Feasibility study and business plan: Feasibility Study vs: Business Plan: Understanding the Difference

1. what are feasibility studies and business plans and why are they important, 2. what is it, what are its components, and how to conduct one, 3. what is it, what are its components, and how to write one, 4. what are the similarities and differences between them, 5. what are the scenarios and situations where you need one or both of them, 6. how to apply them to different types of businesses and projects, 7. how to make your feasibility study and business plan effective and successful, 8. what are the key takeaways and recommendations from your blog.

Before launching a new venture or expanding an existing one, entrepreneurs need to assess the viability and profitability of their ideas. This is where feasibility studies and business plans come in handy. These are two different but complementary tools that can help entrepreneurs make informed decisions and secure funding for their projects. However, many people confuse the two or use them interchangeably, which can lead to misunderstandings and missed opportunities. In this article, we will explore the differences and similarities between feasibility studies and business plans, and how to use them effectively.

- A feasibility study is a preliminary analysis that evaluates the potential and practicality of a business idea. It answers the question: Is this idea worth pursuing ?

- A business plan is a detailed document that describes the goals, strategies, and operations of a business. It answers the question: How will this idea be executed and succeed?

Some of the main differences between feasibility studies and business plans are:

1. Purpose : A feasibility study is used to test the viability of an idea before investing too much time and money into it. It can help entrepreneurs identify the strengths, weaknesses, opportunities, and threats of their idea, as well as the market demand, customer preferences, competition, costs, risks, and legal issues. A feasibility study can also provide a go/no-go decision or a recommendation for further research. A business plan, on the other hand, is used to communicate the vision and direction of a business to potential investors, partners, employees, and customers. It can help entrepreneurs secure funding , attract talent, establish partnerships, and monitor progress. A business plan can also serve as a roadmap for implementing and managing the business.

2. Format : A feasibility study is usually a concise and focused report that summarizes the findings and conclusions of the analysis. It can range from a few pages to a few dozen pages, depending on the complexity and scope of the idea. A business plan is typically a comprehensive and structured document that covers various aspects of the business, such as the executive summary, the company description, the market analysis , the product or service description, the marketing and sales plan, the financial plan, and the appendix. It can range from 10 to 100 pages, depending on the size and stage of the business.

3. Timing : A feasibility study is usually conducted before a business plan , as it can help entrepreneurs determine whether their idea is worth pursuing or not. A feasibility study can save entrepreneurs from wasting time and money on an unfeasible or unprofitable idea. A business plan is usually developed after a feasibility study, as it can help entrepreneurs refine and elaborate on their idea. A business plan can also be updated and revised as the business grows and changes.

An example of a feasibility study is a market research that evaluates the demand and preferences of potential customers for a new product or service . An example of a business plan is a pitch deck that showcases the value proposition, the competitive advantage, and the financial projections of a new venture .

What are feasibility studies and business plans and why are they important - Feasibility study and business plan: Feasibility Study vs: Business Plan: Understanding the Difference

A feasibility study is a crucial step in the process of launching a new venture or project. It is an analysis that evaluates the viability of an idea, product, service, or solution before investing time, money, and resources into it. A feasibility study helps to answer questions such as:

- Is there a market demand for the proposed offering?

- What are the technical, operational, legal, and financial requirements and risks involved?

- How much will it cost to develop, produce, and deliver the offering?

- How much revenue and profit can be expected from the offering?

- What are the strengths, weaknesses, opportunities, and threats (SWOT) of the offering and the business environment?

- What are the alternatives and competitors in the market?

A feasibility study typically consists of the following components:

1. Executive summary : This is a brief overview of the main findings and recommendations of the feasibility study. It should highlight the objectives, scope, methodology, results, and conclusions of the analysis.

2. Market analysis : This is a detailed examination of the current and potential market for the proposed offering. It should include information such as market size, segmentation, trends, growth, demand, customer preferences, buying behavior, and competitive landscape.

3. Technical analysis : This is a thorough assessment of the technical aspects of the proposed offering. It should cover topics such as product or service design , specifications, features, functionality, quality, performance, reliability, safety, and compliance.

4. Operational analysis : This is a comprehensive evaluation of the operational requirements and capabilities of the proposed offering. It should address issues such as production or service delivery processes , equipment, materials, labor, facilities, logistics, distribution, inventory, maintenance, and quality control.

5. Financial analysis : This is a rigorous estimation of the financial implications and outcomes of the proposed offering. It should include elements such as cost-benefit analysis , break-even analysis, cash flow analysis , income statement, balance sheet, return on investment, and sensitivity analysis.

6. Risk analysis : This is a systematic identification and mitigation of the potential risks and uncertainties associated with the proposed offering. It should consider factors such as technical, operational, market, financial, legal, regulatory, environmental, social, and ethical risks.

7. Recommendation and conclusion : This is a clear and concise statement of the overall feasibility and desirability of the proposed offering. It should summarize the main findings and arguments of the feasibility study and provide a recommendation on whether to proceed, modify, or abandon the idea.

To conduct a feasibility study , one should follow these steps:

- Define the objectives and scope of the study

- Gather relevant data and information from primary and secondary sources

- analyze the data and information using appropriate methods and tools

- Evaluate the results and compare them with the predefined criteria and benchmarks

- draw conclusions and make recommendations based on the evidence and logic

For example, suppose a company wants to launch a new online platform that connects freelance writers with clients who need content creation services. A feasibility study would help the company to determine the following:

- The size and characteristics of the target market and the potential demand for the platform

- The technical features and functionality of the platform and the development costs and time involved

- The operational processes and resources required to run and maintain the platform and the service quality and customer satisfaction levels expected

- The financial projections and outcomes of the platform and the revenue streams and cost structures involved

- The risks and challenges that the platform might face and the strategies and contingency plans to overcome them

- The recommendation and conclusion on whether the platform is feasible and profitable and the next steps to take

What is it, what are its components, and how to conduct one - Feasibility study and business plan: Feasibility Study vs: Business Plan: Understanding the Difference

A feasibility study and a business plan are two different but related documents that entrepreneurs and business owners need to prepare before launching a new venture. While a feasibility study evaluates the viability of a business idea, a business plan outlines the strategy and goals of the business . In this article, we will compare and contrast these two documents and explain how to create them.

## How to create a business plan

A business plan is a comprehensive document that describes the vision, mission, objectives, strategies, and financial projections of a business . It serves as a roadmap for the business and a communication tool for potential investors, partners, and stakeholders. A business plan should answer the following questions :

- What is the purpose and value proposition of the business?

- Who are the target customers and what are their needs and preferences?

- What are the products or services that the business will offer and how will they differ from the competitors?

- How will the business reach and attract the customers and what are the marketing and sales strategies ?

- What are the resources and capabilities that the business will need and how will they be acquired and managed?

- What are the risks and challenges that the business will face and how will they be mitigated and overcome?

- What are the financial assumptions and projections that the business will make and how will they be measured and evaluated?

A business plan typically consists of the following components:

1. Executive summary : A brief overview of the business plan that summarizes the main points and highlights the key aspects of the business . It should capture the attention and interest of the readers and entice them to read the rest of the document.

2. Company description : A detailed description of the business that covers its history, vision, mission, values, goals, and structure. It should also include information about the founders, team members, and advisors of the business.

3. Market analysis : A thorough analysis of the industry, market, and competition that the business will operate in. It should identify the size, growth, trends, opportunities, and threats of the market and the strengths, weaknesses, opportunities, and threats of the business. It should also define the target market segment and the customer profile and behavior.

4. Product or service description : A clear and concise description of the products or services that the business will offer and how they will meet the needs and solve the problems of the customers . It should also explain the unique selling proposition and competitive advantage of the products or services and how they will be developed, delivered, and supported.

5. Marketing and sales plan : A strategic plan that outlines the marketing and sales objectives, strategies, and tactics of the business. It should specify the marketing mix elements such as product , price, place, and promotion and how they will be implemented and coordinated. It should also describe the sales process and cycle and how the business will generate leads , convert prospects, and retain customers.

6. Operational plan : A practical plan that describes the operational aspects of the business such as the location, facilities, equipment, technology, inventory, supply chain, quality control, legal and regulatory compliance , and human resources. It should also detail the roles and responsibilities of the staff and the organizational chart and culture of the business.

7. Financial plan : A realistic plan that projects the financial performance and position of the business for the next three to five years. It should include the income statement, balance sheet, cash flow statement , break-even analysis, and financial ratios. It should also state the sources and uses of funds and the assumptions and scenarios that underlie the projections.

8. Appendix : An optional section that contains any additional or supporting information that may be relevant or useful for the readers of the business plan. It may include resumes, testimonials, references, patents, licenses, contracts, charts, graphs, tables, or other documents.

To write a business plan , one should follow these steps:

- Conduct a thorough research on the industry, market, and competition and gather relevant and reliable data and information.

- Define the purpose and scope of the business plan and identify the target audience and their expectations and needs.

- Outline the structure and content of the business plan and organize the information into logical and coherent sections and subsections.

- Write the first draft of the business plan using clear , concise, and persuasive language and tone. Use bullet points, headings, subheadings, and numbers to make the document easy to read and understand. Use examples, anecdotes, and stories to illustrate the concepts and ideas.

- Review and revise the draft of the business plan and check for accuracy , consistency, completeness, and clarity. Eliminate any errors, gaps, or redundancies and improve the flow and transitions of the document. Seek feedback from others and incorporate their suggestions and comments.

- Format and design the final version of the business plan and make it visually appealing and professional. Use fonts, colors, images, and graphics to enhance the presentation and impact of the document. Add a cover page, table of contents, and page numbers to make the document easy to navigate and reference.

A business plan is a dynamic and flexible document that should be updated and revised regularly as the business evolves and grows . It should reflect the current situation and goals of the business and incorporate the feedback and learning from the market and customers. A business plan is a valuable tool for the success and sustainability of any business.

What is it, what are its components, and how to write one - Feasibility study and business plan: Feasibility Study vs: Business Plan: Understanding the Difference

Before launching a new venture or expanding an existing one, entrepreneurs need to assess the viability and profitability of their ideas. Two common tools that can help them with this task are feasibility studies and business plans. Although they are often used interchangeably, they have different purposes, scopes, and contents. In this section, we will explore the similarities and differences between these two documents and how they can complement each other.

- Similarities : Both feasibility studies and business plans are based on research and analysis of the market, the industry, the competitors, and the customers. They both aim to provide evidence and rationale for the proposed venture or project. They both use quantitative and qualitative data to support their claims and projections. They both require clear and concise writing and presentation skills to communicate the findings and recommendations to the stakeholders .

- Differences : The main difference between feasibility studies and business plans is the level of detail and the intended audience . A feasibility study is a preliminary document that evaluates the technical , economic , legal , and social aspects of a potential venture or project. It answers the question: Is this idea feasible? A feasibility study is usually conducted for internal use, such as for the management team or the board of directors . A business plan is a comprehensive document that describes the vision , mission , goals , strategies , and action plans of a venture or project. It answers the question: How will this idea succeed? A business plan is usually prepared for external use, such as for investors, lenders, or partners.

- Examples : To illustrate the differences between feasibility studies and business plans, let us consider two hypothetical scenarios. Suppose you want to open a new coffee shop in your neighborhood. A feasibility study would help you determine the demand , the supply , the costs , and the risks of this idea. You would need to research the market size , the customer preferences , the competitor analysis , the location analysis , the legal requirements , and the financial projections . A business plan would help you define the value proposition , the target market , the marketing mix , the operational plan , the organizational structure , and the financial plan of your coffee shop. You would need to outline the vision statement , the mission statement , the objectives , the strategies , the tactics , and the milestones of your business. Suppose you want to develop a new mobile app that connects users with local service providers. A feasibility study would help you assess the technical , the market , the legal , and the social feasibility of this idea. You would need to research the user needs , the existing solutions , the technology requirements , the data protection , and the social impact of your app. A business plan would help you present the business model , the competitive advantage , the revenue streams , the distribution channels , the customer segments , and the cost structure of your app. You would need to describe the problem , the solution , the unique value proposition , the customer relationships , the key resources , and the key activities of your business.

Both feasibility study and business plan are important tools for entrepreneurs and investors who want to evaluate the potential of a new venture or project. However, they serve different purposes and should be used in different situations. Depending on the nature, scope, and stage of your idea, you may need one or both of them to make informed decisions and secure funding. Here are some scenarios and situations where you need a feasibility study, a business plan, or both:

- You need a feasibility study when you have a new idea or opportunity that you want to explore further. A feasibility study is a preliminary analysis that helps you assess the viability and profitability of your idea before investing too much time and money into it. It helps you identify the market demand, the technical requirements, the operational challenges, the legal and regulatory issues , the financial projections, and the risks and opportunities involved in pursuing your idea. A feasibility study can help you answer questions such as: Is there a need or gap in the market that your idea can fill? Can you deliver your product or service in a cost-effective and efficient way? What are the potential revenues and expenses of your idea? What are the strengths and weaknesses of your idea compared to the existing alternatives? What are the external factors that can affect your idea positively or negatively? A feasibility study can help you determine whether your idea is worth pursuing further or not. For example, if you want to start a new online platform that connects freelance writers and editors, you may conduct a feasibility study to see if there is enough demand for such a service, how you can differentiate yourself from the existing competitors, what are the technical and operational requirements to run the platform, how much it will cost to develop and maintain the platform, and what are the potential revenues and risks involved.

- You need a business plan when you have a feasible idea that you want to execute and communicate. A business plan is a detailed document that describes your business idea, your goals and objectives, your strategies and actions, your resources and capabilities, and your expected outcomes and results. It helps you plan and organize your business activities, track and measure your progress and performance, and communicate and persuade your stakeholders and potential investors. A business plan can help you answer questions such as: What is your mission and vision for your business? Who are your target customers and what are their needs and preferences? How will you reach and serve your customers and what value proposition will you offer them? Who are your competitors and how will you gain a competitive advantage over them? What are your short-term and long-term goals and how will you achieve them? What are the key activities, resources, and partners that you need to run your business? How will you generate revenues and control costs? How will you manage and mitigate the risks and uncertainties in your business environment? A business plan can help you turn your idea into a reality and convince others to support your business. For example, if you have a feasible idea for a new online platform that connects freelance writers and editors, you may create a business plan to outline your business model, your marketing and sales strategies, your financial projections, and your funding requirements.

- You need both a feasibility study and a business plan when you have a complex or large-scale idea that requires a thorough evaluation and a comprehensive plan. Sometimes, your idea may be too complex or large-scale to be assessed by a feasibility study alone or executed by a business plan alone. You may need both a feasibility study and a business plan to cover all the aspects and stages of your idea. A feasibility study can help you explore and validate your idea, while a business plan can help you implement and communicate your idea. You may use the feasibility study as a basis for your business plan, or you may conduct them simultaneously or iteratively. For example, if you want to start a new biotechnology company that develops and commercializes innovative drugs, you may need both a feasibility study and a business plan to evaluate the scientific and commercial potential of your drugs, to plan and manage the research and development process, to secure the intellectual property rights and regulatory approvals, to establish the manufacturing and distribution channels, to market and sell your drugs to the customers and payers, and to raise funds from the investors and partners.

Feasibility studies and business plans are both essential tools for entrepreneurs , investors, and managers who want to evaluate the potential and viability of a new venture or project. However, they are not interchangeable and serve different purposes. A feasibility study is a preliminary analysis that assesses whether a project is technically, financially, and legally feasible, as well as socially and environmentally desirable. A business plan is a comprehensive document that outlines the goals , strategies, and operational details of a venture, as well as its market analysis, financial projections, and risk assessment.

To illustrate how feasibility studies and business plans can be applied to different types of businesses and projects, let us consider the following examples:

1. A restaurant: A feasibility study for a restaurant would examine the demand and supply of the target market, the location and accessibility of the site, the availability and cost of raw materials and equipment, the legal and regulatory requirements , the competition and differentiation, and the social and environmental impact . A business plan for a restaurant would specify the vision and mission, the target customers and value proposition, the menu and pricing, the marketing and promotion, the staffing and management, the financial plan and budget, and the contingency plan and exit strategy .

2. A software product: A feasibility study for a software product would evaluate the technical feasibility of the product idea, the market opportunity and customer needs, the competitive landscape and unique selling proposition, the legal and ethical implications , and the social and environmental benefits . A business plan for a software product would describe the product features and benefits , the customer segments and personas , the go-to-market strategy and channels, the revenue model and pricing , the development and testing process, the team and organization, the financial plan and milestones, and the risk analysis and mitigation .

3. A solar farm: A feasibility study for a solar farm would assess the suitability and availability of the land, the solar radiation and climate conditions, the grid connection and power purchase agreement , the capital and operating costs, the legal and regulatory framework , and the social and environmental impact. A business plan for a solar farm would define the objectives and scope, the market and customer analysis, the technical and operational plan, the marketing and sales plan, the financial plan and cash flow , the organizational and governance structure, and the risk management and sustainability plan.

How to apply them to different types of businesses and projects - Feasibility study and business plan: Feasibility Study vs: Business Plan: Understanding the Difference

A feasibility study and a business plan are both essential tools for entrepreneurs who want to turn their ideas into reality . However, they serve different purposes and should not be confused with each other. A feasibility study is a preliminary analysis that evaluates the viability of a business idea, while a business plan is a comprehensive document that outlines the goals, strategies, and actions of a business. To make your feasibility study and business plan effective and successful, you should follow these tips and best practices :

- conduct a thorough market research . Before you start writing your feasibility study or business plan, you need to understand the market potential, customer needs, competitor strengths, and industry trends of your business idea. You can use various methods such as surveys, interviews, focus groups, online research, and observation to gather relevant data and insights. This will help you validate your assumptions, identify your target market , and assess the demand and profitability of your product or service.

- Define your value proposition and competitive advantage . A value proposition is a clear statement that explains how your product or service solves a customer problem, meets a need, or provides a benefit. A competitive advantage is a unique feature or benefit that sets your business apart from others in the market. You should articulate your value proposition and competitive advantage in your feasibility study and business plan, and demonstrate how they align with your market research and customer feedback . For example, if you are planning to open a vegan bakery, your value proposition could be "We offer delicious and healthy vegan baked goods that cater to the growing demand for plant-based food", and your competitive advantage could be "We use organic and locally sourced ingredients , and we have a loyal customer base from our online presence".

- set realistic and measurable goals and objectives. Your feasibility study and business plan should include specific, attainable, and quantifiable goals and objectives that reflect your vision and mission. goals are the long-term outcomes that you want to achieve, such as increasing sales, expanding market share , or improving customer satisfaction . Objectives are the short-term steps that you need to take to reach your goals, such as launching a new product, hiring more staff, or securing funding. You should also define the key performance indicators (KPIs) that will help you track and measure your progress and success . For example, if your goal is to increase sales, your objective could be "To sell 10,000 units of our new product in the first year", and your KPI could be "The number of units sold per month".

- Develop a realistic and detailed financial plan. A financial plan is a crucial component of your feasibility study and business plan, as it shows the expected costs and revenues of your business , and the projected cash flow and profitability . You should prepare a realistic and detailed financial plan that covers the following aspects: startup costs, operating costs, sales forecast, income statement, balance sheet, and break-even analysis. You should also include a sensitivity analysis that shows how your financial performance would change under different scenarios, such as changes in market conditions, customer demand, or pricing strategy. This will help you assess the financial feasibility and sustainability of your business, and identify the potential risks and opportunities.

- Seek feedback and revise accordingly. Before you finalize your feasibility study and business plan, you should seek feedback from various sources, such as potential customers, partners, investors, mentors, or experts. You should ask for honest and constructive feedback that can help you improve the quality and clarity of your documents, and address any gaps or weaknesses. You should also be open to revise your feasibility study and business plan based on the feedback, and update them regularly as your business evolves and grows. This will help you ensure that your feasibility study and business plan are accurate, relevant, and effective.

After comparing and contrasting the feasibility study and the business plan, we can draw some important conclusions and recommendations for entrepreneurs and investors. These are:

- A feasibility study is a preliminary analysis that evaluates the viability of a business idea or project before committing to a full-scale plan. It helps to identify the strengths, weaknesses, opportunities, and threats (SWOT) of the proposed venture, as well as the market demand, competition, costs, risks, and potential returns.

- A business plan is a comprehensive document that outlines the goals, strategies, and actions of a business, as well as the financial projections, marketing plan, and operational plan. It serves as a roadmap for the execution and management of the business, as well as a communication tool for attracting funding, partners, and customers.

- Both the feasibility study and the business plan are essential for the success of a business, but they serve different purposes and audiences. A feasibility study is more exploratory and tentative, while a business plan is more definitive and persuasive. A feasibility study is mainly for the benefit of the entrepreneur, while a business plan is mainly for the benefit of the investors and other stakeholders.

- Therefore, our recommendations are:

1. Conduct a feasibility study before writing a business plan, to ensure that your business idea or project is worth pursuing and has a reasonable chance of success.

2. Use the findings and recommendations of the feasibility study as the basis for developing your business plan , to ensure that your business plan is realistic, consistent, and aligned with your goals and vision.

3. Tailor your business plan to the specific needs and expectations of your target audience, to ensure that your business plan is clear, concise, and convincing.

For example, if you are planning to start a coffee shop, you should first conduct a feasibility study to assess the demand, competition, location, costs, and risks of your business idea. Based on the results, you can decide whether to proceed with the business plan or not. If you decide to proceed, you should use the feasibility study as a guide to develop your business plan , which should include your mission, vision, objectives, value proposition, market analysis, marketing strategy, operational plan, financial plan, and risk management plan . Depending on who you are presenting your business plan to, you should emphasize different aspects of your business, such as the market opportunity, the competitive advantage, the financial projections, or the social impact.

By following these steps, you can increase the chances of launching and running a successful business. We hope that this blog has helped you understand the difference between a feasibility study and a business plan, and how to use them effectively for your business venture. Thank you for reading and stay tuned for more insights and tips on entrepreneurship and business development .

Read Other Blogs

Visual PPC (Pay-Per-Click) advertising stands as a cornerstone in the digital marketing domain,...

One of the most important metrics for startups to track is the cost per session (CPS), which...

There are a few things you should know about venture capitalists before you start seeking their...

The balance sheet is a financial statement that provides a snapshot of what a company owns and...

The International Monetary Fund (IMF) is a pivotal institution in the global financial landscape,...

Ayurveda is an ancient system of holistic medicine that originated in India and has been practiced...

Private placements represent a cornerstone of startup funding, offering a unique avenue for...

1. The Power of Inclusion: Breaking Down Barriers In today's rapidly evolving business landscape,...

Navigating the complex landscape of regulations in the wellness industry requires a nuanced...

What Are Business Feasibility Studies and Why Are They Important?

- August 22, 2022

- Business Strategy , Growth , Innovation

When your business is in the process of a transition, such as a leadership or ownership transition, you’ll likely be taking on risk. One of the best ways you can evaluate whether the potential benefits of a transition outweigh the risks is with a feasibility study. Before you begin a transition, make sure you know what a feasibility study is, why these studies are so important, and how you can perform one.

What Is a Feasibility Study?

A feasibility study is a detailed analysis that outlines the risk and return of pursuing a plan of action. In a transition, a feasibility study can allow you to determine how much risk a potential transition would entail. A transition feasibility study can also give you the information you need to better predict the likely success of a transition and the potential return on investment.

Why Do a Feasibility Study?

A business feasibility study is essential in evaluating whether or not a transition is likely to succeed. When you conduct a feasibility study for an ownership transition, leadership transition, generational transition, or any other business transition, you’ll need to ask yourself five main feasibility study questions. These questions include:

- What are the viable options? Each plan has multiple courses of action. What is the best option for the company and its key stakeholders? The study will sort through all the options and may even help you identify a hybrid approach.

- Intellectual Property

- Responsible stakeholders – Identify who has accountability and for what part of the plan

- Special considerations

- What is the expected shareholder return for each viable option?

- What is the viability of success?

- What are the risks?

Once you’ve asked yourself the above feasibility study questions and completed the study, you’ll be prepared to decide on the path forward. The decisions will be aligned because the study will give your entire team the data, analysis, and forecasts to help see all your options clearly. The study also allows you to plan for alternatives.

How to Conduct a Feasibility Study

Conducting a feasibility study involves rigor and brutal honesty about where your business is today. To conduct a comprehensive study:

- Gather information: Various types of information should be gathered based on the purpose of the planned transition. This information gathering should include the collection of financial, operational, and market data.

- Stock value

- Weaknesses – define and then develop a plan to overcome

- Opportunities – define and develop a plan of action to take advantage of opportunities

- Threats – define who, what, why, and when. Define how to turn threats into opportunities.

- Are we (am I) willing to do what it takes to achieve the end goal?

- Align with key stakeholders: Once you’ve gathered and analyzed the information, the key stakeholders should meet to align on the next steps and final decisions. In this meeting, make sure everyone understands expectations and the role they play. A team that is aligned will eliminate unwanted surprises down the road and experience a smoother ownership transition process.

Choose Thinc Strategy for Advisory Services

If you’re looking for help conducting a feasibility study, Thinc Strategy’s certified advisors can help. Our team will work with you to create, implement and evaluate a feasibility study that helps you determine whether a transition meets your company’s overall goals and capabilities. Alongside assisting with feasibility studies, our transitional services include external transitions, internal transitions, employee stock ownership plans, and valuations.

Find out more about our feasibility studies and ownership transition planning services today. If you have any questions or want to schedule a free consultation, please contact us .

Acquisition Planning

Integration planning.

Meticulous planning, stakeholder collaboration , and communication.

Valuation Services

Precise Assessments for Informed Decision-Making and Strategic Growth.

Leadership Transitions

Internal transitions, cio: technology & it, cfo: finance & accounting, cmo: sales & marketing.

- the ThincTank

(980) 270-0027

[email protected], 301 government center dr wilmington, nc 28403.

Acquisition Project Management

Acquisition Project Management.1

Our clearly defined process includes expertise in the areas of management, research, market search, analytics, and reporting

Evaluate the merits of any business idea

Thinc will review a variety of materials from the firm including, but not limited to, the past 3-5 years of financial statements, organization chart, key roles, and other relevant materials.

Thinc will meet with the owners to confirm the direction gleaned from our initial interviews and information analysis. We will use this meeting to refine the direction and inputs for the different models.

Thinc will build out the different options using the provided inputs showing the potential outcomes and implications for each model.

Thinc will present the feasibility study, documenting the various options and models. We will also schedule a follow-up conversation, allowing the owners time for reflection on the study, to answer questions and discuss next steps.

Due Diligence Services

Our Due Diligence services offer a detailed examination of the target company, providing critical insights into risks, opportunities, and financial health to support informed business decisions and successful transactions.

Ownership Structure

Government documents, legal filings, client contracts, leased properties, finance, tax, insurance, financial statements, tax returns, managed reports, it & fixed assets, customer segments, market segments, organization, current salaries, benefits & bonuses, hiring & firing practices, employee engagement, finance, insurance, tax, it & fixed assetts.

Thinc has a process that is clearly defined and includes expertise in the areas of management, research, market search, analytics, and reporting

Start Your Journey With Thinc Today.

The Importance of a Feasibility Study

- Small Business

- Setting Up a New Business

- Plan to Start a Business

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Negatives of Segmentation

Strategies for critical thinking & problem solving, challenges of strategic planners.

- How to Write Focus Group Objectives

- How to Develop & Implement an Entrepreneurial Vision

Uncertainty is a constant that businesses of every size face daily. Getting customers in the door, encouraging them to spend, and ultimately generating a profit are basic objectives that can at times seem difficult to achieve. Changing, adapting and incorporating new products and ideas into your business mix are ways to remove some of the uncertainties you face, but without proper forethought and planning, those steps themselves can be highly uncertain. Enter the feasibility study: a chance to ask and get answers to questions that help you to assess potential, and to predict the likelihood of success or failure.

Likely to Succeed

The term “feasible” describes an action or event that is likely, probably or possible to happen or achieve. A feasibility study is the total of the actions you take and the questions you ask to determine whether an idea, thought or plan is likely to succeed. An effective study can guide you on whether you should move forward with your idea, refine it, or scrap it altogether and go back to the drawing board.

Focused and Specific

Feasibility studies are focused and specific. They start with a single question – asking whether the idea, event or action is a viable solution – and force you to focus solely on that question to the exclusion of everything else, drilling down to explore possible outcomes. A feasibility study is not the same as a business plan. A feasibility study is an investigative tool that might cause you to discount an idea, whereas a business plan is call to action. You can, in fact, use a feasibility study as a predecessor to creating a business plan.

The Big Picture

Feasibility studies are important because they force you consider the big picture first and then think in a top-down fashion. In this way, one or two general starter questions lead to a host of additional, more detailed questions that become increasingly narrower in focus as you get closer to reaching an ultimate answer.

For example, asking whether anyone will buy your new-and-improved product and whether it will generate a profit creates additional questions that force you to consider customer need and possible competition, and to identify risks that you may face. You must also describe your product and its benefits, define your target market, and calculate cost along with break-even and profit points.

Alternative Opportunities and Solutions

Feasibility studies offer you the chance to “get it right” before committing time, money and business resources to an idea that may not work in the way you originally planned, causing you to invest even more to correct flaws, remove limitations, and then simply try again. Feasibility studies may also open your eyes to new possibilities, opportunities and solutions you might never have otherwise considered. There are no right or wrong answers to the questions you ask, but an answer you don’t necessarily want or expect can create new profit potential.

- SurveyGizmo: What Is a Feasibility Study, and How Can Surveys Help?

- Investing News: What are Prefeasibility and Feasibility Studies?

Based in Green Bay, Wisc., Jackie Lohrey has been writing professionally since 2009. In addition to writing web content and training manuals for small business clients and nonprofit organizations, including ERA Realtors and the Bay Area Humane Society, Lohrey also works as a finance data analyst for a global business outsourcing company.

Related Articles

Key factors that shape effective goal setting, continuous improvement process definition, how to write an organizational development intervention proposal, guide objectives for a focus group discussion, recruitment & selection questions, the two most important parts of swot analysis, examples of a risk management plan for outdoor events, how to find dispersion on excel, what is the key response action from a target market, most popular.

- 1 Key Factors That Shape Effective Goal Setting

- 2 Continuous Improvement Process Definition

- 3 How to Write an Organizational Development Intervention Proposal

- 4 Guide Objectives for a Focus Group Discussion

11.3 Conducting a Feasibility Analysis

Learning objectives.

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan ). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12 . The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. 46

Financial Feasibility Analysis

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13 .

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

Another critical part of planning for new business owners is to understand the breakeven point , which is the level of operations that results in exactly enough revenue to cover costs (see Entrepreneurial Finance and Accounting for an in-depth discussion on calculating breakeven points and the breakdown of cost types). It yields neither a profit nor a loss. To calculate the breakeven point, you must first understand the two types of costs: fixed and variable. Fixed costs are expenses that do not vary based on the amount of sales. Rent is one example, but most of a business’s other costs operate in this manner as well. While some costs vary from month to month, costs are described as variable only if they will increase if the company sells even one more item. Costs such as insurance, wages, and office supplies are typically considered fixed costs. Variable costs fluctuate with the level of sales revenue and include items such as raw materials, purchases to be sold, and direct labor. With this information, you can calculate your breakeven point—the sales level at which your business has neither a profit nor a loss. 47 Projections should be more than just numbers: include an explanation of the underlying assumptions used to estimate the venture’s income and expenses.

Projected cash flow outlines preliminary expenses, operating expenses, and reserves—in essence, how much you need before starting your company. You want to determine when you expect to receive cash and when you have to write a check for expenses. Your cash flow is designed to show if your working capital is adequate. A balance sheet shows assets and liabilities, necessary for reporting and financial management. When liabilities are subtracted from assets, the remainder is owners’ equity. The financial concepts and statements introduced here are discussed fully in Entrepreneurial Finance and Accounting .

Market Feasibility Analysis

A market analysis enables you to define competitors and quantify target customers and/or users in the market within your chosen industry by analyzing the overall interest in the product or service within the industry by its target market Figure 11.14 . You can define a market in terms of size, structure, growth prospects, trends, and sales potential. This information allows you to better position your company in competing for market share. After you’ve determined the overall size of the market, you can define your target market, which leads to a total available market (TAM) , that is, the number of potential users within your business’s sphere of influence. This market can be segmented by geography, customer attributes, or product-oriented segments. From the TAM, you can further distill the portion of that target market that will be attracted to your business. This market segment is known as a serviceable available market (SAM) .

Projecting market share can be a subjective estimate, based not only on an analysis of the market but also on pricing, promotional, and distribution strategies. As is the case for revenue, you will have a number of different forecasts and tools available at your disposal. Other items you may include in a market analysis are a complete competitive review, historical market performance, changes to supply and demand, and projected growth in demand over time.

Are You Ready?

You’ve been hired by a leading hotel chain to determine the market and financial potential for the development of a mixed-use property that will include a full-service hotel in downtown Orlando, located at 425 East Central Boulevard, in Orlando, Florida. The specific address is important so you can pinpoint existing competitors and overall suitability of the site. Using the information given, conduct a market analysis that can be part of a larger feasibility study.

Work It Out

Location feasibility.

You’re considering opening a boutique clothing store in downtown Atlanta. You’ve read news reports about how downtown Atlanta and the city itself are growing and undergoing changes from previous decades. With new development taking place there, you’re not sure whether such a venture is viable. Outline what steps you would need to take to conduct a feasibility study to determine whether downtown Atlanta is the right location for your planned clothing store.

Applying Feasibility Outcomes

After conducting a feasibility analysis, you must determine whether to proceed with the venture. One technique that is commonly used in project management is known as a go-or-no-go decision . This tool allows a team to decide if criteria have been met to move forward on a project. Criteria on which to base a decision are established and tracked over time. You can develop criteria for each section of the feasibility analysis to determine whether to proceed and evaluate those criteria as either “go” or “no go,” using that assessment to make a final determination of the overall concept feasibility. Determine whether you are comfortable proceeding with the present management team, whether you can “go” forward with existing nonfinancial resources, whether the projected financial outlook is worth proceeding, and make a determination on the market and industry. If satisfied that enough “go” criteria are met, you would likely then proceed to developing your strategy in the form of a business plan.

What Can You Do?

Love beyond walls.

When Terence Lester saw a homeless man living behind an abandoned, dilapidated building, he asked the man if he could take him to a shelter. The man scoffed, replying that Lester should sleep in a shelter. So he did—and he saw the problem through the homeless man’s perspective. The shelter was crowded and smelly. You couldn’t get much sleep, because others would try to steal your meager belongings. The dilapidated building provided isolation away from others, but quiet and security in its own way that the shelter could not. This experience led Lester to voluntarily live as a homeless person for a few weeks. His journey led him to create Love Beyond Walls (www.lovebeyondwalls.org), an organization that aids the homeless, among other causes. Lester didn’t conduct a formal feasibility study, but he did so informally by walking in his intended customers’ shoes—literally. A feasibility study of homelessness in a particular area could yield surprising findings that might lead to social entrepreneurial pursuits.

- What is a social cause you think could benefit from a formal feasibility study around a potential entrepreneurial solution?

- 46 Ulrich Kaiser. “A primer in Entrepreneurship – Chapter 3 Feasibility analysis” University of Zurich Institute for Strategy and Business Economics . n.d. https://docplayer.net/7775267-A-primer-in-entrepreneurship-chapter-3-feasibility-analysis.html

- 47 In a preliminary financial model and business plan, startup costs should be allocated, as they are intended for one-time investments in development; pre-launch costs and other necessary expenses will not carry over once the product/solution has launched.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/entrepreneurship/pages/1-introduction

- Authors: Michael Laverty, Chris Littel

- Publisher/website: OpenStax

- Book title: Entrepreneurship

- Publication date: Jan 16, 2020

- Location: Houston, Texas

- Book URL: https://openstax.org/books/entrepreneurship/pages/1-introduction

- Section URL: https://openstax.org/books/entrepreneurship/pages/11-3-conducting-a-feasibility-analysis

© Jan 4, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Why Feasibility Studies Matter (With Examples)

Published: November 11, 2022

As a business leader, you want your projects to generate a return on investment. So before you begin any new venture, it’s a good idea to complete a feasibility study.

Feasibility studies help to determine the success (or failure) of your proposed project or plan. These types of studies help you make better, informed business decisions. As a result, you can save time and money by starting a plan or a project that you know has a high ROI.

Here, you’ll learn how to run feasibility studies. This post includes:

What is a feasibility study?

Feasibility study benefits, types of feasibility studies, how to write a feasibility study, feasibility study examples.

A feasibility study analyzes a potential project’s benefits, risks, costs, and potential outcomes. After completing a feasibility study, you and your team will have enough information to determine if the proposed project is a worthy investment.

Two types of sales forecasting data are appropriate for feasibility studies:

- Quantitative forecasting uses historical business data to predict trends.

- Qualitative sales forecasting data takes customers’ opinions, market research, and survey results into account.

The type of feasibility study you run determines which type of data you will need. Consider using qualitative forecasting data to determine how well your audience might receive your product. Quantitative data can help you predict revenue.

As a team leader, it’s your job to ensure your team hits yearly sales revenue goals. That may include deciding to take on a project based on projected sales forecasting data.

However, you do not want to take on a proposed plan or project without being sure the project will benefit your organization. Companies with accurate forecasts are 10% more likely to increase revenue yearly , according to Intangent.

That’s why feasibility studies matter. Combine sales forecasting data with the insight from a feasibility report, and you’ll be able to gauge the success rate of your proposed plan before you start.

Other feasibility benefits include:

- Determining if the project is appropriate for your team.

- Making sound decisions for your team.

- Avoiding mistakes.

- Narrowing the focus of the project.

- Determining project and team needs.

- Determining which departments need to be involved in the project.

- Calculating the amount and source of appropriate funding.

- Assessing the success or failure rate of your project.

- Estimating ROI.

Not only do feasibility studies help determine if a proposed plan or project is viable, but they also help narrow the focus of the project. Overall, feasibility studies can help keep your project on track from the start.

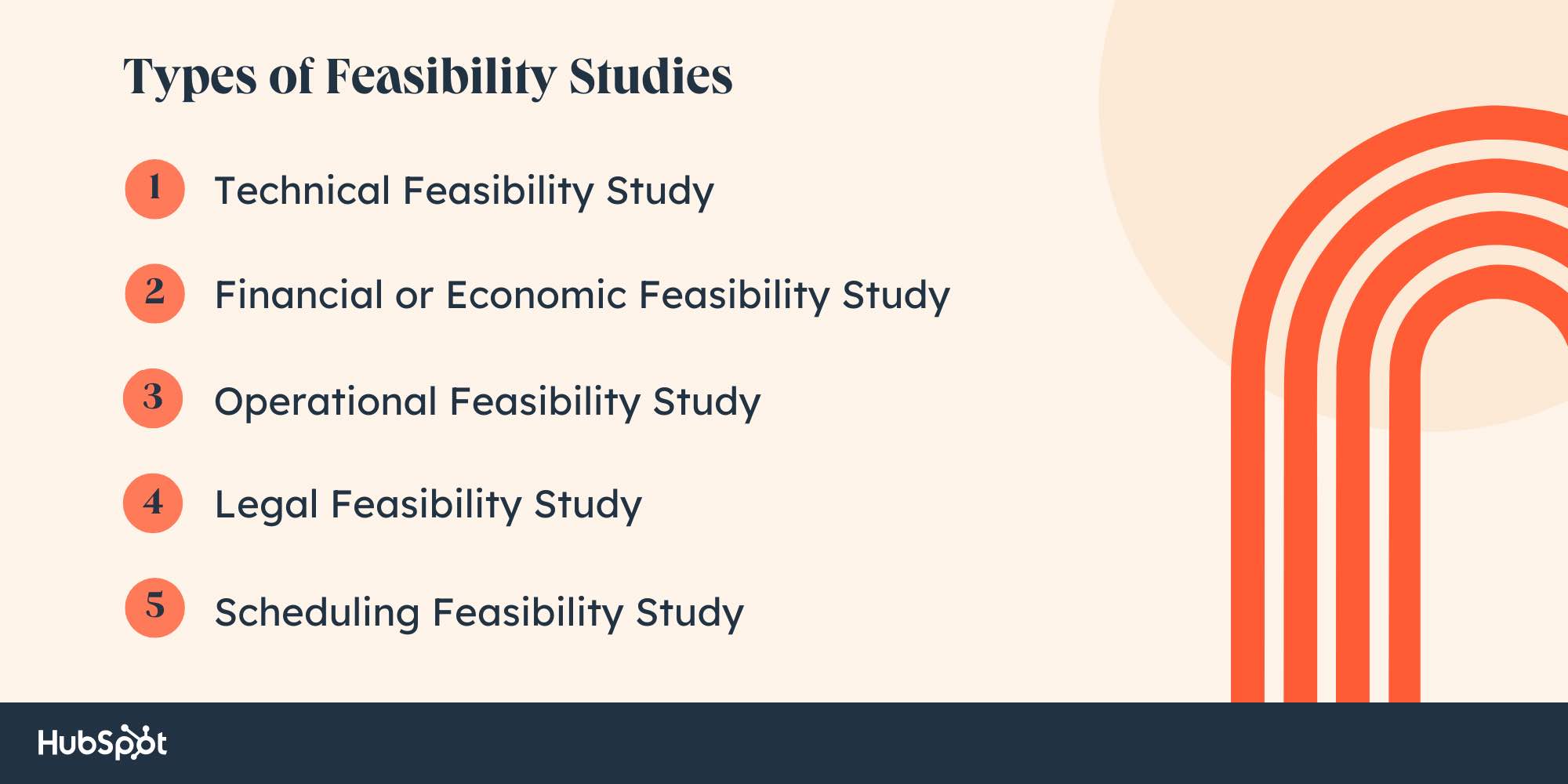

Now that you understand the benefits of feasibility studies, it’s time to determine which kind of feasibility study is best for your team.

Technical Feasibility Study

A technical feasibility study looks at your project’s technical aspects. This type of study answers the question: do you have the specialized resources and capabilities to carry out this project?

You might have the appropriate funding for a project, but a technical feasibility study will help you determine if you have the right processes, systems, and staffing for the job.

Best for: Software development teams and project development teams

Financial or Economic Feasibility Study

Financial feasibility studies can help you determine if you have the funding for your project. Plus, you’ll learn the venture is an overall good investment for your team and your company. These kinds of feasibility studies ask: is the allotted funding amount appropriate for this project?

By completing a financial feasibility study, you’ll have already identified funding sources, expenses, your budget, any potential risks, and expected revenue.

Best for: Financial managers and project managers

Operational Feasibility Study

As the name suggests, an operational feasibility study analyzes whether or not your team is equipped to carry out the proposed plan or project. This feasibility study answers the questions:

- Does your team have the means to complete the project?

- Will the project add value for your team or your customers?

Consider conducting an operational feasibility study if you have developed a solution for a potential problem. This kind of study will help you determine if the solution solves the problem or creates more issues.

Best for: Project managers and stakeholders

Legal Feasibility Study

This feasibility study should be performed to determine if your proposed project is legal and ethical. Legal feasibility studies are designed to keep you and your team aligned with local, state, and federal laws.

If you are unsure if your project is unethical or unlawful, a legal feasibility study will help you make the appropriate decision before you begin.

Best for: Legal departments and project managers

Scheduling Feasibility Study

When starting a new project, you’ll often be asked, “When can we reasonably expect this project to be completed?”

If you and your team are working for clients and are on a deadline, a scheduling feasibility study looks at the project’s timeline. That can help your team determine a reasonable completion date.

After completing a scheduling feasibility study, you might find the plan requires more time than you thought. This is helpful to know before you begin a project.

Best for: Stakeholders, project managers, and their teams

If you are wondering how to write a feasibility study, look no further than our feasibility study template .

Before you jump into writing your own study with our feasibility study template, take a minute to familiarize yourself with each section of the template. Keep in mind, the feasibility study temple can be customized to fit the needs of you and your team.

1. Executive Summary

Your executive summary should be a one-page summary of the entire study. Make sure to include the following:

- The project name.

- A description of the project.

- The goals of the project or plan.

- The target market.

Image Source

2. Business Explanation

This section of the feasibility study is your space to introduce the business concept of your project or plan. Consider discussing:

- The purpose of the project or plan.

- Products or services.

- Competitive advantages.

- Experience of its founders.

If your project is feasible, you’ll want to be as specific as possible in this section and discuss the project’s projected success.

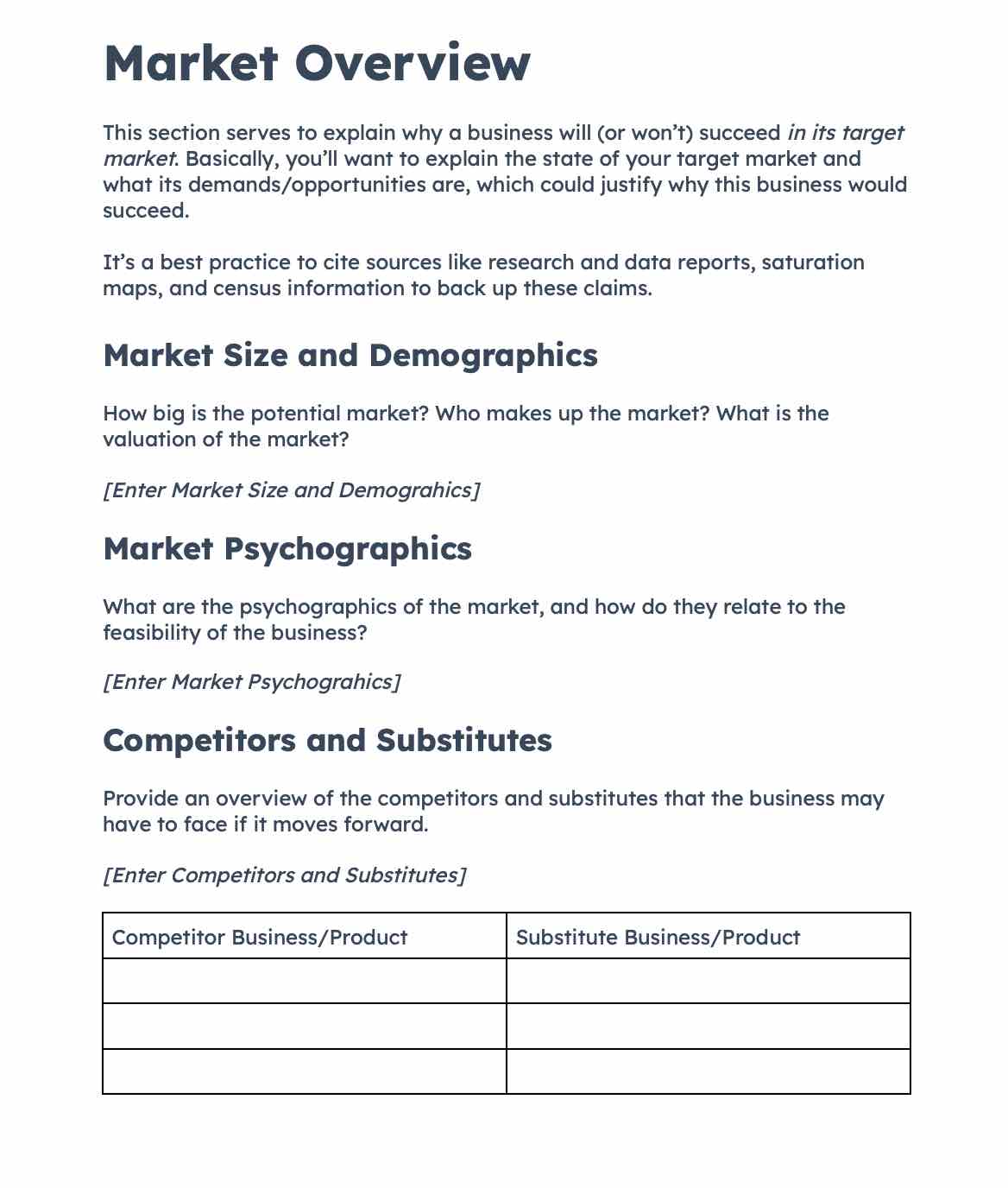

3. Market Overview

This section of your feasibility study should discuss your target market and why your project or plan will (or will not) succeed. You’ll want to discuss your target market in-depth, its pain points, and how your proposed product or service will solve the problems.

You’ll want to include valid data in this section. Consider featuring:

- The market size and demographics.

- The market psychographics.

- Competitors and substitutes.

4. Financial Projections

Every good business endeavor is meant to make a profit. Your feasibility study should determine if the project or plan is a financially wise investment. The financial projections section of the feasibility template outlines and discusses critical financial metrics.

Considering including and discussing:

- Capital needs.

- Projected revenue and expenses.

- Projected revenue needed to break even.

5. Feasibility Assessment and Conclusion

In your conclusion, be as clear and specific about your proposed project or plan as possible. Use statements like, “Based on our assessment of (X), we have deemed this business project feasible.”

Feasibility studies can be helpful across your entire organization — from the sales team to the product development team. Here are a few examples of feasibility studies conducted in various industries.

Howard County Public School System

The Howard County Public School System’s feasibility study dives into projected student enrollment over a 10-year period.

What we love: The school system offers an excellent example of a brief, but thorough, executive summary. In this section, Howard County Public Schools also includes specific historical data used throughout the study.

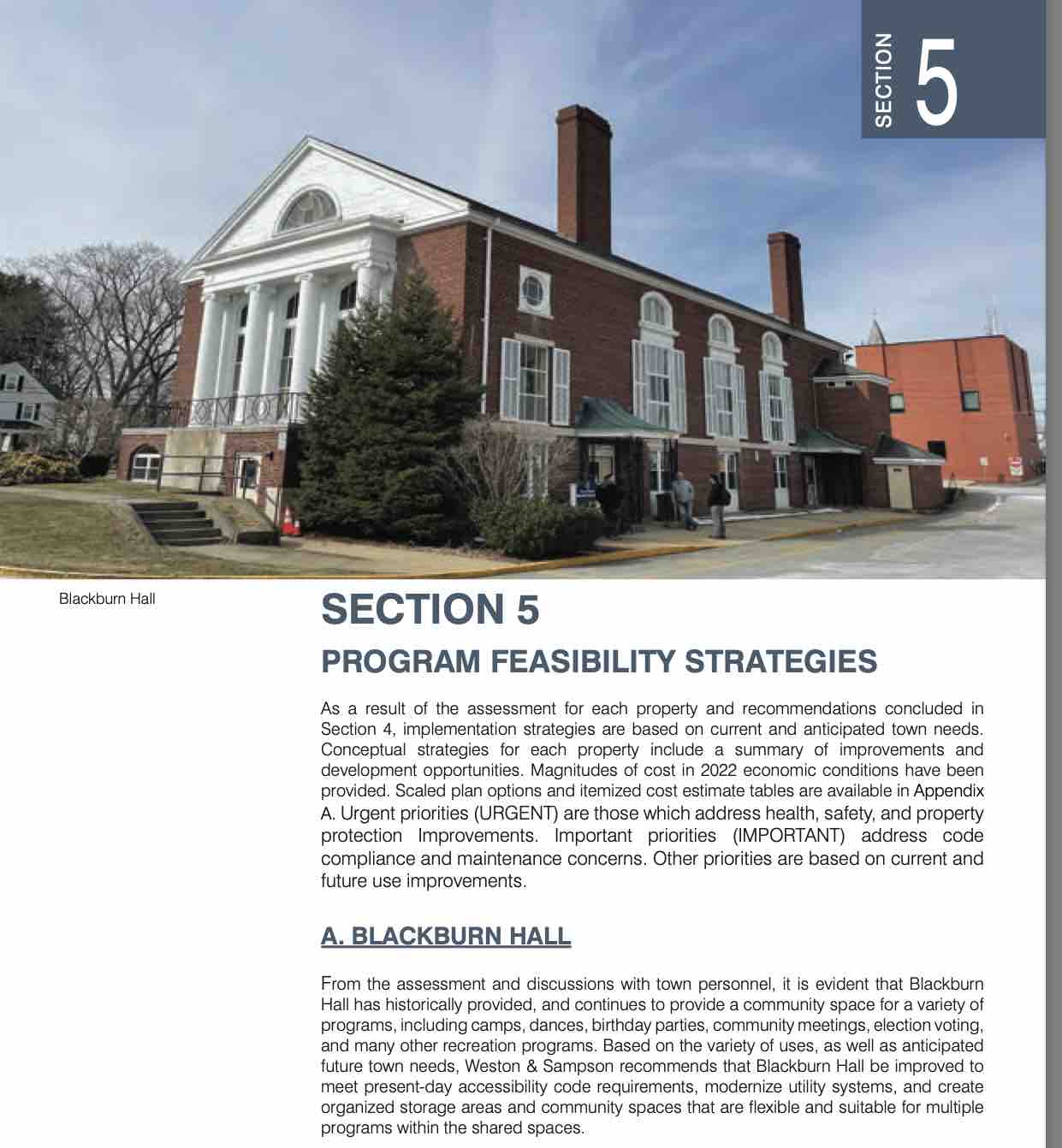

Town of Walpole, Massachusetts

This feasibility study from the Walpole, Massachusetts’ explores the town’s recreation programming and facilities. Throughout, the document includes program recommendations with data that explains how the researchers came to this conclusion.

What we love: This document combines several different types of feasibility studies (financial, technical, and operational) into one comprehensive study. Remember, you can mold your feasibility study to fit your organization’s needs best.

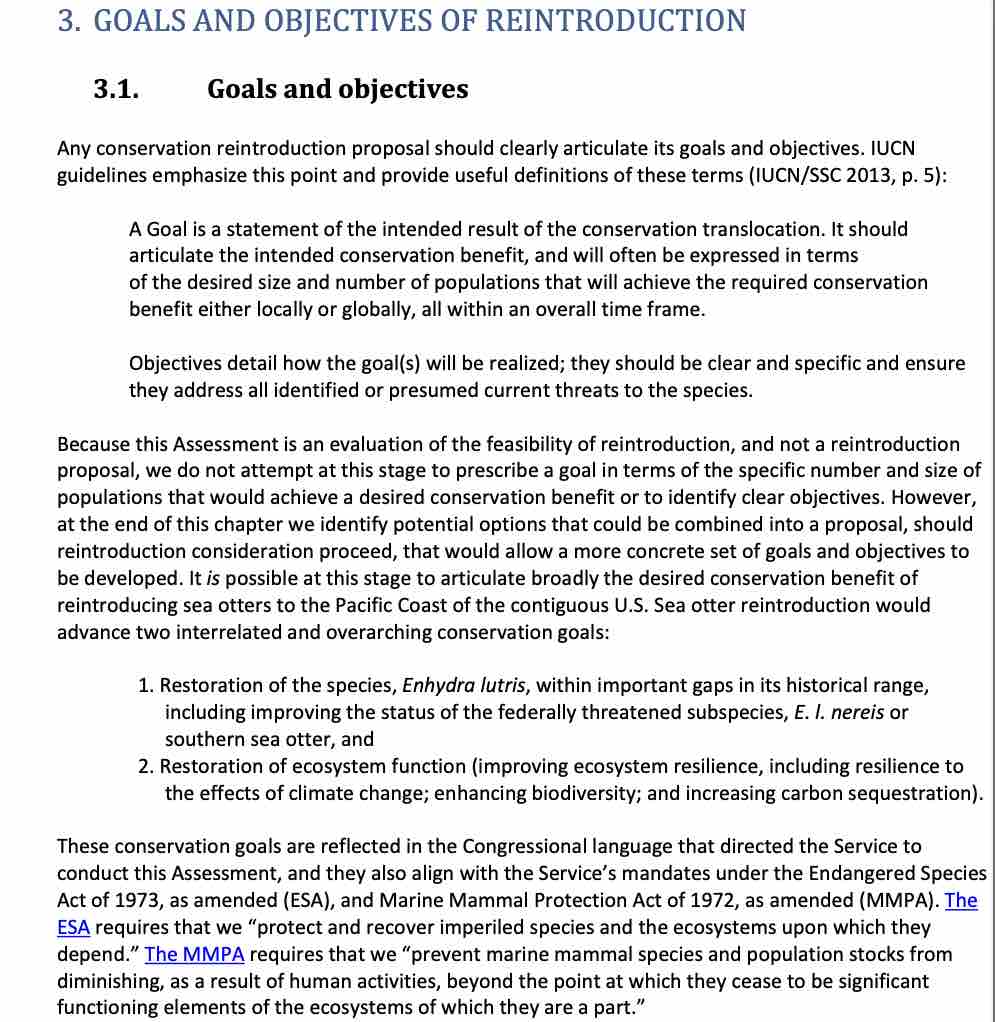

U.S. Fish and Wildlife Service

In this example, the U.S. Fish and Wildlife Service explores the feasibility of reintroducing sea otters to areas of the Pacific coast. This study also provides a model for structuring the objectives section of this document. A good feasibility study is clear and to the point in each section.

What we love: Here, the U.S. Fish and Wildlife Service distinguishes what the study covers (potential options for reintroduction), and what it cannot accomplish (projected population growth from reintroduction).

While your feasibility study seeks to assess a project’s viability, your document will have a limited scope. If you’ll need to gather additional information moving forward, mention that in your feasibility study.

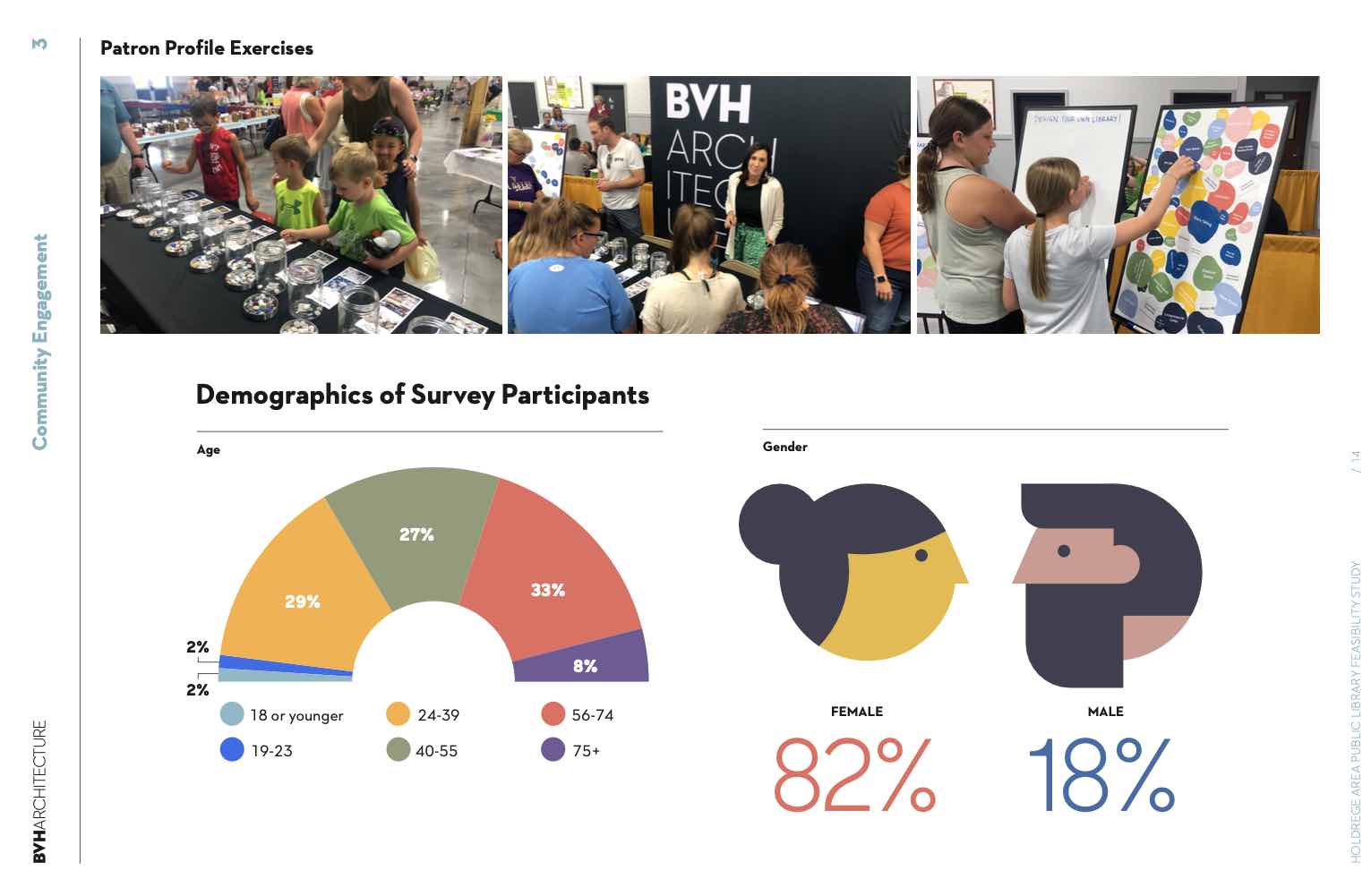

Holdrege Area Public Library

Your feasibility study doesn’t need to be all text. The Holdrege Area Public Library makes use of graphics and charts to convey information in its feasibility study.

What we love: Infographics are easy to read. You can absorb important information with a quick skim.

Running Your Feasibility Study

Accurately predicting the success of a project might seem like a daunting task. But it doesn’t have to be. There are many ways to conduct a feasibility study. Stary by leveraging the tools you already have, like HubSpot’s Forecasting Software and our feasibility study template.

Your job as a sales leader is to help your team increase your organization’s bottom line. With the use of sales forecasting data and feasibility studies, you’ll be able to pursue the projects that will yield the highest ROI.

Don't forget to share this post!

Related articles.

How This Swag Startup Made $3.3 Million in Year One

Fast and Fabulous: Tap into The Billion-Dollar Gourmet Convenience Market

8 Seaweed Startups Riding the $18.4B Green Wave

10 Best Etsy Alternatives to Sell Your Crafts

4 Opportunities in The $884B Home Improvement Business

How Dylan Jacob Scaled BrüMate to $100m+ in 5 Years

7 Opportunities to Make Life Easier for New Moms (and Make Money)

Digital Scent: A $1.2B Market Primed for Innovation

Entrepreneurial Competency: What it Is & Why it Matters

3 Ways to Cash In on Golf's Takeover by Millennials and Gen Z

A free template to help you prove your project's feasibility.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Feasibility-Study.com

Expert and experienced feasibility study consultants feasibility study providers for:.

- SBA Feasibility Study

USDA Feasibility Study

Eb-5 visa feasibility study, bankable feasibility study.

- Dec 26, 2023

The Importance of a Feasibility Study in Business Planning

Updated: Dec 27, 2023

When starting a new business or embarking on a new project, it is crucial to conduct a feasibility study. A feasibility study is an evaluation of the viability of an idea, project, or business. It involves assessing various factors such as market demand, competition, financial resources, and technical feasibility. A well-executed feasibility study provides essential insights that help in making informed decisions and ensuring the success of the business plan.

One of the main reasons why a feasibility study is important in business planning is its ability to identify potential risks and challenges. By evaluating various factors, such as market trends, customer preferences, and competition, a feasibility study enables business owners to foresee potential hurdles they might face in the future and develop strategies to overcome them. This helps to minimize financial losses and maximize the returns on investment.

Furthermore, conducting a feasibility study helps in determining the financial viability of the business plan. It involves assessing the financial requirements of the project, estimating the potential revenue and expenses, and calculating the return on investment. This analysis provides valuable insights into whether the business idea or project is financially feasible. It helps entrepreneurs assess the profitability and sustainability of their venture, enabling them to make necessary adjustments to their business plan.

In addition to financial feasibility, a feasibility study also helps in assessing the technical and operational aspects of the proposed business. It helps to evaluate the availability of resources, such as raw materials, equipment, and skilled labor, necessary for the successful implementation of the business plan. By identifying any potential technical or operational limitations, entrepreneurs can plan and allocate resources more effectively, ensuring smooth business operations.

Moreover, conducting a feasibility study helps in understanding the target market and identifying potential customers. By analyzing market trends, consumer behavior, and preferences, business owners can identify their target audience and develop effective marketing and sales strategies. This allows them to tailor their products or services to better meet the needs and demands of their customers, increasing the chances of success.

Lastly, a feasibility study plays a crucial role in attracting potential investors or securing financial support from banks and financial institutions. Investors and financial institutions often require a thorough feasibility study before providing funding. A well-prepared study with a comprehensive business plan demonstrates the seriousness and viability of the project, instilling confidence in potential stakeholders.

In conclusion, a feasibility study is an indispensable tool in business planning. It provides valuable insights into the potential risks, financial viability, technical requirements, and market conditions of a proposed business or project. By conducting a feasibility study, entrepreneurs can minimize risks, maximize profits, and ensure smooth business operations. Therefore, it is essential to invest time and effort in conducting a thorough feasibility study before embarking on any business venture.

Publisher Details: SBA Feasibility Study Consultants – USDA Feasibility Study Consultants- Feasibility-Study.com https:// www.feasibility-study.com/

Unlock the potential of your business with Feasibility-Study.com – The ultimate destination for comprehensive feasibility studies, empowering you to make informed decisions, maximize profitability, and shape a prosperous future. Join us in revolutionizing your business strategy today!

For more information on feasibility study and business plan contact us anytime.

- New Business Feasibility Study

- Start Up Business Feasibility Study

Recent Posts

The difference between an Appraisal and a Feasibility Study

Choosing a Path: Understanding the Distinction Between a Business Plan and a Feasibility Study

Why Are Feasibility Studies Required by the SBA for Small Business Loans?

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

11.3: Conducting a Feasibility Analysis

- Last updated

- Save as PDF

- Page ID 50688

- Michael Laverty and Chris Littel et al.

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Learning Objectives

By the end of this section, you will be able to:

- Describe the purpose of a feasibility analysis

- Describe and develop the parts of a feasibility analysis

- Understand how to apply feasibility outcomes to a new venture

As the name suggests, a feasibility analysis is designed to assess whether your entrepreneurial endeavor is, in fact, feasible or possible. By evaluating your management team, assessing the market for your concept, estimating financial viability, and identifying potential pitfalls, you can make an informed choice about the achievability of your entrepreneurial endeavor. A feasibility analysis is largely numbers driven and can be far more in depth than a business plan (discussed in The Business Plan ). It ultimately tests the viability of an idea, a project, or a new business. A feasibility study may become the basis for the business plan, which outlines the action steps necessary to take a proposal from ideation to realization. A feasibility study allows a business to address where and how it will operate, its competition, possible hurdles, and the funding needed to begin. The business plan then provides a framework that sets out a map for following through and executing on the entrepreneurial vision.

Organizational Feasibility Analysis

Organizational feasibility aims to assess the prowess of management and sufficiency of resources to bring a product or idea to market Figure 11.12 . The company should evaluate the ability of its management team on areas of interest and execution. Typical measures of management prowess include assessing the founders’ passion for the business idea along with industry expertise, educational background, and professional experience. Founders should be honest in their self-assessment of ranking these areas.

Resource sufficiency pertains to nonfinancial resources that the venture will need to move forward successfully and aims to assess whether an entrepreneur has a sufficient amount of such resources. The organization should critically rank its abilities in six to twelve types of such critical nonfinancial resources, such as availability of office space, quality of the labor pool, possibility of obtaining intellectual property protections (if applicable), willingness of high-quality employees to join the company, and likelihood of forming favorable strategic partnerships. If the analysis reveals that critical resources are lacking, the venture may not be possible as currently planned. 47

Financial Feasibility Analysis

A financial analysis seeks to project revenue and expenses (forecasts come later in the full business plan); project a financial narrative; and estimate project costs, valuations, and cash flow projections Figure 11.13 .

The financial analysis may typically include these items:

- A twelve-month profit and loss projection

- A three- or four-year profit-and-loss projection

- A cash-flow projection

- A projected balance sheet

- A breakeven calculation

The financial analysis should estimate the sales or revenue that you expect the business to generate. A number of different formulas and methods are available for calculating sales estimates. You can use industry or association data to estimate the sales of your potential new business. You can search for similar businesses in similar locations to gauge how your business might perform compared with similar performances by competitors. One commonly used equation for a sales model multiplies the number of target customers by the average revenue per customer to establish a sales projection:

T×A=ST×A=S

Target(ed) Customers/Users×Average Revenue per Customer=Sales ProjectionTarget(ed) Customers/Users×Average Revenue per Customer=Sales Projection