- Accounting Cycle

Home › Accounting › Accounting Cycle › Accounting Cycle

- What is the Accounting Cycle?

Accounting Cycle Steps

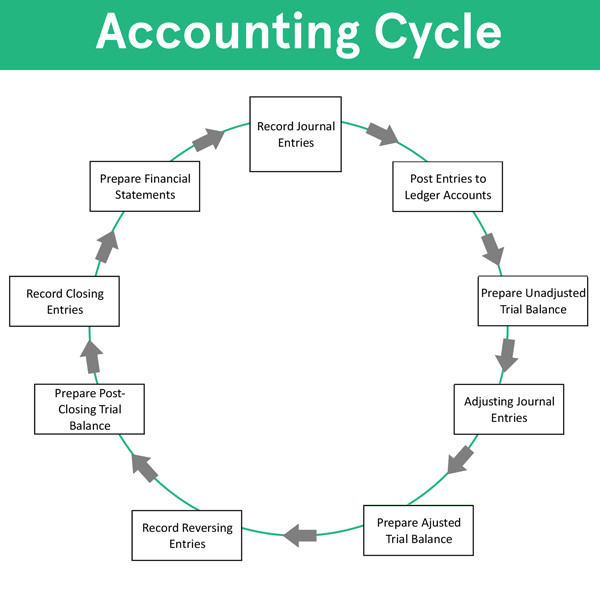

Accounting cycle flow chart.

The accounting cycle is a series of steps starting with recording business transactions and leading up to the preparation of financial statements . This financial process demonstrates the purpose of financial accounting –to create useful financial information in the form of general-purpose financial statements . In other words, the sole purpose of recording transactions and keeping track of expenses and revenues is turn this data into meaning financial information by presenting it in the form of a balance sheet, income statement, statement of owner’s equity, and statement of cash flows.

The accounting cycle is a set of steps that are repeated in the same order every period. The culmination of these steps is the preparation of financial statements. Some companies prepare financial statements on a quarterly basis whereas other companies prepare them annually. This means that quarterly companies complete one entire accounting cycle every three months while annual companies only complete one accounting cycle per year.

This cycle starts with a business event. Bookkeepers analyze the transaction and record it in the general journal with a journal entry. The debits and credits from the journal are then posted to the general ledger where an unadjusted trial balance can be prepared.

After accountants and management analyze the balances on the unadjusted trial balance, they can then make end of period adjustments like depreciation expense and expense accruals. These adjusted journal entries are posted to the trial balance turning it into an adjusted trial balance.

Now that all the end of the year adjustments are made and the adjusted trial balance matches the subsidiary accounts, financial statements can be prepared. After financial statements are published and released to the public, the company can close its books for the period. Closing entries are made and posted to the post closing trial balance.

At the start of the next accounting period, occasionally reversing journal entries are made to cancel out the accrual entries made in the previous period. After the reversing entries are posted, the accounting cycle starts all over again with the occurrence of a new business transaction.

Here are the 9 main steps in the traditional accounting cycle.

- — Identify business events, analyze these transactions, and record them as journal entries

- — Post journal entries to applicable T-accounts or ledger accounts

- — Prepare an unadjusted trial balance from the general ledger

- — Analyze the trial balance and make end of period adjusting entries

- — Post adjusting journal entries and prepare the adjusted trial balance

- — Use the adjusted trial balance to prepare financial statements

- — Close all temporary income statement accounts with closing entries

- — Prepare the post closing trial balance for the next accounting period

- — Prepare reversing entries to cancel temporary adjusting entries if applicable

Some textbooks list more steps than this, but I like to simplify them and combine as many steps as possible.

After this cycle is complete, it starts over at the beginning. Here is an accounting cycle flow chart.

As you can see, the cycle keeps revolving every period. Note that some steps are repeated more than once during a period. Obviously, business transactions occur and numerous journal entries are recording during one period. Only one set of financial statements is prepared however.

Throughout this section, we’ll be looking at the business events and transactions that happen to Paul’s Guitar Shop, Inc. over the course of its first year in business.

Let’s take a look at how Paul starts his accounting cycle below.

- Journal Entries

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Financial Statements

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post Closing Trial Balance

- Reversing Entries

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Financial Statement Prep

- Financial Ratios

5.4 Appendix: Complete a Comprehensive Accounting Cycle for a Business

We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here. The full accounting cycle diagram is presented in Figure 5.14 .

We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. Cliff decides it would be fun to become a barber and open his own shop called “Clip’em Cliff.” He will run the barber shop out of his home for the first couple of months while he identifies a new location for his shop.

Since his Marines career included several years of logistics, he is also going to operate a consulting practice where he will help budding barbers create a barbering practice. He will charge a flat fee or a per hour charge. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice.

He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 5.2 shows his transactions from the first month of business.

Transaction 1: On August 1, 2019, Cliff issues $70,000 shares of common stock for cash.

- Clip’em Cliff now has more cash. Cash is an asset, which is increasing on the debit side.

- When the company issues stock, this yields a higher common stock figure than before issuance. The common stock account is increasing on the credit side.

Transaction 2: On August 3, 2019, Cliff purchases barbering equipment for $45,000; $37,500 was paid immediately with cash, and the remaining $7,500 was billed to Cliff with payment due in 30 days.

- Clip’em Cliff now has more equipment than before. Equipment is an asset, which is increasing on the debit side for $45,000.

- Cash is used to pay for $37,500. Cash is an asset, decreasing on the credit side.

- Cliff asked to be billed, which means he did not pay cash immediately for $7,500 of the equipment. Accounts Payable is used to signal this short-term liability. Accounts payable is increasing on the credit side.

Transaction 3: On August 6, 2019, Cliff purchases supplies for $300 cash.

- Clip’em Cliff now has less cash. Cash is an asset, which is decreasing on the credit side.

- Supplies, an asset account, is increasing on the debit side.

Transaction 4: On August 10, 2019, provides $4,000 in services to a customer who asks to be billed for the services.

- Clip’em Cliff provided service, thus earning revenue. Revenue impacts equity, and increases on the credit side.

- The customer did not pay immediately for the service and owes Cliff payment. This is an Accounts Receivable for Cliff. Accounts Receivable is an asset that is increasing on the debit side.

Transaction 5: On August 13, 2019, Cliff pays a $75 utility bill with cash.

- Clip’em Cliff now has less cash than before. Cash is an asset that is decreasing on the credit side.

- Utility payments are billed expenses. Utility Expense negatively impacts equity, and increases on the debit side.

Transaction 6: On August 14, 2019, Cliff receives $3,200 cash in advance from a customer for services to be rendered.

- The customer has not yet received services but already paid the company. This means the company owes the customer the service. This creates a liability to the customer, and revenue cannot yet be recognized. Unearned Revenue is the liability account, which is increasing on the credit side.

Transaction 7: On August 16, 2019, Cliff distributed $150 cash in dividends to stockholders.

- When the company pays out dividends, this decreases equity and increases the dividends account. Dividends increases on the debit side.

Transaction 8: On August 17, 2019, Cliff receives $5,200 cash from a customer for services rendered.

- Clip’em Cliff now has more cash than before. Cash is an asset, which is increasing on the debit side.

- Service was provided, which means revenue can be recognized. Service Revenue increases equity. Service Revenue is increasing on the credit side.

Transaction 9: On August 19, 2019, Cliff paid $2,000 toward the outstanding liability from the August 3 transaction.

- Accounts Payable is a liability account, decreasing on the debit side.

Transaction 10: On August 22, 2019, Cliff paid $4,600 cash in salaries expense to employees.

- When the company pays salaries, this is an expense to the business. Salaries Expense reduces equity by increasing on the debit side.

Transaction 11: On August 28, 2019, the customer from the August 10 transaction pays $1,500 cash toward Cliff’s account.

- The customer made a partial payment on their outstanding account. This reduces Accounts Receivable. Accounts Receivable is an asset account decreasing on the credit side.

- Cash is an asset, increasing on the debit side.

The complete journal for August is presented in Figure 5.15 .

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. The ledger is visually represented by T-accounts. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account.

Clip’em Cliff’s ledger represented by T-accounts is presented in Figure 5.16 .

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure 5.17 .

Once all of the account balances are transferred to the correct columns, each column is totaled. The total in the debit column must match the total in the credit column to remain balanced. The unadjusted trial balance for Clip’em Cliff appears in Figure 5.18 .

The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made.

On August 31, Cliff has the transactions shown in Table 5.3 requiring adjustment.

Adjusting Transaction 1: Cliff took an inventory of supplies and discovered that $250 of supplies remain unused at the end of the month.

- $250 of supplies remain at the end of August. The company began the month with $300 worth of supplies. Therefore, $50 of supplies were used during the month and must be recorded (300 – 250). Supplies is an asset that is decreasing (credit).

- Supplies is a type of prepaid expense, that when used, becomes an expense. Supplies Expense would increase (debit) for the $50 of supplies used during August.

Adjusting Transaction 2: The equipment purchased on August 3 depreciated $2,500 during the month of August.

- Equipment cost of $2,500 was allocated during August. This depreciation will affect the Accumulated Depreciation–Equipment account and the Depreciation Expense–Equipment account. While we are not doing depreciation calculations here, you will come across more complex calculations, such as depreciation in Long-Term Assets .

- Accumulated Depreciation–Equipment is a contra asset account (contrary to Equipment) and increases (credit) for $2,500.

- Depreciation Expense–Equipment is an expense account that is increasing (debit) for $2,500.

Adjusting Transaction 3: Clip’em Cliff performed $1,100 of services during August for the customer from the August 14 transaction.

- The customer from the August 14 transaction gave the company $3,200 in advanced payment for services. By the end of August the company had earned $1,100 of the advanced payment. This means that the company still has yet to provide $2,100 in services to that customer.

- Since some of the unearned revenue is now earned, Unearned Revenue would decrease. Unearned Revenue is a liability account and decreases on the debit side.

- The company can now recognize the $1,100 as earned revenue. Service Revenue increases (credit) for $1,100.

Adjusting Transaction 4: Reviewing the company bank statement, Clip’em Cliff identifies $350 of interest earned during the month of August that was previously unrecorded.

- Interest is revenue for the company on money kept in a money market account at the bank. The company only sees the bank statement at the end of the month and needs to record as received interest revenue reflected on the bank statement.

- Interest Revenue is a revenue account that increases (credit) for $350.

- Since Clip’em Cliff has yet to collect this interest revenue, it is considered a receivable. Interest Receivable increases (debit) for $350.

Adjusting Transaction 5: Unpaid and previously unrecorded income taxes for the month are $3,400.

- Income taxes are an expense to the business that accumulate during the period but are only paid at predetermined times throughout the year. This period did not require payment but did accumulate income tax.

- Income Tax Expense is an expense account that negatively affects equity. Income Tax Expense increases on the debit side.

- The company owes the tax money but has not yet paid, signaling a liability. Income Tax Payable is a liability that is increasing on the credit side.

The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 5.19 .

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in Figure 5.20 .

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 5.21 .

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance.

The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 5.22 .

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows .

To prepare your financial statements, you want to work with your adjusted trial balance.

Remember, revenues and expenses go on an income statement. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

The income statement for Clip’em Cliff is shown in Figure 5.23 .

Note that expenses were only $25 less than revenues. For the first month of operations, Cliff welcomes any income. Cliff will want to increase income in the next period to show growth for investors and lenders.

Next, Cliff prepares the following statement of retained earnings ( Figure 5.24 ).

The beginning retained earnings balance is zero because Cliff just began operations and does not have a balance to carry over to a future period. The ending retained earnings balance is –$125. You probably never want to have a negative value on your retained earnings statement, but this situation is not totally unusual for an organization in its initial operations. Cliff will want to improve this outcome going forward. It might make sense for Cliff to not pay dividends until he increases his net income.

Cliff then prepares the balance sheet for Clip’em Cliff as shown in Figure 5.25 .

The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. The first entry closes revenue accounts to income summary. To close revenues, Cliff will debit revenue accounts and credit income summary.

The second entry closes expense accounts to income summary. To close expenses, Cliff will credit expense accounts and debit income summary.

The third entry closes income summary to retained earnings. To find the balance, take the difference between the income summary amount in the first and second entries (10,650 – 10,625). To close income summary, Cliff would debit Income Summary and credit Retained Earnings.

The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings.

Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 5.26 .

Now that the temporary accounts are closed, they are ready for accumulation in the next period.

The last step for the month of August is step 9, preparing the post-closing trial balance. The post-closing trial balance should only contain permanent account information. No temporary accounts should appear on this trial balance. Clip’em Cliff’s post-closing trial balance is presented in Figure 5.27 .

At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods.

Concepts In Practice

Reversing entries.

One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice. The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal.

Link to Learning

As we have learned, the current ratio shows how well a company can cover short-term debt with short-term assets. Look through the balance sheet in the 2017 Annual Report for Target and calculate the current ratio. What does the outcome mean for Target ?

Think It Through

Using liquidity ratios to evaluate financial performance.

You own a landscaping business that has just begun operations. You made several expensive equipment purchases in your first month to get your business started. These purchases very much reduced your cash-on-hand, and in turn your liquidity suffered in the following months with a low working capital and current ratio.

Your business is now in its eighth month of operation, and while you are starting to see a growth in sales, you are not seeing a significant change in your working capital or current ratio from the low numbers in your early months. What could you attribute to this stagnancy in liquidity? Is there anything you can do as a business owner to better these liquidity measurements? What will happen if you cannot change your liquidity or it gets worse?

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/5-4-appendix-complete-a-comprehensive-accounting-cycle-for-a-business

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Search Search Please fill out this field.

- Corporate Finance

The 8 Important Steps in the Accounting Cycle

:max_bytes(150000):strip_icc():format(webp)/picture-53886-1440626964-5bfc2a89c9e77c005876da24.jpg)

The eight-step accounting cycle is important to know for all types of bookkeepers. It breaks down the entire process of a bookkeeper’s responsibilities into eight basic steps. Many of these steps are often automated through accounting software and technology programs. However, knowing and using the steps manually can be essential for small business accountants working on the books with minimal technical support.

Key Takeaways

- The accounting cycle is a process designed to make the financial accounting of business activities easier for business owners.

- There are usually eight steps to follow in an accounting cycle.

- The closing of the accounting cycle provides business owners with comprehensive financial performance reporting that is used to analyze the business.

- The eight steps of the accounting cycle are as follows: identifying transactions, recording transactions in a journal, posting, the unadjusted trial balance, the worksheet, adjusting journal entries, financial statements, and closing the books.

- Although almost all accounting is done electronically, it still must be thoroughly checked.

What Is the Accounting Cycle?

The accounting cycle is a basic, eight-step process for completing a company’s bookkeeping tasks. It provides a clear guide for the recording, analysis, and final reporting of a business’s financial activities.

The accounting cycle is used comprehensively through one full reporting period. Thus, staying organized throughout the process’s time frame can be a key element that helps to maintain overall efficiency. Accounting cycle periods will vary by reporting needs. Most companies seek to analyze their performance on a monthly basis, though some may focus more heavily on quarterly or annual results.

Regardless, most bookkeepers will have an awareness of the company’s financial position from day to day. Overall, determining the amount of time for each accounting cycle is important because it sets specific dates for opening and closing. Once an accounting cycle closes, a new cycle begins, restarting the eight-step accounting process all over again.

Understanding the 8-Step Accounting Cycle

The eight-step accounting cycle starts with recording every company transaction individually and ends with a comprehensive report of the company’s activities for the designated cycle timeframe. Many companies use accounting software to automate the accounting cycle. This allows accountants to program cycle dates and receive automated reports.

Depending on each company’s system, more or less technical automation may be utilized. Typically, bookkeeping will involve some technical support, but a bookkeeper may be required to intervene in the accounting cycle at various points.

Every individual company will usually need to modify the eight-step accounting cycle in certain ways in order to fit with their company’s business model and accounting procedures. Modifications for accrual accounting versus cash accounting are usually one major concern.

Companies may also choose between single-entry accounting versus double-entry accounting. Double-entry accounting is required for companies to build out all three major financial statements : the income statement, balance sheet, and cash flow statement.

The 8 Steps of the Accounting Cycle

The eight steps of the accounting cycle include the following:

Step 1: Identify Transactions

The first step in the accounting cycle is identifying transactions. Companies will have many transactions throughout the accounting cycle. Each one needs to be properly recorded on the company’s books.

Recordkeeping is essential for recording all types of transactions. Many companies will use point of sale technology linked with their books to record sales transactions. Beyond sales, there are also expenses that can come in many varieties.

Step 2: Record Transactions in a Journal

The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but companies must also track their expenses. The choice between accrual and cash accounting will dictate when transactions are officially recorded. Keep in mind that accrual accounting requires the matching of revenues with expenses so both must be booked at the time of sale.

Cash accounting requires transactions to be recorded when cash is either received or paid. Double-entry bookkeeping calls for recording two entries with each transaction in order to manage a thoroughly developed balance sheet along with an income statement and cash flow statement.

Generally accepted accounting principles (GAAP) require public companies to utilize accrual accounting for their financial statements, with rare exceptions.

With double-entry accounting, each transaction has a debit and a credit equal to each other, common in business-to-business transactions . Single-entry accounting is comparable to managing a checkbook. It gives a report of balances but does not require multiple entries.

Step 3: Posting

Once a transaction is recorded as a journal entry, it should post to an account in the general ledger . The general ledger provides a breakdown of all accounting activities by account. This allows a bookkeeper to monitor financial positions and statuses by account. One of the most commonly referenced accounts in the general ledger is the cash account which details how much cash is available.

The ledger used to be the gold standard for recording transactions but now that almost all accounting is done electronically, the ledger is less of an active concern as all transactions are automatically logged.

Step 4: Unadjusted Trial Balance

At the end of the accounting period, a trial balance is calculated as the fourth step in the accounting cycle. A trial balance tells the company its unadjusted balances in each account. The unadjusted trial balance is then carried forward to the fifth step for testing and analysis.

This is the first step that takes place once the accounting period has ended and all transactions have been identified, recorded, and posted to the ledger (this is usually done electronically and automatically, but not always).

The purpose of this step is to ensure that the total credit balance and total debit balance are equal. This stage can catch a lot of mistakes if those numbers do not match up.

Step 5: Worksheet

Analyzing a worksheet and identifying adjusting entries make up the fifth step in the cycle. A worksheet is created and used to ensure that debits and credits are equal. If there are discrepancies then adjustments will need to be made.

In addition to identifying any errors, adjusting entries may be needed for revenue and expense matching when using accrual accounting.

Step 6: Adjusting Journal Entries

In the sixth step, a bookkeeper makes adjustments. Adjustments are recorded as journal entries where necessary.

Step 7: Financial Statements

After the company makes all adjusting entries, it then generates its financial statements in the seventh step. For most companies, these statements will include an income statement , balance sheet, and cash flow statement .

Step 8: Closing the Books

Finally, a company ends the accounting cycle in the eighth step by closing its books at the end of the day on the specified closing date. The closing statements provide a report for analysis of performance over the period.

After closing, the accounting cycle starts over again from the beginning with a new reporting period. Closing is usually a good time to file paperwork, plan for the next reporting period, and review a calendar of future events and tasks.

What Is the Difference Between the Accounting Cycle and the Budget Cycle?

The main difference between the accounting cycle and the budget cycle is the accounting cycle compiles and evaluates transactions after they have occurred. The budget cycle is an estimation of revenue and expenses over a specified period of time in the future and has not yet occurred. A budget cycle can use past accounting statements to help forecast revenues and expenses.

What Are the Steps of the Accounting Cycle in Order?

The steps in the accounting cycle are identifying transactions, recording transactions in a journal, posting the transactions, preparing the unadjusted trial balance, analyzing the worksheet, adjusting journal entry discrepancies, preparing a financial statement, and closing the books.

What Is the Main Purpose of the Accounting Cycle?

The main purpose of the accounting cycle is to ensure the accuracy and conformity of financial statements. Although most accounting is done electronically, it is still important to ensure everything is correct since errors can compound over time.

What Are Some of the Advantages and Disadvantages of Accounting?

Some advantages of accounting are that it provides help in taxation, decision making, business valuation, and provides information to important parties like investors and law enforcement. Some disadvantages are that the information may be biased, can be estimated to a degree, can be manipulated, and that the units used to measure business performance, namely cash, change in value.

The Bottom Line

The eight-step accounting cycle process makes accounting easier for bookkeepers and busy entrepreneurs. It can help to take the guesswork out of how to handle accounting activities. It also helps to ensure consistency, accuracy, and efficient financial performance analysis.

EY. " US GAAP Versus IFRS ," Page 2.

:max_bytes(150000):strip_icc():format(webp)/investing15-5bfc2b8fc9e77c00519aa65b.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

5: Completing the Accounting Cycle

- Last updated

- Save as PDF

- Page ID 2776

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

- 5.0: Prelude to Completing the Accounting Cycle

- 5.1: Describe and Prepare Closing Entries for a Business

- 5.2: Prepare a Post-Closing Trial Balance

- 5.3: Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity

- 5.4: Appendix- Complete a Comprehensive Accounting Cycle for a Business

- 5.5: Summary

- 5.6: Practice Questions

Course Resources

Assignments.

The assignments in this course are openly licensed, and are available as-is, or can be modified to suit your students’ needs. Answer keys are available to faculty who adopt Lumen Learning courses with paid support. This approach helps us protect the academic integrity of these materials by ensuring they are shared only with authorized and institution-affiliated faculty and staff.

If you import this course into your learning management system (Blackboard, Canvas, etc.), the assignments will automatically be loaded into the assignment tool.

You can view them below or throughout the course.

- Module 0: Personal Accounting— Assignment: Creating a Budget

- Module 1: The Role of Accounting in Business— Assignment: Lopez Consulting

- Module 2: Accounting Principles— Assignment: Accounting Principles

- Module 3: Recording Business Transactions— Assignment: Recording Business Transactions

- Module 4: Completing the Accounting Cycle— Assignment: Completing the Accounting Cycle

- Module 5: Accounting for Cash— Assignment: Accounting for Cash

- Module 6: Receivables and Revenue— Assignment: Manilow Aging Analysis

- Module 7: Merchandising Operations— Assignment: Merchandising Operations

- Module 8: Inventory Valuation Methods— Assignment: Inventory Valuation Methods

- Module 9: Property, Plant, and Equipment— Assignment: Property, Plant, and Equipment

- Module 10: Other Assets— Assignment: Other Current and Noncurrent Assets

- Module 11: Current Liabilities— Assignment: Calculating Payroll at Kipley Co

- Module 12: Non-Current Liabilities— Assignment: Non-Current Liabilities

- Module 13: Accounting for Corporations— Assignment: Collins Mfg Stockholders’ Equity

- Module 14: Statement of Cash Flows— Assignment: Kachina Sports Company Cash Flows

- Module 15: Financial Statement Analysis— Assignment: Coca Cola FSA

Discussions

The following discussion assignments will also be preloaded (into the discussion-board tool) in your learning management system if you import the course. They can be used as is, modified, or removed. You can view them below or throughout the course.

- Module 0: Personal Accounting— Discussion: Winning the Lottery

- Module 1: The Role of Accounting in Business— Discussion: The Crafty Coffee Crook

- Module 2: Accounting Principles— Discussion: SoftSheets

- Module 3: Recording Business Transactions— Discussion: Baker’s Breakfast Bars

- Module 4: Completing the Accounting Cycle— Discussion: Closing the Books in QuickBooks

- Module 5: Accounting for Cash— Discussion: Counter Culture Cafe

- Module 6: Receivables and Revenue— Discussion: Maximizing Revenue

- Module 7: Merchandising Operations— Discussion: Inventory Controls

- Module 8: Inventory Valuation Methods— Discussion: LIFO, FIFO, Specific Identification, and Weighted Average

- Module 9: Property, Plant, and Equipment— Discussion: Cooking the Books

- Module 10: Other Assets— Discussion: Other Assets

- Module 11: Current Liabilities— Discussion: Current Liabilities

- Module 12: Non-Current Liabilities— Discussion: Off-Balance Sheet Financing

- Module 13: Accounting for Corporations— Discussion: Home Depot

- Module 14: Statement of Cash Flows— Discussion: Facebook, Inc.

- Module 15: Financial Statement Analysis— Discussion: Financial Statement Analysis

Alternative Excel-Based Assignments

For Modules 3–15, additional excel-based assignments are available below.

Module 3: Recording Business Transactions

- Module 3 Excel Assignment A

- Module 3 Excel Assignment B

Module 4: The Accounting Cycle

- Module 4 Excel Assignment A

- Module 4 Excel Assignment B

- Module 4 Excel Assignment C

- Module 4 Excel Assignment D

Module 5: Accounting for Cash

- Module 5 Excel Assignment

Module 6: Receivables and Revenue

- Module 6 Excel Assignment A

- Module 6 Excel Assignment B

Module 7: Merchandising Operations

- Module 7 Excel Assignment

Module 8: Inventory Valuation Methods

- Module 8 Excel Assignment A

- Module 8 Excel Assignment B

- Module 8 Excel Assignment C

Module 9: Property, Plant, and Equipment

- Module 9 Excel Assignment A

- Module 9 Excel Assignment B

Module 10: Other Assets

- Module 10 Excel Assignment

Module 11: Current Liabilities

- Module 11 Excel Assignment

Module 12: Non-Current Liabilities

- Module 12 Excel Assignment A

- Module 12 Excel Assignment B

Module 13: Accounting for Corporations

- Module 13 Excel Assignment A

- Module 13 Excel Assignment B

- Module 13 Excel Assignment C

Module 14: Statement of Cash Flows

- Module 14 Excel Assignment A

- Module 14 Excel Assignment B

Module 15: Financial Statement Analysis

- Module 15 Excel Assignment

Review Problems

There are also three unit review assignments and a final review. These reviews include a document which sets up the problems and an excel worksheet.

Unit 1 Review Problem (After Module 6)

- Review Problem Document

Unit 2 Review Problem (After Module 8)

Unit 3 review problem (after module 9), final review (after module 15).

- Assignments. Authored by : Cindy Moore and Joe Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

Getting an Overview of the Core Terms in Margin Analysis

After completing this lesson, you will be able to:

- Get an Overview of the Core Terms in Margin Analysis

Overview of the Core Terms in Margin Analysis

https://learning.sap.com/learning-journeys/outline-cost-management-and-profitability-analysis-in-sap-s-4hana/outlining-profitability-analysis_b5b7efbb-55ea-4ff5-bc70-15d39d8a14eb

Introduction to Margin Analysis

The following video provides an overview of Margin Analysis.

Master Data

Master data in margin analysis include profitability characteristics and functional areas. Functional areas break down corporate expenditure into different functions, in line with the requirements of cost of sales accounting.

These functions can include:

- Production.

- Administration.

- Sales and Distribution.

- Research and Development.

For primary postings, the functional area is derived according to fixed rules and included in the journal entries. For secondary postings, the functional area and partner functional area are derived from the sender and receiver account assignments to reflect the flow of costs from sender to receiver.

Profitability Characteristics

Profitability characteristics represent the criteria used to analyze operating results and the sales and profit plan. Multiple profitability characteristics are combined to form profitability segments. The combination of characteristic values determines the profitability segment for which the gross margin structure can be displayed. A profitability segment corresponds to a market segment.

For example, the combination of the characteristic values North (Sales region), Electronics (Product group) and Wholesale (Customer group) determine a profitability segment for which the gross margin structure can be displayed.

True vs Attributed Account Assignments

Each activity relevant to Margin Analysis in the SAP system, such as billing, creates line items. G/L line items can carry true or attributed account assignments to profitability segments.

- Goods issue item or billing document item in a sell-from-stock scenario.

- Manual FI posting to profitability segment.

- Primary Costs or Revenue.

- Secondary Costs.

- Balance Sheet Accounts with a statistical cost element assigned.

The derivation of attributed profitability segments is based on the true account assignment object of the G/L line item. This object can be of the following types:

- Cost Center.

- Sales Order.

- Production Order (only for Engineer-to-Order process.)

- Maintenance Order.

- Service Document (service order or service contract.)

After the profitability characteristics are derived, the resulting data is mapped to the G/L line item according to specific mapping rules. An attributed profitability segment is derived to fulfill the requirement of filling as many characteristics in the item as possible to enable the maximum drilldown analysis capability.

Log in to track your progress & complete quizzes

Members save 10% or more on over 100,000 hotels worldwide when you’re signed in

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

Dzerzhinsky in Moscow Oblast Destination Guide Russia

- You are here:

Dzerzhinsky in Moscow Oblast, Russia

Safety Score: 4,4 of 5.0 based on data from 9 authorites. Meaning please reconsider your need to travel to Russia.

Travel warnings are updated daily. Source: Travel Warning Russia . Last Update: 2024-05-20 08:01:38

Explore Dzerzhinsky

Dzerzhinsky in Moscow Oblast is located in Russia about 13 mi (or 21 km) south-east of Moscow, the country's capital.

Local time in Dzerzhinsky is now 02:43 AM (Tuesday). The local timezone is named Europe / Moscow with an UTC offset of 3 hours. We know of 7 airports in the wider vicinity of Dzerzhinsky, of which two are larger airports. The closest airport in Russia is Bykovo Airport in a distance of 8 mi (or 13 km), East. Besides the airports, there are other travel options available (check left side).

There are several Unesco world heritage sites nearby. The closest heritage site in Russia is Church of the Ascension, Kolomenskoye in a distance of 7 mi (or 12 km), West. If you need a place to sleep, we compiled a list of available hotels close to the map centre further down the page.

Depending on your travel schedule, you might want to pay a visit to some of the following locations: Orekhovo-Borisovo Yuzhnoye, Moscow, Cheremushki, Ramenskoye and Vostochnoe Degunino. To further explore this place, just scroll down and browse the available info.

Local weather forecast

Todays local weather conditions & forecast: 21°c / 70 °f.

Tuesday, 21st of May 2024

23°C (73 °F) 15°C (59 °F) Moderate rain, gentle breeze, scattered clouds.

Wednesday, 22nd of May 2024

20°C (67 °F) 11°C (51 °F) Light rain, gentle breeze, broken clouds.

Thursday, 23rd of May 2024

15°C (60 °F) 12°C (53 °F) Broken clouds, gentle breeze.

Hotels and Places to Stay

Master Hotel Kotelniky

Address 2,8 mi Novoryazanskoe sh 5a 140053 Kotelniki Russia

Mini-Hotel Komfort

Address 2,4 mi 2-y Pokrovskiy proezd 12 140055 Kotel'niki Russia

Checkout: 12:00 - Checkin: 12:00 Reception Weekday: 0:00 - 24:00 Weekend: 0:00 - 24:00

Videos from this area

These are videos related to the place based on their proximity to this place.

Attractions and noteworthy things

Distances are based on the centre of the city/town and sightseeing location. This list contains brief abstracts about monuments, holiday activities, national parcs, museums, organisations and more from the area as well as interesting facts about the region itself. Where available, you'll find the corresponding homepage. Otherwise the related wikipedia article.

Ugresha Monastery

Nikolo-Ugreshsky Monastery is a walled stauropegic Russian Orthodox monastery of St. Nicholas the Miracle-Worker located in a suburb of Moscow formerly known as Ugreshi and now called Dzerzhinsky. It is the town's main landmark and is featured on the . The monastery is known to have existed as early as 1521, when the Tatar horde of Mehmed I Giray reduced Ugreshi to ashes. The old katholikon of St. Nicholas (later destroyed by the Soviets) was built in the 16th century.

Located at 55.6217, 37.84 (Lat. / Lng.), about 1 miles away. Wikipedia Article Russian Orthodox monasteries, Buildings and structures in Moscow Oblast, Christian monasteries established in the 14th century, Museums in Moscow Oblast, Religious museums in Russia, Biographical museums in Russia, Decorative arts museums in Russia

These are some bigger and more relevant cities in the wider vivinity of Dzerzhinsky.

Nationwide popular locations

These are the most popular locations in Russia on Tripmondo.

Smaller cities in the vicinity

These are smaller but yet relevant locations related to this place.

THE BEST Butovo Sights & Historical Landmarks

Butovo landmarks.

- Sacred & Religious Sites

- Churches & Cathedrals

- 5.0 of 5 bubbles

- Good for Kids

- Good for Big Groups

- Adventurous

- Budget-friendly

- Good for a Rainy Day

- Hidden Gems

- Good for Couples

- Honeymoon spot

- Good for Adrenaline Seekers

- Things to do ranked using Tripadvisor data including reviews, ratings, photos, and popularity.

1. Butovo Firing Range

2. Old Church of The Holy New Martyrs and Confessors of Russia

IMAGES

VIDEO

COMMENTS

The accounting cycle incorporates all the accounts, journal entries, T accounts, debits, and credits, adjusting entries over a full cycle. Steps in the Accounting Cycle #1 Transactions. Transactions: Financial transactions start the process. If there were no financial transactions, there would be nothing to keep track of.

Here are the 9 main steps in the traditional accounting cycle. — Identify business events, analyze these transactions, and record them as journal entries. — Post journal entries to applicable T-accounts or ledger accounts. — Prepare an unadjusted trial balance from the general ledger. — Analyze the trial balance and make end of period ...

First Four Steps in the Accounting Cycle. The first four steps in the accounting cycle are (1) identify and analyze transactions, (2) record transactions to a journal, (3) post journal information to a ledger, and (4) prepare an unadjusted trial balance. We begin by introducing the steps and their related documentation.

Assignment: Completing the Accounting Cycle. This assignment can be found in Google Docs: Financial Accounting Assignment: Completing the Accounting Cycle. To make your own copy to edit: If you want a Google Doc: in the file menu of the open document, click "Make a copy.". This will give you your own Google Doc to work from. If you want a ...

Accounting Cycle: The accounting cycle is the name given to the collective process of recording and processing the accounting events of a company. The series of steps begin when a transaction ...

Why It Matters; 3.1 Describe Principles, Assumptions, and Concepts of Accounting and Their Relationship to Financial Statements; 3.2 Define and Describe the Expanded Accounting Equation and Its Relationship to Analyzing Transactions; 3.3 Define and Describe the Initial Steps in the Accounting Cycle; 3.4 Analyze Business Transactions Using the Accounting Equation and Show the Impact of Business ...

Welcome to the second module of the course! In this module we take a quick break from the steps of the accounting cycle to introduce a new tool called the worksheet. By the end of this module, you will be able to create a 10 column worksheet on your own while applying your knowledge of adjusting entries from Module 1. What's included.

Step 2: Record Transactions in a Journal . The second step in the cycle is the creation of journal entries for each transaction. Point of sale technology can help to combine steps one and two, but ...

5.0: Prelude to Completing the Accounting Cycle; 5.1: Describe and Prepare Closing Entries for a Business; 5.2: Prepare a Post-Closing Trial Balance; 5.3: Apply the Results from the Adjusted Trial Balance to Compute Current Ratio and Working Capital Balance, and Explain How These Measures Represent Liquidity

Along with the accounting cycle process, you've also gathered data that internal users can rely upon for budget reports, forecasts, and other managerial purposes. These statements and reports are the means for owners and managers involved in a business to see where a company's finances are at any given point in time and make better choices ...

Week 5 - Assignment: Mastering the Accounting Cycle, Part II You've completed all of the work in this assignment. Question 1 of 1 1 / 1 Equipment 900 Unearned Service Revenue $ 20 Notes Payable 2, Owner's Capital 590 Service Revenue 100 Advertising Expense 50 Totals $2,810 $2,

For Modules 3-15, additional excel-based assignments are available below. Module 3: Recording Business Transactions. Module 3 Excel Assignment A. Module 3 Excel Assignment B. Module 4: The Accounting Cycle. Module 4 Excel Assignment A. Module 4 Excel Assignment B. Module 4 Excel Assignment C. Module 4 Excel Assignment D.

Week 5 - Assignment: Mastering the Accounting Cycle, Part II; Acquisition Memo - assignements; ACC 100 Unit 3 Milestone; ACC 100 Unit 4 Milestone; Related documents. ACC 100 Unit 2 Milestone; ACC 100 Unit 3 Challenge 2; ACC 100 Unit 4 Challenge 1; Ethics in Acc; Page 7.1 Week 7 Set Your Priorities; Assignment 1 ACC II Final;

Week 3 Assignment - Mastering the Accounting Cycle, Part I You've completed all of the work in this assignment. Question 1 of 1 1 / 1 (a) start using it only in her new business. She estimates that the equipment is currently worth $ 320. She invests the equipment in the business. 16 Concord realizes that her initial cash investment is not enough.

Question: Week 5 - Assignment: Mastering the Accounting Cycle, Part II1 of 10.4 / 1View PoliciesShow Attempt HistoryCurrent Attempt in ProgressAfter researching the different forms of business organization, Natalie Koebel decides to operate Cookie Creations as a proprietorship. She then starts the process of getting the business running.

Accounting Module 2: Beginning the Accounting Cycle. Property. Click the card to flip 👆. Anything of value that a person or business owns and therefore controls. Click the card to flip 👆. 1 / 11.

Assignment: Completing the Accounting Cycle Smith AC Services Trial Balance Account Title Debit Credit Cash 21,520 Accounts Receivable 9,800 Office Supplies 2,950 Prepaid Insurance 1,900 Prepaid Rent 9,000 Office Equipment 23,000 Accounts Payable 550 John Smith, Capital Contributions 53,000 John Smith, Withdrawals 5,300 Service Fees Earned ...

Functional areas break down corporate expenditure into different functions, in line with the requirements of cost of sales accounting. These functions can include: Production. Administration. Sales and Distribution. Marketing. Research and Development. For primary postings, the functional area is derived according to fixed rules and included in ...

Week 3 Assignment - Mastering the Accounting Cycle, Part I You've completed all of the work in this assignment. Question 1 of 1 1 / 1 (a) 16 Bramble realizes that her initial cash investment is not enough. Her grandmother lends her $1,800 cash, for which Bramble signs a note payable in the name of the business. Bramble deposits the money in ...

Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right.

Discover Dzerzhinsky in Moscow Oblast (Russia). Travel ideas and destination guide for your next trip to Europe. Events, Webcams and more. Lat/Lng: 55.627, 37.858.

Week 7 - Assignment: Mastering the Accounting Cycle, Part III. Unearned Service Revenue. Total Current Liabilities $ Long-term Liabilities Interest Payable Notes Payable Total Long-term Liabilities Total Liabilities Owner's Equity Owner's Capital. Total Liabilities and Owner's Equity $ eTextbook and Media. 370 528 20 2400 2420 2948 ...

Fort Wayne Children's Zoo Winterthur Museum, Garden & Library Marineland Majorca Stonecrop Gardens Al Rudaf Park Sea Girt Beach and Boardwalk Basilica di Santa Maria della Salute Chung Dam Spa & Fitness Accra zoo Detroit-Windsor Tunnel Private tasting in the Douro (1 to 6 people) on a Yacht just for you Helicopter Tour Cartagena - Ciudad Perdida(Lost City) Washington DC Segway Night Tour Grand ...

Assos Joyland Miracle Mile Shops at Planet Hollywood Dig Maine Gems Mangu Disco Music City Circuit Water World Smoky Mountain Deer Farm & Exotic Petting Zoo Willow Beach Crayola Experience Calypso Cabaret No.1 Ladyboy Show in Bangkok with Optional Dinner Show Admission Ticket to Museum of Illusions Orlando Copenhagen Urban Honey Factory - Bybi Tuscan Cooking Class in Central Siena Rafting on ...