Business Acquisition Plan: What to Include in 2024 (+ Template)

Kison Patel is the Founder and CEO of DealRoom, a Chicago-based diligence management software that uses Agile principles to innovate and modernize the finance industry. As a former M&A advisor with over a decade of experience, Kison developed DealRoom after seeing first hand a number of deep-seated, industry-wide structural issues and inefficiencies.

A business acquisition plan is an important component of planning for an M&A transaction, regardless of whether you require external financing. A solid business acquisition plan should lay out the rationale for the investment, and how it will add value for the entity. In this article, FirmRoom takes a closer look at how these documents should be crafted.

Understanding Business Acquisition Plan

A business acquisition plan is a strategy document, which serves the purpose of a business plan for an M&A transaction.

It outlines the motives behind a transaction, profiles of the companies involved in the transaction, how the transaction will generate value for the entity which is driving it, how the two companies will be integrated, and how the merged company (or simply acquired company in the case of an investment firm acquiring a company) is expected to perform.

Reasons to Have a Business Acquisition Plan

An acquisition plan provides its users with a roadmap to making the transaction a success. Even before the transaction is initiated, it acts as a reminder to the sponsors, what they’re looking for, why they’re looking for it, and how they’re going to ensure that the transaction is a success.

In general terms, the reasons to have a business acquisition plan are:

Strategic alignment

The overriding goal of a business acquisition plan, as the opening text alludes to, is strategic alignment: ensuring that those undertaking the deal, for lack of a better expression, ‘stick to the plan’, around the motives and means for making the deal a success.

Valuation and pricing

The plan should include strategies and methodologies for valuing the target company. It should guide the deal participants on how to determine a fair value for the target, assess synergies, and estimate future financial returns. It also sets a limit on how much the company can extend itself financially for a deal to occur.

Financing and resource allocation

Financing (sources and uses of funds) is just one part of the resource allocation conundrum. The business acquisition plan also outlines the working capital needs, who works where, how expenditures are going to shift, what capital assets are required, and more.

Business Acquisition Plan Template

The insight that FirmRoom has gained from working with hundreds of companies on thousands of transaction, have been collated in a business acquisition plan template.

This provides a detailed roadmap of what should be included in an effective business acquisition plan, ensuring that its users have everything in place for the conclusion of a successful transaction.

{{widget-download}}

Creating a Business Acquisition Plan Step-by-Step

While developing a business acquisition plan is recommended, having an ineffective acquisition plan is worse than having none at all.

The document has to be watertight, creating no doubt in the reader’s mind about the benefits of an acquisition.

A strong business acquisition plan should make the reader think that it makes far more sense to go ahead with the transaction than for the company to continue in the status quo.

That being said, the following should only be seen as a rough step-by-step guide to putting together a business acquisition plan:

Strategy development

Best practice:

- Identify where the company wants to be in each of the next five years, possibly on a month-by-month basis, and how it plans to get there. See here for example.

- Identify the key performance indicators that need to be tracked to ensure that the company meets these objectives.

- Based on both of the above, ask whether an acquisition is a crucial part of the company achieving those objectives, before moving forward.

Identifying and evaluating target companies

- Understand where the companies that fit into the strategy will be found , and be thorough and objective in the search for them.

- Be realistic about the companies that can be acquired/merged with, including valuations , so as not to waste resources for other companies and your own.

- Remember that just because a company is the only one that’s available, it doesn’t mean that a transaction is a good idea.

Due Diligence

- Use technology ; any M&A practitioner that decides against using a sound technology platform for due diligence is doomed to failure.

- Adopt a mindset where due diligence is considered an investment in the acquisition, rather than a cost to your own company;

- Do not fall for the M&A acquirer’s fallacy of ‘we’ve come this far, so we can’t go back.’ If due diligence says the deal isn’t right, it isn’t.

- Begin the post-merger integration phase as soon as the deal begins to look like a realistic possibility (something which DealRoom is designed to cater for).

Deal structure and negotiation

- Leverage the findings of due diligence to create a more informed negotiation process.

- Remember that there will be back and forth with the seller, and they can be reasonably expected to overvalue their asset.

- Consider all market outcomes (i.e. downturns, current value of stock vs. future value, etc.) when creating an offer. Avoid irrational exuberance.

Post merger integration (PMI)

- Keep in mind at all times during the PMI phase that this is where most of the value can be generated and lost in a transaction.

- As mentioned, begin the process as soon as possible. If the transaction is visible on the horizon, you need to start thinking about its integration.

- Don’t write this off as a ‘soft’ or unnecessary part of the transaction - it won’t be soft when it impacts on your income statement.

Common mistakes to avoid when writing a business acquisition plan

Despite plenty of advice to the contrary, enthusiastic CXOs often write acquisition plans which fail to avoid the pitfalls.

These are among the most common:

Putting the acquisition before the strategy

The acquisition is part of the overall strategy, not the other way around. Companies that are approached by others about a deal, and then somehow convince themselves that there is a strong rationale for a deal, fall foul to this backwards logic.

Management hubris

M&A is an area ripe with management hubris (take a glance at Google Scholar at all the academic texts that link the two). That means management hubris inevitably finds its way into business acquisition plans. Avoid it at all costs - it’s a highly costly behavioural pattern for companies of all sizes.

Lack of detail

The business acquisition plan is a strategy document, not a marketing one. That is to say, it should break down in a step-by-step fashion how the deal will generate value. The more detailed the better. “Creating an outstanding organization” is great, but writing it in the business acquisition plan won’t add any value.

Business acquisition plan template

A business acquisition plan is a hugely worthwhile document that all M&A practitioners should write in order to discern the value of a transaction and how that value can be extracted. It is the business plan for an M&A transaction.

Get your free template below to receive guidelines on how to create the document and make it work for your transaction.

Frequently Asked Questions (FAQs)

Successful acquisition starts with a great plan

Get your roadmap for precise valuation planning to due diligence checklists and synergy tracking. Close deals faster, smarter.

.png)

Quick Links

Training & Support

Download Free Merger and Acquisition Templates for Business

By Joe Weller | February 15, 2019

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, you’ll find 20 of the most useful merger and acquisition (M&A) templates for business (not legal) use, from planning to valuation to integration. These templates are available for free download in Microsoft Excel, Word, and PowerPoint formats, as well as PDF files.

Free M&A Planning and Strategy Templates

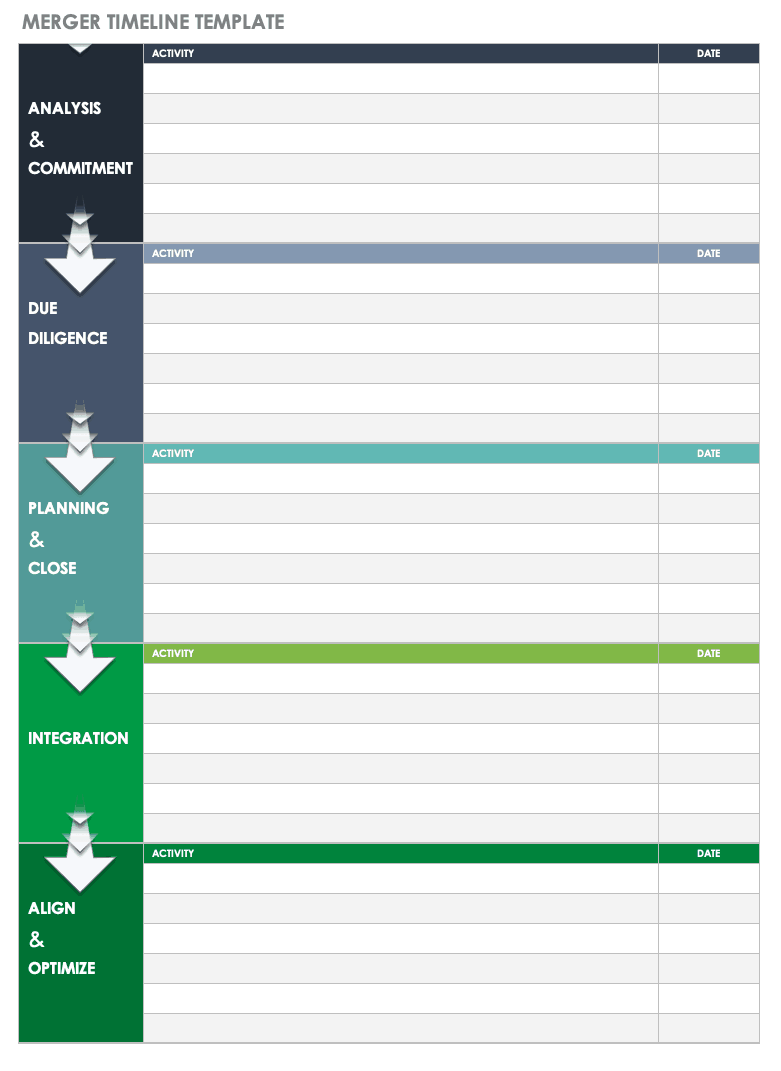

Merger timeline template.

This simple template provides a visual outline for your merger schedule. The timeline separates the phases of a typical merger, with space to list key activities and due dates. You can use this initial schedule throughout the process as a blueprint for your efforts.

Download Merger Timeline Template

Excel | Word | PDF | Smartsheet

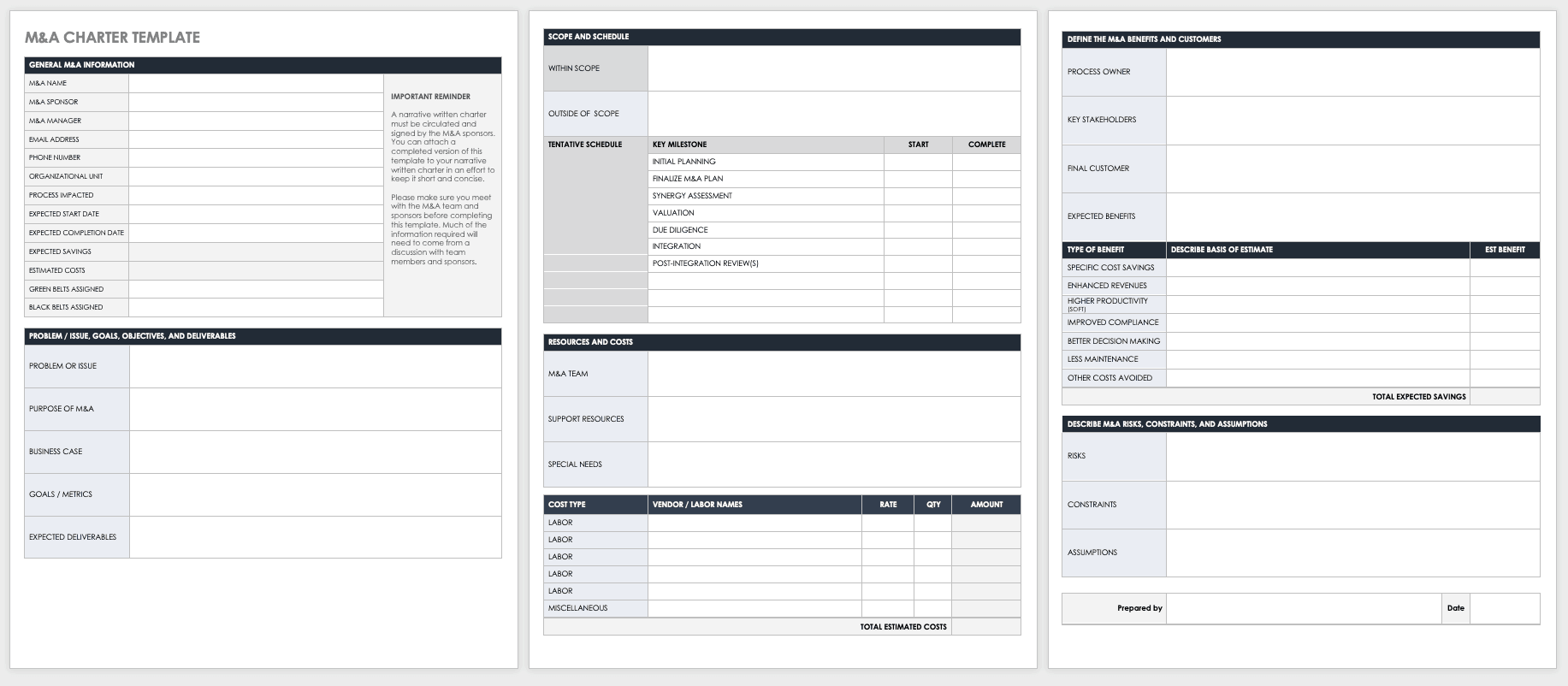

M&A Project Charter Template

A project charter is a formal narrative document in which you detail your goals, proposed budget, schedule, and responsibilities, as well as the problems you hope to solve with your venture — in this case, a merger or an acquisition. Use the Excel template to outline the planned aspects of the M&A; it will be the blueprint for the final narrative document in Word or PDF.

Download M&A Project Charter Template

Excel | Word | PDF

Roles and Responsibilities Template

A merger or acquisition will succeed only when everyone understands their roles and responsibilities from the outset. Use this standard roles and responsibilities template to organize team members by project and list their duties at each phase of the merger. Additionally, you can use this template for staffing and retention when you integrate organizations.

Download Roles and Responsibilities Template

Excel | Word

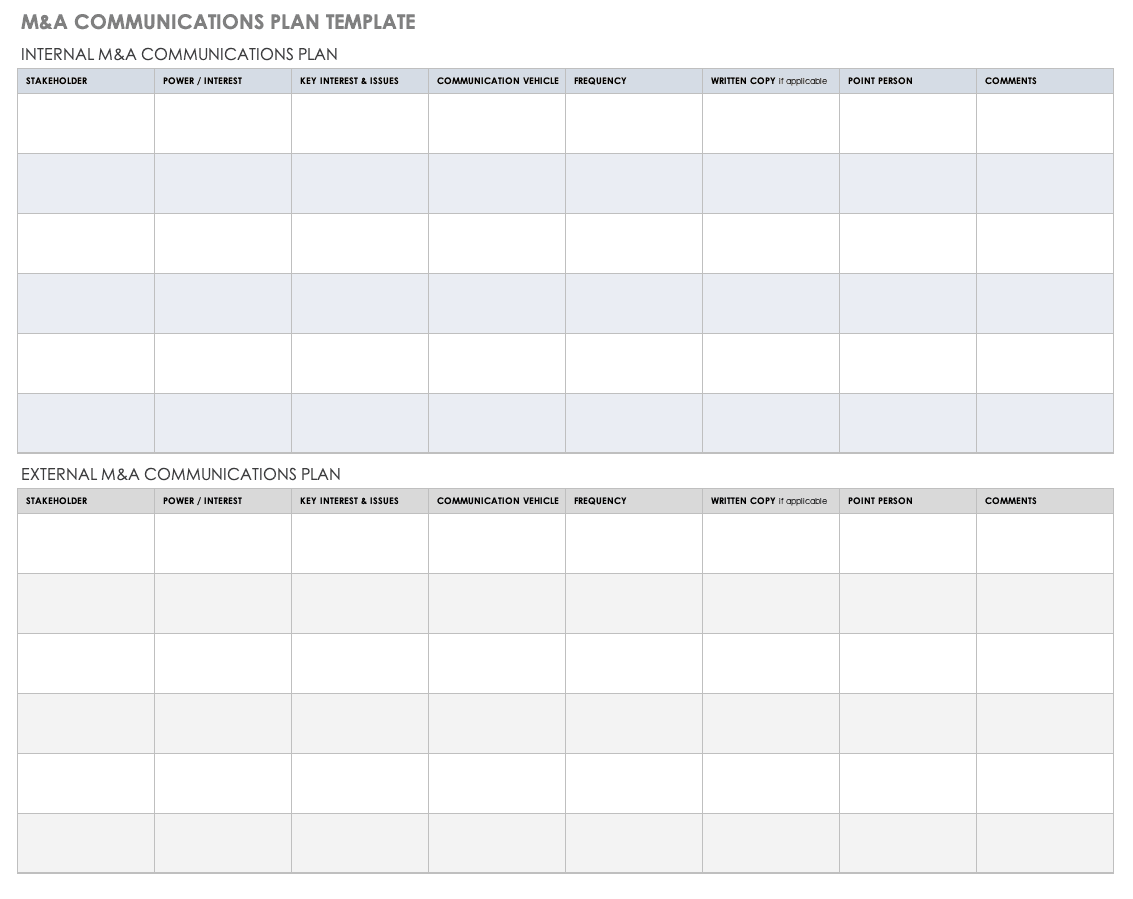

M&A Communication Plan Template

Use this template to plan communication for all stakeholders throughout the M&A process. This template includes separate charts for internal and external communications. It has space to list each stakeholder’s power or interest, their key issues, their communication vehicle and point person, their written copy, their frequency of communication, and any additional comments. Planning your communication at the outset — and updating your strategy along the way — can help ensure that both outside stakeholders and current employees stay up to date throughout the implementation process.

Download M&A Communication Plan Template

Excel | Word | PDF

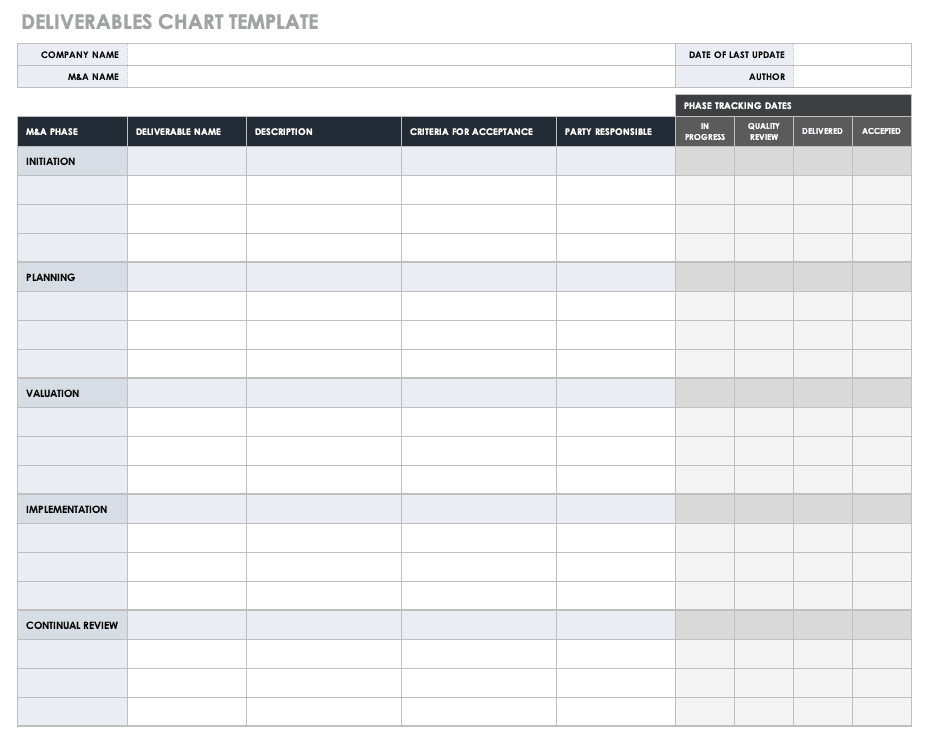

Deliverables Chart Template

This template provides a chart to list each deliverable at every stage of the M&A process, from initiation and valuation through implementation and review. List each deliverable, description, criterion for acceptance, and party responsible, and easily track the status of each item. Built-in child rows allow you to add project phases if your merger or acquisition requires more steps. Refer to this deliverables chart throughout integration to ensure you haven’t missed any details.

Download Deliverables Chart Template

M&A Press Release Template

Available as Word and PDF files, this template provides an outline for formally announcing news of a merger or acquisition. The template includes space for company logo(s), the deal agreement, contact and background information, quotes from executives, and the company boilerplate. But you can add or delete sections to fit the needs of your press release. You can find additional press release templates for business use here .

Download M&A Press Release Template

Word | PDF

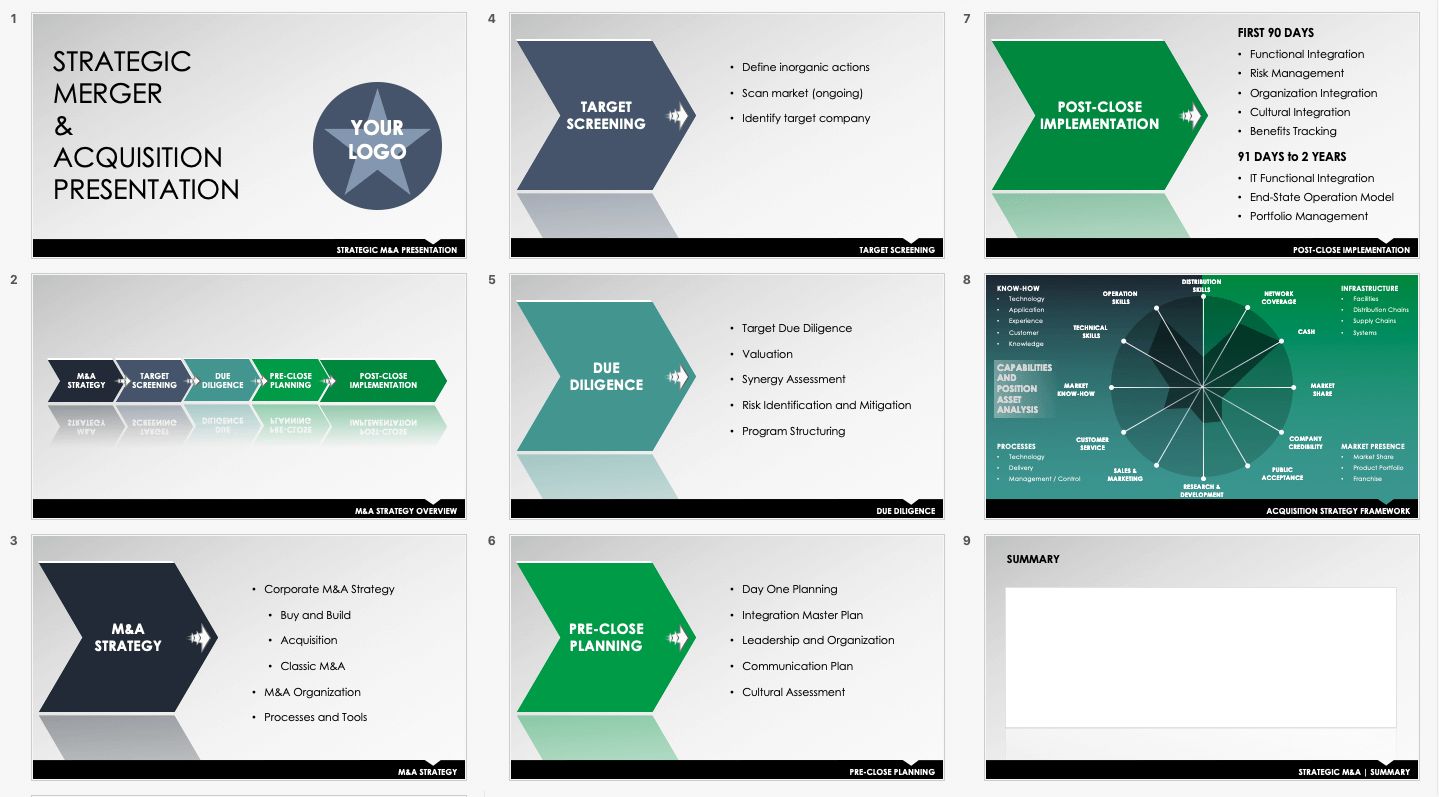

Strategic M&A Presentation Template

Use this PowerPoint deck to present the business case for your M&A strategy. The template includes a slide for each phase of the merger or acquisition, with space to detail your intended approach and processes. The final slide enables you to list list strengths, weaknesses, and resources for different aspects of the target company in a pre-built infographic and functions as a high-level capabilities and asset analysis. Showcase your well-researched strategy and plan with this professional M&A proposal template.

Download Strategic M&A Presentation Template - PowerPoint

Free M&A Valuation and Process Templates

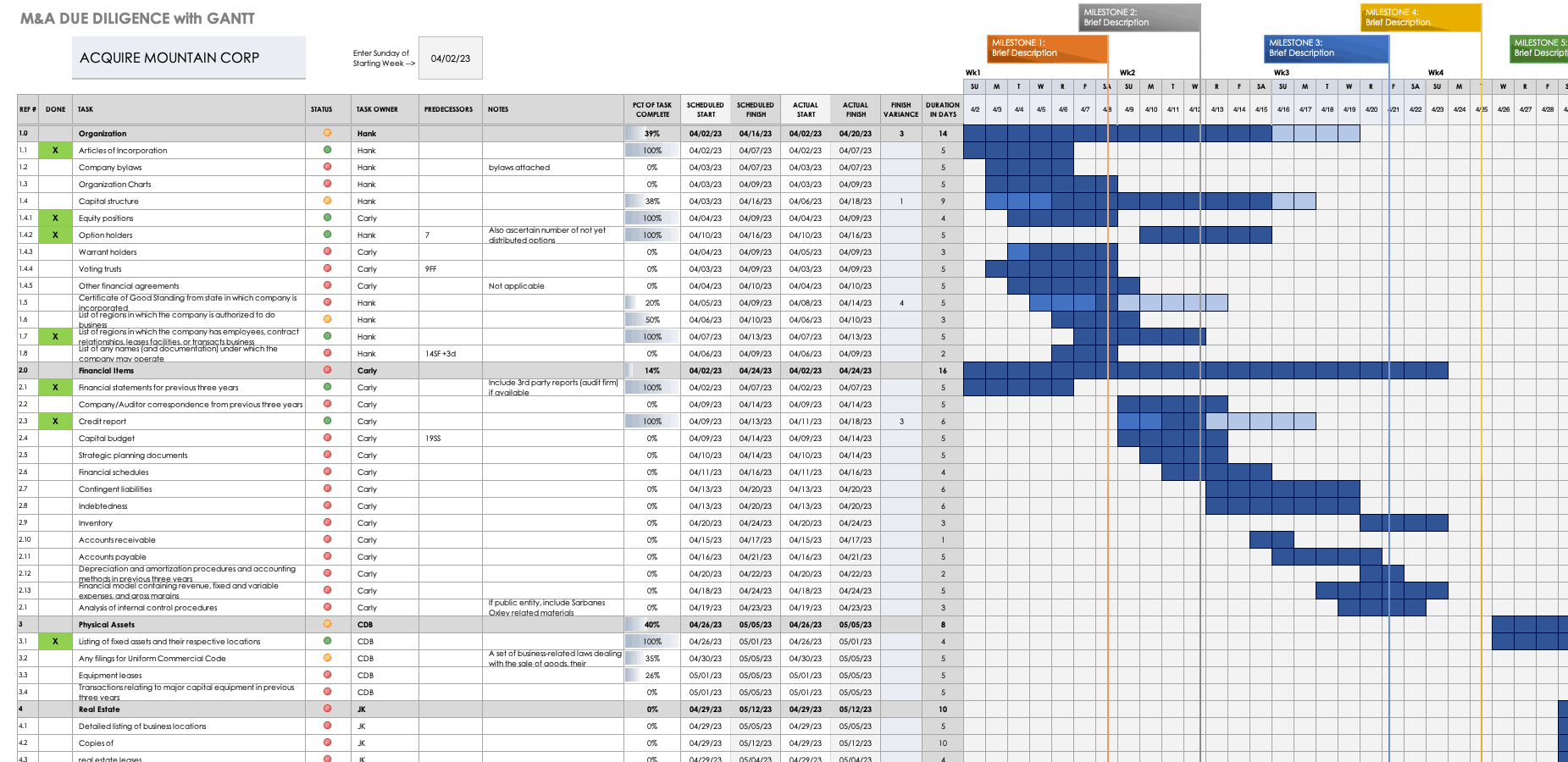

Due diligence template.

Use this template to track and store information about each due diligence item. List all reference information about the item, along with the start and end dates, the party responsible, and the status. Additionally, the built-in Gantt chart allows you to simultaneously track multiple items against your project schedule, so that you can stay on top of every detail and adapt the timeline as needed.

Download Due Diligence Template - Excel

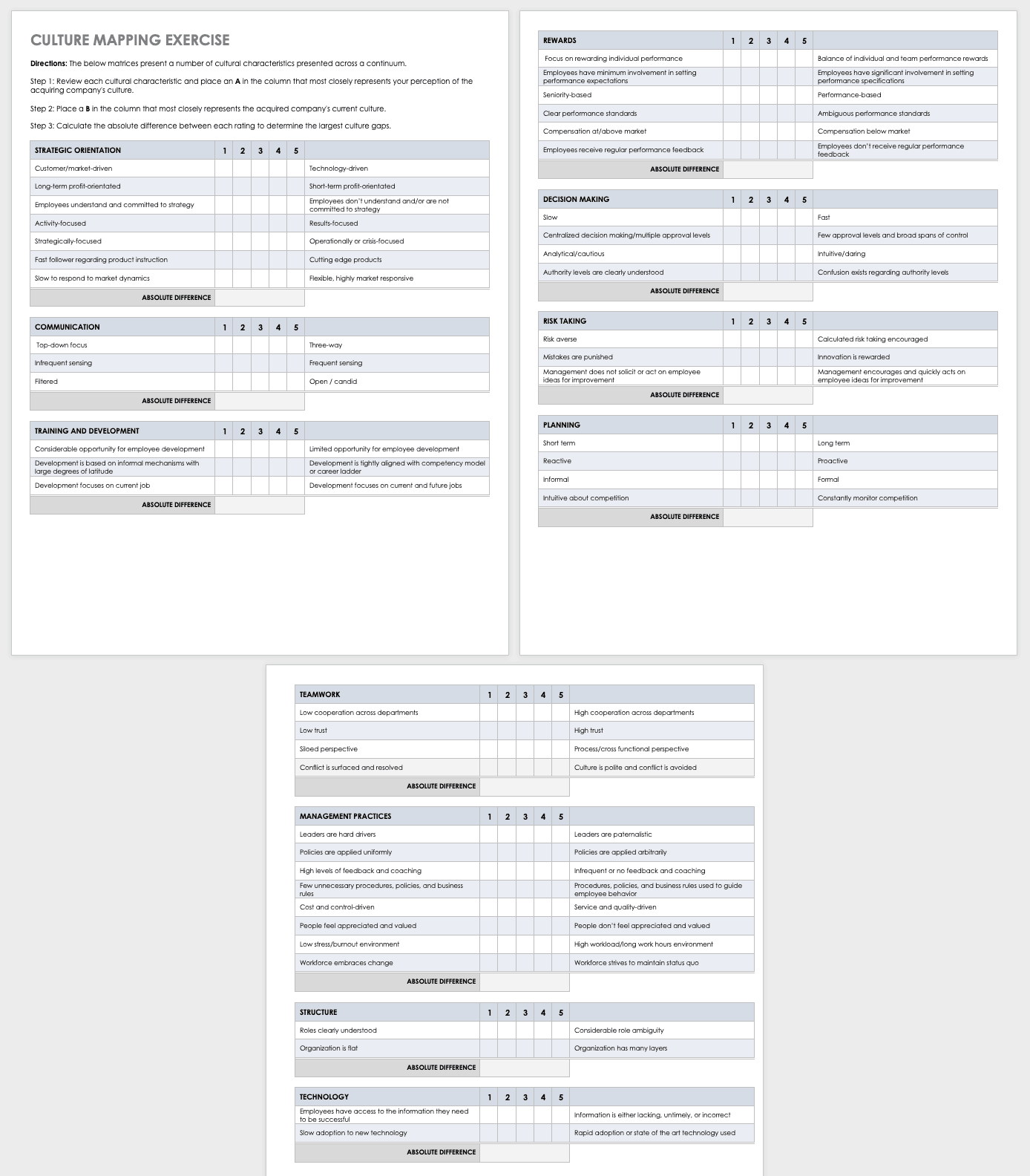

Synergy and Culture Mapping Exercise

Evaluating company synergy is not only about financials, but also about culture. This template walks you through a culture analysis: Using a scale from 1 to 5, evaluate multiple aspects of a company’s strategic orientation, communication, training and development, planning, teamwork, and other operations categories. This exercise will help you identify differences in the two companies, so you can address them during implementation.

Download Synergy and Culture Mapping Exercise

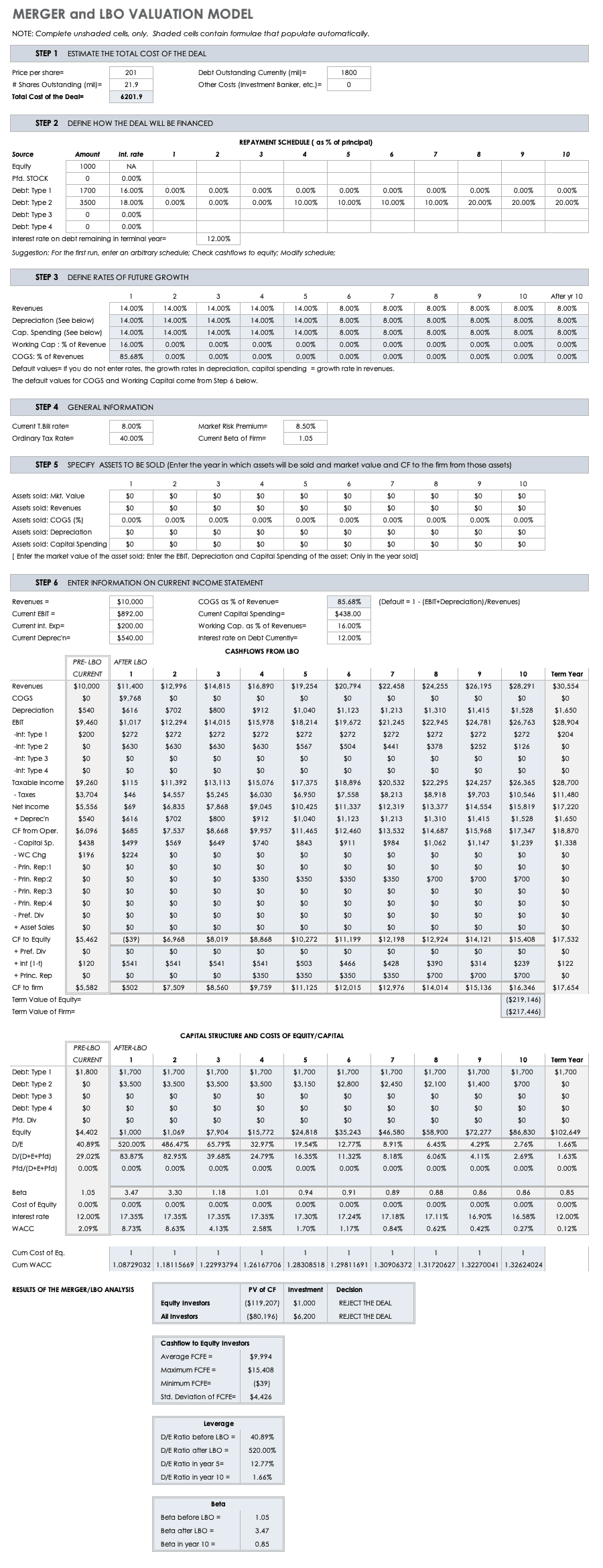

Merger and LBO Model Valuation

A leveraged buyout (LBO) is a type of transaction in which the acquiring company uses borrowed money — including its own and the target company’s assets and equity — to cover the cost of acquisition. This template provides a step-by-step valuation for an LBO, with sample data to guide your own calculations.

Download Merger and LBO Model Valuation

Excel | Google Sheets

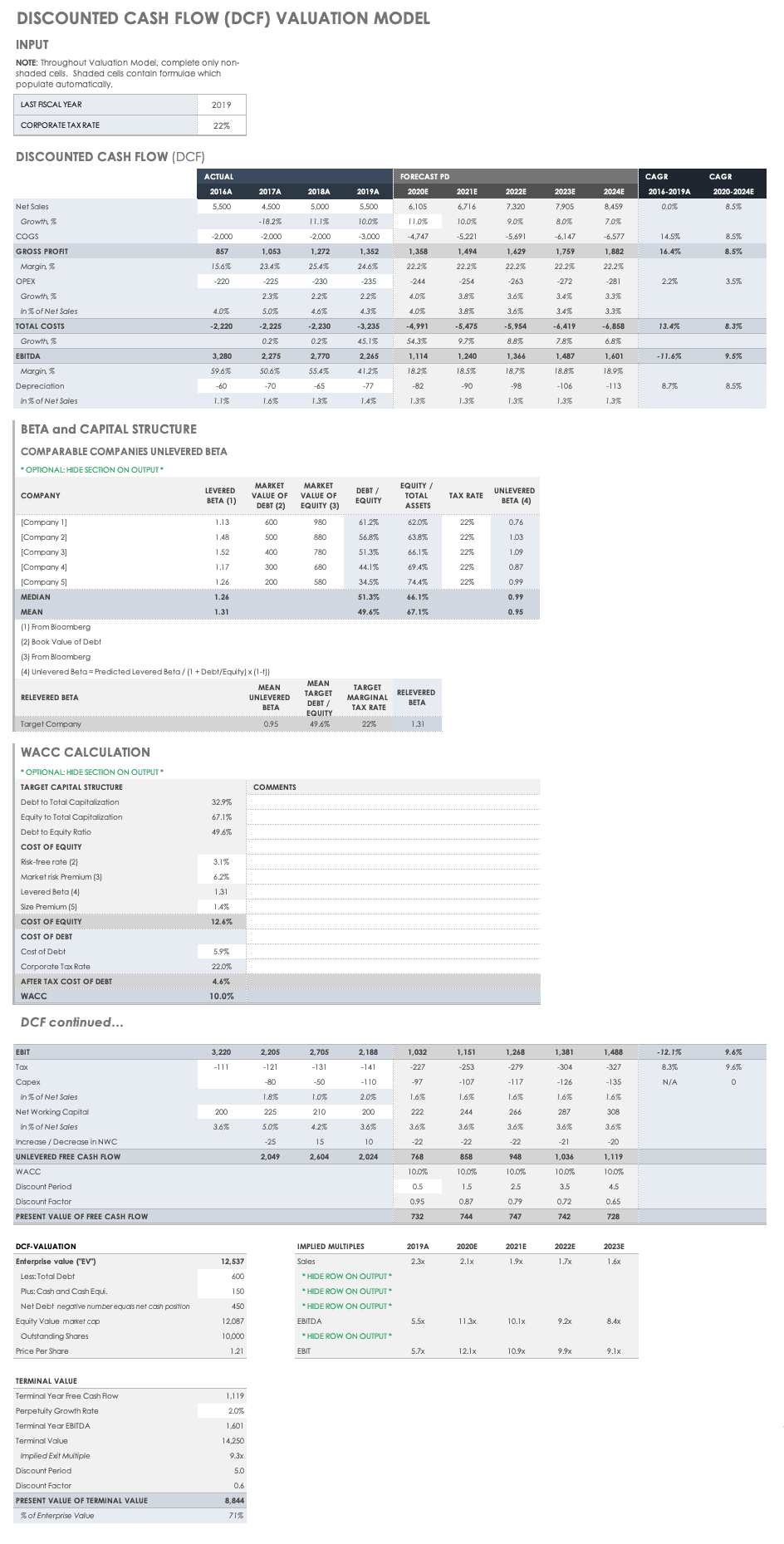

Discounted Cash Flow Valuation Model

Discounted cash flow (DCF) is a valuation method that you can use to evaluate an investment (in this case, merging with or acquiring a company) based on estimates of its future cash flow. Use this template to find the present value of expected future cash flow by inputting net sales, profit, and other financial information, and follow the calculations to determine the value of the investment.

Download Discounted Cash Flow Valuation Model

Free M&A Integration Templates

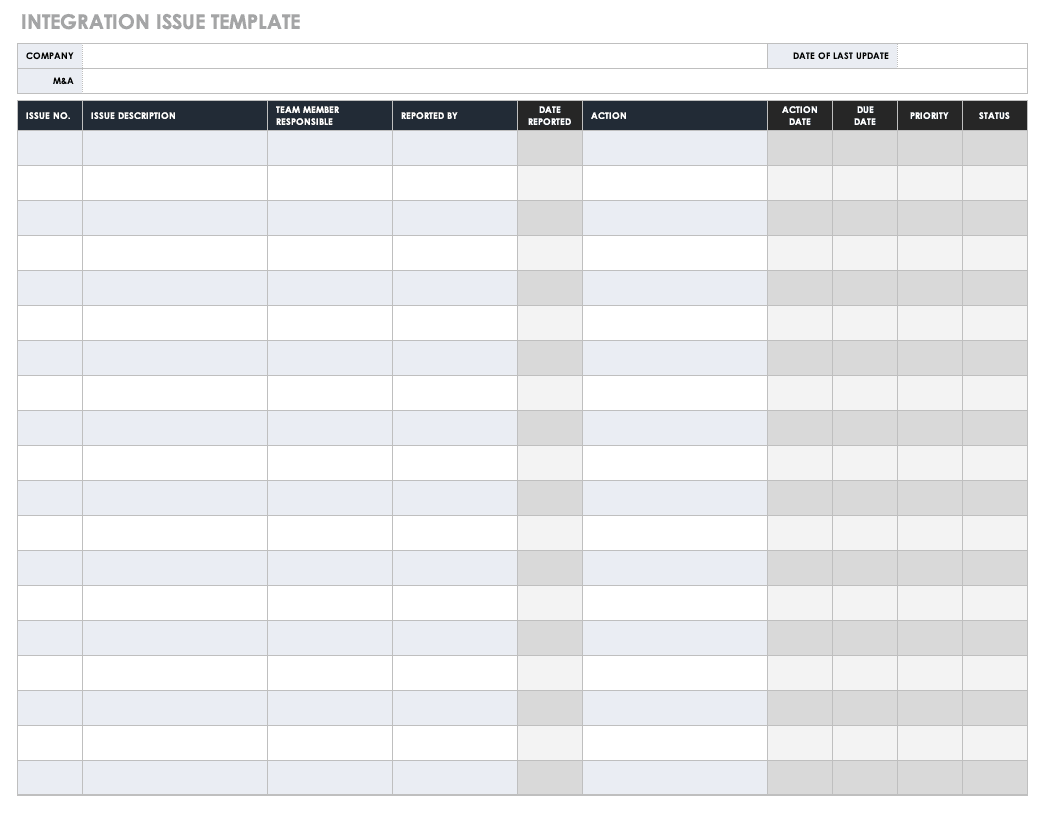

Integration issue form.

Issues are bound to come up during integration, and this simple issue form allows you to track these challenges. The chart includes sections for listing a number and a description for the issue, as well as the team member responsible, the date it was reported, the action taken, the priority, and the status. Thus, you can monitor both the issues that arise and the responsiveness of your team throughout the integration process.

Download Integration Issue Form

Excel | Word | PDF | Smartsheet

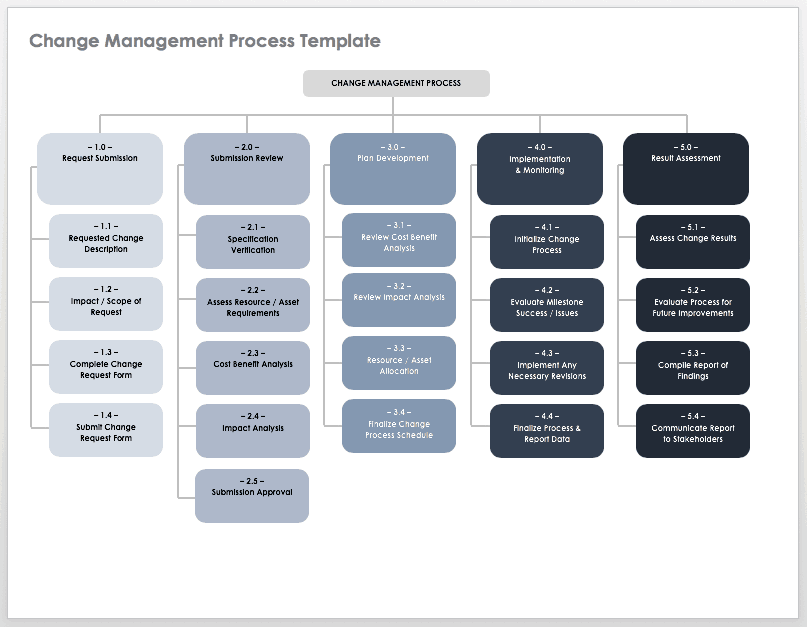

Change Management Process Template

Just like any organizational change, integration requires planning. Use this change management template to outline the processes that will help you integrate the companies’ cultures, finances, roles and responsibilities, and more. This template is formatted like a flow chart, so you can view the entirety of the process schedule.

Download Change Management Process Template

Word | PDF | Smartsheet

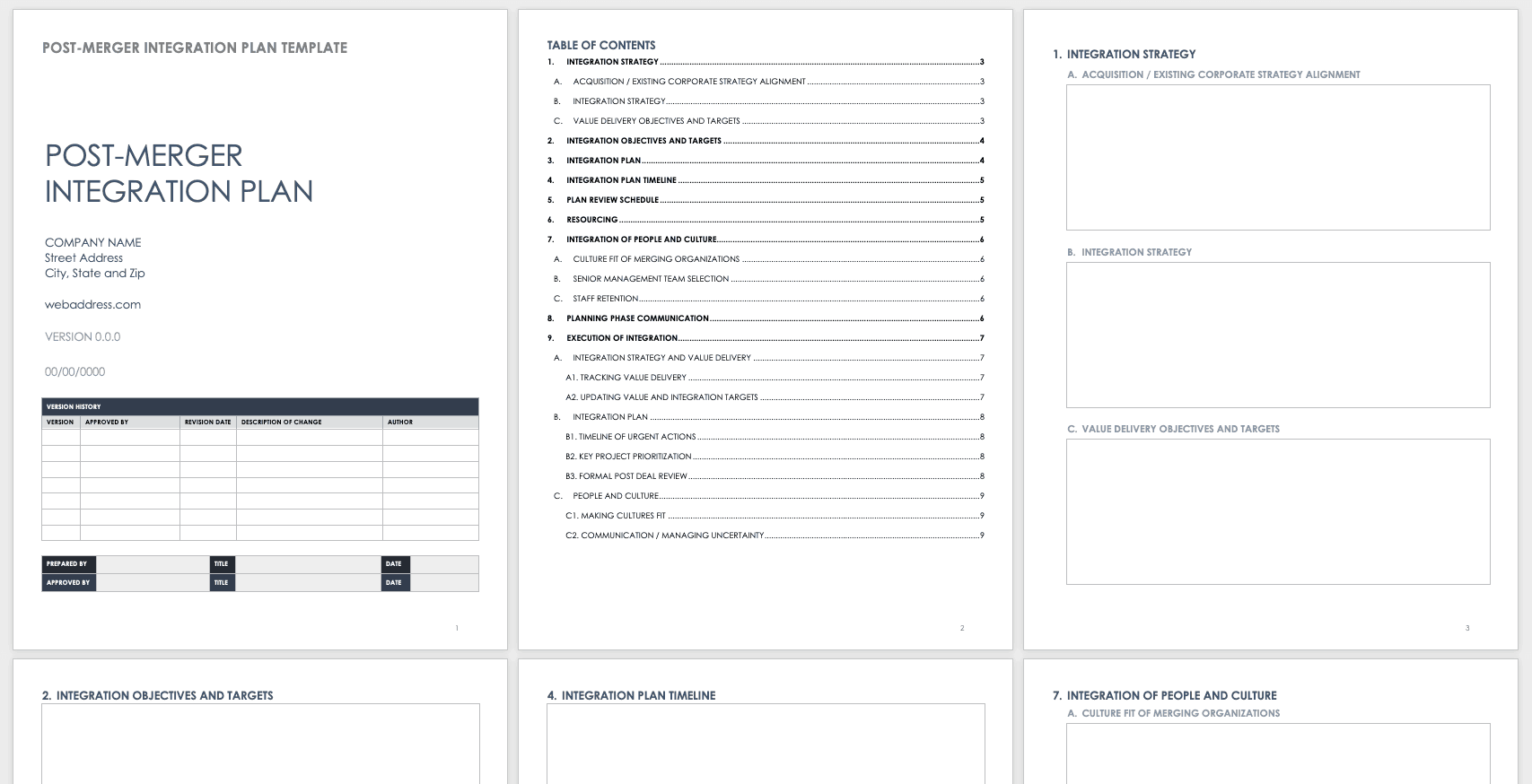

Post-Merger Integration Plan

Once you’ve closed the deal, you need to create an integration plan — typically, a lengthy document that outlines the changes facing each department in terms of structure, communication, and culture. Use this template to detail your integration strategy, objectives, resourcing, and execution plan. This template outlines the categories you can include, but you can adapt it to fit your needs.

Download Post-Merger Integration Plan

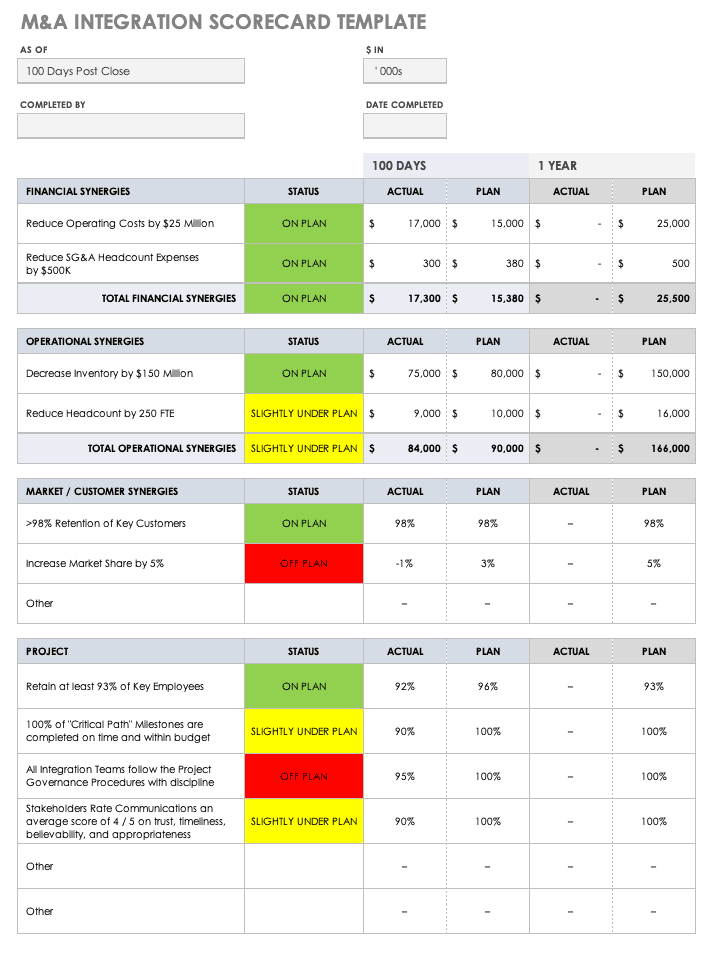

M&A Integration Scorecard Template

Use this template to evaluate integration 100 days and one year after you close the merger or acquisition. The template includes sections for detailing financial and operational synergies, total cost savings, market and customer synergies, and goals and projections for the coming year. By using a scorecard, you can hold yourself accountable to your initial objectives and take lessons for the future. Download the template in Excel or Word for internal data-gathering or as a PowerPoint slide to present to stakeholders and executives.

Download M&A Integration Scorecard Template

Excel | Word | PDF | PowerPoint

Additional M&A Templates

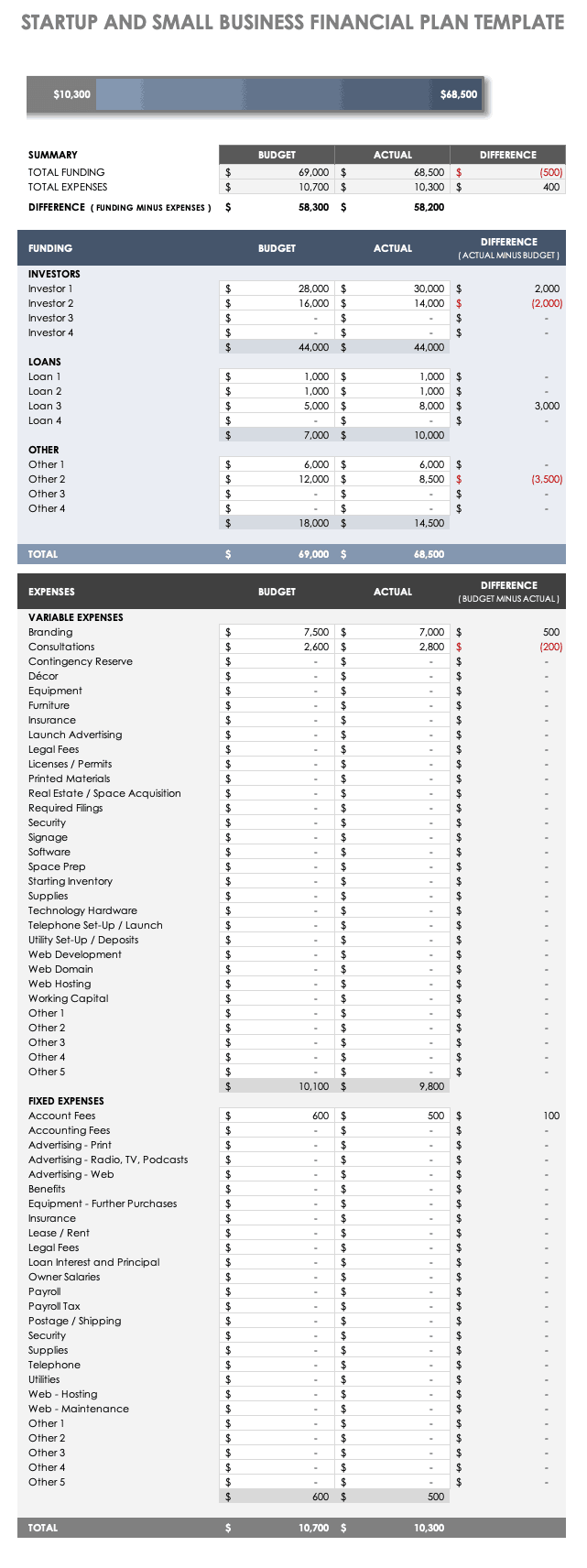

Startup and small-business financial plan.

The templates in this section are not specific to M&A transactions, but they help in the planning and due diligence phases of the process.

Startups and small businesses face different considerations and constraints than do large corporations. Use this simple Excel template to list costs, loans, and expenses, as well as to identify funding sources. This template functions similarly to a budget plan in that it allows you to track estimated and actual costs, as well as make adjustments along the way.

Download Startup and Small Business Financial Plan

Excel | Smartsheet

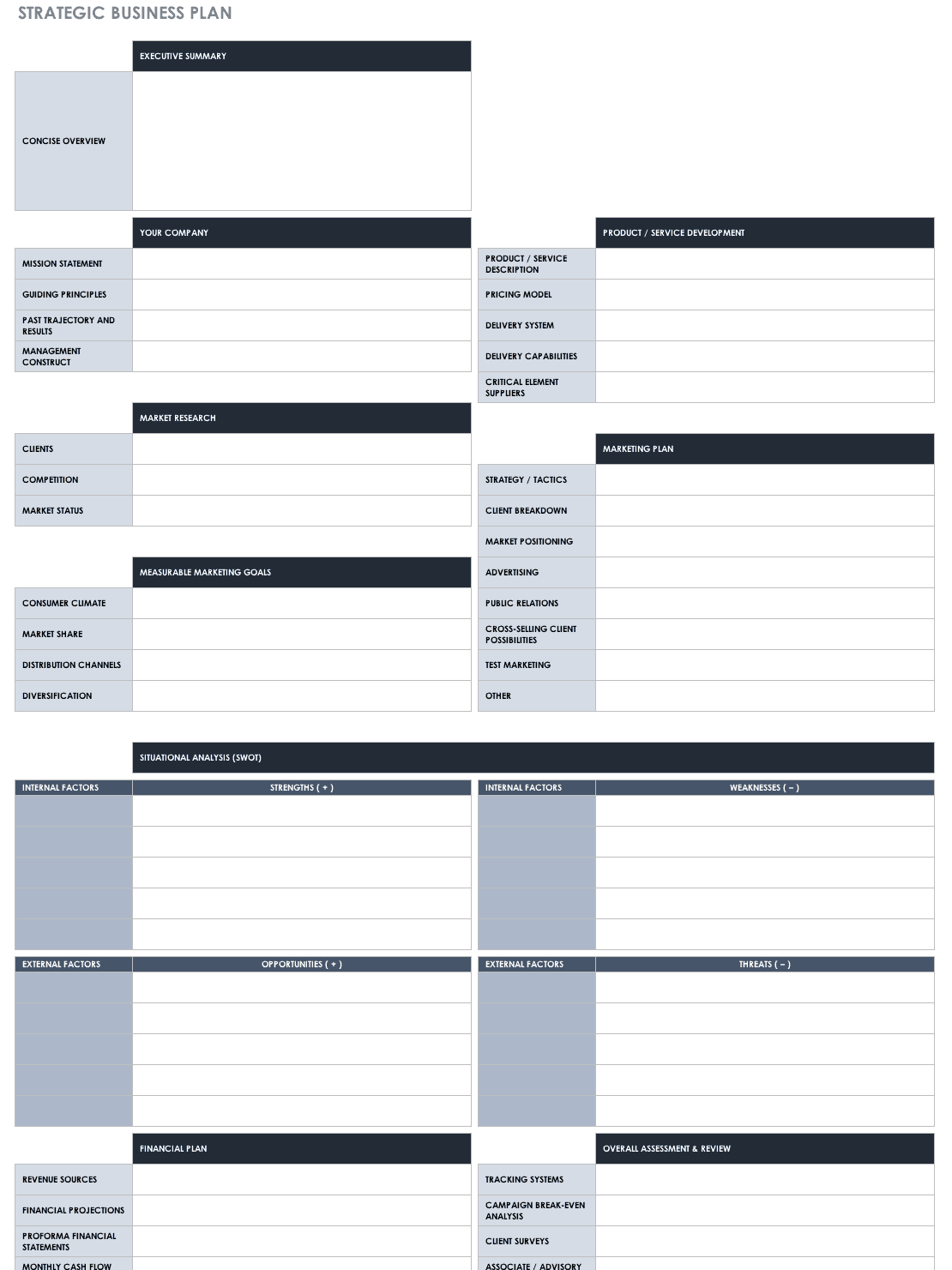

Strategic Business Plan

This comprehensive business plan template aids in planning and can function as a communication tool. With space to include company information, research, goals, and risks, this template provides a one-stop shop for managing all of the moving pieces of your business plan.

Download Strategic Business Plan

Excel | Smartsheet

Risk Management Plan Template

During the M&A planning phase, you need to identify the risks associated with acquiring or merging with another company. This risk management template includes space for analysis and monitoring, numerical calculations, a risk register, and a list of potential risks. Use this template to identify and monitor risks for the duration of your merger or acquisition.

Download Risk Management Plan Template

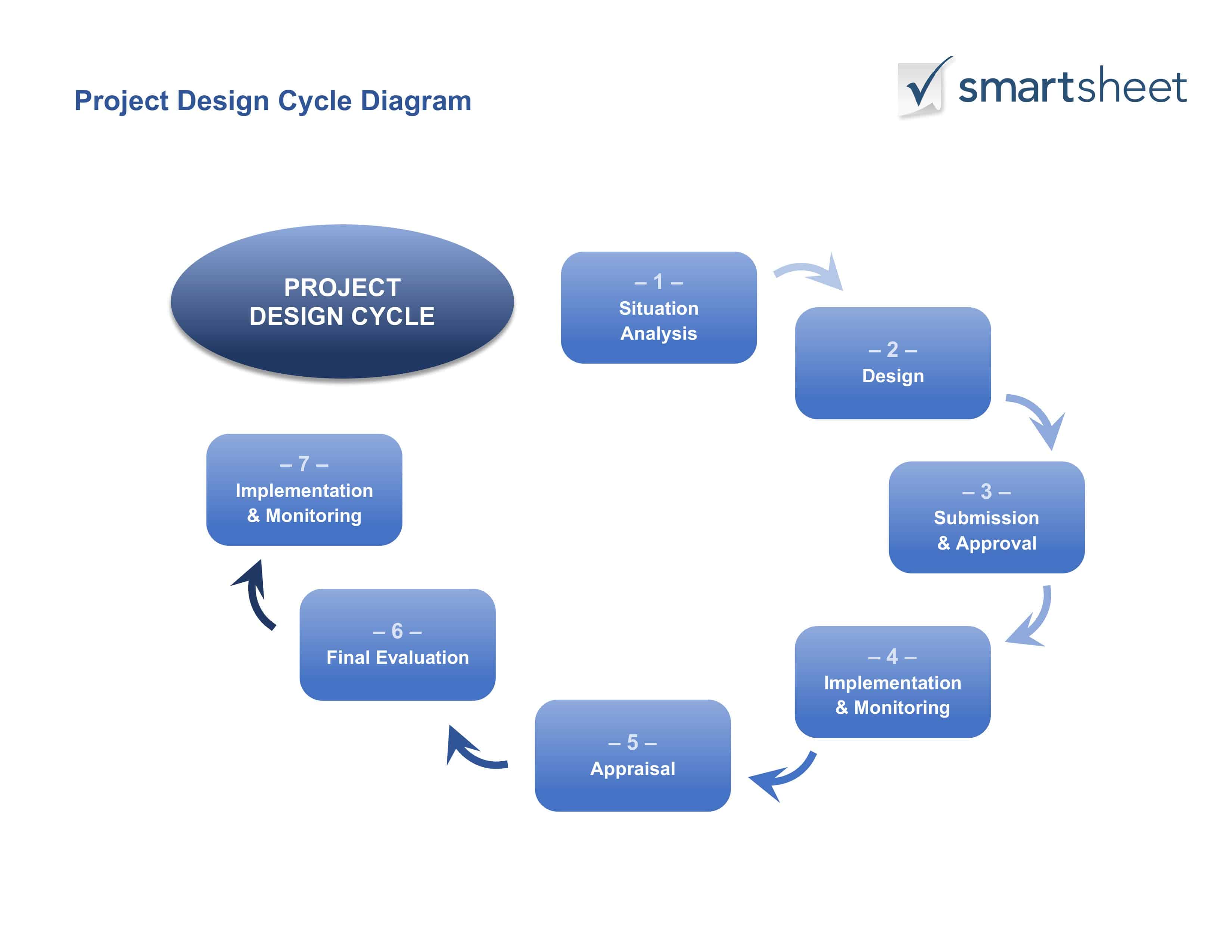

Project Lifecycle Plan

Understanding the lifecycle of your project — including the phases of your merger or acquisition — is crucial to planning the scope, resources, roles and responsibilities, and deliverables. This graphic template allows you to visualize your project lifecycle, from analysis and design all the way through implementation and monitoring. Add or delete phases to fit the needs of your endeavor.

Download Project Lifecycle Plan

What Is M&A?

M&A stands for merger and acquisition , a phrase that describes two companies or organizations that combine into one entity. The driving idea behind a merger or acquisition is that the companies together will be stronger, more competitive, or more profitable than they are by themselves.

Though the term M&A is common, mergers and acquisitions are actually two distinct concepts. A merger occurs when two companies of equal size or profitability come together, renounce their individual titles and stock, and continue as one unit. An acquisition occurs when one company (called the acquiring company ) buys another, smaller company (called the acquired or target company ). However, both terms generally refer to the consolidation of assets and liabilities that occurs when two entities combine into one.

Organizations have many reasons to choose M&A, but they essentially boil down to increasing synergy , the idea that when combined, two entities will be more powerful or competitive than they would each be on their own. On the buy side, the acquiring company might want access to certain technologies, resources, position in the market, or talent; on the sell side, the target company may want greater financial or market security.

There is a legal component to any merger or acquisition, but that is outside the scope of this article. Note that the templates provided here are intended for business use, not for lawyers.

Key Terms in M&A

The following is a list of key terms in M&A:

- Asset vs. Stock Sale: In an asset sale, the acquiring company purchases the target company’s assets and liabilities; a stock sale is the purchase of the owner’s shares in a company. There are financial and liability concerns with both options, so be sure to consult legal counsel when deciding which route to pursue.

- Consolidation: In M&A, this refers to the amalgamation of multiple organizations’ financials. Consolidation occurs in both mergers and acquisitions.

- Joint Venture: This term refers to a business entity that is owned and governed by two or more parties.

- Management Acquisition: Also called a management buyout, this is a type of acquisition in which a company’s existing management buys the company from the existing private owners or the parent company.

- Tender Offer: This is a public, open invitation by a prospective acquirer to all shareholders of a publicly traded company. This potential acquirer interfaces directly with the stockholders to facilitate the exchange.

Tips for Executing M&A Strategy

A successful M&A begins with — and relies on — a well-thought-out, well-researched strategy. Planning is vital for both the acquiring and acquired company, as the process is extremely difficult, with substantial data, staff, and money on the line. Plan early and continuously throughout the merger or acquisition, and set expectations for roles and responsibilities early on in the process. Most M&As involve several people, and you need a strategy for who will own each aspect of the transition.

Once you’ve set your strategic plan for merging with or acquiring a company, you must perform due diligence. As outlined above, due diligence includes numerous assessments, from valuation to the analysis of synergy and culture. Think of due diligence as an in-depth, multifaceted way of contextualizing multiple companies. With proper due diligence, you ensure that the merger or acquisition is a good fit. It also confirms that you have the correct tools and adequate resources in place to integrate with minimal disruption to all involved parties.

For an in-depth look at M&A strategies, read this article. Here is a list of quick tips that will help you get started.

- Be patient. Mergers and acquisitions are long-term investments, so treat them as such. Delays will inevitably arise, so stay patient and build in time for unexpected events.

- Build accountability with your team. Train your team to understand that actions have consequences.

- Continually make reviews. Perform ongoing due diligence.

- Perform an independent integration assessment. Any deal can benefit from external help, especially the kind concerning particularly large or complex organizations.

- Understand regulatory and other legal compliance issues before beginning the process. No merger or acquisition will succeed if it doesn’t meet legal standards. Consult legal counsel early in the process, so you can be sure you’re doing everything properly from the outset.

- Don’t take the first offer. Sell-side parties should get multiple bids to discover their worth, and they shouldn’t be afraid to bargain if necessary.

- Perform valuation systematically. The more you plan strategically, the less likely you are to suffer from information overload as you move through valuation and due diligence. Understand what information you need to obtain (and how you’ll obtain it) before jumping into analysis.

- Create a transition plan. Even after you close the deal, you still have work to do. Create a transition plan to manage the organizational changes that both parties will undergo, clarify staff retention and responsibilities, and monitor integration over time.

Phases of M&A

Typically, mergers and acquisitions follow a similar process that includes the following general phases:

- Planning: Planning includes elements ranging from strategy, initial research, and investor pitching to communication plans and timelines. Thorough planning is crucial to any successful M&A.

- Valuation: This phase entails several specific and highly detailed steps, including financial valuation, culture and synergy mapping, and due diligence. Acquiring companies can use several different techniques to evaluate an organization’s profitability or holdings; many opt to hire outside counsel to perform these analyses.

- Integration: Once you’ve signed the deal, it’s time to integrate the two business entities. Successful integration requires planning for organizational structure, finances, roles and responsibilities, culture, and much more. Be sure to monitor integration over time and strive to continually improve.

For a step-by-step walkthrough of M&A processes, read this article.

Improve Mergers and Acquisitions with Smartsheet for Project Management

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

How To Write an Acquisition Business Plan

In the world of business, acquiring another company is a bold move. It’s a venture filled with both opportunities and risks. To navigate this complex journey successfully, you need a well-structured acquisition business plan. This isn’t just any document; it’s your guiding star, your blueprint, and your key to making this business acquisition a triumphant success.

Acquiring a business is no small feat. It’s a defining moment in the life of any company, and the acquisition business plan is the compass that will lead you through this challenging journey. In this guide, we will not only emphasize the significance of having a comprehensive plan but also provide you with an in-depth understanding of the critical elements that should be present in your plan.

What is Acquisition Planning?

How to create an acquisition business plan step by step, start with an executive summary, get to know your company, understand the industry, evaluate the target business, lay out your acquisition strategy, your marketing and sales game plan, crunch the numbers, deal with potential risks, navigate legal and regulatory matters, meet the team, merger and acquisition business plan template, optimizing a business acquisition plan with structured processes, making it work together, sharing the secrets, one size fits all, more bang for your buck, what makes you special, the big picture.

Acquisition planning is a structured process for identifying and acquiring goods or services to meet an organization’s needs. It is a critical part of the procurement process, as it helps to ensure that the organization gets the best value for its money.

Need a Professional business plan writer?

Elevate your acquisition strategy today!

The executive summary is like the opening scene of a blockbuster movie – it sets the tone and captures the audience’s attention. It’s a concise yet impactful overview of your acquisition strategy. This section serves as the very first impression potential investors and partners will have of your plan.

In your executive summary, include key highlights such as the purpose of the acquisition, the target business, and the expected benefits. Remember, it should be captivating, informative, and compelling.

In the ‘Get to Know Your Company’ section, you provide an extensive profile of your own organization. This is your opportunity to showcase your strengths, experience, and financial stability. It’s essentially the part where you introduce yourself before a crucial presentation.

Outline your company’s history, achievements, and expertise. Explain why your company is the right entity for this acquisition. Make sure to instill confidence in the minds of your readers and potential stakeholders.

An acquisition is not just about buying another company; it’s about entering a new landscape. Understanding the industry in which your target business operates is crucial.

Here, you need to delve deep into the industry. Share insights about market trends, potential for growth, and any challenges that might be on the horizon. This section serves as evidence that you’ve done your homework and are prepared for what lies ahead.

Let’s talk about the business you plan to acquire. In this part of your business plan , it’s your chance to discuss the target business in detail. This includes its history, financial performance, and the assets it brings to the table.

Highlight the aspects of the target business that are promising, and also acknowledge where improvements can be made. This demonstrates your realistic approach and your clear vision for the future.

This is where you outline your plan for acquiring the target business. Your strategy should include the deal structure, financing details, and a clear timeline. Explain how you intend to integrate the newly acquired business into your existing operations seamlessly.

In this section, it’s essential to exhibit your strategic thinking and your ability to execute the acquisition effectively.

Once the acquisition is complete, what’s your strategy for marketing and selling? How will you use this new addition to your portfolio to grow your customer base and, consequently, your revenue?

This part of your plan should outline your marketing and sales strategies post-acquisition. It’s the place to showcase your vision for the future and your ability to drive results.

This is where the hard numbers come into play. Provide detailed financial projections, including income statements, balance sheets, and cash flow forecasts. These projections should offer a clear picture of the expected financial benefits of the acquisition.

These figures are not just dry statistics; they are the financial backbone of your plan, demonstrating the potential return on investment.

Every business venture comes with its share of risks. In this section, you should identify potential risks associated with the acquisition and explain how you plan to address them.

This shows your meticulousness and your commitment to risk mitigation, which is crucial for building trust and confidence among your stakeholders.

Acquisitions often involve complex legal and regulatory matters. It’s essential to discuss these aspects in your plan. If there are compliance issues, explain in detail how you intend to address them.

This section assures your readers that you’re well-prepared to navigate the legal intricacies involved in the acquisition.

A successful acquisition is a team effort. Introduce the key players involved in the acquisition and explain their roles. Highlight their experience, qualifications, and achievements.

By showcasing the strength of your team, you demonstrate that you have the right people in place to execute the plan effectively.

Get specialized business plan services now!

Grab our Merger and Acquisition Business Plan Template to make your merger or acquisition journey smoother. This template is packed with key sections and detailed insights, ensuring you cover all aspects of your acquisition strategy. Let this template be your roadmap as you navigate the complexities of business acquisitions. Start your journey toward a triumphant merger or acquisition business plan today! Download M&A Business Plan Template

Crafting a business acquisition plan isn’t just about signing papers; it’s about blending smart strategies that supercharge success. By weaving organized methods into this plan, you’re making sure that the merging companies don’t just coexist but flourish together.

Think of it as putting puzzle pieces together. Show how a carefully planned approach isn’t just about buying a company; it’s about merging their ways of doing things into a cohesive strategy. This part is about combining different systems, rules, and methods smoothly.

Talk about finding and using the best ways of doing things from the company you’re acquiring. Explain how mixing their successful methods with yours makes everything run smoother and more efficiently.

Show why having a set way of doing things helps. Discuss how having consistent methods, from handling money to everyday tasks, helps the new company grow without unnecessary overlaps.

Explain how having a well-thought-out plan gets you more than just a new company—it increases your profits too. Highlight how bringing in smart strategies boosts how well the business works and makes it stronger.

Talk about the advantage you have—the ability to look at different ways companies work. Explain how this helps you find and use the best ideas, making all your businesses better.

Wrap it up by saying this plan isn’t just a bunch of papers—it’s a map to a successful future. It brings together the best parts of different companies, wipes out any problems, and sends everyone toward success.

In the concluding section of your plan, summarize the key points. Emphasize the potential for success that your acquisition business plan represents. Leave your readers with confidence in your approach and a sense of optimism about the future.

In conclusion, an acquisition business plan is more than just a document; it’s the heart and soul of your acquisition strategy. A meticulously crafted plan, like the one described here, can be your key to not only a successful acquisition but also a confident and prosperous future in the complex world of business acquisitions.

By following these steps and adding depth to each section of your plan, you can create a compelling narrative that instills trust and confidence in your stakeholders. This detailed roadmap will position you to excel in the intricate and rewarding realm of business acquisitions.

What is acquisition in business strategy?

An acquisition is a business deal where one company acquires and assumes control of another company. These transactions are a fundamental component of mergers and acquisitions (M&A), which represents a professional field in corporate law and finance centered on the acquisition, sale, and merging of businesses.

What is acquisition in business example?

An acquisition is a business deal in which one company obtains companies, organizations, or their assets in exchange for some form of consideration from another company. Examples of such transactions include Google’s purchase of Android for $50 million in 2005 and Pfizer’s acquisition of Warner-Lambert for $90 billion in 2000.

How do I prepare my business for acquisition?

- Perform an internal audit.

- Establish a well-organized company structure.

- Tidy up your financial statements.

- Renew your most crucial contracts.

- Create a strategic plan for the next five years.

- Address any pending legal and tax matters.

- Optimize your business operations.

- Ensure you have a top-notch team in position.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

How to Write a Business Plan for an Acquisition

- Small Business

- Business Planning & Strategy

- Write a Business Plan

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

How to Write a Business Plan Outline

How to amend the business name on a court document, how to overcome corporate cultural issues in mergers & acquisitions.

- How to Write a Wedding Planning Business Plan

- Step-Ups in Valuation of Assets for a Newly Acquired Business

Many considerations come with a business acquisition. Not only do you have to consider the cost of the purchase, you have to consider how your business will integrate the newly purchased assets and utilize, or relieve, the employees that come along with the business. The business plan takes these and other acquisition considerations, along with their pros and cons, and organizes them into reusable research and analysis.

Create the business description for your business plan. List the legal business description of your business and indicate that your business is acquiring a business. Provide a detailed account of that business’ history, including staff size, location, legal business description and financial history. Identify the business’ short- and long-term goals and projections.

Create your business plan’s staffing section. List the managers and staff required to complete the business’ operations in a timely and efficient manner. Explain the functions of each manager and identify each of your business’ departments.

Identify the number of acquired employees and show how those employees will be integrated into the business. List the costs of all employment aspects, including costs, such as payroll, training, benefits and severance packages. Create an organizational chart to show the chain of command.

List the location of your business, as well as the locations of any acquired property. Explain how the properties are utilized by the business, as well as the costs for each. Include items such as zoning compliance fees, utilities and taxes in your expense list.

Show if the properties are owned, leased or rented. Address which properties will be retained and which will be released. Determine how your business will utilize the equipment and inventory acquired during the acquisition. Explain the steps that your business will use to control its losses and increase its assets.

Identify the external threats and opportunities that accompany the business acquisition. Look at areas such as customer demands, government regulation and industry competition. Research the identified areas thoroughly. Develop strategies to overcome the threats that accompany the acquisition and ascertain how your company will take advantage of its underlying opportunities.

Identify the products and services that your business will focus on after the acquisition. Categorize the original products and services against the newly acquired ones. Show and explain the costs and procedures of implementing the change requirements and merging the businesses. Identify any newly created products that result from the merge of company resources and identify any new equipment or inventory that will be required.

Identify the target market for your business. Explain how this market has changed as a result of the acquisition. Differentiate the market by separating it into categories of original, acquired and new markets. Address each category separately. Ascertain how your business will maintain its original customer base, and welcome its acquired and new customers.

Create financial statements for your business acquisition. Include personal financial statements for each owner of the business. Provide a balance sheet, income statement and cash flow statement for the business at a point just after the acquisition. Use realistic figures and assumptions when forecasting the business. Include complete financial statements for your original business and acquired business, for the past three years, to support and justify your forecasts.

Use the executive summary to introduce your business, along with the new products and services that result from the acquisition. Highlight your company’s various target markets and briefly review the trends within the industry. Review the reasons for the acquisition and explain how the acquisition will make your company stronger. Limit the executive summary to no more than three pages.

Include a copy of the acquisition contract in the appendix of your business plan, along with supporting documents, such as lease agreements, warranties and building appraisals. Begin the appendix with a content page. Label the documents accordingly and place the appendix at the end of your business plan.

- MasterCard International: The Plan

Writing professionally since 2004, Charmayne Smith focuses on corporate materials such as training manuals, business plans, grant applications and technical manuals. Smith's articles have appeared in the "Houston Chronicle" and on various websites, drawing on her extensive experience in corporate management and property/casualty insurance.

Related Articles

How to create a business plan & where should the executive summary be located, how to write a business plan for an existing business, how to write a farm business plan, how to write a day spa business plan, how to write a business plan for a restaurant or food business, how to create a food service business plan, how to write a clothing boutique business plan, how to create your own shoe line's business plan, how to prepare a business plan for a window cleaning business, most popular.

- 1 How to Create a Business Plan & Where Should the Executive Summary Be Located?

- 2 How to Write a Business Plan for an Existing Business

- 3 How to Write a Farm Business Plan

- 4 How to Write a Day Spa Business Plan

Strategic Acquisition Strategy Plan Template

What is a Strategic Acquisition Strategy Plan?

A strategic acquisition strategy plan outlines the steps a business must take in order to successfully acquire another business. The plan includes researching potential acquisitions, evaluating them, negotiating terms with the target company, and finalizing the acquisition. This plan is essential for businesses that are looking to expand their operations, diversify their product offerings, or enter into new markets.

What's included in this Strategic Acquisition Strategy Plan template?

- 3 focus areas

- 6 objectives

Each focus area has its own objectives, projects, and KPIs to ensure that the strategy is comprehensive and effective.

Who is the Strategic Acquisition Strategy Plan template for?

The Strategic Acquisition Strategy Plan template is designed for businesses of all sizes and industries that are looking to acquire another business. It is a comprehensive plan that is easy to follow and can be tailored to each individual business’s needs. It provides clear objectives, measurable targets, and actionable steps that can help businesses achieve their acquisition goals.

1. Define clear examples of your focus areas

Focus areas are the main areas that need to be addressed when creating a Strategic Acquisition Strategy Plan. Examples of focus areas can include identifying potential acquisitions, negotiating terms, and closing the acquisition. Each focus area should include objectives, measurable targets (KPIs), and actionable projects that need to be completed in order to successfully acquire another business.

2. Think about the objectives that could fall under that focus area

Objectives are the specific goals that need to be achieved in order to reach the overall goal of acquiring another business. Objectives should be clear and actionable, with measurable targets and actionable projects that can be implemented in order to achieve them. Examples of some objectives for the focus area of Identifying Potential Acquisitions could be: Research Potential Acquisitions, and Evaluate Potential Acquisitions.

3. Set measurable targets (KPIs) to tackle the objective

KPIs (key performance indicators) are measurable targets that are used to track progress towards the objectives and overall goal of acquiring another business. Examples of KPIs can include identifying potential acquisition targets, qualifying acquisition targets, and negotiating terms with the target company.

4. Implement related projects to achieve the KPIs

Projects (or actions) are specific activities that need to be completed in order to achieve the KPIs and objectives. Examples of projects can include researching potential acquisitions, evaluating them, and negotiating terms with the target company.

5. Utilize Cascade Strategy Execution Platform to see faster results from your strategy

Cascade Strategy Execution Platform helps business teams create, track, and measure the progress of their strategies. With Cascade, businesses can create actionable plans that are easy-to-follow and measure performance in real-time. By leveraging Cascade, businesses can achieve their acquisition goals faster and more efficiently.

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Business Plan for Buying an Existing Business

Published Oct.18, 2023

Updated Apr.19, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Buying an existing business is a great way to enter a new market, expand your product or service offerings, or leverage the seller’s existing customer base and brand recognition. However, before making an offer, you need a clear and realistic acquisition business plan for running and growing the business post-acquisition.

A business plan for buying an existing business is a document that outlines your vision, goals, strategies, and financial projections for the business you want to buy. It is similar to a regular business plan but also includes information about the seller’s business history, performance, strengths, weaknesses, opportunities, and threats.

A business plan for buying an existing business via franchise business planning services helps you to:

- Evaluate the feasibility and profitability of the deal

- Negotiate the best price and terms with the seller

- Secure financing from lenders or investors

- Manage the transition and integration process smoothly

What to Include In an Acquisition Business Plan?

A business plan for purchasing an existing business should cover all the essential aspects of running and growing a business, such as:

- Executive summary

- Company overview

- Industry analysis

- Marketing plan

- Operations plan

- Organization and management

- Financial plan

Why Do You Need a Business Plan Sample for Buying an Existing Business?

A business plan sample can help you write a business plan for buying an existing business by providing a template and examples of how to structure and present your information. A business plan for buying an existing small business can also inspire you with ideas and insights on improving or innovating the existing business.

To help you get started with writing your acquisition business plan template for buying an existing business, we have created a sample based on buying a restaurant for you.

Executive Summary

We are XYZ Restaurant Group, a company that owns and operates several successful restaurants in New York City. We seek to acquire ABC Restaurant, a well-established and popular Italian restaurant in Brooklyn, New York.

For over two decades, ABC has been a mainstay in the community, earning devoted regulars and renown for top-notch cuisine and hospitality. This 100-seat eatery runs at full capacity for lunch and dinner daily. Raking in $1.2 million yearly with $150,000 left over after expenses, ABC shows no signs of slowing down after its longstanding prosperity.

ABC Restaurant is an excellent opportunity to expand our portfolio and enter a new market. We have identified several areas where we can add value and improve the performance of the restaurant, such as:

- Updating menu and dishes

- Enhancing online presence and marketing

- Renovating interior/exterior

- Hiring and training new staff

We estimate the total cost of acquiring and improving ABC will be $500,000. We project that ABC will generate an annual revenue of $1.5 million and a net profit of $200,000 in the first year after the acquisition and grow by 10% annually.

Company Overview

XYZ Restaurant Group owns and whips up several nifty eats-places in the Big Apple. We’re crackerjack at serving out first-rate delicious eats from all over the world, like Mexican, Thai, Indian, and Mediterranean. Folks rave about our mouthwatering chow, friendly service, cozy mood, and fair coin.

Our mission is to dish up a memorable dining experience that delights taste buds and beats hopes. Our vision is to become top cook in the USA, with a diverse and brainy bill of fare for different chowhounds. We value being the cat’s meow, passionate, upright, diverse, and keeping customers cheerful.

We aim to acquire ABC, a swell and popular Italian hub in Brooklyn. ABC has loyal eaters and a dynamite food and service name. We want to buy ABC because it has a potential for growth and bankroll.

Industry Analysis

The restaurant industry in the USA is a large and diverse sector that includes various types of establishments, such as full-service restaurants, fast-food restaurants, cafés, bars, and catering services.

Here are some key stats regarding the restaurant industry in the USA:

- The food service industry might reach $997B in sales in 2023. (Source – National Restaurant Association )

- There are 749,404 restaurants in the United States as of 2023. (Source – Zippa )

- Between April 2022 and March 2023, new business openings in the restaurant industry increased by 10%. (Source – Yelp )

- The US restaurant industry shall grow at a CAGR of 10.2% in 2022 and 2023.

Some of the key trends and drivers that influence the restaurant industry are:

- Consumer preferences

- Regulations

Our primary competitors in the Italian restaurant segment are:

- Strong brand recognition

- Diverse menu selection

- Provides good value

- Menu lacks innovation

- Food quality is inconsistent

- Customer service needs improvement

- Expensive menu prices

- Small capacity limits covers

- Relies heavily on its location

Marketing Plan

Our marketing plan for ABC is based on the following objectives:

- To increase the awareness and recognition of ABC.

- To attract new customers and retain existing customers.

- To increase the sales and profitability of ABC.

Our business plan for buying an established business consists of the following elements:

- Professionals

- Millennials

- Updating the menu and introducing new dishes

- Enhancing the online presence and marketing

- Renovating the interior and exterior

- Hiring and training new staff and implementing best practices

- Branding – Our brand name is simple, memorable, and distinctive. Our brand logo is a stylized letter A with a fork and knife on either side. Our brand slogan is “ABC: A Taste of Italy.” Our brand colors are red, white, and green, representing the colors of the Italian flag. Our brand voice is friendly, professional, and authentic.

- Offering discounts and coupons

- Implementing dynamic pricing

- Creating bundle deals

- Providing upselling and cross-selling opportunities

- Online – Search engines, social media, email, and blogs, online reviews, testimonials, and referrals

- Offline – Newspapers, magazines, radio, TV, billboards, print ads, radio spots, TV commercials, outdoor signs, flyers, brochures, and business cards

- Events – Trade shows, festivals, and community events via booths, banners, and samples to display using contests, games, and giveaways

Operations Plan

Our operations plan for ABC is based on the following objectives:

- To provide a safe, clean, and comfortable environment

- To deliver high-quality food and service

- To manage our resources and costs effectively

Our business plan for buying an existing company consists of the following elements:

- Location and Facilities – ABC operates at 123 Main Street, Brooklyn, New York. It is a prime location with high foot traffic, visibility, and accessibility. The restaurant occupies a 2,000-square-foot space, including a dining area, kitchen, storage room, restroom, and office. The dining hall has a capacity of 100 seats and can accommodate up to 150 customers at peak times.

- Food: We buy ingredients from XYZ Food Distributors, a local company specializing in Italian food products.

- Beverages: We buy our beverages from ABC Beverage Company, a national company that offers a wide range of alcoholic and non-alcoholic drinks.

- Other: We buy our other supplies from DEF Supply Store, a regional company that provides various supplies.

- Food Safety – Adhere to all FDA and DOHMH guidelines. Monitor and log temps, freshness. Train staff on protocol.

- Service Excellence – Follow XYZ standards for hiring, training, dress code, incentives, feedback. Address complaints ASAP.

- Performance Evaluation – Track KPIs (sales, costs, satisfaction, retention) with POS, software, spreadsheets. Hold regular reviews to improve.

- Business License from NYS Department of State

- Food Service License from DOHMH

- Liquor License from NYS Liquor Authority

- Health Inspection clearance from DOHMH

- Fire Inspection clearance from NYFD

- Workers’ Compensation Insurance

- Liability Insurance

- Sales Tax registration and remittance with NYS Taxation and Finance

- Passed inspections for health, sanitation, and fire safety standards

- Obtained all necessary permits, licenses, registrations, and insurance

Organization and Management

XYZ Group is a partnership between Alex Smith, Park Smith, and Mark Wood, who own 33.3% and oversee strategy, operations, and technology, respectively.

ABC is a subsidiary operated by the following staff:

- General Manager – Reports to Alex Smith, oversees daily strategic and operational planning services

- Chef – Reports to Park Smith, manages kitchen and food preparation

- Sous Chef – Assists the Chef ensures food quality

- Kitchen Staff – Report to Sous Chef, perform various kitchen duties

- Servers – Report to the General Manager, take orders, and serve customers

- Host – Reports to General Manager, greets and seats guests

- Bartender – Reports to General Manager, prepares and serves drinks

- Delivery Driver – Reports to Mark Wood, delivers orders to customers

We have an experienced, competent team at ABC with proper training, compensation, and a collaborative work culture to drive success. The organizational structure establishes clear roles and reporting lines.

Financial Plan

Our financial plan for ABC is based on the following objectives:

- To generate sufficient revenue and profit

- To maintain a positive cash flow

- To secure adequate funding

When buying an existing business, it’s important to determine how much operating capital you should plan for. Our financial plan consists of the following elements:

- Funding Sources

- Assumptions

Income Statement

- Balance Sheet

- Cash Flow Statement

- Ratio Analysis

- Break-Even Analysis

| Year | Revenue | Cost of Goods Sold | Gross Profit | Operating Expenses | Net Profit |

| 1 | $1,500,000 | $450,000 | $1,050,000 | $750,000 | $300,000 |

| 2 | $1,650,000 | $495,000 | $1,155,000 | $825,000 | $330,000 |

| 3 | $1,815,000 | $544,500 | $1,270,500 | $907,500 | $363,000 |

| 4 | $1,996,500 | $598,950 | $1,397,550 | $998,250 | $399,300 |

| 5 | $2,196,150 | $658,845 | $1,537,305 | $1,098,075 | $439,230 |

Get Expert Help with Your Acquisition Business Plan

As you can see, developing a comprehensive business plan for buying an existing business requires significant time and expertise across various areas like finance, operations, marketing, and more. That’s where our expert advisors at OGSCapital can help.

With over 15 years of experience in M&A, strategic planning, and business planning, OGSCapital has helped numerous clients acquire and integrate businesses successfully. Our business plan writers can conduct diligence, analyze the deal, create projections, and craft a winning plan tailored to you. If you’re still thinking about how to buy an existing business, partner with our seasoned advisors to maximize your chances of closing and profiting.

Frequently Asked Questions

What is acquisition in business plan.

Acquisition in a business plan is buying or merging with another company to achieve strategic or financial goals. Acquisition planning can help a company expand its market share, diversify its product portfolio, acquire new technologies or skills, or reduce competition.

How do you create an acquisition plan?

To create a business plan for buying an existing business, you must define your objectives, identify and evaluate targets, conduct due diligence for merger and acquisition , negotiate the deal, plan and execute the integration, and monitor the outcomes.

How do I prepare my business for acquisition?

To prepare your business for acquisition, you should improve your business value, know your valuation range, establish an advisory board and a transition team, clean up your financials and legal documents, and prepare a pitch deck and better buy side due diligence services .

What should be included in an acquisition plan?

A business plan for buying an existing business should include an executive summary, target description, market overview, sales and marketing, financial history and projections, transition plan, deal structure, and appendices/supporting documents.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Case: OGScapital Provides Quality of Earnings (QoE) Support

Ice Vending Machine Business Plan

OGScapital at the National Citizenship and Immigration Conference

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Acquisition Business Plan Template

Start your Acquisition business with our comprehensive business plan template. It features targeted market analysis for the solar energy sector and includes financial projections to ensure your success in the solar installation industry.

.png)

Download the template today!

Features of our acquisition business plan template:.

Market Research: Conduct thorough analysis of local demand for solar installation services, including target demographics, renewable energy incentives, and potential competitors.

Unique Selling Proposition: Clearly define what sets your Acquisition business.

Marketing Strategies: Develop effective plans to promote your solar installation services, including digital marketing, partnerships and referrals

Benefits of Using Our Template:

Targeted Strategy: Develop a focused business plan based on comprehensive market research and analysis, ensuring alignment with local demand and competitive landscape.

Competitive Advantage: Establish a compelling unique selling proposition that differentiates your Acquisition business and attracts customers.

Increased Success Potential: Enhance your chances of success by crafting a strategic business plan that effectively positions your Acquisition business in the market and outlines actionable marketing strategies to attract clients and generate revenue.

Acquisition Business Plan Frequently Asked Questions

Q: why is a business plan crucial for a company acquisition.

A business plan for an acquisition is essential for aligning strategic goals with the operational and financial realities of merging two companies. It facilitates thorough due diligence, helps predict synergies, and identifies potential integration challenges. Additionally, a solid acquisition business plan can attract potential investors or lenders by showcasing the strategic value and long-term vision of the acquisition.

Q: What are the key components of an acquisition business plan?

A: An effective acquisition business plan should encompass the following critical components:

Acquisition Strategy and Rationale: A clear explanation of why the acquisition is being made, including strategic benefits and expected synergies.

Transition Plan: Outline of the steps to integrate the target company into existing operations, addressing both short-term and long-term objectives.

Operations Plan: Strategies for managing combined operational processes, resources, and technology integration.

Risk Analysis and Mitigation: Identification of potential risks with strategies to mitigate them effectively to ensure smooth transition and operational stability.

Q: How can an acquisition business plan aid in securing financing or investor support?

A: A comprehensive acquisition business plan demonstrates a clear understanding of the target company’s value and how the acquisition enhances the combined entity’s market position and financial strength. It provides investors and lenders with detailed financial projections that outline the growth potential and expected return on investment. This plan also addresses risk management and integration strategies, which are critical for convincing stakeholders of the acquisition's viability and strategic value.

We Know a Good Business Plan When we See One

Collectively, our team has reviewed thousands of business plans and has nearly 20 years of experience making SBA loans. We've also helped more than 50,000 businesses create financial projections across many industries and geographies.

Adam served as Executive Director for a SBA microlender in Indiana for over 10 years helping businesses and reviewing thousands of business plans.

.png)

Grace has built hundreds of custom financial models for businesses as well as our projection templates which are used by thousands of businesses every year.

Kyle served as an SBA loan officer for 7 years working directly with startups and business owners to review their business plans, projections, and prepare their loan package.

Lorem ipsum dolor sit amet, consectetur adipiscing elit.

M&A Integration Tools & Templates

Our M&A planning tools and templates help simplify and expedite integration work and help teams produce it in common formats.

The M&A integration project plan tools are organized in these categories:

- Communication

PRITCHETT Merger Integration Certification Workshop Attendees and Website Subscribers can access all the M&A integration tools and templates, not just the free ones. They can also access all the presentations, playbooks, books, articles, checklists, software, assessments, webinars, research, and videos on MergerIntegration.com.

(Partial List - See eMerger Software for more M&A integration tools and templates)

Planning Tools

Reporting tools.

Communications Tools

Governance Tools

Charter tools, culture tools.

Finance & Accounting 90-Day Acquisition Integration Plan

Finance & Accounting 90-Day Acquisition Integration Plan that incudes 93 tasks grouped in the following categories: Budget and Forecast, Insurance Coverage, Limits of Authority, Insurance Policies, Reporting Process, Purchase Price Accounting, and External and Internal Audits.

Sub-Work Stream Budget and Finance

| To obtain Acquired Co. FY25 budget for incorporating into NewCo budget - communicate with Acquired Co. entities/agree on deliverable format |

| To discuss/align on deliverables - Budgets in systems |

| Prepare NewCo budget - high level P&L for Day 30 |

| Prepare NewCo budget - detailed level P&L, BS and CF for Day 60 |

| Make adjustments for synergies / disynergies ... |

Post-Merger Integration Human Resources Plan

27 Initiatives/Activities

1.0 OD - Succession Planning

2.0 OD - Leadership Development

3.0 OD - Training

4.0 OD - Tuition Reimbursement

5.0 OD - Performance Management - Next Year

6.0 OD - Performance Management ...

Cross-Border Day 1 Merger Integration Plan

Excerpt from day 1 cross-border plan for 5 cities and 4 countries.

Internal Comm: FAQs (IT, Payroll info: semi-monthly to bi-weekly, Cobra, Remote I-9s (notarized), holiday, FICA withholding, insurance deductible) Full List of Employees (preferred name, email address, cost center, job title) Establish new vendor as supplier (interim IT support)

Internal Comm: ...

Post-Merger Integration Cross-Border Finance Plan

7-Page Finance Plan from a Cross-Border Merger.

Finalize and communicate organizational structure Coordinate closing process for August 2024 Establish initial treasury linkage to Acquirer

- Weekly cash forecast process established

- Weekly conference call re: cash position set up

- Presentation by NT on capabilities to replace lock box

Develop Tax Efficient Global Reorganization of Acquirer. . .

How to Identify Post-Merger Integration Priorities

In this task, each Integration Team identifies their priority initiatives and action items. Depending on the size, complexity, and resources dedicated to Integration, this activity can take two weeks to a month. The team may work from a generic list of tasks or start at ground zero with analysis of the merging organizations. The objective is to list the short- and long-term initiatives that will help the combined companies achieve the defined merger synergies and goals.

Staffing and Retention Integration Project Plan

Over 70 Staffing and Retention Activities Grouped into these Categories:

- Finalize Organizational Structure for All Functions

- Deploy a Staffing Process to Assess, Select, and Announce All Levels of the Organization below the Management Team

- Management Team Design Tools to Retain Key Talent Prior to Close and Throughout the Transition Period

- Develop a Process for Managing Reductions in Force and Administering Separation Packages and Outplacement Services

- Design an Issue-Free Day 1 From the Employee Perspective. . .

Due Diligence Data Request Checklist for an Acquisition Integration

Sensitive Information

- Top 20 customers by business sales

- Revenue for past 3 years by source

- Sales: Rebates & Discounts

- Top 100 suppliers and the AP spend month by month last 24 months.

Non-Sensitive Information

- Financial systems for reporting and transactions...

Target Operating Model and Roadmap Template

Buyer As-Is Assessment People, Processes, Systems & Tools, Assets & Infrastructure, Contracts

Seller As-Is Assessment People, Processes, Systems & Tools, Assets & Infrastructure, Contracts

End-State Target Operating Model Gaps and Transformation Steps

Strategic Score of Each Integration Initiative

A strategic score is assigned to each of 144 workstream initiatives in a cross-border acquisition integration.

Columns on Excel spreadsheet for each Initiative:

Work Stream, Responsible, Execution by Day 1, Urgency: Hi/Medium/Low, Impact: Hi/Medium/Low, Strategic Score, Ranking in Original Top 10, End State, Impacted Countries, Project Structure, Led By Accountable, Reporting to IMO

Acquisition Project Plan Excel Template

The Excel file includes integration project plan templates for Finance, HR, IT, Corporate, Legal, and Operations.

Column headings in the spreadsheet templates are: Work Streams, Initiatives, Owner, Day 1 Mandatories, Start Date, Completion Date, Key Issues and Risks, Cross Dependencies, and Actions Required.

The templates were utilized in the M&A Integration Playbook - 20 Billion Acquisition.

Evaluation of HR Acquisition Integration Plan

The biggest challenges with this planning team have been:

- Lack of clarity regarding what they own and what they don’t own within their charter (i.e., staffing, severance, retention, titling, compensation, org. design, etc.)

- Slow to develop things that they feel they need more time to work on (staffing, severance, retention, etc.)

- Figuring out if they could engage outside consultants

HR Team Post-Merger Integration Charter

Charter Statement Identify and define the future state OD/HR organization, philosophies, policies, procedures, programs, and support systems. In addition, identify high-level activities, tasks, and costs required to combine the two organizations into the future state organizations. Special attention will be given to high-priority (Day 1) items as well as milestone components to reach the decided end state.

IMO Kick-Off Meeting Agenda: Acquirer-Acquired Company

Time Topic

8:00-8:10 Review objectives and target outcomes of meeting

8:10-8:30 Ensure all participants grounded in legal rules of engagement for go forward planning activities

8:30-8:45 Transaction & Timing Update Communicate deal status and target close date scenarios

8:45-9:00 Overview of key deliverables, timing, R&R’s, and relevant IMO process details ...

M&A Integration Risk Impact/Mitigation Template

Risk : Agreement delayed / production dates push into busy season

Potential Impact : Integration work competing with regular work at busiest time of the year for sales, production, and fulfillment.

Mitigation Plan : Make decision on transferring production into 2022 and fulfill all else from west coast

Potential Cost Impact: Rent costs for Company A, delayed realization of production efficiencies ...

180 Day Post-Merger Integration Plan at 90 Days Post Close

Human Resources: Compensation

- Plan for mid-transition hires

- Communicating changes to salary grade and/or pay adjustments

- Exec Comp: SC compensation changes in System

- All pay changes effective April in System

M&A Integration Scorecard Template

Excel Spreadsheets

10 Instructions

- The latest version of the Integration Scorecard/Milestones will be sent to you via email each Monday. This version will reflect all updates reported through 5:00 pm (Central) the previous Friday.

- Send all weekly updates to Bill Smith at [email protected]

- Make your updates directly to the latest version of the Scorecard/Milestones ...

Post-Merger Integration Dashboard

Post-merger integration status reported by these departments: .

- Corporate Business Development

- Corporate Communications

- Tax Products

- Customer Support

- Human Resources

- Information Technology

- Marketing . . .

Steering Committee Post-Merger Integration Dashboard

The steps to create an integration scorecard and the categories to cover, plus an example

M&A Synergy Plan Template

Synergy types include Headcount, Operations, Sales Procurement , R&D Cost Savings, Pricing Rationalization, Procurement, and Cross Selling.

M&A Cost Synergies Report

M&A Cost Synergies Excel Template plus Example of Completed Template

Instructions for Cost Synergy Template

1) Log each integration activity that increases or decreases headcount and/or expenses with projected time frames.

2) Use "Assumptions and Notes" to describe each integration activity in more detail.

3) Notes regarding general accounting treatment:

- Severance for reductions in Acquiree positions are generally capitalized as part of the purchase price (if the reduction is made within one year).

- Severance for reductions in Acquirer positions are expensed when employees are notified ...

M&A Synergy and Cost Savings Report Templates

Excel spreadsheets to track synergy estimates categorized as labor and non-labor, required and discretionary (strategic vs. nonstrategic).

Estimated M&A Synergies Report

Report template includes conservative, optimistic, and most likely synergy estimates plus their basis for calculation, underlying assumptions, and time frame.

Cross-Border M&A Synergies

Synergies for the following work streams:

- Finance & Corporate Admin Phase One Americas

- Finance & Corporate Admin Phase 2 EMEA

- Legal & Risk Management

- Administration

- Manufacturing Operations

- Columns on the Excel Spreadsheet:

M&A Synergy Template

The M&A Synergy Template captures synergy description, timing, assumptions, risks, cost to achieve, optimistic, conservative, and most likely synergy projections plus actual net synergies achieved.

Status of Post-Merger Integration Guiding Principles

Status of Integration Guiding Principles

Live our values — no compromise People think that overall the leadership teams are exhibiting values

Work together — no “us and them” Still "pockets" of dominant Target and Acquirer groups

Act with urgency — make decisions quickly Still major concerns around the day-to-day decisions are too slow…

Templates for Post-Merger Integration Plan Review

Questions to review communications, costs, and systems in each plan.

Communications

Risk Assessment:

What is the risk of not being able to support the plan from a communications standpoint?

Rate the risk on a scale of 1 to 10 with 1= low risk and 10 = high risk: ...

Workstream Status Report - Sales

Pre-Close Period

- Short-Term target list for short-term wins

- Establish opportunity input, tracking, and reporting in Salesforce

- Define marketing support

- Determine dedicated resources for support sales activity

- Define sales enablement activity / owners

DAY ONE (Close Phase)

- Key talking points for Sales

- Product introduction, product information resource center ...

When and What to Report for a Post-Merger Integration

What do you report? Each team member will provide the following to the M&A Task Force leader: Key Actions/Accomplishments During the Past Week, Key Issues/Decisions Required, Potential Solutions/Help Needed, Next Steps/Actions

How is it reported? Task Force Leaders compile the individual team member reports into a team report and submit it weekly to the IMO. Alternatively, Task Force Leaders may bring the team's report to a regularly scheduled IMO meeting ...

Integration Issue Form and Issue Log