What Is the Business Cycle?

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Are You Retirement Ready?

Table of contents, what is a business cycle.

The business cycle is a natural occurrence in the economy. It is generally described as a sequence of periods of expansion, followed by a period of contraction, and finally a period of recovery.

Importance of Knowing the Business Cycle

Knowing the business cycle is important for a few reasons.

- First, it can help you understand how the economy works.

- Second, it can help you make informed investment decisions.

- Third, it can help you time your business decisions accordingly.

Phases of the Business Cycle

The business cycle has six phases:

1. Expansion

This is the first phase of the business cycle, and it’s generally marked by an increase in economic activity.

GDP (Gross Domestic Product) rises, unemployment falls, and prices increase. During this period, businesses are steadily growing their production and investing in new opportunities.

The peak is the point at which an expansion turns into contraction. It’s also known as the business cycle’s boom phase.

Expansion has reached its maximum growth, and now businesses are maxed out. They no longer have room to grow or invest, so they stop doing both—which affects supply (production), demand (usage of goods and services), employment, investment, prices, etc.

3. Recession

The recession is a period of economic decline that lasts from six months to a year; sometimes it can last up to 18 months or more (referred to as "Depression").

During this period most types of economic activity come to a halt. The unemployment rate rises as businesses lay off workers, and prices for goods and services drop.

4. Depression

This is the lowest point of the business cycle, which may also be referred to as the recession’s trough. At this point, GDP (Gross Domestic Product), employment, production, consumption, investment, personal income , and business profits are all low.

The trough is the bottom of the recession. This is where the economy hits its lowest point. In terms of GDP, employment, investment, prices, etc., it’s generally a very bleak time.

6. Recovery

The recovery phase starts when economic activity begins to rise again. It’s marked by an increase in economic activity, as businesses start hiring again and production begins to pick up.

Unemployment declines and prices begin to increase modestly.

This period can last for months or years depending on how long it takes an economy to recover from a depression—which happens in a small number of depressions that have been studied by economists.

Factors That Shape the Business Cycle

A number of things can trigger the business cycle, such as:

Labor Market Shocks

Changes in labor market conditions (changes in unemployment and wages) can affect businesses’ decisions about hiring and investing.

Demand-side shocks also play a role here: if consumers suddenly start spending more or less money that will affect businesses.

Supply-Side Shocks

These include changes in resource prices (the cost of oil, for example), which could decrease production costs—or they could increase them.

Supply-side shocks also include changes to technology. If technological advances allow companies to produce goods and services more cheaply, this will affect the economy by boosting supply and decreasing prices.

The Bottom Line

Understanding what happens during each phase of the business cycle is important because it can help you make better decisions about your finances.

For example, if you know a recession is on the horizon, you may want to start saving money or investing in short-term assets rather than long-term ones.

Business Cycle FAQs

What is the difference between a recession and a depression.

A recession is a period of economic decline that lasts from six months to a year. Depression is a longer period of economic decline that may last for up to 18 months or more.

How do labor market shocks trigger the business cycle?

Labor market shocks can affect businesses’ decisions about hiring and investing. For example, if unemployment rises, businesses may lay off workers. If wages change, that could also affect businesses’ decisions.

What is the difference between a supply-side shock and a demand-side shock?

A supply-side shock is an event that changes the cost of producing goods or services. A demand-side shock is an event that affects how much consumers want to buy.

How long does it usually take for an economy to recover from a depression?

It depends on how severe the depression is. In some cases, the economy may not fully recover for many years.

How should I react and protect myself in each stage of the business cycle?

During an expansionary period, it can be beneficial to invest in long-term assets. During the recession phase, you may want to start saving money or investing in short-term assets like CDs (Certificates of Deposit). When the economy is booming and prices are high, it could be a good time to buy goods; when the economy is weak this isn’t necessarily the best time to make purchases.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Command Economy

- Cost-Push Inflation

- Demand-Pull Inflation

- Economic Outlook

- Free Market Economy

- GDP Per Capita

- Gross Domestic Product (GDP)

- Gross National Product (GNP)

- Hyperinflation

- Inferior Goods

- Knowledge Economy

- Liquidity Constraints

- Macro Environment

- Mixed Economy

- Monopolistic Competition

- Operation Twist

- Perfect Competition

- Producer Price Index (PPI)

- Purchase Annual Percentage Rate (APR)

- Real Gross Domestic Product (GDP)

- Trade Deficit

- What Does the 80/20 Rule Mean?

- Wholesale Price Index (WPI)

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

Business Cycle: Definition, Characteristics and Phases (With Diagram)

1. Definition of Business Cycle:

A capitalistic economy experiences fluctuations in the level of economic activity. And fluctuations in economic activity mean fluctuations in macroeconomic variables.

At times, consumption, investment, employment, output, etc., rise and at other times these macroeconomic variables fall.

Such fluctuations in macroeconomic variables are known as business cycles. A capitalistic economy exhibits alternating periods of prosperity or boom and depression. Such movements are similar to wave-like movements or see saw movements. Thus, the cyclical fluctuations are rather regular and steady but not random.

Since GNP is the comprehensive measure of the overall economic activity, we refer to business cycles as the short term cyclical movements in GNP. In the words of Keynes : “A trade cycle is composed of periods of good trade characterised by rising prices and low unemployment percentages, alternating with periods of bad trade characterised by falling prices and high unemployment percentages.”

ADVERTISEMENTS:

In brief, a business cycle is the periodic but irregular up-and-down movements in economic activity. Since their timing changes rather unpredictably, business cycles are not regular or repeating cycles like the phases of the moon.

2. Characteristics of Business Cycles:

Following are the main features of trade cycles:

(i) Industrialised capitalistic economies witness cyclical movements in economic activities. A socialist economy is free from such disturbances.

(ii) It exhibits a wave-like movement having a regularity and recognised patterns. That is to say, it is repetitive in character.

(iii) Almost all sectors of the economy are affected by the cyclical movements. Most of the sectors move together in the same direction. During prosperity, most of the sectors or industries experience an increase in output and during recession they experience a fall in output.

(iv) Not all the industries are affected uniformly. Some are hit badly during depression while others are not affected seriously.

Investment goods industries fluctuate more than the consumer goods industries. Further, industries producing consumer durable goods generally experience greater fluctuations than sectors producing nondurable goods. Further, fluctuations in the service sector are insignificant in comparison with both capital goods and consumer goods industries.

(v) One also observes the tendency for consumer goods output to lead investment goods output in the cycle. During recovery, increase in output of consumer goods usually precedes that of investment goods. Thus, the recovery of consumer goods industries from recessionary tendencies is quicker than that of investment goods industries.

(vi) Just as outputs move together in the same direction, so do the prices of various goods and services, though prices lag behind output. Fluctuations in the prices of agricultural products are more marked than those of prices of manufactured articles.

(vii) Profits tend to be highly variable and pro-cyclical. Usually, profits decline in recession and rise in boom. On the other hand, wages are more or less sticky though they tend to rise during boom.

(viii) Trade cycles are ‘international’ in character in the sense that fluctuations in one country get transmitted to other countries. This is because, in this age of globalisation, dependence of one country on other countries is great.

(ix) Periodicity of a trade cycle is not uniform, though fluctuations are something in the range of five to ten years from peak to peak. Every cycle exhibits similarities in its nature and direction though no two cycles are exactly the same. In the words of Samuelson: “No two business cycles are quite the same. Yet they have much in common. Though not identical twins, they are recognisable as belonging to the same family.”

(x) Every cycle has four distinct phases: (a) depression, (b) revival, (c) prosperity or boom, and (d) recession.

3. Phases of a Business Cycle:

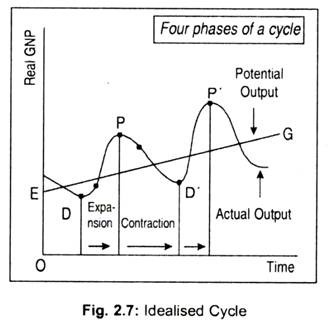

A typical business cycle has two phases expansion phase or upswing or peak and contraction phase or downswing or trough. The upswing or expansion phase exhibits a more rapid growth of GNP than the long run trend growth rate. At some point, GNP reaches its upper turning point and the downswing of the cycle begins. In the contraction phase, GNP declines.

At some time, GNP reaches its lower turning point and expansion begins. Starting from a lower turning point, a cycle experiences the phase of recovery and after some time it reaches the upper turning point the peak. But, continuous prosperity can never occur and the process of downhill starts. In this contraction phase, a cycle exhibits first a recession and then finally reaches the bottom—the depression.

Thus, a trade cycle has four phases:

(i) depression,

(ii) revival,

(iii) boom, and

(iv) recession.

These phases of a trade cycle are illustrated in Fig. 2.7. In this figure, the secular growth path or trend growth rate of GNP has been labelled as EG. Now we briefly describe the essential characteristics of these phases of an idealised cycle.

1. Depression or Trough:

The depression or trough is the bottom of a cycle where economic activity remains at a highly low level. Income, employment, output, price level, etc. go down. A depression is generally characterised by high unemployment of labour and capital and a low level of consumer demand in relation to the economy’s capacity to produce. This deficiency in demand forces firms to cut back production and lay-off workers.

Thus, there develops a substantial amount of unused productive capacity in the economy. Even by lowering down the interest rates, financial institutions do not find enough borrowers. Profits may even become negative. Firms become hesitant in making fresh investments. Thus, an air of pessimism engulfs the entire economy and the economy lands into the phase of depression. However, the seeds of recovery of the economy lie dormant in this phase.

2. Recovery:

Since trough is not a permanent phenomenon, a capitalistic economy experiences expansion and, therefore, the process of recovery starts.

During depression some machines wear out completely and ultimately become useless. For their survival, businessmen replace old and worn-out machinery. Thus, spending spree starts, of course, hesitantly. This gives an optimistic signal to the economy. Industries begin to rise and expectations tend to become more favourable. Pessimism that once prevailed in the economy now makes room for optimism. Investment becomes no longer risky. Additional and fresh investment leads to a rise in production.

Increased production leads to an increase in demand for inputs. Employment of more labour and capital causes GNP to rise. Further, low interest rates charged by banks in the early years of recovery phase act as an incentive to producers to borrow money. Thus, investment rises. Now plants get utilised in a better way. General price level starts rising. The recovery phase, however, gets gradually cumulative and income, employment, profit, price, etc., start increasing.

3. Prosperity:

Once the forces of revival get strengthened the level of economic activity tends to reach the highest point—the peak. A peak is the top .of a cycle. The peak is characterised by an allround optimism in the economy—income, employment, output, and price level tend to rise. Meanwhile, a rise in aggregate demand and cost leads to a rise in both investment and price level. But once the economy reaches the level of full employment, additional investment will not cause GNP to rise.

On the other hand, demand, price level, and cost of production will rise. During prosperity, existing capacity of plants is overutilised. Labour and raw material shortages develop. Scarcity of resources leads to rising cost. Aggregate demand now outstrips aggregate supply. Businessmen now come to learn that they have overstepped the limit. High optimism now gives birth to pessimism. This ultimately slows down the economic expansion and paves the way for contraction.

4. Recession:

Like depression, prosperity or pea, can never be long-lasting. Actually speaking, the bubble of prosperity gradually dies down. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough or depression. Between trough and peak, the economy grows or expands. A recession is a significant decline in economic activity spread across the economy lasting more then a few months, normally visible in production, employment, real income and other indications.

During this phase, the demand of firms and households for goods and services start to fall. No new industries are set up. Sometimes, existing industries are wound up. Unsold goods pile up because of low household demand. Profits of business firms dwindle. Output and employment levels are reduced. Eventually, this contracting economy hits the slump again. A recession that is deep and long-lasting is called a depression and, thus, the whole process restarts.

The four-phased trade cycle has the following attributes:

(i) Depression lasts longer than prosperity,

(ii) The process of revival starts gradually,

(iii) Prosperity phase is characterised by extreme activity in the business world,

(iv) The phase of prosperity comes to an end abruptly.

The period of a cycle, i.e., the length of time required for the completion of one complete cycle, is measured from peak to peak (P to P’) and from trough to trough (from D to D’). The shortest of the cycle is called ‘seasonal cycle’.

Related Articles:

- 5 Phases of a Business Cycle (With Diagram)

- Business Cycles: Definition and Concept

- Business or Trade Cycles in an Economy: Meaning, Definition and Types

- Real GNP and Business Cycle (With Diagram)

- Search Search Please fill out this field.

What Is the Economic Cycle?

- 4 Stages of a Business Cycle

- How to Measure Cycles

Managing Economic Cycles

Economic theory, the bottom line, economic cycle: definition and 4 stages of the business cycle.

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

- Recession: Definition, Causes, Examples and FAQs

- What Causes a Recession?

- Recession-Proof Your Life

- Don't Do This During a Recession

- How Asset Bubbles Cause Recessions

- Recessions and Unemployment

- How The Federal Reserve Fights Recession

- What Happens to Interest Rates

- Recessions and Deflation

- Recessions and Stagflation

- Are Recessions Inevitable?

- Recessions and Depressions: Not So Bad?

- Impact of Recessions on Businesses

- Businesses That Thrive in Recession

- Industries That Thrive on Recession

- The Best Investing Strategy for Recessions

- Characteristics of Recession-Proof Companies

- Take Advantage of a Recession

- Ways to Hedge the Next Recession

- Review of Past Recessions

- The Great Recession

- American Recovery and Reinvestment Act

- Investors Profiting from the Global Financial Crisis

- Double-Dip Recession

- Economic Cycle CURRENT ARTICLE

- Economic Recovery

- Economic Stimulus

- Fiscal Policy

- Growth Recession

- Inverted Yield Curve

- Recession Proof

- Recession Resistant

- K-Shaped Recovery

- L-Shaped Recovery

- U-Shaped Recovery

- V-Shaped Recovery

- W-Shaped Recovery

An economic cycle, also known as a business cycle , refers to economic fluctuations between periods of expansion and contraction. Factors such as gross domestic product (GDP) , interest rates , total employment, and consumer spending can help determine the current economic cycle stage.

Understanding the economic period can help investors and businesses determine when to make investments and when to pull their money out, as each cycle impacts stocks and bonds as well as profits and corporate earnings.

Key Takeaways

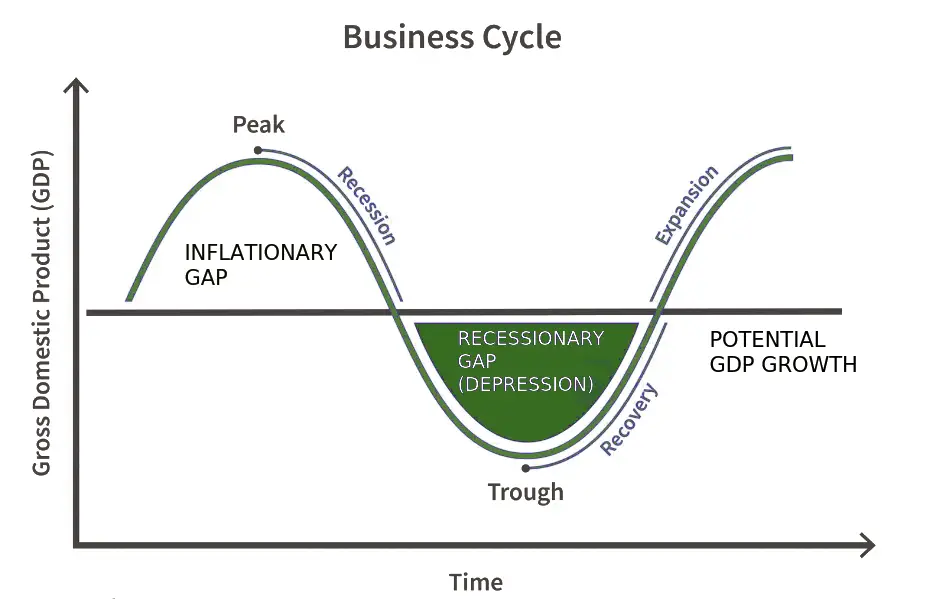

- An economic cycle is the overall state of the economy as it goes through four stages in a cyclical pattern: expansion, peak, contraction, and trough.

- Factors such as GDP, interest rates, total employment, and consumer spending can help determine the current stage of the economic cycle.

- The causes of a cycle are highly debated among different schools of economics.

Investopedia / Mira Norian

Stages of the Economic Cycle

An economic cycle is the circular movement of an economy as it moves from expansion to contraction and back again. Economic expansion is characterized by growth and contraction, including recession, a decline in economic activity that can last several months. Four stages characterize the economic cycle or business cycle.

During expansion, the economy experiences relatively rapid growth, interest rates tend to be low, and production increases. The economic indicators associated with growth, such as employment and wages, corporate profits and output, aggregate demand, and the supply of goods and services, tend to show sustained uptrends through the expansionary stage. The flow of money through the economy remains healthy and the cost of money is cheap. However, the increase in the money supply may spur inflation during the economic growth phase.

The peak of a cycle is when growth hits its maximum rate. Prices and economic indicators may stabilize for a short period before reversing to the downside. Peak growth typically creates some imbalances in the economy that need to be corrected. As a result, businesses may start to reevaluate their budgets and spending when they believe that the economic cycle has reached its peak.

Contraction

A correction occurs when growth slows, employment falls, and prices stagnate. As demand decreases, businesses may not immediately adjust production levels, leading to oversaturated markets with surplus supply and a downward movement in prices. If the contraction continues, the recessionary environment may spiral into a depression .

The trough of the cycle is reached when the economy hits a low point, with supply and demand hitting bottom before recovery. The low point in the cycle represents a painful moment for the economy, with a widespread negative impact from stagnating spending and income. The low point provides an opportunity for individuals and businesses to reconfigure their finances in anticipation of a recovery.

Measuring Economic Cycles

Key metrics determine where the economy is and where it's headed. The National Bureau of Economic Research (NBER) is the definitive source for marking the official dates for U.S. economic cycles. Relying primarily on changes in GDP, NBER measures the length of economic cycles from trough to trough or peak to peak.

Since the 1950s, a U.S. economic cycle, on average, lasted about five and a half years. However, there is wide variation in the length of cycles, ranging from just 18 months during the peak-to-peak cycle in 1981 to 1982 up to the expansion that began in 2009. According to the NBER, two peaks occurred between 2019 and 2020. The first was in the fourth quarter of 2019, a peak in quarterly economic activity. The monthly peak happened in a different quarter, which was noted as taking place in February 2020.

This wide variation in cycle length dispels the myth that economic cycles are a regular natural activity akin to physical waves or swings of a pendulum. But there is debate as to what factors contribute to the length of an economic cycle and what causes them to exist in the first place.

Businesses and investors need to manage their strategy over economic cycles—not so much to control them but to survive them and perhaps profit from them.

Governments, financial institutions, and investors manage the course and effects of economic cycles differently. During a recession, a government may use expansionary fiscal policy and rapid deficit spending . It can also try contractionary fiscal policy by taxing and running a budget surplus to reduce aggregate spending to prevent the economy from overheating during expansion.

Central banks may use monetary policy . When the cycle hits a downturn, a central bank can lower interest rates or implement expansionary monetary policy to boost spending and investment. During expansion, it can employ contractionary monetary policy by raising interest rates and slowing the flow of credit into the economy.

During expansion, investors often find opportunities in the technology, capital goods, and energy sectors. When the economy contracts, investors may purchase companies that thrive during recessions , such as utilities, consumer staples, and healthcare.

Businesses that track the relationship between their performance and business cycles can plan strategically to protect themselves from approaching downturns and position themselves to take maximum advantage of economic expansions. For example, if your business follows the rest of the economy, warning signs of an impending recession may suggest you shouldn't expand. You may be better off building up your cash reserves .

Monetarism suggests that government can achieve economic stability through their money supply's growth rate. It ties the economic cycle to the credit cycle , where changes in interest rates reduce or induce economic activity by making borrowing by households, businesses, and the government more or less expensive.

The Keynesian approach argues that changes in aggregate demand, spurred by inherent instability and volatility in investment demand, are responsible for generating cycles. When business sentiment turns gloomy and investment slows, a self-fulfilling loop of economic malaise can result. Less spending means less demand, which induces businesses to lay off workers. According to Keynesians, unemployment means less consumer spending , and the whole economy sours, with no clear solution other than government intervention and economic stimulus .

What Are the Stages of an Economic Cycle?

An economic cycle, or business cycle, has four stages: expansion, peak, contraction, and trough. The average economic cycle in the U.S. has lasted roughly five and a half years since 1950, although these cycles can vary in length. Factors to indicate the stages include gross domestic product, consumer spending, interest rates, and inflation. The National Bureau of Economic Research (NBER) is a leading source for indicating the length of a cycle.

What Happens in Each Phase of the Economic Cycle?

In the expansionary phase, the economy experiences growth over two or more consecutive quarters. Interest rates are typically lower, employment rates rise, and consumer confidence strengthens. The peak phase occurs when the economy reaches its maximum productive output, signaling the end of the expansion. After that point, employment numbers and housing starts to decline, leading to a contractionary phase. The lowest point in the business cycle is a trough, which is characterized by higher unemployment, lower availability of credit, and falling prices.

What Causes an Economic Cycle?

The causes of an economic cycle are widely debated among different economic schools of thought. Monetarists, for example, link the economic cycle to the credit cycle. Here, interest rates, which intimately affect the price of debt, influence consumer spending and economic activity. On the other hand, a Keynesian approach suggests that the economic cycle is caused by volatility or investment demand, which in turn affects spending and employment.

The economic or business cycle refers to the cyclical pattern experienced by the economy. The economy remains in an expansion phase until it reaches its peak, reversing to the downside and entering a contraction before a trough, and begins to expand once again. GDP, interest rates, employment levels, and consumer spending can help define the economic cycle. Although there are different economic theories to explain what drives the economic cycle , the conditions associated with each stage can impact business and investment decisions.

Congressional Research Service. " Introduction to U.S. Economy: The Business Cycle and Growth ," Page 1.

National Bureau of Economic Research. " Business Cycle Dating ."

National Bureau of Economic Research. " US Business Cycle Expansions and Contractions ."

National Bureau of Economic Research. " NBER Determination of the February 2020 Peak in Economic Activity ."

International Monetary Fund. " Fiscal Policy: Taking and Giving Away ."

International Monetary Fund. " Monetary Policy: Stabilizing Prices and Output ."

International Monetary Fund. " What Is Keynesian Economics? "

:max_bytes(150000):strip_icc():format(webp)/Investopedia-terms-business-cycle-eb0d2a616c914caf87c35491ed78ae2e.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Business Cycle in the U.S. and Australia Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Introduction

Characteristics of the business cycle, analysis: australia and the united states.

Although it is difficult to define the business cycle in one statement, it has one defining characteristic. Belongia (1992, pp. 43), describes the business cycle as ‘characterized by a decline and contraction and a subsequent rise and expansion of aggregate economic activity.’ Economic activity is measured by total employment, output, real income and real expenditures (Belongia & Garfinkel, 1992).

Although the economic cycle is not a steady phenomenon, it tends to exhibit a steady pattern. First, there is an expansion/incline of above-average growth, followed by a peak, then a contraction/decline of below average growth and finally a trough/low point. This is illustrated by figure 1 in the appendix which illustrates the dynamic state of the economic cycle.

As aforementioned, the main characteristic of the business cycle is the incline and decline of economic growth. The cycle is affected by total employment, output, real income and real expenditures. Although defined as a cycle, drastic changes in economic situations are unpredictable and they never pursue a perfunctory pattern.

Primarily, the growth of an economy is measured using real GDP. According to economists, Gross Domestic Product is the measure of value of all goods and services produced within a nation in a given time (Mankiw, 2009). The business cycle basically represents an incline or decline of real GDP. When there is an incline/expansion along the business cycle, it means there is positive growth of real GDP. On the other hand, during a decline in the business cycle, there is a contraction in a country’s real GDP.

Inflation can be defined in general terms as the rise of prices of goods within an economy. When prices of products increase, it indicates that one unit of currency purchases less. In addition, inflation also drives up the cost of production in the country. When cost of production goes up, productivity and nominal GDP go down. If the inflation rate continues to rise over an extended period, real GDP declines. This will be represented in the business cycle by a decline or a trough.

Unemployment is defined as a scenario where people who have vigorously searched for jobs for a period exceeding a month are still devoid of a job (International Labor Organization, 2011).

The major effect of unemployment is the fact that unemployed individuals have a lesser purchasing power due to decreased/depleted earnings which contributes to inflation. As a result unemployment ends up causing a decline in real GDP (Fleser & Dobre-Baron, 2010). Unemployment also reduces a country’s productivity, leading to a further decline in the country’s real GDP.

Over the last decade, the economies of Australia and the United States have undergone upsurge and decline due to different factors. In the last decade, Australia’s real GDP rate has been fluctuating at levels of between 1.2 to 4.8%, growth from 2000 to 2006 was in decline but the situation improved in 2007 before anther decline followed.

The fluctuating growth in GDP has been contributed by growth in business activities in the country from activities in the mining industry that has keeps changing due to world economic outlook. While the United States has also experienced fluctuating GDP growth rates in the last decade, although its growth has seen more steady periods between the years 2002 to 2008.

The growth periods in the US were contributed by good commodity prices and cheaper imports but this changed from 2008 when the US experienced economic meltdown contributed by increased debts and sub-prime mortgage problems. The global economic meltdown of 2008 hit both economies hard, but they have both bounced back. This is shown by figures 4 and 5 in the appendix.

Australia shows a general rise in inflation while the inflation rate in the United States has been relatively stable over the last ten years. Both countries, however, show a significant dip in inflation during the economic meltdown of 2008. Commodity prices plummeted as demand went down for commodities around the globe.

Inflation rates in Australia over the last decade have been fluctuating but in between 2002 and 2006, the rates steadied at around 2.8% and 3.8%. On the other hand, the United States inflation rates have steadied at levels of around 2 to 4% with the year 2008 registering the highest inflation of 4%. This is shown by figures 4 and 5 in the appendix.

Unemployment Rates

Over the last decade the unemployment rates in Australia have been on the downward trend from a high of 6.5% to a low of 4.2% in 2008. This could be attributed to growth in business especially in the fields of agriculture and mining. However since 2008, the unemployment rate has been on the increase due to effects of the economic meltdown of 2008 (Fleser, 2008).

On the other hand, the United States has witnessed growth in unemployment rate from a low of 4% in 2000 to the current levels of around 11%. The weak dollar and bad economic environment has seen the collapse of many industries in the United States contributing to high unemployment levels (Data 360, 2011). This is shown by figures 6 and 7 in the appendix.

Belongia, M. T. & Garfinkel, M. R., 1992. The business cycle: theories and evidence : proceedings of the Sixteenth Annual Economic Policy Conference of the Federal Reserve Bank of St. Louis . Norwell, MA: Kluwer Academic Publishers.

Data 360, 2011. GDP-Real (Adjusted) United States . Web.

Fleser, A. & Dobre-Baron, O., 2010. Economic and Social Implications of Unemployment and Opportunities of Diminishing it. Tome VIII , 3(11), pp.72-77.

IndexMundi, 2011. Australia GDP . Web.

International Labor Organization, 2011. ILO SAYS GLOBAL FINANCIAL CRISIS TO INCREASE UNEMPLOYMENT BY 20 MILLION . Web.

Mankiw, G., 2009. Measurement of Gross Domestic Product. In J. Sabatino, ed. Principles of Economics . 6th ed. Mason, OH: South-Western Cengage Learning. p.494.

QuickMBA, 2010. The Business Cycle . Web.

- Global Financial Meltdown and Its Impact on Saudi Arabia

- How the Skeletal Muscles Derive the Energy for Contraction

- Researching the Aspects of the Ethical Life

- World Economies: Top 10 Exporters and Importers in the World

- Expansion of Export Oriented Industry Subsidies

- The Costs and Benefits of Incurring an Annual Federal Budget Deficit

- Macroeconomics: Determination of GDP

- Macroeconomics: Demand of Super Bowl Tickets

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2018, December 27). Business Cycle in the U.S. and Australia. https://ivypanda.com/essays/the-business-cycle/

"Business Cycle in the U.S. and Australia." IvyPanda , 27 Dec. 2018, ivypanda.com/essays/the-business-cycle/.

IvyPanda . (2018) 'Business Cycle in the U.S. and Australia'. 27 December.

IvyPanda . 2018. "Business Cycle in the U.S. and Australia." December 27, 2018. https://ivypanda.com/essays/the-business-cycle/.

1. IvyPanda . "Business Cycle in the U.S. and Australia." December 27, 2018. https://ivypanda.com/essays/the-business-cycle/.

Bibliography

IvyPanda . "Business Cycle in the U.S. and Australia." December 27, 2018. https://ivypanda.com/essays/the-business-cycle/.

What is Business Cycles? Phases, Types, Theory, Nature

- Post last modified: 1 August 2021

- Reading time: 40 mins read

- Post category: Economics

What is the Business Cycle?

Business Cycle , also known as the economic cycle or trade cycle , is the fluctuations in economic activities or rise and fall movement of gross domestic product (GDP) around its long-term growth trend.

No era can stay forever. The economy too does not enjoy same periods all the time. Due to its dynamic nature, it moves through various phases.

Table of Content

- 1 What is the Business Cycle?

- 2 Business Cycle Definition

- 3.1 Expansion

- 3.3 Contraction

- 4.1 Cyclical nature

- 4.2 General nature

- 5 Types of Business Cycle

- 6.1 Hawtrey Monetary Theory

- 6.2 Innovation Theory

- 6.3 Keynesian Theory

- 6.4 Hicks Theory

- 6.5 Samuelson theory

- 7 Business Economics Tutorial

The change in business activities due to fluctuations in economic activities over a period of time is known as a business cycle . Business cycle are also called trade cycle or economic cycle. Business Cycle can also help you make better financial decisions.

The economic activities of a country include total output, income level, prices of products and services, employment, and rate of consumption. All these activities are interrelated; if one activity changes, the rest of them also change.

Also Read: What is Economics?

Business Cycle Definition

Arthur F. Burns and Wesley C. Mitchel defined business cycle definition as

Business cycle are a type of fluctuation found in the aggregate economic activity of nations that organize their work mainly in business enterprises: a cycle consists of expansions occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; in duration, business cycle vary from more than one year to ten or twelve years; they are not divisible into shorter cycle of similar characteristics with amplitudes approximating their own. Arthur F. Burns & Wesley C. Mitchel

Also Read: What is Demand in Economics

Phases of Business Cycle

4 Phases of Business Cycle are:

Contraction

Let us discuss 4 phases of business cycle in detail:

Expansion is the first phase of a business cycle . It is often referred to as the growth phase .

In the expansion phase, there is an increase in various economic factors, such as production, employment, output, wages, profits, demand and supply of products, and sales. During this phase, the focus of organisations remains on increasing the demand for their products/services in the market.

The expansion phase is characterised by:

- Increase in demand

- Growth in income

- Rise in competition

- Rise in advertising

- Creation of new policies

- Development of brand loyalty

In this phase, debtors are generally in a good financial condition to repay their debts; therefore, creditors lend money at higher interest rates. This leads to an increase in the flow of money.

In the expansion phase, due to increase in investment opportunities, idle funds of organisations or individuals are utilised for various investment purposes. The expansion phase continues till economic conditions are favourable.

Peak is the next phase after expansion. In this phase, a business reaches at the highest level and the profits are stable. Moreover, organisations make plans for further expansion.

Peak phase is marked by the following features:

- High demand and supply

- High revenue and market share

- Reduced advertising

- Strong brand image

In the peak phase, the economic factors, such as production, profit, sales, and employment, are higher but do not increase further.

An organisation after being at the peak for a period of time begins to decline and enters the phase of contraction. This phase is also known as a recession .

An organisation can be in this phase due to various reasons, such as a change in government policies, rise in the level of competition, unfavourable economic conditions, and labour problems. Due to these problems, the organisation begins to experience a loss of market share.

The important features of the contraction phase are:

- Reduced demand

- Loss in sales and revenue

- Reduced market share

- Increased competition

In Trough phase, an organisation suffers heavy losses and falls at the lowest point. At this stage, both profits and demand reduce. The organisation also loses its competitive position.

The main features of this phase are:

- Lowest income

- Loss of customers

- Adoption of measures for cost-cutting and reduction

- Heavy fall in market share

In this phase, the growth rate of an economy becomes negative. In addition, in trough phase, there is a rapid decline in national income and expenditure.

After studying the business cycle , it is important to study the nature of business cycle .

Read: Difference Between Micro and Macro Economics

Nature of Business Cycle

The nature of business cycle helps the organisation to be prepared for facing uncertainties of the business environment.

Cyclical nature

General nature.

Let us discuss the nature of business cycle in detail.

This is the periodic nature of a business cycle. Periodicity signifies the occurrence of business cycle at regular intervals of time. However, periods of intervals are different for different business cycle . There is a general consensus that a normal business cycle can take 7 to 10 years to complete.

The general nature of a business cycle states that any change in an organisation affects all other organisations too in the industry. Thus, general nature regards the business world as a single economic unit.

For example, depression moves from one organisation to the other and spread throughout the industry. The general nature is also known as synchronism.

Read: What is Business Economics?

Types of Business Cycle

Following the writings of Prof .James Arthur and Schumpeter, we can classify business cycle into three types based on the underlying time period of existence of the cycle as follows:

- Short Kitchin Cycle

- Longer Juglar cycle

- Very long Kondratieff Wave

Short Kitchin Cycle (very short or minor period of the cycle, approximately 40 months duration)

Longer Juglar cycle (major cycles, composed of three minor cycles and of the duration of 10 years or so)

Very long Kondratieff Wave (very long waves of cycle, made up of six major cycles and takes more than 60 years to run its course of duration)

Also Read: Scope of Economics

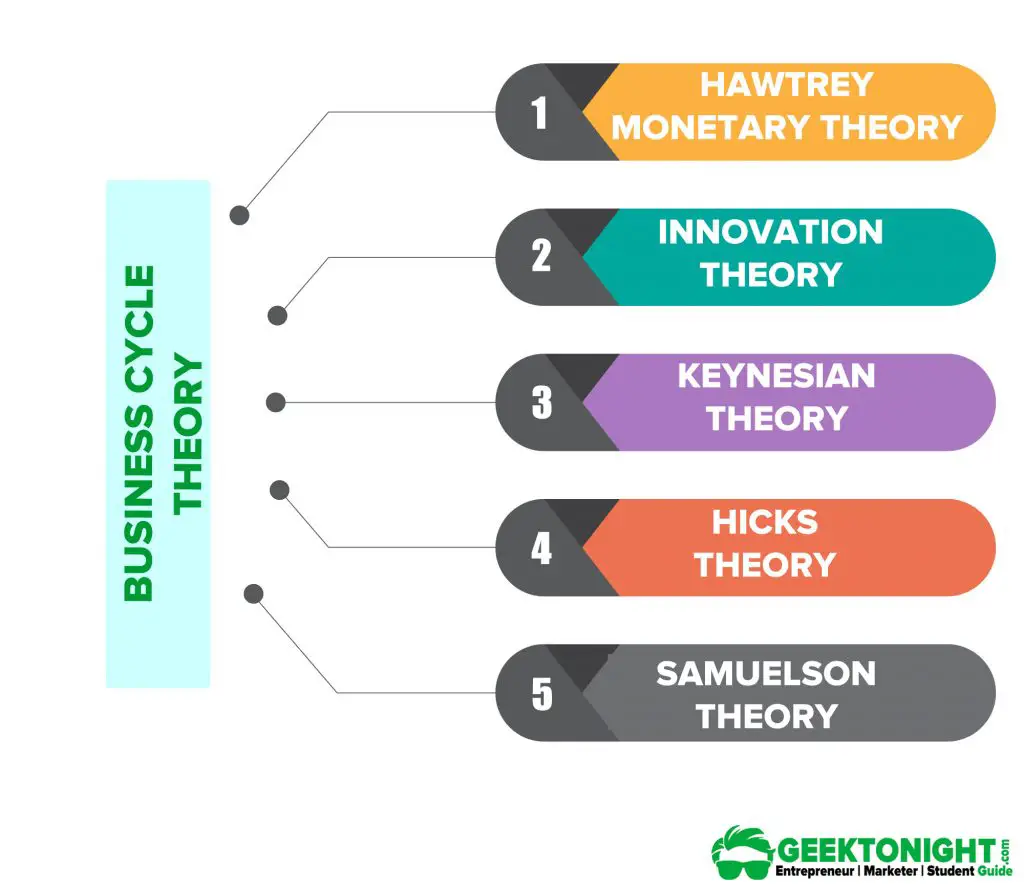

Business Cycle Theory

A business cycle is a complex phenomenon which is common to every economic system. Several theories of business cycle have been propounded from time to time to explain the causes of business cycle.

Business Cycle Theory are:

Hawtrey Monetary Theory

Innovation theory.

- Keynesian theory

Hicks Theory

Samuelson theory.

Hawtray was of opinion that in depression monetary factors play a critical role. The main factor affecting the flow of money and money supply is the credit position by the bank. He made the classical quantity theory of money as the basis of his trade cycle theory .

According to him, both monetary and non-monetary factors also affect trade. His theory is basically the product of the supply of money and expansion of credit. This expansion of credit and other money supply instrument create a cumulative process of expansion which in return increase aggregate demand.

According to this theory the only cause of fluctuations in business is due to instability of bank credit. So it can be concluded that Hawtray’s theory of business cycle is basically depend upon the money supply, bank credits and rate of interests.

Criticism of this Business Cycle theory

- Hawtray neglected the role of non-monetary factors like prosperous agriculture, inventions, rate of profit and stock of capital.

- It only concentrates on the supply of money.

- Increase in interest rates is not only due to economic prosperity but also due to other factors.

- Over-emphasis on the role of wholesalers.

- Too much confidence in monetary policy. vi. Neglect the role of expectations. vii. Incomplete theory of trade cycles.

The innovation theory of business cycle is invented by an American Economist Joseph Schumpeter. According to this theory, the main causes of business cycle are over-innovations.

He takes the meaning of innovation as the introduction and application of such techniques which can help in increasing production by exploiting the existing resources, not by discoveries or inventions. Innovations are always inspired by profits. Whenever innovations are introduced it results into profitability then shared by other producers and result in a decline in profitability.

- Innovation fails to explain the period of boom and depression.

- Innovation may be major factor of investment and economic activities but not the complete process of trade cycle.

- This theory is based on the assumption that every new innovation is financed by the banks and other credit institutions but this cannot be taken as granted because banks finance only short term loans and investments.

Keynesian Theory

The theory suggests that fluctuations in business cycle can be explained by the perceptions on expected rate of profit of the investors. In other words, the downswing in business cycle is caused by the collapse in the marginal efficiency of capital, while revival of the economy is attributed to the optimistic perceptions on the expected rate of profit.

Moreover, Keynesian multiplier theory establishes linkages between change in investment and change in income and employment. However, the theory fails to explain the cumulative character both in the upswing and downswing phases of business cycle and cyclical fluctuations in economic activity with the passage of time.

Hicks extended the earlier multiplier-accelerator interaction theory by considering real world situation. In reality, income and output do not tend to explode; rather they are located at a range specified by the upper ceiling and lower floor determined by the autonomous investment.

In the theory, it is assumed that autonomous investment tends to grow at a constant percentage rate over the long run, the acceleration co-efficient and multiplier co-efficient remain constant throughout the different phases of the trade cycle, saving and investment co-efficient are such that upward movements take away from equilibrium.

The actual output fails to adjust with the equilibrium growth path overtime. In fact it has a tendency to run above it and then below it, and thereby, constitute cyclical fluctuations overtime. This basic intuition can be shown with the help of the following figure.

- Wrong assumption of constant multiplier and acceleration co-efficient.

- Highly mechanical and mathematical device.

- Wrong assumption of no-excess capacity.

- Full-employment ceiling is not independent

According to this theory process of multiplier starts working when autonomous investment takes place in the economy. With the autonomous investment income of the people rises and there is increase in the demand of consumer goods. It directly affected the marginal propensity to consume.

If there is no excess production capacity in the existing industry then existing stock of capital would not be adequate to produce consumer goods to meet the rising demand. Now in order to meet the consumer’s requirements, producers will make new investment which is derived investment and the process of acceleration principle comes into operation.

Then there is rise in income again which in the same manner continue the process of income propagation. So in this way multiplier and acceleration interact and make the income grow at faster rate than expected. After reaching its peak, income comes down to bottom and again start rising.

Autonomous investment is incurred by the government with the objective of social welfare. It is also called public investment. The autonomous investment is the investment which is done for the sake of new inventions in techniques of production.

Derived investment is the investment undertaken in capital equipment which is induced by increase in consumption.

- This model only concentrates on the impact of the multiplier and acceleration and it ignored the role of producer’s expectations, changing business requirements and consumers preferences etc.

- It is not practically possible to compute the fact of multiplier and acceleration principle.

- It has wrong assumption of constant capital output ratio.

Also Read: What is Law of Supply?

- D N Dwivedi, Managerial Economics , 8th ed, Vikas Publishing House

- Petersen, Lewis & Jain, Managerial Economics , 4e, Pearson Education India

- Brigham, & Pappas, (1972). Managerial economics , 13ed. Hinsdale, Ill.: Dryden Press.

- Dean, J. (1951). Managerial economics (1st ed.). New York: Prentice-Hall.

Business Economics Tutorial

( Click on Topic to Read )

- What is Economics?

- Scope of Economics

- Nature of Economics

- What is Business Economics?

- Micro vs Macro Economics

- Laws of Economics

- Economic Statics and Dynamics

- Gross National Product (GNP)

- What is Business Cycle?

- W hat is Inflation?

- What is Demand?

- Types of Demand

- Determinants of Demand

- Law of Demand

- What is Demand Schedule?

- What is Demand Curve?

- What is Demand Function?

- Demand Curve Shifts

- What is Supply?

- Determinants of Supply

- Law of Supply

- What is Supply Schedule?

- What is Supply Curve?

- Supply Curve Shifts

- What is Market Equilibrium?

Consumer Demand Analysis

- Consumer Demand

- Utility in Economics

- Law of Diminishing Marginal Utility

- Cardinal and Ordinal Utility

- Indifference Curve

- Marginal Rate of Substitution

- Budget Line

- Consumer Equilibrium

- Revealed Preference Theory

Elasticity of Demand & Supply

- Elasticity of Demand

- Price Elasticity of Demand

- Types of Price Elasticity of Demand

- Factors Affecting Price Elasticity of Demand

- Importance of Price Elasticity of Demand

- Income Elasticity of Demand

- Cross Elasticity of Demand

- Advertisement Elasticity of Demand

- Elasticity of Supply

Cost & Production Analysis

- Production in Economics

- Production Possibility Curve

- Production Function

- Types of Production Functions

- Production in the Short Run

- Law of Diminishing Returns

- Isoquant Curve

- Producer Equilibrium

- Returns to Scale

Cost and Revenue Analysis

- Types of Cost

- Short Run Cost

- Long Run Cost

- Economies and Diseconomies of Scale

- What is Revenue?

Market Structure

- Types of Market Structures

- Profit Maximization

- What is Market Power?

- Demand Forecasting

- Methods of Demand Forecasting

- Criteria for Good Demand Forecasting

Market Failure

- What Market Failure?

Price Ceiling and Price Floor

Go On, Share article with Friends

Did we miss something in Business Economics Tutorial? Come on! Tell us what you think about our article on Business Cycle | Business Economics in the comments section.

- What is Inflation?

- Determinants of Demand

You Might Also Like

What is revenue types: total, average, marginal, consumer equilibrium: effects on income, substitution, price, what is advertisement elasticity of demand formula, example.

What is Supply Curve? Definition,Type, Example

What is Elasticity of Supply? Definition, Formula, Example, Determinants

What is Income Elasticity of Demand? Types, Formula, Example, Factors

Economic statics and dynamics: definition, what, importance.

What is Demand Schedule? Definition, Example, Graph, Types

What is Law of Demand? Definition, Exceptions, Assumptions

Profit maximization: definition, formula, short run & long run.

What is Inflation in Economics? Definition, Causes, Type, Effects

Leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal Growth

Development

This website uses cookies.

By clicking the "Accept" button or continuing to browse our site, you agree to first-party and session-only cookies being stored on your device to enhance site navigation and analyze site performance and traffic. For more information on our use of cookies, please see our Privacy Policy .

Journal of Economic Perspectives

- Summer 1989

Understanding Real Business Cycles

ISSN 0895-3309 (Print) | ISSN 1944-7965 (Online)

- Editorial Policy

- Annual Report of the Editor

- Research Highlights

- Reading Recommendations

- JEP in the Classroom

- Contact Information

- Current Issue

- Guidelines for Proposals

- Charles I. Plosser

- Article Information

- Comments ( 0 )

JEL Classification

- 131 Economic Fluctuations--Studies

You must enable JavaScript in order to use this site.

IMAGES

VIDEO

COMMENTS

Business Cycles The purpose of this section is to introduce the study of business cycles. By business cycles we mean fluctuations of output around its long term growth trend. In this sense, it complements growth theory to provide a thorough ex-planation of the behavior of economic aggregates: First, output grows secularly.

The business cycle has six phases: 1. Expansion. This is the first phase of the business cycle, and it's generally marked by an increase in economic activity. GDP ( Gross Domestic Product) rises, unemployment falls, and prices increase. During this period, businesses are steadily growing their production and investing in new opportunities.

This is the business cycle. Business cycle. The term "cycle" is a little bit misleading. Whenever you think of a cycle, even the way I drew it, it kind of looks like a nice well-defined pattern and every the same amount of years you're going up and down, it kind of implies that it's predictable. The reality is that the business cycle is very ...

Business cycle, also referred to as economic cycle, is a term mainly used by economics scholars and business practitioners to demonstrate the fluctuating movements (increasing or decreasing) of levels of the gross domestic product (GDP) in an economy over a particular period of time that may vary from several months to a number of years (Ball, 2009).

1. Definition of Business Cycle: A capitalistic economy experiences fluctuations in the level of economic activity. And fluctuations in economic activity mean fluctuations in macroeconomic variables. At times, consumption, investment, employment, output, etc., rise and at other times these macroeconomic variables fall. Such fluctuations in macroeconomic variables are known as business ...

Business Cycle: The business cycle is the fluctuation in economic activity that an economy experiences over a period of time. A business cycle is basically defined in terms of periods of expansion ...

Real gross domestic product (GDP)—total economic output adjusted for inflation—is the broadest measure of economic activity. The economy's movement through these alternating periods of growth and contraction is known as the business cycle. The business cycle has four phases: expansion, peak, contraction, and trough, as shown in Figure 1 ...

Practice. In this unit, you'll learn to identify and examine key measures of economic performance: gross domestic product, unemployment, and inflation. The concept of the business cycle also gives you an overview of economic fluctuations in the short run.

It also involves using human, financial, and informational resources. In this unit, we explore how successful business management requires teamwork, communication, creating a clear corporate mission and culture, following good business ethics, and committing to social responsibility. Completing this unit should take you approximately 16 hours.

During a given business cycle, the economy's output performance can be traced using trend lines. The latter is used to relate one business cycle phase to another, such as one prosperity to another one depression phase to another depression phase. When economic growth is in the offing, trend lines that slope upwards are used.

A business cycle is the repetitive economic changes that take place in a country over a period. It is identified through the variations in the GDP along with other macroeconomics indexes. The four phases of the business cycle are expansion, peak, contraction, and trough. The risk and adverse effects of the phases can be mitigated through wisely ...

Introduction; 1.1 The Nature of Business; 1.2 Understanding the Business Environment; 1.3 How Business and Economics Work; 1.4 Macroeconomics: The Big Picture; 1.5 Achieving Macroeconomic Goals; 1.6 Microeconomics: Zeroing in on Businesses and Consumers; 1.7 Competing in a Free Market; 1.8 Trends in the Business Environment and Competition; Key Terms; Summary of Learning Outcomes

Economic Cycle: The economic cycle is the natural fluctuation of the economy between periods of expansion (growth) and contraction (recession). Factors such as gross domestic product (GDP ...

Essays in Business Cycle Economics by Dana Galizia B.A., The University of Western Ontario, 2005 ... Introduction 1.1Business cycles Since the early part of the twentieth century, a substantial part of economic research has been devoted to the study of business cycles (i.e., persistent but non-permanent fluctuations in economic aggregates ...

Introduction. Although it is difficult to define the business cycle in one statement, it has one defining characteristic. Belongia (1992, pp. 43), describes the business cycle as 'characterized by a decline and contraction and a subsequent rise and expansion of aggregate economic activity.'

The change in business activities due to fluctuations in economic activities over a period of time is known as a business cycle. Business cycle are also called trade cycle or economic cycle. Business Cycle can also help you make better financial decisions. The economic activities of a country include total output, income level, prices of ...

business activity). Points 5 and 6 imply that fiscal and monetary policy actions can add to or reduce macroeconomic instability. 7. Greater confidence of private economic agents, both induced by the ob served business cycle moderation itself and inducing behavior favorable to more stable economic growth. This suggests a role for endogenous and

Understanding Real Business Cycles by Charles I. Plosser. Published in volume 3, issue 3, pages 51-77 of Journal of Economic Perspectives, Summer 1989, Abstract: This brief essay is intended to provide readers with an introduction to the real business cycle approach to business fluctuations. It disc...

Some business cycles last for a brief time while other can take up to 50 years. Shorter cycles represent a weaker cycle and longer lengths represent a stronger cycle. Trend line It shows the general direction in which the economy is moving. It usually has a positive slope because the production capacity of a country increases; over time.

ASSIGNMENT 1 Introduction In macroeconomics, business cycle played an important role to show what a national economy is going; therefore, this essay will define what business cycle is and its characteristics. Besides, all of variables such as Real Gross Domestic Product (RGDP), inflation and unemployment rate and their behaviour in the business ...

The business cycle relates to repetitive fluctuations of expansion and recession in an economy. Over the longer term an economy would normally experience a positive growth in output. Therefore, the business cycle can be defined as the 'short-term fluctuation of total output around its trend path' (Begg et al, 1997, 518).

Study business online free by downloading OpenStax's Introduction to Business textbook and using our accompanying online resources.

ASSIGNMENT 1 Introduction In macroeconomics, business cycle played an important role to show what a national economy is going; therefore, this essay will define what business cycle is and its characteristics. Besides, all of variables such as Real Gross Domestic Product (RGDP), inflation and unemployment rate and their behaviour in the business ...