How to Conduct an Industry Analysis? Steps, Template, Examples

Appinio Research · 16.11.2023 · 39min read

Are you ready to unlock the secrets of Industry Analysis, equipping yourself with the knowledge to navigate markets and make informed strategic decisions? Dive into this guide, where we unravel the significance, objectives, and methods of Industry Analysis.

Whether you're an entrepreneur seeking growth opportunities or a seasoned executive navigating industry shifts, this guide will be your compass in understanding the ever-evolving business terrain.

What is Industry Analysis?

Industry analysis is the process of examining and evaluating the dynamics, trends, and competitive forces within a specific industry or market sector. It involves a comprehensive assessment of the factors that impact the performance and prospects of businesses operating within that industry. Industry analysis serves as a vital tool for businesses and decision-makers to gain a deep understanding of the environment in which they operate.

Key components of industry analysis include:

- Market Size and Growth: Determining the overall size of the market, including factors such as revenue, sales volume, and customer base. Analyzing historical and projected growth rates provides insights into market trends and opportunities.

- Competitive Landscape: Identifying and analyzing competitors within the industry. This includes assessing their market share, strengths, weaknesses, and strategies. Understanding the competitive landscape helps businesses position themselves effectively.

- Customer Behavior and Preferences: Examining consumer behavior , preferences, and purchasing patterns within the industry. This information aids in tailoring products or services to meet customer needs.

- Regulatory and Legal Environment: Assessing the impact of government regulations, policies, and legal requirements on industry operations. Compliance and adaptation to these factors are crucial for business success.

- Technological Trends: Exploring technological advancements and innovations that affect the industry. Staying up-to-date with technology trends can be essential for competitiveness and growth.

- Economic Factors: Considering economic conditions, such as inflation rates, interest rates, and economic cycles, that influence the industry's performance.

- Social and Cultural Trends: Examining societal and cultural shifts, including changing consumer values and lifestyle trends that can impact demand and preferences.

- Environmental and Sustainability Factors: Evaluating environmental concerns and sustainability issues that affect the industry. Industries are increasingly required to address environmental responsibility.

- Supplier and Distribution Networks: Analyzing the availability of suppliers, distribution channels, and supply chain complexities within the industry.

- Risk Factors: Identifying potential risks and uncertainties that could affect industry stability and profitability.

Objectives of Industry Analysis

Industry analysis serves several critical objectives for businesses and decision-makers:

- Understanding Market Dynamics: The primary objective is to gain a comprehensive understanding of the industry's dynamics, including its size, growth prospects, and competitive landscape. This knowledge forms the basis for strategic planning.

- Identifying Growth Opportunities: Industry analysis helps identify growth opportunities within the market. This includes recognizing emerging trends, niche markets, and underserved customer segments.

- Assessing Competitor Strategies: By examining competitors' strengths, weaknesses, and strategies, businesses can formulate effective competitive strategies. This involves positioning the company to capitalize on its strengths and exploit competitors' weaknesses.

- Risk Assessment and Mitigation: Identifying potential risks and vulnerabilities specific to the industry allows businesses to develop risk mitigation strategies and contingency plans. This proactive approach minimizes the impact of adverse events.

- Strategic Decision-Making: Industry analysis provides the data and insights necessary for informed strategic decision-making. It guides decisions related to market entry, product development, pricing strategies, and resource allocation.

- Resource Allocation: By understanding industry dynamics, businesses can allocate resources efficiently. This includes optimizing marketing budgets, supply chain investments, and talent recruitment efforts.

- Innovation and Adaptation: Staying updated on technological trends and shifts in customer preferences enables businesses to innovate and adapt their offerings effectively.

Importance of Industry Analysis in Business

Industry analysis holds immense importance in the business world for several reasons:

- Strategic Planning: It forms the foundation for strategic planning by providing a comprehensive view of the industry's landscape. Businesses can align their goals, objectives, and strategies with industry trends and opportunities.

- Risk Management: Identifying and assessing industry-specific risks allows businesses to manage and mitigate potential threats proactively. This reduces the likelihood of unexpected disruptions.

- Competitive Advantage: In-depth industry analysis helps businesses identify opportunities for gaining a competitive advantage. This could involve product differentiation, cost leadership, or niche market targeting .

- Resource Optimization: Efficient allocation of resources, both financial and human, is possible when businesses have a clear understanding of industry dynamics. It prevents wastage and enhances resource utilization.

- Informed Investment: Industry analysis assists investors in making informed decisions about allocating capital. It provides insights into the growth potential and risk profiles of specific industry sectors.

- Adaptation to Change: As industries evolve, businesses must adapt to changing market conditions. Industry analysis facilitates timely adaptation to new technologies, market shifts, and consumer preferences .

- Market Entry and Expansion: For businesses looking to enter new markets or expand existing operations, industry analysis guides decision-making by evaluating the feasibility and opportunities in target markets.

- Regulatory Compliance: Understanding the regulatory environment is critical for compliance and risk avoidance. Industry analysis helps businesses stay compliant with relevant laws and regulations.

In summary, industry analysis is a fundamental process that empowers businesses to make informed decisions, stay competitive, and navigate the complexities of their respective markets. It is an invaluable tool for strategic planning and long-term success.

How to Prepare for Industry Analysis?

Let's start by going through the crucial preparatory steps for conducting a comprehensive industry analysis.

1. Data Collection and Research

- Primary Research: When embarking on an industry analysis, consider conducting primary research . This involves gathering data directly from industry sources, stakeholders, and potential customers. Methods may include surveys , interviews, focus groups , and observations. Primary research provides firsthand insights and can help validate secondary research findings.

- Secondary Research: Secondary research involves analyzing existing literature, reports, and publications related to your industry. Sources may include academic journals, industry-specific magazines, government publications, and market research reports. Secondary research provides a foundation of knowledge and can help identify gaps in information that require further investigation.

- Data Sources: Explore various data sources to collect valuable industry information. These sources may include industry-specific associations, government agencies, trade publications, and reputable market research firms. Make sure to cross-reference data from multiple sources to ensure accuracy and reliability.

2. Identifying Relevant Industry Metrics

Understanding and identifying the right industry metrics is essential for meaningful analysis. Here, we'll discuss key metrics that can provide valuable insights:

- Market Size: Determining the market's size, whether in terms of revenue, units sold, or customer base, is a fundamental metric. It offers a snapshot of the industry's scale and potential.

- Market Growth Rate: Assessing historical and projected growth rates is crucial for identifying trends and opportunities. Understanding how the market has evolved over time can guide strategic decisions.

- Market Share Analysis: Analyzing market share among industry players can help you identify dominant competitors and their respective positions. This metric also assists in gauging your own company's market presence.

- Market Segmentation : Segmenting the market based on demographics, geography, behavior, or other criteria can provide deeper insights. Understanding the specific needs and preferences of various market segments can inform targeted strategies.

3. Gathering Competitive Intelligence

Competitive intelligence is the cornerstone of effective industry analysis. To gather and utilize information about your competitors:

- Competitor Identification: Begin by creating a comprehensive list of your primary and potential competitors. Consider businesses that offer similar products or services within your target market. It's essential to cast a wide net to capture all relevant competitors.

- SWOT Analysis : Conduct a thorough SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for each competitor. This analysis helps you identify their internal strengths and weaknesses, as well as external opportunities and threats they face.

- Market Share Analysis: Determine the market share held by each competitor and how it has evolved over time. Analyzing changes in market share can reveal shifts in competitive dynamics.

- Product and Pricing Analysis: Evaluate your competitors' product offerings and pricing strategies . Identify any unique features or innovations they offer and consider how your own products or services compare.

- Marketing and Branding Strategies: Examine the marketing and branding strategies employed by competitors. This includes their messaging, advertising channels, and customer engagement tactics. Assess how your marketing efforts stack up.

Industry Analysis Frameworks and Models

Now, let's explore essential frameworks and models commonly used in industry analysis, providing you with practical insights and examples to help you effectively apply these tools.

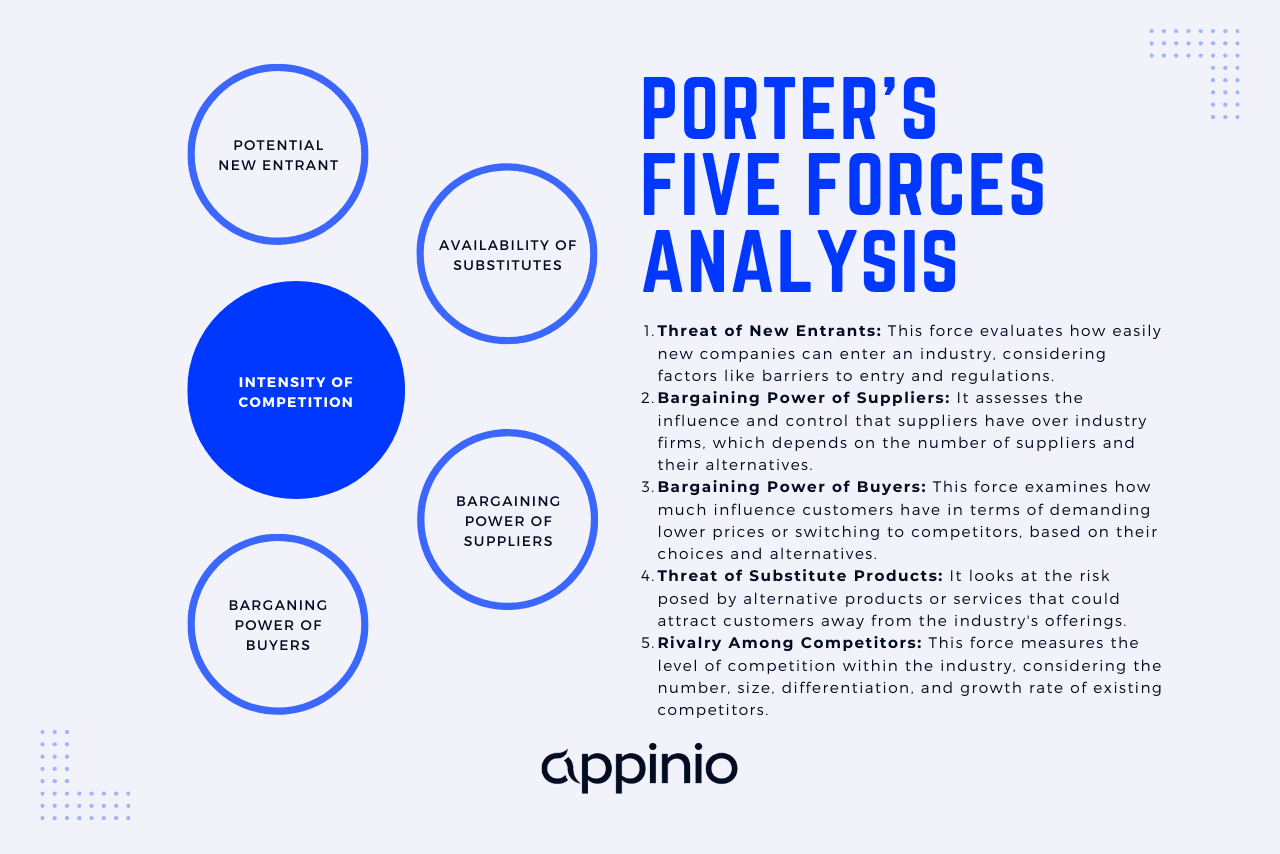

Porter's Five Forces Model

Porter's Five Forces is a powerful framework developed by Michael Porter to assess the competitive forces within an industry. This model helps you understand the industry's attractiveness and competitive dynamics.

It consists of five key forces:

- Threat of New Entrants: This force evaluates how easy or difficult it is for new companies to enter the industry. Factors that increase barriers to entry include high capital requirements, strong brand loyalty among existing players, and complex regulatory hurdles. For example, the airline industry has significant barriers to entry due to the need for large capital investments in aircraft, airport facilities, and regulatory approvals.

- Bargaining Power of Suppliers: This force examines the influence suppliers have on the industry's profitability. Powerful suppliers can demand higher prices or impose unfavorable terms. For instance, in the automotive industry, suppliers of critical components like microchips can wield significant bargaining power if they are few in number or if their products are highly specialized.

- Bargaining Power of Buyers: The bargaining power of buyers assesses how much influence customers have in negotiating prices and terms. In industries where buyers have many alternatives, such as the smartphone market, they can demand lower prices and better features, putting pressure on manufacturers to innovate and compete.

- Threat of Substitutes: This force considers the availability of substitute products or services that could potentially replace what the industry offers. For example, the rise of electric vehicles represents a significant threat to the traditional gasoline-powered automotive industry as consumers seek eco-friendly alternatives.

- Competitive Rivalry: Competitive rivalry assesses the intensity of competition among existing firms in the industry. A highly competitive industry, such as the smartphone market, often leads to price wars and aggressive marketing strategies as companies vie for market share.

Example: Let's consider the coffee shop industry . New entrants face relatively low barriers, as they can set up a small shop with limited capital. However, the bargaining power of suppliers, such as coffee bean producers, can vary depending on the region and the coffee's rarity. Bargaining power with buyers is moderate, as customers often have several coffee shops to choose from. Threats of substitutes may include energy drinks or homemade coffee, while competitive rivalry is high, with numerous coffee chains and independent cafes competing for customers.

SWOT Analysis

SWOT Analysis is a versatile tool used to assess an organization's internal strengths and weaknesses, as well as external opportunities and threats. By conducting a SWOT analysis, you can gain a comprehensive understanding of your industry and formulate effective strategies.

- Strengths: These are the internal attributes and capabilities that give your business a competitive advantage. For instance, if you're a tech company, having a talented and innovative team can be considered a strength.

- Weaknesses: Weaknesses are internal factors that hinder your business's performance. For example, a lack of financial resources or outdated technology can be weaknesses that need to be addressed.

- Opportunities: Opportunities are external factors that your business can capitalize on. This could be a growing market segment, emerging technologies, or changing consumer trends.

- Threats: Threats are external factors that can potentially harm your business. Examples of threats might include aggressive competition, economic downturns, or regulatory changes.

Example: Let's say you're analyzing the fast-food industry. Strengths could include a well-established brand, a wide menu variety, and efficient supply chain management. Weaknesses may involve a limited focus on healthy options and potential labor issues. Opportunities could include the growing trend toward healthier eating, while threats might encompass health-conscious consumer preferences and increased competition from delivery apps.

PESTEL Analysis

PESTEL Analysis examines the external macro-environmental factors that can impact your industry. The acronym stands for:

- Political: Political factors encompass government policies, stability, and regulations. For example, changes in tax laws or trade agreements can affect industries like international manufacturing.

- Economic: Economic factors include economic growth, inflation rates, and exchange rates. A fluctuating currency exchange rate can influence export-oriented industries like tourism.

- Social: Social factors encompass demographics, cultural trends, and social attitudes. An aging population can lead to increased demand for healthcare services and products.

- Technological: Technological factors involve advancements and innovations. Industries like telecommunications are highly influenced by technological developments, such as the rollout of 5G networks.

- Environmental: Environmental factors cover sustainability, climate change, and ecological concerns. Industries such as renewable energy are directly impacted by environmental regulations and consumer preferences.

- Legal: Legal factors encompass laws, regulations, and compliance requirements. The pharmaceutical industry, for instance, faces stringent regulatory oversight and patent protection laws.

Example: Consider the automobile manufacturing industry. Political factors may include government incentives for electric vehicles. Economic factors can involve fluctuations in fuel prices affecting consumer preferences for fuel-efficient cars. Social factors might encompass the growing interest in eco-friendly transportation options. Technological factors could relate to advancements in autonomous driving technology. Environmental factors may involve emissions regulations, while legal factors could pertain to safety standards and recalls.

Industry Life Cycle Analysis

Industry Life Cycle Analysis categorizes industries into various stages based on their growth and maturity. Understanding where your industry stands in its life cycle can help shape your strategies.

- Introduction: In the introduction stage, the industry is characterized by slow growth, limited competition, and a focus on product development. New players enter the market, and consumers become aware of the product or service. For instance, electric scooters were introduced as a new mode of transportation in recent years.

- Growth: The growth stage is marked by rapid market expansion, increased competition, and rising demand. Companies focus on gaining market share, and innovation is vital. The ride-sharing industry, exemplified by companies like Uber and Lyft, experienced significant growth in this stage.

- Maturity: In the maturity stage, the market stabilizes, and competition intensifies. Companies strive to maintain market share and differentiate themselves through branding and customer loyalty programs. The smartphone industry reached maturity with multiple established players.

- Decline: In the decline stage, the market saturates, and demand decreases. Companies must adapt or diversify to survive. The decline of traditional print media is a well-known example.

Example: Let's analyze the video streaming industry . The introduction stage saw the emergence of streaming services like Netflix. In the growth stage, more players entered the market, and the industry saw rapid expansion. The industry is currently in the maturity stage, with established platforms like Netflix, Amazon Prime, and Disney+ competing for market share. However, with continued innovation and changing consumer preferences, the decline stage may eventually follow.

Value Chain Analysis

Value Chain Analysis dissects a company's activities into primary and support activities to identify areas of competitive advantage. Primary activities directly contribute to creating and delivering a product or service, while support activities facilitate primary activities.

- Primary Activities: These activities include inbound logistics (receiving and storing materials), operations (manufacturing or service delivery), outbound logistics (distribution), marketing and sales, and customer service.

- Support Activities: Support activities include procurement (acquiring materials and resources), technology development (R&D and innovation), human resource management (recruitment and training), and infrastructure (administrative and support functions).

Example: Let's take the example of a smartphone manufacturer. Inbound logistics involve sourcing components, such as processors and displays. Operations include assembly and quality control. Outbound logistics cover shipping and distribution. Marketing and sales involve advertising and retail partnerships. Customer service handles warranty and support.

Procurement ensures a stable supply chain for components. Technology development focuses on research and development of new features. Human resource management includes hiring and training skilled engineers. Infrastructure supports the company's administrative functions.

By applying these frameworks and models effectively, you can better understand your industry, identify strategic opportunities and threats, and develop a solid foundation for informed decision-making.

Data Interpretation and Analysis

Once you have your data, it's time to start interpreting and analyzing the data you've collected during your industry analysis.

You can unlock the full potential of your data with Appinio 's comprehensive research platform. Beyond aiding in data collection, Appinio simplifies the intricate process of data interpretation and analysis. Our intuitive tools empower you to effortlessly transform raw data into actionable insights, giving you a competitive edge in understanding your industry.

Whether it's assessing market trends, evaluating the competitive landscape, or understanding customer behavior, Appinio offers a holistic solution to uncover valuable findings. With our platform, you can make informed decisions, strategize effectively, and stay ahead of industry shifts.

Experience the ease of data collection and interpretation with Appinio – book a demo today!

Book a Demo

1. Analyze Market Size and Growth

Analyzing the market's size and growth is essential for understanding its dynamics and potential. Here's how to conduct a robust analysis:

- Market Size Calculation: Determine the total market size in terms of revenue, units sold, or the number of customers. This figure serves as a baseline for evaluating the industry's scale.

- Historical Growth Analysis: Examine historical data to identify growth trends. This includes looking at past year-over-year growth rates and understanding the factors that influenced them.

- Projected Growth Assessment: Explore industry forecasts and projections to gain insights into the expected future growth of the market. Consider factors such as emerging technologies, changing consumer preferences, and economic conditions.

- Segmentation Analysis: If applicable, analyze market segmentation data to identify growth opportunities in specific market segments. Understand which segments are experiencing the most significant growth and why.

2. Assess Market Trends

Stay ahead of the curve by closely monitoring and assessing market trends. Here's how to effectively evaluate trends within your industry.

- Consumer Behavior Analysis: Dive into consumer behavior data to uncover shifts in preferences, buying patterns, and shopping habits. Understand how technological advancements and cultural changes influence consumer choices.

- Technological Advancements: Keep a keen eye on technological developments that impact your industry. Assess how innovations such as AI, IoT, blockchain, or automation are changing the competitive landscape.

- Regulatory Changes: Stay informed about regulatory shifts and their potential consequences for your industry. Regulations can significantly affect product development, manufacturing processes, and market entry strategies.

- Sustainability and Environmental Trends: Consider the growing importance of sustainability and environmental concerns. Evaluate how your industry is adapting to eco-friendly practices and how these trends affect consumer choices.

3. Evaluate Competitive Landscape

Understanding the competitive landscape is critical for positioning your business effectively. To perform a comprehensive evaluation:

- Competitive Positioning: Determine where your company stands in comparison to competitors. Identify your unique selling propositions and areas where you excel.

- Market Share Analysis: Continuously monitor market share among industry players. Identify trends in market share shifts and assess the strategies that lead to such changes.

- Competitive Advantages and Weaknesses: Analyze your competitors' strengths and weaknesses. Identify areas where you can capitalize on their weaknesses and where you need to fortify your own strengths.

4. Identify Key Success Factors

Recognizing and prioritizing key success factors is crucial for developing effective strategies. To identify and leverage these factors:

- Customer Satisfaction: Prioritize customer satisfaction as a critical success factor. Satisfied customers are more likely to become loyal advocates and contribute to long-term success.

- Quality and Innovation: Focus on product or service quality and continuous innovation. Meeting and exceeding customer expectations can set your business apart from competitors.

- Cost Efficiency: Strive for cost efficiency in your operations. Identifying cost-saving opportunities can lead to improved profitability.

- Marketing and Branding Excellence: Invest in effective marketing and branding strategies to create a strong market presence. Building a recognizable brand can drive customer loyalty and growth.

5. Analyze Customer Behavior and Preferences

Understanding your target audience is central to success. Here's how to analyze customer behavior and preferences:

- Market Segmentation: Use market segmentation to categorize customers based on demographics, psychographics , and behavior. This allows for more personalized marketing and product/service offerings.

- Customer Surveys and Feedback: Gather customer feedback through surveys and feedback mechanisms. Understand their pain points, preferences, and expectations to tailor your offerings.

- Consumer Journey Mapping: Map the customer journey to identify touchpoints where you can improve engagement and satisfaction. Optimize the customer experience to build brand loyalty.

By delving deep into data interpretation and analysis, you can gain valuable insights into your industry, uncover growth opportunities, and refine your strategic approach.

How to Conduct Competitor Analysis?

Competitor analysis is a critical component of industry analysis as it provides valuable insights into your rivals, helping you identify opportunities, threats, and areas for improvement.

1. Identify Competitors

Identifying your competitors is the first step in conducting a thorough competitor analysis. Competitors can be classified into several categories:

- Direct Competitors: These are companies that offer similar products or services to the same target audience. They are your most immediate competitors and often compete directly with you for market share.

- Indirect Competitors: Indirect competitors offer products or services that are related but not identical to yours. They may target a slightly different customer segment or provide an alternative solution to the same problem.

- Potential Competitors: These companies could enter your market in the future. Identifying potential competitors early allows you to anticipate and prepare for new entrants.

- Substitute Products or Services: While not traditional competitors, substitute products or services can fulfill the same customer needs or desires. Understanding these alternatives is crucial to your competitive strategy.

2. Analyze Competitor Strengths and Weaknesses

Once you've identified your competitors, you need to analyze their strengths and weaknesses. This analysis helps you understand how to position your business effectively and identify areas where you can gain a competitive edge.

- Strengths: Consider what your competitors excel at. This could include factors such as brand recognition, innovative products, a large customer base, efficient operations, or strong financial resources.

- Weaknesses: Identify areas where your competitors may be lacking. Weaknesses could involve limited product offerings, poor customer service, outdated technology, or financial instability.

3. Competitive Positioning

Competitive positioning involves defining how you want your business to be perceived relative to your competitors. It's about finding a unique position in the market that sets you apart. Consider the following strategies:

- Cost Leadership: Strive to be the low-cost provider in your industry. This positioning appeals to price-conscious consumers.

- Differentiation: Focus on offering unique features or attributes that make your products or services stand out. This can justify premium pricing.

- Niche Market: Target a specific niche or segment of the market that may be underserved by larger competitors. Tailor your offerings to meet their unique needs.

- Innovation and Technology: Emphasize innovation and technology to position your business as a leader in product or service quality.

- Customer-Centric: Prioritize exceptional customer service and customer experience to build loyalty and a positive reputation.

4. Benchmarking and Gap Analysis

Benchmarking involves comparing your business's performance and practices with those of your competitors or industry leaders. Gap analysis helps identify areas where your business falls short and where improvements are needed.

- Performance Benchmarking: Compare key performance metrics, such as revenue, profitability, market share, and customer satisfaction, with those of your competitors. Identify areas where your performance lags behind or exceeds industry standards.

- Operational Benchmarking: Analyze your operational processes, supply chain, and cost structures compared to your competitors. Look for opportunities to streamline operations and reduce costs.

- Product or Service Benchmarking: Evaluate the features, quality, and pricing of your products or services relative to competitors. Identify gaps and areas for improvement.

- Marketing and Sales Benchmarking: Assess your marketing strategies, customer acquisition costs, and sales effectiveness compared to competitors. Determine whether your marketing efforts are performing at a competitive level.

Market Entry and Expansion Strategies

Market entry and expansion strategies are crucial for businesses looking to enter new markets or expand their presence within existing ones. These strategies can help you effectively target and penetrate your chosen markets.

Market Segmentation and Targeting

- Market Segmentation: Begin by segmenting your target market into distinct groups based on demographics , psychographics, behavior, or other relevant criteria. This helps you understand the diverse needs and preferences of different customer segments.

- Targeting: Once you've segmented the market, select specific target segments that align with your business goals and capabilities. Tailor your marketing and product/service offerings to appeal to these chosen segments.

Market Entry Modes

Selecting the proper market entry mode is crucial for a successful expansion strategy. Entry modes include:

- Exporting: Sell your products or services in international markets through exporting. This is a low-risk approach, but it may limit your market reach.

- Licensing and Franchising: License your brand, technology, or intellectual property to local partners or franchisees. This allows for rapid expansion while sharing the risk and control.

- Joint Ventures and Alliances: Partner with local companies through joint ventures or strategic alliances. This approach leverages local expertise and resources.

- Direct Investment: Establish a physical presence in the target market through subsidiaries, branches, or wholly-owned operations. This offers full control but comes with higher risk and investment.

Competitive Strategy Formulation

Your competitive strategy defines how you will compete effectively in the target market.

- Cost Leadership: Strive to offer products or services at lower prices than competitors while maintaining quality. This strategy appeals to price-sensitive consumers.

- Product Differentiation: Focus on offering unique and innovative products or services that stand out in the market. This strategy justifies premium pricing.

- Market Niche: Target a specific niche or segment within the market that is underserved or has particular needs. Tailor your offerings to meet the unique demands of this niche.

- Market Expansion : Expand your product or service offerings to capture a broader share of the market. This strategy involves diversifying your offerings to appeal to a broader audience.

- Global Expansion: Consider expanding internationally to tap into new markets and diversify your customer base. This strategy involves thorough market research and adaptation to local cultures and regulations.

International Expansion Considerations

If your expansion strategy involves international markets, there are several additional considerations to keep in mind.

- Market Research: Conduct in-depth market research to understand the target country's cultural, economic, and legal differences.

- Regulatory Compliance: Ensure compliance with international trade regulations, customs, and import/export laws.

- Cultural Sensitivity: Adapt your marketing and business practices to align with the cultural norms and preferences of the target market.

- Localization: Consider adapting your products, services, and marketing materials to cater to local tastes and languages.

- Risk Assessment: Evaluate the political, economic, and legal risks associated with operating in the target country. Develop risk mitigation strategies.

By carefully analyzing your competitors and crafting effective market entry and expansion strategies, you can position your business for success in both domestic and international markets.

Risk Assessment and Mitigation

Risk assessment and mitigation are crucial aspects of industry analysis and strategic planning. Identifying potential risks, assessing vulnerabilities, and implementing effective risk management strategies are essential for business continuity and success.

1. Identify Industry Risks

- Market Risks: These risks pertain to factors such as changes in market demand, economic downturns, shifts in consumer preferences, and fluctuations in market prices. For example, the hospitality industry faced significant market risks during the COVID-19 pandemic, resulting in decreased travel and tourism .

- Regulatory and Compliance Risks: Regulatory changes, compliance requirements, and government policies can pose risks to businesses. Industries like healthcare are particularly susceptible to regulatory changes that impact operations and reimbursement.

- Technological Risks: Rapid technological advancements can disrupt industries and render existing products or services obsolete. Companies that fail to adapt to technological shifts may face obsolescence.

- Operational Risks: These risks encompass internal factors that can disrupt operations, such as supply chain disruptions, equipment failures, or cybersecurity breaches.

- Financial Risks: Financial risks include factors like liquidity issues, credit risk , and market volatility. Industries with high capital requirements, such as real estate development, are particularly vulnerable to financial risks.

- Competitive Risks: Intense competition and market saturation can pose challenges to businesses. Failing to respond to competitive threats can result in loss of market share.

- Global Risks: Industries with a worldwide presence face geopolitical risks, currency fluctuations, and international trade uncertainties. For instance, the automotive industry is susceptible to trade disputes affecting the supply chain.

2. Assess Business Vulnerabilities

- SWOT Analysis: Revisit your SWOT analysis to identify internal weaknesses and threats. Assess how these weaknesses may exacerbate industry risks.

- Financial Health: Evaluate your company's financial stability, debt levels, and cash flow. Identify vulnerabilities related to financial health that could hinder your ability to withstand industry-specific challenges.

- Operational Resilience: Assess the robustness of your operational processes and supply chain. Identify areas where disruptions could occur and develop mitigation strategies.

- Market Positioning: Analyze your competitive positioning and market share. Recognize vulnerabilities in your market position that could be exploited by competitors.

- Compliance and Regulatory Adherence: Ensure that your business complies with relevant regulations and standards. Identify vulnerabilities related to non-compliance or regulatory changes.

3. Risk Management Strategies

- Risk Avoidance: In some cases, the best strategy is to avoid high-risk ventures or markets altogether. This may involve refraining from entering certain markets or discontinuing products or services with excessive risk.

- Risk Reduction: Implement measures to reduce identified risks. For example, diversifying your product offerings or customer base can reduce dependence on a single revenue source.

- Risk Transfer: Transfer some risks through methods such as insurance or outsourcing. For instance, businesses can mitigate cybersecurity risks by purchasing cyber insurance.

- Risk Acceptance: In cases where risks cannot be entirely mitigated, it may be necessary to accept a certain level of risk and have contingency plans in place to address potential issues.

- Continuous Monitoring: Establish a system for continuous risk monitoring. Regularly assess the changing landscape and adjust risk management strategies accordingly.

4. Contingency Planning

Contingency planning involves developing strategies and action plans to respond effectively to unforeseen events or crises. It ensures that your business can maintain operations and minimize disruptions in the face of adverse circumstances. Key elements of contingency planning include:

- Risk Scenarios: Identify potential risk scenarios specific to your industry and business. These scenarios should encompass a range of possibilities, from minor disruptions to major crises.

- Response Teams: Establish response teams with clearly defined roles and responsibilities. Ensure that team members are trained and ready to act in the event of a crisis.

- Communication Plans: Develop communication plans that outline how you will communicate with employees, customers, suppliers, and other stakeholders during a crisis. Transparency and timely communication are critical.

- Resource Allocation: Determine how resources, including personnel, finances, and equipment, will be allocated in response to various scenarios.

- Testing and Simulation: Regularly conduct tests and simulations of your contingency plans to identify weaknesses and areas for improvement. Ensure your response teams are well-practiced and ready to execute the plans effectively.

- Documentation and Record Keeping: Maintain comprehensive documentation of contingency plans, response procedures, and communication protocols. This documentation should be easily accessible to relevant personnel.

- Review and Update: Continuously review and update your contingency plans to reflect changing industry dynamics and evolving risks. Regularly seek feedback from response teams to make improvements.

By identifying industry risks, assessing vulnerabilities, implementing risk management strategies, and developing robust contingency plans, your business can navigate the complexities of the industry landscape with greater resilience and preparedness.

Industry Analysis Template

When embarking on the journey of Industry Analysis, having a well-structured template is akin to having a reliable map for your exploration. It provides a systematic framework to ensure you cover all essential aspects of the analysis. Here's a breakdown of an industry analysis template with insights into each section.

Industry Overview

- Objective: Provide a broad perspective of the industry.

- Market Definition: Define the scope and boundaries of the industry, including its products, services, and target audience.

- Market Size and Growth: Present current market size, historical growth trends, and future projections.

- Key Players: Identify major competitors and their market share.

- Market Trends: Highlight significant trends impacting the industry.

Competitive Analysis

- Objective: Understand the competitive landscape within the industry.

- Competitor Identification: List direct and indirect competitors.

- Competitor Profiles: Provide detailed profiles of major competitors, including their strengths, weaknesses, strategies, and market positioning.

- SWOT Analysis: Conduct a SWOT analysis for each major competitor.

- Market Share Analysis: Analyze market share distribution among competitors.

Market Analysis

- Objective: Explore the characteristics and dynamics of the market.

- Customer Segmentation: Define customer segments and their demographics, behavior, and preferences.

- Demand Analysis: Examine factors driving demand and customer buying behavior.

- Supply Chain Analysis: Map out the supply chain, identifying key suppliers and distribution channels.

- Regulatory Environment: Discuss relevant regulations, policies, and compliance requirements.

Technological Analysis

- Objective: Evaluate the technological landscape impacting the industry.

- Technological Trends: Identify emerging technologies and innovations relevant to the industry.

- Digital Transformation: Assess the level of digitalization within the industry and its impact on operations and customer engagement.

- Innovation Opportunities: Explore opportunities for leveraging technology to gain a competitive edge.

Financial Analysis

- Objective: Analyze the financial health of the industry and key players.

- Revenue and Profitability: Review industry-wide revenue trends and profitability ratios.

- Financial Stability: Assess financial stability by examining debt levels and cash flow.

- Investment Patterns: Analyze capital expenditure and investment trends within the industry.

Consumer Insights

- Objective: Understand consumer behavior and preferences.

- Consumer Surveys: Conduct surveys or gather data on consumer preferences, buying habits , and satisfaction levels.

- Market Perception: Gauge consumer perception of brands and products in the industry.

- Consumer Feedback: Collect and analyze customer feedback and reviews.

SWOT Analysis for Your Business

- Objective: Assess your own business within the industry context.

- Strengths: Identify internal strengths that give your business a competitive advantage.

- Weaknesses: Recognize internal weaknesses that may hinder your performance.

- Opportunities: Explore external opportunities that your business can capitalize on.

- Threats: Recognize external threats that may impact your business.

Conclusion and Recommendations

- Objective: Summarize key findings and provide actionable recommendations.

- Summary: Recap the most critical insights from the analysis.

- Recommendations: Offer strategic recommendations for your business based on the analysis.

- Future Outlook: Discuss potential future developments in the industry.

While this template provides a structured approach, adapt it to the specific needs and objectives of your Industry Analysis. It serves as your guide, helping you navigate through the complex landscape of your chosen industry, uncovering opportunities, and mitigating risks along the way.

Remember that the depth and complexity of your industry analysis may vary depending on your specific goals and the industry you are assessing. You can adapt this template to focus on the most relevant aspects and conduct thorough research to gather accurate data and insights. Additionally, consider using industry-specific data sources, reports, and expert opinions to enhance the quality of your analysis.

Industry Analysis Examples

To grasp the practical application of industry analysis, let's delve into a few diverse examples across different sectors. These real-world scenarios demonstrate how industry analysis can guide strategic decision-making.

Tech Industry - Smartphone Segment

Scenario: Imagine you are a product manager at a tech company planning to enter the smartphone market. Industry analysis reveals that the market is highly competitive, dominated by established players like Apple and Samsung.

Use of Industry Analysis:

- Competitive Landscape: Analyze the strengths and weaknesses of competitors, identifying areas where they excel (e.g., Apple's brand loyalty ) and where they might have vulnerabilities (e.g., consumer demand for more affordable options).

- Market Trends: Identify trends like the growing demand for sustainable technology and 5G connectivity, guiding product development and marketing strategies.

- Regulatory Factors: Consider regulatory factors related to intellectual property rights, patents, and international trade agreements that can impact market entry and operations.

- Outcome: Armed with insights from industry analysis, you decide to focus on innovation, emphasizing features like eco-friendliness and affordability. This niche approach helps your company gain a foothold in the competitive market.

Healthcare Industry - Telehealth Services

Scenario: You are a healthcare entrepreneur exploring opportunities in the telehealth sector, especially in the wake of the COVID-19 pandemic. Industry analysis is critical due to rapid market changes.

- Market Size and Growth: Evaluate the growing demand for telehealth services, driven by the need for remote healthcare during the pandemic and convenience factors.

- Regulatory Environment: Understand the evolving regulatory landscape, including changes in telemedicine reimbursement policies and licensing requirements.

- Technological Trends: Explore emerging technologies such as AI-powered diagnosis and remote monitoring that can enhance service offerings.

- Outcome: Industry analysis underscores the potential for telehealth growth. You adapt your business model to align with regulatory changes, invest in cutting-edge technology, and focus on patient-centric care, positioning your telehealth service for success.

Food Industry - Plant-Based Foods

Scenario: As a food industry entrepreneur , you are considering entering the plant-based foods market, driven by increasing consumer interest in health and sustainability.

- Market Trends: Analyze the trend toward plant-based diets and sustainability, reflecting changing consumer preferences.

- Competitive Landscape: Assess the competitive landscape, understanding that established companies and startups are vying for market share.

- Consumer Behavior: Study consumer behavior, recognizing that health-conscious consumers seek plant-based alternatives.

- Outcome: Informed by industry analysis, you launch a line of plant-based products emphasizing both health benefits and sustainability. Effective marketing and product quality gain traction among health-conscious consumers, making your brand a success in the plant-based food industry.

These examples illustrate how industry analysis can guide strategic decisions, whether entering competitive tech markets, navigating dynamic healthcare regulations, or capitalizing on shifting consumer preferences in the food industry. By applying industry analysis effectively, businesses can adapt, innovate, and thrive in their respective sectors.

Industry Analysis is the compass that helps businesses chart their course in the vast sea of markets. By understanding the industry's dynamics, risks, and opportunities, you gain a strategic advantage that can steer your business towards success. From identifying competitors to mitigating risks and formulating competitive strategies, this guide has equipped you with the tools and knowledge needed to navigate the complexities of the business world.

Remember, Industry Analysis is not a one-time task; it's an ongoing journey. Keep monitoring market trends, adapting to changes, and staying ahead of the curve. With a solid foundation in industry analysis, you're well-prepared to tackle challenges, seize opportunities, and make well-informed decisions that drive your business toward prosperity. So, set sail with confidence and let industry analysis be your guiding star on the path to success.

How to Conduct Industry Analysis in Minutes?

Introducing Appinio , the real-time market research platform that transforms how you conduct Industry Analysis. Imagine getting real-time consumer insights in minutes, putting the power of data-driven decision-making at your fingertips. With Appinio, you can:

- Gain insights swiftly: Say goodbye to lengthy research processes. Appinio delivers answers fast, ensuring you stay ahead in the competitive landscape.

- No research degree required: Our intuitive platform is designed for everyone. You don't need a PhD in research to harness its capabilities.

- Global reach, local insights: Define your target group precisely from over 1200 characteristics and access consumer data in over 90 countries.

Join the loop 💌

Be the first to hear about new updates, product news, and data insights. We'll send it all straight to your inbox.

Get the latest market research news straight to your inbox! 💌

Wait, there's more

16.05.2024 | 30min read

Time Series Analysis: Definition, Types, Techniques, Examples

14.05.2024 | 31min read

Experimental Research: Definition, Types, Design, Examples

07.05.2024 | 29min read

Interval Scale: Definition, Characteristics, Examples

How to Conduct an Industry Analysis

8 min. read

Updated March 18, 2024

I bet you agree: You need to know the industry you want to start a business in, and the kind of business you want to start, before you can start it.

Industry analysis is part of good management. That’s not just for the business planning, but rather for business survival, beginning to end. Most of the people who successfully start their own business have already had relevant business experience before they start, most often as employees.

But in this article, I focus on how to consolidate and formalize that industry knowledge into a formal business plan .

Although all business owners need to know their industry, the documented details and explanations are mainly for when you’re writing a business plan you need to show to outsiders, like bank lenders or investors . You’ll need to do some industry analysis so you’re able to explain the general state of your industry, its growth potential, and how your business model fits into the landscape.

And if your business plan is more of an internal strategic roadmap, you should still be very sure—whether you have to prove it to others or not—that you know your market, even if you don’t do a formal industry analysis. Whether you’re a service business, manufacturer, retailer, or something else, you want to know your industry inside and out.

- What to cover in your industry analysis

Whether you write it all out in a formal business plan or not, when you’re doing your industry analysis, you’re looking at the following:

- Industry participants

- Distribution patterns

- Competition and buying patterns

Everything in your industry that happens outside of your business will affect your company. The more you know about your industry, the more advantage and protection you will have.

A complete business plan discusses:

- General industry economics

- Participants

- Factors in the competition

- And whatever else describes the nature of your business to outsiders

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

A note on finding industry information

The internet has had an enormous impact on the state of business information. Finding information isn’t really the problem anymore, after the information explosion and the huge growth in the internet beginning in the 1990s and continuing in the 21st century.

Even 10 or 15 years ago, dealing with information was more a problem of sorting through it all than of finding raw data. That generality is truer every day. There are websites for business analysis, financial statistics, demographics, trade associations, and just about everything you’ll need for a complete business plan.

You should know who else sells in your market. You can’t easily describe a type of business without describing the nature of the participants. There is a huge difference, for example, between an industry like broadband television services, in which there are only a few huge companies in any one country, and one like dry cleaning, in which there are tens of thousands of smaller participants.

This can make a big difference to a business and a business plan. The restaurant industry, for example, is what we call “pulverized,” meaning that it, like the dry cleaning industry, is made up of many small participants. The fast-food business, on the other hand, is composed of a few national brands participating in thousands of branded outlets, many of them franchised .

Economists talk of consolidation in an industry as a time when many small participants tend to disappear and a few large players emerge. In accounting, for example, there are a few large international firms whose names are well-known, and tens of thousands of smaller firms. The automobile business is composed of a few national brands participating in thousands of branded dealerships, and in computer manufacturing, for example, there are a few large international firms whose names are well-known, and thousands of smaller firms.

Products and services can follow many paths between suppliers and users.

Explain how distribution works in your industry:

- Is this an industry in which retailers are supported by regional distributors, as is the case for computer products, magazines, or auto parts?

- Does your industry depend on direct sales to large industrial customers?

- Do manufacturers support their own direct sales forces, or do they work with product representatives?

Some products are almost always sold through retail stores to consumers, and sometimes these are distributed by distribution companies that buy from manufacturers. In other cases, the products are sold directly from manufacturers to stores. Some products are sold directly from the manufacturer to the final consumer through mail campaigns, national advertising, or other promotional means.

In many product categories, there are several alternatives, and distribution choices are strategic.

Amazon made direct delivery a huge competitive advantage, especially in its earlier years. Doordash and competitors chose to be intermediaries between restaurants and customers, and several businesses offer prepackaged meal ingredients delivered with instructions for finishing the preparations in the consumers’ kitchens. Now major grocery chains offer grocery delivery. Red Box made a strategy of DVDs in kiosks. An entire industry of food delivery options gives consumers choices like restaurant meals or fresh meals ingredients being delivered. Many products are distributed through direct business-to-business (B2B) sales and in long-term contracts such as the ones between car manufacturers and their suppliers of parts, materials, and components. In some industries, companies use representatives, agents, or commissioned salespeople.

Technology can change the patterns of distribution in an industry or product category. The internet, for example, changed options for software distribution, books, music, and other products. Cable communication first, and more recently streaming, changed the options for distributing video products and video games. Some kinds of specialty items sell best with late-night infomercials on television, but others end up working on the web instead of television.

Distribution patterns may not be as critical to most service companies, because distribution is normally about physical distribution of specific physical products such as a restaurant, graphic artist, professional services practice, or architect.

For a few services, the distribution may still be relevant. A phone service, cable provider, or an internet provider might describe distribution related to physical infrastructure. Some publishers may prefer to treat their business as a service, rather than a manufacturing company, and in that case distribution may also be relevant.

It is essential to understand the nature of competition in your market. This is still in the general area of describing the industry or type of business.

Explain the general nature of competition in this business, and how the customers seem to choose one provider over another:

- What are the keys to success?

- What buying factors make the most difference—is it price? Product features? Service? Support? Training? Software? Delivery dates?

- Are brand names important?

In the computer business, for example, competition might depend on reputation and trends in one part of the market, and on channels of distribution and advertising in another. In many business-to-business industries, the nature of competition depends on direct selling, because channels are impractical.

Price is vital in products competing with each other on retail shelves, but delivery and reliability might be much more important for materials used by manufacturers in volume, for which a shortage can affect an entire production line.

In the restaurant business, for example, competition might depend on reputation and trends in one part of the market, and on location and parking in another.

In many professional service practices, the nature of competition depends on word of mouth, because advertising is not completely accepted. Is there price competition between accountants, doctors, and lawyers? How powerful are the insurance decisions in medicine, like in or out of network? How do people choose travel agencies or florists for weddings? Why does someone hire one landscape architect over another? Why choose Starbucks, a national brand, over the local coffee house? All of this is the nature of competition.

The key to your specific industry analysis is a collection of decisions and educated guesses you’ll probably have to make for yourself. There are few pat answers. Maybe it’s easy parking, a great location, great reviews on Amazon or Yelp, or recommendations on social media. You can’t necessarily look this up. It’s the kind of educated guessing that makes some businesses more successful than others.

- Main competitors

Do a very complete analysis of your main competitors. Make a list, determining who your main competitors are. What are the strengths and weaknesses of each?

Consider your competitors’:

- Financial position

- Channels of distribution

- Brand awareness

- Business development

- Technology, or other factors that you feel are important

- In what segments of the market do they operate? What seems to be their strategy? How much do they impact your products, and what threats and opportunities do they represent?

Finding competitive information

Competitive research starts with a good web search. Look up competitors’ websites and social media, then search for mentions, reviews, announcements, and even vacancies and job search information. An amazing array of competitive information is posted in plain sight, where anybody can find it.

From, there, for a good review of additional sources of information, I suggest Practical Market Research Resources for Entrepreneurs , also here on Bplans.

Competitive matrix

A lot of businesses organize competitive analysis into a competitive matrix. The standard competitive matrix shows how different competitors stack up according to significant factors.

Some people also use a SWOT analysis to think about competition in terms of opportunities and threats, the “OT” of SWOT. Opportunities and threats are generally taken as externals, which would include competition, so it’s valuable to run a SWOT analysis on your business to help figure this out.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

7 Min. Read

Target Market Examples

4 Min. Read

How to Define Your Target Market

10 Min. Read

How to Create a Detailed User or Buyer Persona

3 Min. Read

How to Use TAM, SAM, SOM to Determine Market Size

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What Is an Industry Analysis and Trends Business Plan?

An industry analysis and trends business plan is a component of a business plan that provides a comprehensive insight into industry conditions and trends. 3 min read updated on February 01, 2023

An industry analysis and trends business plan is a component of a business plan that provides a comprehensive insight into industry conditions and trends that can impact a company's success and growth. A thorough analysis of your industry and its trends can give you and other people a clearer idea of the feasibility and relevance of your business idea or goals.

Elements of a Business Plan

There are many different types of business plans. When you are creating your business plan, the information you choose to include will depend on your audience and personal preferences, as well as the questions you wish to answer and problems you seek to solve. While business plans may vary greatly, most of them contain the following elements:

- Executive summary

- Business description

- Analysis of business environment analysis

- Industry analysis

- Market analysis

- Competitive analysis

- Marketing plan

- Management plan

- Operations plan

- Financial projections

- What Is an Industry Analysis?

An industry analysis enables you to gain a better understanding of the industry and market in which you will be conducting business. By conducting an industry analysis before you start writing your business plan , you will be able to:

- Identify industry trends, such as potentially problematic aspects of the industry

- Identify trends and opportunities in products and services

- Calculate capital requirements

- Determine business risks and find ways to reduce them

An industry analysis must be specific to the industry in which you are conducting or are planning to conduct business. With the information you obtain from the analysis, you can devise a long-term strategy to mitigate risks and take full advantage of growth opportunities.

It is important not to confuse an industry analysis with a competitor or market analysis. An industry analysis seeks to describe the products or services offered in a specific industry and the boundaries of the marketplace in relation to economic, political, and regulatory issues. In other words, it defines the scope of the marketplace. A market analysis , on the other hand, helps you determine whether or not a market within your industry will be profitable for your products or services.

Conducting an Industry Analysis

The most widely used method for evaluating any industry was devised by Michael E. Porter from Harvard University. This method can help you create an effective strategy for competing in your industry. According to Porter, all industries and markets are influenced by five forces, which include:

- Ease of entry — Companies that are already operating in an industry will enjoy a competitive advantage over newcomers. However, their profits will be reduced unless they find a way to slow down or block the new entries. As for new businesses, they will face a variety of barriers, including government regulations, patents and copyrights, and customer loyalty.

- Suppliers' power — Suppliers of materials, products, or services can have a significant impact on a business' ability to compete. In the event that there are few suppliers offering the products or materials or few alternative products, the suppliers have the power to dictate quantities, prices, and delivery times for companies that have no choice but to buy from them.

- Buyers' power — In an industry where buyers can choose from many competing products, consumers will have strong bargaining power. This can affect the ability of a company to price its products or services without being afraid of losing customers.

- Availability of alternative products — In the situation where two businesses with similar products are competing within an industry, both of them will benefit as their marketing efforts will generally increase demand for their products. However, their market share will be reduced if there is another company selling a different kind of products that can serve as a substitute for theirs.

- Competitive rivalry — Competitive rivalry takes into account the number of competitors present in a particular industry, as well as their relative strength. In an industry where many companies are selling similar products, there is little opportunity for one company to control consumers' or suppliers' tendency to go elsewhere.

There are many free industry analysis tools and resources available to business owners who are preparing to create a business plan, such as:

- Securities and Exchange Commission

- U.S. Census Bureau

- Hoover's Online

- Thomas Register

- Library of Congress Legislative Information

- Websites of trade associations and companies

If you need help creating an industry analysis and trends business plan, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Business Plan Outline: Everything You Need To Know

- How to Make a Business Plan Format

- Parts of Business Plan and Definition

- Business Description Outline

- Market Analysis: Everything You Need To Know

- Service Business Plan

- IT Company Business Plan

- Clothing Boutique Business Plan Outline

- Business Plan for Existing Company

Analyze your market like a pro with this step-by-step guide + insider tips

Don’t fall into the trap of assuming that you already know enough about your market.

No matter how fantastic your product or service is, your business cannot succeed without sufficient market demand .

You need a clear understanding of who will buy your product or service and why .

You want to know if there is a clear market gap and a market large enough to support the survival and growth of your business.

Industry research and market analysis will help make sure that you are on the right track .

It takes time , but it is time well spent . Thank me later.

WHAT is Market Analysis?

The Market Analysis section of a business plan is also sometimes called:

- Market Demand, Market Trends, Target Market, The Market

- Industry Analysis & Trends, Industry & Market Analysis, Industry and Market Research

WHY Should You Do Market Analysis?

First and foremost, you need to demonstrate beyond any reasonable doubt that there is real need and sufficient demand for your product or service in the market, now and going forward.

- What makes you think that people will buy your products or services?

- Can you prove it?

Your due diligence on the market opportunity and validating the problem and solution described in the Product and Service section of your business plan are crucial for the success of your venture.

Also, no company operates in a vacuum. Every business is part of a larger overall industry, the forces that affect your industry as a whole will inevitably affect your business as well.

Evaluating your industry and market increases your own knowledge of the factors that contribute to your company’s success and shows the readers of your business plan that you understand the external business conditions.

External Support

In fact, if you are seeking outside financing, potential backers will most definitely be interested in industry and market conditions and trends.

You will make a positive impression and have a better chance of getting their support if you show market analysis that strengthens your business case, combining relevant and reliable data with sound judgement.

Let’s break down how to do exactly that, step by step:

HOW To Do Market Analysis: Step-by-Step

So, let’s break up how market analysis is done into three steps:

- Industry: the total market

- Target Market: specific segments of the industry that you will target

- Target Customer: characteristics of the customers that you will focus on

Step 1: Industry Analysis

How do you define an industry.

For example, the fashion industry includes fabric suppliers, designers, companies making finished clothing, distributors, sales representatives, trade publications, retail outlets online and on the high street.

How Do You Analyze an Industry?

Briefly describe your industry, including the following considerations:

1.1. Economic Conditions

Outline the current and projected economic conditions that influence the industry your business operates in, such as:

- Official economic indicators like GDP or inflation

- Labour market statistics

- Foreign trade (e.g., import and export statistics)

1.2. Industry Description

Highlight the distinct characteristic of your industry, including:

- Market leaders , major customer groups and customer loyalty

- Supply chain and distribution channels

- Profitability (e.g., pricing, cost structure, margins), financials

- Key success factors

- Barriers to entry preventing new companies from competing in the industry

1.3. Industry Size and Growth

Estimate the size of your industry and analyze how industry growth affects your company’s prospects:

- Current size (e.g., revenues, units sold, employment)

- Historic and projected industry growth rate (low/medium/high)

- Life-cycle stage /maturity (emerging/expanding/ mature/declining)

1.4. Industry Trends

- Industry Trends: Describe the key industry trends and evaluate the potential impact of PESTEL (political / economic / social / technological / environmental / legal) changes on the industry, including the level of sensitivity to:

- Seasonality

- Economic cycles

- Government regulation (e.g. environment, health and safety, international trade, performance standards, licensing/certification/fair trade/deregulation, product claims) Technological change

- Global Trends: Outline global trends affecting your industry

- Identify global industry concerns and opportunities

- International markets that could help to grow your business

- Strategic Opportunity: Highlight the strategic opportunities that exist in your industry

Step 2: Target Customer Identification

Who is a target customer.

One business can have–and often does have–more than one target customer group.

The success of your business depends on your ability to meet the needs and wants of your customers. So, in a business plan, your aim is to assure readers that:

- Your customers actually exist

- You know exactly who they are and what they want

- They are ready for what you have to offer and are likely to actually buy

How Do You Identify an Ideal Target Customer?

2.1. target customer.

- Identify the customer, remembering that the decision-maker who makes the purchase can be a different person or entity than the end-user.

2.2. Demographics

- For consumers ( demographics ): Age, gender, income, occupation, education, family status, home ownership, lifestyle (e.g., work and leisure activities)

- For businesses ( firmographic ): Industry, sector, years in business, ownership, size (e.g., sales, revenues, budget, employees, branches, sq footage)

2.3. Geographic Location

- Where are your customers based, where do they buy their products/services and where do they actually use them

2.4 Purchasing Patterns

- Identify customer behaviors, i.e., what actions they take

- how frequently

- and how quickly they buy

2.5. Psychographics

- Identify customer attitudes, i.e., how they think or feel

- Urgency, price, quality, reputation, image, convenience, availability, features, brand, customer service, return policy, sustainability, eco-friendliness, supporting local business

- Necessity/luxury, high involvement bit ticket item / low involvement consumable

Step 3: Target Market Analysis

What is a target market.

Target market, or 'target audience', is a group of people that a business has identified as the most likely to purchase its offering, defined by demographic, psychographic, geographic and other characteristics. Target market may be broken down to target customers to customize marketing efforts.

How Do You Analyze a Target Market?

So, how many people are likely to become your customers?

To get an answer to this questions, narrow the industry into your target market with a manageable size, and identify its key characteristics, size and trends:

3.1. Target Market Description

Define your target market by:

- Type: B2C, B2B, government, non-profits

- Geographic reach: Specify the geographic location and reach of your target market

3.2. Market Size and Share

Estimate how large is the market for your product or service (e.g., number of customers, annual purchases in sales units and $ revenues). Explain the logic behind your calculation:

- TAM (Total Available/Addressable/Attainable Market) is the total maximum demand for a product or service that could theoretically be generated by selling to everyone in the world who could possibly buy from you, regardless of competition and any other considerations and restrictions.

- SAM (Serviceable Available Market) is the portion of the TAM that you could potentially address in a specific market. For example, if your product/service is only available in one country or language.

- SOM (Service Obtainable Market / Share of Market) is the share of the SAM that you can realistically carve out for your product or service. This the target market that you will be going after and can reasonably expect to convert into a customer base.

3.3. Market Trends

Illustrate the most important themes, changes and developments happening in your market. Explain the reasons behind these trends and how they will favor your business.

3.4. Demand Growth Opportunity

Estimate future demand for your offering by translating past, current and future market demand trends and drivers into forecasts:

- Historic growth: Check how your target market has grown in the past.

- Drivers past: Identify what has been driving that growth in the past.

- Drivers future: Assess whether there will be any change in influence of these and other drivers in the future.

How Big Should My Target Market Be?

Well, if the market opportunity is small, it will limit how big and successful your business can become. In fact, it may even be too small to support a successful business at all.

On the other hand, many businesses make the mistake of trying to appeal to too many target markets, which also limits their success by distracting their focus.

What If My Stats Look Bad?

Large and growing market suggests promising demand for your offering now and into the future. Nevertheless, your business can still thrive in a smaller or contracting market.

Instead of hiding from unfavorable stats, acknowledge that you are swimming against the tide and devise strategies to cope with whatever lies ahead.

Step 4: Industry and Market Analysis Research

The market analysis section of your business plan should illustrate your own industry and market knowledge as well as the key findings and conclusions from your research.

Back up your findings with external research sources (= secondary research) and results of internal market research and testing (= primary research).

What is Primary and Secondary Market Research?

Yes, there are two main types of market research – primary and secondary – and you should do both to adequately cover the market analysis section of your business plan:

- Primary market research is original data you gather yourself, for example in the form of active fieldwork collecting specific information in your market.

- Secondary market research involves collating information from existing data, which has been researched and shared by reliable outside sources . This is essentially passive desk research of information already published .

Unless you are working for a corporation, this exercise is not about your ability to do professional-level market research.

Instead, you just need to demonstrate fundamental understanding of your business environment and where you fit in within the market and broader industry.

Why Do You Need To Do Primary & Secondary Market Research?

There are countless ways you could go collecting industry and market research data, depending on the type of your business, what your business plan is for, and what your needs, resources and circumstances are.