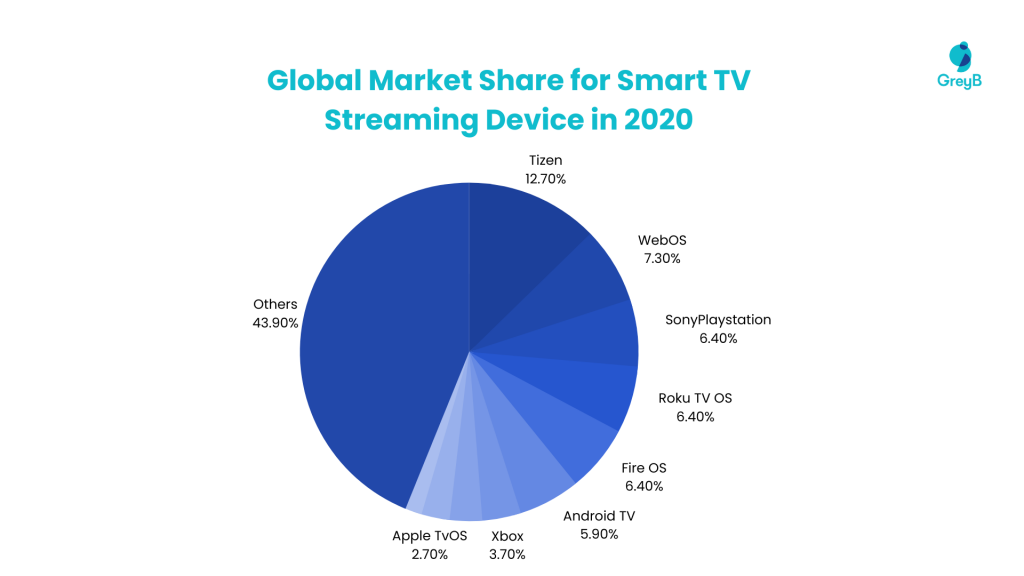

Tizen is the largest TV streaming platform globally among smart TVs in use, with a market share of around 13% as of the end of 2020, followed by LG’s WebOS with 6.4% market shares, Sony PlayStation, Roku TV OS, and Amazon’s Fire OS tied for third place. Apple TvOS had a market share of 2.7% as of 2020.

Smart TV Streaming Device Market Share Worldwide As Of 2020 (%)

Apple’s machine learning teams are conducting cutting-edge research in machine learning and artificial intelligence. The team employs machine learning to educate their devices to comprehend the environment in the same way that humans do. Apple did a research study to investigate the feasibility of inferring accessibility for mobile apps from their display pixels.

Using a dataset of manually collected and annotated iPhone app screens, they trained a robust, quick, memory-efficient on-device model to recognize UI components. Due to this research, Apple launched the Screen Recognition function, which combines machine learning and computer vision to recognize and present material readable by VoiceOver for apps that would otherwise be inaccessible.

Even in May 2021, Apple Inc. hired Samy Bengio , a former prominent Google AI scientist. The hiring will lead to the establishment of a new AI research team within Apple, led by John Giannandrea. Bengio pioneered the “deep learning” methods that underpin today’s AI systems for processing photos, audio, and other data types.

Machine learning and artificial intelligence are now present in almost every aspect of the iPhone.

“I think that Apple has always stood for that intersection of creativity and technology. And I think that when you’re thinking about building smart experiences, having vertical integration, all the way down from the applications, to the frameworks, to the silicon, is really essential… I think it’s a journey, and I think that this is the future of the computing devices that we have, is that they are smart, and that, that smart sort of disappears.” – John Giannandrea, Senior Vice President for Machine Learning and AI Strategy at Apple

Apple has made a practice of crediting machine learning with boosting specific functions in the iPhone, Apple Watch, or iPad, but it seldom goes into much detail.

Apple has taken a more subtle and astute approach to AI. Apple hinted at various AI and ML-powered improvements and enhancements in its June 2020 announcements for iOS, iPadOS, and macOS.

- The Apple Watch utilizes machine learning to identify motions and detect sleep. Users only need to wear the Apple Watch to bed, and it will track their sleep.

- The new handwashing functionality on the Apple Watch, which utilizes AI to detect when one is scrubbing the mitts and starts a countdown, is one of the greatest examples of Apple’s approach.

- One of the features in iOS that allow the iPhone to listen for things like doorbells, sirens, dogs barking, or babies crying is sound alerts. AI excels at picture recognition tasks, and recognizing both Chinese and English characters is an accurate model.

- Apple HomeKit, a smart home solution, allows customers to use their smartphones to control and interact with connected gadgets. Users can utilize the HomeKit framework to provide a means for users to configure accessories and define actions to control them. Users may even bundle actions together and use Siri to initiate them.

- In iOS 14, Apple included a translation app. The app’s purpose is to provide translations from one language to another. Because of the inbuilt on-device machine learning, the Translate app works offline. The program includes various beneficial features while learning a new language and seeking to communicate with someone who speaks an anonymous language.

- Handwriting recognition is a difficult challenge for AI because the more natural a task is for humans, the more difficult it is for AI. In the most recent iPadOS update, when users draw anything with the Apple Pencil, the iPad can recognize their handwriting and, using Scribble, transform it into written text. It works in the same way that most machine learning does.

Artificial intelligence and its subset, machine learning, are being employed to improve the user experience in various Apple gadgets.

Comparison with Google, Amazon, Microsoft

Google paid $400 million for a DeepMind startup in 2014. This company provides various AI-powered solutions, ranging from picture and speech recognition to human simulation in video games. Google employs AI in various mundane tasks, including Gmail reply suggestions and sophisticated search algorithms. In addition, the business just released TensorFlow, a machine learning technology that is open to use by any developer.

Google also has Google Assistant, which assists users in doing daily chores more effectively and timely. It is supported by a wide range of devices (Sonos speakers, Samsung smart TVs, and Philips Hue) and is one of the most extensively used AI solutions today. Duplex is an AI-powered voice that assists users in scheduling business appointments using Google Assistant. The most recent PAIR initiative from Google in AI is worth mentioning. PAIR is an acronym that stands for People + AI Research and attempts to make working with AI as pleasurable and helpful as possible.

When consumers think about Amazon in AI, the first thing that comes to mind is Alexa. This is another virtual assistant that can set alarms, send alerts, and communicate by speech and is supported by Amazon Echo Dot speakers.

Amazon has lately launched the Alexa Shopping functionality. Customers may now use Alexa to place orders on Amazon. The assistant may add things to the basket, delete them, track their progress, and alert customers when they are delivered. Voice shopping reached $40 million by 2020; Amazon made a very smart move.

Microsoft Research AI is a Microsoft-founded organization dedicated to AI research and development. Since the corporation currently uses AI in its processes (Skype chatbots, data analysis, interaction with Cortana, and so on), it’s no surprise that it further intends to increase the usage of AI.

Aside from that, Microsoft has been releasing AI-powered products through its Azure cloud computing service and working on AI integration into Office 365. By 2018, Microsoft bought five artificial intelligence (AI) technology firms. Microsoft’s most recent purchase was XOXCO, a software product design and development firm.

Apple has Siri, one of the world’s most popular virtual assistants. Siri was initially developed as an app and released on the Apple app store by Nuance Communications, Inc. in February 2010. Apple acquired it two months later, on April 27, 2010, for approximately $200 million. Siri was then introduced with the launch of iPhone 4S on October 4, 2011.

It offers face recognition, which is entertaining to experiment with and improves security. Furthermore, Apple employs AI to identify fraud and improve battery usage, appearing to be an equal competitor.

Apple does not spend as heavily on AI as Google or Amazon. Second, it takes a fairly local approach, with its CreateML framework only operating on iOS devices, whereas most businesses train their ML models in the cloud.

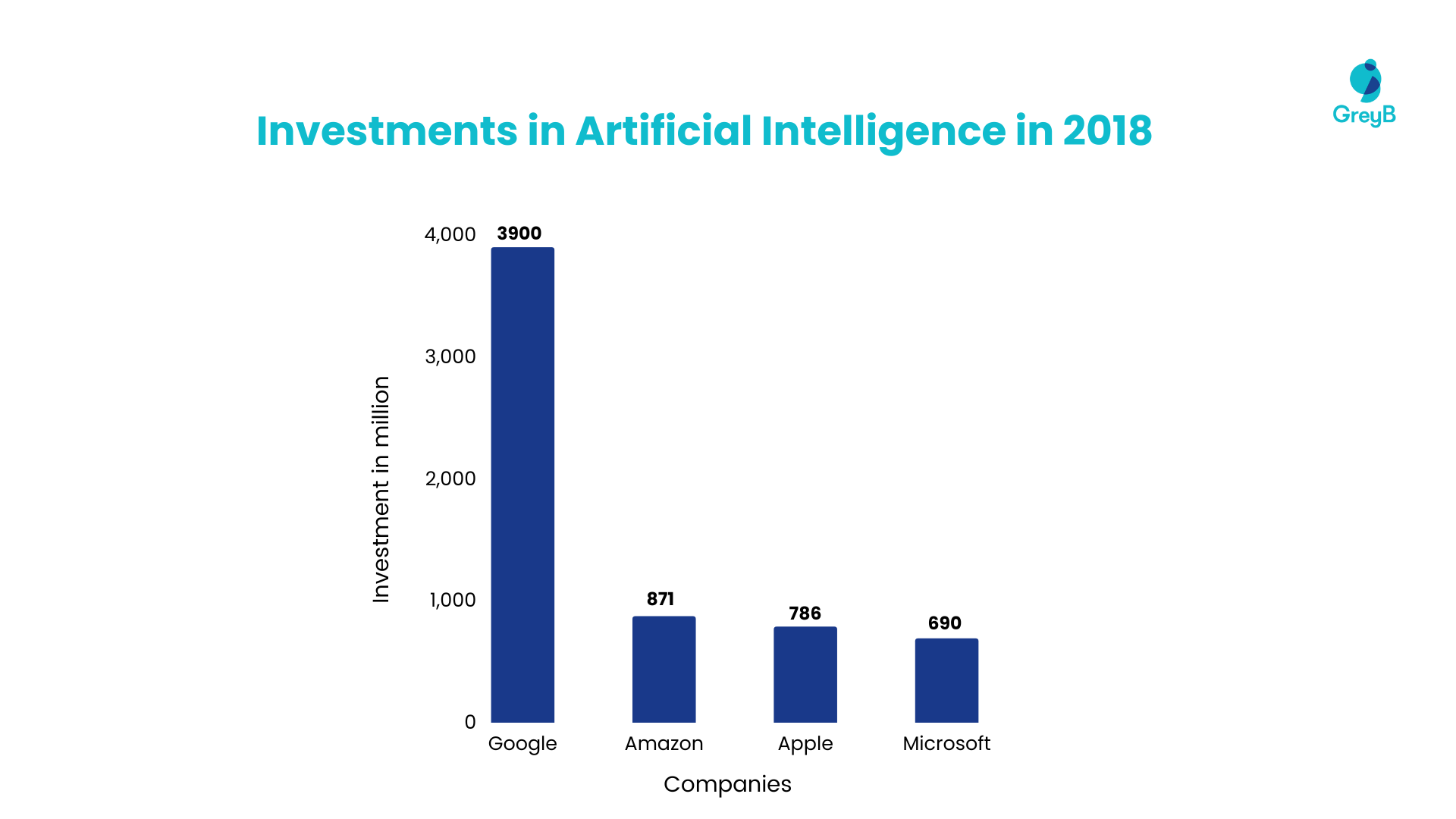

Since 2006, Google has invested over $3.9 billion in AI in disclosed transactions. There have been several organizations that have invested money in acquiring AI startups up till 2018. Some of these businesses are Amazon ($871 M), Apple ($786 M), and Microsoft ($690 M).

Acquisitions Related to AI

According to a report from GlobalData, Apple acquired around 25 artificial intelligence firms between 2016 to 2020. The various acquisitions that Apple made include:

- Emotient (Jan 2016)

Emotient, a San Diego business developing artificial intelligence technology that scans facial expressions to determine emotions, was bought by Apple. Apple did not specify the details of the acquisition in the report.

- Flyby Media (Jan 2016)

Apple acquired Flyby Media, an augmented reality business that created technology that lets mobile phones “see” the world around them. Apple has been interested in virtual reality for several years. The purchase occurred shortly after Apple announced the hiring of a prominent AR/VR specialist, Doug Bowman. Apple may have been working on technology that will someday find its way to the iPhone, similar to Google’s Project Tango, which delivers computer vision to mobile devices.

- Gliimpse (August 2016)

Gliimpse, a health data firm, was purchased by Apple for around $200 million. Gliimpse allowed users to import their medical information into a single virtual environment. Apple’s incorporation of Gliimpse into its existing products appeared to be more evident, given that the business has been working on health-related software for some years now. It was simple to see how Gliimpse, with its structured data centered on individuals, would be useful in products such as HealthKit, ResearchKit, and CareKit. Thus opening a gateway for Apple in the healthcare sector .

- Turi (August 2016)

Turi, a machine learning and artificial intelligence business, was purchased by Apple for more than $200 million. The acquisition is part of Apple’s bigger push into artificial intelligence and machine learning. Apple’s ambitions for Turi’s technology are unknown, but the corporation has been expanding its Siri personal assistant and associated technologies to make a larger push into artificial intelligence.

- Tuplejump (September 2016)

Tuplejump, a machine learning team based in India and the United States, was bought by Apple. The acquisition was motivated by Apple’s interest in “FiloDB,” an open-source project developed by Tuplejump to quickly apply machine learning ideas and analytics to enormous volumes of complicated data as it came in.

- RealFace (February 2017)

Apple has spent $2 million acquiring the Israeli company RealFace, a cybersecurity and machine learning business focusing on face recognition technologies. RealFace’s software employs exclusive IP in the realm of “frictionless face recognition,” which enables quick learning from facial traits.

- DeskConnect (March 2017)

DeskConnect, the start-up behind Workflow, was acquired by Apple. Workflow is similar to Automator, an Apple utility tool that comes with macOS Sierra but has no iOS counterpart. DeskConnect’s namesake cross-platform file-transfer tool was discontinued last month. Apple’s AirDrop, Handoff, and Universal Clipboard, among other services, were recommended by the firm.

- Lattice Data (May 2017)

Apple invested $200 million in acquiring Lattice Data, an AI firm. By acquiring Lattice Data, Apple was prepared to expand into machine learning and artificial intelligence. Around 20 engineers also joined Apple.

- SensoMotoric Instruments (June 2017)

SensoMotoric Instruments, a German provider of eye-tracking eyewear and systems, was acquired by Apple. SensoMotoric has created eye-tracking technology for virtual reality headsets such as the Oculus Rift, which monitors the wearer’s gaze and aids in the reduction of motion sickness, a major side effect of VR. Apple revealed a prototype set of “smart glasses” that would link to an iPhone and show the wearer “pictures and other information.”

- Regaind (September 2017)

Regaind, a French firm, was bought by Apple. Regaind had been working on a machine vision API for analyzing photo content. Apple used this technique to improve the Memories tab in the Photos app. iOS builds albums depending on events, location, and other factors. Using Regaind, iOS may search for aesthetically similar photographs, display the best image as cover art, and generate a recap movie with the finest photographs. Apple has integrated Regaind technology with the new Face ID sensor in the iPhone X, for example, to enhance animoji facial expressions.

- Pop Up Archive (December 2017)

Pop Up Archive, an Oakland-based online platform focused on developing tools to transcribe, organize, and search audio recordings, was bought by Apple. Apple, the long-dominating hands-off curator of the podcast world, has bought a technology aimed at boosting the knowability and sortability of the hundreds of thousands of broadcasts delivered via its Apple Podcast platform.

- Spektral (October 2018)

Apple invested over $30 million in Spektral, a computer vision business in Denmark that has worked on segmentation technology. Spektral’s initial application may have been the rather outdated world of school photos and the most prominent contribution Spektral might make to Apple’s photographic industry.

- Asaii (October 2018)

Apple invested less than $100 million in Asaii, a music analytics start-up focused on discovering new and rising musicians. The acquisition comes as Spotify, Apple Songs’s major competitor, expands its reach beyond conventional popular performers and supports unsigned musicians, who may now submit their music straight to the service.

- Silk Labs (November 2018)

Silk Labs, a firm focused on developing on-device machine learning software, had been acquired by Apple. The purchase perfectly fit Apple’s privacy-focused approach to artificial intelligence. Apple followed a similar approach to AI development, distinguishing itself from competitors such as Google, which collects large volumes of user data and analyses it on the cloud.

- PullString (February 2019)

PullString was acquired by Apple for around $30 million. It is a big indication of Apple’s plan to make Siri creation easier for iOS developers. The acquisition also provides Apple with extensive domain experience in the areas of voice app development, voice app designer and developer requirements, and the complexities of both Amazon Alexa and Google Assistant.

- Laserlike (March 2019)

Laserlike, a machine learning start-up, has been bought by Apple. Laserlike uses machine learning to collect massive amounts of data from the web and then give user-specific findings via an eponymous app. The transaction was made for an unknown purpose, according to Apple. Laserlike’s team may be trying to improve Siri’s long-struggling capacity to retrieve relevant information from the web.

- Lighthouse AI (March 2019)

Apple purchased Lighthouse’s patents for AI-powered home security cameras (eight patents and patent applications). Even the Lighthouse’s Co-Founders, along with about 20 employees, had joined Apple. Apple’s current emphasis on AI-driven home security systems is part of a broader tech industry embrace of so-called smart or connected homes, which include a large number of AI-driven and machine-to-machine gadgets.

- Drive.ai (June 2019)

Apple bought Drive.ai in June 2019. As a consequence of the agreement, hundreds of Drive.ai developers joined the tech giant’s top-secret Project Titan. Apple bought the company’s assets, including its self-driving vehicles.

- Spectral Edge (December 2019)

Apple invested an unknown sum in another UK start-up, Spectral Edge, in an apparent move to strengthen the iPhone camera. Spectral Edge created Phusion, a computer photography approach that employs infrared light that is invisible to the human eye to sharpen and restore color in smartphone images.

- Xnor.ai (January 2020)

Apple acquired Xnor.ai, a Seattle business specializing in low-power, edge-based artificial intelligence solutions. The transaction was completed for around $200 million. According to the agreement, Xnor’s AI-enabled picture identification technologies might become standard capabilities in future iPhones and cameras.

- Voysis (April 2020)

Apple Inc. acquired Voysis, an Irish artificial intelligence firm, in April 2020 for an undisclosed amount. Voysis’ technology, which includes a platform that adds vocal interactions to digital shops, might be used to improve the understanding of what consumers say by Apple’s Siri speech assistant.

- Inductiv Inc. (May 2020)

Apple Inc. acquired Inductiv Inc., a machine-learning firm situated in Ontario, Canada. Inductiv created technology that employs artificial intelligence to automate the job of detecting and repairing data problems. This technology will be used by Apple in a variety of products and improve Siri data.

- Subverse Corp.(Scout FM) (September 2020)

Apple Inc. acquired Subverse Corp. (Scout FM), a start-up that makes listening to podcasts more like tuning into radio stations, to strengthen its service in the face of increasing competition from Spotify. While other podcast applications, such as Apple’s, allow users to select an individual podcast to listen to, Scout FM established podcast stations on various themes. Scout FM was popular among Apple device owners and could be linked with CarPlay. This interface shows on compatible car screens when an iPhone is connected, and Apple’s Siri digital assistant.

- Vilynx (October 2020)

Apple Inc. invested $50 million in acquiring the artificial intelligence and vision firm Vilynx Inc. Vilynx technology might be adapted to Siri and Apple’s general search operations.

Apple Services

Apple has been working on different services to increase revenue, especially when iPhone sales are declining since 2018. Apple knew that it was bound to happen, so the company made several tactics to boost its revenue. One is simply to increase the price.

Apple iPhone, iPad, Watch, and Macbook average prices have seen growth that helped Apple consistently increase its revenue. But that tactic was a short-term plan and Apple Couldn’t rely on it for the long term. That’s where Apple services come into the picture.

Apple has introduced several services in the past 6 to 7 years, such as Apple Pay, App Store, Apple News+, Apple Music, Apple TV+, Apple Podcasts, Apple Fitness+, etc.

Apple generated $53.7 Billion in 2020 through its services, which accounted for 19% of total revenue. Surely, the number will keep growing in the coming years as Apple has a solid user base and is making the services a part of their ecosystem, which will help in user experience.

iMessage is Apple’s instant messaging service for iPhone, iPad, and Mac devices. iMessage, which debuted with iOS 5 in 2011, allows users to share messages, photographs, stickers, and other content between any Apple devices through the Internet. iMessage is exclusively available on Apple devices. That implies users won’t be able to send an iMessage to their Android contacts. Apple prioritizes privacy, which is why everything users transmit as an iMessage is encrypted from beginning to end. This implies that no one can intercept or read it except the person to whom it was sent, even Apple. In reality, even if they have a smartphone, they cannot force their way into a user’s iMessages. No, not without a user passcode. Apple has been chastised by the US government for this same reason, since it cannot, even if it wanted to, expose iMessages.

Apple’s FaceTime is a video chat application. FaceTime was built by Apple on an open standard, which implies that it may be utilized across a variety of platforms and that other manufacturers may exploit FaceTime’s protocol. But instead, FaceTime was only available to customers of Apple products until recently. With the release of iOS 15, FaceTime is coming out of the Apple closet. The software giant is making it possible for people who have Android phones and Windows laptops to hop on FaceTime calls — no iPhone required (well not really tho).

Before you jump to search the FaceTime app on the play store, here’s the catch- you won’t find it. Users will be able to join a FaceTime call on their Android and Windows devices using a link, so long as the person scheduling or starting the call has an Apple device and an Apple account. It now has a market share of less than 0.01%. Zoom is the market leader in this industry, with a 39.66% market share followed by GoToWebinar with a 20.64% market share, and Cisco Webex with a 16.48% market share.

Apple Maps and Google Maps have transformed the way we locate destinations, discover local businesses, and share directions with friends. Both serve the same objective, although their navigation tools and interfaces differ slightly . Google Maps, which debuted in 2005, has been the leading mobile mapping service since the smartphone’s inception. Apple acquired Placebase on July 7, 2009, to build its own Maps application for iPhone and iPad. This app didn’t come until 2012 and was stuck with technical challenges for years.

With the introduction of iOS 13 and iPadOS 13, Apple gained a foothold. Apple Maps was upgraded to exclude third-party navigation data in favor of new data obtained exclusively by Apple. The new maps are significantly more precise and accurate, thanks to millions of miles driven in camera- and LiDAR-equipped automobiles, new high-resolution satellite photos, Apple staffers canvassing areas on foot with radar modules strapped to their backs, and plenty of aerial photography.

Apple included routes for bicycles, routing for electric cars, congestion zones, and Guides for discovering the finest locations to visit in cities around the world in iOS 14 and iPadOS 14. Apple Maps is only available on Apple devices, including iPhones, iPads, and Apple Watches. It’s incorporated into all Apple-branded products, including Macs. It is not available on devices that are not part of the Apple ecosystem.

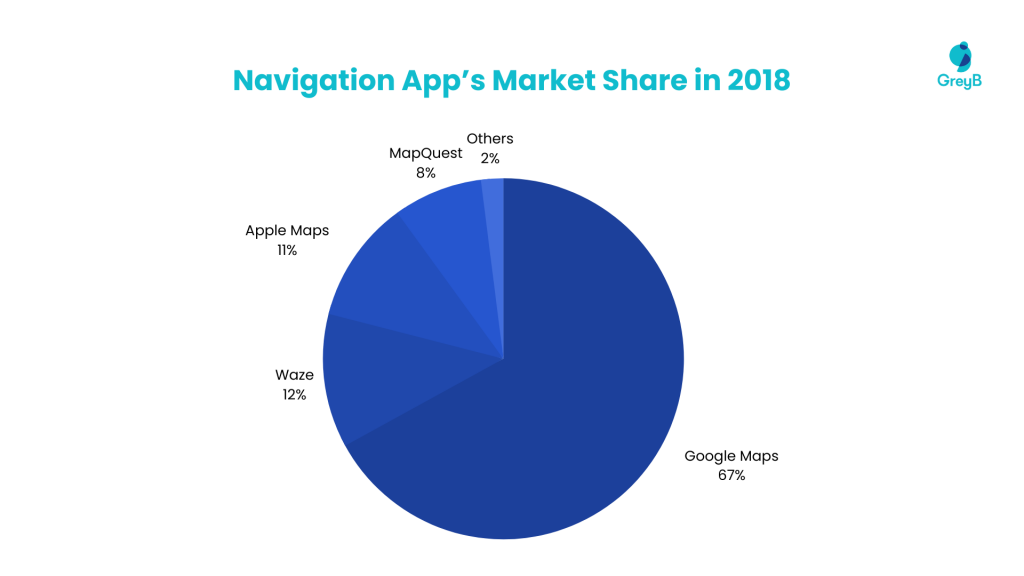

According to the latest survey data from The Manifest in 2018, the majority of smartphone owners use navigation applications, with the majority preferring Google Maps. It has a market share of 67% compared to 12% for Waze, 11% for Apple Maps, and 8% for MapQuest.

Apple’s digital software distribution platform for iOS devices is known as the App Store. The App Store, which debuted in 2008, allows software developers to publish content designed exclusively for the iPad, iPhone, and iPod touch. Apps may also be downloaded for the Apple Watch through the iOS App Store.

The App Store is more than just a shop; it is an innovative place dedicated to delivering incredible experiences. A large part of it is ensuring that the applications the firm provides adhere to the highest privacy, security, and content standards.

Android users have a choice of 3.48 million apps as of the first quarter of 2021, making Google Play the app store with the most available apps . With about 2.22 million iOS apps available, the Apple App Store stands second in the ranking.

While the actual number of applications may vary since Apple and Google constantly delete low-quality material from their app stores, the number of applications has continuously increased over the years.

Since 2008, the App Store has paid out more than $200 billion to developers.

According to mobile expert Horace Dediu, who provided even more current data which are as follows:

- $1.8 billion in App Store sales over the week between Christmas Eve and New Year’s Eve (+27% year on year)

- $540 million in App Store sales on January 1, 2021 (+40% year on year)

- 600 million: The number of iPhone users with an active subscription.

According to Apple, the App Store saw $643 billion in total commercial transactions in 2020, a 24% increase compared to 2019. At the present rate of growth, the indicated economic value might exceed $1 trillion within two years.

Apple TV+ is Apple’s own TV and movie streaming service. It features award-winning shows, captivating dramas, ground-breaking documentaries, children’s entertainment, comedy, and more. Every month, new Apple Originals are added. The service is positioned as Apple’s direct competitor to Netflix, Amazon Prime Video, and Disney+, and will exclusively offer original programming via the existing Apple TV app, which is available on various platforms.

It is available on a monthly subscription basis and is accessible across several devices via the most recent version of the Apple TV app. Apple TV+ provides ad-free, unique programming that has either been green-lit or created in-house by Apple.

A family membership to Apple TV+ costs £4.99 / $4.99 per month. Apple’s services package, which includes Apple Music, Apple TV+, Apple Arcade, Apple News+, and Fitness+, was launched in October 2020. Apple TV+ is accessible on iOS/iPadOS devices and the Mac via the Apple TV app.

A survey was conducted in May 2020, with Apple’s reader at Android Authority, ‘Which streaming service would they pick if they could only pick one?’ From this survey, it was seen that Apple TV+ captured less than 1% of the total vote. The majority of consumers complained that the library was just too small, while it would work better as a second or third membership for people who can’t get enough content.

Position in the Market Compared To Others

Apple TV+ was marketed as a unique curated stream of entertainment available exclusively through the Apple TV app. Despite Apple’s investments in new movies and programming for its streaming service Apple TV+, the platform is still considered to gain a large success. During the fourth quarter of 2020, it was reported that Apple TV+ has only a 3% market share in the United States, trailing competitors such as Netflix, Disney+, and even Peacock.

Apple TV+ was not the most popular streaming service in the fourth quarter of 2020. Apple TV+ trailed Peacock, NBCUniversal’s streaming service launched in July 2019, which had a 6% market share during the same period. Netflix maintained its 31% market share of streaming platforms in the United States, while Amazon Prime Video grew and drew close to 22%. Hulu came in second with 14%, followed by Disney+ with 13%, and HBO Max with 9%.

In 2020, Apple had a terrible year because most productions were halted due to the COVID-19 pandemic. Apple TV+’s catalog is extremely modest in comparison to its competitors because it only includes original movies and series. Apple extended the Apple TV+ trial term to members who had previously completed the one-year free trial in January 2021.

Apple is in a unique position since it both creates original video content and distributes third-party video bundles. Apple’s aim to become the “bundler of bundles” looks to profit when power shifts from one or two corporations to a lot of others. Apple TV+, Apple’s streaming video service, was priced at $4.99 per month, which was less than any other major provider.

As additional competitors plan to launch their services with larger video libraries consisting of famous series and movies, the firm was obliged to keep the pricing low . Within a few months of its inception, the one-year free trial had propelled Apple TV+ to the top of the streaming services.

Apple’s Plan to Increase Its Streaming Business

Tim Cook, Apple’s CEO, announced the debut of video streaming, news subscriptions, and a credit card in 2019. Apple took a calculated move to join the video streaming sector. The choice to enter the video streaming market is a little departure from the company’s core business, which has garnered its brand recognition.

Furthermore, since Apple has broadened its horizons in the services category, the launch of a video streaming service appeared to be an opportune decision, since this sector has a lot of untapped development potential.

- Online video streaming might be thought of as a replacement for television. In the United States, video streaming services have already surpassed television in terms of household penetration, with 69% of homes using a video streaming service.

- Apple has the economies of scale to enter this market with relative ease. It has significant client loyalty and may be able to gain clients more readily as a result of its loyal client base. Furthermore, with the aid of its existing products, the firm may be able to effortlessly pull in its existing consumers on video streaming services.

Apple TV+ is less expensive than the majority of its competitors. It costs $4.99 per month, which is less than half the price of a standard Netflix membership, and it is free for the first year for customers who buy Apple gadgets. Even now, Apple has been collecting older movies and episodes for its TV+ streaming service, intending to build a back library of material that can compete with the massive libraries offered on Netflix, Hulu, and Disney+. According to sources familiar with the topic, the company’s video-programming executives have received presentations from Hollywood studios about licensing older content for TV+ and have purchased several episodes and movies.

It is predicted that in the future the company might acquire Disney . If Apple is serious about becoming a large SVOD player, which they may not be, abandoning Apple TV+ and redirecting its programming to Disney’s established streaming portfolio makes sense. Disney is the only studio large enough to propel Apple into streaming dominance, and it just so happens to fit Apple’s family-friendly image and public values.