Just one more step to your free trial.

.surveysparrow.com

Already using SurveySparrow? Login

By clicking on "Get Started", I agree to the Privacy Policy and Terms of Service .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Enterprise Survey Software

Enterprise Survey Software to thrive in your business ecosystem

NPS® Software

Turn customers into promoters

Offline Survey

Real-time data collection, on the move. Go internet-independent.

360 Assessment

Conduct omnidirectional employee assessments. Increase productivity, grow together.

Reputation Management

Turn your existing customers into raving promoters by monitoring online reviews.

Ticket Management

Build loyalty and advocacy by delivering personalized support experiences that matter.

Chatbot for Website

Collect feedback smartly from your website visitors with the engaging Chatbot for website.

Swift, easy, secure. Scalable for your organization.

Executive Dashboard

Customer journey map, craft beautiful surveys, share surveys, gain rich insights, recurring surveys, white label surveys, embedded surveys, conversational forms, mobile-first surveys, audience management, smart surveys, video surveys, secure surveys, api, webhooks, integrations, survey themes, accept payments, custom workflows, all features, customer experience, employee experience, product experience, marketing experience, sales experience, hospitality & travel, market research, saas startup programs, wall of love, success stories, sparrowcast, nps® benchmarks, learning centre, apps & integrations, testimonials.

Our surveys come with superpowers ⚡

Blog Marketing

5 Types of Biases in Market Research and How to Avoid Them

Sophia madhavan.

Last Updated:

8 April 2024

Table Of Contents

- Types of market research bias

- Social Desirability Bias

- Habituation Bias

- Sponsor Bias

- Confirmation Bias

- Culture Bias

How can bias impact market research?

Wrapping up.

No research can escape bias. Never has, never will. Assuming that everyone else sees the world the same as we do is only human. That is what leads to market research bias .

However, don’t start second-guessing every study and survey you did right away! We also have ways to avoid market research bias almost completely.

Types of market research bias (and how to avoid them)

Let’s explore the types of research biases that are most common while conducting market research so that you will know how to combat them.

These biases can be grouped into two categories: respondent bias and researcher bias .

To elaborate – when it comes to market research, there are two human elements participating in it: the researcher and the respondent . Both come with individual packages of biases and presumptions which will reflect in what they do.

A. Respondent Bias

1. social desirability bias.

In this bias, the respondents give incorrect information in order to be accepted or liked. So, they answer the questions to please and show themselves in the best possible light. Thus, skewing your market research conclusions.

For example, if there are questions about drinking and driving, few would admit to doing it. Since it’s a condemned activity, the respondent might lie to avoid criticism or judgment.

How to avoid it

- Frame your questions to allow answers that may not be socially desirable.

- You can also ask indirect questions. For example, asking about how a third person (or imaginary person) would think, feel or act in a socially sensitive situation.

- Lastly, you can switch your survey setting to ‘Anonymous’, and provide a disclaimer at the start of the survey that all responses are confidential. This allows the respondents to portray their own feelings and provide honest answers.

2. Habituation Bias

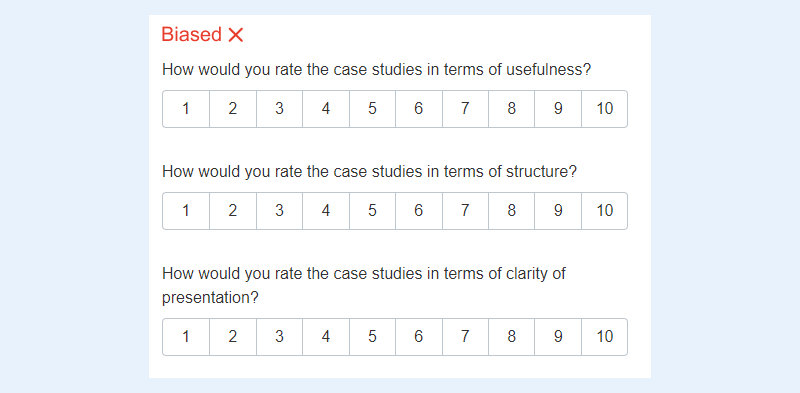

Questions that are worded in a similar fashion may get the same answers. When respondents see repetitive questions, they go on auto-pilot mode and stop being responsive. Then, they start giving similar responses to different questions asked in a similar way.

For example, if you have multiple questions that require the respondents to rate the quality of the service or products, the respondents might automatically mark ‘slightly agree’ or ‘slightly disagree’ without properly reading the questions.

- Keep your questions conversational to engage your respondents.

- Frame each question differently to minimize habituation.

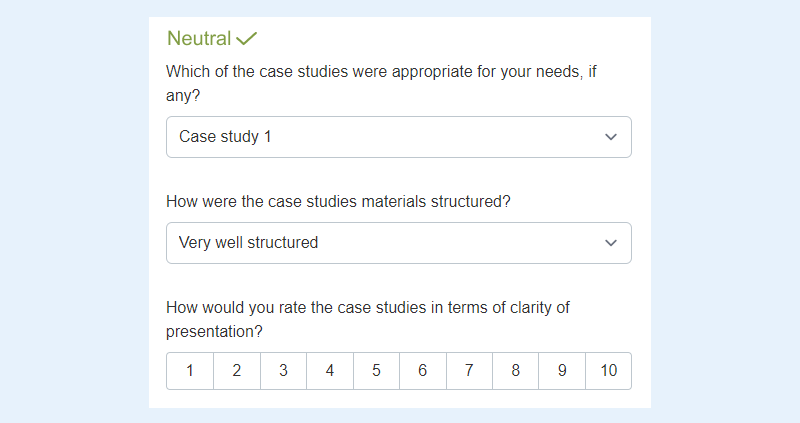

- Use a mix of question types to avoid repetition.

Survey tools such as SurveySparrow have lots of interesting question types like multiple choice, image choice, open-ended, ratings, slider, etc.

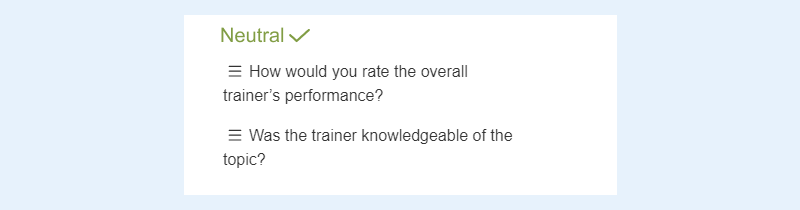

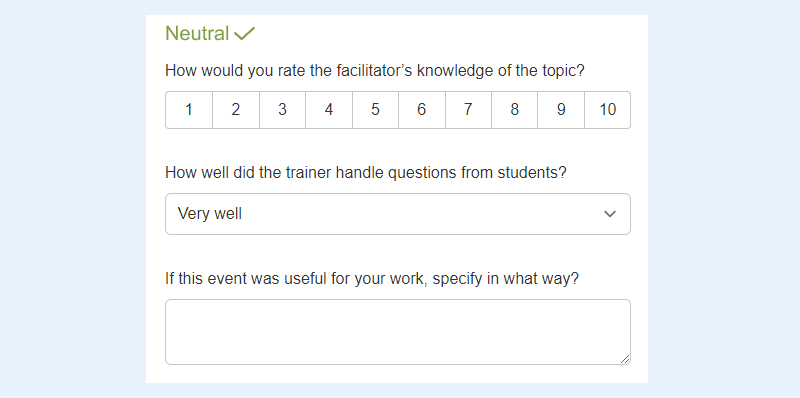

What you see right below is a Product Market Research Survey template created with the platform. It is an excellent example of arranging different question types to make the survey feel like a conversation.

If you’re in a hurry, feel free to use it. You can also customize it the way you like.

But, if you want to explore, sign up and create your first survey from scratch.

Market Research Survey Template

Don’t you feel like completing it? Weren’t you hooked? That’s exactly what you should aim for!

3. Sponsor Bias

When respondents suspect or know the sponsor of the research, their opinions, experiences, and feelings about the sponsor may influence how they answer the questions concerning that particular brand.

Let’s take an example of a personal care survey where a shampoo brand is one of the sponsors. When asked about their favorite shampoo, the respondent might choose the survey sponsor out of obligation – especially if rewards are involved.

Health studies are another example. Many health studies are condemned to be skewed because they have been funded by pharmaceutical companies.

- Maintain a neutral stance. Limit the urge to reinforce positive respondent feedback.

- Avoid disclosing the name of the survey sponsors. You can remove any sign of the logos.

- If you must mention the sponsors, mention them as part of a ‘thank you’ message after the respondent has submitted the survey.

Related: How to set up personalized Thank You pages

B. Researcher Bias

1. confirmation bias.

One of the most recognized and pervasive forms of bias in market research is confirmation bias.

In this type of bias, the researcher is convinced of a belief or hypothesis and uses respondents’ responses as evidence to confirm that belief.

Simply put, confirmation bias is seeing what you want to see and focusing on evidence that supports what you already believe.

For example, imagine that the election season is here. The articles and opinion columns you tend to seek would most probably have the candidate you support portrayed in a good light, while the opposition candidate is in a negative shade.

- Re-evaluate respondents’ impressions.

- Check for unsupported or unsubstantiated claims.

- Try to challenge and overcome your assumptions and hypotheses.

2. Culture Bias

Culture bias is an extension of confirmation bias. It stems from assumptions we have about other cultures based on the values and standards we have for our own culture.

Collected responses or generated reports are undermined or over-sensationalized because of the researcher’s culture bias.

For example, a ‘proud’ American could very well be biased when asked about issues that affect the Latino community in the US. Stereotyping undermines facts.

- Move towards cultural relativism .

- Show unconditional positive regard for all cultures.

- Be aware of your own cultural assumptions.

Bias is a pure product of human nature . It seeps into the thinking and reasoning of a human mind to reflect research that is biased too.

Nevertheless, we cannot just accept that when it comes to research. There is nothing more damaging than a skewed or biased study. Hidden research bias can change the way a researcher words questions and answer options. This could lead to data that is misleading or outright false.

No market research is 100% free from survey biases. But you can definitely reduce or avoid them with the proper tools .

You can only see the world through your own experiences and opinions. That makes it difficult to not be biased, in one way or another.

Learning more about the kind of survey biases that can creep into your market research can help you successfully counter them. The different types of market research bias above can be minimized if you ask the right market research questions at the right time while being aware of the various sources of bias.

If you’re setting up a new market research project, it’s up to you to report accurate results that have not been skewed by biased data. Want to learn how? Talk to us – we’re a chat away.

Senior Director at SurveySparrow

Mommy during the day and Marketer by the night!

You Might Also Like

50+ market research questions to ask your target audience, sampling errors: avoid these 7 sampling errors at any cost, competitive analysis survey: why competitive research is worth your time, see it to believe it..

Please enter a valid Email ID.

14-Day Free Trial • Cancel Anytime • No Credit Card Required • Need a Demo?

Start your free trial today

No Credit Card Required. 14-Day Free Trial

Request a Demo

Want to learn more about SurveySparrow? We'll be in touch soon!

Grow your audience with market research surveys

Get the data you need with sleek survey templates loaded with expertly crafted questions. try surveysparrow for free..

14-Day Free Trial • No Credit card required • 40% more completion rate

Hi there, we use cookies to offer you a better browsing experience and to analyze site traffic. By continuing to use our website, you consent to the use of these cookies. Learn More

- Start For Free

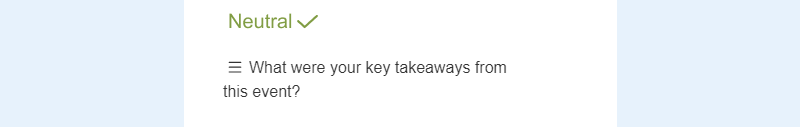

10 Examples Of Biased Questions In Surveys (To Avoid Using)

Surveys bridge the gap between customers and brands. The questions asked through the survey serve as an outlet for customers to express their emotions and opinions.

At the same time, brands can leverage survey questions to learn more about the customers and what they feel about their products and services. However, asking biased survey questions can send all your effort and time down the drain.

In this extensive guide, we take a deep dive into the world of survey questions and address the impact of biased questions on their effectiveness.

We will discuss different types of biased survey questions and learn about them through examples. Moreover, we will share tips you can implement to avoid using biased survey questions once and for all.

Let’s get started!

| Table of contents |

|---|

Collect feedback with JustFeedback

JustFeedback helps your business increase profits and reduce risk by improving your customer experience

Setup in seconds No credit card required

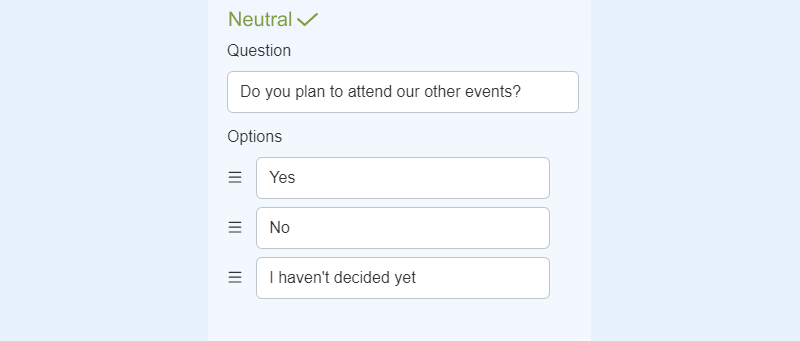

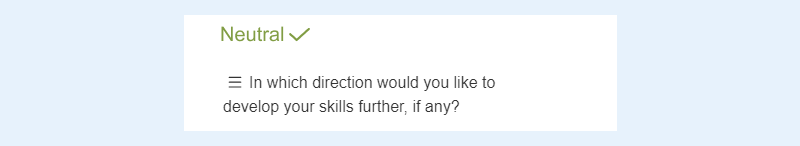

What is a biased survey question?

Biased survey questions are ones that are not neutral.

As the name suggests, they drive respondents toward a specific response and hinder their ability to provide honest feedback. Biased survey questions are generally vague and unclear, and lead to confusion and chaos.

As we discuss the different types of biased survey questions and their examples, you will realize how these biases put customers in a tough spot and impact their responses.

A biased survey question can affect the effectiveness of the survey and you might even end up collecting incorrect responses unintentionally.

Such unreliable survey responses may lead to bad decision-making, especially if the brand is using surveys to identify cracks in its customer experience strategy.

How does survey bias impact business?

A company’s reputation is attached to the customer surveys. The worse the survey questions, the more the reputation declines.

As a brand, you should prioritize effective and bias-free survey question writing as modern-day customers tend to opt out of surveys if the questions are vague, confusing, and lack context.

Since answers to biased survey questions are inaccurate and often skewed, you might even end up jeopardizing any data-driven strategy running in your company.

Besides, respondents might render your brand as unethical and unprofessional if you ask them biased survey questions.

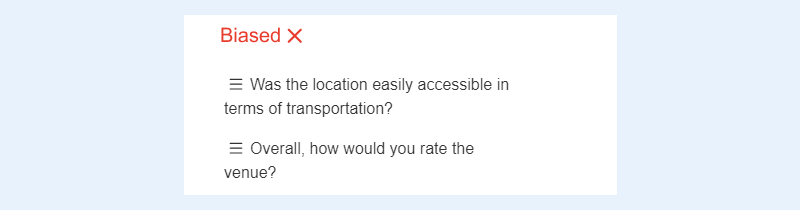

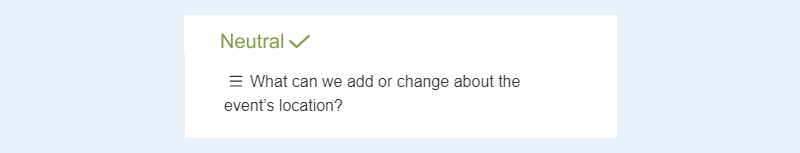

10 types & examples of biased survey questions

Let’s move forward and discuss the various types of biased survey questions. We have also included examples of biased questions to facilitate better understanding.

1. Double-barreled questions

As the name suggests, these are biased survey questions that are essentially two questions disguised as one. At the same time, the respondent can only give one answer to both the disguised questions. For example,

Double-barreled question — “Was the product sturdy and functional?”

Now this is a question that is inquiring the respondent about two different aspects of the product — material strength and functionality.

The respondent has only one opportunity to rate both metrics. The product might have got the job done, but that doesn’t necessarily mean it is sturdy, and vice versa.

2. Leading questions

Manipulation takes a whole new level with leading questions. These are biased survey questions that have only one motive — to lead the respondent to a certain answer.

Leading questions are framed as a statement seeking confirmation or denial from the respondent. For example,

Leading question — “The product helped solve your problem. Correct?”

This is quite an obvious leading question as it explicitly expresses the preferences of the interviewer.

The only way to avoid leading questions in a survey is by providing respondents with adequate freedom and refraining from adding personal opinions to the question.

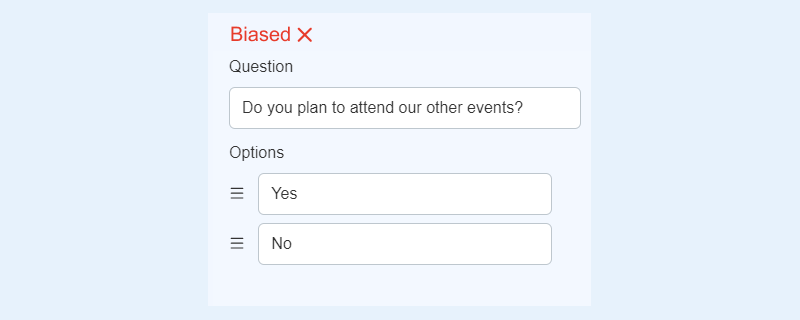

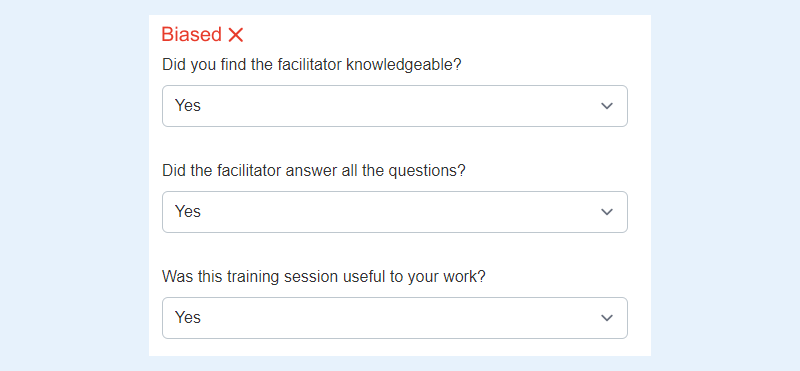

3. Dichotomous questions

As the name suggests, dichotomous questions are biased survey questions that offer respondents only two answer choices.

Brands using dichotomous questions find it easier to interpret results and make analysis simpler. Here is an example of a dichotomous question,

Dichotomous question — “Do you plan to purchase our product?”

Again, the question pushes respondents into a corner. Dichotomous questions make respondents give a yes/no answer. Therefore, they will either choose one of the two answer choices or simply opt out of the survey.

The best way to deal with dichotomous question bias is by adding a “maybe” or “don’t know” option for respondents who wish to express uncertainty.

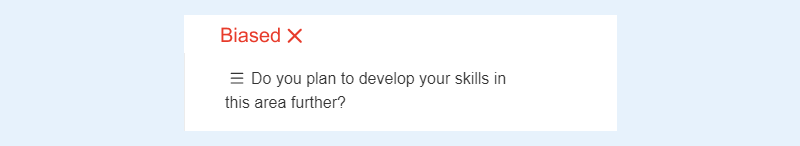

4. Social desirability bias questions

The respondents to these survey questions are humans. We are social beings and a significant percentage of our decisions are based on social approval.

Brands can leverage such social desirability bias by making respondents choose a socially approved answer to their survey questions. For example,

Social desirability bias question — “Do you plan to move into a more comfortable accommodation?”

For most respondents, the answer to the question would be “yes” because we all seek growth as individuals.

Now, there will be respondents who are happy with their present accommodation. Thus, social desirability bias in a survey question makes it difficult to solicit honest answers.

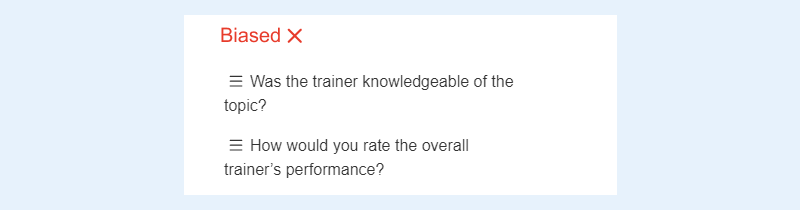

5. Assimilation bias

The way you structure a survey can also impact the answers respondents leave.

While a change in words can impact survey results, a change in structure can also deform the meaning of the questions, especially when multiple questions are stacked together. For example,

Assimilation bias — “Did the product function properly?” followed by “How would rate the product on functionality?”

Functionality can be quite a broad topic. When these two questions are stacked together, respondents might rate the product on functionality thinking that the product functions properly, as asked in the first question.

Moreover, respondents might ignore other metrics of product success since the question focuses only on functionality.

6. Absolute questions

The biased survey questions containing absoluteness are often presented using words like “all, never, none, always.” The reason behind this is the ability of these terms to push the respondent to a corner and retrieve a desired response. For example,

Absolute questions — “Have you never shopped at our store?”

These biased survey questions are framed in a way the respondent feels accused of not being part of the brand. The “pushiness” of the questions can make people leave extreme responses, without even considering their options.

However, brands can always make a conscious choice of omitting such words and sentences and rephrasing the question to avoid absoluteness.

7. Loaded questions

Another type of biased survey question worth mentioning in the post is a loaded question. Now, these are survey questions that put forward an assumption and push respondents to consider it.

One should note that the assumptions made in the question can be false for some respondents. Regardless, a loaded question functions similarly to a leading question — directing people to a desired response. For example,

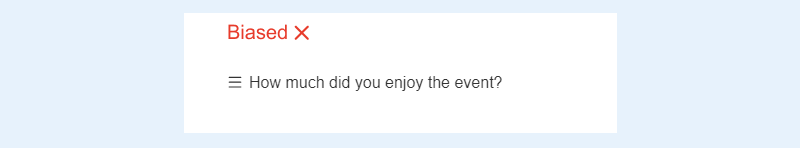

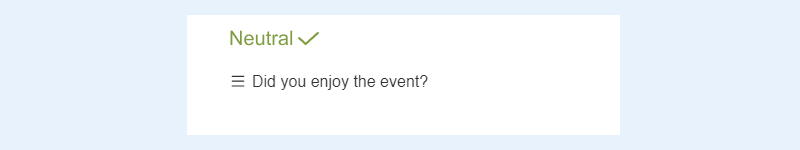

Loaded question — “How much did you enjoy using our product?”

The question comes with a presumption that customers enjoyed using the product. The only thing the surveyor wants to know is how much the customers enjoyed it. This survey question falls flat for people who didn’t enjoy using the product at all.

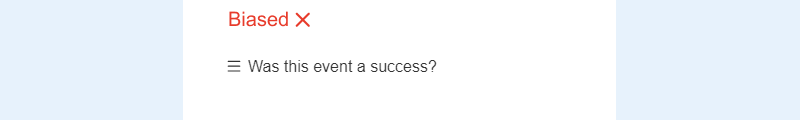

8. Vague questions

This biased survey question type is a classic. While the other biased questions mentioned in the post only tend to limit respondents’ freedom, vague survey questions add a touch of confusion and chaos.

A vague question, as the name suggests, includes words that have no definite meaning and are open to different interpretations. For example,

Vague question — “Was the marketing campaign a success?”

Now, “success” can have different meanings for different people. Therefore, it is best to avoid vague biased survey questions. It can be achieved by focusing more on definite parameters and qualities and less on subjective interpretations.

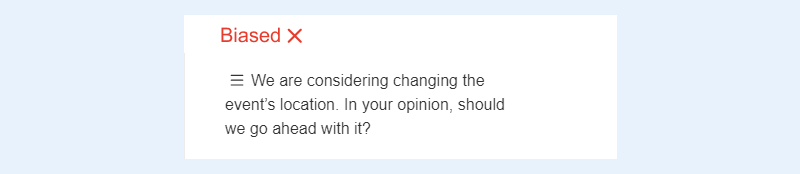

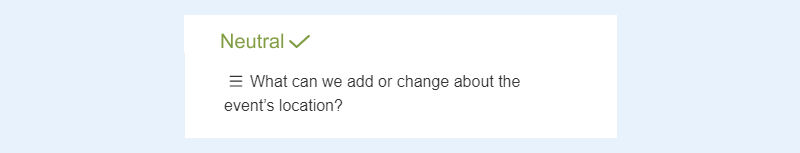

9. Demand characteristics bias questions

Most customers have a sense of why you are running surveys and soliciting feedback. The very realization that companies are running surveys to get better can make respondents answer the surveys in a certain way.

Demand characteristics bias makes respondents answer surveys assuming what you need or what is the most favorable answer. For example,

Demand characteristics bias — “We are considering diversifying our product line-up. Should we go ahead with the decision?”

Many respondents will say “yes” because they assume diversifying is the way to go or something you need. The best way to avoid demand characteristics bias is by removing assumptions in the question.

10. Contrast effect

The contrast effect is quite similar to the assimilation effect discussed earlier. Here, respondents will have to consider two or more questions when responding to the survey.

However, respondents might assume that since you have already covered an issue in the first question, they don’t have to consider it when answering the second question, and so on. For example,

Contrast effect — “Did you purchase the product easily on our website?” followed by “How would you rate your customer experience?”

Even if the respondents found it easy to purchase the product on your website, they might not have liked the overall customer experience, and vice versa. In other words, you will only end up consolidating confusing data.

Factors contributing to biased survey questions

What are the factors that can lead you to write biased survey questions? Since there are several elements involved in survey questions, you will have to consider the following factors to avoid writing biased questions —

The choice of words and phrases in a survey question can have a major impact on how participants respond. The question can trigger biases if the words are used to imply a certain response. Use words/phrases that support the question’s intent.

We have already discussed how multiple questions stacked together can impact participants’ responses. Assimilation and contrast biases are prime examples of how the order of questions can drastically change responses.

Make sure the survey questions are in the correct order before you hit send.

3. Response

Answer choices depend on the type of survey questions.

However, the answer options you provide with the questions can lead to bias if they don’t provide adequate freedom to the respondents. We suggest you include all possible responses to help respondents provide honest customer feedback.

As a brand or surveyor, you have got to keep things neutral. The context can be simplified by providing the participants with adequate information regarding the survey’s purpose. Use neutral language and tone to not trigger assumptions and biases.

How do we avoid biased survey questions?

Since biased survey questions can significantly impact the effectiveness of responses and lead to confusion and misinformation, we highly recommend avoiding biased survey questions by following these tips.

The very first thing you’d want to ensure is that you understand the different types of biased survey questions. We have discussed some of the most important ones in the post. Read them thoroughly to make bias identification easier.

Always go for multiple question structures when drafting survey questions. This makes it easier to avoid biases as you are deliberately randomizing the question order.

Besides, you can leverage different types of questions with different rating scales. It can help participants share feedback in unique ways.

Another effective way to avoid biased survey questions is to let fresh eyes have a look at the questions. Gather feedback from your colleagues about the questions and identify any potential source of bias. Make changes accordingly.

We highly recommend you pre-test the survey to evaluate the effectiveness of the questions and survey flow. Create a small group of respondents and test the questions on them.

Lastly, you’d want to avoid any assumptions, overloading, confusing language, and jargon when writing survey questions. Make sure you write clearly and consider user experience as well.

Wrapping Up

Survey bias, as discussed in the post, can quickly flush all your hard work down the toilet. Therefore, you should stay alert and ensure that the questions are well-tested before pushing the “send” button.

We highly recommend you look at the survey questions from the perspective of respondents and see if you can answer the questions without bias.

Moreover, keep things simple and your questions neutral when drafting a customer survey. Did you find this post helpful? Stay tuned for more informative posts in the future.

Ready to create surveys with JustFeedback ?

🚀 Collect feedback with JustFeedback customer experience survey tools Start For Free

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Surveys

Wording Bias: What it is with Examples

When designing your questionnaire, many things can go wrong if we ignore the details. This can mean that our research returns incorrect data and invalidates our study.

In this article, we will talk about wording bias, and we will explain everything you need to know about one of the most common research biases and some tips to avoid it.

What is wording bias?

Wording bias, also called question-wording bias, happens in a survey when the wording of a question systematically influences the responses. Wording bias leads to survey data becoming less valuable as it is inaccurate.

A survey question is biased if it is phrased or formatted in a way that prepossesses people towards a specific answer. Also, if the survey questions are hard to understand, it is difficult for customers to answer honestly.

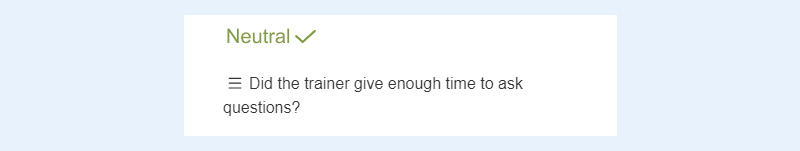

Example of Wording Bias

Wording Bias can be caused in various ways, all related to how the interviewer or the team formulates their questions and answer options, below, we share some of the most common cases and some examples so you can identify them.

Let’s say your questionnaire contains the following question:

Are you in favor of building a shopping center that could increase traffic in the area? YES | NO

In the example above, we include additional information likely to influence people’s perceptions and how they tend to answer that question. As you can see, information about the possible adverse effect of the construction in the area is included, so the response trend would surely lean NO.

If the question were:

Are you in favor of constructing a shopping center that will provide employment to more than 20 families in the area? YES | NO

We can distinguish that information that influences the respondent’s perception is also included. On this occasion, the trend is undoubtedly inclined to YES. However, this does not mean that it is correct since there is still a bias, and for the validity of any study, it is always desirable to seek neutrality in the opinion of the people surveyed, so in this example:

Are you in favor of constructing a new mall in the area? YES | NO

It would be a slightly better-posed question since unnecessary and biased information is eliminated.

This was just one example of how the way the question is formulated can impact the study results.

However, there are other ways to cause wording bias, either by altering the instructions on how to answer the survey or how you formulate the answer options.

How can I reduce wording bias?

When you create a survey , the order of both questions and answer options in your survey matters. Questions that come early in your survey might impact how respondents respond to questions later in your study.

Here are some tips to avoid making these mistakes when creating your questionnaire .

Short and clear questions and answers

Keep your questions short and precise. Ask neutrally worded questions. Your question shouldn’t have too much information, and it shouldn’t have too little. It should be just right. Respondents are less likely to answer if the question is too long. Or if they do not understand the question.

Leading questions

Avoid leading questions. Instead of asking a leading question like “Are you satisfied with our service?” you can ask about the quality of service provided.

Simple Answers

If answer options are long and unfamiliar, the respondent may face difficulties answering the questions. One technique to ask a question precisely is to use a matrix question with multiple answer choices.

Carry out a pilot survey

Before launching your questionnaire to your entire database or sending a whole fleet of interviewers throughout the city, we recommend that you do a small test where you include control and feedback questions to identify areas for improvement and if the questionnaire does not have any type of bias or error that could compromise the integrity of the study.

Are you ready to lunch your first survey?

We hope that these tips will help you when designing your survey and conducting your research. We remind you that at QuestionPro, we have all the types of questions necessary to design an ideal questionnaire for your projects.

In addition, our analysis module will allow you to see the results in real-time to identify any anomaly or manage your information to avoid including biased data or data that is not of value for the study.

LEARN MORE SIGN UP FREE

MORE LIKE THIS

Techathon by QuestionPro: An Amazing Showcase of Tech Brilliance

Jul 3, 2024

Stakeholder Interviews: A Guide to Effective Engagement

Jul 2, 2024

Zero Correlation: Definition, Examples + How to Determine It

Jul 1, 2024

When You Have Something Important to Say, You want to Shout it From the Rooftops

Jun 28, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Root out friction in every digital experience, super-charge conversion rates, and optimise digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered straight to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Meet the operating system for experience management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- What is a Survey?

- Survey Bias Types

What is survey bias?

How can survey bias influence my research/results, which survey type is most likely to be affected by survey bias, what are the 3 types of survey bias, how can qualtrics prevent survey bias, try qualtrics for free, survey bias types that researchers need to know about.

23 min read You’re ready to start a new research project, but how can you ensure you get the best and most accurate results? In this article, we tackle the most common types of survey bias, and provide best-practice advice on how to address them to ensure you get honest, accurate answers from your research.

When it comes to understanding your audience at scale, few options are as good as a market research report or offline or online survey.

Having information on customer preferences, behaviours , likes and dislikes, income, and demographics — the list goes on — helps businesses to create more tailored products and services, as well as captivating experiences.

But even if you create and distribute the surveys, how can you ensure that they’re fair, unbiased, and contain questions that are easy for respondents to answer? This is where ‘bias’ comes in — and reducing it is key to creating great surveys that gather data, encourage honest responses, and benefit your business.

Bias is defined as a “deviation of results or inferences from the truth, or processes leading to such a deviation” and it occurs in every survey. It’s impossible to eradicate bias as each person’s opinion is subjective. This includes the researcher, who thinks up the questions and plans the research, and the participants, who answer the questions and share their thoughts.

There are several ways survey bias can influence the accuracy and integrity of interviews, as well as the answers provided by participants. For example:

- Selection: How was the survey sample selected? How many participants completed the survey? Was the sample broad enough to capture the most valuable insights?

- Response: How are participants swayed by leading factors from the interviewer? Such as the questions asked, their format, and the respondent’s desires to be socially accepted?

- Interviewer: Is the interviewer unconsciously sending signals to participants that could alter their answers? Are the interviewers biased ? Are the survey questions tailored towards specific outcomes?

These are just a few ways survey response biases can creep into research projects. In this guide, we’ll share a few examples of the above and how you can reduce sampling bias and survey bias. First, how can survey bias influence your survey data, response rate , and survey results?

Free eBook: The Qualtrics Handbook of Question Design

Survey bias can cause a plethora of problems for researchers, including:

Data issues: The data produced doesn’t accurately reflect the opinions of participants, as there are less than truthful responses, extreme responses, or inaccurate answers. This data won’t help you reach your goals.

Poor strategies and investment: As management and senior leaders base future business decisions on market research and survey insights, survey bias can affect how they invest money, time, and resources — potentially taking the wrong course of action.

Low return on investment: Poor insights lead to poor product performance. When you’re targeting the wrong customers as a result of survey biases, e.g. leading questions, you won’t get the information you need to improve your offerings and the overall experience.

Dissatisfaction: Stakeholders and investors will be dissatisfied with performance levels and may reduce market research budgets over the long term.

Inconclusive research: Surveys may need to be repeated to test whether the data or the researchers are at fault, which takes time, money, and resources.

Ultimately, good actions, progress, and innovation are based on good data quality. If the management can’t rely on or trust the research results for accuracy, then it’s a lose-lose situation for all people involved.

There is no single survey type that experiences more bias than another. Bias can affect all survey types, including:

- Panel interviews

- One-on-one fact-to-face interviews

- Group interviews

- Telephone interviews

- Webinar or video polls

Survey bias is a universal issue that researchers should be aware of and plan for before every research project. The best thing to do is to think about survey design and use the right survey tools to empower respondents to answer honestly. This way, you can get accurate, valuable survey results.

1. Selection bias

Selection bias creates inaccurate or unrepresentative data. This is because it’s gained in an unfair way that’s detrimental to the accuracy and goals of the research.

For example, you could select a non-random sample, a sample that has a crucial market segment unaccounted for, or a sample that doesn’t engage can all affect data results by providing too much, not enough, or the wrong kind of feedback. You could also choose to focus on samples that validate your own viewpoints and perspectives (confirmation bias), offering no new insights for your teams to act on.

Sampling bias

Sampling bias, also known as selection bias, is when your sample is unrepresentative and will not provide the right feedback to support the goals of the survey research.

Some samples forget to include the right target customer market segment. This can lead to inaccurate data results. For example, if your brand makes toys for children and you’re wondering about their aesthetic appeal, surveying a sample made up of parents would tell you why the parents buy the toy, but not why the toy is considered appealing to children.

Sampling bias can also occur when the researcher creates a one-sided sample because they believe they know who the survey should target.

But while they might be correct, creating a one-sided sample may overstate the importance of respondents’ feedback, as well as miss the diverse viewpoints of other non-customer segments that may want to use your product or service.

Examples of sampling bias

- Certain population groups aren’t covered in polling or survey sampling, leading to skewed sample data results.

- Non-probability sampling methods are used incorrectly. Non-probability sampling methods don’t offer the same bias-removal benefits as probability sampling (which use a random sample).

Non-response bias

Even with a perfect sample selection (no sampling bias), respondents may not answer the survey. But why?

Well, they may not like filling in surveys, or their email could be inactive (so make sure to keep your data up to date). They might not like your brand or don’t understand the purpose of your survey. Or they might just hang up the phone, or throw the survey in the bin.

Whatever the reason, your results won’t be indicative of the full sample. This means that, because of unresponsive sample members, you may miss out on crucial data that would help you analyse trends or identify correlations.

For every survey, there will be those who don’t answer. The idea is to keep this to a minimum, ideally a small percentage of the full sample survey size. If the percentage of unresponsive sample members is higher than average, you know that your results have a non-response bias.

Examples of non-response bias

- A survey that is aimed at finding out the views of criminals or closed-off groups would more than likely have low participation from these groups as they don’t want to share their illegal activities or share the information they know. Therefore, the remaining responses would be from participants that might not best represent the target market of the research.

- A survey that can be filled in and posted may have more responses than an electronic survey done over the phone if respondents live in an area with poor signal coverage.

Survivorship bias

What if your sample is in itself filled with the wrong kind of people, just because the right kind of people are no longer available to speak to (e.g. you’ve no longer got their details)? Survivorship bias is where you target the right customer market segment, but due to natural turnover, you only have the people who are left — the ‘survivors’.

These ‘survivors’ are more likely to be favourable and biased in their results. But to get the full picture, you have to hear from the people who are not around anymore, as they represent the full picture.

Example of survivorship bias

A brand is looking to understand why employee turnover is so high, so they do research with their current employees. However, the people that will give them the insights as to why they left are those that have left the organisation. As they aren’t part of the research sample, the results will have survivorship bias.

2. Response bias

Response bias is when your sample provides responses based on the survey questions, but the answers they provide aren’t what they really believe or think. Instead, participants’ survey responses are based on the structure and language of the questions , leading them to answer in a particular way.

Some examples of response bias in action are:

- Asking about customer satisfaction but only providing two positive responses and one negative, e.g. Very Satisfied, Satisfied and Dissatisfied. To balance the survey questions, consider adding two positive and two negative options.

- Taking an emotional approach to questions — e.g. “Your parents are getting old and would like to see their grandchildren. Would you consider having a child soon?”

Extreme response bias

For this response bias, some participants will choose an extreme answer value to answer a question that has a scale as an answer (e.g. Likert scale). This will increase the response bias if the question is phrased in a way that suggests that the right answer is an extreme-ended one.

This is more common where the researcher has failed to make the question neutral, or if the question has a ‘closed’ yes or no response that forces you to be extreme in your approach.

Examples of extreme bias

- The question: ‘Is it okay to spank your children as a form of rearing education?’ would elicit a strong response bias in favour or against the practice of physical discipline.

- The question: ‘Should a family member have the right to end their own life if they have a terminal illness?’ is an emotive topic that forces a participant to think of a stressful scenario and decide on a strong position.

Neutral response bias

This type of response bias occurs when the researcher creates questions that are not specific enough, or don’t evoke a strong enough response for respondents to pick an extreme either way.

As a result, participants pick a neutral position on a Likert answer scale. This doesn’t help the overall results of the research, as you would like to have a mixture of extreme and neutral responses that tell you more about your participants’ varied views.

Example of neutral bias

On a scale of 1 to 5, how do you feel about these animals?

Dog, cat, bear, lion, goldfish

(Scale of 1-5, where 1 is Hate and 5 is Love)

For pet owners, or non-pet owners, the answers will be neutral as, without experience of owning each one, it’s unlikely they’ll have an extreme view.

Acquiescence bias

Acquiescence bias (also known as the yes bias, the friendliness bias, and the confirmation bias) tends to be one of the more commonly recognised response biases by researchers.

This bias is the tendency for survey respondents to agree with the survey questions, without their response being a true reflection of their own position or beliefs. This is because it’s easier to say yes and agree — to please a researcher or complete a survey — than to hold a disagreeable position.

This occurs when the question is phrased in a way that asks the participant to confirm a statement, or when the question is answered with opposing pairs, such as ‘Agree / disagree’, ‘True / false’, and ‘Yes / no’.

Examples of acquiescence bias

- ‘When you have your coffee, do you enjoy it with milk or without?’ This question presumes that the participant has and enjoys coffee. They may dislike coffee and enjoy another beverage instead.

- ‘Do you consider yourself a good person?’ This question would ultimately end in a ‘yes’ answer as participants are unlikely to answer in a way that makes them look unfavourable. This is an example of a leading question, one that leads you towards a particular answer.

Question order bias

Question order bias , or order-effects bias, occurs when related questions are placed in a certain order. For example, once a participant answers one question positively or negatively, the participants feel they have to answer any follow-on, related questions the same way.

This is a bias based on the participant’s desire to be consistent with their answers, whereas, in reality, there could be different answers to a set of questions on one topic.

Examples of question order bias

- Asking the primary question in a loaded way, for example: ‘Do you want kids?’ and then following up with questions about the perception of motherhood or fatherhood. The former question sets up the participant for an extreme answer (yes or no). The second question could relate to the participant’s view of their own parents, though the order of the questions suggests that this is a follow-on question to be answered similarly.

- Another example is double-barrelled questions that ask two things at the same time, implying that they’re linked. For example, What do you think of this clothing brand and the management?’

Social desirability bias or conformity bias

Survey takers may want to appear more socially desirable or attractive to the interviewer as people are careful about how they appear to others. From a survey perspective, this could be respondents answering uncharacteristically or lying to appear in a positive light.

The researcher’s choice of topic could be the source of the issue, or it could be the participant’s insecurity or comfort with the topic that affects their answers.

Examples of social desirability bias

- If participants are influenced by societal ‘norms’ for behaviour and appearance, e.g. how a person ‘should’ appear or act, this can affect their answers. For example, drinking can lead to binge drinking and health problems, yet it’s an acceptable social norm for workers and teams.

- Social desirability bias may also cause participants to go over the top and inflate their own status to seem more successful or progressive than they actually are. For example, lying about their annual income or level of education.

3. Interviewer bias

The last type of survey bias is created by the actions of the interviewer . The way that a question is asked, or the way the interviewer makes a participant feel in the survey, can impact what results they receive back.

As the reliability of the data is on the line, the interviewer owes it to themselves to do their best to remove bias, though they may not even realize what they’re doing.

Demand characteristic bias

When a participant is doing a survey, they are aware that they’re in an interview setting and may act differently because of that. If you recall how nerve-wracking interviews are for a new job, you’ll see why you might say something that wasn’t accurate or wholly true because of the pressure on you.

As such, researchers will get biased responses from surveys that are incredibly formal or hosted in an uncomfortable setting. To help respondents and get accurate data and valuable data — researchers need to help participants forget that they are being interviewed and asked survey questions.

Examples of demand characteristic bias

- If the survey starts without a good introduction, the participant doesn’t understand the purpose of the study and spends time trying to figure it out, while still being asked questions at the same time. This can lead to pressure and stress, and you won’t get the best answers out of them during this time.

- If the setting of the interviews is unwelcoming and you don’t do your best to keep the participant comfortable, the discomfort the participant feels may come through into the way they answer their questions — rushed or anxiously.

Reporting bias

Reporting bias arises when the research team decides on the publication of the research based on the positive or negative outcome, from the analysis of the data.

Examples of reporting bias

A healthcare research team found that they can’t make a case that their medical painkiller cream decreases pain when used on test participants. The brand may choose not to publish the results sharing this information, which is unethical and doesn’t represent the facts based on the research.

How to prevent survey bias

Given how prevalent bias in surveys is, what can you do about it to protect your survey work, but to make sure you get the right answers back from survey takers? Answers based on their beliefs, needs , and views?

Here are some suggestions that will help prevent survey response bias:

Selection bias

- Add in a ‘don’t know’ or ‘not applicable’ option in answers so that the participant doesn’t feel the need to answer a question incorrectly or not at all.

- Ensure you have an up-to-date participant list that covers the right target audiences and is a random sample. If you need help knowing what is a good sample size, try our free sample calculator tool .

- Ask non-respondents to participate in a follow-up survey. Sometimes, people are busy and miss the email invitation. A second round may provide more ‘yeses’ that will help create a better picture of results.

- Consider the best way to reach your target audience so you can connect with them. This means that you won’t get survivorship bias where the longest-serving participants are the only ones available to interview.

Response bias

- Avoid phrasing questions emotionally or using emotional topics, unless you’re trained to provide guidance and support for participants that react badly or are emotionally triggered by the questions.

- Write questions in a neutral way that doesn’t indicate a preference for one answer or another. For example, ‘Do you like coffee?’ becomes ‘How do you feel about coffee?’

- Avoid simple ‘yes and no’ questions that don’t allow for elaboration or mixed viewpoints. Instead, use a scale or multiple choice answers.

- Ask someone in your company to review the questions for bias. A fresh pair of eyes can really help identify issues and areas for improvement.

- Provide incentives for participants to complete the survey. This will help keep them focussed and engaged with the survey until the end.

- Ask one question at a time to avoid double-barrelled questions that might confuse participants or make them respond a certain way.

- Mix topics questions up so that there are no linked groups on a topic that occur one after the other, preventing question order bias.

- Avoid emotionally charged language to prevent extreme response bias.

- If you’re always getting a lot of ‘yes’ responses, try an answer scale range that doesn’t encourage acquiescence bias. For example, “Definitely will not, Probably will not, Don’t know, Probably will and Definitely will.”

- If your participants are not happy to be interviewed for the survey, you can try suggesting anonymous feedback so that you’re able to collect key insights that you wouldn’t have gotten otherwise.

Interviewer bias

- Stay neutral and professional as you survey, so that you don’t unconsciously show a preference for one answer over another. This allows for unbiased responses that aren’t fed by unconscious body language or tone of voice.

- Provide a clear welcome and introduction without telling the participants about what’s coming up as questions. This means participants won’t have time to stress about the survey questions coming up and can take each question at a time.

- Be nice to the participants and thank them for their time. Your participants want to know their time is being taken seriously. A warm manner can help them feel at ease.

You might have sampling bias in your marketing list, or you might have inadvertently created questions that lead the participant to a specific answer. But why take the risk when you can see the hundreds of questions on offer with our free survey templates ?

But you can go one step further. With our integrated all-in-one solutions, you can get all your surveys, customer and participant data in one place.

With the ability to improve your survey quality using AI and create research surveys by just dragging and dropping the right modules, you have everything you need. What’s more, you’ll benefit from analytics and dashboard reporting, giving you both an at-a-glance and comprehensive view of responses.

Our survey and panel management tools can help you reach the right audiences around the world, right when you need them. And with the inbuilt intelligence assisting with personalisation, you can boost response rates and show the customer that they’re front of mind.

After all, 13,000 of the world’s best brands that use our software can’t be all wrong!

But if you want to know where to start with your survey questions, we can help. Find out what kind of questions our experts have created for use in your surveys to reduce the risk of survey bias.

eBook: The Qualtrics Handbook of Question Design

Related resources

Thematic analysis 11 min read, post event survey questions 10 min read, choosing the best survey tools 16 min read, survey app 11 min read, close-ended questions 7 min read, survey vs questionnaire 12 min read, likert scales 14 min read, request demo.

Ready to learn more about Qualtrics?

Common biased survey questions & how to avoid them

Many businesses invest time, energy, and maybe even a few virtual sweat drops into creating the perfect questions for a survey. But when the results roll in, they seem to be suspiciously one-sided. This happens due to inherent bias present in the survey questions.

Biased survey questions can infiltrate even the most well-intentioned surveys and lead you down a path of misleading data and wasted effort.

This article explains:

What is a biased question?

- Different types of survey biases to avoid

- Some biased survey question examples

- And bonus tips to help you get the honest feedback you need

According to Merriam-Webster , bias in a survey is a type of survey error where one outcome or answer is encouraged over others.

Biased survey questions are worded in a way that pushes respondents to pick a certain answer instead of giving you their honest opinion.

Some characteristics of biased survey questions include:

- A leading tone that nudges the survey taker to a particular answer option

- Emotionally charged words that sway respondent’s opinions

- Build-in assumptions about the respondents’ experiences

- Double meanings or confusing and multiple interpretations

- Limited range of responses that don’t capture the full range of survey taker’s opinions.

- Imbalance question framing that presents one side of the issue more prominently

Biased questions can lead to some major problems for your survey, such as:

- Unreliable data: If people feel pressured to answer a certain way, your data won’t reflect their true feelings.

- Wasted time and resources: You spend time and resources creating a survey. Biased questions that produce inaccurate results make the whole effort pointless.

- Frustrated respondents: Nobody likes to be manipulated. Biased questions can annoy participants and make them less likely to finish your survey.

6 types of bias in surveys and how to avoid them

Now, let’s go deeper into specific types of survey bias and understand them with biased and unbiased survey question examples.

Leading Bias

Leading question bias occurs when survey questions subtly guide respondents toward a particular answer.

These questions plant a seed in the respondent’s mind and make them more likely to pick an answer that reflects the bias in the question itself.

- Biased Question : “Don’t you agree that our new product is the best on the market?”

What makes it biased : This question assumes the respondent agrees with the statement without providing an opportunity to express differing opinions. It leads the respondent to affirm the product’s superiority, which inflates the positive feedback.

Fixed Question : “What are your thoughts on our new product compared to others available on the market?”

- Biased Question : “How much do you love our amazing customer service?”

What makes it biased : This question presupposes that the respondent loves your customer service and frames the response positively without considering differing opinions or experiences. It forces respondents to provide positive feedback regardless of their actual feelings.

Fixed Question : “How would you rate your experience with our customer service on a scale from 1 to 5”

Question-Wording Bias

This type of survey bias means your survey contains confusing, vague questions or has unnecessary technical jargon that is difficult to understand.

- Biased question : How would you rate the level of synergism within our cross-functional teams?

Why it’s biased : This question uses jargon (“synergism,” “cross-functional”) that some respondents might not understand. If they don’t know what you are asking, their answer does not reflect their true opinion.

Fixed question : How well do different departments within our company collaborate and work together?

- Biased Question : “What do you think about the recent changes?”

What makes it biased : This question is too broad and doesn’t specify which changes are being referred to. Respondents may have different interpretations of what changes are being discussed.

Fixed Question : “What are your thoughts on the recent changes to our company’s vacation policy?”

Double Barrelled Questions

Double-barreled questions combine two separate inquiries into one, forcing the respondents to answer both with a single response. Research suggests that asking double-barrelled questions nullifies the validity of the survey.

- Biased Question : “Do you think the company provides a supportive work environment and ample opportunities for career growth?”

What makes it biased : This double-barrelled question combines two distinct inquiries about the work environment and career growth opportunities. Respondents may agree with one aspect but disagree with the other, which results in confusion and potentially inaccurate responses.

Fixed Question : “Do you feel the company provides a supportive work environment? Additionally, do you believe there are ample opportunities for career growth within the company?”

- Biased Question : “How satisfied are you with the product quality and the delivery speed?”

What makes it biased : This question also addresses two separate aspects—product quality and delivery speed—without allowing respondents to differentiate their satisfaction levels for each. It assumes that satisfaction with one aspect automatically implies satisfaction with the other, which may not be true.

Fixed Question : “On a scale from very dissatisfied to very satisfied, please rate your satisfaction with the quality of the product. Separately, please rate your satisfaction with the speed of delivery.”

Question Order Bias

Question order bias refers to the way the order of your questions can influence how respondents answer later questions.

- Biased Question : “Do you agree that our product is affordable? How satisfied are you with its quality?”

What makes it biased : The order of these questions may influence respondents’ perceptions. If respondents are asked about affordability first, they might consider the price when rating quality. It might lead to a lower or higher satisfaction score.

Fixed Questio n: “How satisfied are you with the quality of our product?

Next question: Do you find our product to be affordable?”

- Biased Question : “How likely are you to recommend our product to a friend? Did you find the product easy to use?”

What makes it biased : By asking about the likelihood of recommendation before inquiring about the product’s ease of use, respondents’ perceptions of usability may be influenced by their intent to recommend and produce a biased response.

- Fixed Question : “Please rate its ease of use on a scale of 1 to 5. Then, indicate how likely you are to recommend the product to a friend on the same scale.”

Assumptive Bias

Assumptive bias occurs when your survey question makes an assumption that might not be true for all respondents. The assumptions skew your data because you don’t capture the real respondent’s beliefs, experiences, or preferences.

- Question : Since our new loyalty program launched, how much more frequently have you been shopping with us?

Why it’s biased : This question assumes the respondent is aware of and has participated in the new loyalty program. It might miss valuable feedback from those who haven’t heard about it yet.

Fixed question : Are you aware of our new loyalty program? If yes, how has it impacted your shopping frequency with us?

- Biased Question : “Given the popularity of our new product, how likely are you to recommend it to a friend?”

What makes it biased : This question presupposes that the new product is popular and assumes that popularity correlates with the likelihood of recommendation. It may influence respondents to give a positive recommendation based on perceived popularity rather than their product assessment.

- Fixed Question : “On a scale from very unlikely to very likely, how likely are you to recommend our new product to a friend based on your personal experience with it?”

Negative and Double Negative Bias

Negative bias happens when you ask biased survey questions with a negative term that forces respondents to interpret “no” as the positive answer. Double negatives take it a step further and use two downright confusing negatives.

- Biased question : Do you find the long wait times at checkout to be not bothersome?

Why it’s biased : This question uses a negative term (“not bothersome”) and makes it unclear whether a “yes” means they find the wait times acceptable.

Fixed question : How satisfied are you with the wait times at checkout? (Very Dissatisfied, Dissatisfied, Neutral, Satisfied, Very Satisfied)

- Biased question : “Don’t you agree that the new policy isn’t ineffective?”

What makes it biased : This question contains a double negative (“isn’t ineffective”), which can confuse respondents. It’s unclear whether the intention is to assess agreement with the policy’s effectiveness or ineffectiveness, leading to potentially contradictory responses.

Fixed question : “Do you believe the new policy is effective in achieving its intended goals?”

Tips to avoid biased survey questions

Here are some tips to help you create crystal-clear survey questions that get you real feedback.

- Ensure your questions are free from loaded or emotionally charged language. Avoid jargon and overly complex sentence structures.

- Provide balanced response options to avoid skewing responses toward one end of the spectrum.

- Don’t prime respondents with positive or negative questions that influence their answers later on.

- Include an “Other” or “Not applicable” option to accommodate respondents whose experiences may not align with the provided choices.

- Stick to one topic per question to prevent confusion and ensure respondents provide relevant answers.

Unbiased survey questions lead to accurate data

Unbiased surveys are essential for accurate data-driven decision-making. They save you time, resources, and frustration.

Now that you know different types of question bias, you can ensure your surveys are clear and concise, and capture honest feedback.

Formaloo is a user-friendly survey maker and form builder that lets you design clear, unbiased questions, gather valuable data, and easily analyze your findings.

Sign up for free today.

Inspiration

How to ask open-ended questions crucial tips and examples.

9 ways to make more engaging surveys

Best feedback survey questions

5 Errors in surveys to avoid to collect authentic data

Get started for free.

Formaloo is free to use for teams of any size. We also offer paid plans with additional features and support.

What you want is what you get

Formaloo for

Formaloo is the best customer engagement platform that lets you build beautiful forms, quizzes, customer portals, CRMs, and any other business apps without any code - all in one place! More than 25,000 businesses use Formaloo every day to create customer engagement tools like quizzes, calculation forms, membership websites, client portals, HR dashboards, and smart surveys with AI.

Made with passion by Formaloo team © 2024 Formaloo Solutions Inc. 10 Dundas St, Toronto, Canada. All rights reserved.

Find the right market research agencies, suppliers, platforms, and facilities by exploring the services and solutions that best match your needs

list of top MR Specialties

Browse all specialties

Browse Companies and Platforms

by Specialty

by Location

Browse Focus Group Facilities

Manage your listing

Follow a step-by-step guide with online chat support to create or manage your listing.

About Greenbook Directory

IIEX Conferences

Discover the future of insights at the Insight Innovation Exchange (IIEX) event closest to you

IIEX Virtual Events

Explore important trends, best practices, and innovative use cases without leaving your desk

Insights Tech Showcase

See the latest research tech in action during curated interactive demos from top vendors

Stay updated on what’s new in insights and learn about solutions to the challenges you face

Greenbook Future list

An esteemed awards program that supports and encourages the voices of emerging leaders in the insight community.

Insight Innovation Competition

Submit your innovation that could impact the insights and market research industry for the better.

Find your next position in the world's largest database of market research and data analytics jobs.

For Suppliers

Directory: Renew your listing

Directory: Create a listing

Event sponsorship

Get Recommended Program

Digital Ads

Content marketing

Ads in Reports

Podcasts sponsorship

Run your Webinar

Host a Tech Showcase

Future List Partnership

All services

Dana Stanley

Greenbook’s Chief Revenue Officer

Research Methodologies

December 14, 2022

Bias in Marketing Research: How to Avoid and Minimize

Author’s Note: I’ve always been interested in biases. A poster of The Cognitive Bias Codex hangs in one of our home offices; and, I’ve bookmarked and often look at that interactive…

by Karen Lynch

Head of Content at Greenbook

Author’s Note: I’ve always been interested in biases. A poster of The Cognitive Bias Codex hangs in one of our home offices; and, I’ve bookmarked and often look at that interactive wiki to learn more. Just like I looked to two industry experts to learn more about bias in research for this article: Jeff Henning and Ray Poynter . Many thanks to you both for serving GreenBook as expert sources. We value your contribution to this piece, just as we value our readers.

Have you ever asked a question while assuming you already knew the answer? That’s a simple example of a bias. As humans, we inadvertently experience bias in every aspect of our lives. Our personal biases influence the lens through which we look at the world. And while some biases are innocuous, some are harmful; and, bias in market research can have a negative effect on the findings.

What is Marketing Research Bias?

Research bias is defined as any type of feedback that skews the market research’s results. There are five types of market research bias to look out for:

- Social desirability bias – This bias boils down to research participants thinking they should answer questions in a way that paints them in a positive light. For example, if surveying on gender discrimination, no one wants to admit they have misjudged someone solely based on their gender.

Food for Thought: Challenges and Ideas for Addressing Bias

- Sponsorship bias – Most likely one of the more common types of biases, results are skewed in preference of the organization paying for the market research. Popular examples of this often appear in the food industry, such as The Coca-Cola Company funding obesity research.

- Confirmation bias – This type of bias occurs when the researcher intentionally or unintentionally seeks to “confirm” their hypothesis by crafting leading questions or cherry-picking data.

- Culture bias – When researchers analyze data and make assumptions through their own unique lens of their upbringing, heritage, and community, this is cultural bias.

What is the Most Prevalent Type of Marketing Research Bias?

“the most prevalent bias is the ‘say/do gap’ – people saying they will do things that it turns out they don’t do.”.

Experts also have differing opinions regarding the most prevalent types of bias in research. According to Roy Poynter, Chief Research Officer at Platform One, “The most prevalent bias is the ‘say/do gap’ – people saying they will do things that it turns out they don’t do.” For Jeff Henning, Chief Research Officer at Researchscape International, the most prevalent bias boils down to a nonresponse. Other opinions state confirmation bias is the most common type.

How to Reduce and Avoid Marketing Research Bias

Why even bother reducing market research bias? First, it’s problematic because it often skews results. It’s important to critically and independently collect and report on data. Second, strong biases make it difficult to come to a true scientific conclusion that can be repeated and fact-checked by third parties. Researchers should do everything they can to proactively minimize and avoid bias.

4 Ways to Minimize Marketing Research Bias

There are specific ways to avoid each specific type of market research bias. Howe, it’s important to keep your personal perspective in check in both quantitative and qualitative research .

1. Follow Random Sampling Best Practices

Avoid bias in your sampling pool by ensuring each element has an equal chance of representation. Use randomization tools to select an assortment. For digital research, work to avoid bots with layered fraud mitigation techniques.

2. Pay Attention to How Questions Are Worded

Asking the wrong questions can lead you to the wrong answers. Since survey questions are written by humans, it’s inevitable that we subconsciously put our personal perspective into our language. Use open-ended questions to avoid steering subjects in a specific direction. Henning said, “Researchers control the questionnaire, which can often add bias. Studying questionnaire writing or using an expert minimizes instrument bias.”

3. Use a Survey Method That Makes It Easy for All Types of People to Participate

For example, if you are surveying how many commuters walk to work, and you only stand out in the street with a clipboard, you inherently miss everyone who drives or bikes to work. Poynter explained, “We need to use approaches that have been developed to be robust in the face of bias, and we need to triangulate and take different readings from different points to get a more predictive result.”

4. Use an Agile Research Method

A scalable, agile research method allows for innovation and a customer-specific focus. With continuous feedback, a minimal viable product, and sprint work, research can be human-centric and easily adaptable to changes. Researchers can get more mileage out of current efforts and focus on other initiatives simultaneously.

Bias Isn’t Completely Avoidable – But It’s Mitigable

Research will never completely avoid bias, but market research experts can get better and better at spotting bias before it influences results. An agile approach can help quickly find, solve, and document biases so they’re avoided in the future. Less bias means more accurate results, which furthers your field of research and leads to true breakthrough.

Karen Lynch

72 articles

The views, opinions, data, and methodologies expressed above are those of the contributor(s) and do not necessarily reflect or represent the official policies, positions, or beliefs of Greenbook.

Comments are moderated to ensure respect towards the author and to prevent spam or self-promotion. Your comment may be edited, rejected, or approved based on these criteria. By commenting, you accept these terms and take responsibility for your contributions.

More from Karen Lynch

Future List Honorees

Greenbook Future List Spotlight: Jasmin Goodman

Learn about Dr. Jasmin Goodman, Founder of The J. Michelle Group, who combines academic insight with real-world research in diversity & authentic stor...

June 27, 2024

Read article

Transforming Marketing, Consumer Behavior, and Startup Innovation

Dive into the world of AI in advertising and explore data-driven personalized marketing. Explore AI-...

June 26, 2024

Watch video

Embracing AI Innovations and Ensuring Data Quality

Dive into Apple's AI strategy and its effects on various industries. Explore the significance of dat...

June 20, 2024

Navigating Change and Accelerating Research

Learn the significance of contingency plans in the face of AI platform outages. Explore Walmart Data...

June 13, 2024

Top in Quantitative Research

Moving Away from a Narcissistic Market Research Model

Why are we still measuring brand loyalty? It isn’t something that naturally comes up with consumers, who rarely think about brand first, if at all. Ma...

Devora Rogers

Chief Strategy Officer at Alter Agents

May 31, 2023

Qualitative Research

The Stepping Stones of Innovation: Navigating Failure and Empathy with Carol Fitzgerald

Natalie Pusch

Senior Content Producer at Greenbook

March 16, 2023

Play Episode

Sign Up for Updates

Get content that matters, written by top insights industry experts, delivered right to your inbox.

67k+ subscribers

Weekly Newsletter

Greenbook Podcast

Event Updates

I agree to receive emails with insights-related content from Greenbook. I understand that I can manage my email preferences or unsubscribe at any time and that Greenbook protects my privacy under the General Data Protection Regulation.*

Get the latest updates from top market research, insights, and analytics experts delivered weekly to your inbox

Your guide for all things market research and consumer insights

Create a New Listing

Manage My Listing

Find Companies

Find Focus Group Facilities

Tech Showcases

GRIT Report

Expert Channels

Get in touch

Marketing Services

Future List

Publish With Us

Privacy policy

Cookie policy

Terms of use

Copyright © 2024 New York AMA Communication Services, Inc. All rights reserved. 234 5th Avenue, 2nd Floor, New York, NY 10001 | Phone: (212) 849-2752

Biased survey questions: types, examples, and ways to avoid them

The most common types of bias in event feedback surveys

Ekaterina Orlova

Read more posts by this author.

The process of collecting feedback is a dialogue between an interviewer and a respondent. And like in every dialogue, there can be misunderstandings. Due to the indirect form of the conversation, they become even more troublesome than usual.

If you want to receive valid and useful feedback from your survey, you need to express your thoughts clearly and concisely, avoiding biased questions.

What is a biased question?

A biased question is an unquiry asked in a way to solicit a certain answer from a respondent or unclear to them. Sometimes, they are born from wrong choice of words and questions order, sometimes - caused by social and psychological factors. Both surveyor and respondent might be unaware of it, still falling to its trap subconsciously.

Biased questions prevents people from sharing honest impressions and damage the feedback received. Although eliminating them completely is next to impossible as you cannot predict the reaction of each person, but knowing what types of bias are out there will help you watch out for them and mitigate their influence.

Types of biased questions

Just like there are many ways to affect a respondent's choice, there are many different types of biases and questions born from them:

- Double-barreled question

Absolute questions

Leading questions, loaded questions, dichotomous questions, vague questions, social desirability bias, demand characteristics bias, assimilation effect, contrast effect, acquiescence bias.

- Straightlining.

Double-barreled questions

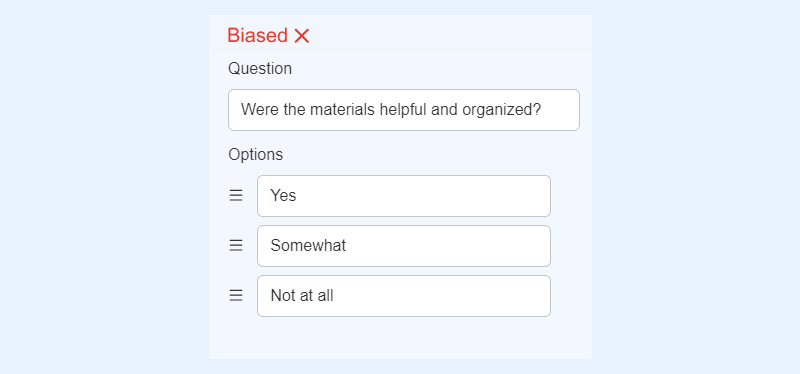

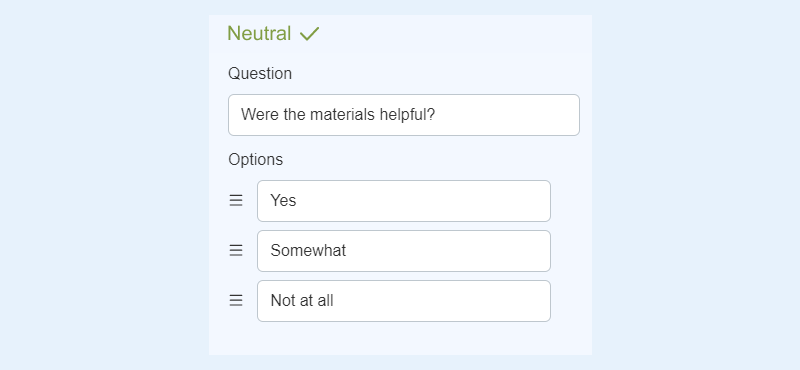

A double-barreled question combines two questions in one and asks for one answer to both. It is easy to miss because adding more information often seems like a good idea.

This sentence asks about two different matters: the effectiveness of the materials and their structure. It’s not necessarily that both of them are on the same quality level. A respondent might find materials extremely helpful, but not very well organized. Thus, they will be at a loss as to what to answer. And when you will be reading their replies, you also won’t be able to pinpoint which of the two matters caused problems.

How to avoid double-barreled questions? Try to be concise and simple whenever possible. Stay away from long descriptions that use several words to define one point. Make sure that you address only one side of the topic in each field.

To check yourself, imagine how you would be analyzing results. If you receive a negative answer, will you be able to understand where the problem lies?