- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Business Plan Real Estate

Real Estate Business Plan Template

Download our template and create a business plan for your real estate business!

Updated September 22, 2023 Written by Josh Sainsbury | Reviewed by Brooke Davis

A real estate business plan is as essential as a business plan for any new or existing business. This step-by-step guide will explain how to make a real estate business plan, provide a real estate business plan template for you to work with, and explain how and why each step is necessary for your business plan to be effective.

We also provide links to downloadable templates to help you create your real estate business plan and sample plans to show you the best ways to tailor your plan for any number of real estate business needs.

Whether you seek investors to grow your business or want to track your goals from year to year as your business develops, a carefully crafted plan will help you.

Why You Need a Business Plan for Your Real Estate Business

How to write a business plan for real estate, real estate business plan sample.

The real estate business plan fills several needs. It gives you an outline of your business goals and the direction you want your business to take. It keeps you in line with industry trends. It lets you monitor your annual performance and change your goals as the market changes.

An effective real estate business plan also acts as a financial summary of your business, showing how it stands about your competition and the industry. The business plan acts as a road map for you and a snapshot of your business for any investors or bankers who want to understand your business.

A real estate business plan will help you spot risks and weaknesses early in your business development and help you set realistic goals for your business.

These are known as SMART goals: Specific, Measurable, Achievable, Relevant, and Time-based goals.

Creating a business plan without goals is like starting a journey without a destination. Having a destination without a map means going down many blind alleys, taking unnecessary detours, and wasting time as you frequently need to return and start again.

Your business plan will help you avoid these pitfalls and adjust your course while you travel towards your final goal — a successful real estate business.

You must cover critical topics and include the correct information to ensure your business plan is as effective as possible. Follow our guide to writing a well-formed real estate business plan below.

1. Executive Summary

The executive summary contains an overall review of the rest of the business plan. It should include an outline of your history, your mission statement, and an overview of the rest of the report.

This section will include things like:

- Target clients with a fictional “ideal buyer” persona;

- Target neighborhoods, price ranges, and listings;

- Market overviews and potential threats and opportunities;

- A marketing plan outline.

- Your mission statement. This should include where and how your agency was founded, discuss the legal and financial structure, and stress your dedication to your customers and any special advantages you provide to your target clients.

2. Management Team

If you have a management team or a group that has contributed to the business’s success, summarize their names and contributions.

This section highlights everyone who has been involved in your business.

- Owners, founders, and original managers;

- New management, assigned duties and areas, and specific clients;

- Planned management expansion and anticipated managerial goals.

- Include all information about your managers, names, positions and duties, education and work history, past business successes, and other relevant details. Think of this section as your management team’s biography.

As the business expands, your management team section will be one section that needs constant improvement and updating.

3. Products and Services

Your products and services should be phrased to make you unique in the industry and highlight how you stand out from your competitors. As a real estate business, what do you provide for your clients that others do not? How do your agents compare with your competition?

In real estate, your product is your listing and your brand. What is it that makes your company the one that your target buyer wants to use? In this section, you will highlight the following:

- Your niche market and how you acquire specific listings in your area;

- Your lead generation model and the way you obtain leads that differentiate you from your competitors;

- Your branding. A defining brand can be nebulous, and many firms resort to hiring a brand agent to help them customize and market their brand. You may be a family-friendly agent or specialize in the young professionals market. Determining how you present yourself is critical to your service profile.

4. Customers and Marketing

The customers and marketing section lets you identify your niche within the real estate business and how you intend to reach them.

You defined your ideal customer in your executive summary; now is where you expand on your perfect customer “persona.” A “persona” is the industry name for the imaginary person you sell to.

- Their demographics, age, gender, job, family preference, and income.

- Deal-breakers. What do they have to have in a home? What can they do without?

- Amenities, recreation, entertainment. Does your ideal buyer need dog parks nearby or bike paths? Do they want access to the water or the theater district?

- What type of neighborhood is your ideal buyer looking for? Do they need a school district or prefer to be far from children?

After establishing your ideal customer, you can select the viability of your marketing niche. For instance, is your buyer likely to be a first-time buyer? If so, what percentage of first-time sales were made in your chosen area in the last two years?

The more detailed you can make your Customers and Marketing section, the more you know how your business will likely thrive in your chosen area.

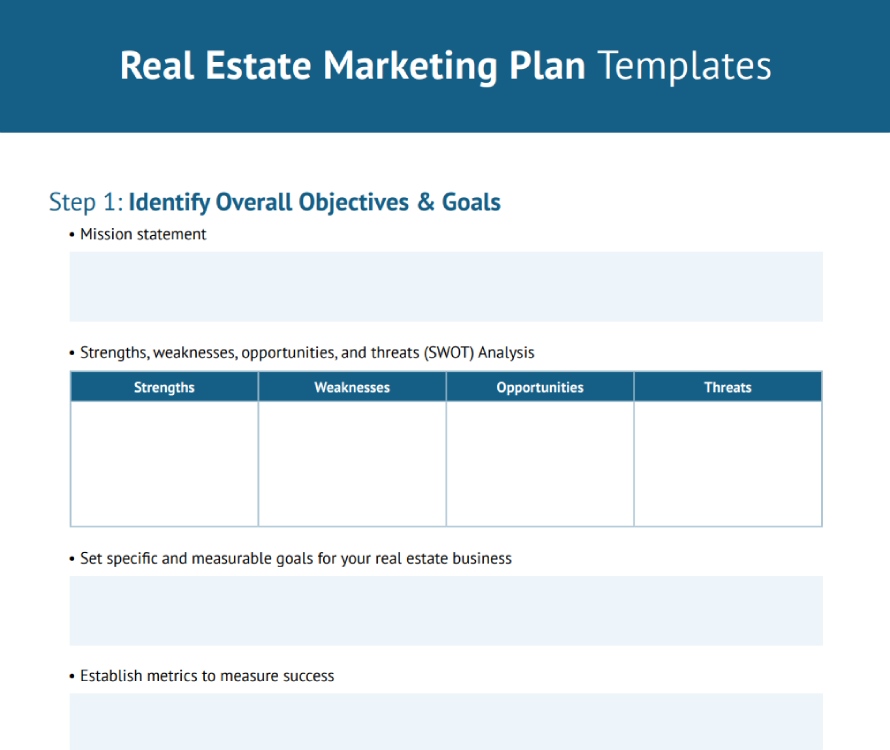

5. SWOT Analysis

Strengths, weaknesses, opportunities, and threats are necessary for every business analysis. In what areas are you and your business strongest, and where do you need improvement?

Investors appreciate a business owner who can accurately pinpoint their good and bad points and demonstrate how to improve.

This analysis should be fact-based, not opinion-based. You should be able to provide statistics and metrics for your and your competitors’ business research. Some things to consider are:

- In what areas of your business plan are you strongest? Are they similar or dissimilar to your nearest competitor’s strengths?

- In what areas are you weakest? Are you weak where your competitors are strongest?

- What opportunities can you exploit in the next six to 12 months? Are these opportunities unavailable to your competitors?

- What threats are you facing in the next year? How can you avoid these threats or turn them into advantages?

By analyzing your business objectively and reviewing all the facts and numbers, you can determine how you will be placed in the next year.

6. Financials

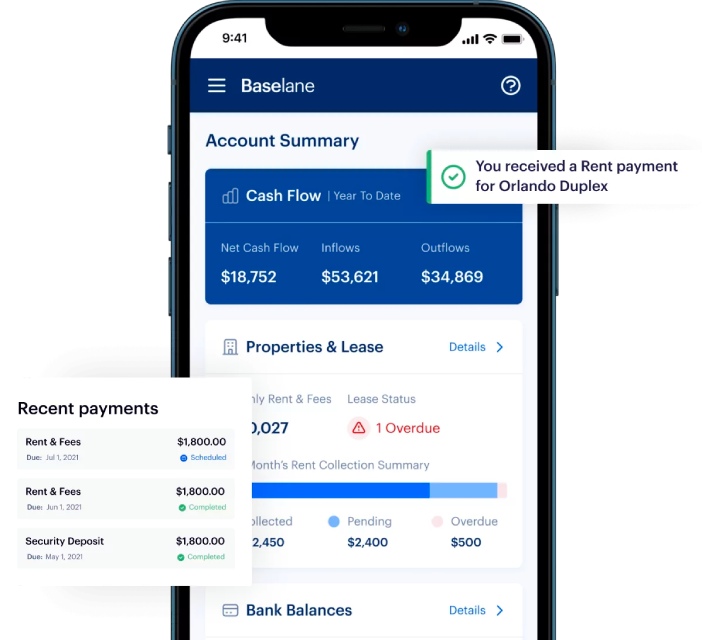

The meat of your business plan is the financials. This includes your expenses, annual income forecast (sales, commissions, or other income), cash flow, and costs. As your business grows, your business plan will include previous years’ financials to track the growth.

Your financials should include, at a minimum:

- Expenses. These include operating expenses, whether you have a physical location or are still in the virtual stage of operations, licensing and permitting, fees and filing costs, and other operating expenses. If you have employees, it will also include payroll.

- The past income portion will track how much you have already made. You should be able to show how many leads you have generated, how many transactions you made, and your income from those efforts.

- Future income is how much you would like to make going forward. You can estimate how many leads are needed per transaction and how many transactions per sale from your past efforts.

- Goals. With this information, you should include your projections for the next year and five-year periods. Presumably, you wish to increase profit over the next five years. You can demonstrate how to achieve these goals using income tracking and market research.

7. Operations

Operations contain the moving parts of your financial projections. This section describes how you intend to reach your business goals in the upcoming year. This section might also include upcoming personnel changes, office expansions, etc.

Real Estate operations can include your projected hours of operation, your action plan for achieving your goals, and your marketing and advertising plan. Initially, this may be somewhat fluid if you do not plan to have set hours of operation or a brick-and-mortar office.

Later, as your business increases, this section will include business hours, open house times, etc.

8. Appendix

If your real estate business plan includes any ancillary documents, such as your Articles of Incorporation or a Business Purchase Agreement , they would be included in the Appendix.

After your first real estate business plan, your previous years’ plans will go into the Appendix so they can be reviewed by potential investors or by your board. You can also include your quarterly statements and other financial documents.

Your Appendix is the section for any documents you want to have that are not essential for your readers’ overall understanding.

Now that you know what goes into your real estate business plan, all that is left for you to do is click on the business plan creation template and begin. Ensure you have all your documentation and research-ready in advance, and the template will provide you with cues as to what information needs to go into which spaces.

After filling in all the blanks, the template will generate a real estate business plan to your specifications.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

- Business plans

Real Estate Business Plan Template

Used 4,872 times

Start off your new real estate business on the right foot by using a real estate business plan template to ensure your goals, visions, and finances are sorted.

e-Sign with PandaDoc

Created by:

[Sender.FirstName] [Sender.LastName]

[Sender.Company]

Prepared for:

[Recipient.FirstName] [Recipient.LastName]

[Recipient.Company]

Executive Summary

[Sender.Company] , located at [Sender.State] , is a new (Add type, i.e., residential, commercial, industrial) real estate brokerage firm specializing in (Add specialty). The company will operate professionally, conveniently located next to [Sender.StreetAddress] [Sender.City] [Sender.PostalCode] . [Sender.Company] is headed by [Sender.FirstName] [Sender.LastName] , (Add important credentials of the Sender).

[Sender.Company] ’s services include:

Listing rentals for landlords.

Assisting tenants in finding rentals.

Selling homes.

Helping buyers find homes.

By serving both renters and homeowners, [Sender.Company] hopes to become a long-term partner with each client rather than part of a one-time transaction.

Business Description

The business is currently being run out of (address).

Since incorporation, the Company has achieved the following milestones:

Found office space and signed Letter of Intent to lease it

Developed the company’s name, logo, and website located at (Enter website)

Hired an interior designer for the decor and furniture layout

Determined equipment and fixture requirements

Began recruiting key employees

Mission Statement

[Sender.Company] ’s long-term goal is to become the number-one name in residential real estate brokerage in terms of the right balance of price and customer service quality.

We seek to do this by ensuring customer satisfaction and developing a loyal and trusting clientele.

The following are a series of steps that will lead to this long-term success. [Sender.Company] expects to achieve the following milestones in the following (Add number) months:

Date | Milestone |

|---|---|

(Date 1) | Finalize lease agreement |

(Date 2) | Design and build out [Sender.Company] office |

(Date 3) | Hire and train initial staff |

(Date 4) | Kickoff of the promotional campaign |

(Date 5) | Reach break-even |

Customer Segments

[Sender.Company] will serve the residents and businesses in (Enter company location).

The area we serve is affluent and has the disposable income/profits required to demand off-premises catering services.

Renters and Potential Renters

Description: Temporary renters or those saving towards a purchase. Some are lifelong renters.

Age Range: _______ (Avg. age: 25)

Unique: Fast apartment turnover rate.

Home Buyers

Description: Mostly newcomers, often from a distance.

Age Range: _______ (Avg. age: 33)

Preferences: Value brokers knowledgeable about both listings and the local real estate market.

Home Sellers

Description: Mostly relocating, some upgrading or downsizing within the community.

Age Range: _______ (Avg. age: 45)

Preferences: Seek brokers skilled in pricing, staging, and negotiation.

Description: Owners renting out space, from professional landlords to those capitalizing on extra space.

Preferences: Value brokers adept at pricing, finding tenants, and handling initial inquiries.

Real Estate Industry Overview

Last year, the U.S. real estate sale and brokerage agencies generated $_______ billion in revenue and employed _______ people.

_______ businesses operated in this market, averaging $_______ per business.

Average employee wage in the industry was $_______.

Economic Significance

Real estate's health is crucial for the American economy.

Key metrics like new home sales, listings, and prices are closely monitored.

Revenue Streams

Brokerage fees, commissions, property management, consulting, and appraisal fees are major revenue sources.

Economies of Scale

Modest economies of scale exist, favoring larger firms, though many remain too small to fully benefit.

Key Players

Major industry players include Realogy, Equity Residential, AIMCO, HomeServices, and RE/MAX.

Products, Programs, and Services

[Sender.Company] will be able to provide clients with the following services:

Services | |

|---|---|

| By listing rental and for sale condominiums, apartments, and homes on its own website – including its clients and others, [Sender.Company] will develop a resource that is known in the local area as a go-to site for the most comprehensive real estate listings. |

| [Sender.Company] will promote its client’s properties in local newspapers, magazines, and even television when appropriate, offering great visibility for the properties it lists. |

| For a standard one-month broker’s fee, [Sender.Company] will match clients seeking rental apartments with apartments meeting their specifications as closely as possible, choosing from listings by [Sender.Company], by other brokers, and by landlords. |

| For the standard 3% commission, [Sender.Company] will find buyers, negotiate on behalf of the seller, and process the seller’s paperwork related to the sale. |

| For the standard 3% commission, [Sender.Company] will find appropriate homes to buy, submit offers for the buyer, negotiate on behalf of the buyer, and process the buyer’s paperwork related to the purchase. |

| Seminars at the real estate office or at larger venues when appropriate will be offered to present topics such as preparing one’s home for sale, how to look for undervalued properties, what type of improvements have the greatest effect on a home’s value, etc |

As [Sender.FirstName] [Sender.LastName] understands, the key to a successful real estate brokerage business is building referrals and a long-term reputation as a trustworthy agent in the community. [Sender.FirstName] [Sender.LastName] will continue to reach out to past clients in future years to answer questions and to continue to develop a relationship.

Marketing Plan

The [sender.company] brand.

The [Sender.Company] brand will focus on the Company’s unique value proposition:

Client-focused residential real estate brokerage services, where the Company’s interests are aligned with the customer

Service built on long-term relationships and personal attention

Big-firm expertise in a small-firm environment

Promotions Strategy

[Sender.Company] will initially invest significant time and energy into contacting potential clients and building an initial client base.

Referral Strategy

Encourage Referrals: [Sender.Company] will incentivize clients for referrals, fostering organic growth.

Strategic Networking: [Sender.Company] will actively network with home contractors, real estate developers, and businesses importing employees, generating qualified leads.

Internet Promotion

SEO and PPC Focus: [Sender.Company] will invest in local SEO and pay-per-click advertising, optimizing website traffic.

Content-Rich Website: The website will showcase [Sender.Company] as a reputable real estate brokerage.

Publications

Key Listings: Properties will be featured in local publications, maximizing exposure.

Targeted Brochures: Brochures will be distributed in locations frequented by potential clients.

Community Engagement: Free seminars will be offered to familiarize residents with [Sender.Company] 's expertise and character.

Pricing Strategy

[Sender.Company] ’s pricing will rely on the standard industry rates to neither be perceived as a luxury nor a discount broker. 3% is the commission on sales and 3% on purchases.

Apartments and other rentals will have fees paid only by the tenants at the standard rate of one month’s rent. By seeking quality clients and maintaining long-term relationships with them, [Sender.Company] will fend off pressure to discount their rates, even in down markets.

Operations Plan

[Sender.Company] will carry out its day-to-day operations primarily on an appointment basis.

[Sender.FirstName] [Sender.LastName] will work as needed, including weekends and prime showing times, and generally take days off on weekdays.

Management Organization

Founder's expertise.

Founder: [Sender.FirstName] [Sender.LastName]

Experience: (Number of years) years as a licensed real estate broker.

Credentials: (Enter credentials)

Specialization: (Specify area of specialization and years of experience)

Achievements

Accolades: (Enter any awards or accolades)

Licensing and Affiliations

License: (Enter state), (Enter other states)

Association Membership: National Association of Realtors

Administrative Support

[Sender.Company] employs (Assistant.Name), an experienced assistant, to handle various administrative duties in the office. (Assistant.Name) has worked with C-level executives and possesses significant administrative experience.

Financial Plan

Revenue and cost drivers.

[Sender.Company] ’s revenues will come primarily from the commissions earned from client real estate sales, purchases, and rental fees. Half of the deals each quarter are expected to be rentals, one-quarter of sales, and one-quarter of purchases.

As with most services, labor expenses will be key cost drivers. [Sender.FirstName] [Sender.LastName] and future brokers will earn a competitive base salary. Furthermore, the costs of transactions are projected to be roughly 40% of regular commission revenue and cover the advertising of listings, travel and supply costs for clients, and other direct costs for each deal.

Moreover, ongoing marketing expenditures are also notable cost drivers for [Sender.Company] .

Capital Requirements and Use of Funds

[Sender.Company] is seeking total funding of (Enter the amount needed) of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

Store design/build: $(Enter value)

Working capital: $(Enter value) to pay for marketing, salaries, and lease costs until [Sender.Company] reaches the break-even point

Key Assumptions and Forecasts

The following table reflects the key revenue and cost assumptions made in the financial model.

Clients per Quarter | Average |

|---|---|

FY 1 | (Enter amount) |

FY 2 | (Enter amount) |

FY 3 | (Enter amount) |

FY 4 | (Enter amount) |

Annual Lease/Rent per location: | $(Enter amount) |

5 Year Annual Income Statement

Revenue | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

Service A | | | | | |

Service B | | | | | |

| | | | | |

Total Revenue: | $ | $ | $ | $ | $ |

| | | | | |

Expenses and Costs | |||||

Cost of goods sold | | | | | |

Lease | | | | | |

Marketing | | | | | |

Salaries | | | | | |

Other expenses | | | | | |

| | | | | |

Total expenses: | | | | | |

| | | | | |

Pre-tax income: | | | | | |

| | | | | |

Net income: | | | | | |

Net profit margin: | | | | | |

5 Year Annual Balance Sheet

Assets | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

Cash | | | | | |

Accounts receivable | | | | | |

Inventory | | | | | |

| | | | | |

Total current assets: | | | | | |

Fixed assets: | | | | | |

Depreciation: | | | | | |

Net fixed assets: | | | | | |

| | | | | |

Total Assets: | | | | | |

| | | | | |

Total Equity and Liability | |||||

Debt | | | | | |

Accounts payable | | | | | |

Total liabilities | | | | | |

Share capital | | | | | |

Retained earnings | | | | | |

Total equity | | | | | |

| | | | | |

Total liabilities and equity: | | | | | |

5 Year Annual Cash Flow Statement

Cash flow from operations | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

Net income (loss) | | | | | |

Change in working capital | | | | | |

Depreciation | | | | | |

Net cash flow from operations | | | | | |

| | | | | |

Cash flow from investments | |||||

Investment | | | | | |

Net cash flow | | | | | |

| | | | | |

Cash flow from financing | |||||

Cash from equity | | | | | |

Cash from debt | | | | | |

Net cash flow | | | | | |

| | | | | |

Summary | |||||

Net cash flow | | | | | |

Cash at beginning of period | | | | | |

Cash at end of period | | | | | |

Confidentiality Statement

The confidential information and trade secrets described above shall remain the exclusive property of the real estate business. They shall not be shared or removed from the premises of the real estate business under any circumstances whatsoever without the express prior written consent of the real estate business.

List any additional documents that might provide more information on your real estate business or operations here.

[Recipient.FirstName] [Recipient.LastName]

Care to rate this template?

Your rating will help others.

Thanks for your rate!

Useful resources

- Featured templates

- Sales proposals

- NDA agreements

- Operating agreements

- Service agreements

- Sales documents

- Marketing proposals

- Rental and lease agreement

- Quote templates

- 1×1 Solo Agent (Bi-Weekly)

- 1×1 Solo Agent (Weekly)

- Admin & Ops

- Executive Team

- Brokerage/Corporate

- Group Coaching Programs

- Online Store

- Agent Management Portal

- Nashville – ICC Regional Summit

- Las Vegas – ICC Regional Summit

- Million Dollar Visit

- Login to your ICC Account

Free Real Estate Business Plan Template Download

Download this free real estate business plan template along with the action steps form to maximize plan implementation.

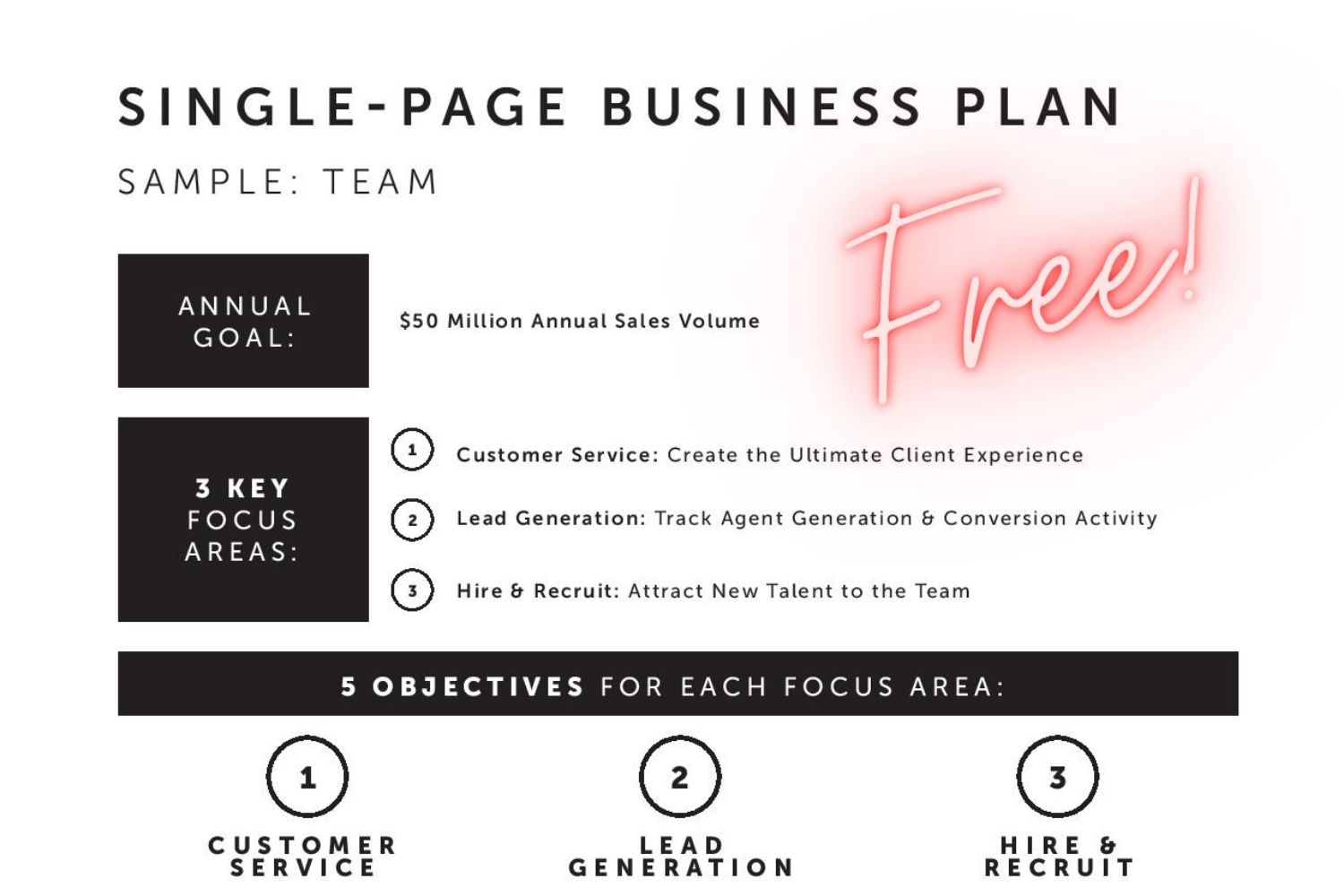

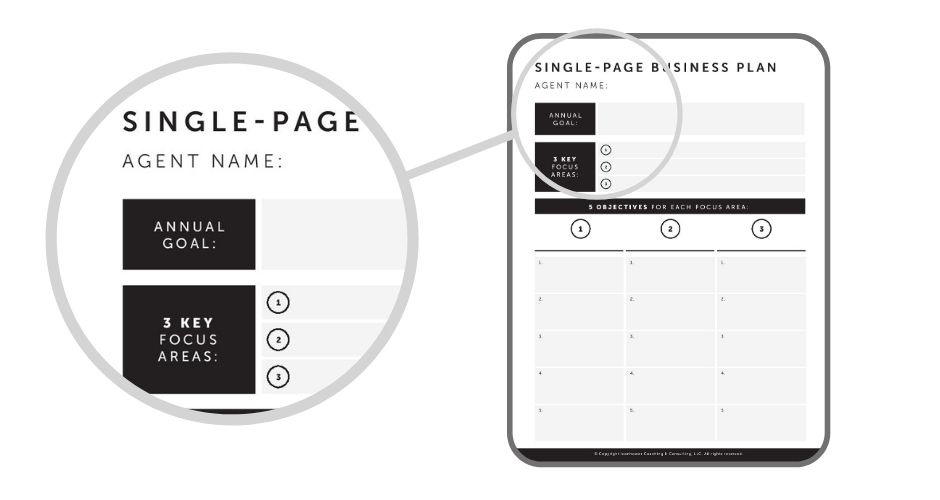

‘Tis the season to create your real estate business plan — and let this FREE downloadable template be your guide! In today’s video, I’ll walk you through how to create your 1-3-5 one-page business plan for your real estate business. I’ll also go over strategies to make your business plan work. To access your free download of the 1-3-5 one-page business plan as well as the action steps form, scroll down to the end of this blog post. Tune in to my video, below, for added insight and guidance.

VIDEO: Free Real Estate Business Plan Template Download

Business plans that work

Here are a few quick tips to consider as you craft your 1-3-5 single-page real estate business plan using our free templates below.

1. The 1-3-5- format is key — one big annual goal at the top, followed by three key focus areas that are broken into five objectives for each.

2. A single page document keeps your business plan streamlined and simple. Gone are the days of large, multi-page business plans that you know you’ll never read again. Keeping everything on one page forces you to focus on what matters and ensures that you will be able to read it again and again throughout the year to re-center yourself.

3. Be SMART. Make your goal , focus areas, and objectives SMART (Specific, Measurable, Achievable, Relevant, and Time-bound ).

4. Stretch but don’t strain. This goes along with making your goal, focus areas, and objectives SMART. You want to create goals that will stretch you, but you don’t want to stretch so much that you hurt yourself. A lofty goal that is well beyond reach can be very damaging.

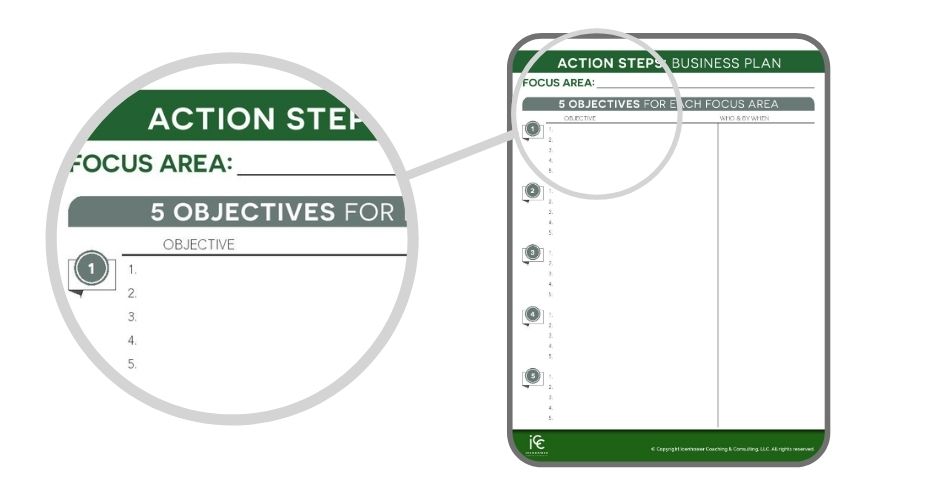

5. Create action steps with due dates to help you prioritize. If there’s one supportive document we recommend to your business plan, its an action steps page. These action steps turn goals into actionable to-do items with concrete deadlines.

Download your FREE real estate business plan template

To download your free single-page real estate business plan template, click the image below! Create your big annual goal, your three key focus areas, and your five key objectives for each focus area.

Action steps to support your business plan

For your free download of the Action Steps fillable PDF form from the video above, click on the image below. These Action Steps will help you prioritize your to-dos that will help you achieve your five objectives from your real estate business plan template.

Need more help?

Maybe you are feeling behind, or overwhelmed, or like you need a little guidance to make a business plan that you know you’ll stick with. Take a look at our Business Planning course , which will walk you through the process step by step. And if you need more help in general, or if you need to create an implementation plan, hire an ICC coach today. It all starts with a completely free consultation call — reach out today!

Check out our latest posts:

- Real Estate Team Marketing Ideas & Sources

- Real Estate Price Reduction Process for Agents

- Real Estate Listing Presentation When Competing With Another Agent

- Real Estate Sales Training Program to Train High Producing Realtors

- How to Train Top Producing Agents

Realtor Production Standards -.

Top realtor time management..

Brian Icenhower

Brian Icenhower is the CEO and Founder of Icenhower Coaching & Consulting (ICC), which provides customized coaching and training programs to many of the highest producing real estate agents, teams, and brokerage owners in North America. This progressive company also produces online courses, podcasts, training materials, white label training portals, speaking events, video modules, and real estate training books. ICC is one of the largest real estate coaching companies in the world with thousands of clients and a large team of the most accomplished coaches in the industry.

Join the email list to get free content!

- First Name *

- Hidden Are you from the US?

- I consent to receive email and text communications from Icenhower Coaching & Consulting Inc. I consent to receive email and text communications from Icenhower Coaching & Consulting Inc.

- Email This field is for validation purposes and should be left unchanged.

Follow Us on Social Media

Online Courses:

Let's connect

- Last Name *

- What would you like to gain from having a Real Estate Coach? *

- Company Name

- Office Phone Number *

- Number of Users & Any Requests: *

- Hidden Are you in the US?

- Name This field is for validation purposes and should be left unchanged.

- Phone This field is for validation purposes and should be left unchanged.

Download Your Event Resources

Share with your network.

- Buyer Agent 101

- Listing Agent 101

- Getting Your License

- Open Houses

- Stats + Trends

- Realtor Safety

- Social Media

- Website Marketing

- Referral Marketing

- Property Marketing

- Branding + PR

- Marketing Companies

- Purchasing Leads

- Prospecting

- Paid Advertising

- Generate Listings

- Generate Buyer Leads

- Apps + Software

- Lead Gen Companies

- Website Builders

- Predictive Analytics

- Brokerage Tech

- Building a Brokerage

- Recruiting Agents

- Lead Generation

- Tech Reviews

- Write for Us

Articles and reviews at The Close are editorially independent. We may make money when you click on links to our partners. Learn more.

7 Steps to Writing a Real Estate Business Plan (+ Template)

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise. See full bio

- Do Agents Really Need a Business Plan?

- Write a Real Estate Business Plan in 7 Easy Steps

- Identify Who You Are as a Real Estate Agent

- Analyze Your Real Estate Market

- Identify Your Ideal Client

- Conduct a SWOT Analysis

- Establish Your SMART Goals

- Create Your Financial Plan

- Track Your Progress & Adjust as Needed

- Bringing It All Together

Are you ready to take your business to the next level? I’ve got just the thing to help you— a foolproof real estate business plan. But before you start thinking, “Ugh, not a boring business plan for real estate,” hear me out. I’ve got a template that’ll make the process a breeze. Plus, I’ll walk you through seven easy steps to craft a plan to put you ahead of the game and have you achieve your wildest real estate dreams in no time. Your success story starts now.

Key Takeaways:

- A well-crafted business plan is your roadmap to success. It guides your decisions and keeps you focused on your goals.

- Create a solid plan by defining your mission, vision, and values, analyzing your market and ideal client, conducting a SWOT analysis, setting SMART goals, and creating a financial plan.

- Regularly track your progress, review your key performance indicators (KPIs), stay flexible, and seek accountability to ensure long-term success.

- Remember, your Realtor business plan should evolve with your business. Embrace change and stay focused on your goals to make your real estate dreams a reality.

Do Agents Really Need a Real Estate Business Plan?

Absolutely. Your real estate agent business plan is your roadmap to success. Without it, you risk losing direction and focus in your real estate career.

A well-crafted business plan helps you:

- Understand your current position in the market

- Set clear and achievable goals

- Create a roadmap for success

- Track your progress and performance

- Make informed decisions and adjustments

Think of your real estate business planning as your GPS, guiding you from your current situation to your desired destination. It serves as your North Star, keeping you focused and on track, even in challenging times. Invest the time to create a solid business plan, and you’ll be well-positioned to succeed in your market and achieve your goals. Your future self will appreciate the effort you put in now.

Before we dive into this section, get our real estate business plan template ( click here to go back up to grab it ) and work through it as I explain each section. I’ll give you some direction on each element to help you craft your own business plan.

1. Identify Who You Are as a Real Estate Agent

Let’s start with your “why.” Understanding your purpose for choosing real estate is crucial because it is the foundation for your business plan and guides your decision-making process. Defining your mission, vision, and values will help you stay focused and motivated as you navigate your real estate career.

Mission: Your mission statement defines your purpose for choosing real estate. It clearly states what you’re trying to do, the problem you want to solve, and the difference you want to make.

Ex: Wanda Sellfast’s mission is to empower first-time homebuyers in Sunnyvale, California, to achieve their dream of homeownership and build long-term wealth through real estate.

Vision: Your vision statement focuses on the ultimate outcome you want to achieve for your clients and community.

Ex: Wanda Sellfast’s vision is a Sunnyvale, where everyone has the opportunity to own a home and build a stable, secure future, creating a more inclusive and prosperous community for all.

Values: Your core values are the guiding principles that shape your behavior, decisions, and interactions with clients and colleagues.

Ex: Wanda Sellfast’s core values include:

- Integrity: Being honest, transparent, and ethical in all dealings.

- Dedication: Being devoted to clients’ success and going the extra mile.

- Community: Building strong, vibrant communities and giving back.

Clearly defining your mission, vision, and values lays the foundation for a strong and purposeful real estate business that will help you positively impact your clients’ lives and your community.

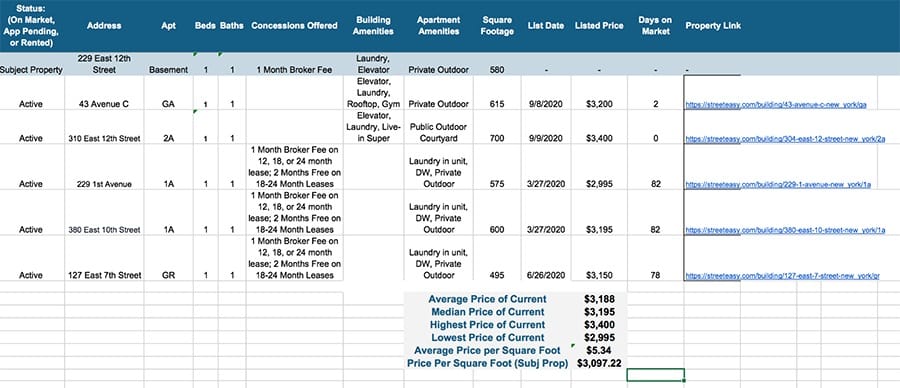

2. Analyze Your Real Estate Market

As a real estate pro, you must deeply understand your local market. This knowledge includes knowing key metrics such as average days on market, average price points, common home styles and sizes, and demographic trends. When someone asks about the market, you should be able to confidently roll those numbers off your tongue without hesitation.

To quickly become the local expert, choosing specific farm areas to focus on is crucial. Concentrate your marketing efforts and build your local knowledge in a handful of communities and neighborhoods.

Some places to do research include:

- Your local MLS: Check your hot sheet daily

- Zillow: Check out the Premier Agents who show up in your neighborhood

- Social media: Who is targeting their posts to your area?

- Direct mail: Check your mailbox for flyers and postcards

- Drive by: Drive through your farm areas to see who has signs in yards

Once you’ve identified your target areas, start conducting comparative market analyses (CMAs) to familiarize yourself with the properties and trends in those neighborhoods. That way, you’ll provide accurate insights to your clients and make informed decisions in your business.

Remember to research your competition. Understand what other agents working in the same area are doing, who they’re targeting, and identify any gaps in their services. This understanding will help you differentiate yourself from your competition and better serve your clients’ needs. In our real estate business planning template, I ask you to examine and record:

- Trends: Track key metrics, such as days on market and average sold prices, to stay informed about your specific market.

- Market opportunities: Identify situations where there are more buyers and sellers (or vice versa) in the marketplace so you can better advise your clients and find opportunities for them and your business.

- Market saturation: Recognize areas where there may be an oversupply of certain property types or price points, allowing you to adjust your strategy accordingly.

- Local competition: Analyze your competitors’ strengths, weaknesses, and gaps in their services to identify opportunities for differentiation and possibilities to create a more meaningful impact.

Remember, real estate is hyper-local. While national and state news can provide some context, your primary focus should be on specific needs and trends within your target areas and the clients you want to serve. By thoroughly analyzing your local real estate market, you’ll be well-equipped to make informed decisions, provide valuable insights to your clients, and ultimately build a successful and thriving business.

3. Identify Your Ideal Client

When creating your real estate business plan, it’s crucial to identify your ideal client. You can’t be everything to everyone, no matter how much you think you should. And trust me, you certainly don’t want to work with every single person who needs real estate advice. By focusing on your ideal client, you’ll create a targeted marketing message that effectively attracts the right people to your business—those you want to work with.

Think of your target market as a broad group of people who might be interested in your services, while your ideal client is a specific person you are best suited to work with within that group. To create a detailed profile of your ideal client, ask yourself questions like:

- What age range do they fall into?

- What’s their family situation?

- What’s their income level and profession?

- What are their hobbies and interests?

- What motivates them to buy or sell a home?

- What are their biggest fears or concerns about the real estate process?

Answering these questions will help you create a clear picture of your ideal client, making it easier to tailor your marketing messages and services to meet their needs. Consider using this ideal client worksheet , which guides you through the process of creating a detailed client avatar. This will ensure you don’t miss any important aspects of their profile, and you can refer back to it as you develop your marketing plan .

By incorporating your ideal client into your overall business plan, you’ll be better equipped to make informed decisions about your marketing efforts, service offerings, and growth strategies. This clarity will help you build stronger relationships with your clients, stand out from the competition, and ultimately achieve your real estate business goals.

4. Conduct a SWOT Analysis

If you want to crush it in this business, you’ve got to think like an entrepreneur. One of the best tools in your arsenal is a SWOT analysis. It sounds ominous, but don’t worry, it’s actually pretty simple. SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. It’s all about taking a good, hard look at yourself and your business.

| What do you slay at? Maybe you're a master negotiator or have a knack for finding hidden gem properties. Whatever it is, own it and make it the backbone of your strategy. | What's happening in your market that you can use to your advantage? Is there an untapped niche or a new technology that could help you streamline your business? |

| We all have weaknesses, so don't be afraid to admit yours. You may not be the best at staying organized or struggle with marketing. The key is to be honest with yourself and either work on improving those areas or hire someone to help you. | There's competition out there, but don't let that keep you up at night. Instead of obsessing over what other agents are doing, focus on your game plan and stick to it. Identifying threats means recognizing things outside your control that could hinder your success, like the slowing real estate market or limited inventory. |

By conducting a SWOT analysis as part of your real estate business plan, you’ll have a clear picture of your current situation and your future goals. And don’t just do it once and forget about it—review and update it regularly to stay on top of your game.

5. Establish Your SMART Goals

If you want to make it big in real estate, setting goals is an absolute must . But not just any goals— I’m talking about SMART goals . SMART stands for Specific , Measurable , Achievable, Relevant , and Time-bound . It’s like a recipe for success, ensuring your goals are clear, realistic, and have a deadline.

Your SMART goals are an integral part of your overall business plan for real estate. They should be stepping stones to help you achieve your long-term vision and mission. So, analyze your SWOT analysis, ideal client, and market, and craft goals that will help you dominate your niche.

Example Smart Goal: Close 10 transactions in the next quarter.

Make sure to provide as many details as possible behind your goals. Don’t just say, “I want to sell more houses.” That’s too vague. In the example above, the goal is specific: “close 10 transactions.”

If you can’t measure your progress, how will you know if you’re crushing it or falling behind? Ensure your goals have numbers attached to track your success or see where you need to focus more energy. “Close 10 transactions” has a specific number, so you have a way to measure your progress.

I know you’ve got big dreams for your real estate business , but Rome wasn’t built in a day. Set goals that stretch you beyond your comfort zone but are still achievable. This way, you’ll gain confidence, build momentum, and push yourself to new heights. Closing 10 transactions in a quarter is a lofty goal, but it’s still achievable. Your goals should stretch you but still be within your reach.

Relevant goals are the ones that actually move the needle for your business. Sure, becoming the next TikTok sensation might be a lot of fun, but unless TikTok generates most of your clients, it won’t help you close more deals. Your goals should be laser-focused on the activities and milestones that will help you grow your real estate career. In the example above, the goal is specifically related to real estate.

Deadlines are your friend. Without a timeline, your goals are just wishes. Give yourself a precise end date and work backward to create a plan of action. In the example, the deadline for achieving the goal is the end of the current quarter. If you don’t achieve the goal, you can evaluate where the shortfall was and reset for the next quarter.

“Setting goals is the first step in turning the invisible into the visible.”

Tony Robbins

Remember, just like your SWOT analysis, your goals aren’t set in stone. Review and adjust them regularly to stay on track and adapt to business and market changes.

6. Create Your Financial Plan

Financial planning might not be your idea of a good time, but this is where your real estate business plan really comes together. Thanks to all the research and strategizing you’ve done, most of the heavy lifting is already done. Now, it’s just a matter of plugging in the numbers and ensuring everything adds up.

In this real estate business plan template section, you’ll want to account for all your operating expenses. That means everything from your marketing budget to your lead generation costs. Don’t forget about the little things (like printer ink, file folders, thank you cards, etc.)—they might seem small, but they can add up quickly. Some typical expenses to consider include:

- Marketing and advertising (business cards, website , social media ads )

- Lead generation ( online leads , referral fees, networking events )

- Office supplies and equipment (computer, printer, software subscriptions )

- Transportation (gas, car maintenance, parking)

- Professional development (training, courses, conferences )

- Dues and memberships (MLS fees, association dues)

- Insurance (errors and omissions, general liability)

- Taxes and licenses (business licenses, self-employment taxes)

Once you’ve figured out your expenses, it’s time to reverse-engineer the numbers and determine how many deals you need to close each month to cover your costs. If you’re just starting out and don’t have a track record to go off of, no worries! This planning period allows you to set a budget and create a roadmap for success.

Pro tip: Keep your personal and business finances separate. Never dip into your personal cash for business expenses. Not only will it make tax time a nightmare, but it’s way too easy to blow your budget without even realizing it.

If you’re evaluating your starting assets and realizing they don’t quite match your startup costs, don’t panic. This new insight is just a sign that you must return to the drawing board and tweak your strategy until the numbers line up. It might take some trial and error, but getting your financial plan right from the start is worth it.

7. Track Your Progress & Adjust as Needed

You’ve worked hard and created a killer real estate business plan, and you’re ready to take on the world. But remember, your business plan isn’t a one-and-done deal. It’s a living, breathing document that needs to evolve as your business grows and changes. That’s why it’s so important to track your progress and make adjustments along the way.

Here are a few key things to keep in mind:

- Set regular check-ins: Schedule dedicated time to review your progress and see how you’re doing against your goals, whether weekly, monthly, or quarterly.

- Keep an eye on your KPIs: Your key performance indicators (KPIs) are the metrics that matter most to your business. Things like lead generation, conversion rates, and average sales price can give you a clear picture of your performance.

- Celebrate your wins: When you hit a milestone or crush a goal, take a moment to celebrate. Acknowledging your successes will keep you motivated and energized.

- Don’t be afraid to pivot: If something isn’t working, change course. Your real estate business plan should be flexible enough to accommodate new opportunities and shifting market conditions.

- Stay accountable: Find an accountability partner, join a mastermind group, or work with a coach to help you stay on track and overcome obstacles.

“It’s the small wins on the long journey that we need in order to keep our confidence, joy, and motivation alive.”

Brendon Burchard

Remember, your real estate business plan is your roadmap to success. But even the best-laid plans need to be adjusted from time to time. By tracking your progress, staying flexible, and keeping your eye on the prize, you’ll be well on your way to building the real estate business of your dreams.

How do I start a real estate business plan?

Use this step-by-step guide and the downloadable real estate business plan template to map your business goals, finances, and mission. Identify your ideal client so you can target your marketing strategy. Once you’ve completed all the business plan elements, put them into action and watch your real estate business grow.

Is starting a real estate business profitable?

In the most simple terms, absolutely yes! Real estate can be an extremely profitable business if it’s run properly. But you need to have a roadmap to follow to keep track of your spending vs income. It’s easy to lose track of expenses and overextend yourself when you don’t have a set plan.

How do I jump-start my real estate business?

One of the easiest ways to jump-start any business is to set clear goals for yourself. Use this guide and the downloadable template to ensure you have clear, concise, trackable goals to keep you on track.

How do I organize my real estate business?

Start by setting some SMART goals to give yourself a concrete idea of what you see as success. Then, make sure you’re using the right tools—customer relationship manager (CRM), website, digital document signing, digital forms, etc., and make sure you have them easily accessible. Try keeping most of your business running from inside your CRM. It’s much easier to keep everything organized if everything is in one place.

Now, you have a step-by-step guide to creating a real estate business plan that will take your career to the next level. Taking the extra time to map your path to success is an essential step in helping you achieve your goals. Spend the extra time—it’s worth it. Now, it’s time to do the work and make it happen. You’ve got this!

Have you created your real estate business plan? Did I miss any crucial steps? Let me know in the comments!

As a licensed real estate agent in Florida, Jodie built a successful real estate business by combining her real estate knowledge, copywriting, and digital marketing expertise.

49 Comments

Add comment cancel reply.

Your email address will not be published. Required fields are marked *

Related articles

How to become a successful military relocation professional (mrp).

Helping service members find and sell their homes is a challenging, lucrative, and personally rewarding niche.

How to Build a Real Estate Team in 7 Steps + Mistakes to Avoid

According to a recent National Association of Realtors survey, more than 26% of Realtors in the United States belong to teams. Real estate teams are a fantastic way to share the costs of marketing, broaden your expertise, and mitigate the risks that are a part of a volatile industry like real estate.

45 Bad Real Estate Photos Agents Actually Posted (+ How to Fix Them)

There’s just something about the combination of real estate agent + homeowner + camera that leads to artistic disasters. Check out this epic collection as well as six expert tips on staging and photography so your images never end up on our list.

Success! You've been subscribed.

Help us get to know you better.

Real Estate Broker Business Plan PDF Example

- June 17, 2024

- Business Plan

Creating a comprehensive business plan is crucial for launching and running a successful real estate broker. This plan serves as your roadmap, detailing your vision, operational strategies, and financial plan. It helps establish your real estate broker’s identity, navigate the competitive market, and secure funding for growth.

This article not only breaks down the critical components of a real estate broker business plan, but also provides an example of a business plan to help you craft your own.

Whether you’re an experienced entrepreneur or new to the real estate industry, this guide, complete with a business plan example, lays the groundwork for turning your real estate broker business concept into reality. Let’s dive in!

Our real estate broker business plan is structured to cover all essential aspects needed for a comprehensive strategy. It outlines the business’s operations, marketing strategy , market environment, competitors, management team, and financial forecasts.

- Executive Summary : Offers an overview of your real estate broker business’s concept, market analysis , management, and financial strategy.

- Facility & Location: Describes the business’s operational base, amenities, and why its location is appealing to potential clients.

- Services & Rates: Lists the services provided by your real estate broker business, including types of brokerage services offered and pricing structure.

- Key Stats: Shares industry size , growth trends, and relevant statistics for the real estate brokerage market.

- Key Trends: Highlights recent trends affecting the real estate sector.

- Key Competitors : Analyzes main competitors nearby and how your business differs from them.

- SWOT : Strengths, weaknesses, opportunities, and threats analysis.

- Marketing Plan : Strategies for attracting and retaining customers.

- Timeline : Key milestones and objectives from start-up through the first year of operation.

- Management: Information on who manages the real estate broker business and their roles.

- Financial Plan: Projects the business’s 5-year financial performance, including revenue, profits, and expected expenses.

Real Estate Broker Business Plan

Fully editable 30+ slides Powerpoint presentation business plan template.

Download an expert-built 30+ slides Powerpoint business plan template

Executive Summary

The Executive Summary introduces your real estate brokerage’s business plan, offering a concise overview of your brokerage and its services. It should detail your market positioning, the range of real estate services you offer, its location, size, and an outline of day-to-day operations.

This section should also explore how your real estate brokerage will integrate into the local market, including the number of direct competitors within the area, identifying who they are, along with your brokerage’s unique selling points that differentiate it from these competitors.

Furthermore, you should include information about the management and co-founding team, detailing their roles and contributions to the brokerage’s success. Additionally, a summary of your financial projections, including revenue and profits over the next five years, should be presented here to provide a clear picture of your brokerage’s financial plan.

Make sure to cover here _ Business Overview _ Market Overview _ Management Team _ Financial Plan

Business Overview

For a Real estate broker, the Business Overview section can be concisely divided into 2 main slides:

Facility & Location

Briefly describe the brokerage’s office environment, emphasizing its design, comfort, and the overall atmosphere that welcomes clients. Mention the office location, highlighting its accessibility and the convenience it offers to clients, such as proximity to major business districts, shopping centers, or ease of parking. Explain why this location is advantageous in attracting your target clientele.

Services & Rates

Detail the range of real estate services offered, from residential and commercial property sales to property management , leasing, and real estate consulting. Outline your pricing strategy , ensuring it reflects the quality of services provided and matches the market you’re targeting. Highlight any packages, commission structures, or special deals that provide added value to your clients, encouraging repeat business and customer loyalty.

Make sure to cover here _ Facility & Location _ Services & Rates

Market Overview

Industry size & growth.

In the Market Overview of your real estate brokerage business plan, start by examining the size of the real estate industry and its growth potential. This analysis is crucial for understanding the market’s scope and identifying expansion opportunities.

Key Market Trends

Proceed to discuss recent market trends , such as the increasing consumer interest in smart home technology, sustainable and energy-efficient properties, and virtual property tours. For example, highlight the demand for services that cater to first-time homebuyers, luxury property seekers, and commercial real estate investors. Emphasize the growing importance of online listings and digital marketing strategies in attracting and engaging potential clients.

Key Competitors

Then, consider the competitive landscape, which includes a range of real estate firms from large national chains to local independent brokers, as well as online real estate platforms. For example, emphasize what makes your brokerage distinctive, whether it’s through exceptional customer service, a comprehensive range of services, or specialization in certain property types or market segments. This section will help articulate the demand for real estate services, the competitive environment, and how your brokerage is positioned to thrive within this dynamic market.

Make sure to cover here _ Industry size & growth _ Key competitors _ Key market trends

Dive deeper into Key competitors

First, conduct a SWOT analysis for the real estate broker , highlighting Strengths (such as experienced agents and a comprehensive range of services), Weaknesses (including high operational costs or strong competition), Opportunities (for example, an increasing demand for sustainable properties), and Threats (such as economic downturns that may decrease consumer spending on real estate).

Marketing Plan

Next, develop a marketing strategy that outlines how to attract and retain clients through targeted advertising, promotional discounts, engaging social media presence, and community involvement.

Finally, create a detailed timeline that outlines critical milestones for the real estate brokerage’s launch, marketing efforts, client base growth, and expansion objectives, ensuring the business moves forward with clear direction and purpose.

Make sure to cover here _ SWOT _ Marketing Plan _ Timeline

Dive deeper into SWOT

Dive deeper into Marketing Plan

The Management section focuses on the optician business’s management and their direct roles in daily operations and strategic direction. This part is crucial for understanding who is responsible for making key decisions and driving the real estate broker toward its financial and operational goals.

For your real estate broker business plan, list the core team members, their specific responsibilities, and how their expertise supports the business.

Financial Plan

The Financial Plan section is a comprehensive analysis of your financial projections for revenue, expenses, and profitability. It lays out your real estate broker’s approach to securing funding, managing cash flow, and achieving breakeven.

This section typically includes detailed forecasts for the first 5 years of operation, highlighting expected revenue, operating costs and capital expenditures.

For your real estate broker business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement), as well as your key assumptions (e.g. number of customers and prices, expenses, etc.).

Make sure to cover here _ Profit and Loss _ Cash Flow Statement _ Balance Sheet _ Use of Funds

Related Posts

Home Inspection Business Plan PDF Example

Competitive Analysis for a Real Estate Broker Business (Example)

- May 14, 2024

- Business Plan , Competitive Analysis

Competitive Analysis for a Home Inspection Business (Example)

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

Real Estate Investing & Rental Management | How To

How to Write a Real Estate Investment Business Plan (+ Free Template)

Published September 22, 2023

Published Sep 22, 2023

REVIEWED BY: Gina Baker

WRITTEN BY: Jealie Dacanay

This article is part of a larger series on Investing in Real Estate .

- 1 Write Your Mission & Vision Statement

- 2 Conduct a SWOT Analysis

- 3 Choose a Real Estate Business Investing Model

- 4 Set Specific & Measurable Goals

- 5 Write a Company Summary

- 6 Determine Your Financial Plan

- 7 Perform a Rental Market Analysis

- 8 Create a Marketing Plan

- 9 Build a Team & Implement Systems

- 10 Have an Exit Strategy

- 11 Bottom Line

A real estate investment business plan is a guide with actionable steps for determining how you’ll operate your real estate investing business. It also indicates how you’ll measure your business’ success. The plan outlines your mission and vision statement, lets you conduct a strengths, weaknesses, opportunities, and threats (SWOT) analysis, and sets goals in place. It’s similar to a business plan for any business, but the objectives are geared toward how you will manage the business, grow your investment, and secure funding.

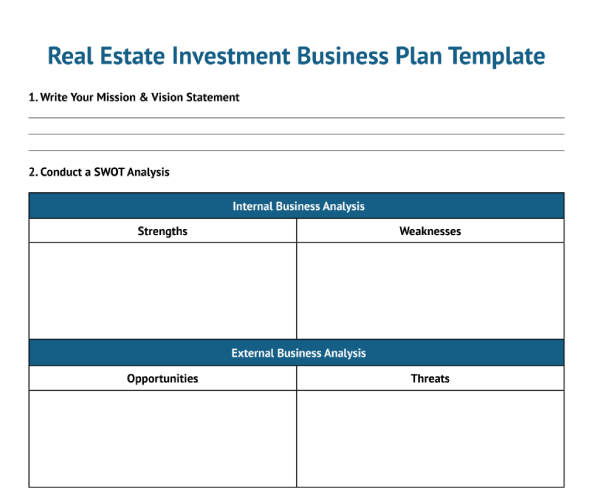

We’ve created a free real estate investment business plan template for you to download and use as a guide as you read through the article and learn how to write a business plan for real estate investment:

FILE TO DOWNLOAD OR INTEGRATE

Free Real Estate Investment Business Plan Template

Thank you for downloading!

1. write your mission & vision statement.

Every real estate investment business plan should begin with a concrete mission statement and vision. A mission statement declares actions and strategies the organization will use—serving as its North Star in achieving its business or investment objectives. A strong mission statement directs a real estate business, keeps teams accountable, inspires customers, and helps you measure success.

Before you compose your mission statement, you need to think about the following questions to do it effectively:

- What exactly is our business? The answer should encompass the essential functions of your real estate organization.

- How are we doing it? The response must explain your real estate goals and methods based on your core principles.

- Who are we doing it for? The response explains who your primary market is.

- What are our guiding principles? The “why” for your real estate company’s existence.

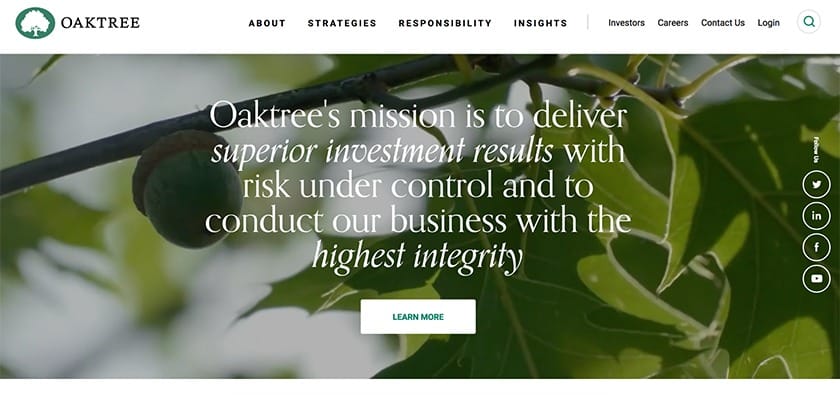

Mission statement example (Source: Oak Tree Capital )

The example above provides the mission statement of Oak Tree Capital. As a real estate investment business, it’s clear what its ultimate business objective is and how it will approach investing with integrity to maximize profit. Essentially, the investment company will drive monetary results—while maintaining its moral principles.

On the other hand, vision statements differ slightly from mission statements. They’re a bit more inspirational and provide some direction for future planning and execution of business investment strategies. Vision statements touch on a company’s desires and purpose beyond day-to-day operational activity. A vision statement outlines what the business desires to be once its mission statement is achieved.

For more mission statement examples, read our 16 Small Business Mission Statement Examples & Why They Inspire article and download our free mission statement template to get started.

If you want to write a vision statement that is truly aspirational and motivating, you should include your significant stakeholders as well as words that describe your products, services, values, initiatives, and goals. It would be best if you also answer the following questions:

- What is the primary goal of your organization?

- What are the key strengths of your business?

- What are the core values of your company?

- How do you aim to change the world as a business?

- What kind of global influence do you want your business to have?

- What needs and wants does your company have?

- How would the world be different if our organization achieved its goals?

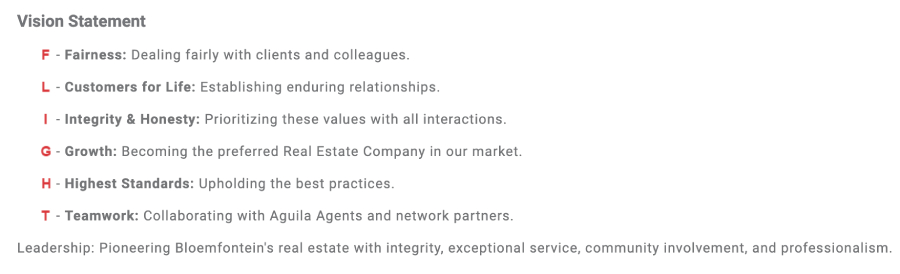

In the example below from Aguila Real Estate, it hopes to be the preferred real estate company in its market.

Example of a vision statement (Source: Aguila Real Estate )

To make it easier, download our free template and follow our steps to create a vision statement for your small business. Take a look also at our 12 Inspiring Vision Statement Examples for Small Businesses in 2023 article to better understand how to create an impactful vision statement.

2. Conduct a SWOT Analysis

A SWOT analysis section of your real estate investing business plan template helps identify a business’ strengths, weaknesses, opportunities, and threats. This tool enables real estate investors to identify internal areas of improvement within their business through their strengths and weaknesses.

The opportunities and threats can assist with motivating a team to take actions that keep them ahead of an ever-changing real estate landscape. For a real estate business investor, the SWOT analysis is aimed at helping grow and protect investments over time.

Strengths & Weaknesses

Specifically for real estate investing, strengths and weaknesses correlate with the investment properties’ success and touch on items that will drive investment growth. The strengths can be the property’s location, condition, available amenities, and decreased vacancy. All of these items contribute to the success of a property.

On the contrary, the weaknesses include small unit sizes, excessive expenditures (finances to repair, upgrade, properties to acquire), low rents, and low cap rates. These weaknesses indicate less money is being collected and a lower overall return on investment (ROI). They are all factors that limit cash flow into the business and are internal factors that an investor can change.

See below for an example of strengths and weaknesses that could be included in a SWOT analysis:

| WEAKNESSES | STRENGTHS |

|---|---|

| Already owns a portfolio of land and residential properties | Rent prices and cap rates are low |

| Familiarity with the geographical area | The average unit size is small |

| Has resources and capabilities that will contribute to the success | High rental vacancy rate in the area |

Opportunities & Threats

Opportunities and threats are external factors that can affect an investment business. You don’t have control over these items, but you can maneuver your business to take advantage of the opportunities or mitigate any long-term effects of external threats. Opportunities relating to investment properties can be receiving certification with a city as a preferred development or having excess equity.

However, threats to an investment property do not need to be particularly connected to the property itself. They can be factors that affect your overall business. For example, interest rates may be high, which cuts your profits if you obtain a mortgage during that time frame.

An example of possible opportunities and threats for an investment business could be:

| OPPORTUNITIES | THREATS |

|---|---|

| Future infrastructural development in the area | High interest rates |

| Receiving certification with a city as a preferred development | Poor school district |

| Building transportation (train station) in the area | High taxes |

After creating your SWOT analysis, an investor can use these factors to develop business goals to support your strengths and opportunities while implementing change to combat the weaknesses and threats you anticipate. It also helps investors prioritize what items need to be addressed to succeed. These factors in a SWOT can change as the business grows, so don’t forget to revisit this portion and continuously reevaluate your SWOT.

3. Choose a Real Estate Business Investing Model

The core of real estate investing is to purchase and sell properties for a profit. How to make that profit is a factor in identifying your investment model. Different investing models are beneficial to an investor at different times.

For example, when interest rates are low, you may consider selling your property altogether. When interest rates are high and it is more difficult for people to obtain a mortgage, you may choose to rent out your properties instead. Sometimes, you must try a few models to see what works best for your business, given your area of expertise.

We’ve identified some investment business models to consider:

- Buy and hold: This strategy mainly involves renting out the property and earning regular rental income. This is also considered the BRRRR method : buy, rehab, rent, refinance, and repeat until you have increased your portfolio.

- Flipping properties : Flipping a property entails purchasing, adding value, and selling it higher than the investment costs. Many investors have a set profitability number they would like to hit but should consider market fluctuations on what they can realistically receive during the sale. Read our article on how to find houses to flip for more information.

- Owner-occupied: Investors can live in the property while renting out extra units to reduce their housing costs and have rental income coming in simultaneously. This model is best if you own multifamily units, especially duplexes, triplexes, or fourplexes . It’s also a great way to understand the complexities of being a landlord. You can transition your unit to another renter when you want to move.

- Turnkey: Buying a turnkey property is the best option for investors who wish to enter the real estate market without having to deal with renovations or tenant management. It’s a practical way for seasoned investors to diversify their portfolios with fewer time commitments.

Investors don’t have to stick to one model, and they can have a few of these investment models within their portfolio, depending on how much effort they would like to put into each property. Before choosing an investment model, consider which will help you meet your investing goals most efficiently.

Read our Investing in Real Estate: The 14-Tip Guide for Beginners article to learn how real estate investment works and other investing business models. Also, if you’re new to real estate investing and are looking for foundational knowledge to get started or seeking information about the best online courses for real estate investing, look at our The 13 Best Real Estate Investing Courses Online 2023 article.

4. Set Specific & Measurable Goals

The next step to completing a real estate investment business plan for real estate investing is to set SMART goals. SMART is an acronym that stands for specific, measurable, achievable, relevant, and time-bound. Creating goals that contain all of the criteria of SMART goals results in extremely specific goals, provides focus, and sets an investor up for achieving the goals. The process of creating these goals takes some experience and continued practice.

An investor’s goals can consist of small short-term goals and more monumental long-term goals. Whether big or small, ideal goals will propel your business forward. For example, your end goal could be having a specific number of properties in your portfolio or setting a particular return on investment (ROI) you want to achieve annually.

Remember that your SMART goals don’t always have to be property-related just because you’re an investor. They can be goals that help you improve your networking or public speaking skills that can also add to a growing business.

Example of improving goals with SMART in mind:

Begin creating SMART goals with an initial goal. Then, take that initial goal and break it down into the different SMART components. SMART goals leave no room for error or confusion. The specific, measurable, and time-bound criteria identify the exact components for success.

However, the relevant and achievable parts of the goal require a little extra work to identify. The relevancy should align with your company’s mission, and extra research must be performed to ensure the goal is attainable.

Initial goal: Receive a 5% return on investment from the property

Smart goal:

- Specific: I want to achieve a 5% return on the 99 Park Place property.

- Measurable: The goal is to sell it for greater than or equal to $499,000.

- Achievable: The current market value for a two-bedroom in Chicago is selling for $500,000 and growing by 1% yearly.

- Relevant: I aim to meet my overall portfolio returns by 20% annually.

- Time-bound: I want to offload this property in the next three years.

5. Write a Company Summary

The company summary section of a business plan for investors is a high-level overview, giving insight into your business, its services, goals, and mission, and how you differentiate yourself from your competition. Other items that can be included in this overview are business legal structure, business location, and business goals. The company summary is beneficial if you want to involve outside investors or partners in your business.

Example company profile from Choueri Real Estate

A company summary is customizable to your target audience. If you’re using this section to recruit high-level executives to your team, center it around business operations and corporate culture. However, if you’re looking to target funding and develop investor relationships for a new project, then you should include investor-specific topics relating to profitability, investment strategy, and company business structure.

Partners and outside investors will want to consider your company’s specific legal business structure to know what types of liabilities are at hand. Legal business structure determines how taxes are charged and paid and what legal entity owns the assets. This information helps determine how the liabilities are separated from personal assets. For example, if a tenant wants to seek legal damages against the landlord and the property is owned by an LLC, personal assets like your personal home will not be at risk.

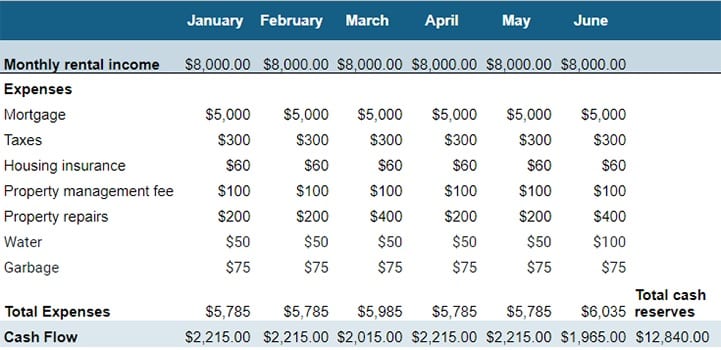

6. Determine Your Financial Plan

The most essential part of creating a real estate investing business is the financial aspect since much of the business involves purchasing, managing, and selling real estate. To buy real estate initially, you’ll have to determine where funding will come from. Funding can come from your personal assets, a line of credit, or external investors.

A few options are available to real estate investors when obtaining a loan to purchase properties. The lending options available to most real estate investors include the following:

- Mortgage: This is one of the most common means of obtaining financing. A financial institution will provide money based on a borrower’s credit score and ability to repay the loan.

- Federal Housing Authority (FHA) loans : This loan is secured by the FHA to assist with getting you a low down payment or lower closing costs, and sometimes easily obtain credit. There are some restrictions to qualify for this loan—but it could be suitable for newer investors who want to begin investing starting with their primary home.