- Newsletters

- Best Industries

- Business Plans

- Home-Based Business

- The UPS Store

- Customer Service

- Black in Business

- Your Next Move

- Female Founders

- Best Workplaces

- Company Culture

- Public Speaking

- HR/Benefits

- Productivity

- All the Hats

- Digital Transformation

- Artificial Intelligence

- Bringing Innovation to Market

- Cloud Computing

- Social Media

- Data Detectives

- Exit Interview

- Bootstrapping

- Crowdfunding

- Venture Capital

- Business Models

- Personal Finance

- Founder-Friendly Investors

- Upcoming Events

- Inc. 5000 Vision Conference

- Become a Sponsor

- Cox Business

- Verizon Business

- Branded Content

- Apply Inc. 5000 US

Inc. Premium

How to Write the Financial Section of a Business Plan

An outline of your company's growth strategy is essential to a business plan, but it just isn't complete without the numbers to back it up. here's some advice on how to include things like a sales forecast, expense budget, and cash-flow statement..

A business plan is all conceptual until you start filling in the numbers and terms. The sections about your marketing plan and strategy are interesting to read, but they don't mean a thing if you can't justify your business with good figures on the bottom line. You do this in a distinct section of your business plan for financial forecasts and statements. The financial section of a business plan is one of the most essential components of the plan, as you will need it if you have any hope of winning over investors or obtaining a bank loan. Even if you don't need financing, you should compile a financial forecast in order to simply be successful in steering your business. "This is what will tell you whether the business will be viable or whether you are wasting your time and/or money," says Linda Pinson, author of Automate Your Business Plan for Windows (Out of Your Mind 2008) and Anatomy of a Business Plan (Out of Your Mind 2008), who runs a publishing and software business Out of Your Mind and Into the Marketplace . "In many instances, it will tell you that you should not be going into this business." The following will cover what the financial section of a business plan is, what it should include, and how you should use it to not only win financing but to better manage your business.

Dig Deeper: Generating an Accurate Sales Forecast

Editor's Note: Looking for Business Loans for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you with information for free:

How to Write the Financial Section of a Business Plan: The Purpose of the Financial Section Let's start by explaining what the financial section of a business plan is not. Realize that the financial section is not the same as accounting. Many people get confused about this because the financial projections that you include--profit and loss, balance sheet, and cash flow--look similar to accounting statements your business generates. But accounting looks back in time, starting today and taking a historical view. Business planning or forecasting is a forward-looking view, starting today and going into the future. "You don't do financials in a business plan the same way you calculate the details in your accounting reports," says Tim Berry, president and founder of Palo Alto Software, who blogs at Bplans.com and is writing a book, The Plan-As-You-Go Business Plan. "It's not tax reporting. It's an elaborate educated guess." What this means, says Berry, is that you summarize and aggregate more than you might with accounting, which deals more in detail. "You don't have to imagine all future asset purchases with hypothetical dates and hypothetical depreciation schedules to estimate future depreciation," he says. "You can just guess based on past results. And you don't spend a lot of time on minute details in a financial forecast that depends on an educated guess for sales." The purpose of the financial section of a business plan is two-fold. You're going to need it if you are seeking investment from venture capitalists, angel investors, or even smart family members. They are going to want to see numbers that say your business will grow--and quickly--and that there is an exit strategy for them on the horizon, during which they can make a profit. Any bank or lender will also ask to see these numbers as well to make sure you can repay your loan. But the most important reason to compile this financial forecast is for your own benefit, so you understand how you project your business will do. "This is an ongoing, living document. It should be a guide to running your business," Pinson says. "And at any particular time you feel you need funding or financing, then you are prepared to go with your documents." If there is a rule of thumb when filling in the numbers in the financial section of your business plan, it's this: Be realistic. "There is a tremendous problem with the hockey-stick forecast" that projects growth as steady until it shoots up like the end of a hockey stick, Berry says. "They really aren't credible." Berry, who acts as an angel investor with the Willamette Angel Conference, says that while a startling growth trajectory is something that would-be investors would love to see, it's most often not a believable growth forecast. "Everyone wants to get involved in the next Google or Twitter, but every plan seems to have this hockey stick forecast," he says. "Sales are going along flat, but six months from now there is a huge turn and everything gets amazing, assuming they get the investors' money." The way you come up a credible financial section for your business plan is to demonstrate that it's realistic. One way, Berry says, is to break the figures into components, by sales channel or target market segment, and provide realistic estimates for sales and revenue. "It's not exactly data, because you're still guessing the future. But if you break the guess into component guesses and look at each one individually, it somehow feels better," Berry says. "Nobody wins by overly optimistic or overly pessimistic forecasts."

Dig Deeper: What Angel Investors Look For

How to Write the Financial Section of a Business Plan: The Components of a Financial Section

A financial forecast isn't necessarily compiled in sequence. And you most likely won't present it in the final document in the same sequence you compile the figures and documents. Berry says that it's typical to start in one place and jump back and forth. For example, what you see in the cash-flow plan might mean going back to change estimates for sales and expenses. Still, he says that it's easier to explain in sequence, as long as you understand that you don't start at step one and go to step six without looking back--a lot--in between.

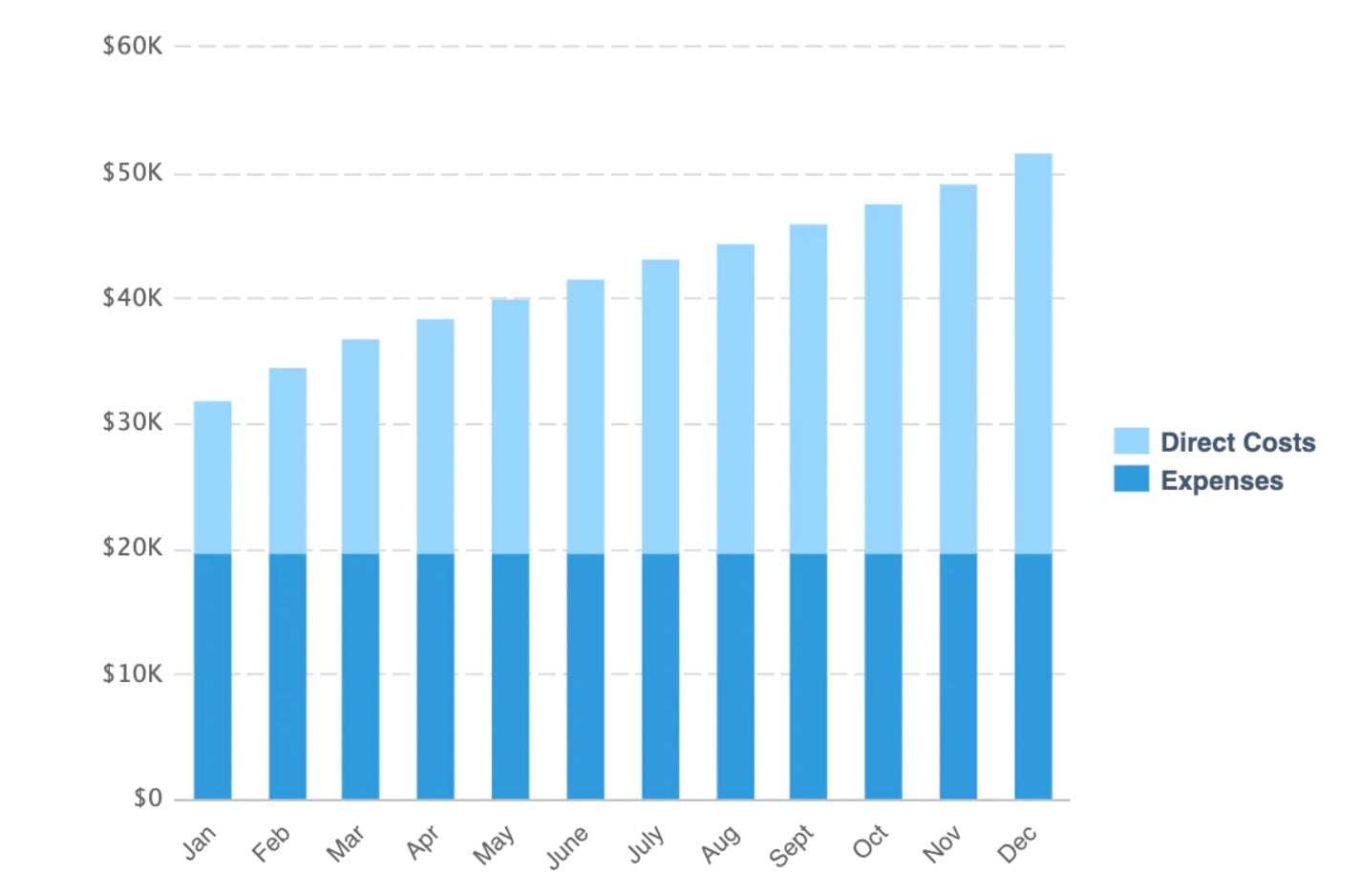

- Start with a sales forecast. Set up a spreadsheet projecting your sales over the course of three years. Set up different sections for different lines of sales and columns for every month for the first year and either on a monthly or quarterly basis for the second and third years. "Ideally you want to project in spreadsheet blocks that include one block for unit sales, one block for pricing, a third block that multiplies units times price to calculate sales, a fourth block that has unit costs, and a fifth that multiplies units times unit cost to calculate cost of sales (also called COGS or direct costs)," Berry says. "Why do you want cost of sales in a sales forecast? Because you want to calculate gross margin. Gross margin is sales less cost of sales, and it's a useful number for comparing with different standard industry ratios." If it's a new product or a new line of business, you have to make an educated guess. The best way to do that, Berry says, is to look at past results.

- Create an expenses budget. You're going to need to understand how much it's going to cost you to actually make the sales you have forecast. Berry likes to differentiate between fixed costs (i.e., rent and payroll) and variable costs (i.e., most advertising and promotional expenses), because it's a good thing for a business to know. "Lower fixed costs mean less risk, which might be theoretical in business schools but are very concrete when you have rent and payroll checks to sign," Berry says. "Most of your variable costs are in those direct costs that belong in your sales forecast, but there are also some variable expenses, like ads and rebates and such." Once again, this is a forecast, not accounting, and you're going to have to estimate things like interest and taxes. Berry recommends you go with simple math. He says multiply estimated profits times your best-guess tax percentage rate to estimate taxes. And then multiply your estimated debts balance times an estimated interest rate to estimate interest.

- Develop a cash-flow statement. This is the statement that shows physical dollars moving in and out of the business. "Cash flow is king," Pinson says. You base this partly on your sales forecasts, balance sheet items, and other assumptions. If you are operating an existing business, you should have historical documents, such as profit and loss statements and balance sheets from years past to base these forecasts on. If you are starting a new business and do not have these historical financial statements, you start by projecting a cash-flow statement broken down into 12 months. Pinson says that it's important to understand when compiling this cash-flow projection that you need to choose a realistic ratio for how many of your invoices will be paid in cash, 30 days, 60 days, 90 days and so on. You don't want to be surprised that you only collect 80 percent of your invoices in the first 30 days when you are counting on 100 percent to pay your expenses, she says. Some business planning software programs will have these formulas built in to help you make these projections.

- Income projections. This is your pro forma profit and loss statement, detailing forecasts for your business for the coming three years. Use the numbers that you put in your sales forecast, expense projections, and cash flow statement. "Sales, lest cost of sales, is gross margin," Berry says. "Gross margin, less expenses, interest, and taxes, is net profit."

- Deal with assets and liabilities. You also need a projected balance sheet. You have to deal with assets and liabilities that aren't in the profits and loss statement and project the net worth of your business at the end of the fiscal year. Some of those are obvious and affect you at only the beginning, like startup assets. A lot are not obvious. "Interest is in the profit and loss, but repayment of principle isn't," Berry says. "Taking out a loan, giving out a loan, and inventory show up only in assets--until you pay for them." So the way to compile this is to start with assets, and estimate what you'll have on hand, month by month for cash, accounts receivable (money owed to you), inventory if you have it, and substantial assets like land, buildings, and equipment. Then figure out what you have as liabilities--meaning debts. That's money you owe because you haven't paid bills (which is called accounts payable) and the debts you have because of outstanding loans.

- Breakeven analysis. The breakeven point, Pinson says, is when your business's expenses match your sales or service volume. The three-year income projection will enable you to undertake this analysis. "If your business is viable, at a certain period of time your overall revenue will exceed your overall expenses, including interest." This is an important analysis for potential investors, who want to know that they are investing in a fast-growing business with an exit strategy.

Dig Deeper: How to Price Business Services

How to Write the Financial Section of a Business Plan: How to Use the Financial Section One of the biggest mistakes business people make is to look at their business plan, and particularly the financial section, only once a year. "I like to quote former President Dwight D. Eisenhower," says Berry. "'The plan is useless, but planning is essential.' What people do wrong is focus on the plan, and once the plan is done, it's forgotten. It's really a shame, because they could have used it as a tool for managing the company." In fact, Berry recommends that business executives sit down with the business plan once a month and fill in the actual numbers in the profit and loss statement and compare those numbers with projections. And then use those comparisons to revise projections in the future. Pinson also recommends that you undertake a financial statement analysis to develop a study of relationships and compare items in your financial statements, compare financial statements over time, and even compare your statements to those of other businesses. Part of this is a ratio analysis. She recommends you do some homework and find out some of the prevailing ratios used in your industry for liquidity analysis, profitability analysis, and debt and compare those standard ratios with your own. "This is all for your benefit," she says. "That's what financial statements are for. You should be utilizing your financial statements to measure your business against what you did in prior years or to measure your business against another business like yours." If you are using your business plan to attract investment or get a loan, you may also include a business financial history as part of the financial section. This is a summary of your business from its start to the present. Sometimes a bank might have a section like this on a loan application. If you are seeking a loan, you may need to add supplementary documents to the financial section, such as the owner's financial statements, listing assets and liabilities. All of the various calculations you need to assemble the financial section of a business plan are a good reason to look for business planning software, so you can have this on your computer and make sure you get this right. Software programs also let you use some of your projections in the financial section to create pie charts or bar graphs that you can use elsewhere in your business plan to highlight your financials, your sales history, or your projected income over three years. "It's a pretty well-known fact that if you are going to seek equity investment from venture capitalists or angel investors," Pinson says, "they do like visuals."

Dig Deeper: How to Protect Your Margins in a Downturn

Related Links: Making It All Add Up: The Financial Section of a Business Plan One of the major benefits of creating a business plan is that it forces entrepreneurs to confront their company's finances squarely. Persuasive Projections You can avoid some of the most common mistakes by following this list of dos and don'ts. Making Your Financials Add Up No business plan is complete until it contains a set of financial projections that are not only inspiring but also logical and defensible. How many years should my financial projections cover for a new business? Some guidelines on what to include. Recommended Resources: Bplans.com More than 100 free sample business plans, plus articles, tips, and tools for developing your plan. Planning, Startups, Stories: Basic Business Numbers An online video in author Tim Berry's blog, outlining what you really need to know about basic business numbers. Out of Your Mind and Into the Marketplace Linda Pinson's business selling books and software for business planning. Palo Alto Software Business-planning tools and information from the maker of the Business Plan Pro software. U.S. Small Business Administration Government-sponsored website aiding small and midsize businesses. Financial Statement Section of a Business Plan for Start-Ups A guide to writing the financial section of a business plan developed by SCORE of northeastern Massachusetts.

Editorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means editors and reporters research and write on these products free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site.

The Daily Digest for Entrepreneurs and Business Leaders

Privacy Policy

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

Quickbooks Sync and compare with your quickbooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth and investor readiness

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

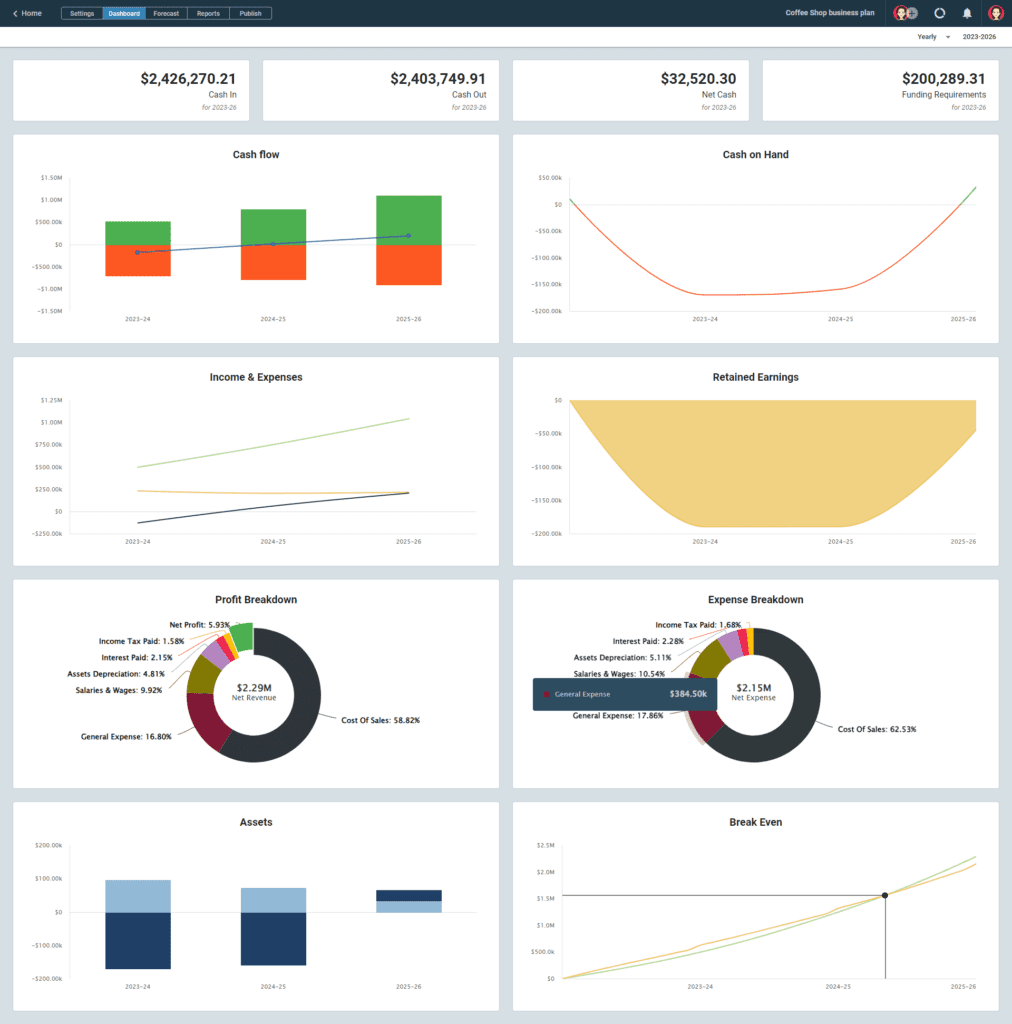

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

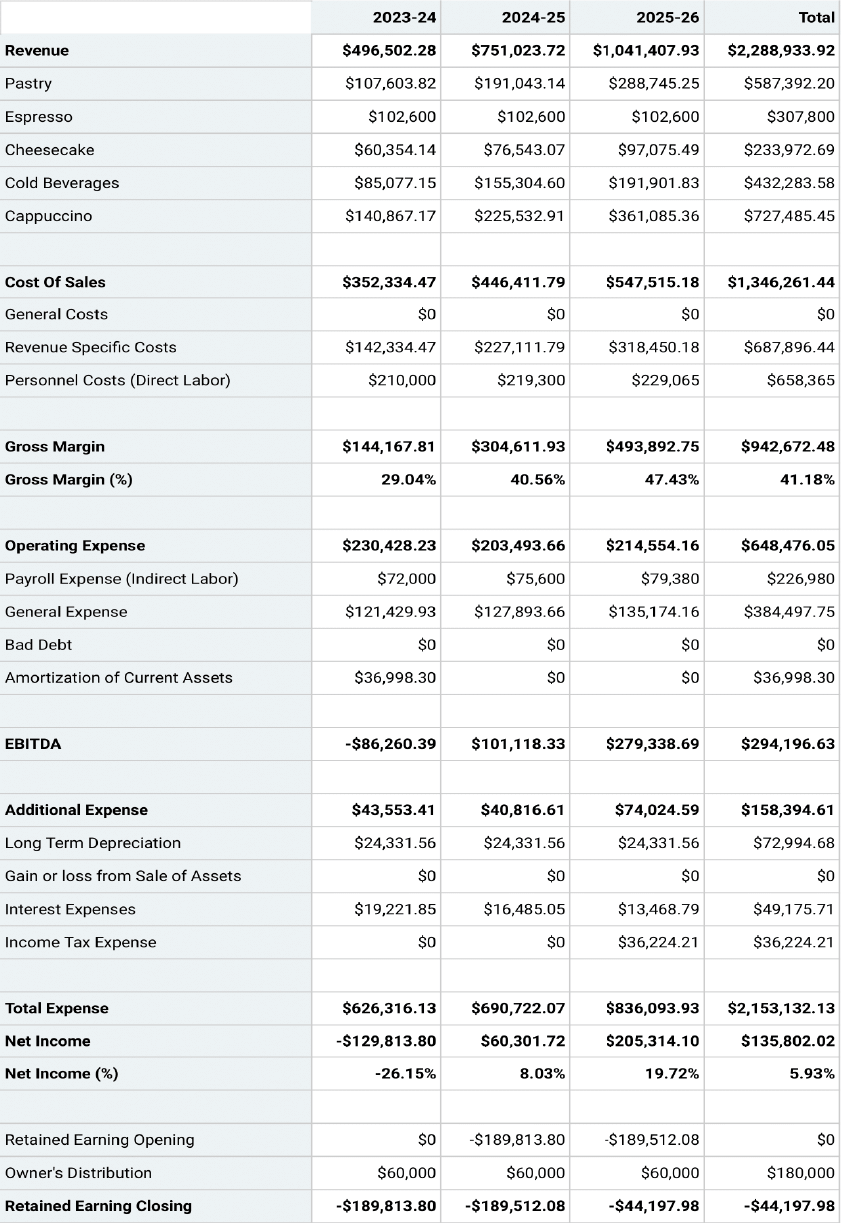

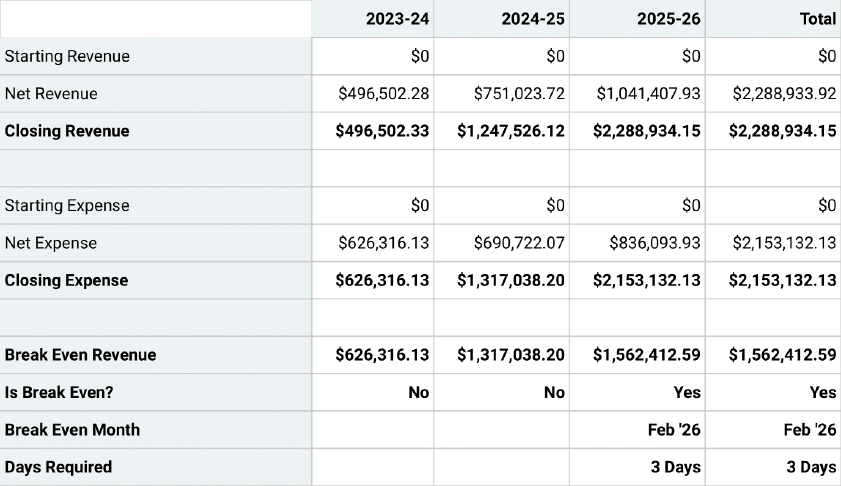

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Business Plan Financial Summary - The Devil Is In The Detail

A business plan financial summary can be a key factor in the overall success of your business plan. Make your projections too grand and without justifiable data and you can lose the trust of your reader. The goal of a business plan financial summary is to provide a snapshot of the financial health, performance, and future projections of your enterprise. In this blog post, we will guide you through the process of creating a compelling financial summary. Whether you're a startup looking to secure funding or an established company planning to scale, this comprehensive guide will serve as an invaluable tool on your business journey.

Table of Contents

Understanding the Financial Summary

- Key Components

- Step By Step

Revenue/Sales Forecast

Expenses projection, cash flow statement, income statement, balance sheet, break-even analysis.

- Ratios & KPIs

- Putting It Altogether

- Tips & Best Practices

Wrapping It All Up

The financial summary, at its core, is a succinct and high-level overview of the financial data that shows your business's viability and potential profitability. Unlike the financial projections section, which delves into detailed predictions about future income, expenses, and cash flows, the financial summary provides a more digestible summary of these figures. Its purpose is to communicate the key aspects of your financial strategy and give stakeholders - investors, banks, and even team members - an accessible snapshot of your business's financial health and plans. A well-crafted financial summary gives potential investors the assurance they need about your business's ability to generate profit, manage expenses, and, ultimately, provide a return on their investment. It guides decision-making processes and plays a significant role in securing funding.

Business Plan Financial Summary - Key Components

A financial summary is a composite of several key components, each contributing to a comprehensive picture of your business's financial trajectory.

- Revenue/Sales Forecast: This projects the amount of money your business anticipates to make from the sale of products or services over a certain period. It forms the basis of your profit expectations and is critical in strategising your business's growth.

- Expenses Projection: This includes your forecast of both fixed costs (rent, salaries, utilities) and variable costs (production materials, commissions, advertising). Getting a handle on projected expenses is essential in planning for profitability and cash flow management.

- Cash Flow Statement: This reflects how changes in balance sheet accounts and income affect your cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. It’s vital for understanding the liquidity and financial flexibility of your business.

- Income Statement: Also known as a profit and loss statement, it shows your revenues, costs, and expenses over a period. This statement is your business's report card, showing its profitability during a specific time frame.

- Balance Sheet: This gives a snapshot of your company's net worth at a specific point in time. It lists all your business's assets, liabilities, and shareholders' equity - the difference between assets and liabilities.

- Breakeven Analysis: This is the point when your total revenue equals total costs. Knowing your breakeven point is crucial for determining pricing, setting sales budgets, and planning for future growth.

- Financial Ratios and Key Performance Indicators (KPIs): These metrics help assess the financial health, performance, and growth potential of your business. They can highlight strengths, pinpoint weaknesses, and guide strategic decision-making.

In the coming sections, we will delve into each of these components in greater detail, illuminating how to create, analyze, and utilize them effectively in your financial summary.

Building a Financial Summary Step-by-Step

Creating a revenue forecast may seem daunting at first, especially for new businesses without historical sales data. But don't be discouraged; it is achievable through a blend of market research, a clear understanding of your target audience, and strategic sales goals. Begin by defining your potential market and then estimating the portion of this market that your business can reasonably capture (your market share). This market share, when multiplied by the price of your product or service, forms the basis of your revenue forecast. Here, it is crucial to base your estimates on practical figures rather than optimistic ones. Overestimating sales can lead to disappointments and financial missteps. It's also worth noting that your revenue forecast will likely change as your business grows and gathers more data. Remember, your sales forecast isn't set in stone. It's an evolving aspect of your business plan that should be reviewed and adjusted regularly based on the realities of your business operations. An effective revenue forecast is a balance between ambition and realism.

After outlining your revenue forecast, the next step is to estimate your business's expenses. A comprehensive and accurate expense projection is paramount in ensuring your business stays financially sustainable and on the path to profitability. Expenses typically fall into two categories: fixed and variable. Fixed costs are those that don't change with the level of goods or services you produce. They include rent, utilities, insurance, salaries, and any other costs that remain constant regardless of business activity. These costs are often easier to predict as they don't vary much over time. Variable costs, on the other hand, fluctuate based on your business volume. They include the costs of raw materials, shipping, sales commissions, and other expenses that rise and fall with your business activity. When projecting expenses, start by listing all potential costs—both fixed and variable—that your business is likely to incur. Then, estimate the amount of each cost based on historical data if available, or industry averages for new businesses. Consider the likely changes to your costs over time. For example, rent may increase due to inflation, or your raw material costs may fluctuate based on supplier prices or changes in demand. Accuracy in expense projection is vital; underestimating your expenses can lead to financial strain and cash flow issues down the line. Regularly revisiting and updating your expense projection will keep it in line with the realities of your business, helping you make informed decisions about pricing, budgeting, and growth. With a clear understanding of your expenses, you can create a more informed and accurate cash flow statement, which we will delve into in the next section.

A cash flow statement, one of the most critical components of a financial summary, provides a comprehensive picture of how money moves in and out of your business. This document gives stakeholders a clear view of your business's liquidity—its ability to cover short-term obligations. The cash flow statement breaks down into three main sections: Cash from Operating Activities : This section reveals how much cash your business generates from its core operations, such as sales of goods or services. It also includes cash spent, like operating expenses. A positive number here indicates that the company's operations are generating more cash than it is using, which is a good sign of financial health. Cash from Investing Activities : This part shows cash gained or spent through investing activities. These could include the purchase or sale of assets, like property or equipment, or investments in other businesses. A negative number here is typical for growing businesses making substantial investments. Cash from Financing Activities : This reveals the cash inflows from investors or banks and outflows to shareholders, such as dividends or share buybacks. Positive cash flow from financing activities means more money is flowing into the business than flowing out, indicating growth or expansion. The bottom line of the cash flow statement reveals the net increase or decrease in cash for the period. If this number is negative, it could be a warning sign that the company is not generating enough cash from its operations and may need to reevaluate its business model. In essence, the cash flow statement offers an in-depth look at your company's ability to generate cash to sustain its operations and finance its growth. It complements the income statement and balance sheet to give a holistic view of a business's financial health.

Another pivotal component of your financial summary is the Income Statement , also known as a Profit and Loss Statement (P&L). The income statement shows your business's profitability over a specific period, typically a quarter or a year. The income statement provides a structured summary of your revenues, costs, and expenses. Here's a general format for how to create it: Revenues : This includes all the income your business generates, primarily from selling goods or services. It is generally listed at the top of the income statement. Cost of Goods Sold (COGS) : This section includes the direct costs associated with producing the goods or services sold by the business. It typically includes material costs and direct labour costs. Gross Profit : This is calculated by subtracting the Cost of Goods Sold from the Revenues. It shows the profit made after deducting the costs directly related to the goods or services provided. Operating Expenses : These are costs not directly tied to a specific product or service. It includes items such as salaries, utilities, rent, marketing, and depreciation. Operating Income : This is calculated by subtracting Operating Expenses from the Gross Profit. It gives the profit made from a company's core business operations. Net Income : Finally, subtracting any other expenses (like taxes and interest) from the Operating Income gives the Net Income. This is the bottom line that shows the total earnings (or losses) of the business after all costs and expenses are accounted for. A well-structured income statement not only showcases your business's profitability but also offers valuable insights into operational efficiency, cost management, and the potential for future growth. After understanding your business's profitability, the next step is to get a holistic view of your financial health with the Balance Sheet, which we will discuss in the next section.

A Balance Sheet provides a snapshot of your business's financial health at a specific point in time. It lists all your business's assets, liabilities, and shareholders' equity, giving you a holistic picture of your financial standing. The balance sheet is based on the following fundamental accounting equation: Assets = Liabilities + Shareholders' Equity Here's what each term means: Assets: These are resources owned by the business that have economic value. Assets can be tangible (like cash, inventory, property, and equipment) or intangible (like patents, trademarks, and copyrights). Liabilities: These are obligations the business owes to others. Liabilities can be current (due within a year, like accounts payable, wages, and taxes) or long-term (due over a more extended period, like bank loans or mortgage payments). Shareholders' Equity: Also known as owner's equity, it represents the net value of the business. It's what's left over when you subtract liabilities from assets. It reflects the money that would be left if the company sold all its assets and paid off all its liabilities. A balance sheet offers a wealth of information for potential investors. It allows them to assess the company's liquidity (current assets vs. current liabilities), efficiency (inventory and receivable turnover), and financial structure (debt vs. equity). It's important to regularly review and update your balance sheet to reflect the dynamic nature of business transactions and to maintain a clear and accurate picture of your business's financial health.

A Break-even Analysis is an essential tool in your financial summary arsenal. It helps you determine the minimum amount of sales needed to cover all your costs—both fixed and variable. In other words, it’s the point at which total revenue equals total costs, and your business neither makes a profit nor suffers a loss. The formula for calculating the break-even point is straightforward: Break-Even Point (in units) = Total Fixed Costs / (Selling Price per Unit - Variable Cost per Unit) Here's what each term represents: Total Fixed Costs: These are the costs that do not change with the level of output, such as rent, salaries, and insurance. Selling Price per Unit: This is the price at which you sell your product or service to customers. Variable Cost per Unit: These are costs that vary with the level of production, like raw materials or direct labour costs. Understanding your break-even point is vital for several reasons: Pricing Strategy: It helps you determine how to price your products or services. If your selling price is too low, you might sell a lot, but you might also struggle to cover your costs. Sales Targets: It can guide you in setting realistic sales targets that ensure profitability. Growth Planning: It allows you to gauge the impact of increased production and whether scaling up would be financially beneficial. Investor Attraction: Investors may use your break-even analysis to understand the risk involved in your business. Remember that your break-even point is not static—it will shift as costs, prices, and other variables change. Make sure to recalculate it regularly to stay on top of your financial situation.

Financial Ratios and Key Performance Indicators (KPIs)

Financial Ratios and Key Performance Indicators (KPIs) are like the vital signs of your business, providing a quick snapshot of its health and performance. They allow you to analyze your business's financial situation, highlight areas of strength and weakness, and compare performance over time or against industry standards. Here are some of the most critical ratios and KPIs that you should consider including in your financial summary:

- Profit Margin : This measures profitability for each dollar of sales. It's calculated by dividing net profit by total revenue. A higher profit margin indicates a more profitable business.

- Current Ratio : This measures your ability to pay back short-term liabilities (debts and payables) with short-term assets (cash, inventory, receivables). The higher the ratio, the better your company's liquidity position.

- Quick Ratio : Similar to the current ratio but excludes inventory from assets. It provides a more stringent view of your company's ability to meet short-term obligations.

- Debt to Equity Ratio: This shows the proportion of equity and debt the company is using to finance its assets. A lower ratio generally implies a company has been less aggressive in financing its growth with debt, which in turn reduces the risk of default.

- Return on Equity: This shows how much profit a company generates with the money shareholders have invested. A higher ROE indicates more effective management.

- Inventory Turnover: This measures how quickly inventory is sold. A higher turnover rate can indicate strong sales or ineffective buying.

Your business may also have unique KPIs based on its industry or specific operational metrics. For example, a software-as-a-service (SaaS) company might focus on churn rate (the rate at which customers cancel their subscriptions), while a retail store might track same-store sales (comparing sales in the same store locations for two different periods). If you are looking for a guide on business plans for your specific industry, check out our business plan guides homepage.

Business Plan Financial Summary - Putting it All Together

The financial summary is where you bring together all the various elements discussed so far into a coherent and compelling narrative. This section provides an overview of the financial aspects of your business, giving readers an at-a-glance understanding of your company's financial position and future expectations. The bulk of the work will be done in preparing the various components of the business financial summary that have been outlined above. The key is taking the main parts of each section of giving the reader a full overview of the financial status and projections. Be sure to Include graphs and charts where possible to aid readability. As with any financial projections don't overstate or create numbers that you can't justify. If pitching to investors they will quickly lose confidence in your business plan if you use unrealistic projections or targets.

Tips and Best Practices for Creating a Financial Summary

Creating a comprehensive and compelling financial summary can seem daunting, but with the right approach, it can be a powerful tool to drive your business success. Here are some tips and best practices to help you on your way:

- 1. Keep it Simple: Your financial summary should be clear and easy to understand. Avoid excessive jargon or overly complex calculations. Use tables, charts, and graphs to visually represent data and highlight key points.

- Be Conservative in Your Estimates: It's better to underestimate your revenues and overestimate your expenses. This approach ensures that any surprises are more likely to be positive than negative.

- Base Projections on Realistic Assumptions: Make sure your financial forecasts are grounded in reality. Use historical data, industry benchmarks, and realistic market assumptions. Always explain the basis of your assumptions.

- Regularly Update Your Projections: Your financial summary isn't a one-time document. It should be reviewed and updated regularly to reflect changes in your business or market conditions.

- Be Transparent: Don't hide or minimise potential financial issues. Transparency about risks and challenges shows that you understand them and have plans to address them.

- Seek Expert Advice: If you're not financially savvy, consider enlisting the help of an accountant or financial advisor. They can ensure your financial summary is accurate and complete.

- Use a Bottom-Up Approach for Sales Forecasting: Instead of starting with total market size and estimating your share, start by considering your capacity—how much you can realistically expect to sell based on your resources and capabilities.

- Factor in Seasonality if Relevant: If your business experiences regular sales fluctuations throughout the year, ensure this is reflected in your revenue forecast and cash flow statement.

- Tell a Story: While numbers are crucial, remember to weave them into a compelling narrative. Use your financial summary to tell the story of your business's path to profitability and financial stability

In the final section, we will provide a conclusion to wrap up the blog.

Crafting a detailed and convincing financial summary is an integral part of your business plan. It not only gives you a clear perspective of your business's financial health and viability but also demonstrates to potential investors that you have a firm grasp on the financial aspects of running a business. Remember, the aim is not to dazzle with complex financial jargon or overly optimistic forecasts. Instead, the goal is to provide a realistic, well-reasoned, and transparent account of your business's financial situation and outlook. Here at Action Planr we have a full suite of guides on all sections of the business plan, to help you on your way to business sucess.

Thank you! You’ll receive an email shortly.

Oops! Something went wrong while submitting the form :(

Learning ZoNe

- GLOBAL SEARCH

- WEB SUPPORT

18 Entrepreneurs Share Essential Skills One Needs to be a CEO

16 Entrepreneurs Explain What Work Means to Them

25 entrepreneurs share essential skills one needs to be a ceo.

22 Entrepreneurs Share How They Incorporate Health and Fitness into Their Day

8 Entrepreneurs Reveal How Much They Work In a Week

11 Entrepreneurs Reveal Their Why/Motivation

12 Entrepreneurs Share Views on Whether Entrepreneurs are Born or Made

7 Entrepreneurs Share Essential Skills One Needs to be a CEO

30 Entrepreneurs Share Essential Skills One Needs to be a CEO

- Wordpress 4 CEOs

How to Create a Google Business Profile / Tips to Optimize Google Business Profile

How to Get Your Product Into Walmart- {Infographic}

Make Money using Facebook – Make Great Posts

2 Interesting Updates from WordPress 4.8 Evans

How To Know If Your Business Idea Will Succeed

This is How to Write a Converting Email Autoresponder Series

15 Entrepreneurs Explain What They Love And/Or Hate About WordPress

6 Updates That I’m Paying Attention to with WordPress 4.7 – Vaughan

Download Our Free Guide

5 Entrepreneurs Share Their Favorite Business Books

18 Entrepreneurs and Business Owners Reveal Their Best Leadership Tips

30 Entrepreneurs Share Their Thoughts On the Role of Middle Management Within Organizations

30 Entrepreneurs Reveal The Future Trends They Anticipate in Entrepreneurship

27 Entrepreneurs Reveal The Future Trends They Anticipate in Entrepreneurship

7 Entrepreneurs Reveal Their Business Goals for 2024

27 Entrepreneurs List Their Favorite Business Books

14 Entrepreneurs Describe Their Leadership Style

30 Entrepreneurs Define The Term Disruption

25 Entrepreneurs Define Innovation And Disruption

16 Entrepreneurs Define The Term Disruption

15 Entrepreneurs Define Innovation And Disruption

- GUEST POSTS

- WEBSITE SUPPORT SERVICES

- FREE CBNation Buzz Newsletter

- Premium CEO Hack Buzz Newsletter

Business Plan 101: Financial History

The financial history is the last financial statement that needs to be in your business plan. It is an overall summary of the financial disposition of your company from start to finish. The financial history will vary depending upon if you have a new business or if you have an established business. The information that is included in this document will encompass all of the previous financial documentation that you put together for this business plan.

If your company is a new business then you will only have projections for your financial history. Because it is a new business, if you apply for a loan, a bank will ask for your personal financial history because it is an indication of how you handle your personal finances and presumably and indicator of how the finances of your business will also be managed. If it is an established business, you will be required to present a business financial history that will show how viable your business is. The information that you need to put together for your financial history is much of the same information that you needed to put together other financial documents. You will need to show your assets, liabilities, and net worth. You will be asked for any contingent liabilities which are debts you may owe in the future. You will need a profit and loss statement, any real estate holdings the company may have, how the company is structured, any audit information, and detailed information of the insurance coverage for your company.

Related Posts

How to have difficult money conversations at work- [infographic], the importance of trusted user identity verification to counter fraud in the financial-sector – [infographic].

Business Plan 101: Personal Financial Statement

Business plan 101: financial plan.

This Teach a CEO focuses on Google Business Profile formerly Google My Business. List your business on Google with a...

![financial history in business plan How to Have Difficult Money Conversations at Work- [Infographic]](https://storage.googleapis.com/stateless-ceoblognation-com/sites/8/2021/05/pexels-olia-danilevich-5466806-scaled.jpg)

Money conversations can be difficult regardless of setting, but talking about money at work is especially challenging. People have often...

![financial history in business plan The Importance of Trusted User Identity Verification to Counter Fraud in the Financial-Sector – [Infographic]](https://teach.ceoblognation.com/wp-content/uploads/sites/8/2020/10/credit-card-5547852_640.jpg)

Financial firms often deploy verification processes when onboarding clients and authorizing transactions. These steps are essential in ensuring that the...

![financial history in business plan Top 5 Budgeting Techniques to Help You Save More Money – [Infographic]](https://teach.ceoblognation.com/wp-content/uploads/sites/8/2020/06/piggy-bank-968302_640.jpg)

Top 5 Budgeting Techniques to Help You Save More Money – [Infographic]

Attaining financial accomplishment is a feat unlike any other. While it may mean differently for each individual, most will agree...

Business Plan 101: Technology Plan

- Pingback: Why Did You Start Your Business? Week of May 12th - Hearpreneur

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Privacy Policy Agreement * I agree to the Terms & Conditions and Privacy Policy .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Join CBNation Buzz

Our Latest CBNation Content:

- IAM2127 – Leveraging on Technology to Enhance Productivity and Efficiency

- IAM2126 – Understanding SEO Strategy, Widens Your Visibility

- IAM2125 – Maximizing Business Success with the Eight Pillars

- IAM2124 – CEO And Founder Empowers People To Embrace Their Natural Form And Celebrate Their Unique Bodies

- IAM2123 – CEO and President Offers Innovative Tech Solution in Commercial Cleaning

- IAM2122 – Entrepreneur and Inventor Focuses on Movie Deal for her Screenplay

Our Sponsors

Join thousands of subscribers & be the first to get new freebies.

What is CBNation?

We're like a global business chamber but with content... lots of it.

CBNation includes a library of blogs, podcasts, videos and more helping CEOs, entrepreneurs and business owners level up

CBNation is a community of niche sites for CEOs, entrepreneurs and business owners through blogs, podcasts and video content. Started in much the same way as most small businesses, CBNation captures the essence of entrepreneurship by allowing entrepreneurs and business owners to have a voice.

CBNation curates content and provides news, information, events and even startup business tips for entrepreneurs, startups and business owners to succeed.

+ Mission: Increasing the success rate of CEOs, entrepreneurs and business owners.

+ Vision: The media of choice for CEOs, entrepreneurs and business owners.

+ Philosophy: We love CEOs, entrepreneurs and business owners and everything we do is driven by that. We highlight, capture and support entrepreneurship and start-ups through our niche blog sites.

Our Latest Content:

- CEO Empowers Women’s Foot Health and Wellness

- Counselor Explores the Challenges of Mental Health and Substance Abuse

- IAM2121 – Personal Life Expert and Psychotherapist Helps People Create Extraordinary Lives

- IAM2120 – Founder Helps Companies Get Clients Through Cold Outreach Campaigns

Privacy Overview

- Teach A CEO

Share on Mastodon

The Importance of Understanding Financial History

By henry sheykin, introduction.

Making sound business decisions requires an understanding of the financial data of a company's historical performance. By analyzing this information, leaders can draw valuable insights about the direction a business is headed and the steps that need to be taken in order to ensure growth. This article examines the importance of utilising historical financial data to make projections when creating a business plan.

Having a clear understanding of past financial performance is vital when creating a business plan and making projections. Historical financial data ranges from past profits and losses to cash flow statements, balance sheets and more. Examining this data allows us to observe trends in the company, identify areas to improve upon, and discover new opportunities.

Reasons why understanding financial history is important:

- Helps to forecast future performance;

- Allows for better cash flow management;

- Provides insight into cost controls;

- Highlights potential unseen risks;

- Improves customer targeting.

History of Financial Data

Analyzing historical financial data is an essential tool for entrepreneurs looking to establish a business. Having access to past data points from different businesses can provide key insights that can help inform successful business plans moving forward. When undertaking this exercise, there are two primary aspects to consider: the types of financial records being reviewed and the tools used for analysis.

What types of financial records are reviewed

The types of financial data reviewed for an historical analysis are largely dependent on the business and the utilization of any related services. Generally, this includes consideration of records from income statements and balance sheets that review the performance of i.e.: sales, profits and expenses. Additional considerations can include customer and supplier data, as well as information regarding market trends, pricing and performance and inventory costs.

What tools are used to analyze the information

In order to accurately interpret the wealth of historical data, entrepreneurs can employ the use of powerful analytical tools. Many popular software solutions offer the ability to compare records across different producers and services, and can even provide customized marketing data. This can provide insights into trends from past financial and market conditions, which can help entrepreneurs better assess the viability of their business plans.

- Advanced statistics software

- Predictive analytics

- Big data analysis tools

- Data visualization platforms

In conclusion, entrepreneurs considering founding a business can use historical financial data to get an inside look into a variety of markets. By leveraging the right analytical tools, they can gain insight into trends, pricing and other parameters directly related to their business plan.

| Daily Cash Flow Template DOWNLOAD |

Identifying Trends

Historical financial data is a great resource for identifying trends in the business environment. With this data, business owners can examine fluctuations in the market and analyse changes in customer spending. A review of this data can help business owners develop more effective plans and projects that take into account a variety of market conditions.

Examining Fluctuations in the Market

By leveraging historical financial data, business owners can gain insight into the overall economic environment and how it has been changing over time. By examining fluctuations in the market, such as changes in supply and demand or an increase or decrease in certain industries, business owners can better identify risks and opportunities to capitalise on. Having an understanding of the economic climate can help inform decisions on how best to invest resources, as well as anticipate shifts in customer behaviour.

Analysing Changes in Customer Spending

In addition to examining changes in the overall economy, historical financial data can provide insight into patterns in customer spending. As the economy shifts, customers may adjust the way they purchase goods and services. Studying previous customer behaviour and spending patterns can provide business owners with a better understanding of current and potential markets, as well as help them adjust their plans and projects accordingly.

By analysing changes in customer spending, business owners can better understand the trends and volatility of the market. This information can help inform their forecasts, plans, and projects, while ensuring they remain agile in the changing economic landscape.

Utilizing Financial Data

Financial management is an essential part of any business. To ensure long-term success, business owners must understand the historical financial trends that influence their decisions. Utilizing financial data to develop thoughtful business plans and project growth is a skill that requires practice and knowledge of how to interpret financial information. Here are a few tips to help you get started:

Setting Business Goals

You cannot create an effective business plan without first outlining clear goals. Financial data can help you assess the feasibility of these goals and provide data points to help you create attainable objectives. When setting business goals, consider past performance, industry norms, and the resources you have available. Having a foundation of financial data to understand what is feasible and what would be impossible to accomplish is essential.

Understanding the Impact of Expansions

Expanding your business is a big decision and can have a large impact on the overall financial health. Using historical financial data can help you evaluate the potential profitability of a planned expansion. For example, if you are considering adding a new product or service, you can look at past performance to see what impact this has had on your organization. You can assess the dangers of entering new markets and determine if an expansion is the right move for your organization.

Determining the Effectiveness of Investments

Making investments is an essential part of running a business, and understanding the return on these investments is crucial to planning for the future. Utilizing financial data can help you measure the success and value of different investments. For example, if you invest in new products, you can look at the historical sales figures to evaluate whether the investment was worthwhile. Knowing which investments have given you the most return can help you make informed decisions going forward.

| Expert-built startup financial model templates |

Making Projections

Projections are essential for businesses to measure if their plan will be successful. It helps forecast the likely outcome of the businesses' objectives, depending on various internal and external factors that can affect its success. With reliable historical financial data, business owners can make calculated predictions based on past events that may influence the future, and better plan out their business strategy.

Factors that influence projections

The external environment is unpredictable and constantly changing, however there are certain factors that business owners must consider when forecasting the future of their companies’ performance. By researching and analyzing current economic, industry, and market trends, business owners can predict how their plans may turn out by accounting for expectations and industry standards.

It is also important to consider any internal changes that may affect the business’s projections. Internal changes could include staffing, budgeting, output, product development and marketing strategies. Business owners must ensure that all plans are valid and feasible through conducting market analysis surveys and customer polls.

Utilizing data to make educated estimations

By using accurate historical financial data, business owners are able to make educated estimations on their future performance. This data could include market share, balance sheets, project timeframes, employee costs, and market returns. Historical data can give business owners a general idea of the direction their plans should take.

However, it is important to note that historical data is only a reference point when making estimations. Business owners should also take into account any recent changes in the market and industry that could affect future results. This could include the introduction of new competitors, changing customer preferences, or market disruption.

Acting on Findings

Once financial data has been analyzed and the resulting findings have been reviewed and understood, the next step is to act on these findings. Using the information to adjust goals and expectations allows for business owners and stakeholders to have a much better understanding of their current financial standing and allows for an appropriate plan of action going forward.

Use of Findings to Adjust Goals and Expectations

By using the findings from the historical financial data, business owners and stakeholders can better understand where their business is currently, and set expectations on the potential growth and decline of the business adjusted for external market forces. This allows for a better understanding of the financial health of the business in the short and long term, and what goals can reasonably be achieved.

Implementing Strategies to Increase Business Success

Understanding what can realistically be achieved based on financial data can help create strategies to increase business success. Through analyzing data such as profitability and amount of debt, business owners can craft plans and measures to improve the bottom line. This could include slowing, or increasing, production levels, restructuring debt obligations, or investing in updated technology.

- Adjusting production levels based on financial performance

- Restructuring debt obligations to best suit the financial position

- Investing in updated technology to improve manufacturing and productivity efficiencies

In conclusion, using historical financial data is an invaluable tool when making business plan projections. It is an effective way to make more accurate plans in areas such as budgeting, forecasting, cost-benefit analysis, gauging consumer demand, competitive edge, and strategic evaluation. With an accurate assessment of the past, businesses can make more reliable plans for the future.

Using financial data can also be helpful in spotting trends, making long-term investments, and deciding which industry to take part in. Many companies, especially startups, have had great success by utilizing this method to accurately hypothesize market trends and effectively capitalize on them.

In short, financial data is an invaluable resource that should not be underestimated. By taking the time to review and analyze past financial results, companies can create more reliable plans with the confidence of knowing what may or may not happen in their respective industry.

Summary of the Information Presented

This blog post covered how financial data is essential in making accurate business plan projections. It discussed how analyzing financial trends can enable a company to budget more effectively, forecast demand, and make better decisions when it comes to making long-term investments. The blog post further outlined the importance of gathering and utilizing data from the past to better inform decisions for the future.

Final Remarks on the Importance of Financial Data

Financial data is invaluable for businesses looking to make accurate projections and plans. Companies should take the time to review and analyze the data they have collected and make the most of it in order to maximize their business goals. This will enable them to create sound plans and make better decisions that will ultimately benefit their business in the long run.

$169.00 $99.00 Get Template

Related Blogs

- Understanding the Benefits of Venture Debt for Start-Ups

- Utilizing Scenario Planning to Support Risk Management

- Unlocking the Potential of Financial Modeling

- How to Leverage Financial Planning and Analysis for Business Growth

- Pro Forma Income Statement or How to Make It

Leave a comment

Your email address will not be published. Required fields are marked *

Please note, comments must be approved before they are published

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Business Plan Financials Summary

Business Plan Financials Summary

… our financials show this …

Business Plan Financials Summary Presentation

The presentation of the business plan financials summary will depend on the nature of the business and the information selected from the detailed financial projections. In order to gain an understanding of the business, the investor will want to see the numbers for between three and five years ahead, and if available, two years back.

This is part of the financial projections and Contents of a Business Plan Guide , a series of posts on what each section of a simple business plan should include. The next post in this series sets out a summary of the existing investors in the business.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

- Account Log In |

- View / Sign Loan Docs |