Summary of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations

When a company (or another entity) plans to sell an asset and / or stop some part of its business, then it might affect its future cash flows, profitability and overall financial situation.

Therefore, the users of financial statements, mainly investors, should be informed about these events.

That’s why the standard IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations was issued – to highlight the results of discontinued operations and to separate them from the results of ongoing or continuing activities.

So, if you or your company plans to sell some non-current assets and discontinue some operations, then IFRS 5 is for you.

The only exception is when a company regularly sells assets normally considered as non-current. In this case, these sales represent one of primary activities and the related assets are inventories in fact. For example, a car dealer presents all vehicles for resale under IAS 2 Inventories, not under IFRS 5.

Let’s take a closer look to the main IFRS 5 rules.

Objective of IFRS 5

IFRS 5 focuses on 2 main areas:

- It specifies the accounting treatment for assets (or disposal groups) held for sale , and

- It sets the presentation and disclosure requirements for discontinued operations .

Let me point out that you should apply IFRS 5 for all non-current assets – no exception.

The standard IFRS 5 lists some measurement exceptions and you can read about them in the later paragraphs, but you still need to present and disclose the information about these assets under IFRS 5.

When to classify an asset as held for sale

You should classify a non-current asset as held for sale if its carrying amount will be recovered principally through a sale rather than continuing use.

The same applies for a disposal group.

Disposal group is a new concept introduced by IFRS 5 and it represents a group of assets and liabilities to be disposed of together as a group in a single transaction.

For example, when a company runs a few divisions and decides to sell one division, then all assets (including PPE, inventories, deferred tax, etc.) and all liabilities of that division would represent a disposal group.

What if we abandon an asset?

The question is whether you should classify a non-current asset as held for sale in the case when you plan to stop using it, or abandon it.

The answer is NO.

Because, you will recover its carrying amount through asset’s continuing use and not sale.

What does it practically mean?

Well, it means that you will NOT apply “held-for-sale accounting”, i.e. you will NOT keep an asset at lower of fair value less costs to sell and its carrying amount (as specified below).

But, it also means, that you WILL need to assess the criteria for presenting the abandoned asset or operation as discontinued operation.

When will an asset be recovered through a sale?

In other words, what are the conditions for classifying an asset as held for sale?

First of all, the asset or disposal group must be available for immediate sale in its present conditions and the sale must be highly probable .

IFRS 5 sets a few criteria for the sale to be highly probable:

- Management must be committed to a plan to sell the asset;

- An active program to find a buyer must have been initiated;

- The asset must be actively marketed for sale at a price reasonable to its current fair value;

- The sale is expected to be completed within 1 year from the date of classification;

- Significant changes to the plan are unlikely.

The similar criteria also apply to assets held for distribution to owners.

How to account for assets held for sale

Once you classify an asset or a disposal group as held for sale, then you should measure it under IFRS 5.

However, IFRS 5 lists a few measurement exceptions (IFRS 5.5):

- Deferred tax assets ( IAS 12 Income Taxes ).

- Assets arising from employee benefits ( IAS 19 Employee Benefits ).

- Financial assets within the scope of IFRS 9 Financial Instruments .

- Non-current assets that are accounted for in accordance with the fair value model in IAS 40 Investment Property .

- Non-current assets that are measured at fair value less costs to sell in accordance with IAS 41 Agriculture.

- Contractual rights under insurance contracts as defined in IFRS 4 Insurance Contracts.

When you classify any of the above types of assets as assets held for sale, you continue measuring them under the same accounting policies as before classification (e.g. financial instrument held for sale will still be measured under IFRS 9, not IFRS 5).

Why have we classified these assets as held for sale though?

The reason is that although you don’t change their accounting treatment, you change their presentation and disclosures. You will still need to present these assets separately from others and disclose some additional information.

All other assets not excluded in the above list must be measured at lower of their carrying amount and fair value less costs to sell . That’s the main measurement principle of IFRS 5.

How to do it?

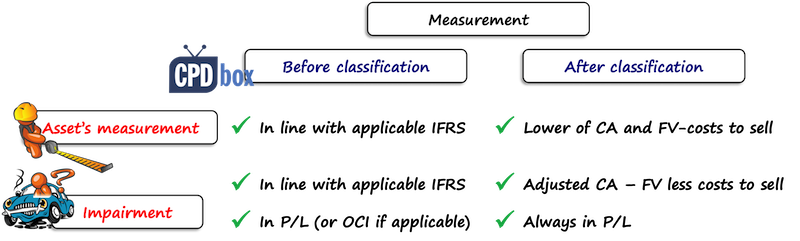

Measurement after classification

Immediately before you classify an asset as held for sale, you should measure it under applicable IFRS. For example, you would measure an item of property, plant and equipment under IAS 16.

Subsequently, after you classified an asset as held for sale, you should measure it at lower of its carrying amount and fair value less costs to sell (except for measurement exceptions listed above).

With regard to any impairment, immediately before classification as held for sale, the impairment is recognized in line with the applicable IFRSs, for example, under IAS 36 for property, plant and equipment.

In this case, you would recognize any impairment loss in profit or loss, but sometimes also in other comprehensive income – that’s when you apply revaluation model for your property, plant and equipment and you have a revaluation surplus to decrease.

After you classify an asset as held for sale, you would recognize any impairment loss in profit or loss only.

What are discontinued operations

IFRS 5 specifies that you need to pay special attention to presenting any discontinued operation. But, what is it?

It is a component of an entity (understand: a cash-generating unit or a group of cash-generating units) that either has been disposed of or is classified as held for sale , and at the same time:

- Represents a separate major line of business or geographical area of operations,

- Is part of a plan to dispose it of, or

- Is a subsidiary acquire exclusively with a view to resale. (IFRS 5.32)

How to present discontinued operations

Once you identify a discontinued operation, you should present it separately from other continuing operations in your financial statements.

Thus, the readers of your financial statements will be able to see what you put away and what you keep going on in order to generate future profits and cash flows.

More specifically, you should present (IFRS5.33):

- The post-tax profit or loss of discontinued operations, and

- The post tax gain or loss recognized on the measurement to fair value less costs to sell a or on the disposal of assets or disposal groups.

- In the statement of cash flows : the net cash flows attributable to the operating, investing and financing activities of discontinued operations. You can present these disclosures in the notes or in the financial statements themselves.

- In the statement of financial position (IFRS5.38): you shall present a non-current asset or assets of a disposal group classified as held for sale separately from other assets. The same applies for liabilities of a disposal group classified as held for sale.

Please watch the following video with a summary of IFRS 5 Non-current Assets Held for Sale and Discontinued Operations:

JOIN OUR FREE NEWSLETTER AND GET

report "Top 7 IFRS Mistakes" + free IFRS mini-course

Please check your inbox to confirm your subscription.

116 Comments

Dear Silvia, I have a question with regards to the trading properties. The trading property has been valued by a third party and in the previous year and has recognized a loss in the profit and loss. when its come to the current year the same Trading property has been valued and shown a gain as per the valuation. In this context, what will be the treatment in the financial statements?

hello hope this would be helpful if you are using ( IAS 40 investment property) directly recognize the current year gain in the statement of profit and loss and in the statement of financial position change it to the new fair value

in which section of the cashflow you present the sale of a building classified as held for sale? will the proceeds go to investing activities? The gain/loss on sale will go to operating activity as non-cash adjustment to the net income?

The ordinary course of the business is NOT to sell buildings. thank you! Thank you.

Alvin, according to IFRS 5.33c, you should disclose the net CF from investing, operating and financing activities related to discontinued operations. So if that building relates to discontinued operations, it is a separate amount within investing activities; if it is only held-for-sale asset without any operation being discontinued, then within investing activities. Best, S.

Hello, I’m from a banking industry. My question is the accounting treatment (initial recognition & subsequence measurement) of a bank purchase a collateral (land/building) from customer so that the customer can use the money to pay off their debt. The bank will resell the land/building within 1 year.

If a subsidiary was purchased with a view to be disposed, can you please advise what needs to be disclosed in the statement of cash flows? Is it the net cash flows attributable to the operating, investing and financing activities?

Dear Georgette,

If a subsidiary was purchased with a view to be disposed of in the near future, the transaction would be considered a discontinued operation, and the results of the subsidiary’s operations would be presented separately in the income statement and the statement of cash flows.

In the statement of cash flows, the cash flows attributable to the discontinued operation would be presented separately from the continuing operations. The net cash flows attributable to the discontinued operation would include the cash received from the sale of the subsidiary, as well as any cash flows related to the operation of the subsidiary during the period prior to its disposal. These cash flows would be classified as operating, investing, or financing activities, depending on the nature of the cash flow.

It is important to note that the disclosure requirements for a discontinued operation can vary depending on the accounting standards applicable to the company. Companies should consult with their accounting advisors and refer to the relevant accounting standards when preparing their financial statements.

If a subsidiary is acquired with the intention of selling it in the near future, the transaction is treated as a discontinued operation and the results of the subsidiary’s operations are presented separately in the income and cash flow statements.

Cash flows attributable to discontinued operations are presented separately from continuing operations in the statement of cash flows. Net cash flows attributable to discontinued operations include cash received from the sale of subsidiaries and cash flows related to the subsidiary’s operations during the period prior to the sale. These cash flows are classified as operating, investing or financing activities depending on the nature of the cash flow.

It is important to note that disclosure requirements for discontinued operations may vary depending on the accounting standards applicable to the company. Companies should consult their accounting advisors and refer to relevant accounting standards when preparing their financial statements.

Please how do you account for the disposal of non-current assets held for sale where the consideration or proceeds is yet to be received?

When you deliver the asset, then you do recognize the revenue from its sale and a receivable.

Investment in shares of company, Which is 55 %, so it is a subsidiary. After many years, as subsidiary not started business, i want to sell the investment in subsidiary as approved by Board/Shareholders on 31/3/2021, and want to recover my money. buyer is found, sale is highly probable and to be completed with in year. Money not received at 31/3/21, it will be recovered 50% on 15/6/21 and balance on 15/12/21, whether i would consolidate as at 31/3/21, or classify held for sale, and on 30/6/21 whether i classify held for sale and consolidate upto 15/6/21, and if classified as held for sale it would not be consolidated?

Dear Silvia, our company bought major previously abounded factory, with intention to restart the business. It is completely different line of activity from the main Company’s activity. However, the management decided not to enter into the new line, and the factory, together with the equipment will be sold. The management did not actively seek for a buyer during 2020, due to COVID – 19. How to classify abounded factory sold with intention to rebuild the business, and later on concluded not to reorganize the factory, and to sell it. The fair value has been assessed as of 31 December 2020. Thanks

The accounting treatment for the abandoned factory will depend on whether it meets the definition of a discontinued operation under IFRS 5 “Non-current Assets Held for Sale and Discontinued Operations”. According to IFRS 5, a discontinued operation is a component of an entity that has been disposed of or is classified as held for sale and represents a separate major line of business or geographical area of operations, or is part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations.

If the factory meets the criteria for a discontinued operation, it should be classified as such and the results of its operations should be separately presented in the income statement. Any gain or loss on disposal should also be separately disclosed.

If the factory does not meet the criteria for a discontinued operation, it should be accounted for as a non-current asset held for sale, and should be measured at the lower of its carrying amount and fair value less costs to sell. Any impairment losses should be recognized in profit or loss.

Since the management has already decided to sell the factory and has assessed its fair value as of December 31, 2020, it should be accounted for as a non-current asset held for sale. Any changes in fair value subsequent to the date of assessment will not be recognized in the financial statements.

Once the factory is sold, any gain or loss on disposal should be recognized in profit or loss, and the factory should be derecognized from the balance sheet.

Great Website

Asset held for sale can depreciate if still in operation?We are doing the impairment loss instead.

Please reply

if an asset that is held for sale continues to be used in operations, it may still be subject to depreciation or amortization until it is sold. In this case, the asset should continue to be accounted for in accordance with the relevant accounting standards until it meets the criteria to be classified as held for sale.

If an asset held for sale is impaired, the impairment loss should be recognized in the income statement and the carrying amount of the asset should be reduced to its fair value less costs to sell. This is consistent with the lower of cost or market principle that applies to assets held for sale.

In BBP, eg 1. A full year Subsidiary met Held For Sale requirements From Oct 1. First 9 months were consolidated and last 3 months reported under IFRS 5 as discontinued. In eg 2 A Subsidiary was acquired Oct. 1 with a view for resale with requirements met 31 December, the reporting date. The full 3 months were reported under IFRS 5 as discontinued operation. I am confused because under eg 1 discontinuation IFRS 5 took effect from Oct. 1 when requirements were met and under eg 2 requirements were met at 31 Dec but they still discontinued from Oct. 1 using IFRS 5 accounting. Please explain. BPP Chap 13 examples.

Hello, may I kindly recommend looking to the BPP book solutions? I am sure there will be the right explanation 🙂

Dear Silvia, thank you for your work simply amazing. Related to the topic, I have a question relating to the accounting for other side, when a company has discontinued operation or a disposal group, however instead of selling it company decides to create a separate entity (with same shareholders) and give this assets to that company (demerger of a sort however, the assets/liabilities in a new company were classified as discontinued operations), can you reference me what the accounting in the new entity for this assets/liabilities/equity should be. Thanks in advance.

if an assets is sold on going concern basis eg running business . is it included under IFRS 5 or not

I have problems on understanding the impairment losses and reversals.

In my understanding, IAS 36 would be ineffective if asset or disposal group has been classified as Asset Held for sale. So, the impairment loss for asset or disposal group that has be classified as Asset held for sale, is the difference between Carrying Amount and FV less cost to sale,right?

How about the other asset that are not within the scope of IFRS 5 such as deferred tax expense and so on? How does the impairment loss is recognized?

Hi Silvia i have a question regarding how i treat the entries under ifrs 5 when calculating total Carrying Amount Inventory(1/7/2017) 7 500 000 Inventory(30/6/2018) 5 900 000 Liabilities related to plant-1/7/2017 4 650 000 -30/06/2018 3 480 000 Investments (1/07/2017)(fair value) 15 000 000 (30/06/2018) fair value 18 000 000 Required Outline the accounting treatment for the group assets in terms of IFRS 5 on 30/06/2018

Hi silvia, I have a questions regarding on the recognition of impairment losses and reversals. Can you please explain in detail?

An impairment loss posses when we have indicator only. when the carring amount grater than the recoverable amount and the indicator should be internal and external. then the carried amount would be there cost added and accumulated dep added to the impaired loss amount. after we deduct the impairment loss in the PPE asset, we test every year to find the reversals amount. the reversals amount should not be grater than the impairment loss .

Dear Selvia How are you my teacher i just wanna to ask is still there (IFRS – 4 ) as you wright • Contractual rights under insurance contracts as defined in IFRS 4 Insurance Contracts. After Issuance IFRS – 17 or the IFRS- 17 Still Not Not implemented yet

Hello Madam, If a subsidiary company transfer whole business to its parent company through the Business Transfer agreement then this is called as discounted operation ?. After business transfer subsidiary is not having any business.

Hi If you sell cars and you sold 8 cars for R80000 each vat inclusive. Markup is 45% on cost. What will be the income earned from the sale of vehicles? Do you deduct the vat inclusive or not Will the income be R640000?

Leave a Reply Cancel reply

Recent Comments

- Silvia on IFRS 15 vs. IAS 18: Huge Change Is Here!

- Mo on IFRS 15 vs. IAS 18: Huge Change Is Here!

- Silvia on Depreciation of ROU related to land

- Pauline on Depreciation of ROU related to land

- ahmed on IFRS 3 Business Combinations

- Accounting Policies and Estimates (14)

- Consolidation and Groups (24)

- Current Assets (21)

- Financial Instruments (54)

- Financial Statements (48)

- Foreign Currency (9)

- IFRS Videos (65)

- Insurance (3)

- Most popular (6)

- Non-current Assets (54)

- Other Topics (15)

- Provisions and Other Liabilities (44)

- Revenue Recognition (26)

JOIN OUR FREE NEWSLETTER

report “Top 7 IFRS Mistakes” + free IFRS mini-course

1514305265169 -->

We use cookies to offer useful features and measure performance to improve your experience. By clicking "Accept" you agree to the categories of cookies you have selected. You can find further information here .

Non-Current Assets Held for Sale and Discontinued Operations: IFRS 5

Updated: Sep 2, 2019

Entities sometimes intend to sell their non-current assets (e.g. Property, Plant and Equipment) and/or their operations. While the intention to sell a small piece of equipment may not affect investment decisions, the intention to sell off factories and operating units can affect investors’ choices. Because we must abide by the Financial Reporting Characteristics (specifically " Relevance ") and ensure that we are presenting all relevant information, we must ensure that readers of the financial statements know whether non-current assets and disposal groups are being held for sale. IFRS 5 provides guidance to help us determine when and how we should classify a non-current asset or disposal group as held for sale.

In this article, we review:

When to classify the non-current asset or disposal group as "Held for Sale."

How to recognize and measure the asset or disposal group once it is "Held for Sale."

How to present the potential sale in the Financial Statements.

When To Classify:

Non-Current assets (e.g. Property, Plant and Equipment) and disposal groups should be classified as “Held-for-Sale” when the “carrying amount will be recovered principally through a sale transaction rather than through continuing use.” (IFRS 5)

A disposal group is a group of assets that are to be disposed of together, in a single transaction (including their directly associated liabilities - e.g. a mortgage on a property). The group should include any goodwill acquired through a business combination and directly attributed to the disposal group. Examples of disposal groups include: operating units, cash generating units, and subsidiaries.

Throughout this article it is important to make clear that we are distinguishing between current and non-current assets. Current assets (such as most inventory) are expected to be sold or disposed of within the year. Therefore, there is no need to classify them in any special manner. We only address non-current assets when referring to “assets” in this article. However, disposal groups may include current assets as part of their bundle. For example - the sale of a subsidiary may include the subsidiary’s inventory on hand.

Now back to our original classification... In order for us to expect the carrying amount to be recovered principally through a sale, the following must be true about the non-current asset and/or disposal group:

1) It must be available for immediate sale in its current condition, AND

2) The sale must be highly probable:

The appropriate level of management must be committed to selling the asset AND

An active plan to find a buyer for the asset must have been initiated AND

The asset must be actively marketed at a reasonable price AND

A sale should be expected within 12 months from classification as held for sale. If the asset/disposal group takes longer than 12 months to sell, it will remain classified as Held-for-Sale as long as the remaining criteria are met, and as the delay is caused by events or circumstances that are not within the entity's control (e.g. a market downturn).

If an entity acquires asset(s) or disposal group(s) with the intention of selling/disposing of them, the entity can classify the asset(s)/disposal group(s) as Held-for-Sale at the acquisition date, as long as the criteria above are met.

Recognition and Measurement:

Initial recognition.

The asset(s) or disposal groups are initially valued at the lower of:

1) Carrying amount

2) Fair value (FV) less selling cost

Selling costs do not include tax on disposal

If FV less selling cost is < Carrying Amount, then we need to record an Impairment Loss . For more information about Impairment Losses , click here .

Sample Journal Entry:

The following is a sample journal entry assuming there is an impairment loss.

Subsequent Recognition

After the asset(s) or disposal group(s) have been classified as held for sale, they must be measured at every reporting period, at the lower of:

Carrying amount

FV less selling cost

Subsequent recognition can result in a further impairment loss (if FV less cost to sell < Carrying Amount), which is reported in Statement of Profit or Loss, as per the Impairment Criteria . Subsequent recognition can also result in a gain (if FV less cost to sell > Carrying Amount). As described in our article about Revaluations , gains first reverse any prior impairments and then anything more than the impairment loss becomes a Revaluation Surplus . See this article to review Revaluations .

The following is a sample journal entry assuming there is a gain after a prior impairment loss.

Depreciation

No depreciation is recorded when assets or disposal groups are held for sale.

Presentation

Non-Current Assets or Disposal Groups:

Non-Current Assets and disposal groups Held for Sale are presented in their own category “Non-Current Assets Classified as Held for Sale” in the Statement of Financial Position under the “Assets” category.

Disposal groups can include both assets and liabilities - we must therefore ensure that all elements are presented transparently. As such, the liabilities of a disposal group classified as held for sale must be presented separately from other liabilities. These liabilities cannot be offset by assets or presented as a single amount.

Discontinued Operations:

In order for an asset to be considered a discontinued operation, it must have been disposed of or classified as Held for Sale, and:

“represent a separate major line of business or geographical area of operations, OR

be part of a single coordinated plan to dispose of a separate major line of business or geographical area of operations OR

be a subsidiary acquired exclusively with a view to resale.” (IFRS 5)

The discontinued operation is presented in the Statement of Comprehensive Income as the total of:

“the post-tax profit or loss of discontinued operations AND

the post-tax gain or loss recognized on the measurement to fair value less costs to sell or on the disposal of the assets or disposal group(s) constituting the discontinued operation.” (IFRS 5)

Help improve this article

If you have feedback or questions, please leave a comment in the section below.

Click our Sign Up button (top of page) to receive updates, additional exam prep information and to connect with our community.

Up Next: Disposal of Long-lived Assets and Disposal Groups: ASPE 3475 ->

Recent Posts

Analyzing Financial Issues

When analyzing financial case studies, always break them down into smaller issues, which can then be addressed individually. If you are writing your CPA Exams (CFE or others), exam time will be const

Statement of Financial Position / Balance Sheet Elements

The Statement of Financial Position (a.k.a Balance Sheet using Canadian ASPE accounting standards) presents the company's total assets, liabilities and the netted amount - called shareholder's equity.

Statement of Profit or Loss / Income Statement Elements

The Statement of Profit or Loss (a.k.a. Income Statement using Canadian ASPE) shows the company's earnings and expenses. Different countries may have their own unique presentation standards for the sa

Commentaires

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

CPD technical article

01 January 2017

The challenge of implementing IFRS 5

Multiple-choice questions

Graham Holt

Implementation of ifrs 5 can be a complex and time-consuming exercise with significant judgment required, explains graham holt, studying this technical article and answering the related questions can count towards your verifiable cpd if you are following the unit route to cpd and the content is relevant to your learning and development needs. one hour of learning equates to one unit of cpd. we'd suggest that you use this as a guide when allocating yourself cpd units..

This article was first published in the January 2017 international edition of Accounting and Business magazine.

Over the last few years, the Interpretations Committee of the International Accounting Standards Board (IASB) has been considering certain issues relating to IFRS 5, Non-current Assets Held for Sale and Discontinued Operations . This article discusses some of those issues.

IFRS 5 requires an entity to classify non-current assets as held for sale when the assets' carrying amount will be recovered principally through a sale transaction rather than through continuing use. The standard further sets out more detailed conditions that an entity has to meet within the context of a typical sale transaction.

These conditions include: a commitment to a plan to sell the asset; the asset being available for immediate sale; and the sale being highly probable within a 12-month time period. When an assets is classified as held for sale, the entity has to measure the asset at the lower of its carrying amount and fair value less costs to sell. At first sight these conditions and accounting practices seem straightforward but several issues have arisen since the standard was introduced.

One issue relates to whether loss of control other than through outright sale can result in a held-for-sale classification. For example, an entity could lose control through dilution of the shares held by the entity or due to call options held by a non-controlling shareholder.

The question therefore is whether ‘loss of control' is a factor that brings the event within the scope of IFRS 5, or whether there also needs to be a disposal. The loss of control is a significant economic event that meets the IFRS 5 requirements, and triggers the held-for-sale classification, provided the other relevant criteria are met. This is regardless of whether the entity will retain a non-controlling interest in its former subsidiary after the sale. This means that the recovery of the carrying amount of non-current assets or disposal group has changed to a method other than continuing use.

It is argued that the current objective of IFRS 5 is to capture non-current assets (or disposal groups) over which an entity is committed to lose control, irrespective of the form of the transaction other than abandonment. Additionally, the non-current assets (or disposal group) must be available for immediate disposal, and it must be highly probable that the entity will lose control. The loss of control is a significant economic event and information about the event helps users to assess the timing, amount and uncertainty of an entity's future cashflows.

Another issue relates to whether an impairment loss recognised for a disposal group should be allocated to non-current assets in the group to the extent that it reduces the carrying amount of such assets to below their fair value less costs to sell. The Interpretations Committee has discussed this issue and noted that in determining the order of an impairment allocation to non-current assets, IFRS 5 does not refer to IAS 36, Impairment of Assets , which states that an impairment loss for a CGU (cash-generating unit) should not reduce the carrying amount of an asset below the highest of:

- its fair value less costs of disposal (if measurable)

- its value in use (if determinable)

As a result, the Interpretations Committee has tentatively stated that IAS 36 does not affect the allocation of an impairment loss for a disposal group. However, it is still unsure as to whether the amount of impairment losses should be limited to: the carrying amount of the non-current assets measured under IFRS 5; the net assets of a disposal group; the total assets of a disposal group; or the non-current assets with the possible recognition of any liability for the excess.

The interpretation of the definition of ‘discontinued operation' has come under scrutiny, particularly with regard to the concept in IFRS 5 of ‘separate major line of business or geographical area of operations'. IFRS 5 says that a discontinued operation is a component of an entity that either has been disposed of, or is classified as held for sale and meets certain conditions, two of which are part of a single coordinated plan, and that the discontinuance ‘represents separate major line of business or geographical area of operations'.

This latter concept can be interpreted differently depending on how the entity determines its operating segments. Generally speaking, the disposal of a reportable segment will be the type of strategic shift that qualifies as a discontinued operation. The definition of discontinued operations is an area that the IASB has attempted to revise, but the issue has not yet been resolved.

There are different practices as regards how transactions between continuing and discontinued operations are treated. Some entities eliminate the transactions in full without any adjustments, while others eliminate with adjustments to reflect how transactions between continuing or discontinued operations will be reflected in continuing operations going forward.

Finally, some entities do not eliminate such transactions. IFRS 5 attempts to address this issue by requiring an entity to ‘present and disclose information that enables users of the financial statements to evaluate the financial effects of discontinued operations and disposals of non-current assets (or disposal groups)'.

The standard itself does address how to reflect the impact of transactions between continuing and discontinued operations, but some believe that IFRS 5 requires adjustments to reflect the anticipated impact of the disposal to be included on the income statement itself rather than providing additional information in the notes.

The Interpretations Committee discussed this issue and concluded that there were no requirements or guidance in IFRS 5 or IAS 1, Presentation of Financial Statements , in relation to the presentation of discontinued operations that could override the consolidation requirements in IFRS 10, Consolidated Financial Statements . At this point, the committee agreed that an entity was required to eliminate intra-group transactions in full prior to determining the presentation of continuing and discontinued operations. However, subsequently the committee felt that this and other issues were too broad for it to address, which indicated that a broad-scope project on IFRS 5 was necessary.

Clarification

In 2013, IFRS 5 was amended to clarify the situation where a disposal group or non-current asset ceases to be classified as held for sale and is a subsidiary, joint operation, joint venture, associate or a portion of an interest in a joint venture or an associate (subsidiary et al). However, for a non-current asset (or a disposal group) that is not a subsidiary et al, ceasing to be classified as held for sale results in the inclusion of any measurement adjustment in profit or loss in the current period.

In contrast, if a change to a sale plan involves a subsidiary et al, then IFRS 5 requires retrospective amendments. Questions have arisen as to why there is inconsistency between the two treatments and whether retrospective amendment applies not only to measurement but also to presentation. The Interpretations Committee felt that the retrospective amendment should apply to both measurement and presentation aspects of financial statements but because there was no observable diversity in practice, it has not taken this any further.

Another issue relates to a situation in which an impairment loss recorded for a disposal group that is classified as held for sale subsequently reverses. IFRS 5 requires the recognition of a gain for a subsequent increase in fair value less costs to sell of a disposal group. However, specifically, the question focuses on whether an impairment loss relating to goodwill can be reversed.

Guidance on the reversal of an impairment loss for goodwill generally is set out in IAS 36, which states that an impairment loss recognised for goodwill should not be reversed in a subsequent period. IFRS 5 includes multiple references to IAS 36 but omits any reference to the above requirement. By not recognising a reversal of an impairment loss for goodwill, it essentially means that the disposal group is seen as comprising separate assets and liabilities, which are subject to different measurement requirements within IFRS.

No consensus

If the disposal group is seen as a single asset or liability, then the recognition and measurement requirements should be applied to the disposal group as a whole, rather than the individual assets and liabilities. The Interpretations Committee has discussed this issue three times at its past meetings and could not reach a consensus.

Another issue is whether IFRS 5 applies to a disposal group that consists mainly, or entirely, of financial instruments. IFRS 5 states that financial assets are excluded from its scope for measurement purposes. This issue is particularly relevant where the disposal group is expected to be sold at a loss. In applying the requirement of IFRS 5, it is possible that the loss is recognised only when the sale effectively occurs and this conflicts with the measurement principles in IFRS 5, which require measurement at fair value less costs to sell at the date of a ‘disposal group' classification. The Interpretations Committee noted that this was another example of the IFRS 5 measurement challenges.

Discontinuing a business operation or deciding to sell a major asset are important commercial events, which are likely to have a significant effect on an entity's results and net assets. IFRS 5 can have a significant effect on a company's profit or loss, the carrying values of its assets and on the presentation of results.

Implementation of IFRS 5 can be a complex and time-consuming exercise with significant judgment required especially in the areas above.

Graham Holt is director of professional studies at the accounting, finance and economics department at Manchester Metropolitan Business School

Related topics

- Corporate reporting

"The definition of discontinued operations is an area that the IASB has attempted to revise, but the issue has not yet been resolved"

- ACCA Careers

- ACCA Career Navigator

- ACCA-X online courses

Useful links

- Make a payment

- ACCA Rulebook

- Work for us

- Supporting Ukraine

Using this site

- Accessibility

- Legal & copyright

- Advertising

Send us a message

Planned system updates

View our maintenance windows

Loading Results

No Match Found

IFRS 9 – case studies

Financial instruments are pervasive across all reporting entities and even more so in the financial services sector. In the nineties, there were a lot of problems with the accounting for financial instruments. In response to that the IASB issued IAS 39. However, the global financial crisis of 2008 has shown us that simplifications to the complex IAS 39 were necessary, so the IAS 39 has been replaced by IFRS 9 effective as of 1 January 2018. There are a number of IFRS standards that are relevant to financial instruments.

This e-learning module provides practice cases relating to IFRS 9 financial instruments. The cases will go into more detail of the application of the scoping, classification and measurement and the impairment under IFRS 9. Hedge accounting is not included these practice cases for IFRS 9 but is covered in a separate module.

Different modules in the IFRS for Banks curriculum cover the different subtopics of IFRS 9 (classification, measurement, impairment and hedge accounting). In this case study e-learning, you will learn how to apply what has been covered in those modules. As such a basic understanding of IFRS 9 is expected. You can complete this course without having completed the other IFRS 9 e-learnings in the series, but is advisable to complete the others first.

This e-learning module will illustrate the application of some sections of IFRS 9 by means of cases.

At the end of this module, the participant will be able to:

Apply the theoretical knowledge in a case study on the scoping of IFRS 9

Apply the theoretical knowledge in a case study on classification and measurement

Apply the theoretical knowledge in a case study on impairment

This e-learning course is part of an e-learning series designed by PwC for the introduction of the IFRS 9 standard and to explain the impact for banks.

Our financial instruments related IFRS e-learnings are specifically designed for those in financial and actuarial functions within banks. These modules are also of interest to those working within Reporting, Controlling, IT, Internal Audit, Risk, ALM / Treasury, Account Management and Tax.

Subject Matter Expertise

The IFRS subject matter experts within our Capital Markets and Accounting Advisory Services group have designed the modules together with learning experts. They have extensive knowledge of and experience in implementing IFRS for banks and other financial institutions. In designing the modules, they have focused on the relevance and impact of IFRS, in theory and in practice, for banks specifically.

This e-learning course takes approximately 50 minutes to complete, and as such, it can provide 1 learning hour – 1 CPD point based on a 50-minute hour. Upon completion of this course, you can print the certificate of completion as an evidence that you undertook the course.

Click here for purchasing

Further information:

Training hours: 50 minutes

Language: English

- Topics: IFRS, Reporting

- Sector: Banks

Training method: E-learning

Type: Single course

Geographic relevance: Global

More information on corporate package solutions

© 2023 - 2024 PwC. All rights reserved. “PwC” refers to PricewaterhouseCoopers Auditing Ltd. and PricewaterhouseCoopers Hungary Ltd. which are member of the PwC network. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Privacy Statement

- Cookie Policy

- About Site Provider

- Work & Careers

- Life & Arts

- Currently reading: In-house lawyers: case studies

- Practitioners: persuasion with a dash of comedy

- Intrapreneurs: leaders who turn ideas into action

- Burnout concerns prompt shift in law firm wellbeing policies

- Rewards for training spark ‘healthy competition’ at law firms

- Practice of law: case studies

- Business of law: case studies

In-house lawyers: case studies

- In-house lawyers: case studies on x (opens in a new window)

- In-house lawyers: case studies on facebook (opens in a new window)

- In-house lawyers: case studies on linkedin (opens in a new window)

- In-house lawyers: case studies on whatsapp (opens in a new window)

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The case studies below, featuring the most innovative legal teams in the Asia-Pacific region highlight examples of their work in the following areas:

Operational transformation

New product and services

Sustainability and impact

Commercial and strategic advice, digital solutions, using generative artificial intelligence, people and skills.

All the case studies were researched, compiled and ranked by RSGI. “Winner” indicates that the organisation won an FT Innovative Lawyers Asia-Pacific award for 2024

Read the other FT Innovative Lawyers Asia-Pacific ‘Best practice case studies’, which showcase the standout innovations made for and by people working in the legal sector:

Practice of law Business of law

Winner: Telstra Originality: 9; Leadership: 8; Impact: 8; Total: 25 The legal team at the Australian telecoms company has built on previous improvements to the way it prioritises work from the rest of the business. It created a tool that measures capacity and provides the team with a system for discussing its scope to take on work — deciding how to prioritise tasks within the team, or justifying putting them out to external counsel. The resulting transparency on capacity and costs has enhanced relationships with the rest of the business.

HSBC O: 8; L: 8; I: 8; Total: 24 In 2023, the bank’s regional legal team built and deployed several tools, including a digital portal to receive legal requests from the business, a centralised system for approving marketing campaigns, and a chatbot to handle responses to routine queries. They are, so far, used by the digital legal team, the litigation department, and one of the banking teams.

Highly commended

Boston Consulting Group O: 8; L: 8; I: 7; Total: 23 As part of BCG’s strategy to increase artificial intelligence and digital consulting fees significantly by 2026, its legal department in the region is collaborating with counterparts across the firm in initiatives such as overhauling risk and contractual frameworks. Internally, it is adopting workload management software and trialling generative AI automation tools.

IAG O: 7; L: 8; I: 8; Total: 23 In 2023, the Australian insurance company’s legal team improved its operations by automating the generation of complex contracts and by extending its programme for managing external spending to its teams in New Zealand. The team also introduced a dashboard that displays quarterly and monthly reports on legal expenditures and how external law firms perform.

Zongteng Group O: 7; L: 8; I: 8; Total: 23 Lawyers at the Chinese logistics business built a database that collects details of global legislation, legal commentaries and cases, and names of recommended external counsel in countries where the business operates. The resource helps the small legal team, mainly based in China, to provide global legal advice.

WiseTech Global O: 6; L: 8; I: 7; Total: 21 To gain support from the business for several operational changes, lawyers recorded precisely how they spent their time — an unusual practice for in-house teams. The scrutiny helped identify where alterations, such as introducing a contract management system, would help improve efficiency. The improvements have saved the team hundreds of hours in answering routine queries.

BHP O: 6; L: 7; I: 7; Total: 20 In preparation for making use of generative AI, the mining group’s legal team has upgraded its systems to store documents in one place and to collect structured data. The team estimates that the move has already cut lawyers’ time spent on administrative tasks by a quarter.

Toll Group O: 6; L: 7; I: 7; Total: 20 The legal team at the global logistics business introduced an automation tool to speed up contract approval. Some 3,000 requests have been yielding valuable insights, such as how often negotiators deviate from standard contract terms.

Dentsu O: 6; L: 7; I: 6; Total: 19 The Japanese-led global advertising group’s Asia-Pacific legal team worked with the chief technology officer and other departments to improve and extend oversight of new products’ commercial viability and any potential data privacy questions, as well as other legal risks.

Equinix O: 6; L: 7; I: 6; Total: 19 The regional section of the data centre operator’s global legal team has centralised and streamlined several processes to enhance its contract management systems.

New products and services

Joint winners: Hong Kong Exchanges and Clearing and HSBC Both legal teams: Originality: 8; Leadership: 8; Impact: 9; Total: 25 Launched in May 2023, the stock exchange operator’s Swap Connect programme allows offshore investors access to China’s $5tn interest rate swaps market, and is similar to existing programmes in Hong Kong that allow offshore investors to trade mainland bonds and stocks.

At Hong Kong Exchanges and Clearing (HKEX), the legal team helped structure the link-up, backed by the Shanghai Clearing House and the China Foreign Exchange Trade System, and worked to secure regulatory approval in the territory and mainland. At HSBC, lawyers drafted the contracts used by both the onshore and offshore investors.

DBS Bank O: 7; L: 9; I: 7; Total: 23 In 2023, the Singaporean bank set up a group to improve its handling of customer safety, led by a senior member of the legal team. It created an enhanced anti-malware tool for DBS to prevent users of its banking app logging in remotely if it detects signs of fraudulent activity. The bank says this change has stopped S$14mn ($10.3mn) being taken fraudulently from accounts. Another product enables digital deposits but only in-person withdrawals.

CIMB O: 6; L: 7; I: 8; Total: 21 Lawyers at the Malaysian banking group advised it on the rollout of online business loans and personal loans to domestic customers in the country.

Westpac O: 6; L; 7; I; 8; Total: 21 Lawyers at the Australian bank supported the product team in redesigning its mobile banking app, advising on new features, consumer rights and data protection.

Winner: Asian Development Bank Originality: 8; Leadership: 9; Impact: 8; Total: 25 The bank is working with UN agencies to send aid to people in Afghanistan without money passing through the Taliban. Usually, ADB works directly with governments to provide funding but, because the Taliban is not generally recognised as a government by the international community, aid had to be delivered through other channels.

The legal team successfully argued to stakeholders that, because Afghanistan does not exercise jurisdiction over UN agencies, those organisations are appropriate entities through which to deliver aid.

The lawyers negotiated with the UN agencies to ensure the arrangement met ADB’s strict transparency requirements, such as it being able to inspect any suppliers the UN contracted with as part of the collaboration.

DBS Bank O: 7; L: 8; I: 8; Total: 23 Since 2020, the legal and compliance team at the Singapore bank has run “hackathons”, alongside other organisations, to try to address wider social problems. The 2023 edition focused on mental resilience. Some 27 ideas were generated, two of which are being explored for further development.

MTR Corporation O: 6; L: 8; I: 7; Total: 21 The Hong Kong railway operator’s legal team helped it to execute its environmental, social and governance strategy. This included developing a new corporate structure and working to secure a patent for a product that uses cameras and AI to prevent damage to escalators from discarded objects.

Standard Chartered Bank O: 7; L: 7; I: 6; Total: 20 Sustainability experts in the Apac region’s legal team developed a process whereby the bank can assess and mitigate competition and antitrust risk when working on sustainable projects with counterparts in the banking industry.

Klook O: 7; L: 6; I: 7; Total: 20 After the travel company came under criticism over animal welfare standards at wildlife attractions, it took action to improve them. The legal team piloted a programme, working with accreditation business Asian Captive Elephant Standards, to help five elephant visitor attractions that sold tickets through Klook to meet the new standards. Some venues listed on Klook may still offer close-quarter wildlife experiences, but these are not promoted or sold through the Klook site itself.

Winner: SoftBank Originality: 8; Leadership: 9; Impact: 9; Total: 26 The legal team advised the Japanese investment group on last September’s initial public offering of its UK chip designer Arm in the US. To expedite the deal, lawyers also helped SoftBank acquire an additional 25 per cent of Arm from its Saudi-backed investment partner Vision Fund, the $100bn vehicle that is managed by SoftBank itself.

The lawyers negotiated with investors and dealt with scrutiny over this related-party transaction. The legal team also dealt with the US Securities and Exchange Commission in preparation for Arm’s IPO, which saw the Japanese company raise nearly $5bn while retaining 90 per cent of the business — making it the largest US listing in almost two years.

Asian Development Bank O: 7; L: 8; I: 8; Total: 23 The legal team at the Manila-based institution advised on the arrangement, structuring and syndication of a $692mn financing package signed last March to fund the construction of Monsoon Wind Power Project — the largest wind power plant in south-east Asia. Electricity generated from the plant under construction, the first wind farm in Laos, will be sold to neighbouring Vietnam. Features such as a $50mn concessional financing package, in case of delays, provide additional reassurance for commercial lenders.

Hong Kong Exchanges and Clearing (HKEX) O: 6; L: 9; I: 8; Total: 23 Lawyers at the stock exchange operator advised on narrowing the period between pricing and the start of share trading in an IPO from five days to two, via its new settlement platform Fast Interface for New Issuance, which was launched last year. The team worked with different stakeholders to digitise the previously paper-based system.

Australian Nuclear Science and Technology Organisation O: 7; L: 7; I: 7; Total: 21 The public research body’s lawyers worked with Australian legal design firm Inkling to improve the project agreements it uses when collaborating with a range of industry and academic partners. New contracts that clearly set out expectations and undertakings of projects are designed to improve the relationships between the organisation, including ANSTO scientists, and external researchers when working together on collaborations.

HSBC O: 7; L: 7; I: 7; Total: 21 Lawyers designed the documentation for HSBC’s role as sole settlement bank for a scheme to link Hong Kong’s Faster Payment System with PromptPay in Thailand. Nine banks and payment providers have so far signed up to use the scheme.

Recruit O: 7; L: 7; I: 7; Total: 21 Legal and data teams at Japan’s biggest recruitment agency, which has been expanding AI services for job searches and matching, have developed a new governance and review process to ensure compliance with AI and anti-discrimination laws globally.

Winner: Tencent Originality: 8; Leadership: 8; Impact: 9; Total: 25 The legal team at the Chinese technology company has set up a platform to simplify and speed up the review process when artificial intelligence features are added to Tencent apps. Product developers answer a series of questions about how they plan to use AI in an app and where the data will come from, which allows the legal team to say within a day if it should go ahead.

UBS O: 8; L: 9; I: 7; Total: 24 A tool devised by the Swiss bank’s lawyers in collaboration with the IT team assists in approval for data-transfer requests. It saves an estimated 1,000 hours of lawyer time annually and allows for faster approval of outsourcing projects at the bank.

Flex O: 7; L: 8; I: 7; Total: 22 To comply with the US-based manufacturing company’s data-security requirements, the China legal team bought a licence outright for a contract lifecycle management platform in order to be able to customise it. The tool works on English- and Chinese-language documents and has cut the review time required for procurement contracts from days to hours.

Fazz O: 7; L: 7; I: 7; Total: 21 The legal team at the Singaporean fintech is collaborating with police and government agencies in the city state to help prevent cyber crime. The lawyers have created a tool that streamlines responses to requests for information from the police.

AS Watson O: 6; L: 7; I: 7; Total: 20 The group legal team at the Hong Kong-based global health and beauty retailer has customised a legal operations management platform to act as a contract management system. The new system automates document drafting, streamlines the approvals process and cuts contract review times by up to 50 per cent.

Klook O: 6; L: 7; I: 7; Total: 20 The legal team at the Hong Kong-based travel company adopted a contract management system, for both sales and procurement, to handle a year-on-year doubling in contracts without adding more lawyers.

Winner: DBS Bank Originality: 9; Leadership: 8; Impact: 8; Total: 25 As a proof-of-concept exercise, the legal team used an application to retrieve news articles about customers that it wished to scrutinise over potential illicit or illegal activities. It then used generative artificial intelligence to summarise the items to highlight relevant coverage. The full version of this tool went live earlier this year and the team is piloting several other uses for generative AI in detecting money laundering and fraud.

Telstra O: 9; L: 8; I: 7; Total: 24 The legal team at the Australian telecoms business is testing a generative AI tool’s accuracy for translating laws, such as those regarding billing, into obligation statements for the business. The AI assesses Telstra’s processes for ensuring compliance and suggests measures to improve them.

Westpac O: 8; L: 8; I: 8; Total: 24 In collaboration with law firms, technology companies and other professional services businesses, the legal team at the Australian bank tested several generative AI tools in different scenarios. The team says it is already seeing productivity gains. One of the most promising tools links the bank’s underlying regulations and policies to its supplier contracts, which allows users to better understand the reasoning behind certain contract clauses.

Lazada O: 7; L: 8; I: 8; Total: 23 The legal team at the south-east Asian ecommerce business used generative AI to accelerate its contract review process and to identify common risks across different agreements. The team estimates that contract review is already 20 per cent to 30 per cent faster on its standard work.

GLP O: 7; L: 7; I: 7; Total: 21 The legal team at the Singapore-based international logistics company worked with colleagues, including the chief financial officer and the IT team, to store financial and legal documents centrally. This will give the business’s generative AI tool better access to data.

LG Chem O: 7; L: 8; I: 6; Total: 21 The legal team at the South Korean chemical company is using generative AI tools on Chinese and Korean-language documents, to help review the contents of contracts and redraft clauses more easily. It is currently used for simple contracts, such as non-disclosure agreements.

McKinsey & Company O: 7; L: 7; I: 7; Total: 21 Asia-Pacific lawyers at the consulting business are using its internal generative AI tool, Lilli, to help craft responses to external counsel, to critique their own legal arguments, and to assist in translation as the business uses more than 10 languages in the region.

Winner: Boston Consulting Group Originality: 8; Leadership: 9; Impact: 9; Total: 26 The US-based consultancy is aiming to double the proportion of fees it gets from AI and digital consulting to 40 per cent of its global revenues by 2026 (last year, revenues were $12.3bn). To help with this, BCG’s legal team in the region has hired a range of experts in technology, intellectual property, the metaverse, and AI ethics. To keep abreast of the latest developments in the field, the team has designated individuals to gather and update information across their practice areas to feed into different parts of the business.

Nanyang Technological University O: 7; L: 8; I: 9; Total: 24 At the start of 2024, the Singaporean university’s 22-person legal team established a “360” structure that expects all its lawyers to have a working knowledge of all areas that the institution may need advice on. There are still specialists, but most queries can now be answered by anyone in the department.

DBS Bank O: 8; L: 9; I: 6; Total: 23 The legal and compliance team at Singapore’s biggest bank has developed a strategy for coping with the anticipated disruption of generative AI in its business. It plans to move those doing work that becomes obsolete into new areas, while other jobs will be redesigned to create pooled resources that can better serve multiple business teams, assisted by AI tools. As many as 80 per cent of the legal team now use generative AI tools regularly.

HSBC O: 7; L: 8; I: 8; Total: 23 The bank’s legal team in the region centralised its training programmes on a single platform that allows lawyers to track their progress, view past materials, and create a customised development plan. Topics range from sustainability to digital and personal banking.

FedEx O: 7; L: 8; I: 7; Total: 22 Ten lawyers at the package delivery business used their training in more flexible working to introduce new practices to the rest of the region’s legal team.

Another 20 team members joined a workshop to help develop a chatbot that can assist in answering routine legal queries and accessing template documents.

Telstra O: 6; L: 8; I: 8; Total: 22 The legal team at the Australian telecoms business launched a training scheme for new graduate recruits and paralegals, where successful applicants rotate through several areas of Telstra’s in-house department and can spend six months to a year on secondment at an external law firm.

Uber O: 7; L: 8; I: 7; Total: 22 Members of the ride-hailing app’s regional legal team are now obliged to work as taxi drivers or food delivery riders one day per quarter, and share feedback with operations and product teams on how the business can be improved.

Airbnb O: 7; L: 7; I: 7; Total: 21 The holiday rental website set up a training scheme to prepare lawyers with skills required for senior roles. It comprises a dozen training sessions on key areas of legal expertise. Sessions include role-playing a presentation to a board of directors.

Macquarie O: 7; L: 7; I: 7; Total: 21 Lawyers at the Australia-based financial services group created an intranet for the business. It provides regularly updated resources about various areas of legal advice and identifies the best person to contact for each topic.

MSD (Merck) O: 7; L: 8; I: 6; Total: 21 The multinational pharmaceutical company’s legal team in China has launched a diversity and inclusion programme for five law firms it works with. The programme pairs in-house counsel and private practice lawyers at different seniority levels to discuss ideas and challenges in the field.

Jera O: 6; L: 7; I: 7; Total: 20 The legal team at the Japanese power company has adopted a new system for the intake and allocation of work. It uses the resulting data to identify skills gaps and shape training and hiring.

McCain Foods O: 6; L: 8; I: 6; Total: 19 The Asia-Pacific legal team at the global frozen foods company rebranded internally, with the aim of making its communications, such as legal notifications, more immediately noticeable to the rest of the business.

Promoted Content

Explore the series.

Follow the topics in this article

- Law Add to myFT

- Legal services Add to myFT

- Tencent Holdings Ltd Add to myFT

- Standard Chartered PLC Add to myFT

- SoftBank Group Corp Add to myFT

Comments have not been enabled for this article.

International Edition

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for Board Matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

How Mojo Fertility is helping more men conceive

26-Sep-2023 Lisa Lindström

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13-Sep-2023 Nobuko Kobayashi

How a global biopharma became a leader in ethical AI

15-Aug-2023 Catriona Campbell

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

Press release

Extreme E and EY publish Season 3 report, recording 8.2% carbon footprint reduction as female-male performance gap continues to narrow

09-Apr-2024 Michael Curtis

EY announces acceleration of client AI Business Model adoption with NVIDIA AI

20-Mar-2024 Barbara Dimajo

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13-Sep-2023 Rachel Lloyd

No results have been found

Recent Searches

How do you steady the course of your IPO journey in a changing landscape?

EY Global IPO Trends Q1 2024 provides insights, facts and figures on the IPO market and implications for companies planning to go public. Learn more.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

Artificial Intelligence

EY.ai - a unifying platform

Select your location

close expand_more

IFRS 18 changes financial performance reporting

International Director, Global IFRS Services, Ernst & Young Global Limited

Related topics

Ifrs 18 requires all companies using ifrs standards to provide relevant information that enhances transparency in their financial performance..

- IFRS 18 replaces IAS 1 and responds to investors’ demand for better information about companies' financial performance.

- New requirements include: new categories and subtotals in the statement of profit or loss, disclosure of MPMs and enhanced requirements for grouping information.

T he International Accounting Standards Board (IASB) published IFRS 18 Presentation and Disclosure in Financial Statements in April 2024. This new standard will help companies to provide information about their financial performance that is useful to users of financial statements in assessing the prospects for future net cash inflows to the company and in assessing management’s stewardship of the company’s economic resources. It represents the completion of a major standard-setting project on the presentation of financial statements and, therefore, will have significant implications for many companies reporting under IFRS.

IFRS 18 represents the most significant changes to the presentation of financial performance in recent times and requires companies to reconsider the overall structure of the statement of financial performance.

How EY can help

Audit services

We merge traditional and innovative approaches, combined with a consistent methodology, to deliver quality audit services to you. Find out more.

New features of primary financial statements

One of the key features of IFRS 18 is to require companies to classify all items of income and expenses into one of the five categories of operating, investing, financing, income taxes and discontinued operations. The first three categories are new; IFRS 18 provides specific guidance to assist preparers in identifying items to be classified in each respective category especially for companies with specified main business activities of investing in assets or providing finance to customers. The categories are complemented by the requirement to present subtotals and totals for “operating profit or loss,” “profit or loss before financing and income taxes” and “profit or loss”.

The new standard also provides that the aggregation and disaggregation of items of assets, liabilities, equity, revenue, expenses and cash flows are based on shared characteristics. Companies are required to aggregate or disaggregate items to present line items in the primary financial statements to provide useful structured summaries. Furthermore, in the notes to the financial statements, companies are required to aggregate or disaggregate items to provide material information, but in doing so, must not obscure material information.

When IFRS 18 becomes effective, it is expected that the new guidance and requirements applicable to categories, subtotals and totals will enhance their comparability across companies. For example, operating profit or loss is a defined term under IFRS 18 applicable to all companies allowing users to better understand the performance of a company’s operations and compare operating profit or loss across companies.

IFRS 18 creates an opportunity for companies to revisit and change their communication strategy for their financial performance and determine the MPMs going forward.

Management-defined performance measures (MPMs)

Another important feature of the new standard is management-defined performance measures. An MPM is a subtotal of income and expenses not listed in IFRS accounting standards, nor specifically required to be presented or disclosed by an IFRS accounting standard. Companies use MPMs in public communications outside financial statements to communicate to users management’s view of an aspect of the financial performance of the company as a whole.

Furthermore, IFRS 18 requires companies to disclose information about all their MPMs in a single note to the financial statements. It also requires disclosure of how the measure is calculated, how it provides useful information to users and a reconciliation to the most comparable subtotal specified by IFRS accounting standards.

As MPMs are required disclosures under IFRS 18, they will be subject to audit. The disclosure requirements will also enhance transparency and communication effectiveness of a company’s financial performance.

The successful implementation of IFRS 18 will require companies to update their financial statement close process and make the necessary changes to its information systems, also taking into due consideration the information needs of users of financial statements, especially investors.

Effective date and transition

IFRS 18 is effective for annual reporting periods beginning on or after 1 January 2027, and is to be applied retrospectively for comparative periods. The effective date of the standard will depend on the local regulatory requirements in different jurisdictions. Earlier application is permitted and must be disclosed in the notes. If a company applies IAS 34 Interim Financial Statements in preparing condensed interim financial statements in the first year of applying the standard, the company is required to present headings it expects to use in applying IFRS 18 and subtotals consistent with the requirements in the standard. In addition, a company is required to disclose reconciliations for each line item presented in the statement of financial performance for the comparative periods immediately preceding the current and cumulative current periods.

Between now and the date of initial application, companies will need to redesign the income statement and the cash flow statement, re-evaluate the disclosures to be included in the notes to the financial statements, restate comparatives (both annual and interim financial statements) and prepare the reconciliations for transition disclosure purposes. Companies need to plan ahead in a timely manner as the process could take considerable time and involve financial reporting, legal and investor relations personnel, among others.

IFRS 18 replaces IAS 1 Presentation of Financial Statements as the primary source of requirements in IFRS accounting standards for financial statement presentation which will provide better information to users. Some of the changes it introduces include new presentation requirements related to the statement of profit or loss, including three new categories for items of income and expense – operating, financing, investing.

IFRS 18 requires companies to improve labelling, as well as aggregation and disaggregation of information in financial statements. Companies will also need to disclose management-defined performance measure in the notes to the financial statement.

Related articles

What companies need to consider for classification of liabilities

How IFRS classifies liabilities with covenants as current or non-current is changing in January 2024. Learn more

How companies could be affected by proposed amendments to IFRS 9

A proposed change to IFRS 9 requires settlement date accounting for derecognizing financial assets and liabilities. Learn more

About this article

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

IMAGES

VIDEO

COMMENTS

International Financial Reporting Standard 5 Non-current Assets Held for Sale and Discontinued Operations (IFRS 5) is set out in paragraphs 1-45 and Appendices A-C. All the paragraphs have equal authority. Paragraphs in bold type state the main principles. Terms defined in Appendix A are in italics the first time they appear in the Standard.

IFRS 5 outlines how to account for non-current assets held for sale (or for distribution to owners). In general terms, assets (or disposal groups) held for sale are not depreciated, are measured at the lower of carrying amount and fair value less costs to sell, and are presented separately in the statement of financial position. Specific disclosures are also required for discontinued ...

In this case, these sales represent one of primary activities and the related assets are inventories in fact. For example, a car dealer presents all vehicles for resale under IAS 2 Inventories, not under IFRS 5. Let's take a closer look to the main IFRS 5 rules. Objective of IFRS 5. IFRS 5 focuses on 2 main areas:

IFRS 5 deals with the accounting for non-current assets held-for-sale, and the presentation and disclosure of discontinued operations. It introduces a classification for non-current assets which is called 'held-for-sale'. An entity classifies a non-current asset as held-for-sale if its carrying amount will be recovered mainly through ...

IFRS 5 - Non-current Assets Held for Sale and Discontinued Operations . By: Brendan Doyle, BA (Hons) in Accounting, MBS Accounting, MA, H. Dip. Ed. Examiner in Professional 1 Corporate Reporting . This article is designed to clarify and illustrate the requirements of IFRS 5 in so far as they are examinable on the P1 Corporate Reporting paper.