Medicare Interactive Medicare answers at your fingertips -->

Participating, non-participating, and opt-out providers, outpatient provider services.

You must be logged in to bookmark pages.

Email Address * Required

Password * Required

Lost your password?

If you have Original Medicare , your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare . A provider’s type determines how much you will pay for Part B -covered services.

- These providers are required to submit a bill (file a claim ) to Medicare for care you receive. Medicare will process the bill and pay your provider directly for your care. If your provider does not file a claim for your care, there are troubleshooting steps to help resolve the problem .

- If you see a participating provider , you are responsible for paying a 20% coinsurance for Medicare-covered services.

- Certain providers, such as clinical social workers and physician assistants, must always take assignment if they accept Medicare.

- Non-participating providers can charge up to 15% more than Medicare’s approved amount for the cost of services you receive (known as the limiting charge ). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare’s approved amount for covered services.

- Some states may restrict the limiting charge when you see non-participating providers. For example, New York State’s limiting charge is set at 5%, instead of 15%, for most services. For more information, contact your State Health Insurance Assistance Program (SHIP) .

- If you pay the full cost of your care up front, your provider should still submit a bill to Medicare. Afterward, you should receive from Medicare a Medicare Summary Notice (MSN) and reimbursement for 80% of the Medicare-approved amount .

- The limiting charge rules do not apply to durable medical equipment (DME) suppliers . Be sure to learn about the different rules that apply when receiving services from a DME supplier .

- Medicare will not pay for care you receive from an opt-out provider (except in emergencies). You are responsible for the entire cost of your care.

- The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you.

- Opt-out providers do not bill Medicare for services you receive.

- Many psychiatrists opt out of Medicare.

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you. However, they can still charge you a 20% coinsurance and any applicable deductible amount.

Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Update your browser to view this website correctly. Update my browser now

Medicare Reimbursement: When and How to Get Reimbursed

Written by: Corey Whelan

Reviewed by: Eboni Onayo, Licensed Insurance Agent

Key Takeaways

Medicare reimbursement payments are made to beneficiaries who pay Medicare’s portion of their bill out-of-pocket.

Medicare reimbursement also can refer to payments made to doctors who accept Medicare assignment and perform healthcare services.

If you have Original Medicare Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities. Original Medicare is provided by the federal government and is made up of two parts: Part A (hospital insurance) and Part B (medical insurance). , you need to use a specific form when you apply for reimbursement. You also need a copy of your doctor’s bill.

If you have Medicare Advantage Medicare Advantage ( Medicare Part C ) is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare (Parts A and B) and Medicare Prescription Drug Plan (Part D). , you will file for reimbursement directly through your plan, not through Medicare.

If you have Part D drug coverage Medicare Part D is prescription drug coverage for people enrolled in Medicare. Part D is optional and is offered by private insurance companies. , you will fill out a form called a Coverage Determination Request and submit it to your Part D sponsor.

What is a Medicare Reimbursement?

If you are asked to pay more for healthcare than you are supposed to based on your Medicare coverage, you are eligible for Medicare reimbursement.

Doctors, providers and facilities also receive a form of Medicare reimbursement when they are paid by Medicare for approved services or items they provide. When you foot more of that bill than you’re supposed to based on your coverage, you are due reimbursement.

As a Medicare beneficiary, you probably see providers who accept Medicare assignment. You may have out-of-pocket costs such as copays and coinsurance you’re responsible for and expect to pay.

Occasionally, you may see a doctor or provider who doesn’t accept Medicare. Or you may go to a hospital or see a doctor who bills you for the full amount, instead of billing Medicare directly. When this happens, you can file a claim with Medicare, requesting reimbursement for that portion of your bill. Medicare reimbursement rates will depend on the details of your coverage.

Who is eligible for Medicare reimbursement?

Any Medicare beneficiary who pays their entire healthcare bill upfront, rather than only their specified portion, is entitled to Medicare reimbursement. Reimbursement may be full or partial, based upon the services received and the agreement the provider has with Medicare.

Any doctor, provider or facility that accepts Medicare assignment is eligible for Medicare reimbursement. Non-participating Medicare providers who agree to accept Medicare for specific procedures or services are also eligible for Medicare reimbursement.

While that’s true, the form of Medicare reimbursement that matters to you is the money you are due to be paid when you overpay. If that happens, here’s what you do.

Looking for dental, vision and hearing coverage?

Original Medicare (Part A and Part B) Reimbursement

Medicare establishes reimbursement rates for all the healthcare services and items they cover. Providers who accept Medicare agree to these fees and cannot charge patients more for them. This includes inpatient services paid for under Medicare Part A . It also includes outpatient services paid for under Medicare Part B . Part A and Part B are the two parts that comprise Original Medicare.

When you see a doctor that accepts Medicare assignment, you will be required to pay your portion of the Medicare-approved amount for the service provided.

If you see a doctor who doesn’t accept Medicare assignment, they may not file a claim with Medicare for their services. They may also charge you up to 15% more than the Medicare rate. This is known as an excess charge.

Sometimes, a hospital may fail to file a claim with Medicare. You may also receive a bill from a doctor who doesn’t accept Medicare assignment. This sometimes happens when you are a hospital inpatient. It can also happen when you receive care or testing in an emergency room setting. If you receive a bill from a doctor or hospital that you weren’t expecting, ask them if they accept Medicare assignment and if they have already billed Medicare. If they are not willing or able to submit a claim, you can file for Medicare reimbursement.

Medicare Advantage Reimbursement

Medicare Advantage (Part C) is an alternative way to get Medicare benefits. Part C plans are purchased through private insurers.

If you have a Part C plan, you don’t file for reimbursement from Medicare. Instead, you file a claim with the insurer who manages your plan. Your insurer will be able to provide you with the appropriate form you need to use. This is typically done when you see a doctor who is out of your plan’s network.

Part C plans usually have a provider network of doctors, pharmacies, suppliers and facilities. If you choose to see a doctor out of network, your out-of-pocket costs will be higher. If you pay the full amount of your bill, you can file a reimbursement claim for your plan’s portion of it directly with your insurer. Part C plans usually pay a lower amount for out-of-network physicians and suppliers than they do for those in-network.

Start your Medicare PlanFit CheckUp today.

Medicare Part D Prescription Reimbursement

Part D is prescription drug coverage you obtain through a private insurer. Part D plans have a formulary that includes the medications they cover, as well as the costs you can expect to pay for your prescriptions.

When you fill a prescription either in person or online, your pharmacist will inform you if your cost is higher than expected. They will also let you know if your provider doesn’t cover the medication you need. When a drug isn’t in your formulary, you may pay for it out-of-pocket or choose an alternative medication that your plan covers. Medications that aren’t included in a plan’s formulary are not usually reimbursed by the plan.

If you pay the full amount for a medication or vaccine that your plan covers, you can file for reimbursement. This sometimes occurs when you use an out-of-network pharmacy. It may also happen when you use an in-network pharmacy, although this is less common. In these instances, you need to file a Coverage Determination Request in order to receive Medicare reimbursement. A Coverage Determination Request refers to any decision made about your coverage by your Part D plan insurer.

Medicare Reimbursement Forms

If you have Original Medicare and wish to file for reimbursement, you need CMS Form 1490-S TRUSTED & VERIFIED cms.gov , the Patient’s Request for Medical Payment. This form is available in English and in Spanish.

You’ll provide information about the claim including your name, address, Medicare number, and other contact information. You’ll also need to give the exact date and place of service, your diagnosis and information about the reason why you required medical services. You will also need to submit an itemized bill from your doctor in addition to the form.

Your completed form should be mailed directly to the Medicare contractor who oversees the processing of your claims. A state list of Medicare contractors appears in the instructions section of the form. If you need more information or aren’t sure where to send your form, contact Medicare at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

For Part D reimbursements you will use a Model Coverage Determination Request Form. [i]

For Part C reimbursements, contact your health insurance company. They will point you to the appropriate form you need to use and provide instructions on how to file a claim.

Coverage Determinations TRUSTED & VERIFIED cms.gov . CMS.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

CMS.gov: Official Site Medicare & Medicaid Resources

Medicare Claims Address

Medicare Claims Address: Filing Claims by Mail

Medicare.gov

Medicare.gov: Tips for Navigating the Official Medicare Website

Medicare Office Near Me

Find a Medicare Office and Local Medicare Resources Near You

Medicare Appeals

The Medicare Appeals Process

Medicare Phone Number

Medicare Administration

Social Security & Railroad Benefits

Get On Track: Railroad Retirement and Social Security

Let’s see if you qualify for Medicare savings today!

The independent source for health policy research, polling, and news.

What to Know About How Medicare Pays Physicians

Alex Cottrill , Juliette Cubanski , and Tricia Neuman Published: Mar 06, 2024

More than 65 million people— nearly 20% of the U.S. population —receive their health insurance coverage through the federal Medicare program. In 2021, Medicare spending comprised one-fifth (21%) of national health care spending and 13% of the federal budget . The largest share of total Medicare spending ( 48% in 2021 ) is dedicated to Part B services, including physician services, outpatient services, and physician-administered drugs, and accounts for 26% of national payments for physician and clinical services.

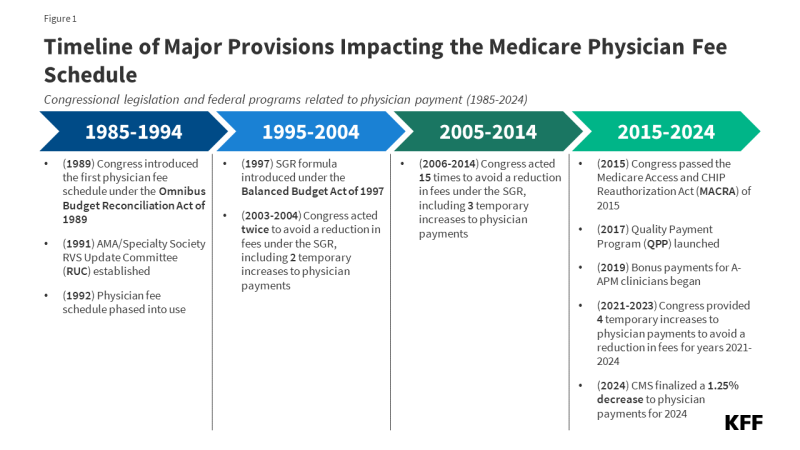

Each year, the Centers for Medicare and Medicaid Services (CMS) updates Medicare payments to physicians and other clinicians through rulemaking, based on parameters established under law. In November 2023, CMS finalized a 3.4% decrease in the physician fee schedule conversion factor, a key aspect of payment rates under the Medicare program, resulting in a 1.25% decrease in overall payments that is expected to vary by specialty . These changes, along with several others, went into effect on January 1, 2024 (Figure 1). Congress is expected to vote on legislation that would mitigate these payment reductions temporarily, from March 9, 2024 through the remainder of the year.

Figure 1: Timeline of Major Provisions Impacting the Medicare Physician Fee Schedule

Physician and other professional groups, including the American Medical Association, the Medical Group Management Association, and the American Hospital Association, have opposed the payment cuts and expressed concerns that loss of revenue could push physicians to opt out of the Medicare program, leading to access problems for Medicare beneficiaries. Physicians are not required to take Medicare patients, but most do; just 1% opted out of the program in 2023.

The new legislation that adjusts physician payments through the remainder of the year is one of several recent proposals from policymakers aimed at canceling out or mitigating these payment reductions. Since 2020, Congress has enacted four temporary, one-year increases to physician payment rates to avoid reductions in fees. Others, including MedPAC , have proposed broader changes to address concerns with the current payment system. A bipartisan group of senators recently announced the formation of a Medicare payment reform working group, with the goal of investigating long-term reforms to the physician fee schedule, and additional legislation is expected later in the year.

This issue brief answers key questions about how physicians are paid under the Medicare program, and reviews policy options under discussion for payment reform. The brief is focused primarily on the physician payment system used in traditional Medicare, as Medicare Advantage plans have flexibility to pay providers differently; currently there is no information on how much Medicare Advantage plans pay providers. (See Appendix for a glossary of relevant programs, legislation, and terms.)

1. What is the Medicare physician fee schedule?

Medicare reimburses physicians and other clinicians based on the physician fee schedule , which assigns payment rates for more than 10,000 health care services , such as office visits, diagnostic procedures, or surgical procedures. For services provided to traditional Medicare beneficiaries, Medicare typically pays the provider 80% of the fee schedule amount, with the beneficiary responsible for a maximum of 20% in coinsurance. Physicians who participate in Medicare agree to accept this arrangement as payment in full (known as accepting “assignment”) for all Medicare covered services. Others, known as non-participating physicians, may accept “assignment” on a claim-by-claim basis and may choose to bill for larger amounts by charging additional coinsurance, up to a limit. Physicians who opt out of the program altogether enter into private contracts with their Medicare patients, are not limited to charging fee schedule amounts, and do not receive any reimbursement from Medicare.

Fee schedule rates for a given service are based on a weighted sum of three components: clinician work, practice expenses, and professional liability insurance (also known as medical malpractice insurance), measured in terms of relative value units (RVUs). Together these three components represent the overall cost and effort associated with a given service, with more costly or time-intensive services receiving a higher weighted sum. Each component is adjusted to account for geographic differences in input costs, and the result is multiplied by the fee schedule conversion factor (an annually adjusted scaling factor that converts numerical RVUs into payment amounts in dollars).

Payment rates specified under the physician fee schedule establish a baseline amount that Medicare will pay for a given service, but payments may be adjusted based on other factors, such as the site of service, the type of clinician providing the service, and whether the service was provided in a designated health professional shortage area . Physicians can also receive quality-based payment adjustments under the Quality Payment Program (QPP) (see question 6).

2. How does Medicare update physician payment rates?

Annual updates to the physician fee schedule include statutorily-required updates to the conversion factor under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) (see question 5), as well as other adjustments to reflect the addition of new services, changes in input costs for existing services, and other factors. A multispecialty committee of physicians and other professionals, known as the AMA/Specialty Society RVS Update Committee (RUC) , issues annual recommendations to advise CMS on the weighting of new or revised service codes.

Under current law, the projected cost of all changes to the physician fee schedule must be budget neutral, that is, the changes may not raise total Medicare spending by more than $20 million in a given year. This requirement was established by the Omnibus Budget Reconciliation Act of 1989 to address concerns that constraints on physician fees for specific services would lead to increases in service volume, potentially driving growth in Medicare spending for physician services over time. The law requires CMS to adjust fee schedule spending when projected costs exceed the threshold, typically by decreasing the conversion factor relative to the statutory update called for by MACRA.

3. How have physician payment rates changed in 2024?

CMS recently finalized payment changes for 2024, including increases in payment for a range of services related to primary care, behavioral health, and direct patient care, among others (see question 4). Due to the statutory requirement under the Omnibus Budget Reconciliation Act of 1989 that CMS preserve budget neutrality when adjusting physician payment rates, these service-specific increases necessitated a decrease to the fee schedule conversion factor to offset additional costs. Budget neutrality adjustments are made separately from statutory adjustments under MACRA and any temporary payments provided by Congress, both of which may also impact the conversion factor in a given year.

The 3.4% decrease to the conversion factor finalized for 2024 reflects the following adjustments to these three factors: (1) a -2.18% budget neutrality adjustment, (2) a 0% statutory increase under MACRA for 2024, and (3) -1.25% reduction in temporary payments provided by Congress for 2024 under the Consolidated Appropriations Act of 2023 .

The combined impact of these changes is a -1.25% decrease in overall payments under the physician fee schedule relative to 2023, according to CMS. Payment changes are expected to vary by specialty , however. For example, clinicians most directly impacted by service-specific changes, such as those in primary care and behavioral health, are projected to see a net increase in payments, while clinicians in radiology, physical and occupational therapy, and some surgical specialties are projected to see the largest net decrease.

Congress is expected to vote on pending legislation which would mitigate the 3.4% decrease to the fee schedule conversion factor, a change which is expected to result in a modest increase to physician payment rates across all specialties, relative to current law.

4. What other changes have been finalized by CMS for 2024?

Many of the provisions in the physician fee schedule final rule for 2024 are part of a wider effort by CMS and the Department of Health and Human Services (HHS) to improve health equity and increase support for primary care services, addressing long-standing concerns about the gap in compensation between primary and specialty care physicians (see question 7). CMS has also implemented two provisions of the Consolidated Appropriations Act of 2023 , which expand Medicare coverage for a range of behavioral health services. The final payment rule for 2024 includes the following key changes:

- CMS has added new billing codes to the physician fee schedule, allowing clinicians to bill separately for time dedicated to care coordination and direct patient care services, such as caregiver training, assessment of health-related social needs, and coordination with community health workers, care navigators, and peer support specialists.

- CMS has added a new add-on payment that allows clinicians to bill at higher rates for evaluation and management visits deemed to be complex, such as visits that are central to coordinating all of a patient’s needed health services or part of treatment for a serious, ongoing health condition.

- CMS has added new billing codes related to psychotherapy for crisis services, and existing codes can be billed by a broader range of providers. Additionally, new types of behavioral health providers, such as mental health counselors (MHCs) and marriage and family therapists (MFTs) can now bill for reimbursement under the physician fee schedule, following legislation passed under the Consolidated Appropriations Act of 2023 .

- CMS has extended several telehealth flexibilities that were granted on a temporary basis during the COVID-19 pandemic through the end of 2024, including provisions that allow Medicare beneficiaries to receive telehealth services from any site, including their home, delay the requirement for an in-person visit within six months of initiating mental or behavioral telehealth services, and allow telehealth services to be offered by Rural Health Clinics and Federally Qualified Health Centers .

- CMS has added health and well-being coaching to the Medicare Telehealth Services list through the end of 2024, and Social Determinants of Health Risk Assessments have been added on a permanent basis. Finally, CMS has expanded the definition of covered telehealth practitioners to include qualified occupational therapists, physical therapists, speech-language pathologists, and audiologists.

The new rules also include updates to the Medicare Shared Savings Program (MSSP) , as well as other changes related to payment for opioid treatment programs, preventive vaccine administration, and a variety of other health services.

5. How have Medicare payments to physicians evolved over time?

Medicare has revised its system of payment for physician services numerous times over the years (Figure 1). The current payment system was established under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) , which included a schedule for annual, statutorily-defined updates to the conversion factor, a key determinant of payment rates under the physician fee schedule. These updates are set by legislation and do not vary based on underlying economic conditions. However, further adjustments to preserve budget neutrality and supplemental payments provided by Congress may result in conversion factor updates that are higher or lower than the statutory update in a given year.

The physician payment framework established by MACRA was intended to stabilize fluctuations in payment caused by the prior payment system under the Medicare Sustainable Growth Rate (SGR) formula , which set annual targets for Medicare physician spending based on growth in the gross domestic product (GDP). Under the SGR, if spending exceeded its target in a given year, payment rates would be cut the following year, while spending that was below the target led to increased rates. As with the current system, rates were subject to further adjustment for budget neutrality if the projected cost of all fee schedule spending increased by more than $20 million for the year.

The SGR was established by the Balanced Budget Act of 1997 to slow the growth in Medicare spending for physician services, but the formula garnered criticism , as growth in service volume and rising costs led to several years of spending that exceeded the growth target, necessitating payment cuts from 2002 onward. Between 2002 and 2015, Congress enacted 17 short-term interventions (so-called “doc-fixes”) to delay the cuts and provide temporary increases to physician payments, but did so without repealing the SGR, which resulted in accumulated deficits over time.

MACRA permanently eliminated the SGR formula, preventing a 21.2% cut in physician fees slated for 2015 and replacing it with 0% statutory increases to the conversion factor through 2025 (later raised to 0.5% from 2016-2019), followed by modest annual increases from 2026 onward. While overall payments were not scheduled to increase for the first decade of MACRA’s operation, the legislation also included new pathways to allow for payment increases through bonus payments and quality-based payment adjustments under the Quality Payment Program (QPP) (see question 6).

Although MACRA has stabilized payments under the physician fee schedule to some degree, rates have continued to fluctuate over the last decade. Since 2020, Congress has provided four temporary, one-year increases to fee schedule rates to boost payment during the COVID-19 pandemic and offset prior budget-neutrality cuts, raising concerns that the cycle of “doc-fixes” under the SGR formula has not been wholly fixed (see question 7).

6. How does the QPP factor into physician payments?

The Quality Payment Program (QPP) was established by MACRA in 2015 to create financial incentives for health care providers to control costs and improve care quality. Under the QPP, physicians and other clinicians who participate in qualified advanced alternative payment models (A-APMs) , such as select accountable care organizations (ACOs) and others , are eligible for bonus payments if they meet certain participation thresholds. A-APMs are a type of value-based care model in which the provider bears some financial risk for the costs of care, typically by sharing in a portion of financial savings and losses relative to a benchmark. Qualifying A-APM clinicians receive an annual 5% bonus through 2024, which will be lowered to 3.5% in 2025, and replaced with an annual 0.75% increase to the conversion factor beginning in 2026 (relative to a 0.25% increase for all other clinicians). Roughly 240,000 clinicians received this bonus in 2022, based on participation during the 2020 payment year.

Clinicians who do not participate in A-APMs, or do not meet the participation criteria for A-APM bonus payments, are subject to additional reporting requirements under the Merit-based Incentive Payment System (MIPS) , which adjusts payments up or down depending on a clinician’s performance on certain quality metrics. Clinicians are required to participate in MIPS if they are eligible, but many are exempt , such as those in certain specialties (e.g., podiatrists), those in their first year of Medicare participation, and those who serve a low volume of Medicare patients. Roughly half of all Medicare Part B providers (49%) were eligible for MIPS in 2019.

Payment adjustments under MIPS are capped each year ( between +9% and -9% in 2022 ), and savings generated from clinicians who incur negative adjustments are used to fund positive adjustments for those who qualify. Because a relatively small share of clinicians have incurred negative adjustments each year since MIPS was implemented, positive adjustments have generally been much lower than the annual cap. In 2022, roughly 850,000 clinicians received positive adjustments up to 1.87%, while just 19,000 clinicians received negative adjustments down to -9%.

7. What concerns have been raised about the current payment system?

Criticism of the recent payment cuts under the physician fee schedule has focused on three primary concerns about the way in which Medicare pays physicians and other clinicians. These include: (1) the overall adequacy of Medicare payments to cover medical practice costs and incentivize participation in the Medicare program, (2) the gap in compensation between primary and specialty care clinicians, and (3) the success of the QPP at achieving its goal of incentivizing quality improvements and cost-efficient spending.

Payment Adequacy: Physician groups and others have expressed concern that certain aspects of the current payment system, such as the requirement for budget neutrality under the physician fee schedule and the limited flexibility of conversion factor updates under MACRA, have resulted in payment rates that are too low to keep up with inflation in medical practice costs. Practice expenses are one component of the relative-value calculation used to determine payment rates for fee schedule services, but the need to preserve budget neutrality makes it difficult for CMS to increase payment for some services without also decreasing payment in other areas, such as by lowering the fee schedule conversion factor.

Physician groups and others have pointed out that statutory increases to the conversion factor under MACRA are not scheduled to begin until 2026, and do not vary based on underlying economic conditions. Further, a prior KFF review of the literature has shown that Medicare pays less for physician services , on average, than private insurers, leading physician groups and some policymakers to warn about potential access issues for beneficiaries that could result if physicians are driven to opt out of the Medicare program in the future due to payment rates.

However, access problems for beneficiaries have generally not materialized to date. According to MedPAC, Medicare beneficiaries report access to clinician services that is equal to, or better than , that of privately insured individuals. A recent KFF analysis found that just 1% of all non-pediatric physicians had opted out of the Medicare program in 2023, suggesting that the current fee structure has not substantially discouraged participation. Moreover, MedPAC estimates that virtually all Medicare claims (99.7% in 2021) are accepted on “assignment” and paid at the standard rate, with beneficiaries in traditional Medicare facing no more than the standard 20% coinsurance rate.

Primary Care Compensation: A second concern with the current payment system is that Medicare does not adequately pay for primary care services, as reflected by the gap in Medicare payments between primary and specialty care clinicians. Payments under the physician fee schedule are generally higher for procedures (e.g., surgeries) than non-procedural services (e.g., evaluation and management). MedPAC has expressed concern that this imbalance encourages clinicians to focus on more costly and profitable services at the expense of high-value, but less profitable, services, such as patient education, preventive care, and coordination across care teams, which leads to higher physician spending over time.

Role of the QPP: QPP programs such as MIPS and bonus payments for A-APM clinicians are designed to create incentives for quality improvements, care coordination, and high-value services. While the share of clinicians who qualify for A-APM bonuses has increased substantially since the QPP began (from roughly 99,000 in 2017 to 271,000 in 2021), some policymakers have argued that greater incentives are needed to encourage providers to take on the financial risks and high startup costs associated with these models. Additionally, MedPAC has expressed concern that MIPS, the quality-based payment program for clinicians who do not participate in A-APMs, does not give providers enough incentives to improve quality and control costs. As noted earlier, a large share of clinicians are exempt from the program, and because few participants receive negative adjustments, positive adjustments are relatively modest .

8. What policy proposals have been put forward to address concerns with the current physician payment system?

In addition to legislation that directly addresses the 2024 payment cuts, policymakers and others have put forward a number of strategies to revise the current physician payment system. These include measures to prevent fluctuations in payment from year to year, provide additional support to primary care and safety-net providers, and create stronger incentives for efficient spending, care coordination, and participation in A-APMs.

Several bills have been introduced in Congress that would raise or modify the budget neutrality threshold, allowing CMS greater flexibility to adjust payment rates to reflect evolving policy priorities without necessitating a mandatory payment cut. For example, legislation has been introduced that would provide regular updates to the budget neutrality threshold based on growth in the Medicare Economic Index (MEI), a measure of inflation in the prices of goods and services used by clinicians to provide care. Further, a bipartisan coalition of physicians in Congress recently introduced the Strengthening Medicare for Patients and Providers Act , which would tie annual updates to the fee schedule’s conversion factor to the annual percentage increase in the MEI.

In 2023, MedPAC also recommended a one-time inflation-based increase to physician payment rates in 2024 (equal to 50% of the projected increase in the MEI), but has not recommended annual updates for inflation, focusing instead on targeted strategies to bolster payments to primary care clinicians and safety-net providers. Their recommendations include a permanent add-on payment for services provided to low-income Medicare beneficiaries, raising payment in these instances by 15% for claims billed by primary care clinicians and 5% for claims billed by non-primary care clinicians.

MedPAC has voiced support for the goals behind MACRA and the QPP, including the financial incentives offered to A-APM participants under current law. At the same time, MedPAC has recommended significant changes to the design of the QPP, including the elimination of MIPS, based on concerns that it does not give providers enough incentives to make significant practice improvements. In its place, MedPAC has recommended a voluntary program designed to mimic the structure of A-APMs and other alternative payment models , allowing clinicians to transition into these models more gradually. Finally, some policymakers have introduced legislation that would extend bonus payments for qualifying A-APM clinicians though the end of 2026.

In addition to these more targeted proposals, a bipartisan group of senators recently announced the formation of a Medicare payment reform working group, which will investigate long-term reforms to the physician fee schedule and updates to the physician payment legislation provided by MACRA.

Not yet 10 years out from the passage of MACRA, these measures suggest growing interest in Medicare physician payment reform, beyond addressing the physician fee cuts finalized for 2024. Designing payment approaches that address concerns raised by interested parties to compensate physicians adequately while restraining spending growth represents a challenge for policymakers.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.

- Health Costs

- Federal Budget

- Access to Care

Also of Interest

- How Many Physicians Have Opted Out of the Medicare Program?

- Recent Changes to Medicare Coverage of Dental Services from the 2023 and 2024 Medicare Physician Fee Schedule Final Rules

- 10 Things to Know About Medicaid Managed Care

Speak with a Licensed Insurance Agent 877-388-0596 - TTY 711 (M-F 8am-9pm, Sat 9am-8pm EST)

How Does Medicare Reimburse Hospitals?

Medicare provides coverage for millions of Americans over the age of 65 or individuals under 65 who have certain permanent disabilities. Medicare recipients can receive care at a variety of facilities, and hospitals are commonly used for emergency care, inpatient procedures, and longer hospital stays. Medicare benefits often cover care at these facilities through Medicare Part A, and Medicare reimbursement for these services varies. Billing is based on the provider’s relationship with Medicare and the average cost of care for a specific diagnosis or procedure.

What Medicare Benefits Cover Hospital Expenses? Medicare Part A is responsible for covering hospital expenses when a Medicare recipient is formally admitted. Part A may include coverage for inpatient surgeries, recovery from surgery, multi-day hospital stays due to illness or injury, or other inpatient procedures. Part A covers the first 60 days of a hospital stay after the associated deductible and coinsurance payments have been made. Part A also includes coverage for skilled nursing facilities and hospice care.

What Does it Mean for a Hospital to “Accept Assignment?” Medicare determines reimbursement based on whether or not a provider participates in Medicare services. This is known as “accepting assignment.” Providers that fully accept assignment are known as participating providers. They agree to accept all of Medicare’s predetermined prices for all procedures and tests that are provided under Medicare coverage. This means that no matter what a hospital normally charges for a procedure, they agree to only charge Medicare recipients a set price. The majority of providers fall into this category.

If a provider is a non-participating provider, it means that they have not signed a contract with Medicare to accept the insurance company’s prices for all procedures, but they do for accept assignment for some. This is mainly due to the fact that Medicare reimbursement amounts are often lower than those received from private insurance companies. For these providers, the patient may be required to pay for the full cost of the visit up front and can then seek personal reimbursement from Medicare afterwards.

The amount for each procedure or test that is not contracted with Medicare can be up to 15 percent higher than the Medicare approved amount. In addition, Medicare will only reimburse patients for 95 percent of the Medicare approved amount. This means that the patient may be required to pay up to 20 percent extra in addition to their standard deductible, copayments, coinsurance payments, and premium payments.

While rare, some hospitals completely opt out of Medicare services. This means that patients who obtain care at these facilities will not receive any Medicare reimbursement and will need to pay for the full cost of the procedure out of pocket. These providers are also not limited on the amount they can charge for their procedures.

Determining Medicare Reimbursement Rates If a healthcare provider does accept assignment for some or all procedures, the billing is done based on a preset list of diagnoses and associated billing codes. Medicare uses a pay-per-service model that uses Diagnosis-Related Groups (DRGs). Each DRG is based on a specific primary or secondary diagnosis, and these groups are assigned to a patient during their stay depending on the reason for their visit.

Up to 25 procedures can impact the specific DRG that is assigned to a patient, and multiple DRGs can be assigned to a patient during a single stay. The DRGs assigned can also be influenced by patient age and gender.

Each DRG is rated based on severity with three levels: Major Complication, Complication, or Non-Complication. The highest level, Major Complication, often significantly contributes to a patient’s illness and also often requires significant hospital resources and is associated with a higher cost. Non-Complications are associated with fewer required resources and do not impact patient health as severely.

Reimbursement is based on the DRGs and procedures that were assigned and performed during the patient’s hospital stay. Each DRG is assigned a cost based on the average cost based on previous visits. This assigned cost provides a simple method for Medicare to reimburse hospitals as it is only a simple flat rate based on the services provided.

Related articles:

How Much Does Medicare Cost the Government? (Opens in a new browser tab)

How Does a Medicare Advantage Plan Work? (Opens in a new browser tab)

Medicare Advantage and Part D plans and benefits offered by the following carriers: Aetna Medicare, Anthem Blue Cross Blue Shield, Anthem Blue Cross, Aspire Health Plan, Cigna Healthcare, Dean Health Plan, Devoted Health, Florida Blue Medicare, GlobalHealth, Health Care Service Corporation, Healthy Blue, Humana, Molina Healthcare, Mutual of Omaha, Premera Blue Cross, Medica Central Health Plan, SCAN Health Plan, Scott and White Health Plan now part of Baylor Scott & White Health, Simply, UnitedHealthcare®, Wellcare, WellPoint

Need A Medicare Advantage Quote?

Request A Free Consultation For Medicare Advantage Plans

What Is Medicare Reimbursement?

Medicare reimbursement is when a doctor or healthcare facility receives payment directly from Medicare for providing care to a Medicare enrollee.

Medicare sets reimbursement rates for each of its covered services, so when a provider accepts Medicare assignment, they agree to these rates and may not ask the patients to pay more. A doctor who accepts assignment may only charge the patient for their deductible or coinsurance , filing a claim for reimbursement from Medicare for the remaining charges.

In some cases, however, a doctor who does not accept assignment may still provide care to a Medicare beneficiary and decline to file a claim for Medicare reimbursement. In this scenario, the beneficiary must front the full cost of care, which may exceed Medicare’s set rates, and submit their own claim for reimbursement.

Table of Contents

How does medicare reimbursement work.

If you have Original Medicare and seek a covered service from a provider who does not accept assignment, you may have to file for Medicare reimbursement. Here’s how reimbursement works for each part of Medicare .

Medicare Part A

Medicare Part A provides hospital insurance. If you seek hospital services from a facility that does not accept assignment and declines to file its own reimbursement claim to Medicare, you may have to seek reimbursement yourself.

Medical services covered by Part A include:

- Inpatient hospital care

- Skilled nursing facilities

- Nursing homes

- Home healthcare

If you seek any of the above types of care from a facility that does not accept assignment, you may have to file for Medicare reimbursement. Medicare might reimburse you directly, or the facility might receive the reimbursement from Medicare and issue you a refund accordingly.

Medicare Part B

Medicare Part B covers medically necessary and preventative health services. You may have to seek Medicare reimbursement under Part B if your provider does not accept assignment or file their own reimbursement claim for the following types of services:

- Ambulance transportation

- Bone mass measurement

- Care as part of a clinical research study

- Clinical lab services

- Counseling to quit smoking

- Durable medical equipment

- Emergency department services

- Health screenings and tests

- Home health services

- Inpatient or outpatient care or partial hospitalization for a mental health condition

- Medical nutrition, occupational, or physical therapy

- Preventative healthcare

- Services and supplies for kidney dialysis

- Vaccinations

When Medicare issues your reimbursement, you may receive it directly or receive it in the form of a refund from your provider.

Medicare Advantage

Unlike Original Medicare, which comprises Part A and Part B, Medicare Advantage (also called Part C) plans come from private insurance companies. All Medicare Advantage Plans provide the same coverage as Original Medicare, plus added benefits like prescription drug coverage, vision , and dental.

If you have a Medicare Advantage Plan , you may not file for reimbursement from Medicare since your health coverage comes from a private insurer. If you seek covered health services and the facility or doctor bills you rather than your insurance company for the cost, you may have to seek reimbursement from your insurance provider.

Medicare Advantage Plans vary by provider, so ask your insurance company how to file for reimbursement should this situation occur.

Medicare Part D

Medicare Part D covers prescription drugs. As with Medicare Advantage, Part D plans come from private insurance providers, so their specific benefits and terms of coverage vary from company to company.

Because you receive Part D coverage through a private company, you will never request Medicare reimbursement for products or services covered under Part D.

If you pay out of pocket for services covered under Part D, you might file for reimbursement from your Part D Plan’s insurance provider. However, this process varies among individual providers; contact yours for detailed guidance on how to request reimbursement.

Medicare Part B only pays for 80% of the cost of its covered services. Medigap, also called Medicare supplementary insurance, helps pay for the remaining 20% to reduce the beneficiary’s out-of-pocket expenses .

Medigap plans are only available to Original Medicare enrollees through private insurance companies; if you have a Medicare Advantage Plan, you may not purchase Medigap. If you receive a covered service from a health provider who accepts assignment, Medigap may reimburse you for your portion of the treatment cost.

However, because Medigap plans come from private providers, you will not file claims for Medigap reimbursement to Medicare directly. Contact your Medigap provider to learn about its specific reimbursement process.

How Are Reimbursements Determined?

Medicare revises its established reimbursement rates for covered services on an annual basis. A select committee helps determine these rates each year, with committee members including a mix of medical professionals and other professionals.

The process of determining reimbursement rates is complex and often warrants criticism from the medical community for lacking transparency. Generally, reimbursement rates account for the following factors:

- The type of product or service

- The type of health provider or facility

- How complex the service is

- Where the service takes place

- Adjustments for inflation

The Medicare program is not required to accept the committee’s recommendations for reimbursement rates , but in more than 90% of cases, it has.

What Happens if Medicare Does Not Reimburse You in Full?

Medicare may not provide reimbursement for services that are not medically necessary or covered by Original Medicare. If Medicare denies your request for reimbursement and you disagree with the decision, you may file an appeal .

In some cases, if you file for Medicare reimbursement, you may not receive the full amount you paid out of pocket for your covered service. Remember, Medicare pre-establishes its reimbursement rates. If your health provider does not accept assignment, they did not agree to cap charges at the Medicare-approved rate. For this reason, you may not get all of your money back.

How To Receive Medicare Reimbursement

If you paid out of pocket for a Medicare-covered service from a provider who does not accept assignment, first ask the provider to file the Medicare reimbursement claim. If they decline to do so, it’s up to you to request reimbursement from Medicare. Here’s how to do it:

- Download the Patient’s Request for Medical Payment (Form CMS-1490S) from the Centers for Medicare and Medicaid Services (CMS) website.

- Follow the provided instructions to complete the form, including a detailed explanation of why you are filing the claim instead of your health provider.

- Provide an itemized bill, your provider’s name and address, your diagnosis, details on when and where you received the service, and a description of the service, along with any other information that might support your claim.

- Make a copy of your completed form to keep for your personal record.

- Consult the CMS’s Medicare contractor directory to determine where you should mail your claim.

- Mail a completed Form CMS-1490S to your Medicare contractor.

If you are unable to file the claim yourself, you may designate someone else to do it for you. In this case, make sure to download and complete the Authorization to Disclose Personal Health Information (Form CMS-10106) from CMS’s website.

As a Medicare beneficiary, you may receive covered services from a medical provider who does not accept assignment from Medicare. For you to get coverage for these services, you or your provider must file a claim for reimbursement from Medicare.

If your provider refuses or otherwise declines to file for Medicare reimbursement, it’s up to you to do so, which involves downloading, completing, and mailing in the appropriate form.

If you have a Medicare Advantage Plan, you must file reimbursement through your private insurance provider rather than through Medicare directly. The same applies if you are seeking reimbursement for services covered by Medicare Part D or Medigap.

Frequently Asked Questions

Yes, Medicare does not reimburse enrollees for health services that are not medically necessary or covered by Original Medicare. Such services might include dental care , eye exams , cosmetic surgery , custodial care, and hearing aids . Moreover, Medicare does not provide reimbursements to Medicare Advantage enrollees or for Medigap or Part D claims.

No, Medicare does not reimburse beneficiaries for premium costs. However, some types of Medicare Advantage Plans offer Part B premium reduction benefits, through which the plan pays for some or all of the Part B premium. Moreover, some employers may offer Medicare Part B premium reimbursements.

You’re just a few steps away from seeing your Medicare Advantage plan options.

Everything PTs Need to Know About Accepting Medicare Assignment

There's no one-size-fits-all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

There's no one-size-fits-all all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

Get the latest news and tips directly in your inbox by subscribing to our monthly newsletter

Discuss any topic within rehab therapy, and chances are that Medicare will come up at some point. Whether it’s talking about Medicare and direct access or Medicare supervision requirements , it’s hard to avoid discussing the ins and outs of the program, given its prominence in healthcare at large. However, there’s one question that probably doesn't get asked enough: do providers have to participate in Medicare? We’re going to dive into the specifics of what rehab therapists can and can’t do when it comes to accepting Medicare assignment, and the pros and cons of each.

What it means to “accept Medicare assignment”

In short, accepting Medicare assignment means signing a contract to accept whatever Medicare pays for a covered service as full payment. Participating and non-participating status only applies to Medicare Part B; Medicare Advantage plans operate with contracts similar to commercial insurance with in-network and out-of-network providers.

Participating Providers

If you’re accepting Medicare assignment for all covered services, you are considered to be a participating provider under Medicare and may not charge patients above and beyond what Medicare agrees to pay. In this case, you can charge 100% of the Medicare Physician Fee Schedule (MPFS) and are paid at 80% of that rate, minus the Multiple Procedure Payment Reduction (MPPR) and the 2% sequestration adjustment.

You may, however, collect patient deductibles and coinsurances—although, as explained in the Medicare payer guide , these providers typically ask Medicare to pay its share before collecting anything from the patient. Per the same resource, these providers are required to submit claims directly to Medicare for reimbursement and cannot charge patients for the claim submission. As Dr. Jarod Carter, PT, DPT, MTC, writes in Medicare and Cash-Pay PT Services , “This is the most common and best-understood relationship that physical therapists have with Medicare.”

Because Medicare beneficiaries often pay less out-of-pocket costs when receiving care from a provider who accepts assignment, patients may be more willing to work with these providers. Thus, if you accept assignment, you may have access to not only more Medicare patients but also more potential referral partners who only work with assignment-accepting providers.

You must accept whatever Medicare deems appropriate compensation, and as we know, that’s below market value more often than not. Given the recently announced cuts to assistant-provided services and the 8% cut to all physical therapy services , accepting assignment may be increasingly less appealing to physical therapists. That said, if you serve a large Medicare population, the volume of patients you see may make it financially beneficial for you to continue playing by Medicare’s rules.

If you don’t want to accept Medicare assignment, what are your other options?

Non-participating providers.

As Meredith Castin explains in 4 Things to Know About Billing for Cash-Pay PT , Medicare also allows physical therapists to be non-participating providers (a.k.a. non-enrolled providers), which simply means that, while they are still in a contractual relationship with Medicare (and thus, are eligible to provide covered services to Medicare beneficiaries), they have not agreed to accept assignment across the board.

If a non-participating provider opts to accept assignment for a case, they can charge 95%.

If they do not accept assignment but still treat the patient, these providers may charge up to what Medicare calls “the limiting charge” for a service—which is 15% above the Medicare allowed amount. Non-participating providers may choose to accept assignment for some services, but not others —or no services at all. For services that are not under assignment, the provider may collect payment directly from the patient; however, he or she must still bill Medicare, so that Medicare may reimburse the patient.

Non-participating providers are still eligible to serve Medicare beneficiaries, but they maintain some degree of freedom when it comes to pricing their services. In other words, if you are a non-participating provider, you are less beholden to what Medicare deems as appropriate payment than you are as a participating provider.

That said, you do still have to charge within Medicare’s limit, which means your freedom is far from total. Additionally, because patients may have to pay more out of pocket for your services and/or pay and wait for reimbursement from Medicare, you may have to work harder to convince them that you’re worth the financial investment. With the right data and marketing , it’s definitely doable; it may just require more effort.

No Relationship with Medicare

Physicians are eligible to “opt-out” of Medicare, which means that even if they are neither participating nor non-participating providers, they can still see Medicare beneficiaries on a cash-pay basis. Physical therapists do not enjoy the same privilege. So, if you decide not to be a Medicare participating provider or non-participating provider, then you effectively have no relationship with Medicare. Thus, you are not able to provide Medicare-covered services to Medicare beneficiaries.

That said, all physical therapists, regardless of their relationship with Medicare, may provide never-covered services to Medicare beneficiaries, including wellness services. According to Castin, though, providers who go down that route, “need to be very clear about Medicare’s definition of ‘wellness services’ versus ‘physical therapy services.’” According to cash-pay PT Jarod Carter , it’s imperative for your documentation to clearly support that the services were indeed wellness as opposed to therapy.

As a provider with no relationship with Medicare, you’re not required to play by Medicare’s rules when it comes to reporting requirements or (lowball) payments. You’re also not at all affected by Medicare’s most recent cuts, which, quite frankly, is a big bonus.

However, as of 2007 , 15% of the US population was enrolled in Medicare; that’s 44 million people—most of whom could benefit from seeing a physical therapist to improve function and mobility and decrease pain. And that number is projected to grow to 79 million people by 2030. As such, choosing not to play ball with Medicare means you’re walking away from a very large market of patients who need your services.

It’s your decision.

Deciding on accepting Medicare assignment—and what type of relationship you’d like to have with Medicare—is not an easy decision to make, and there are a lot of factors to take into consideration before getting involved or breaking it off with this substantial federal payer. That said, it is important to know that you have options. Have more questions about what it means to accept assignment as a PT? Ask them below, and we’ll do our best to find you an answer.

Related posts

Understanding the ICD-10 Code for Deconditioning

Choosing an ICD-10 Code For Low Back Pain

Founder Letter: This Mother’s Day, Give Working Moms Support—Not Just Lip Service

Medicare and Cash-Pay PT Services, Part 1: The Must-Know Concepts to Avoid Legal Issues and Capitalize on Opportunities

Medicare and Direct Access

The Medicare Maintenance Care Myth

Learn how WebPT’s PXM platform can catapult your practice to new heights.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

CMS Newsroom

Search cms.gov.

- Physician Fee Schedule

- Local Coverage Determination

- Medically Unlikely Edits

Prospective Payment Systems - General Information

A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for inpatient hospital services). CMS uses separate PPSs for reimbursement to acute inpatient hospitals, home health agencies, hospice, hospital outpatient, inpatient psychiatric facilities, inpatient rehabilitation facilities, long-term care hospitals, and skilled nursing facilities. See Related Links below for information about each specific PPS.

Zipcode to Carrier Locality File

This file is primarily intended to map Zip Codes to CMS carriers and localities. This file will also map Zip Codes to their State. In addition, this file contains an urban, rural or a low density (qualified) area Zip Code indicator.

Provider Center

For a one-stop resource webpage focused on the informational needs and interests of Medicare Fee-for-Service (FFS) providers, including physicians, other practitioners and suppliers, go to the Provider Center (see under "Related Links" below).

Zip Code to Carrier Locality File - Revised 05/14/2024 (ZIP)

Zip Codes requiring 4 extension - Revised 05/14/2024 (ZIP)

Changes to Zip Code File - Revised 02/15/2024 (ZIP)

2023 End of Year Zip Code File (ZIP)

2022 End of Year Zip Code File (ZIP)

2021 End of Year Zip Code File - Revised 05/27/2022 (ZIP)

2020 End of Year Zip Code File (ZIP)

2019 End of Year Zip Code File (ZIP)

2018 End of Year Zip Code File (ZIP)

2017 End of Year Zip Code File - Updated 11/15/2017 (ZIP)

2016 End of Year Zip Code File (ZIP)

2015 End of Year Zip Code File (ZIP)

2014 End of Year Zip Code File (ZIP)

Related Links

- Acute Inpatient PPS

- All Fee-For-Service Providers

- Home Health PPS

- Hospice Center

- Inpatient PPS PC Pricer

- Inpatient Psychiatric Facility PPS

- Inpatient Rehabilitation Facility PPS

- Long-Term Care Hospital PPS

- Skilled Nursing Facility PPS

Hospital beds

Medicare Part B (Medical Insurance) covers hospital beds as durable medical equipment (DME) that your doctor prescribes for use in your home.

Your costs in Original Medicare

After you meet the Part B deductible you pay 20% of the Medicare-approved amount (if your supplier accepts assignment ). Medicare pays for different kinds of DME in different ways. Depending on the type of equipment:

- You may need to rent the equipment.

- You may need to buy the equipment.

- You may be able to choose whether to rent or buy the equipment.

Make sure your doctors and DME suppliers are enrolled in Medicare. It’s also important to ask a supplier if they participate in Medicare before you get DME. If suppliers are participating in Medicare, they must accept assignment (which means, they can charge you only the coinsurance and Part B deductible for the Medicare‑approved amount). If suppliers aren’t participating and don’t accept assignment, there’s no limit on the amount they can charge you.

Find out cost

To find out how much your test, item, or service will cost, talk to your doctor or health care provider. The specific amount you’ll owe may depend on several things, like:

- Other insurance you may have

- How much your doctor charges

- If your doctor accepts assignment

- The type of facility

- Where you get your test, item, or service

Related resources

- Where to get covered DME items

- How can I file a complaint?

Is my test, item, or service covered?

A .gov website belongs to an official government organization in the United States.

A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

- About the Diabetes Self-Management Education and Support (DSMES) Toolkit

- Participate

- Patient Success With DSMES Through Telehealth

- DSMES Promotion Playbook Resources

- Terminology and Glossary

- How to Increase Referrals and Overcome Barriers to Participation Resources

- Who Provides DSMES Services: Staffing and Delivery Models

- DSMES Coverage Policies: Reimbursement and Sustainability

- Building the Business Case for DSMES

Resources for Medicare Reimbursement

- The Centers for Medicare & Medicaid Services (CMS) provides reimbursement for Medicare beneficiaries for diabetes self-management training (DSMT) under certain conditions.

- Access CMS resources to ensure DSMT services can be reimbursed.

CMS resources for DSMT

Reimbursement guidelines change often. The following CMS resources contain the latest information about Medicare reimbursement for DSMT.

- DSMT Accreditation Program

- Medicare Preventive Services

- Medicare Benefit Policy Manual, Chapter 15 – Covered Medical and Other Health Services (Rev. 11905, 03-16-23)

- Medicare Claims Processing Manual, Chapter 12 – Physicians/Nonphysician Practitioners (Rev. 11828, 02-02-23)

- MLN Matters Number: MM3185 Diabetes Self-Management Training Services

- CMS Manual System, Pub 100-20 One-Time Notification, Transmittal 1755

- Medicare Claims Processing Manual, Chapter 18 – Preventive and Screening Services (Rev. 11902, 03-16-23)

- CMS Manual System, Pub 100-02 Medicare Benefit Policy, Transmittal 109

- MLN Matters® Number: MM6510, Diabetes Self-Management Training (DSMT) Certified Diabetic Educator

- Program Memorandum, CMS, Transmittal AB-02-151, Oct. 25, 2002, Clarification Regarding Non-physician Practitioners Billing on Behalf of a Diabetes Outpatient Self-Management Training Services (DSMT) Program and the Common Working File Edits for DSMT & Medical Nutrition Therapy (MNT)

Additional resources

Visit the new DSMT Accreditation Program webpage for information on the certification process and accrediting organizations.

For questions or concerns, providers, patients, accrediting organizations, and stakeholders can contact the new CMS helpdesk: [email protected] .

Learn what Medicare reimbursement rates for DSMT are in your area.

See the Clarification of National Standards Permitting Qualified RDs, RNs, or Pharmacists to Individually Furnish Diabetes Self-Management Training Services .

For detailed information about Medicare reimbursement eligibility and guidelines, visit the Medicare reimbursement guidelines page.

Diabetes Self-Management Education and Support (DSMES) Toolkit

The DSMES Toolkit is a comprehensive resource for achieving success in diabetes self-management education and support (DSMES) services.

Cape Cod Hospital to pay $24.4 million following DOJ investigation into Medicare billing practices

/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/WVCCQM6GKSXS6PQPUN4EAQTPHU.JPG)

Cape Cod Hospital has agreed to pay the federal government nearly $24.4 million to resolve allegations that it knowingly submitted Medicare claims that failed to comply with billing requirements.

A Department of Justice investigation found that cardiac surgeons at the hospital did not sufficiently document patient evaluations for transcatheter aortic valve replacements, known as TAVR, required for Medicare reimbursement. Richard Zelman, a former cardiologist at the hospital who first called attention to the lapses in a 2022 lawsuit against the hospital, will receive nearly $4.4 million of the civil settlement for his whistleblower role.

The hospital “knowingly submitted hundreds of claims to Medicare for TAVR procedures that did not comply” with requirements, according to the settlement agreement , resulting in the hospital submitting “millions of dollars of false claims to Medicare.” In some cases, there weren’t enough physicians examining the patient’s suitability for the TAVR procedure, and in others, doctors didn’t document or share their findings.

The investigation, which covered the time period between the beginning of the TAVR program in 2015 until the end of 2022, involved the hospital’s interventional cardiologists and cardiac surgeons employed by Brigham and Women’s Hospital contracted by Cape Cod Hospital.

Advertisement

“Medicare permitted coverage for this newly developed cardiac procedure only under certain conditions, to ensure patient safety. Cape Cod Hospital ignored those rules and received millions of dollars from Medicare to which it was not entitled. This conduct persisted for years despite internal warnings,” acting United States Attorney Joshua S. Levy for the District of Massachusetts said in a statement.. “This investigation and settlement ensure that patient safety is prioritized over a hospital’s bottom line.”

The settlement is the largest of its kind involving a Massachusetts hospital, according to Gregg Shapiro, the attorney representing Zelman.

“Dr. Zelman is gratified that the government conducted a thorough investigation and that the case has been successfully resolved,” Shapiro said.

In a statement, Cape Cod Hospital board chairman Bruce Johnston praised the hospital’s care and the leadership of chief executive Michael Lauf.

“Though it is unfortunate to be in this situation, the Board of Trustees remains confident in and supportive of the organization’s leadership,” he said. “Under Lauf’s leadership, Cape Cod Hospital has grown both in reputation and in size and now eagerly anticipates the opening of a new patient care pavilion, which will house a state-of-the-art cancer center, consolidate the Hospital’s many cardiology programs, and add 32 more medical/surgical beds to address increasing demand.”

Cape Cod Hospital is part of Cape Cod Healthcare , which also operates Falmouth Hospital, six urgent care centers, homecare and hospice services, and other health programs.

Zelman, the former medical director for the hospital’s Heart and Vascular Institute who started the TAVR program in 2015, first exposed the improper practices in a lawsuit against the hospital and its CEO in late 2022. In that suit, which was dropped less than two months later, Zelman claimed he was fired for blowing the whistle on practices that he said prioritized non-Medicare or Medicaid patients for valve replacement procedures because their insurance provider reimbursed the hospital at higher rates. This practice, the lawsuit claimed, prioritized “revenue generation over patient safety.”

Cape Cod Hospital has denied these charges and noted that the settlement is unrelated to that lawsuit. The settlement does not mean that patients who received TAVR procedures were harmed, the hospital said, or that the hospital billed Medicare for procedures that were unnecessary.

Many of the doctors involved in the improper documentation are no longer employed or contracted there, according to the hospital. Documentation practices have been augmented and its clinicians are believed to be in compliance with Medicare requirements, the hospital said.

The hospital has also entered into a five-year agreement with the Office of the Inspector General for Health and Human Services to strengthen the hospital’s corporate compliance program and has taken measures to shore up the documentation of evaluations for potential TAVR candidates.

Katie Johnston can be reached at [email protected] . Follow her @ktkjohnston .

IMAGES

VIDEO

COMMENTS

If your doctor, provider, or supplier doesn't accept assignment: You might have to pay the full amount at the time of service. They should submit a claim to Medicare for any Medicare-covered services they give you, and they can't charge you for submitting a claim. If they refuse to submit a Medicare claim, you can submit your own claim to ...

Medicare assignment is a fee schedule agreement between the federal government's Medicare program and a doctor or facility. When Medicare assignment is accepted, it means your doctor agrees to the payment terms of Medicare. Doctors that accept Medicare assignment fall under one of three designations: a participating doctor, a non ...

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies, without paying a deductible or coinsurance if the provider accepts assignment.

Medicare Part B Reimbursement. Doctor visits, durable medical equipment, and outpatient care fall under Medicare Part B.When making doctors' appointments, always ask if the doctor accepts Medicare assignment; this helps you avoid having to seek reimbursement.

Doctors that take Medicare can sign a contract to accept assignment for all Medicare services, or be a non-participating provider that accepts assignment for some services but not all. A medical provider that accepts Medicare assignment must submit claims directly to Medicare on your behalf. They will be paid the agreed upon amount by Medicare ...

1. Participating providers, or those who accept Medicare assignment. These providers have an agreement with Medicare to accept the Medicare-approved amount as full payment for their services. You don't have to pay anything other than a copay or coinsurance (depending on your plan) at the time of your visit.

Summary: Medicare Assignment is an agreement between healthcare providers and Medicare, where providers accept the Medicare-approved amount as full payment, preventing them from charging beneficiaries extra. This benefits Medicare beneficiaries by controlling their costs and ensuring they only pay deductibles and copayments.

Medicare reimbursement is when Medicare pays for health services provided to Medicare enrollees. Most providers file claims directly to Medicare, so patients rarely need to file a claim. ... A medical provider that accepts Medicare assignment agrees to accept $80 as payment in full and will not charge the patient for the $20 balance.

When non-participating providers do not accept assignment, they may not collect reimbursement from Medicare; rather, they bill the Medicare patient directly, typically up front at the time of service.

Afterward, you should receive from Medicare a Medicare Summary Notice (MSN) and reimbursement for 80% of the Medicare-approved amount. The limiting charge rules do not apply to durable medical equipment (DME) ... Many psychiatrists opt out of Medicare. Providers who take assignment should submit a bill to a Medicare Administrative Contractor ...

Medicare reimbursement also can refer to payments made to doctors who accept Medicare assignment and perform healthcare services. If you have Original Medicare Original Medicare is a fee-for-service health insurance program available to Americans aged 65 and older and some individuals with disabilities.

Physician Fee Schedule Look-Up Tool. To start your search, go to the Medicare Physician Fee Schedule Look-up Tool . To read more about the MPFS search tool, go to the MLN® booklet, How to Use The Searchable Medicare Physician Fee Schedule Booklet (PDF) . Page Last Modified: 05/07/2024 11:09 AM. Help with File Formats and Plug-Ins.

Nonassignment of Benefits. The second reimbursement method a physician/supplier has is choosing to not accept assignment of benefits. Under this method, a non-participating provider is the only provider that can file a claim as non-assigned. When the provider does not accept assignment, the Medicare payment will be made directly to the beneficiary.

Non-assignment of Benefits. Non-assigned is the method of reimbursement a physician/supplier has when choosing to not accept assignment of benefits. Under this method, a non-participating provider is the only provider that can file a claim as non-assigned. When the provider does not accept assignment, the Medicare payment will be made directly ...

In November 2023, CMS finalized a 3.4% decrease in the physician fee schedule conversion factor, a key aspect of payment rates under the Medicare program, resulting in a 1.25% decrease in overall ...

Determining Medicare Reimbursement Rates If a healthcare provider does accept assignment for some or all procedures, the billing is done based on a preset list of diagnoses and associated billing codes. Medicare uses a pay-per-service model that uses Diagnosis-Related Groups (DRGs). Each DRG is based on a specific primary or secondary diagnosis ...

Medicare reimbursement is when a doctor or healthcare facility receives payment directly from Medicare for providing care to a Medicare enrollee. Medicare sets reimbursement rates for each of its covered services, so when a provider accepts Medicare assignment, they agree to these rates and may not ask the patients to pay more.

What it means to "accept Medicare assignment". In short, accepting Medicare assignment means signing a contract to accept whatever Medicare pays for a covered service as full payment. Participating and non-participating status only applies to Medicare Part B; Medicare Advantage plans operate with contracts similar to commercial insurance ...

A: If your doctor doesn't "accept assignment," (ie, is a non-participating provider) it means he or she might see Medicare patients and accept Medicare reimbursement as partial payment, but wants to be paid more than the amount that Medicare is willing to pay. As a result, you may end up paying the difference between what Medicare will ...

You pay nothing for your yearly depression screening if your doctor or health care provider accepts assignment. After you meet the Part B deductible , you pay 20% of the Medicare-approved amount for visits to your health care provider to diagnose or treat your condition.; If you get your services in a hospital outpatient clinic or hospital outpatient department, you may have to pay an ...

Prospective Payment Systems - General Information. A Prospective Payment System (PPS) is a method of reimbursement in which Medicare payment is made based on a predetermined, fixed amount. The payment amount for a particular service is derived based on the classification system of that service (for example, diagnosis-related groups for ...