+971 4 457 8200

Refer & earn.

Home > Business Plan Templates > Insurance Agency Business Plan Template With Examples

Insurance Agency Business Plan Template With Examples

Apr 7, 2024 | Business Plan Templates

As you navigate through this insurance agency business plan template, remember that the primary goal is to thoroughly represent your business concept, operational plans, and financial projections for your insurance agency.

This template is merely a guide; it’s essential to tailor it to fit your agency’s unique attributes and market positioning, ensuring your ideas and strategic direction are communicated effectively. Because every insurance agency is different in its own way, it is okay to modify this business plan to suit your specific situation better.

Always back up your findings with solid data wherever possible and provide clear, concise explanations. Insurance can be a complex field for many individuals.

Your ability to simplify these complexities into understandable terms will serve you well in your plan and in the agency’s overall operations.

Table of Contents

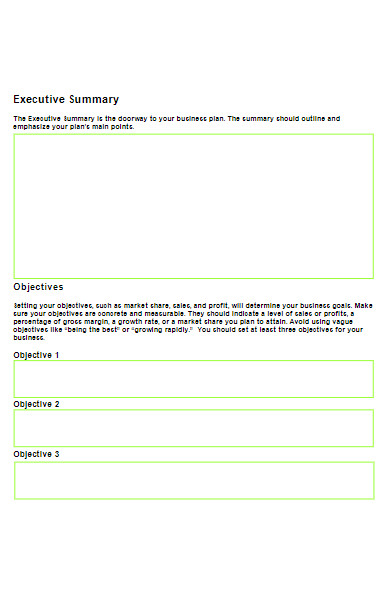

1. Executive Summary

The executive summary provides a brief, comprehensive synopsis of your insurance agency. While it appears at the beginning of your plan, it is often written last to ensure that it encapsulates all critical points from the rest of the sections.

Introduction and Agency Overview

Start by succinctly introducing your insurance agency—its name, the types of insurance it covers (auto, health, home, life, etc.), and why it stands out in the market.

Example: SecureNow Insurance Agency is a customer-centric firm that provides holistic, efficient, and tailored insurance solutions. Its primary focus is on auto, home, health, and comprehensive business insurance packages.

Mission and Vision Statement

Your mission and vision should communicate the agency’s core principles, strategic goals, and commitment to its clientele.

Example: Our mission is to ensure our clients have peace of mind by offering personalised insurance coverage that adequately caters to their particular needs. Our vision is to be the leading insurance agency known for its exceptional customer service and innovative insurance solutions.

Geographic Area and Accessibility

Detail the area where your insurance agency primarily operates. Discuss where you have a significant market presence and the main demographic in these regions.

Example: SecureNow operates within the tri-state area, serving thousands of individuals, families, and businesses within these regions, offering them convenience and quicker claim processing.

Type of Insurance Services Offered

Briefly describe the kind of insurance services you provide.

Example: SecureNow offers a multitude of comprehensive insurance products – auto insurance for various vehicle classes, home insurance covering homeowners and rentals, health insurance with personalised plans, and business insurance covering liability, worker’s compensation, and commercial property.

Key Goals and Objectives

Outline your key short-term and long-term goals. These should be SMART (Specific, Measurable, Achievable, Realistic, Time-bound) goals.

Example: Our primary goal for the next year is to grow our customer base by 25% and increase our policy renewal rate to 85%. Over the next five years, we aim to expand into two additional states and to be rated among the top 5 most trusted insurance agencies in our operating regions.

2. Services Overview

This section offers an in-depth understanding of your insurance agency’s offerings, their relevance, and their potential impact on your customers’ lives.

Service Definition and Themes

Describe in detail the insurance products and services your agency provides. Explain the guiding principles for each type of insurance policy.

Example: SecureNow Insurance Agency provides a range of insurance services, each framed to offer our customers maximum protection and peace of mind. They encompass Auto Insurance, accommodating a range of vehicles and drivers; Home Insurance, offering comprehensive coverage for homeowners and renters; Health Insurance, aligning with varying needs and budgets; and Business Insurance, offering tailored solutions from liability to commercial asset protection.

Range of Insurance Services

List and highlight the main features of the services under each insurance type.

Example: Our Auto Insurance includes liability coverage, collision, comprehensive, and personalised bundles. Our Home Insurance provides coverage for the structure, personal belongings, liability, and additional living expenses. Health Insurance varies from basic coverage options to more comprehensive plans, including specific disease policies. Business Insurance delivers solutions for property damage, worker’s compensation, liability protections, and more.

Target Customer Analysis

Detail who benefits most from your policies, indicating how they are targeted and why they are the principal focus of your services.

Example: Our target customers range from young drivers seeking auto insurance, homeowners and renters needing property protection, individuals and families requiring health coverage, and large and small businesses seeking to mitigate their operational risks. Our focus remains on these groups as they represent a broad segment of the population most in need of reliable, affordable, and customizable insurance solutions.

3. Agency History and Organisation

This section provides a historical background of your insurance agency and insight into its organisational structure.

Legal Status and Structure

Specify your agency’s legal status—is it a limited liability company (LLC) , a partnership , a corporation, or a sole proprietorship ? Discuss why the particular business structure was chosen.

Example: SecureNow operates as a Limited Liability Company (LLC), chosen for its protective attributes and flexibility. This structure offers protection against personal liability and provides operational and management flexibilities akin to a partnership.

Owners and Management Team

Briefly introduce your agency’s owners and management, outlining their experience and contributions.

Example: SecureNow is owned and managed by John Doe and Jane Smith. John, a seasoned insurance professional with over 20 years in the industry, manages strategic decisions and partnerships. With an extensive background in customer service and operations, Jane oversees day-to-day operations, ensuring top-notch customer service and smooth agency functioning.

Key Milestones

Highlight key milestones in your agency’s history to demonstrate growth and impact over time.

Example: SecureNow was established in 2010 as a two-person firm, initially only offering auto insurance. In 2012, we expanded our services to include home insurance, followed by health insurance in 2015. We introduced our comprehensive business insurance solutions in 2018. Today, we serve over 10,000 clients across the tri-state area, thanks to our continuously expanding product portfolio and customer-centric approach.

4. Business Model

This section will depict how your agency operates, generates revenue, and strives towards financial sustainability.

Primary Revenue Sources

Describe your insurance agency’s main sources of income; this could include commissions, contingency bonuses, and fee-based services.

Example: SecureNow’s primary revenue stream comes from commissions on each policy sold and renewed. We also earn contingency bonuses based on reaching certain targets set by the insurance carriers and fee-based income from consulting services for complex business insurance needs.

Planned Partnerships and Collaborations

Consider any partnerships or collaborations you intend to establish, including partnerships with other businesses, insurance carriers, and influential organisations.

Example: SecureNow is looking to form partnerships with major auto retailers and real estate agencies to provide insurance services to their customers, broadening our customer reach. We are also planning to collaborate with niche insurance carriers, expanding our range of specialised insurance products.

Special Projects

If any special initiatives are planned that can boost agency income or offer significant benefits to your agency, explain them here.

Example: One of our major upcoming initiatives is the launch of a comprehensive mobile app aimed at streamlining claim processes, making it easier for customers to buy, manage, and claim insurance. This app will not only help in customer retention but, with features like refer-a-friend, it will also help attract new customers .

5. Market Analysis

This section offers a deep dive into the market in which your insurance agency operates, including existing market needs, target demographics, and competitive environment.

Current Market Needs

Describe the insurance-related needs currently observed in your market. Use data and real examples to illustrate these needs.

Example: The tri-state area where we operate has a high concentration of small businesses (over 200,000), representing a significant demand for reliable business insurance solutions. Additionally, with an average of 5 million registered vehicles and a high homeownership rate, there is a substantial need for auto and home insurance packages.

Target Market Analysis

Detail the demographic, socioeconomic, and other relevant characteristics of the customers your agency aims to serve.

Example: Our target market encompasses small business owners in need of robust business insurance, drivers requiring comprehensive, affordable auto insurance, homeowners and renters seeking varying degrees of home insurance, and individuals/families at different life stages seeking health coverage. Our customer base is diverse and spans demographics, posing unique insurance needs, which we aim to cover comprehensively.

Competitive Analysis

Assess other insurance agencies operating in the same space, explore their approach, and underscore how your services differentiate.

Example: While other agencies in the region primarily deal with one or two types of insurance, SecureNow sets itself apart by providing a comprehensive roster of insurance services – auto, home, health, and business. Coupled with our personalised approach and excellent customer service, we offer a one-stop solution for varied insurance needs.

Positioning and Strategy

Explain how your agency is positioned to cater to market needs, target demographics, and competitive landscape. Detail your strategy to meet these needs.

Example: SecureNow positions itself as a full-service insurance agency, offering a wide range of products that cater to diverse customer segments under one roof. Our strategy involves educating our customers about their insurance needs and providing them with personalised solutions. We leverage our strong relationships with various insurance carriers to offer competitive rates and comprehensive coverage.

6. Marketing and Acquisition Strategy

This section outlines how you plan to attract new clients to your insurance agency, generate awareness about your range of services, and retain existing customers.

Marketing Strategy

Outline your approach to increase visibility and generate leads.

Example: SecureNow’s marketing strategy leverages both online and offline channels. We use Search Engine Optimization (SEO) and paid search advertising to increase our online visibility on popular search engines. Simultaneously, we utilise direct mail campaigns, local radio advertisements, and community events to broaden our reach within the local community.

Acquisition Plan

Describe your plan to acquire new customers. This plan may incorporate strategies like referral incentives, partnerships with other businesses, and lead-generation methods.

Example: We focus on customer referrals, offering incentives for every successful referral. SecureNow also plans to collaborate with local automobile dealerships and real estate agencies, providing insurance services to their customers to garner new clients.

Community Engagement and Outreach

Discuss your initiatives to engage with the community beyond the provision of insurance services.

Example: SecureNow regularly holds free insurance education seminars and financial planning workshops for the local community. We sponsor local events and sports teams, contributing to our brand visibility and showcasing our commitment to the community.

7. Operations

This section will cover how your insurance agency functions on a day-to-day basis, detailing staff recruitment, technology needs, and the agency’s operational structure.

Team Recruitment and Roles

Define how you plan to staff your insurance agency—the roles required, standards for each position, hiring plans, and recruitment strategies.

Example: SecureNow intends to recruit a mix of experienced professionals and new talent for roles including Insurance Agents, Customer Service Representatives, and Claims Handlers. We will also employ digital marketing experts to oversee our online presence and a strong management team to lead the agency. We aim to recruit from local colleges and also via online job portals to find individuals passionate about the insurance sector.

Office Structure and Management

Discuss the composition and function of your office. What roles do your employees play, and how are tasks divided among them?

Example: Our office operates with a hierarchy of Management, Sales, Customer Service, and Claims. While the management team oversees agency operations and strategic partnerships, the sales team focuses on acquiring new business and maintaining relationships with existing customers. The customer service team handles customer queries and escalations, and the claims team oversees the smooth processing of insurance claims.

Technology Requirements

Discuss the technology you need for smooth operation. This might include CRM for client management, digital tools for online marketing, or efficient hardware/software for everyday tasks.

Example: SecureNow utilises a CRM system to manage our client database, policy renewals, and marketing campaign data. We also employ digital tools like Google Analytics for online marketing efforts and use secure data servers to store sensitive data.

Office Space Requirements

Outline your requirements in terms of physical location. Do you need office spaces, meeting rooms, or parking lots?

Example: SecureNow currently operates from a commercial office building with spaces allocated for customer interactions, staff operations, and a meeting room. As a part of our five-year plan, we aim to open two more branch offices within the tri-state area.

8. Sales Strategy and Customer Retention

This section covers how your insurance agency plans to sell its services to potential customers and retain current clients.

Sales Tactics

Outline your strategy to sell insurance policies.

Example: SecureNow’s sales approach is primarily consultative, focusing on understanding customer needs and providing tailored insurance solutions. Our sales team is well-trained to communicate the benefits of our policies effectively and clarify any potential questions or doubts.

Website and Social Media

Discuss your agency’s online presence and how it would be used for customer communication and selling policies.

Example: SecureNow maintains an intuitive website where customers can learn about various insurance products, get quotes, and contact us for further assistance. We also run social media profiles on major platforms, sharing information on insurance basics, updates about our services, and customer success stories.

Customer Engagement and Retention

Explain how you plan to retain customers and enhance their satisfaction.

Example: SecureNow emphasises customer retention through personalised service, timely claim settlements, and regular communication. Our devoted customer service team efficiently handles policy inquiries and claim requests. We also run a loyalty rewards program that offers discounts on policy renewals and additional services for long-term customers.

9. Financial Projections

This section focuses on your agency’s financial aspects, detailing how funds will be generated and utilised.

Current/Projected Budget

Detail out whether you’re presenting your current budget or projecting a budget for the next financial year, including income and expenses.

Example: SecureNow’s projected income for the upcoming financial year is $1 million, taking into account commissions, fee-based incomes, and other sources. Operating expenses (office rent, staff salaries, marketing spending) are expected to amount to around $650,000, with profit expected to stand at $350,000 post-tax.

Proposed Financing

Discuss your proposed financing options, such as loans, investors, etc.

Example : At the moment, SecureNow operates on revenue earned through commissions and fee-based services. However, we are considering inviting investors for future expansion plans and exploring low-interest business loan options for immediate cash flow support.

Key Financial Assumptions and Justifications

Detail underlying assumptions in your financial plan, justifying why these assumptions have been made.

Example: Our projected revenue assumes a 15% increase in new policies and a 90% customer renewal rate based on the previous year’s growth. We believe this is achievable given our aggressive marketing plan and the introduction of new insurance products. We have also accounted for a 5% contingency fund in our budget to cover unexpected expenses.

10. Appendices

This section includes any additional documents or supporting material related to your agency’s business plan.

Organisational Chart

Include a visual representation of your insurance agency’s structure.

Example: An organisational chart highlighting the hierarchy from management to sales, customer service, and the claims department will make the agency structure clearer to stakeholders.

Resumes of Key Staff

Attach resumes or brief bios of key members of your management and staff to assure potential investors, partners, or even customers of their qualifications and expertise.

Example: We have included the resume of our Agency Manager, who has extensive insurance sector experience and has led SecureNow to become one of the most preferred insurance agencies in the area.

Detailed Budget

Provide a detailed budget if your financial plan references an annual budget with a breakdown of income and expenditures.

Example: An exhaustive breakdown of our annual budget shows our judicious allocation of resources, justifying operational expenses and projected revenues.

Related Market Research

Include any market research or customer data analysis that supports your business plan and gives weight to the strategies presented.

Example: Data from a Recent Customer Survey indicates high satisfaction levels with our services, validating our customer-centric approach. Similarly, results from a Market Analysis show a steady demand for comprehensive and personalised insurance solutions in our operating area, supporting our expansion plans.

Wrapping Up Our Insurance Agency Business Plan Template

Remember, an effective business plan doubles as a roadmap for your agency and an instrument of engagement for potential investors, partners, and high-ranking personnel you may seek to attract to your organisation.

Taking the time to complete this process will help you better understand your market, operational, and financial goals, which will help you navigate your insurance agency to success. Good luck!

Recent Posts

- Accounting (35)

- Business and Leadership Skills (62)

- Business Plan Templates (9)

- Business Setup (56)

- Business Software and Tools (60)

- Business Success and Challenges (72)

- Entrepreneurship (184)

- Featured Posts (30)

- Finance (61)

- Free Zones (35)

- Human Resources (54)

- Living in Dubai (23)

- Mainland (15)

- UAE Company Setup (139)

- Uncategorized (1)

Start your business today

Book your free 15 minute consultation.

Avoid expensive mistakes when setting up your business. Talk to one of our experts now.

Want to save on your business setup?

Starting a business? Check out our latest business setup offers now!

How much does it cost to start a company in Dubai?

Find out how much investment you’ll need to launch your own company in the UAE.

Get your FREE copy of our UAE Business Setup Guide

Discover the trade secrets to starting and growing a successful business in the UAE.

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

Agency Performance Partners

How to Create an Insurance Agency Business Plan

Posted on November 6, 2023 by Kelly Donahue Piro

Wondering how to create an insurance agency business plan?

🏢 Are you an ambitious individual looking to grow your insurance agency but unsure where to begin? 🏢

📈 Whether you’re a seasoned insurance professional v someone passionate about insurance and financial services, our podcast is tailored to guide you through every step of the process.

🔍 **1. Understanding the Purpose of Your Business Plan**: We unravel the significance of a well-crafted business plan and how it serves as your roadmap to success. It’s not just a formality; it’s a dynamic tool that drives your agency towards growth and prosperity.

💡 **2. Identifying Your Target Market and Niche**: We discuss the importance of defining your target audience and finding a unique niche in the market. Differentiating yourself from the competition is crucial in the competitive landscape of insurance.

📊 **3. Conducting Market Research**: Learn how to analyze market trends, customer needs, and competitor strategies to make informed decisions for your insurance agency.

📝 **4. Crafting Your Agency’s Mission and Vision**: We explore how a compelling mission and vision statement can inspire your team, attract clients, and align your agency’s values with long-term goals.

💼 **5. Formulating Your Business Strategy**: Discover the key elements that should be included in your business strategy, covering marketing, sales, operations, and financial projections.

📈 **6. Setting Achievable Goals and Milestones**: Learn how to set realistic short-term and long-term goals to measure your agency’s progress effectively.

🗂️ **7. Organizing Your Business Structure**: Gain insights into the different business structures suitable for insurance agencies and how to choose the one that aligns with your vision.

👥 **8. Assembling Your Dream Team**: We discuss the importance of hiring and retaining the right talent to drive your agency forward and maintain a positive work culture.

🚀 **9. Developing a Solid Marketing Plan**: Explore various marketing strategies to promote your insurance agency effectively and reach your target audience.

💼 **10. Creating a Financial Plan**: Gain a clear understanding of the financial aspect of your business plan, including expenses, operational expenses, and projected revenue.

Tune in to our debut episode to gain practical tips, expert advice, and inspiration that will set you on the path to growing a successful insurance agency.

Let’s embark on this exciting journey of growing your agency! 🚀🏆

🔔Check out the blog associated with this video: Insurance Agency Business Plan: How to Get Started

- Get Our Free End of Year Planning Team Survey Questions

- Need Help Getting Your Agency Plan Together ?

- Learn About the 6 Things You Need To Know About Running An Agency

- Need More Help? Book a Meeting with APP

- Did You Know? We can do a training day or speaking event just for you !

- Subscribe to Our Podcast – take our videos on the go!

We’re Agency Performance Partners; APP is your insurance agency’s best friend when it comes to training, strategies, brutal truth & tough love that’ll grow your agency with hugs & high fives along the way….just like a BFF. LEARN MORE

Most Popular

- How To Retain Customers In Insurance: Renewal Reviews

- Retention Meaning In Insurance: How Valuable to Your Agency Is Boosting Retention?

- Insurance Policy Review With Pilkey Hopping & Ekberg

- Insurance Customer Retention: Short Term & Long Term Strategies

- Insurance Policy Retention: Getting To A 96% Retention Rate

Editor's Picks

- Insurance Endorsement Process to Save Your Butt

- Insurance Producer Job Description:Why Can’t Account Managers & Producers Get Along: Insurance Producer Job Description

- Insurance Sales Professional vs. Agent: What’s The Difference?

Featured Post

- Life Insurance Script: How to Cross Sell Life Insurance

- How To Overcome The Top 6 Insurance Sales Objections

- Customer Retention Strategy In the Insurance Industry: How To Set Up Renewal Reviews

Subscribe to our Weekly Insurance Growth Strategy

Get growth....

- 3 Minute Videos

- APP Agency Team

- Insurance Hard Market: Thriving In Year 2

- Agency Strategic Planning

- Insurance Leadership – Management Skill Development Program

- Insurance Rate Increase Training

- How To Explain & Sell Insurance Coverage

- Agency Assessment

- Insurance Agency Processes

- Agency Retention

- Agency Efficiency

- Customer Service Training

- Insurance Sales Training

- Agency Training Plan

- Agency School

- Agency Performance Program

- Work With Us

- Other Cool Stuff

- Agency Process Packs

- AppX Commercial Insurance Sales Training

- AppX Retention Online Course

- Converting Calls Into Opportunity

- Reducing Remarketing

- How To Cross Sell Insurance

- How To Build Your Insurance Agency Success Roadmap

- How to Hire and Keep Top Talent in Your Agency

- Agency Interactive

- Log Into Agency School

- Running An Agency

- Time Management

* Mandatory fields

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. Consent.

- Agents Blog

- Running & Growing your Agency

- Upcoming Webinars

- IAA Presentations

- Share this Hub

- EverQuote Pro Blog »

Launch Your New Insurance Agency With This Business Plan Template

Whether you're a brand new agent or one with several decades of experience, the idea of opening a new insurance agency probably seems daunting—where do you start?

One of the first things you’ll need to do is come up with a business plan for your insurance agency. After all, you can walk into a bank or a potential investor’s office looking for funding, but you won’t get very far unless you have a robust insurance agency business plan that proves you’re on the right track toward turning a profit in the near future.

Follow the steps below when building out your insurance business plan to maximize your chances of securing funding and getting your new agency off to a strong start.

7 Steps To Build Your Insurance Agency Business Plan

1. develop your executive and business summaries..

In business plan terms, the executive summary is the driving force behind your other decisions. It should explain why you’re starting your agency. The business summary is similar, but it should narrow down your “why” into a list of “hows.”

Ask yourself:

- Why do you want to open an agency?

- What types of insurance do you wish to sell?

- What do you hope to accomplish?

- What return on investment do you expect to receive?

- How are you going to generate demand and ensure supply for your service?

Jot your answers down so you can refer back to them as you move forward.

2. Decide whether you want to be a captive agent or an independent agent.

Many large agencies, such as Allstate and Farmers, work with captive agents who can only sell insurance for that specific provider. Independent agents, on the other hand, can sell insurance for multiple providers, but they get locked out of working with the big-name captive carriers who only work with captive agents. (Read more about captive agents here and get a seasoned agent’s POV on both types of agents here. )

Before you can nail down the details of the rest of your business plan, you’ll have to make a choice between these two options.

3. Do a market analysis.

Though it might seem like a tedious process, conducting a thorough market analysis is crucial to your success. Analyzing your local market—including the backgrounds, shopping behaviors, and preferences of your target customers—gives you the insights you’ll need to attract these folks to your business.

Your market analysis will look a little different depending on whether you prefer to be a captive or an independent agent. The state you live in is another factor that will affect your analysis—in fact, it may even influence your decision to be captive or independent.

Take a close look at the demographics of your region.

- How many homeowners live in your state?

- What’s the average insurance premium per home?

- How many people live in each home, on average?

- How many drivers live in your state?

- How many vehicles does the average household own?

- Do you live in an area with an aging population ?

- How many families live in your region?

- What insurance carriers do locals in your state gravitate toward?

- In your area, what might be some successful strategies for retaining clients (rather than just acquiring them)?

These questions are all important, but pay particular attention to the last one. If you open an agency without a plan for client retention, you’re going to struggle. And, unfortunately, this is one of the most overlooked aspects of an insurance agency business plan.

4. Identify where you’ll find your first clients.

It’s one thing to know there are X number of potential clients living in your state, but it’s quite another to have a plan that will help you reach out to those folks and land your first policy sales.

Some investors will require a list of leads before they’ll even consider funding your agency. Even if it’s not a requirement, it’s always a good idea to have a pipeline ready to go. This is where getting set-up for purchasing warm leads from EverQuote can put you in a great position for success.

Plus, tackling this step before you even open your doors will help you better understand the costs you’ll incur—and therefore how much startup funding you will need.

You might also consider other options, such as placing ads in local newspapers, going to networking events, investing in digital marketing, sponsoring local Little League teams, or asking for referrals.

5. Create a financial plan.

Many new agencies fail because their owners overlooked something critical during startup. Do your best to look at your financial plans from every angle:

- Where will you find leads, and how much will they cost?

- What is your advertising budget?

- Does this budget line up with the going rates of local newspapers, billboards, or online ads?

- Do you plan to have 1099 employees or W2 employees selling insurance for your agency?

- How will you decide on a commission and benefits structure for these employees?

- What retention and loss ratios (for clients and employees) do you expect based on the numbers of other agencies in your area?

- How will you handle the delay between policy renewals and income hitting your bank account?

- If there are X amount of people shopping for insurance in your area, what percentage of those people are in a niche you can serve?

- From that percentage of potential clients, how many do you think you can successfully land?

- If you sell policies to these customers, how much will you earn from their premiums?

- How do your projected profits compare to your expected advertising costs, the cost to buy leads, office rent, and other expenses?

Take detailed notes of your calculations, and try to run the numbers a few different ways to obtain a conservative outcome, a likely outcome, and a “best case scenario.”

6. Draw up a formal business plan using a proven format.

Your notes will be incredibly valuable as you move forward, but you’ll need a way to present them clearly and concisely in a way that looks attractive to investors.

Loan officers and investors don’t want to read long-form essays detailing your business background and your ideas for the future. Keep your format simple and straightforward, with clear sections that answer the questions investors will want to know.

We recommend a format similar to the following:

Executive Summary Overall mission Primary objectives Keys to success Financial plans Profit forecast for at least three years Business Summary Business overview Summary of startup costs Funding you’ll require Company executives/ownership Services Services you provide Market Analysis Overall business analysis Details of your competition Buying patterns of your competition Your planned buying patterns Market segmentation and analysis Target market strategies Include details for each market segment Strategy Your competitive edge Marketing strategy Sales strategy Yearly sales projections Key milestones Management Your plan for finding staff Financial Plan Funding you have accepted Funding you will need Detailed startup costs Calculations for your break-even point Projected profit Yearly profit Gross and net yearly profit Anticipated losses, if any Cash flow patterns Plans for balance sheet Calculations of important business ratios

7. Revise and adjust your plan over time.

You may not secure funding for your agency immediately. Even if you do, you’ll likely find that your real world numbers don’t match up exactly with your calculated projections. Plus, carriers frequently change their underwriting policies, and the economy itself is always in a state of flux.

Keep your business plan current by updating the information anytime circumstances change.

Start your journey with a full lead pipeline from EverQuote.

One of the scariest parts about starting a new agency is not being certain where and when you’ll be able to start making sales.

Skip the fear and the unknown and go right to making sales with warm real-time leads from EverQuote. Whether you’re still trying to find startup funding or your doors are already open, you can always boost your business and maximize your chances of a steady income by working with EverQuote.

Connect with us today.

Topics: Featured , Insurance Agency Growth

About the Author Chris Durling, VP of P&C Sales

Chris Durling is a visionary leader in P&C insurance sales and distribution, with over 10 years of experience in the industry.

Most Recent Articles

Scott Grates, insurance agent and co-founder of Insurance Agency Optimization, is renowned for his...

When it comes to nurturing your insurance agency’s online business reputation, there are numerous...

If the year 2023 had a buzzword, that buzzword was definitely AI. Artificial intelligence took off...

Despite current economic complexities, many industries are still hiring at a dependable pace. Among...

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job,...

Creating a new insurance agency is a complex process, just like building any new business from the...

Is buying warm life insurance leads the right option for your business?

It can be! Keep reading for...

Previous Article

Next Article

Ready to see what partnering with EverQuote can do for you?

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers.

Terms of Use

Privacy Policy

For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers

Insurance Agency Business Plan Template

Written by Dave Lavinsky

Writing a Successful Business Plan For Your Insurance Agency + Template

If you’re looking to start or grow an insurance agency , you need a business plan. Your plan will outline your business goals and strategies, and how you plan on achieving them. It will also detail the amount of funding you need, and if needed, present a case to investors and lenders regarding why they should invest in your business.

In this article, we’ll explain why you should invest the time and energy into creating an insurance agency business plan, and provide you with an insurance agency business plan template that includes an overview of what should be included in each section. Download the Ultimate Insurance Agency Business Plan Template here >

Why Write a Business Plan For an Insurance Agency ?

There are many reasons to write a business plan for an insurance agency , even if you’re not looking for funding. A business plan can help you see potential pitfalls in your business strategy, as well as identify opportunities you may not have considered. It can also help you track your progress and adjust your plans as needed.

That said, if you are looking for funding, a business plan is essential. Investors and lenders want to see that you have a solid understanding of your industry, your customers, and your competition. They also want to know that you have a realistic view of your financial situation and how much money you’ll need to get started.

How To Write a Business Plan For an Insurance Agency

While every business plan is different, there are 10 essential components that all insurance agency business plans should include:

Executive Summary

Company description, industry analysis, customer analysis, competitor analysis, marketing plan, operations plan, management team, financial plan.

Keep in mind that you’ll need to tailor this information to your specific type of insurance agency , but these 10 components should be included in every plan.

The executive summary is the first section of your business plan, but it’s often written last. This is because it provides an overview of the entire document.

In the executive summary, briefly explain what your business does, your business goals, and how you plan on achieving them. You should also include a brief overview of your financial situation, including how much money you’ll need to get started.

For organizational purposes, you could create headings for each main section of your business plan to highlight the key takeaways.

For example, your insurance agency executive summary might look something like this:

Company Overview

[Insert Company Introduction / Short Summary]

Business Goals

[Insert Business Goals & How You Plan To Achieve Them]

Industry Overview

[Insert Industry Statistics on the Size of Your Market]

Competition

[Insert Overview of Competitors & Your Competitive Advantage]

[Insert Information About The Marketing Strategies You Will Use To Attract Clients/Customers]

Financial Overview

You can add and/or remove sections as needed, but these are the basics that should be included in every executive summary.

The next section of your insurance agency business plan is the company description, where you’ll provide an overview of your business.

Include information about your:

- Company History & Accomplishments To Date

Mission Statement and/or Company Values

With regards to the company overview, here you will document the type of insurance agency you operate. For example, there are several types of insurance agencies such as:

- Life insurance agency

- Health insurance agency

- Auto insurance agency

- Homeowners insurance agency

- Commercial Insurance Agency

For example, an insurance agency company description might look something like this:

We are an X type of insurance agency .

Company History

If an existing company: Since launching, our team has served X customers and generated $Y in revenue.

If startup: I conceived [company name] on this date. Since that time, we have developed the company logo, found potential space, etc.

This is just an example, but your company description should give potential investors a clear idea of who you are, what you do, and why you’re the best at what you do.

The next section of your business plan is the industry analysis. In this section, you’ll need to provide an overview of the industry you’re in, as well as any trends or changes that might impact your business.

Questions you will want to answer include:

- What is the overall size of the insurance industry?

- How is the industry growing or changing?

- What are the major trends affecting the insurance industry?

- Who are the major players in the insurance industry?

For example, your industry analysis might look something like this:

The size of the insurance industry is $XX billion.

It is currently growing at an annual rate of XX% and is expected to reach $XX billion by the year 20XX. The insurance industry has been booming in recent years.

Major trends affecting the industry are larger companies consolidating and the rise of digital marketing and e-commerce.

How We Fit Into The Industry

This is just an example, but your industry analysis should give potential investors a clear idea of the overall industry, and how your company fits into that industry.

The next section of your insurance agency business plan is the customer analysis. In this section, you’ll need to provide an overview of who your target customers are and what their needs are.

- Who are your target customers?

- What are their needs?

- How do they interact with your industry?

- How do they make purchasing decisions?

You want a thorough understanding of your target customers to provide them with the best possible products and/or services. Oftentimes, you will want to include the specific demographics of your target market, such as age, gender, income, etc., but you’ll also want to highlight the psychographics, such as their interests, lifestyles, and values.

This information will help you better understand your target market and how to reach them.

For example, your customer analysis might look something like this:

Target Market & Demographics

The demographic (age, gender, location, income, etc.) profile of our target insurance agency customer is as follows:

– Age: 25-60

– Gender: Male/Female

– Location: Anywhere in the United States

– Income: $50,000-$250,000

– Education: College degree or higher

Psychographics

Our core customer interests are as follows:

– Saving money: They are always looking for ways to save money, whether it’s on their insurance premiums or other household expenses.

– Convenience: They value convenience and want to be able to do business with companies that make their lives easier.

In summary, your customer analysis should give potential investors a clear idea of who your target market is and how you reach them.

The next section of your business plan is the competitor analysis. In this section, you’ll need to provide an overview of who your major competitors are and their strengths and weaknesses.

- Who are your major competitors?

- What are their strengths and weaknesses?

- How do they compare to you?

You want to make sure that you have a clear understanding of your competition so that you can position yourself in the market. Creating a SWOT Analysis (strengths, weaknesses, opportunities, threats) for each of your major competitors helps you do this.

For example, your competitor analysis might look something like this:

Major Competitors

XYZ Company is our major competitor. Its offerings include this, this and this. Its strengths include XYZ, and its weaknesses include XYZ.

Competitive Advantage

Your competitor analysis should give potential lenders and investors a clear idea of who your major competitors are and how you compare to them.

The next section of your business plan is the marketing plan. In this section, you’ll need to provide an overview of your marketing strategy and how you plan on executing it.

Specifically, you will document your “4 Ps” as follows:

- Products/Services : Here is where you’ll document your product/service offerings.

- Price : Detail your pricing strategy here.

- Place : Document where customers will find you and whether you will use distribution channels (e.g., partnerships) to reach them.

- Promotion : Here you will document how you will reach your target customers. For instance, insurance agencies often reach new customers via promotional tactics including online advertising, direct mail, and personal selling.

For example, your marketing plan might look something like this:

Products/Services

We offer the following products/services:

We will use a premium pricing strategy to establish ourselves as the highest quality brand.

We will serve customers directly and through a partnership with XYZ company.

As you can see, your marketing plan should give potential investors a clear idea of your marketing objectives, strategies, and tactics.

The next section of your business plan is the operations plan. In this section, you’ll need to provide an overview of your company’s day-to-day operations and how they will be structured.

- What are your company’s daily operations?

- How are your company’s operations structured?

- Who is responsible for each task?

Your operations plan should be detailed and concise. You want to make sure that potential investors have a clear understanding of your company’s day-to-day operations and how they are structured.

You will also include information regarding your long-term goals for your operations and how you plan on achieving them.

For example, your operations plan might look something like this:

Daily Operations

Our company’s daily operations include XYZ.

Operational Structure

Our company is structured as follows:

- Department 1

- Department 2

- Department 3

Each department is responsible for XYZ tasks.

Long-Term Goals

Our long-term goals for our operations are to achieve the following over the next five years.

Date 1: Goal 1

Date 2: Goal 2

Date 3: Goal 3

Date 4: Goal 4

Your operations plan should give readers a clear idea of your company’s day-to-day operations, how they are structured, and your long-term goals for the company.

The next section of your business plan is the management team. In this section, you’ll need to provide an overview of your management team and their experience.

- Who is on your management team?

- What are their qualifications?

- What is their experience?

Your management team ideally includes individuals who are experts in their respective fields. You want to make sure that lenders and investors have a clear understanding of your management team’s qualifications and experience, and feel they can execute on your plan.

For example, your management team might look something like this:

Our management team is comprised of the following X individuals with the following experience.

Team Member 1:

Team member 1’s qualifications and experience include XYZ.

Team Member 2:

Your management team should give potential lenders and investors a clear idea of who is on your team and how their qualifications and experience will help your company succeed.

The final core section of your business plan is the financial plan. In this section, you’ll need to provide an overview of your company’s financials.

- What are your company’s projected revenues?

- What are your company’s projected expenses?

- What is your company’s projected growth rate?

- How much funding do you need and for what purposes? For example, most startup insurance agencies need outside funding for pre-launch activities such as licenses, office space, and marketing initiatives.

Your financial plan should give potential investors a clear understanding of your company’s financials. While you may include a summary of this information in this section, you will include full financial statements in the appendix of your business plan.

For example, your financial plan might look something like this:

Our company’s projected revenues over the next five years are $XYZ.

Expenses & Net Income

Our company’s projected expenses and net income over the next five years are $XYZ.

Uses of Funding

This is just an example, but your financial plan should give potential investors a clear idea of your company’s financial projections.

The final section of your business plan is the appendix. In this section, you’ll need to provide any additional information that was not included in the previous sections.

This may include items such as:

- Full financial statements

- Resumes of key management team members

- Letters of reference

- Articles or press releases

- Marketing materials

- Product information

- Any other relevant information

By including this information in the appendix, you are allowing potential investors and lenders to learn more about your company.

In summary, writing an insurance agency business plan is a vital step in the process of starting and/or growing your own business.

A business plan will give you a roadmap to follow. It can also help you attract investors and partners.

By following the tips outlined in this article, you can be sure that your business plan will be effective and help you achieve your goals.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Insurance Agency Business Plan Template you can finish your plan in just 8 hours or less!

Finish your business plan today!

1777 SW Chandler Ave. Suite 267 Bend, OR 97702

Business Plan Services Business Plan Writing Business Plan Consultants

- We're Hiring!

Crafting an Effective Insurance Agency Business Plan

If you're an independent insurance agent, you know that success doesn't happen by chance. It requires strategic planning and a clear roadmap for the future. That's where an insurance agency business plan comes into play.

In this guide, we'll explore what a business plan is, why it's essential, and how to create one tailored to your home insurance agency.

At a glance:

- Crafting a well-defined insurance agency business plan provides strategic direction and goal-setting for success.

- A comprehensive business plan allows for adaptability in an ever-evolving industry.

- Defining your brand, researching funding options, and staying compliant with regulations, are the ingredients that can transform your business plan into an effective tool for growth.

Benefits of having a business plan

Having a solid roadmap is like holding a compass in a dense forest. It not only guides you on how to become a successful insurance agency, but also ensures you stay on course.

Strategic direction

So let’s continue that analogy: you’re on a road trip without a map, compass, or GPS. You might eventually reach your destination, but it would be a long and uncertain journey. Similarly, running an insurance agency without a business plan is like traveling without a guide. A well-crafted plan provides a clear path and helps you stay focused on your goals.

Goal setting

Setting realistic and achievable goals is vital for any business. Your insurance agency business plan acts as a compass, allowing you to establish clear objectives. Whether you want to increase your client base, revenue, or expand your services, a business plan helps you chart the course.

Investor confidence

If you find yourself in a place to seek external funding, whether from investors or lenders, a comprehensive business plan is a must. It demonstrates that you've thought through your business strategy, increasing your chances of securing financial support.

Adaptability

The insurance industry is never stagnant, and as such adaptability is key. A business plan isn't set in stone; it's a living document that can be adjusted as circumstances change. If done correctly, it allows you to stay flexible and make informed decisions as market trends shift.

Key components of an insurance agency business plan

Your business plan is the document that transforms your vision into a tangible reality, ensuring your journey as an independent insurance agent is not only successful but prosperous too.

Let’s explore the key components of an effective business plan, including the executive summary, company overview and more.

Executive summary

The executive summary serves as the elevator pitch for your entire business plan. It's designed to capture the reader's attention and give them a quick, compelling overview of your insurance agency. You'll want to concisely highlight your agency's mission, vision, and goals. Think of it as distilling your agency's essence into a few powerful sentences. It's an invitation for the reader to learn more about your agency's journey.

Company overview

The company overview is your opportunity to introduce your insurance agency in detail. It's where you set the stage for the rest of your business plan. In this section, you’ll want to dive into the history of your agency, including its founding story, location(s), and size. You should also describe every type of insurance product you offer and provide a snapshot of what makes your agency unique.

Industry analysis

The industry analysis puts your industry knowledge to good use. It's all about understanding the broader insurance market, including its trends, challenges, and opportunities. In this section, you'll research and present data and insights into the insurance industry. Discuss market trends, regulatory changes, and any challenges that could impact your independent agency. Identifying opportunities within the industry allows you to position your agency effectively to take advantage of them.

Customer analysis

Understanding your target market is essential for tailoring your services and marketing efforts effectively. Create detailed buyer personas that encompass their needs, preferences, and pain points. This information is the foundation for developing products and services that resonate with your audience.

Competitive analysis

Knowing your competition is about gaining insights into their strengths and weaknesses. When performing your market analysis, or market research, be sure to look at factors like their market share, marketing strategy, pricing models, and customer service practices. Understanding how you stack up against the competition will help you develop a winning strategy that sets your agency apart.

Marketing plan

Your marketing plan is the strategic playbook for how you'll attract and retain clients. Specify your marketing channels, both online and offline; outline your budget and set measurable goals. Whether it's through digital advertising, content marketing, or print advertising, your marketing plan should maximize your independent insurance agency's reach and impact.

Operations plan

The operations plan is the behind-the-scenes blueprint for how your independent agency runs day-to-day. Detail your team structure, office setup, and technology requirements. It's about ensuring smooth workflow and efficient service delivery. This section gives a clear picture of how your agency operates on a daily basis.

Management team

Your management team is the engine that drives your agency. Introduce the key members of your management team and highlight their expertise. Explain how their skills and experiences contribute to the agency's success.

Financial plan

The financial plan is the heart of your business plan. It's where you demonstrate that your agency is not just a vision but a financially viable venture. For any enterprise, including insurance agencies, it’s important to provide detailed financial projections in your business plan, including income statements, balance sheets, and cash flow statements. Set clear financial goals and explain how you intend to achieve them.

Tips for creating an effective insurance agency business plan

Creating an insurance agency business plan is akin to crafting that roadmap we talked about earlier. But here's the twist—this isn't just any road; it's twisting and on an ever-changing landscape. To navigate it successfully, you need more than just directions; you need insider tips and tricks.

Define your brand

Your brand is more than just a logo; it's who you are. Define your brand identity, including your mission statement, core values, and unique selling proposition. A strong brand will set you apart in a crowded market.

Research funding options

If you need capital to start or expand your agency, explore different funding options, which could include personal savings, loans, or investors. Your business plan should outline your funding needs and how you intend to secure the necessary capital.

Apply for licenses

Ensure that you comply with all regulatory requirements in your area. This includes obtaining the necessary licenses and insurance policies to operate legally. Failing to do so could jeopardize your agency's success.

Set goals and establish metrics

Your business plan should include specific, measurable, and time-bound goals. Track key performance indicators to measure your progress and adjust your strategy accordingly. Regularly reviewing and updating your plan keeps you on the path to success.

A strategic roadmap for success

For an independent insurance agency, a well-crafted business plan is not simply a document; it's a dynamic tool that provides strategic direction, fosters adaptability, and instills investor confidence. By defining your brand, understanding your market, and detailing your operational and financial strategies, your insurance agency business plan becomes the compass guiding you through the complexities of the industry.

With clear goals, a solid management team, and a proactive approach to change, your agency can navigate the insurance industry effectively, ensuring not only agency survival but also sustainable growth

Request an Appointment with Openly

A partnership with Openly empowers you to deliver outstanding service with speed and ease while offering comprehensive coverage tailored to your clients' needs.

About the Author

Alyssa Little | Senior Content Strategist

Alyssa is the Senior Content Strategist at Openly, collaborating with industry thought leaders to provide insightful and informative content in the home insurance space. With over 15 years experience in content marketing strategy, copywriting, and editing, Alyssa has refined her expertise through her work at such companies as Gartner, Nike, and Trupanion. Alyssa holds a BA in History from the University of Puget Sound and an MA in Museum Studies from Newcastle University.

Related Blogs

May 18, 2023

December 21, 2023

May 15, 2023

How To Write an Insurance Agency Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance agencies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance agency owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Agency Business Plan?

An insurance agency business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Agency Business Plan?

An insurance agency business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Agency Business Plan

The following are the key components of a successful insurance agency business plan:

Executive Summary

The executive summary of an insurance agency business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance agency

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance agency business, you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance agency firm, mention this.

You will also include information about your chosen insurance agency business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance agency business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance agency industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, customers of an insurance agency may include individuals, families and small businesses.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance agency services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance agency may have:

- In-depth knowledge of the insurance industry

- Broad product offering

- Customer focus and commitment to service

- Well-trained and experienced team

- Proven track record

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance agency via a mix of all the channels listed.

Operations Plan

This part of your insurance agency business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance agency include reaching $X in sales. Other examples include signing up a certain number of customers, expanding to a new location, or launching a new product or service.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Agency

Balance sheet.

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Insurance Agency

Cash flow statement.

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup insurance agency .

Sample Cash Flow Statement for a Startup Insurance Agency

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.