How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

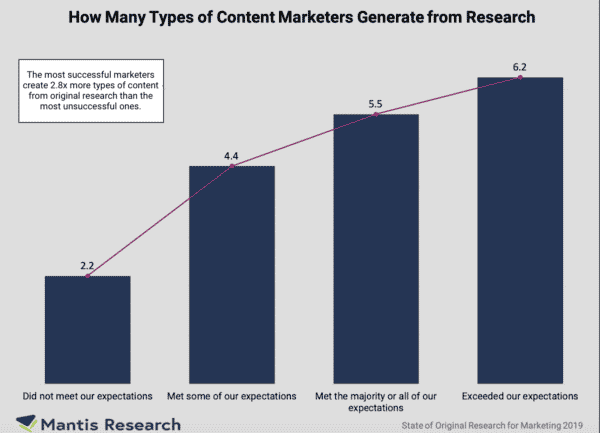

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

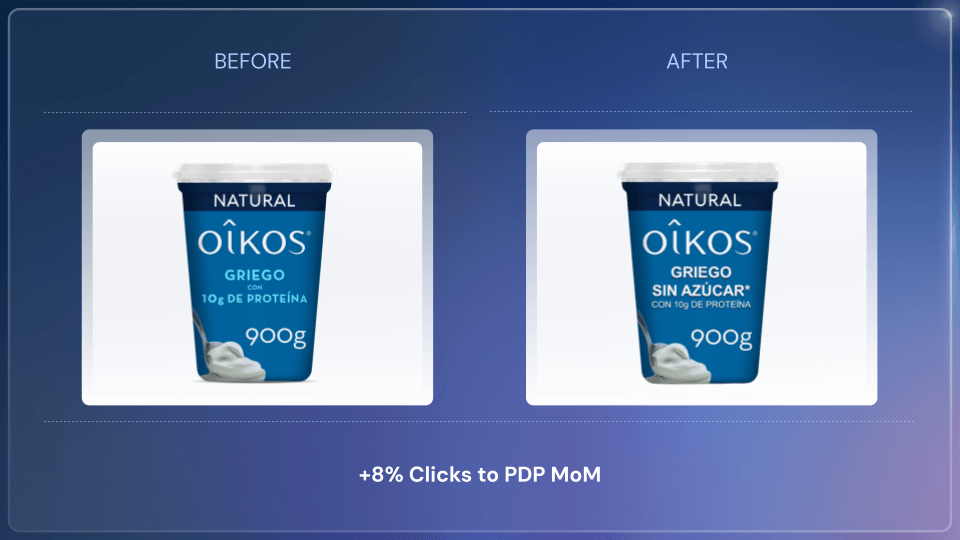

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

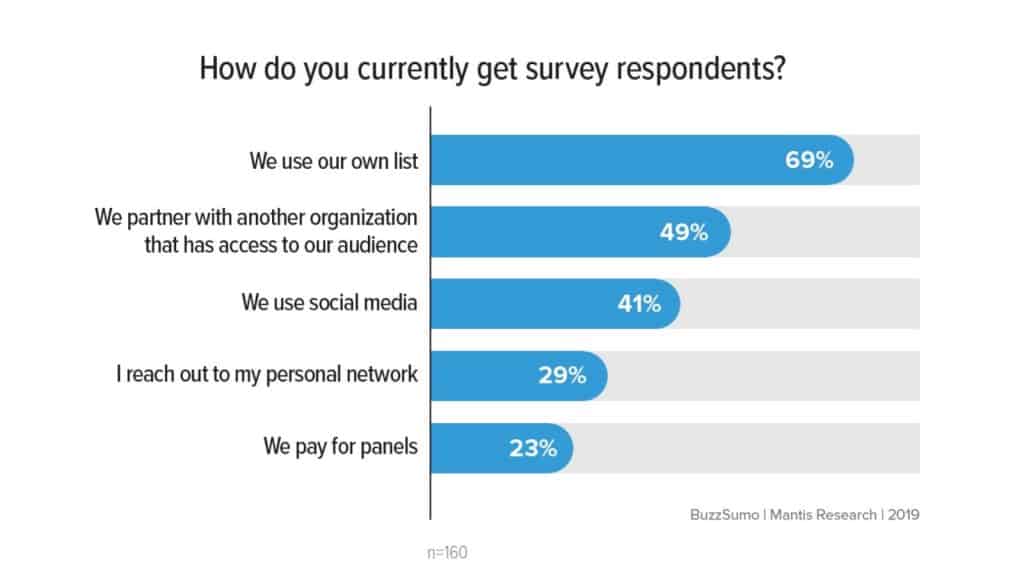

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

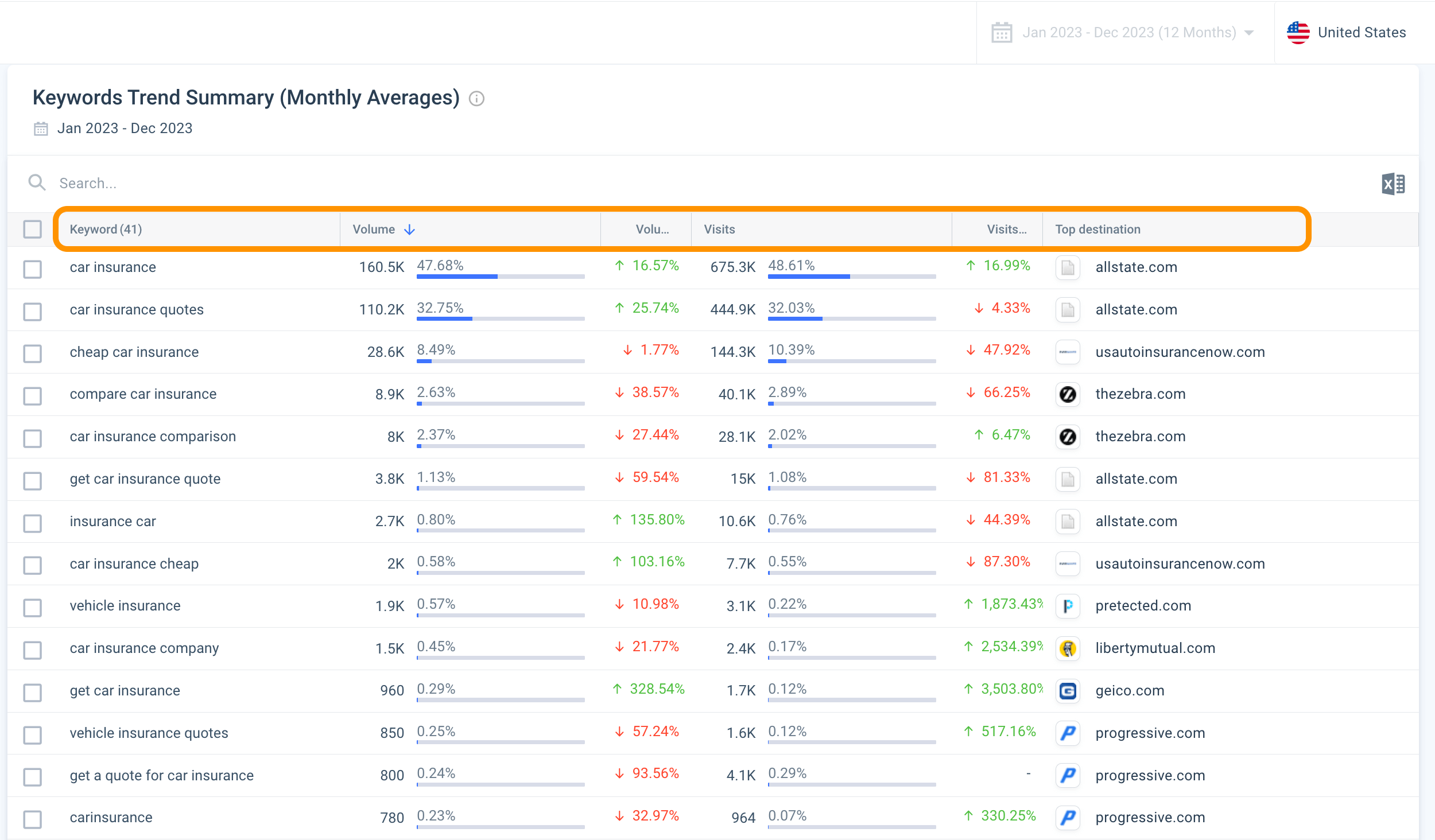

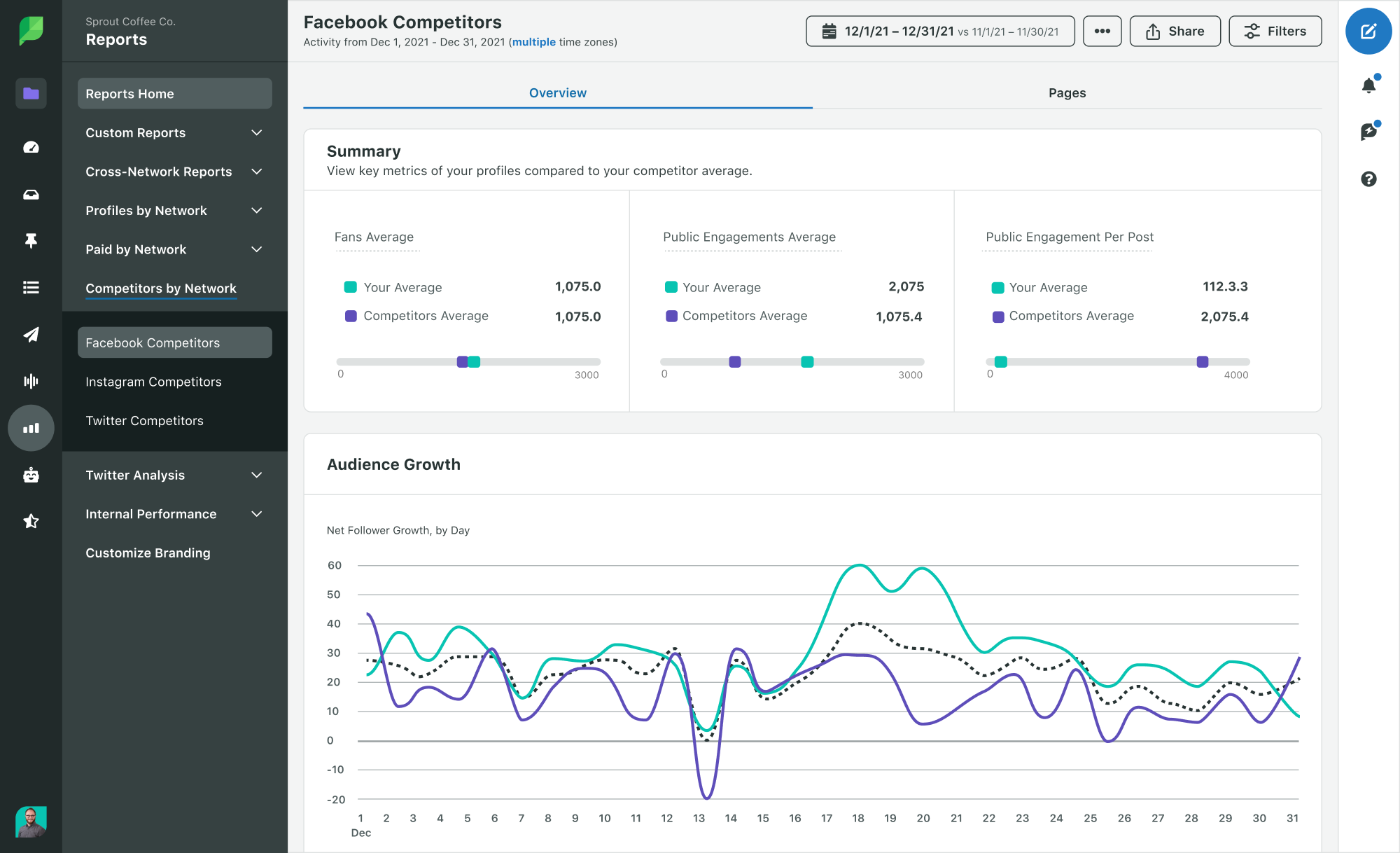

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

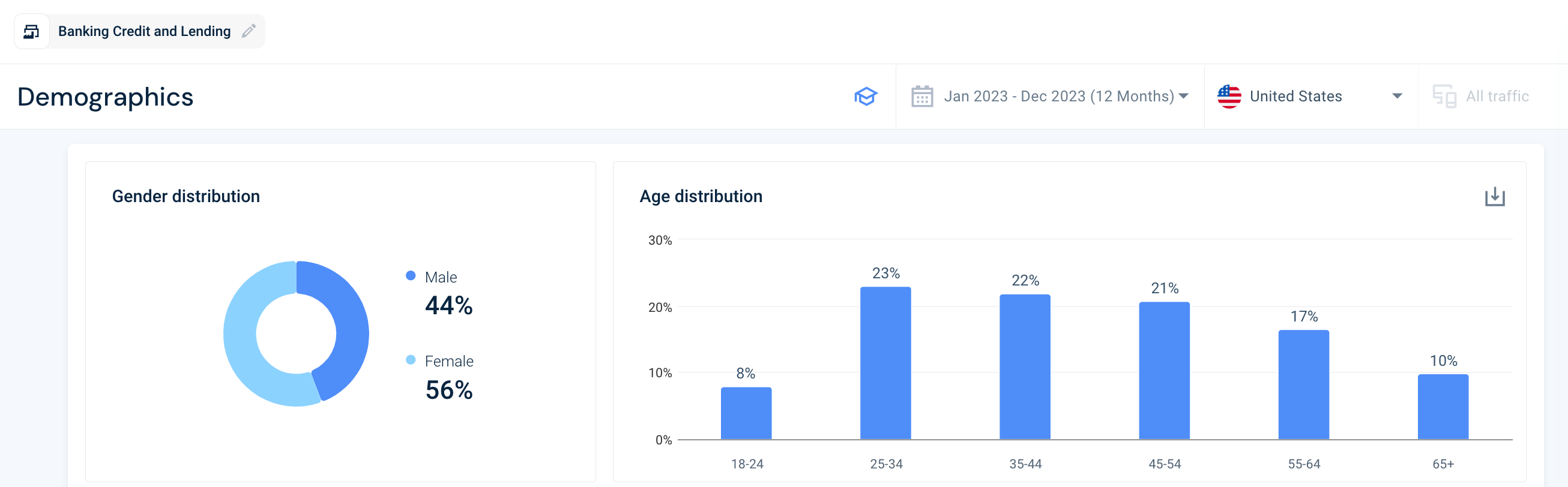

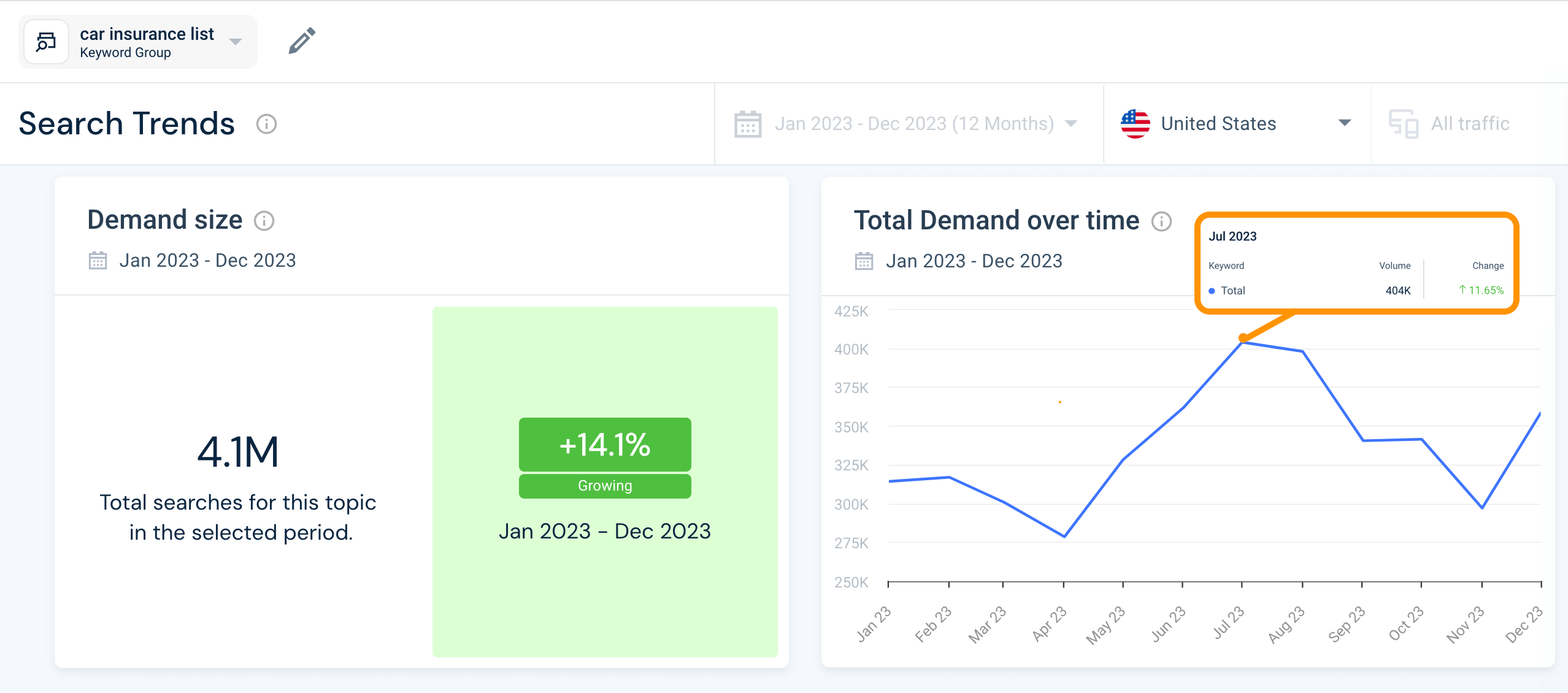

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

How to Conduct an Industry Analysis? Steps, Template, Examples

Appinio Research · 16.11.2023 · 39min read

Are you ready to unlock the secrets of Industry Analysis, equipping yourself with the knowledge to navigate markets and make informed strategic decisions? Dive into this guide, where we unravel the significance, objectives, and methods of Industry Analysis.

Whether you're an entrepreneur seeking growth opportunities or a seasoned executive navigating industry shifts, this guide will be your compass in understanding the ever-evolving business terrain.

What is Industry Analysis?

Industry analysis is the process of examining and evaluating the dynamics, trends, and competitive forces within a specific industry or market sector. It involves a comprehensive assessment of the factors that impact the performance and prospects of businesses operating within that industry. Industry analysis serves as a vital tool for businesses and decision-makers to gain a deep understanding of the environment in which they operate.

Key components of industry analysis include:

- Market Size and Growth: Determining the overall size of the market, including factors such as revenue, sales volume, and customer base. Analyzing historical and projected growth rates provides insights into market trends and opportunities.

- Competitive Landscape: Identifying and analyzing competitors within the industry. This includes assessing their market share , strengths, weaknesses, and strategies. Understanding the competitive landscape helps businesses position themselves effectively.

- Customer Behavior and Preferences: Examining consumer behavior , preferences, and purchasing patterns within the industry. This information aids in tailoring products or services to meet customer needs.

- Regulatory and Legal Environment: Assessing the impact of government regulations, policies, and legal requirements on industry operations. Compliance and adaptation to these factors are crucial for business success.

- Technological Trends: Exploring technological advancements and innovations that affect the industry. Staying up-to-date with technology trends can be essential for competitiveness and growth.

- Economic Factors: Considering economic conditions, such as inflation rates, interest rates, and economic cycles, that influence the industry's performance.

- Social and Cultural Trends: Examining societal and cultural shifts, including changing consumer values and lifestyle trends that can impact demand and preferences.

- Environmental and Sustainability Factors: Evaluating environmental concerns and sustainability issues that affect the industry. Industries are increasingly required to address environmental responsibility.

- Supplier and Distribution Networks: Analyzing the availability of suppliers, distribution channels, and supply chain complexities within the industry.

- Risk Factors: Identifying potential risks and uncertainties that could affect industry stability and profitability.

Objectives of Industry Analysis

Industry analysis serves several critical objectives for businesses and decision-makers:

- Understanding Market Dynamics: The primary objective is to gain a comprehensive understanding of the industry's dynamics, including its size, growth prospects, and competitive landscape. This knowledge forms the basis for strategic planning.

- Identifying Growth Opportunities: Industry analysis helps identify growth opportunities within the market. This includes recognizing emerging trends, niche markets, and underserved customer segments.

- Assessing Competitor Strategies: By examining competitors' strengths, weaknesses, and strategies, businesses can formulate effective competitive strategies. This involves positioning the company to capitalize on its strengths and exploit competitors' weaknesses.

- Risk Assessment and Mitigation: Identifying potential risks and vulnerabilities specific to the industry allows businesses to develop risk mitigation strategies and contingency plans. This proactive approach minimizes the impact of adverse events.

- Strategic Decision-Making: Industry analysis provides the data and insights necessary for informed strategic decision-making. It guides decisions related to market entry, product development, pricing strategies, and resource allocation.

- Resource Allocation: By understanding industry dynamics, businesses can allocate resources efficiently. This includes optimizing marketing budgets, supply chain investments, and talent recruitment efforts.

- Innovation and Adaptation: Staying updated on technological trends and shifts in customer preferences enables businesses to innovate and adapt their offerings effectively.

Importance of Industry Analysis in Business

Industry analysis holds immense importance in the business world for several reasons:

- Strategic Planning: It forms the foundation for strategic planning by providing a comprehensive view of the industry's landscape. Businesses can align their goals, objectives, and strategies with industry trends and opportunities.

- Risk Management: Identifying and assessing industry-specific risks allows businesses to manage and mitigate potential threats proactively. This reduces the likelihood of unexpected disruptions.

- Competitive Advantage: In-depth industry analysis helps businesses identify opportunities for gaining a competitive advantage. This could involve product differentiation, cost leadership, or niche market targeting .

- Resource Optimization: Efficient allocation of resources, both financial and human, is possible when businesses have a clear understanding of industry dynamics. It prevents wastage and enhances resource utilization.

- Informed Investment: Industry analysis assists investors in making informed decisions about allocating capital. It provides insights into the growth potential and risk profiles of specific industry sectors.

- Adaptation to Change: As industries evolve, businesses must adapt to changing market conditions. Industry analysis facilitates timely adaptation to new technologies, market shifts, and consumer preferences .

- Market Entry and Expansion: For businesses looking to enter new markets or expand existing operations, industry analysis guides decision-making by evaluating the feasibility and opportunities in target markets.

- Regulatory Compliance: Understanding the regulatory environment is critical for compliance and risk avoidance. Industry analysis helps businesses stay compliant with relevant laws and regulations.

In summary, industry analysis is a fundamental process that empowers businesses to make informed decisions, stay competitive, and navigate the complexities of their respective markets. It is an invaluable tool for strategic planning and long-term success.

How to Prepare for Industry Analysis?

Let's start by going through the crucial preparatory steps for conducting a comprehensive industry analysis.

1. Data Collection and Research

- Primary Research: When embarking on an industry analysis, consider conducting primary research . This involves gathering data directly from industry sources, stakeholders, and potential customers. Methods may include surveys , interviews, focus groups , and observations. Primary research provides firsthand insights and can help validate secondary research findings.

- Secondary Research: Secondary research involves analyzing existing literature, reports, and publications related to your industry. Sources may include academic journals, industry-specific magazines, government publications, and market research reports. Secondary research provides a foundation of knowledge and can help identify gaps in information that require further investigation.

- Data Sources: Explore various data sources to collect valuable industry information. These sources may include industry-specific associations, government agencies, trade publications, and reputable market research firms. Make sure to cross-reference data from multiple sources to ensure accuracy and reliability.

2. Identifying Relevant Industry Metrics

Understanding and identifying the right industry metrics is essential for meaningful analysis. Here, we'll discuss key metrics that can provide valuable insights:

- Market Size: Determining the market's size, whether in terms of revenue, units sold, or customer base, is a fundamental metric. It offers a snapshot of the industry's scale and potential.

- Market Growth Rate: Assessing historical and projected growth rates is crucial for identifying trends and opportunities. Understanding how the market has evolved over time can guide strategic decisions.

- Market Share Analysis: Analyzing market share among industry players can help you identify dominant competitors and their respective positions. This metric also assists in gauging your own company's market presence.

- Market Segmentation : Segmenting the market based on demographics, geography, behavior, or other criteria can provide deeper insights. Understanding the specific needs and preferences of various market segments can inform targeted strategies.

3. Gathering Competitive Intelligence

Competitive intelligence is the cornerstone of effective industry analysis. To gather and utilize information about your competitors:

- Competitor Identification: Begin by creating a comprehensive list of your primary and potential competitors. Consider businesses that offer similar products or services within your target market. It's essential to cast a wide net to capture all relevant competitors.

- SWOT Analysis : Conduct a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for each competitor. This analysis helps you identify their internal strengths and weaknesses, as well as external opportunities and threats they face.

- Market Share Analysis: Determine the market share held by each competitor and how it has evolved over time. Analyzing changes in market share can reveal shifts in competitive dynamics.

- Product and Pricing Analysis: Evaluate your competitors' product offerings and pricing strategies . Identify any unique features or innovations they offer and consider how your own products or services compare.

- Marketing and Branding Strategies: Examine the marketing and branding strategies employed by competitors. This includes their messaging, advertising channels, and customer engagement tactics. Assess how your marketing efforts stack up.

Industry Analysis Frameworks and Models

Now, let's explore essential frameworks and models commonly used in industry analysis, providing you with practical insights and examples to help you effectively apply these tools.

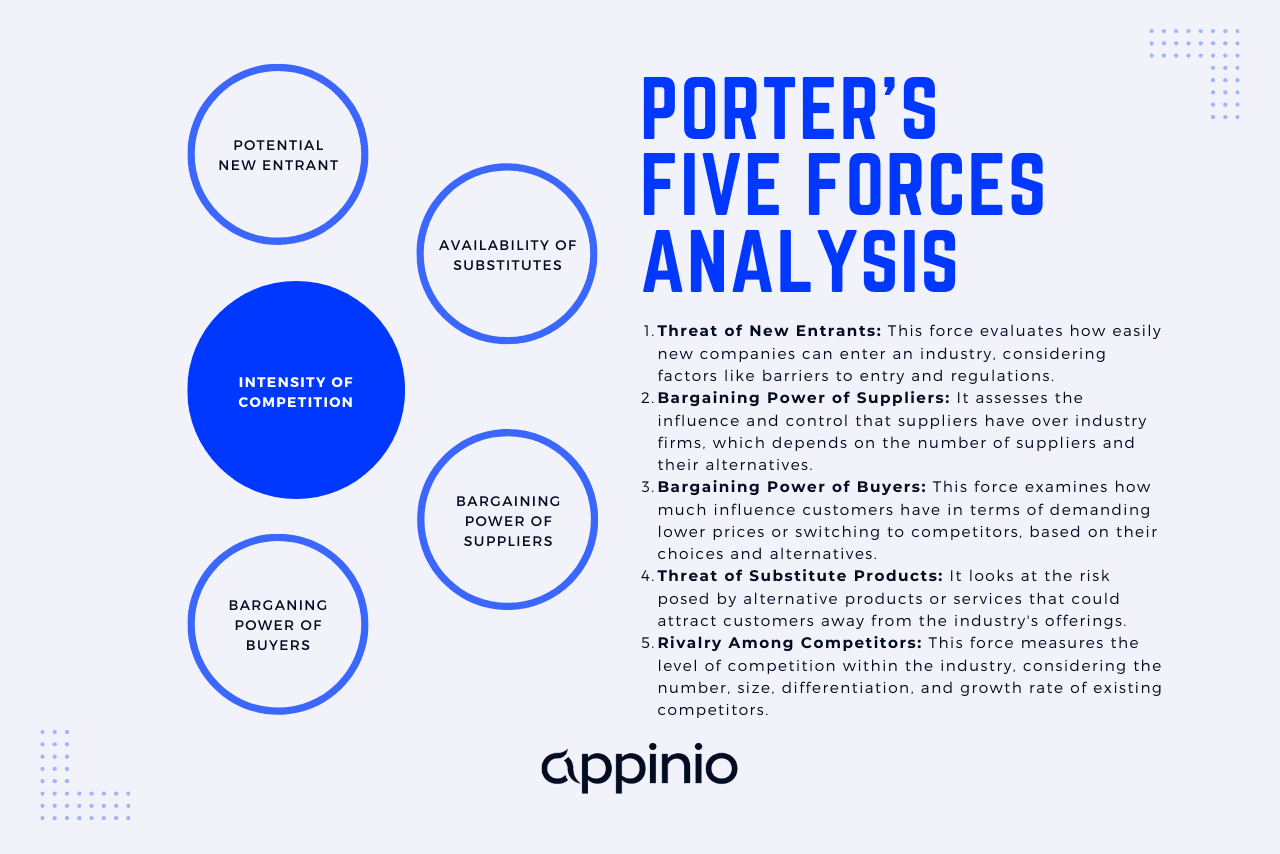

Porter's Five Forces Model

Porter's Five Forces is a powerful framework developed by Michael Porter to assess the competitive forces within an industry. This model helps you understand the industry's attractiveness and competitive dynamics.

It consists of five key forces:

- Threat of New Entrants: This force evaluates how easy or difficult it is for new companies to enter the industry. Factors that increase barriers to entry include high capital requirements, strong brand loyalty among existing players, and complex regulatory hurdles. For example, the airline industry has significant barriers to entry due to the need for large capital investments in aircraft, airport facilities, and regulatory approvals.

- Bargaining Power of Suppliers: This force examines the influence suppliers have on the industry's profitability. Powerful suppliers can demand higher prices or impose unfavorable terms. For instance, in the automotive industry, suppliers of critical components like microchips can wield significant bargaining power if they are few in number or if their products are highly specialized.

- Bargaining Power of Buyers: The bargaining power of buyers assesses how much influence customers have in negotiating prices and terms. In industries where buyers have many alternatives, such as the smartphone market, they can demand lower prices and better features, putting pressure on manufacturers to innovate and compete.

- Threat of Substitutes: This force considers the availability of substitute products or services that could potentially replace what the industry offers. For example, the rise of electric vehicles represents a significant threat to the traditional gasoline-powered automotive industry as consumers seek eco-friendly alternatives.

- Competitive Rivalry: Competitive rivalry assesses the intensity of competition among existing firms in the industry. A highly competitive industry, such as the smartphone market, often leads to price wars and aggressive marketing strategies as companies vie for market share.

Example: Let's consider the coffee shop industry . New entrants face relatively low barriers, as they can set up a small shop with limited capital. However, the bargaining power of suppliers, such as coffee bean producers, can vary depending on the region and the coffee's rarity. Bargaining power with buyers is moderate, as customers often have several coffee shops to choose from. Threats of substitutes may include energy drinks or homemade coffee, while competitive rivalry is high, with numerous coffee chains and independent cafes competing for customers.

SWOT Analysis

SWOT Analysis is a versatile tool used to assess an organization's internal strengths and weaknesses, as well as external opportunities and threats. By conducting a SWOT analysis, you can gain a comprehensive understanding of your industry and formulate effective strategies.

- Strengths: These are the internal attributes and capabilities that give your business a competitive advantage. For instance, if you're a tech company, having a talented and innovative team can be considered a strength.

- Weaknesses: Weaknesses are internal factors that hinder your business's performance. For example, a lack of financial resources or outdated technology can be weaknesses that need to be addressed.

- Opportunities: Opportunities are external factors that your business can capitalize on. This could be a growing market segment, emerging technologies, or changing consumer trends.

- Threats: Threats are external factors that can potentially harm your business. Examples of threats might include aggressive competition, economic downturns, or regulatory changes.

Example: Let's say you're analyzing the fast-food industry. Strengths could include a well-established brand, a wide menu variety, and efficient supply chain management. Weaknesses may involve a limited focus on healthy options and potential labor issues. Opportunities could include the growing trend toward healthier eating, while threats might encompass health-conscious consumer preferences and increased competition from delivery apps.

PESTEL Analysis

PESTEL Analysis examines the external macro-environmental factors that can impact your industry. The acronym stands for:

- Political: Political factors encompass government policies, stability, and regulations. For example, changes in tax laws or trade agreements can affect industries like international manufacturing.

- Economic: Economic factors include economic growth, inflation rates, and exchange rates. A fluctuating currency exchange rate can influence export-oriented industries like tourism.

- Social: Social factors encompass demographics, cultural trends, and social attitudes. An aging population can lead to increased demand for healthcare services and products.

- Technological: Technological factors involve advancements and innovations. Industries like telecommunications are highly influenced by technological developments, such as the rollout of 5G networks.

- Environmental: Environmental factors cover sustainability, climate change, and ecological concerns. Industries such as renewable energy are directly impacted by environmental regulations and consumer preferences.

- Legal: Legal factors encompass laws, regulations, and compliance requirements. The pharmaceutical industry, for instance, faces stringent regulatory oversight and patent protection laws.

Example: Consider the automobile manufacturing industry. Political factors may include government incentives for electric vehicles. Economic factors can involve fluctuations in fuel prices affecting consumer preferences for fuel-efficient cars. Social factors might encompass the growing interest in eco-friendly transportation options. Technological factors could relate to advancements in autonomous driving technology. Environmental factors may involve emissions regulations, while legal factors could pertain to safety standards and recalls.

Industry Life Cycle Analysis

Industry Life Cycle Analysis categorizes industries into various stages based on their growth and maturity. Understanding where your industry stands in its life cycle can help shape your strategies.

- Introduction: In the introduction stage, the industry is characterized by slow growth, limited competition, and a focus on product development. New players enter the market, and consumers become aware of the product or service. For instance, electric scooters were introduced as a new mode of transportation in recent years.

- Growth: The growth stage is marked by rapid market expansion, increased competition, and rising demand. Companies focus on gaining market share, and innovation is vital. The ride-sharing industry, exemplified by companies like Uber and Lyft, experienced significant growth in this stage.

- Maturity: In the maturity stage, the market stabilizes, and competition intensifies. Companies strive to maintain market share and differentiate themselves through branding and customer loyalty programs. The smartphone industry reached maturity with multiple established players.

- Decline: In the decline stage, the market saturates, and demand decreases. Companies must adapt or diversify to survive. The decline of traditional print media is a well-known example.

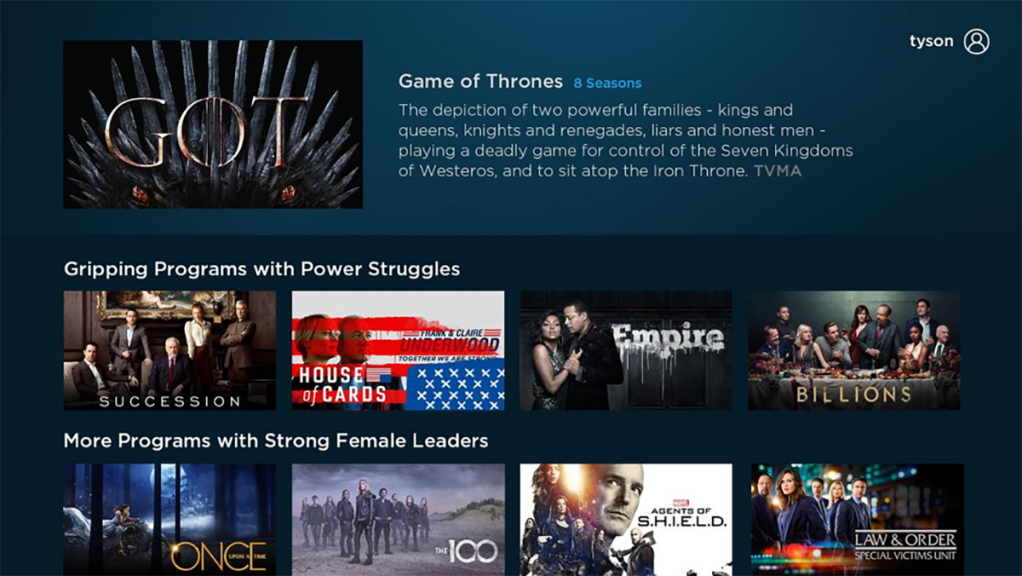

Example: Let's analyze the video streaming industry . The introduction stage saw the emergence of streaming services like Netflix. In the growth stage, more players entered the market, and the industry saw rapid expansion. The industry is currently in the maturity stage, with established platforms like Netflix, Amazon Prime, and Disney+ competing for market share. However, with continued innovation and changing consumer preferences, the decline stage may eventually follow.

Value Chain Analysis

Value Chain Analysis dissects a company's activities into primary and support activities to identify areas of competitive advantage. Primary activities directly contribute to creating and delivering a product or service, while support activities facilitate primary activities.

- Primary Activities: These activities include inbound logistics (receiving and storing materials), operations (manufacturing or service delivery), outbound logistics (distribution), marketing and sales, and customer service.

- Support Activities: Support activities include procurement (acquiring materials and resources), technology development (R&D and innovation), human resource management (recruitment and training), and infrastructure (administrative and support functions).

Example: Let's take the example of a smartphone manufacturer. Inbound logistics involve sourcing components, such as processors and displays. Operations include assembly and quality control. Outbound logistics cover shipping and distribution. Marketing and sales involve advertising and retail partnerships. Customer service handles warranty and support.

Procurement ensures a stable supply chain for components. Technology development focuses on research and development of new features. Human resource management includes hiring and training skilled engineers. Infrastructure supports the company's administrative functions.

By applying these frameworks and models effectively, you can better understand your industry, identify strategic opportunities and threats, and develop a solid foundation for informed decision-making.

Data Interpretation and Analysis

Once you have your data, it's time to start interpreting and analyzing the data you've collected during your industry analysis.

You can unlock the full potential of your data with Appinio 's comprehensive research platform. Beyond aiding in data collection, Appinio simplifies the intricate process of data interpretation and analysis. Our intuitive tools empower you to effortlessly transform raw data into actionable insights, giving you a competitive edge in understanding your industry.

Whether it's assessing market trends, evaluating the competitive landscape, or understanding customer behavior, Appinio offers a holistic solution to uncover valuable findings. With our platform, you can make informed decisions, strategize effectively, and stay ahead of industry shifts.

Experience the ease of data collection and interpretation with Appinio – book a demo today!

Book a Demo

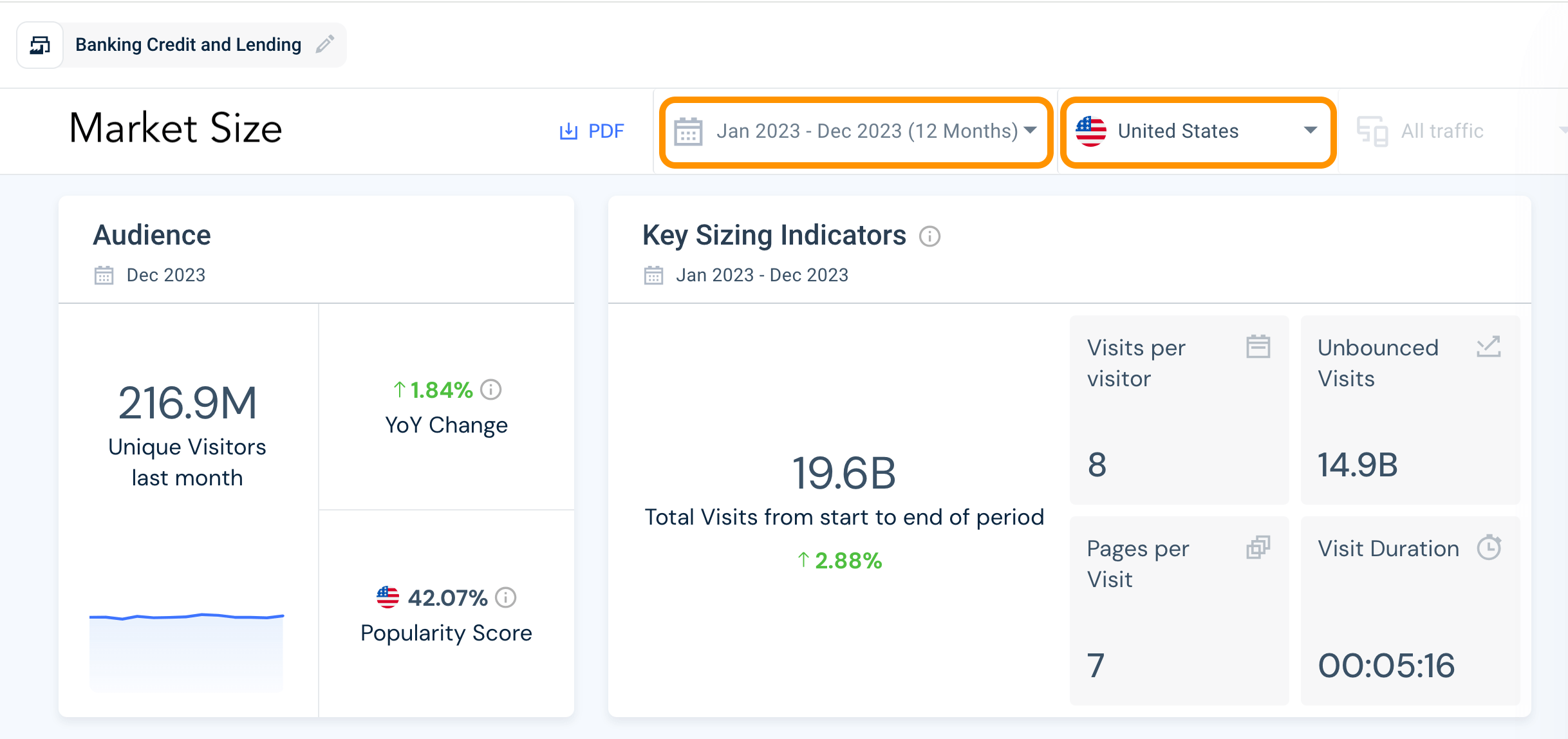

1. Analyze Market Size and Growth

Analyzing the market's size and growth is essential for understanding its dynamics and potential. Here's how to conduct a robust analysis:

- Market Size Calculation: Determine the total market size in terms of revenue, units sold, or the number of customers. This figure serves as a baseline for evaluating the industry's scale.

- Historical Growth Analysis: Examine historical data to identify growth trends. This includes looking at past year-over-year growth rates and understanding the factors that influenced them.

- Projected Growth Assessment: Explore industry forecasts and projections to gain insights into the expected future growth of the market. Consider factors such as emerging technologies, changing consumer preferences, and economic conditions.

- Segmentation Analysis: If applicable, analyze market segmentation data to identify growth opportunities in specific market segments. Understand which segments are experiencing the most significant growth and why.

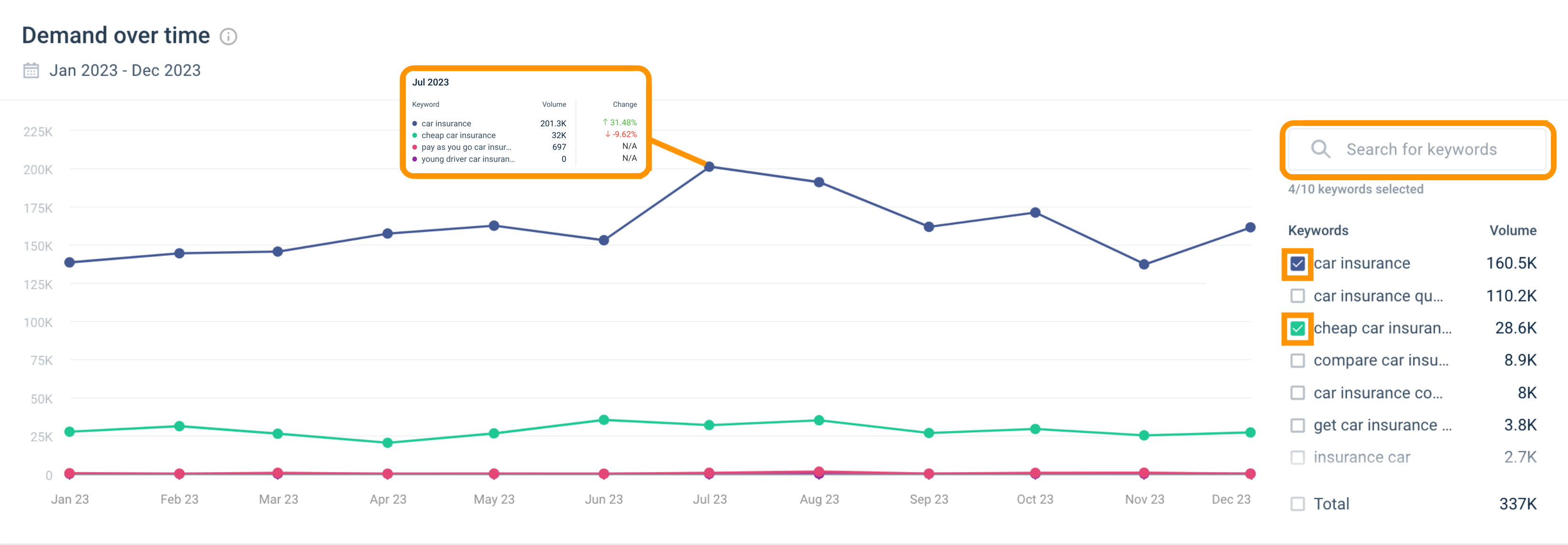

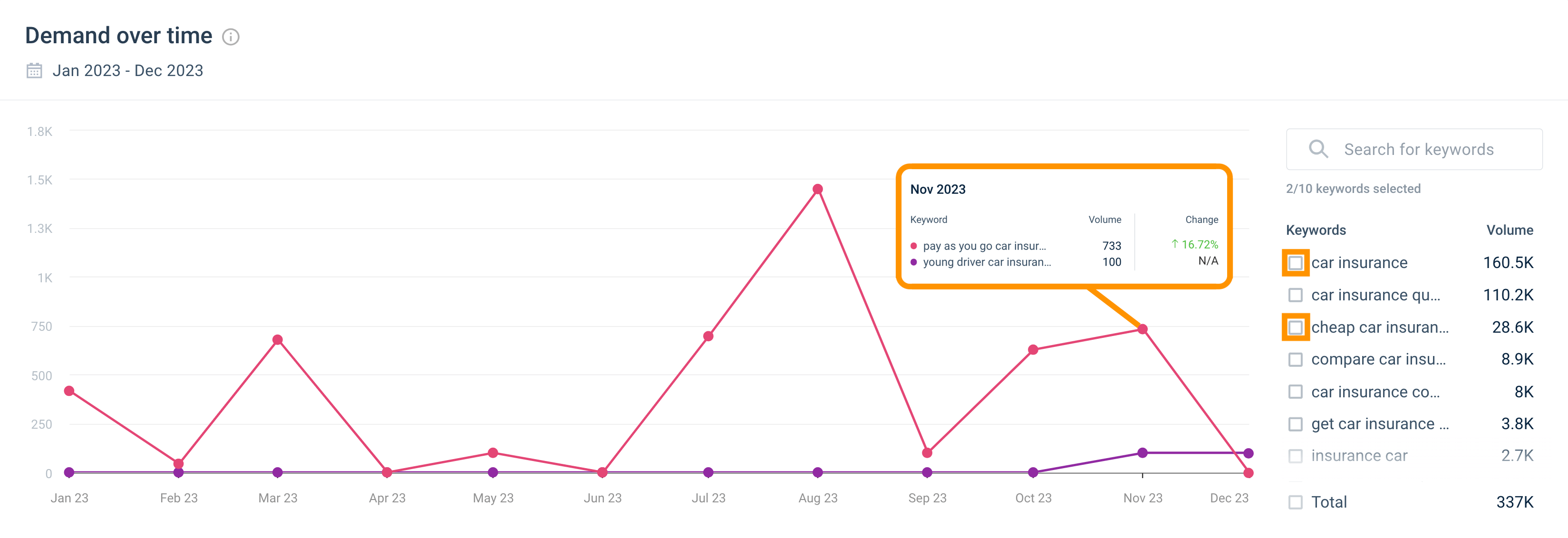

2. Assess Market Trends

Stay ahead of the curve by closely monitoring and assessing market trends. Here's how to effectively evaluate trends within your industry.

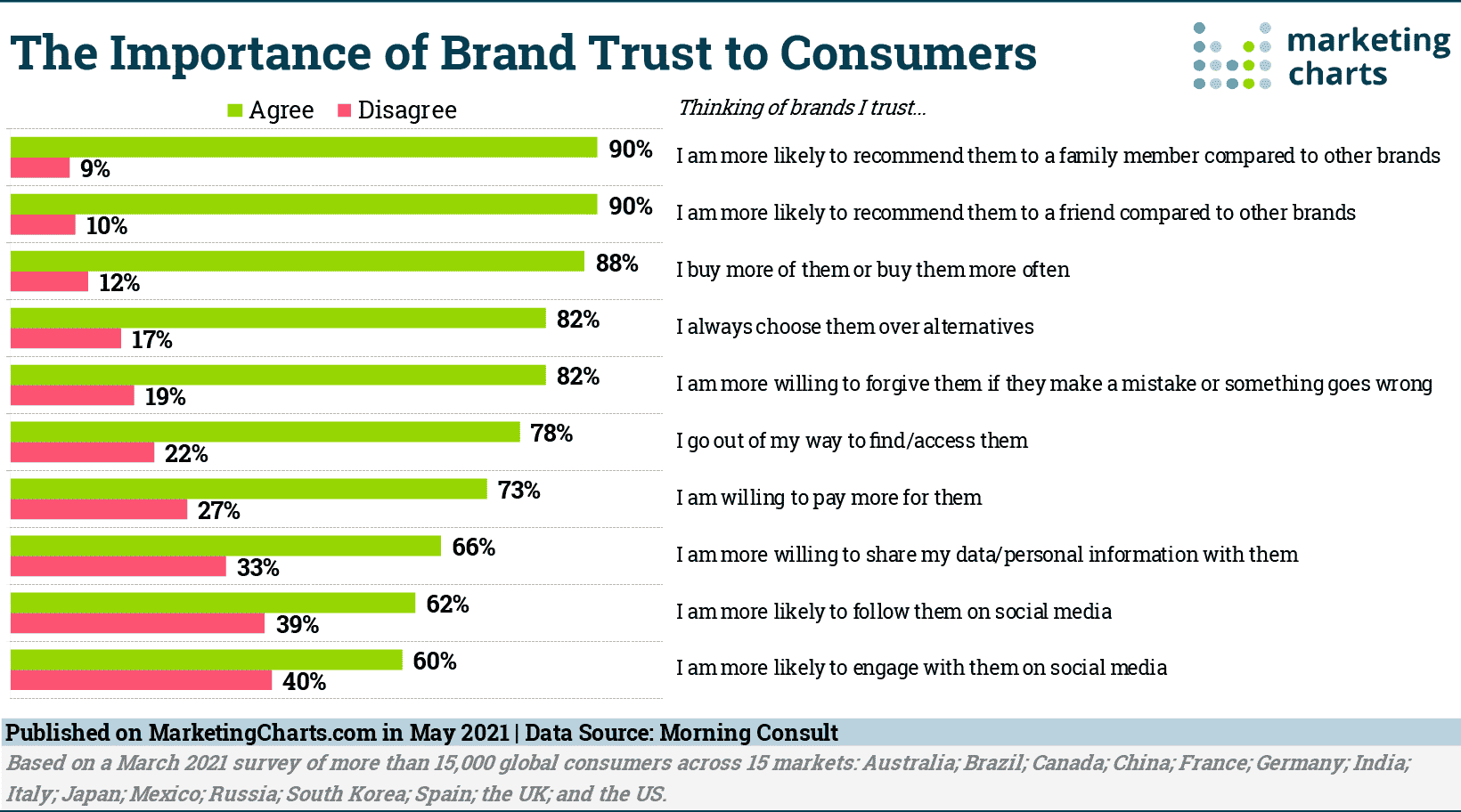

- Consumer Behavior Analysis: Dive into consumer behavior data to uncover shifts in preferences, buying patterns, and shopping habits. Understand how technological advancements and cultural changes influence consumer choices.

- Technological Advancements: Keep a keen eye on technological developments that impact your industry. Assess how innovations such as AI, IoT, blockchain, or automation are changing the competitive landscape.

- Regulatory Changes: Stay informed about regulatory shifts and their potential consequences for your industry. Regulations can significantly affect product development, manufacturing processes, and market entry strategies.

- Sustainability and Environmental Trends: Consider the growing importance of sustainability and environmental concerns. Evaluate how your industry is adapting to eco-friendly practices and how these trends affect consumer choices.

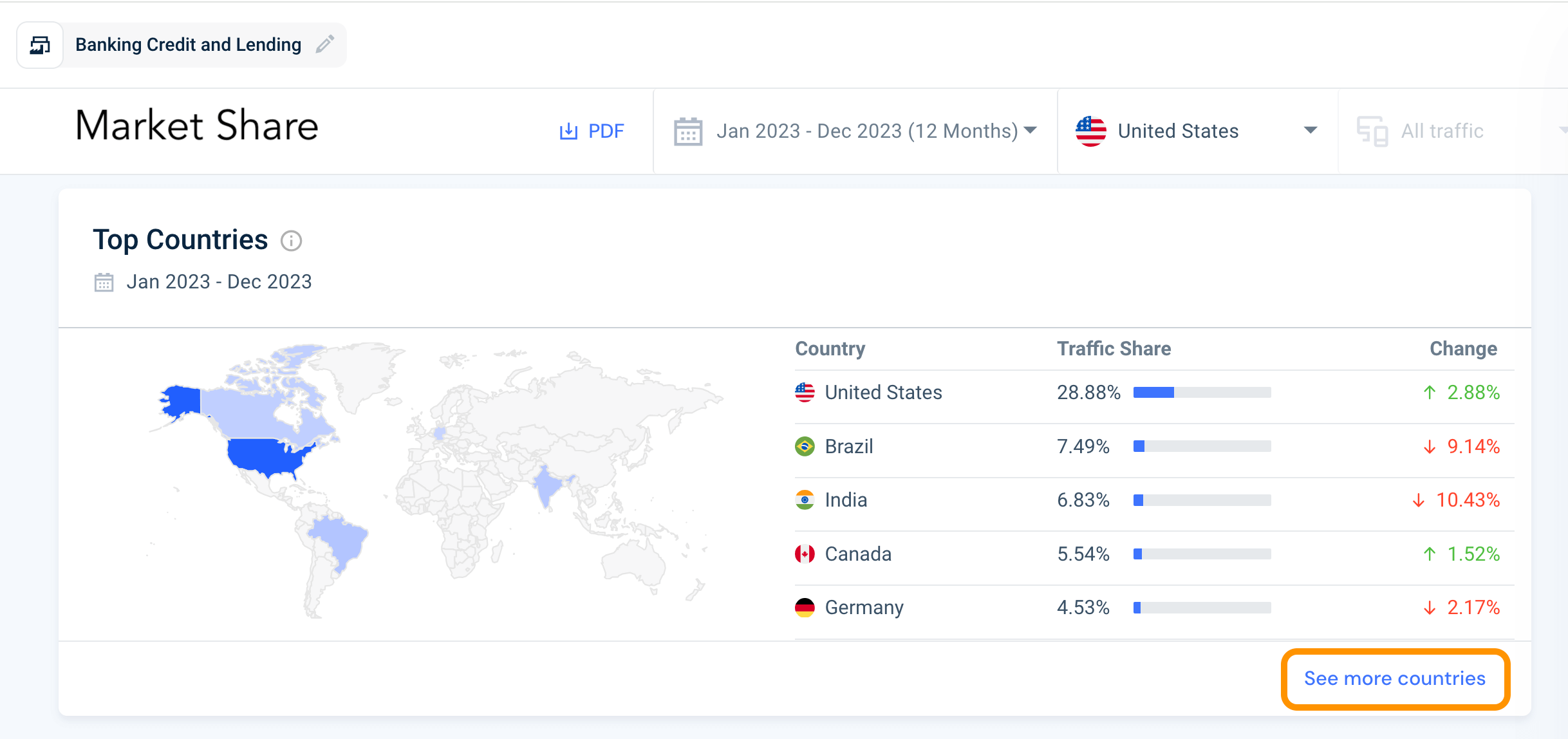

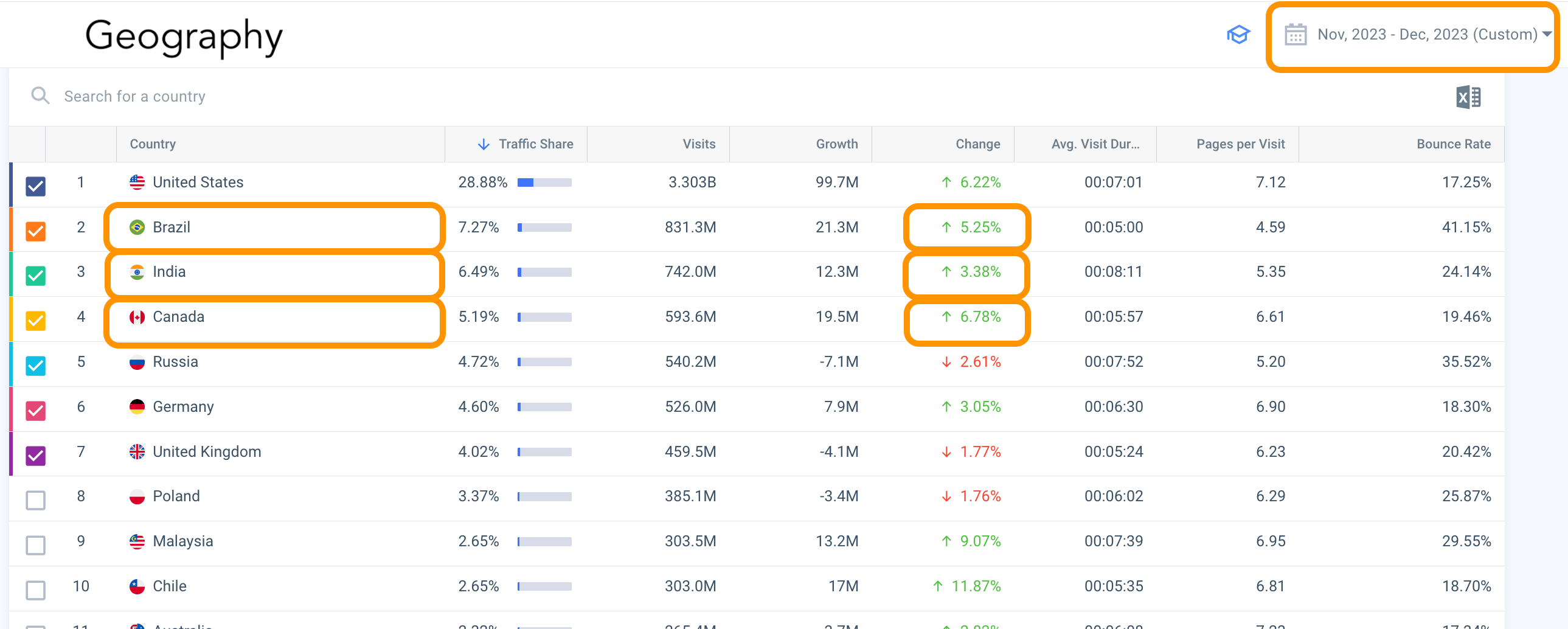

3. Evaluate Competitive Landscape

Understanding the competitive landscape is critical for positioning your business effectively. To perform a comprehensive evaluation:

- Competitive Positioning: Determine where your company stands in comparison to competitors. Identify your unique selling propositions and areas where you excel.

- Market Share Analysis: Continuously monitor market share among industry players. Identify trends in market share shifts and assess the strategies that lead to such changes.

- Competitive Advantages and Weaknesses: Analyze your competitors' strengths and weaknesses. Identify areas where you can capitalize on their weaknesses and where you need to fortify your own strengths.

4. Identify Key Success Factors

Recognizing and prioritizing key success factors is crucial for developing effective strategies. To identify and leverage these factors:

- Customer Satisfaction: Prioritize customer satisfaction as a critical success factor. Satisfied customers are more likely to become loyal advocates and contribute to long-term success.

- Quality and Innovation: Focus on product or service quality and continuous innovation. Meeting and exceeding customer expectations can set your business apart from competitors.

- Cost Efficiency: Strive for cost efficiency in your operations. Identifying cost-saving opportunities can lead to improved profitability.

- Marketing and Branding Excellence: Invest in effective marketing and branding strategies to create a strong market presence. Building a recognizable brand can drive customer loyalty and growth.

5. Analyze Customer Behavior and Preferences

Understanding your target audience is central to success. Here's how to analyze customer behavior and preferences:

- Market Segmentation: Use market segmentation to categorize customers based on demographics, psychographics , and behavior. This allows for more personalized marketing and product/service offerings.

- Customer Surveys and Feedback: Gather customer feedback through surveys and feedback mechanisms. Understand their pain points, preferences, and expectations to tailor your offerings.

- Consumer Journey Mapping: Map the customer journey to identify touchpoints where you can improve engagement and satisfaction. Optimize the customer experience to build brand loyalty.

By delving deep into data interpretation and analysis, you can gain valuable insights into your industry, uncover growth opportunities, and refine your strategic approach.

How to Conduct Competitor Analysis?

Competitor analysis is a critical component of industry analysis as it provides valuable insights into your rivals, helping you identify opportunities, threats, and areas for improvement.

1. Identify Competitors

Identifying your competitors is the first step in conducting a thorough competitor analysis. Competitors can be classified into several categories:

- Direct Competitors: These are companies that offer similar products or services to the same target audience. They are your most immediate competitors and often compete directly with you for market share.

- Indirect Competitors: Indirect competitors offer products or services that are related but not identical to yours. They may target a slightly different customer segment or provide an alternative solution to the same problem.

- Potential Competitors: These companies could enter your market in the future. Identifying potential competitors early allows you to anticipate and prepare for new entrants.

- Substitute Products or Services: While not traditional competitors, substitute products or services can fulfill the same customer needs or desires. Understanding these alternatives is crucial to your competitive strategy.

2. Analyze Competitor Strengths and Weaknesses

Once you've identified your competitors, you need to analyze their strengths and weaknesses. This analysis helps you understand how to position your business effectively and identify areas where you can gain a competitive edge.

- Strengths: Consider what your competitors excel at. This could include factors such as brand recognition, innovative products, a large customer base, efficient operations, or strong financial resources.

- Weaknesses: Identify areas where your competitors may be lacking. Weaknesses could involve limited product offerings, poor customer service, outdated technology, or financial instability.

3. Competitive Positioning

Competitive positioning involves defining how you want your business to be perceived relative to your competitors. It's about finding a unique position in the market that sets you apart. Consider the following strategies:

- Cost Leadership: Strive to be the low-cost provider in your industry. This positioning appeals to price-conscious consumers.

- Differentiation: Focus on offering unique features or attributes that make your products or services stand out. This can justify premium pricing.

- Niche Market: Target a specific niche or segment of the market that may be underserved by larger competitors. Tailor your offerings to meet their unique needs.

- Innovation and Technology: Emphasize innovation and technology to position your business as a leader in product or service quality.

- Customer-Centric: Prioritize exceptional customer service and customer experience to build loyalty and a positive reputation.

4. Benchmarking and Gap Analysis

Benchmarking involves comparing your business's performance and practices with those of your competitors or industry leaders. Gap analysis helps identify areas where your business falls short and where improvements are needed.

- Performance Benchmarking: Compare key performance metrics, such as revenue, profitability, market share, and customer satisfaction, with those of your competitors. Identify areas where your performance lags behind or exceeds industry standards.

- Operational Benchmarking: Analyze your operational processes, supply chain, and cost structures compared to your competitors. Look for opportunities to streamline operations and reduce costs.

- Product or Service Benchmarking: Evaluate the features, quality, and pricing of your products or services relative to competitors. Identify gaps and areas for improvement.

- Marketing and Sales Benchmarking: Assess your marketing strategies, customer acquisition costs, and sales effectiveness compared to competitors. Determine whether your marketing efforts are performing at a competitive level.

Market Entry and Expansion Strategies

Market entry and expansion strategies are crucial for businesses looking to enter new markets or expand their presence within existing ones. These strategies can help you effectively target and penetrate your chosen markets.

Market Segmentation and Targeting

- Market Segmentation: Begin by segmenting your target market into distinct groups based on demographics , psychographics, behavior, or other relevant criteria. This helps you understand the diverse needs and preferences of different customer segments.

- Targeting: Once you've segmented the market, select specific target segments that align with your business goals and capabilities. Tailor your marketing and product/service offerings to appeal to these chosen segments.

Market Entry Modes

Selecting the proper market entry mode is crucial for a successful expansion strategy. Entry modes include:

- Exporting: Sell your products or services in international markets through exporting. This is a low-risk approach, but it may limit your market reach.

- Licensing and Franchising: License your brand, technology, or intellectual property to local partners or franchisees. This allows for rapid expansion while sharing the risk and control.

- Joint Ventures and Alliances: Partner with local companies through joint ventures or strategic alliances. This approach leverages local expertise and resources.

- Direct Investment: Establish a physical presence in the target market through subsidiaries, branches, or wholly-owned operations. This offers full control but comes with higher risk and investment.

Competitive Strategy Formulation

Your competitive strategy defines how you will compete effectively in the target market.

- Cost Leadership: Strive to offer products or services at lower prices than competitors while maintaining quality. This strategy appeals to price-sensitive consumers.

- Product Differentiation: Focus on offering unique and innovative products or services that stand out in the market. This strategy justifies premium pricing.

- Market Niche: Target a specific niche or segment within the market that is underserved or has particular needs. Tailor your offerings to meet the unique demands of this niche.

- Market Expansion : Expand your product or service offerings to capture a broader share of the market. This strategy involves diversifying your offerings to appeal to a broader audience.

- Global Expansion: Consider expanding internationally to tap into new markets and diversify your customer base. This strategy involves thorough market research and adaptation to local cultures and regulations.

International Expansion Considerations

If your expansion strategy involves international markets, there are several additional considerations to keep in mind.

- Market Research: Conduct in-depth market research to understand the target country's cultural, economic, and legal differences.

- Regulatory Compliance: Ensure compliance with international trade regulations, customs, and import/export laws.

- Cultural Sensitivity: Adapt your marketing and business practices to align with the cultural norms and preferences of the target market.

- Localization: Consider adapting your products, services, and marketing materials to cater to local tastes and languages.

- Risk Assessment: Evaluate the political, economic, and legal risks associated with operating in the target country. Develop risk mitigation strategies.

By carefully analyzing your competitors and crafting effective market entry and expansion strategies, you can position your business for success in both domestic and international markets.

Risk Assessment and Mitigation

Risk assessment and mitigation are crucial aspects of industry analysis and strategic planning. Identifying potential risks, assessing vulnerabilities, and implementing effective risk management strategies are essential for business continuity and success.

1. Identify Industry Risks

- Market Risks: These risks pertain to factors such as changes in market demand, economic downturns, shifts in consumer preferences, and fluctuations in market prices. For example, the hospitality industry faced significant market risks during the COVID-19 pandemic, resulting in decreased travel and tourism .

- Regulatory and Compliance Risks: Regulatory changes, compliance requirements, and government policies can pose risks to businesses. Industries like healthcare are particularly susceptible to regulatory changes that impact operations and reimbursement.

- Technological Risks: Rapid technological advancements can disrupt industries and render existing products or services obsolete. Companies that fail to adapt to technological shifts may face obsolescence.

- Operational Risks: These risks encompass internal factors that can disrupt operations, such as supply chain disruptions, equipment failures, or cybersecurity breaches.

- Financial Risks: Financial risks include factors like liquidity issues, credit risk , and market volatility. Industries with high capital requirements, such as real estate development, are particularly vulnerable to financial risks.

- Competitive Risks: Intense competition and market saturation can pose challenges to businesses. Failing to respond to competitive threats can result in loss of market share.

- Global Risks: Industries with a worldwide presence face geopolitical risks, currency fluctuations, and international trade uncertainties. For instance, the automotive industry is susceptible to trade disputes affecting the supply chain.

2. Assess Business Vulnerabilities

- SWOT Analysis: Revisit your SWOT analysis to identify internal weaknesses and threats. Assess how these weaknesses may exacerbate industry risks.

- Financial Health: Evaluate your company's financial stability, debt levels, and cash flow. Identify vulnerabilities related to financial health that could hinder your ability to withstand industry-specific challenges.

- Operational Resilience: Assess the robustness of your operational processes and supply chain. Identify areas where disruptions could occur and develop mitigation strategies.

- Market Positioning: Analyze your competitive positioning and market share. Recognize vulnerabilities in your market position that could be exploited by competitors.

- Compliance and Regulatory Adherence: Ensure that your business complies with relevant regulations and standards. Identify vulnerabilities related to non-compliance or regulatory changes.

3. Risk Management Strategies

- Risk Avoidance: In some cases, the best strategy is to avoid high-risk ventures or markets altogether. This may involve refraining from entering certain markets or discontinuing products or services with excessive risk.

- Risk Reduction: Implement measures to reduce identified risks. For example, diversifying your product offerings or customer base can reduce dependence on a single revenue source.

- Risk Transfer: Transfer some risks through methods such as insurance or outsourcing. For instance, businesses can mitigate cybersecurity risks by purchasing cyber insurance.

- Risk Acceptance: In cases where risks cannot be entirely mitigated, it may be necessary to accept a certain level of risk and have contingency plans in place to address potential issues.

- Continuous Monitoring: Establish a system for continuous risk monitoring. Regularly assess the changing landscape and adjust risk management strategies accordingly.

4. Contingency Planning

Contingency planning involves developing strategies and action plans to respond effectively to unforeseen events or crises. It ensures that your business can maintain operations and minimize disruptions in the face of adverse circumstances. Key elements of contingency planning include:

- Risk Scenarios: Identify potential risk scenarios specific to your industry and business. These scenarios should encompass a range of possibilities, from minor disruptions to major crises.

- Response Teams: Establish response teams with clearly defined roles and responsibilities. Ensure that team members are trained and ready to act in the event of a crisis.

- Communication Plans: Develop communication plans that outline how you will communicate with employees, customers, suppliers, and other stakeholders during a crisis. Transparency and timely communication are critical.

- Resource Allocation: Determine how resources, including personnel, finances, and equipment, will be allocated in response to various scenarios.

- Testing and Simulation: Regularly conduct tests and simulations of your contingency plans to identify weaknesses and areas for improvement. Ensure your response teams are well-practiced and ready to execute the plans effectively.

- Documentation and Record Keeping: Maintain comprehensive documentation of contingency plans, response procedures, and communication protocols. This documentation should be easily accessible to relevant personnel.

- Review and Update: Continuously review and update your contingency plans to reflect changing industry dynamics and evolving risks. Regularly seek feedback from response teams to make improvements.

By identifying industry risks, assessing vulnerabilities, implementing risk management strategies, and developing robust contingency plans, your business can navigate the complexities of the industry landscape with greater resilience and preparedness.

Industry Analysis Template

When embarking on the journey of Industry Analysis, having a well-structured template is akin to having a reliable map for your exploration. It provides a systematic framework to ensure you cover all essential aspects of the analysis. Here's a breakdown of an industry analysis template with insights into each section.

Industry Overview

- Objective: Provide a broad perspective of the industry.

- Market Definition: Define the scope and boundaries of the industry, including its products, services, and target audience.

- Market Size and Growth: Present current market size, historical growth trends, and future projections.

- Key Players: Identify major competitors and their market share.

- Market Trends: Highlight significant trends impacting the industry.

Competitive Analysis

- Objective: Understand the competitive landscape within the industry.

- Competitor Identification: List direct and indirect competitors.

- Competitor Profiles: Provide detailed profiles of major competitors, including their strengths, weaknesses, strategies, and market positioning.

- SWOT Analysis: Conduct a SWOT analysis for each major competitor.

- Market Share Analysis: Analyze market share distribution among competitors.

Market Analysis

- Objective: Explore the characteristics and dynamics of the market.

- Customer Segmentation: Define customer segments and their demographics, behavior, and preferences.

- Demand Analysis: Examine factors driving demand and customer buying behavior.

- Supply Chain Analysis: Map out the supply chain, identifying key suppliers and distribution channels.

- Regulatory Environment: Discuss relevant regulations, policies, and compliance requirements.

Technological Analysis

- Objective: Evaluate the technological landscape impacting the industry.

- Technological Trends: Identify emerging technologies and innovations relevant to the industry.

- Digital Transformation: Assess the level of digitalization within the industry and its impact on operations and customer engagement.

- Innovation Opportunities: Explore opportunities for leveraging technology to gain a competitive edge.

Financial Analysis

- Objective: Analyze the financial health of the industry and key players.

- Revenue and Profitability: Review industry-wide revenue trends and profitability ratios.

- Financial Stability: Assess financial stability by examining debt levels and cash flow.

- Investment Patterns: Analyze capital expenditure and investment trends within the industry.

Consumer Insights

- Objective: Understand consumer behavior and preferences.

- Consumer Surveys: Conduct surveys or gather data on consumer preferences, buying habits , and satisfaction levels.

- Market Perception: Gauge consumer perception of brands and products in the industry.

- Consumer Feedback: Collect and analyze customer feedback and reviews.

SWOT Analysis for Your Business

- Objective: Assess your own business within the industry context.

- Strengths: Identify internal strengths that give your business a competitive advantage.

- Weaknesses: Recognize internal weaknesses that may hinder your performance.

- Opportunities: Explore external opportunities that your business can capitalize on.

- Threats: Recognize external threats that may impact your business.

Conclusion and Recommendations

- Objective: Summarize key findings and provide actionable recommendations.

- Summary: Recap the most critical insights from the analysis.

- Recommendations: Offer strategic recommendations for your business based on the analysis.

- Future Outlook: Discuss potential future developments in the industry.

While this template provides a structured approach, adapt it to the specific needs and objectives of your Industry Analysis. It serves as your guide, helping you navigate through the complex landscape of your chosen industry, uncovering opportunities, and mitigating risks along the way.

Remember that the depth and complexity of your industry analysis may vary depending on your specific goals and the industry you are assessing. You can adapt this template to focus on the most relevant aspects and conduct thorough research to gather accurate data and insights. Additionally, consider using industry-specific data sources, reports, and expert opinions to enhance the quality of your analysis.

Industry Analysis Examples

To grasp the practical application of industry analysis, let's delve into a few diverse examples across different sectors. These real-world scenarios demonstrate how industry analysis can guide strategic decision-making.

Tech Industry - Smartphone Segment

Scenario: Imagine you are a product manager at a tech company planning to enter the smartphone market. Industry analysis reveals that the market is highly competitive, dominated by established players like Apple and Samsung.

Use of Industry Analysis:

- Competitive Landscape: Analyze the strengths and weaknesses of competitors, identifying areas where they excel (e.g., Apple's brand loyalty ) and where they might have vulnerabilities (e.g., consumer demand for more affordable options).

- Market Trends: Identify trends like the growing demand for sustainable technology and 5G connectivity, guiding product development and marketing strategies.

- Regulatory Factors: Consider regulatory factors related to intellectual property rights, patents, and international trade agreements that can impact market entry and operations.

- Outcome: Armed with insights from industry analysis, you decide to focus on innovation, emphasizing features like eco-friendliness and affordability. This niche approach helps your company gain a foothold in the competitive market.

Healthcare Industry - Telehealth Services

Scenario: You are a healthcare entrepreneur exploring opportunities in the telehealth sector, especially in the wake of the COVID-19 pandemic. Industry analysis is critical due to rapid market changes.

- Market Size and Growth: Evaluate the growing demand for telehealth services, driven by the need for remote healthcare during the pandemic and convenience factors.

- Regulatory Environment: Understand the evolving regulatory landscape, including changes in telemedicine reimbursement policies and licensing requirements.

- Technological Trends: Explore emerging technologies such as AI-powered diagnosis and remote monitoring that can enhance service offerings.

- Outcome: Industry analysis underscores the potential for telehealth growth. You adapt your business model to align with regulatory changes, invest in cutting-edge technology, and focus on patient-centric care, positioning your telehealth service for success.

Food Industry - Plant-Based Foods

Scenario: As a food industry entrepreneur , you are considering entering the plant-based foods market, driven by increasing consumer interest in health and sustainability.

- Market Trends: Analyze the trend toward plant-based diets and sustainability, reflecting changing consumer preferences.

- Competitive Landscape: Assess the competitive landscape, understanding that established companies and startups are vying for market share.

- Consumer Behavior: Study consumer behavior, recognizing that health-conscious consumers seek plant-based alternatives.

- Outcome: Informed by industry analysis, you launch a line of plant-based products emphasizing both health benefits and sustainability. Effective marketing and product quality gain traction among health-conscious consumers, making your brand a success in the plant-based food industry.

These examples illustrate how industry analysis can guide strategic decisions, whether entering competitive tech markets, navigating dynamic healthcare regulations, or capitalizing on shifting consumer preferences in the food industry. By applying industry analysis effectively, businesses can adapt, innovate, and thrive in their respective sectors.

Industry Analysis is the compass that helps businesses chart their course in the vast sea of markets. By understanding the industry's dynamics, risks, and opportunities, you gain a strategic advantage that can steer your business towards success. From identifying competitors to mitigating risks and formulating competitive strategies, this guide has equipped you with the tools and knowledge needed to navigate the complexities of the business world.

Remember, Industry Analysis is not a one-time task; it's an ongoing journey. Keep monitoring market trends, adapting to changes, and staying ahead of the curve. With a solid foundation in industry analysis, you're well-prepared to tackle challenges, seize opportunities, and make well-informed decisions that drive your business toward prosperity. So, set sail with confidence and let industry analysis be your guiding star on the path to success.

How to Conduct Industry Analysis in Minutes?

Introducing Appinio , the real-time market research platform that transforms how you conduct Industry Analysis. Imagine getting real-time consumer insights in minutes, putting the power of data-driven decision-making at your fingertips. With Appinio, you can:

- Gain insights swiftly: Say goodbye to lengthy research processes. Appinio delivers answers fast, ensuring you stay ahead in the competitive landscape.

- No research degree required: Our intuitive platform is designed for everyone. You don't need a PhD in research to harness its capabilities.