We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Research Daily

Top analyst reports for amd, pepsico & sap.

by Mark Vickery

Today's Research Daily features new research reports on 16 major stocks, including Advanced Micro Devices, Inc. (AMD), PepsiCo, Inc. (PEP) and SAP SE (SAP), as well as two micro-cap stocks FitLife Brands, Inc. (FTLF) and National Presto Industries, Inc. (NPK).

Weekly Market Analysis

All eyes on inflation readings and walmart earnings this week.

by Mayur Thaker

moving average rule still bullish, but joblessness on the rise right as personal savings are depleted are going to weigh on consumer spending.

Market Outlook

Top 5 stocks to buy in the flourishing building products industry, industry outlook, putting the u.s. and world economies together, economic outlook, the underrated global consumer: zacks may strategy, market strategy, retail earnings: a closer look, earnings preview, current earnings outlook reflects positivity, earnings trends, zacks equity research 15/16.

We cover more than 1,000 of the most widely followed stocks in our Equity Research Reports. Each report features independent research from our analysts and provides in-depth analysis on a company, its fundamentals and its growth prospects. Quickly access reports for New Upgrades and New Downgrades.

You can also find a report on the ticker of your choice, or access all of the stock reports covered by Zacks analysts.

View All Zacks Equity Research Reports

Zacks Analyst Reports

New upgrades: wday , vnom , sig , scco , gps , slg , zto , atge , nep , intu, workday ( wday quick quote wday ) upgraded: 05/18/24.

Workday is benefiting from increasing demand for human capital management and financial software solutions, diversified product portfolio, expanding customer base and strong liquidity.

View Report

Viper Energy Inc. ( VNOM Quick Quote VNOM ) Upgraded: 05/18/24

Viper Energy Inc. generates a strong and steady royalty income from the mineral interests in the Permian Basin.

Signet Jewelers ( SIG Quick Quote SIG ) Upgraded: 05/18/24

Signet implemented significant cost-saving initiatives, leading to a notable improvement in its financial performance. The digital business is the key growth driver.

Southern Copper ( SCCO Quick Quote SCCO ) Upgraded: 05/18/24

Southern Copper is poised to grow on the back of its copper reserves, solid growth projects and sound balance sheet. Further, a solid long-term outlook for metal prices bodes well.

The Gap ( GPS Quick Quote GPS ) Upgraded: 05/18/24

Gap has been gaining from lower airfreight, improved promotions and cost-cutting actions. It is on track with the execution of its Power Plan 2023 plan.

SL Green Realty ( SLG Quick Quote SLG ) Upgraded: 05/18/24

High demand for top-quality office properties in key markets, a diverse tenant base, opportunistic investments to enhance its portfolio quality are key growth drivers for SL Green.

ZTO Express Cayman ( ZTO Quick Quote ZTO ) Upgraded: 05/18/24

Robust performance of the express delivery services unit is impressive.

Adtalem Global Education ( ATGE Quick Quote ATGE ) Upgraded: 05/17/24

Cost-saving moves, inclusion of Walden University and strategic partnerships will drive growth.

NextEra Energy Partners ( NEP Quick Quote NEP ) Upgraded: 05/15/24

The acquisition of renewable assets, sale of non-core assets, organic growth projects and focus on domestic operation — which are acting as tailwinds — will boost its performance.

Intuit ( INTU Quick Quote INTU ) Upgraded: 05/14/24

We are positive about Intuit’s growing SMB exposure and believe that its strategic acquisitions will boost the segment. Increased adoption of its cloud-based services and products is another positive.

New Downgrades: RHI , AAP , ALGT , CBRL , HMC , NEE , GPRO , TDY , SONY , NVST

Robert half inc. ( rhi quick quote rhi ) downgraded: 05/18/24.

Robert Half operates in a competitive market while being exposed to foreign currency exchange risks.

Advance Auto Parts ( AAP Quick Quote AAP ) Downgraded: 05/18/24

Rising debt levels and elavated supply chain costs are major headwinds.

Allegiant ( ALGT Quick Quote ALGT ) Downgraded: 05/18/24

High debt and rising operating expenses are limiting bottom-line growth.

Cracker Barrel Old Country Store ( CBRL Quick Quote CBRL ) Downgraded: 05/18/24

Softer comps, increasing costs and traffic concerns are potential headwinds for an industry.

Honda Motor Co. ( HMC Quick Quote HMC ) Downgraded: 05/18/24

Weakness in Power Products unit, rising debt pile, high labor costs and escalating R&D and capex needs pose concerns.

NextEra Energy ( NEE Quick Quote NEE ) Downgraded: 05/17/24

Stringent regulations, inherent risk of operating nuclear generation facilities and unfavorable supply costs could adversely impact earnings

GoPro ( GPRO Quick Quote GPRO ) Downgraded: 05/17/24

GoPro operates in an intensely competitive camera and camcorder market. It is susceptible to high product concentration risk.

Teledyne Technologies ( TDY Quick Quote TDY ) Downgraded: 05/15/24

Rising fuel price and supply chain constraints may hurt Teledyne Technologies’ growth. Shortage of skilled labor pose risk for the stock

Sony ( SONY Quick Quote SONY ) Downgraded: 05/14/24

Sluggish macroeconomic conditions, along with stiff competition and supply chain troubles remain concerns.

Envista ( NVST Quick Quote NVST ) Downgraded: 04/26/24

Unfavorable currency movement and weak solvency were major dampeners during the quarter. Strong competitors also pose a tough challenge for Envista.

Featured Reports: AMZN , NFLX , BAC , DRI , BA , VLO , BABA , CHK , MSFT , TGT

Amazon.com ( amzn quick quote amzn ) upgraded: 05/21/24.

Amazon is benefiting from its Prime program, delivery and logistic system in the e-commerce space. Further, its dominant position in cloud market is a positive.

Netflix ( NFLX Quick Quote NFLX ) Upgraded: 05/21/24

Netflix’s growing subscriber base, driven by content strength, focus on originals across various genres and languages, rapid international expansion and partnerships with telcos are key drivers.

Bank of America ( BAC Quick Quote BAC ) Upgraded: 05/16/24

High rates, decent loan demand, efforts to improve revenues and expansion into new markets will likely aid Bank of America. Technological advancement will keep aiding cross-selling opportunities.

Darden Restaurants ( DRI Quick Quote DRI ) Upgraded: 05/20/24

Ruth’s Chris acquisition, various sales-boosting initiatives and cost-saving efforts undertaken by the company are expected to drive growth.

Boeing ( BA Quick Quote BA ) Upgraded: 05/21/24

Long-term prospects of global services unit, improving air passenger traffic as well as increasing fiscal defense budget are expected to boost Boeing's growth

Valero Energy ( VLO Quick Quote VLO ) Upgraded: 05/21/24

Among all the independent refiners, Valero offers the most diversified refinery base.

Alibaba ( BABA Quick Quote BABA ) Upgraded: 05/17/24

The company’s dominance in the China's e-commerce market, retail strength, and solid growth opportunities in international market are positives.

Chesapeake Energy ( CHK Quick Quote CHK ) Upgraded: NA

Chesapeake’s operations expand across leading oil and gas resources in the United States

Microsoft ( MSFT Quick Quote MSFT ) Upgraded: 05/17/24

The enterprise refresh cycle, new subscription model, Azure and strength in Gaming segment will continue to generate sizeable cash flows.

Target ( TGT Quick Quote TGT ) Upgraded: 05/20/24

Target’s initiatives, including the development of omni-channel capacities, diversification and localization of assortments along with emphasis on flexible format stores, bode well.

Find a Report

Get timely analysis that provides the reason behind the Zacks Rank for more than 4,400 stocks

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

So let’s briefly go through the main sections of these reports, using the two examples above:

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

More than 1,800 contributors. Multi-asset class coverage. Global reach.

Get insights your business needs to gain a competitive edge with access to Real-Time or Aftermarket Research from leading brokerage, independent, and market research providers around the globe.

- On This Page

Real-Time Research

Aftermarket Research

- RatingsXpress®

Research Updates

Power your investment decisions.

Whether you’re generating investment ideas, performing financial analysis, or conducting risk assessments, our robust collection of sell-side research reports can help you gain the insights you need. Combine our research offerings with the power of data and analytics from the S&P Capital IQ Pro platform for a comprehensive enterprise-wide solution.

Keep up with the latest research from leading analysts worldwide with our extensive collection of broker and independent research reports. We provide streamlined access to research from the world’s largest investment banks, high quality regional brokers, boutiques and independents—along with the tools you need to monitor, search, and audit reports efficiently.

Our Aftermarket Research collection features more than 35 million analyst research reports from 1,800+ global investment research providers, including top-ranked investment banks such as Citi, Credit Suisse, Barclays, UBS, J.P. Morgan, HSBC, and Deutsche Bank. Gain the essential insights you need to monitor the markets and find new opportunities.

RatingsXpress®: Research

Leverage textual analysis and machine learning for investment, credit risk modeling, and developing sentiment/early warning models with RatingsXpress: Research, S&P Global Ratings’ digitized credit research.

1,800+ CONTRIBUTORS. 35+ MILLION RESEARCH DOCUMENTS.

Access our recap of 2023 broker research coverage

Real-time investment research.

Our comprehensive collection of real-time research features equity, fixed income, sector, economic, and strategy reports from leading analysts worldwide. Download analyst earnings models in their original Excel format for easy manipulation and streamline your workflow with our sophisticated search functionality, alerting tools, and links into the portals of top investment banks.

Access real-time research reports

including equity, fixed income, sector, economic and strategy reports from thousands of brokers.

Connect seamlessly

into the proprietary portals of the world's leading investment banks.

Pinpoint search results

by analyst, broker or report type.

Stay up-to-date with watchlists

and customized alerts delivered directly to your inbox.

Access real-time entitlements

by submitting contact information for your brokers to our support team

The market moves in real time. Don’t miss any key developments.

Explore our research solutions.

Deep sector coverage, analyze firms from a 360° perspective, insights on emerging trends, bolster market knowledge, get in-depth reports from 1,800+ research providers with aftermarket research.

- Access to a vast library of sector-focused investment research can help you stay on top of your most crucial markets. The Aftermarket Research collection from S&P Global Market Intelligence brings you fresh, exclusive insights from the leading brokers in each key sector, such as Barclays, Citi, Credit Suisse, Deutsche Bank, J.P. Morgan, Macquarie, ODDO BHF, UBS, and more.

- View our complimentary infographics to see how deep our Aftermarket Research coverage goes for the 11 GICS sectors by region and five of the largest global stock indices .

- Investment research customers are provided with direct access to our team of research experts for seamless diagnostic training and in-depth support. Customers can access our research without mid-term overage charges.

Tap into expert analysis on your next M&A target

- Assessing the credit risk of your peers, competitors and acquisition targets can be challenging if you don’t have high-quality research to help drive your due diligence.

- Company-level insights from the brokers in our Aftermarket Research collection can help users discover key information, including financial performance, leverage and valuations, to fuel risk analysis.

- See how the Aftermarket Research offering helped a bank assess the creditworthiness of potential acquisitions and enabled a leading private equity firm gain insights on ideal portfolio targets

Find out what Wall Street’s top analysts are saying with access to more than 35 million reports

- The Aftermarket Research collection from S&P Global Market Intelligence provides users with access to valuable company research and sector investment research from the world’s top brokers, providing you with a single source of insights on the latest trends, developments, and company performance.

- To help quantify the growing focus on the hottest topics in the financial markets, we've taken stock of the increased volume of inflation-related investment reports available in our Aftermarket Research collection and created infographics to visualize report totals, broker coverage, and some popular equity research reports. Access our latest infographics on AI , bank earnings , and electric vehicles .

Adapt to abrupt changes or dive into a new segment with exclusive research

- The Aftermarket Research platform is integrated into the S&P Capital IQ Pro and Capital IQ platforms for easy access to more than 35 million broker research reports on new or core markets. Users can preview research before downloading, create alerts to stay on top of the latest content, and search for research by company, topic, contributor, and other criteria.

- Read our case studies to learn how we help investment banks , commercial banks , universities , and other corporations monitor key trends for a competitive advantage.

- Learn more about the key regional brokers that have been added to our research library, underscoring our commitment to continually deliver new expert insights to our customers.

Unlock Valuable Insights for Your Law Firm with S&P Global Aftermarket Research

Search for Research with our AI-powered Document Viewer

Discovering and analyzing Investment Research on the Capital IQ Pro platform is now much easier, as research reports are now available on the Document Viewer. This tool enables users to:

- Instantly locate keywords and concepts within research reports

- Share excerpts with colleagues to enhance project collaboration

- Add personalized annotations to documents

- Access related company filings, transcripts, and investor presentations on a single screen

- Export tables directly to Excel with one click, with fully formatted data, ready for models and calculations.

The enhanced Document Viewer can help you stay ahead of the market and your competition by finding exactly what you need. Company and industry forecasts, and critical opinions from the market's leading research firms are at your fingertips. View our interactive tutorial to see how you can access investment research through the Document Viewer.

Learn about the top five Aftermarket Research reports from each month

Ratingsxpress ®.

Data scientists, research teams, and quantitative strategists interested in textual analysis and machine learning for investment, credit risk modeling, and developing sentiment/early warning models can now use RatingsXpress: Research, S&P Global Ratings’ digitized credit research.

Create meaningful financial benchmarks

for internal risk models.

Gain more insights

into when the credit quality of an entity may be shifting.

Better differentiate

between issuers with the same rating.

Enhance your analysis with current and historical credit ratings.

Get the insights you need to power your decisions.

Hdfc securities investment research now available through s&p capital iq pro, wells fargo is now available in s&p global’s aftermarket research collection, tudor, pickering, holt & co. research now available, mizuho securities is now available in s&p global’s aftermarket research, shore capital is now available in s&p global’s aftermarket research collection, william blair officially added as an aftermarket research contributor, jmp securities is now available in the s&p global market intelligence aftermarket research collection, needham & company is now available in the s&p global market intelligence aftermarket research collection, baird research is now exclusively available in s&p global’s aftermarket research collection, s&p global market intelligence becomes exclusive provider of citigroup aftermarket research, nomura securities is now available in the s&p global market intelligence aftermarket research collection, request follow up.

You're one step closer to unlocking our suite of financial information solutions and services. Fill out the form so we can connect you to the right person.

We're proud of our recent awards!

- Best Corporate Actions Data Initiative, 2023

- Best Overall Sell-Side Technology Provider, 2023

- Most Innovative Regulatory Solution (Climate Risk & Transaction Reporting), 2023

- Best Overall Data Product or Service, 2023

And, we delight in supporting our customers with 24x7x365 customer service and a 98% customer service satisfaction rate. If your company has a current subscription for S&P Capital IQ Pro, you can register as a new user for access to the platform(s) covered by your license at S&P Capital IQ Pro or S&P Capital IQ

- Business Email *

- First Name *

- Last Name *

- Company Name *

- My most critical business need is (click plus sign to expand for more options): * Required field Capital Formation Workflow tools and capabilities that support every step of a transaction, from advice and deal origination, to portfolio risk analysis, optimization, and management. Add value and achieve greater operational efficiencies pre-, during, and post-trade. Deal Performance and Portfolio Monitoring Deal Valuation Execution Investor Targeting Market Monitoring and Idea Generation Credit & Risk Solutions With intuitive analytical tools, expert insights, robust data, and skilled managed services our credit, risk, and regulatory compliance solutions provide a single source of truth about your customers, suppliers, counterparties, and investments. Analytical Services Buy Side Risk Management China Credit Analytics Climate Credit Risk Models Credit Assessment Scorecards Credit Ratings and Research Credit Ratings Data and Delivery Default, Transition and Recovery Data Derivatives Counterparty Credit Risk FRTB Credit Risk Models Supplier Risk Indicator™ XVA Data & Distribution A single data source for detailed information on the companies, industries, and markets that matter to you - delivered via Desktop, Feed, API, and Cloud. Built on a foundation of reliable, timely, and differentiated data, delivered seamlessly. Alpha Signals Alternative Data Cross Reference Services Data Visualization & Charting Dividend Forecasting Enterprise Data Management Financial Digital Solutions Flexible Delivery Options Fundamental Financial Data Kensho Solutions OTC Derivatives Pricing and Valuation Data Short Interest Sector Coverage Textual Data Digital Transformation/Tech Make digital transformation a reality and overcome the challenges of the exponential growth of data. Track evolving technology disruptors and consumer preferences with analysis ranging from film to broadband, programming, and emerging technologies. 451 Research Media and Telecom Research Media and Telecommunications Outlooks Technology Research and Consulting Economics & Country Risk Our data, models, and experts provide companies with the complete perspective - from global economic strengths to industry level health and down to street-level risk assessments and everything in between. Comparative Industry Analysis Economic Insights Geopolitical Risk Purchasing Managers Index - PMI(TM) Regional Explorer: Economics, Risk, and Data Analytics Scenarios and Modeling Security and Intelligence Financial Technology Solutions Industry-leading enterprise solutions tailored to financial markets. Our proven software solutions and analytics help buy and sell-side firms uncover insights, increase efficiency, reduce and manage risk and maintain compliance Enterprise Data Management Loan Portfolio and Agency Administration Loan Syndication, Trading & Agency Loan Trade Settlement Portfolio Modelling & OMS Private Markets Portfolio Monitoring Investor Relations Harness the analytics, advisory solutions, and industry benchmarks to identify the right opportunities. Effectively monitor the financial markets, peers, and their company performance with next-gen solution-based workflow tools and advisory services. Investor Relations Advisory Services Investor Relations Digital Desktop Investor Targeting Market Data Desktop for IR Stock Surveillance & Identification Sustainability Solutions & Reporting Leveraged Loans Simplify operations and gain insights throughout the leveraged loan lifecycle. Our data and software span deal origination, syndication, portfolio modeling, trading, loan servicing, and portfolio risk analysis. Loan Portfolio Administration Loan Pricing & Reference Data Loan Syndication, Trading & Agency Loan Trade Settlement Portfolio Modelling & OMS Post Trade Processing Address compliance, maintain flexibility and keep costs low with trade processing solutions for FX, OTC derivatives, syndicated loans, commodities and documentation. Commodity Tracker Corporate Actions Corporate Actions Data OSTTRA Proxy Voting Risk & Regulatory Managed Services Securities Processing Private Markets Build a 360° view of the private markets with insights, data, software, and tools. Gain transparency into private capital flows at each stage of the fund lifecycle. Work seamlessly across PE, VC, Private Debt, and Real Assets. ESG Solutions Investor Contacts Portfolio Monitoring Private Asset Valuation Services Private Company Data Private Credit Solutions Private Markets Intelligence Risk, Compliance, & Reporting Industry-leading solutions, advisory and managed services changing the way you manage risk and regulatory compliance. Alternative Economic Scenarios Counterparty Manager Country Risk Investment Model Custodian Solutions for Risk and Regulatory Compliance Data Management Cappitech KYC Services Managed Services for Networks & Regulatory Solutions Maritime & Trade Risk & Compliance Supplier Risk Indicator™ Tax Solutions Third Party Risk Management Supply Chain Intelligence Unrivaled data on every stage of the global supply chain. From manufacturers and buyers to shipping and logistics, get the trade coverage you need to stay ahead of the competition. Built with powerful data visualizations and machine learning. Data Management Panjiva Supply Chain Intelligence Global Trade Analytics Suite Country Risk Supply Chain Spend Analytics Supplier Risk Indicator™ Sustainability Manage, measure, and report on ESG risks and opportunities. Our suite of in-depth data, analytics, and expert advisors help guide your ESG journey to a sustainable future. Get an integrated suite of solutions to support unique ESG requirements. Environmental Data and Climate Analytics ESG Data Management ESG Portfolio Analytics Financial Impact of Physical Climate Risks S&P Global ESG Scores TCFD Reporting Sustainability Solutions & Reporting Other (please specify in comments)

- Capital Formation Credit, Risk, & Regulation Data & Distribution Digital Transformation/Tech ESG & Sustainability Economics & Country Risk Financial Technology Solutions Issuer & IR Solutions Leveraged Loans Post Trade Processing Private Markets Risk, Compliance, & Reporting Sector Coverage Supply Chain Other (please specify in comments)

We generated a verification code for you:

- Enter verification Code here? * Incorrect Verification Code

- Yes, I would like to receive promotional emails containing essential industry insights, event invitations, and relevant solutions from S&P Global Market Intelligence.

One of our representatives will be in touch soon.

Thank you for your interest in S&P Global Market Intelligence! We noticed you've identified yourself as a student. Through existing partnerships with academic institutions around the globe, it's likely you already have access to our resources. Please contact your professors, library, or administrative staff to receive your student login.

At this time we are unable to offer free trials or product demonstrations directly to students. If you discover that our solutions are not available to you, we encourage you to advocate at your university for a best-in-class learning experience that will help you long after you've completed your degree. We apologize for any inconvenience this may cause.

Standard & Poor's Capital IQ: Research Reports

- Venture Capital

- Research Reports

- Company Filings

- Idea Generation

- Merger Types

- CFRA's The Outlook

- Business Relationships (Supply Chain)

- Capital Debt Structure

- Financials Glossary

- Industry Surveys

Research Reports on Capital IQ

Using Capital IQ, you can search for analysts' research reports on public companies, mutual funds and industries.

From your dashboard, or any other screen on Capital IQ, place your cursor over the tab titled Research , on the horizontal row of tabs near the top of the page. From there, type in the name or symbol of a company or mutual fund in the search box. Add other criteria as needed. Then press the Search button. The results for company searches may include industry reports as well as company reports. Please note - only research reports published by firms associated with Standard and Poor's, such as CFRA, are available through our Capital IQ subscription. Others are only available in brief summaries.

To search for the latest reports by a specific analyst or firm, leave the Name/Symbol box empty, and select a name from the drop-down menu under Contributors . Next, press the Search button.

CFRA Industry Surveys

To access CFRA's latest industry surveys, select the Industry Surveys tab from the ribbon near the top of the screen.

- << Previous: Venture Capital

- Next: Screening >>

- Last Updated: Jan 26, 2023 2:02 PM

- URL: https://libguides.nypl.org/CapitalIQ

Get 14 Days Free

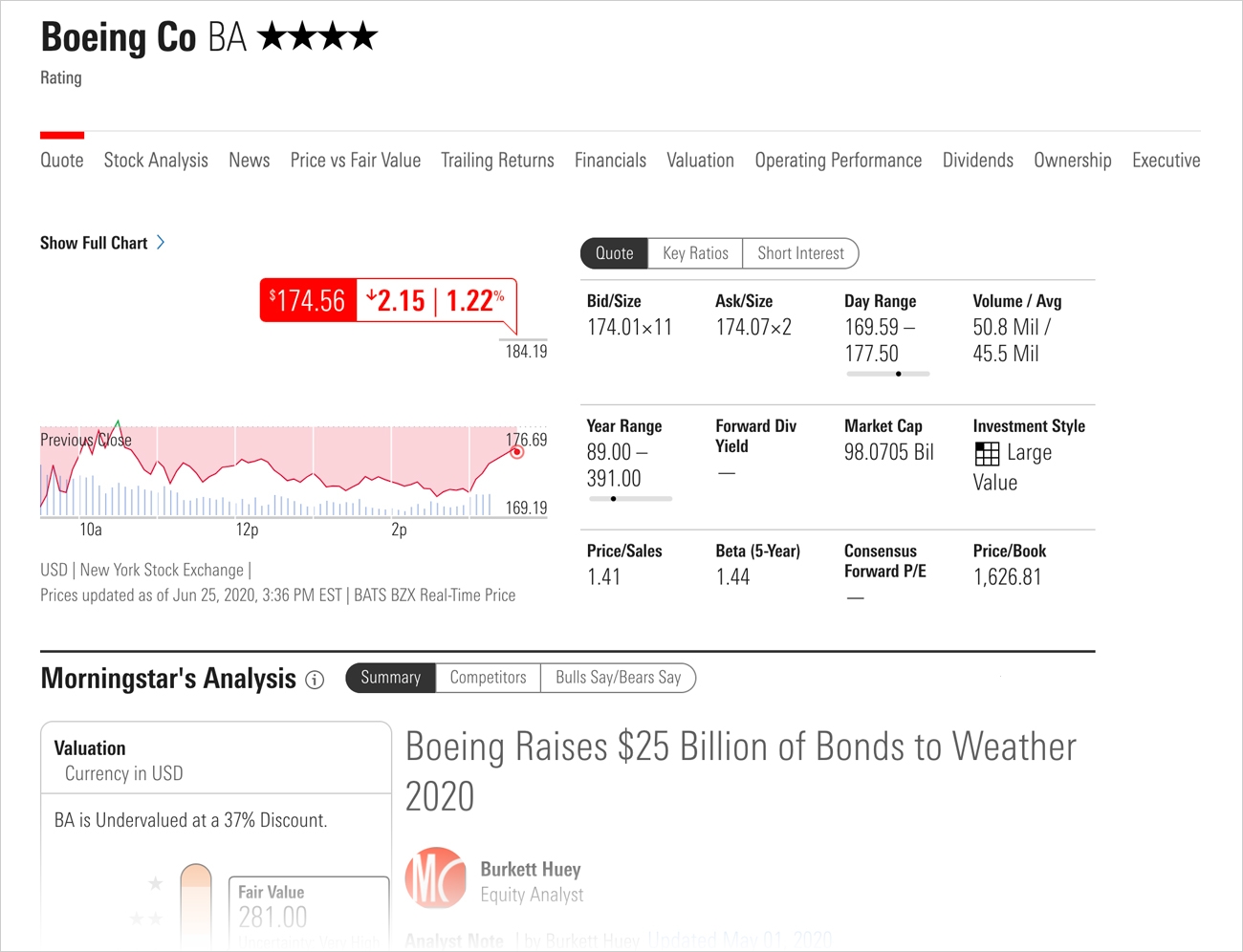

Morningstar Equity Research - published in last 90 days

- All Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- All Star Ratings

- Company Website

- Our Signature Methodologies

Connect With Us

- Global Contacts

- Advertising Opportunities

Terms of Use Privacy Policy Modern Slavery Statement Cookie Settings Disclosures

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here

Penn Libraries FAQ

- Penn Libraries

Q. How do I find analyst reports (investment bank research)?

- Exhibitions

- Fisher Fine Arts

- General Information

- Phased Library Services

- Rare Books & Special Collections

- Systematic Reviews

- University Archives & Records Center

Answered By: Lippincott Library Last Updated: Apr 21, 2024 Views: 172181

Use LSEG Workspace (formerly Refinitiv).

- To find analyst reports (also known as sell-side, broker, or equity research reports) for a specific company, search for that firm's ticker symbol or name in the top search box. Then, on the News & Research menu, click on Company Research . Use filters near the top of the page to refine your search.

- To screen for analyst reports based on a set of criteria, type ADVRES in the search bar and select the Research Advanced Search app, or click on Research in the main menu. then, click on Advanced Research . You can filter for reports by industry, geography, contributor, keywords, and more.

Note: LSEG Workspace has a 150-page daily limit for viewing and downloading research content. This limit is in lieu of retail prices listed on reports and resets at 12:00 AM Eastern Time daily.

Bloomberg (see access details ) contains some analyst reports.

- Type your company's ticker symbol, then hit the yellow EQUITY key, then type DSCO and hit the green GO key.

- To find reports by industry or keyword, type RES and hit the green GO key.

Morningstar equity research reports and analyst cash flow models can be found in PitchBook .

Hoovers contains some analyst reports as well.

- Type in a company name and select the company you want.

- Scroll down the screen; if available, analyst reports appear under Advanced on the left side.

- Share on Facebook

Was this helpful? Yes 0 No 0

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

Search Broker Reports From 1,000+ Sources In Seconds with AlphaSense

Explore the many ways broker research and reports on the AlphaSense platform can power faster, smarter insights and decision-making for your organization.

of the top consultancies

of the top asset management firms

largest pharmaceutical companies

of the S&P 100

Traditionally considered a source of insight for sell-side firms, broker research and reports now provide critical insight for corporate and consulting professionals . In addition, corporate strategy professionals are increasingly turning to broker research to analyze market landscapes and better understand analyst assessments of market and industry trends, as well as performance of competitive peers.

However, manually finding broker reports and extracting the insights they contain requires significant time and effort—think multiple search engine queries and hours of combing through countless documents to identify important information. And even when you locate the right reports, broker research is often stuck behind frustrating paywalls.

The AlphaSense platform transforms the research experience by providing you with access to top broker research and other premium content and data sources , such as Wall Street Insights® , all within a single, centralized platform.

With AI search technology supporting your research, you’ll also be able to quickly identify insights to uncover new opportunities, stay one step ahead of your market competitors, and deliver exceptional results for your clients.

Wall Street Insights®

AlphaSense provides global reports from 1,000+ research providers (comprised of sell-side analysts, strategists, and research teams) that cover companies, industries, asset classes, and economies.

Our default proprietary offering Wall Street Insights® features equity research from the world’s leading brokerage firms including, but not limited to:

- Goldman Sachs

- Morgan Stanley

- Credit Suisse

Wall Street Insights® showcases both real-time and after-market research, is sourced from both broker partnerships and vendors, and covers North America, EMEA, APAC, and LATAM regions.

With Wall Street Insights®, you can conduct more comprehensive competitive analysis , improve client interactions, enhance internal research and strategy, and save your organization time and money with AI and automations.

Broker Reports You Can Access on the AlphaSense Platform

On the AlphaSense platform, users can access several critical types of equity research reports, including:

- Upgrades/downgrades: published when a stock analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

Unlock Market Moving Insights Faster with AI & Automation

When you rely on an equity research platform that utilizes the power of AI search technology, you can be more confident in your research, knowing you are no longer at the mercy of human error. AlphaSense also allows you to automate certain research processes that previously would have required hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

Smart Search

Smart Search technology doesn’t just recognize the keywords included in your query—it understands the intent behind your search, delivering content sources with the highest relevance and value to your search. It allows you to find all relevant data points with a single search, saving countless hours and increasing precision in your research.

Additionally, broker research is often inconsistently tagged because different firms may use different classification taxonomies, or include their own terms to define industries and trends. In addition to recognizing relevant language patterns, Smart Search assigns correct tagging to reports from thousands of analysts and research firms, regardless of which analyst published the report.

Smart Synonyms , our proprietary element of Smart Search, weeds out the sources that may include similar keywords but are not topically significant to your research, meaning you’ll never have to cut through excess noise to find the insights you need.

Relevance Rankings

AlphaSense automatically ranks results by their relevance to your research using a number of algorithmic factors, including search term proximity, Smart Synonyms, and document decay. You can be confident that the content sources at the top of your search results page are the ones most aligned with your current research needs.

Smart Alerts

Without a centralized search system, analysts are left to perform multiple manual searches and parse through Google Alerts for the ones with real relevance. On the AlphaSense platform, real-time alerts are customizable and can be set up for a particular company, industry, keyword, or topic (or a set/list of any of the above).

Customized alerts and watchlists give analysts real-time notifications about important news and updates while also ensuring they aren’t bogged down with alerts that are not in tune with what they really need (i.e. Google Alerts and other public search engine options).

Generative AI

AlphaSense’s generative AI is purpose-built for business professionals, leaning on 10+ years of AI tech development. Our proprietary genAI tool, Smart Summaries , generates insights across all four key perspectives—company documents, news, expert calls, and broker research.

Sourced from across all broker research you are entitled to, published within the past 90 days, and covers sections including:

- Upgrades and downgrades – Covers which brokers have upgraded/downgraded this company within the past 90 days and why

- SWOT analysis – Covers the topics/trends identified as strengths/opportunities or threats/weaknesses from across broker reports about this company

- Competitive landscape – Covers the competitive landscape for this company from across broker reports

The Missing Perspective

Here at AlphaSense, we talk about market research in terms of the four perspectives . For every market-moving event, what are the perspectives of companies, news outlets, industry experts, and analysts on the topic?

Historically, the latter has been the most challenging to access because companies needed to have existing relationships with specific brokerage or investment banking firms to get those insights. But with AlphaSense, you get easy access to multiple firms’ equity research, which allows you to take your research and strategic decision-making to the next level.

Broker research reports have always been used by investors and hedge fund managers to come up with lucrative investment ideas and make smarter investment decisions. Now it is commonplace for cutting-edge corporations to utilize analyst perspectives in order to quickly get smart on market landscapes and understand analysts’ expectations on market trends, industry, and peer performance.

Here are just a few of the ways AlphaSense users rely on broker research to navigate ever-evolving market conditions and stay in the know about important trends:

Forecasting for the Future

In the interconnected world we live in today, economic, socio-political, and natural events that occur continents away can impact the success of your business. You need to know what market experts are saying about what’s happening in the world.

One of the biggest developments from the COVID-19 pandemic was the rise of virtual healthcare, or telemedicine. Using AlphaSense, our users were able to monitor rising mentions of the topic across all four perspectives, but it was specifically broker research that proved to be the most abundant source of information in the platform discussing the future of telemedicine, with analysts unanimously agreeing that healthcare systems will have no choice but to adopt telemedicine into their practices going forward.

Using broker research and our platform, we can forecast the trends and outlooks in the healthcare tech space for the future , based on current trends and analysis in areas like AI, medical robotics, and digital therapeutics

Following the Evolution of a Market Trend

ESG has been a dominant force in the investment world over the past several years. It was a trend that arrived forcefully and showed no signs of slowing down in importance to investors and consumers alike—until it did.

Using AlphaSense, we were able to track the trajectory of the ESG movement—from its meteoric rise to the forefront of corporate discourse to its suddenly uncertain future as public scrutiny and distrust continue to build .

Armed with the four perspectives, AlphaSense users were able to follow changing ESG dynamics and clearly understand the trend’s evolution, including shifting public and company sentiment and expectations. Broker research, in particular, was critical for staying ahead of these shifts. It not only informed users on all relevant information early on, but also gave interpretations and expert analyses of this information, allowing them to manage risk, capitalize on new opportunities, and gain a competitive edge.

Peer Analysis

Peer analysis is critical for organizations to achieve and maintain dominance in their respective fields. This means accurately identifying and interpreting industry trends, opportunities, and threats, so you can respond quickly and effectively. AlphaSense helps you stay informed on your peers with customizable watch lists and alerts that notify you whenever a new investment research piece is published featuring one of the companies in your industry.

When analyzing competitors, it is also important to understand what growth areas those companies are anticipating. By benchmarking competitors’ R&D investments , you can gain valuable insight into companies’ strategies and use that knowledge for your own strategic decision-making.

Broker research provides instant access to sales revenue forecasts for specific products, as well as R&D percentage of sales for specific companies, and you can find every relevant equity research piece quickly and easily in AlphaSense.

Groundbreaking Insights from Industry Experts

Monitoring macro trends and conditions is essential for smart investing and apt decision making for any company. The broker research on AlphaSense provides consistent expert insight and direct commentary on economic trends, opportunities, and challenges, so that you can avoid being caught off guard by an unexpected market-shifting event.

When the popular stationary bike company, Peloton Interactive, first announced its decision to partner with industry giant Amazon, many were blindsided. But those who were relying on the four perspectives available through AlphaSense were able to spot the telling signs and key milestones that led up to this deal .

In particular, broker research in the AlphaSense platform showed that this decision was not unexpected at all, but rather played into Peloton’s overall strategy to recoup lost capital by spending less on digital advertising and relying instead on Amazon’s massive customer base.

Broker Research (aka Equity or Sell-Side Research) involves reports, models, and estimates on companies, industries, fixed income, currencies and commodities, strategy, and economics. Broker reports are reports developed by sell-side firms for consumption by investors, fund managers, and corporate professionals to better understand market dynamics and make smarter business and investment decisions.

You can subscribe to have access to a specific broker’s research content, and/or you can often purchase individual reports or documents you want to access. With a platform solution like AlphaSense, however, you can bypass individual subscriptions and paywalls to access research in a single, centralized place.

The “best” brokerage report depends on your specific needs and research goals. Top brokers in the research field include JP Morgan, Credit Suisse, Morgan Stanley, Barclays, and HSBC (among others) — all accessible on the AlphaSense Platform.

Check that the broker is registered with the SEC . You can also use FINRA’s BrokerCheck Database to research broker track records and credentials in-depth.

AlphaSense’s premium research database (including exclusive Wall Street Insights® ) offers comprehensive data combined with in-depth capital market expertise.

Coupled with advanced AI-powered semantic search capabilities, analysts and researchers are able to access information faster, analyze market sentiment across multiple sources, and pinpoint the exact insights they need to inform decisions.

When you’re on the AlphaSense platform, you can say goodbye to individual subscription expenses, the need for manual, time-consuming research, and a reliance on outdated search methods (like CTRL-F) to find important insights.

AlphaSense provides access to many types of broker reports — industry analyses, flash reports, commodities reports, company analyses and more — from top names in the research field, including:

- Morningstar

- Deutsche Bank

Try AlphaSense for Free

The AlphaSense platform offers access to premium content that powers confident research—you’ll have the tools, resources, and support you need to execute a full-scale strategy to drive results.

If you’re ready to level up your research for smarter investing, start by exploring all that AlphaSense has to offer.

5 Critical Content Sources for Conducting Market Research

Alternative Data

What’s The Best Way To Consume Broker Research?

Equity Research Reports: What’s In Them & How to Access

Private Equity Trends and Outlook for 2024

- Search Search Please fill out this field.

- Equity Research Analyst: The Job

- Career Paths

- Educational Qualifications

- Advanced Positions

- Additional Qualifications

- Equity Research Analyst FAQs

Equity Research Analyst: Career Path and Qualifications

:max_bytes(150000):strip_icc():format(webp)/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

Equity research analysts work for both buy-side and sell-side firms in the securities industry. They produce research reports, projections, and recommendations concerning companies and stocks. Typically, an equity analyst specializes in a small group of companies in a particular industry or country to develop the high-level expertise necessary to produce accurate projections and recommendations .

These analysts monitor market data and news reports and speak to contacts in the companies and industries they study to update their research daily.

Key Takeaways

- Equity research analysts work for both buy-side and sell-side firms in the securities industry producing research reports, projections, and recommendations surrounding companies and stocks.

- Most equity research analysts have a bachelor's degree in finance, accounting, economics, or business administration.

- Having a background in statistics and mathematics is beneficial for equity research analysts.

- Senior equity research analysts often have a master's degree. A Chartered Financial Analyst (CFA) designation, awarded by the CFA Institute, is recommended for analysts who want to move up the career ladder.

What Does an Equity Research Analyst Do?

In a buy-side firm—such as a wealth management firm , a pension fund, or a hedge fund—an equity research analyst typically supplies information and recommendations to the firm's investment managers, who oversee client investment portfolios and make final decisions about what securities to hold.

In a sell-side firm, such as a brokerage or a bank, an equity research analyst typically produces reports and recommendations for the firm's sales agents. The agents then go on to use the information to sell investments to their clients and the general public.

Analysts generally spend less time on financial modeling and more time writing reports and developing recommendations.

Career Paths in Equity Research

Most equity research analysts begin in entry-level research associate positions after completing bachelor's degree programs. Research associates work under the direction of a senior equity research analyst creating financial models and conducting research. New hires may work with a variety of analysts over the course of months as a general introduction to the job.

Most research associates are eventually assigned to a single working group covering a small group of firms. With more experience and excellent performance, associates can move directly into analyst positions, taking more active roles in the research process.

Educational Qualifications for an Equity Research Analysts

To work in equity research , a candidate must have a bachelor's degree, preferably in a relevant business discipline such as finance, accounting, economics, or business administration. Undergraduate degrees that provide in-depth quantitative training are also good options, including degrees in mathematics, statistics, engineering, and physics.

A master's degree is not required to advance into senior analyst positions. However, a master's degree in business administration or finance can help pave the way for career advancement, especially advancement into portfolio and fund management positions.

Many equity research analyst positions require a license from FINRA.

Non-business majors should consider taking some courses in finance and other business disciplines if considering a career as an equity research analyst.

Advanced Positions in Equity Research

After several years of working in junior positions, some analysts return to school to earn master's degrees.

Although, high-performing analysts may continue into more senior research roles without returning to school. A senior equity research analyst who has a high degree of expertise in their specialty area can move into an investment management role overseeing a research team and an investment portfolio.

A portfolio manager is responsible for using the information supplied by equity research analysts and other staff to manage the mix of securities in a portfolio daily.

Other Qualifications for Equity Research Analysts

The preeminent professional qualification for equity research analysts and others working in securities research is the Chartered Financial Analyst (CFA) designation, which is awarded by the CFA Institute .

This designation requires candidates to have a minimum of 4,000 hours of qualifying experience. Consequently, it is generally considered a qualification for advancement into more senior positions in the field. The designation requires candidates to pass a series of three examinations.

Many equity research analysts require a license from the Financial Industry Regulatory Authority (FINRA) , a national body charged with oversight of securities firms and brokers. The licensing process typically requires sponsorship from an employing firm, so most analysts complete license requirements only after hiring is complete.

How Much Does an Equity Research Analyst Get Paid?

According to GlassDoor, the average salary for an equity research analyst in the U.S. in 2023 is $114,225.

How Many Hours per Week Can a Research Equity Analyst Expect to Work?

An equity research analyst can expect to work up to 60 hours per week on a typical week, which can increase to upwards of 80 hours per week during earnings season.

Who Do Equity Research Analysts Work for?

Equity research can be divided into sell-side and buy-side firms. Sell-side analysts work for investment banks and brokerages and research stocks in order to provide investment recommendations for their clients and the public. Buy-side analysts research stocks to identify investments for their own firm to invest in.

CFA Institute. " Become a Member ."

Financial Industry Regulatory Authority. " Standards for Admission ."

GlassDoor. " How Much Does an Equity Research Analyst Make? "

Mergers and Inquisitions. " The Equity Research Associate: Remnant of a Dying Industry, or the Hero That Gotham Deserves ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-167326832-5c3762a446e0fb000128fb6a.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore Blockchain

Client Service

Process Payments

Manage Funds

Safeguard Information

Banking-as-a-service

Send Payments

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve