- Resources for Entrepreneurs > Become an Entrepreneur > Business Startup Instructions

Starting a Generator Rental & Leasing Business

Business Startup Instructions

Thinking about opening a generator rental and leasing business? Here is a summary of all the basic steps you ought to know about starting and running a generator rental and leasing business.

Thinking about opening a generator rental and leasing business? We tell you what you need to know to get started.

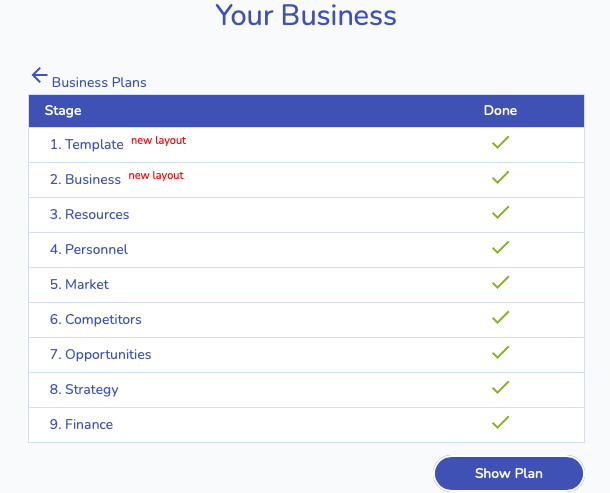

Tips for Creating a Great Generator Rental & Leasing Company Business Plan

A business plan is the skeletal framework for your generator rental and leasing business's mission, goals and strategic vision.

In contemporary business culture, business plans are also litmus tests used by external interests to assess real world viability and marketability.

Early in the process, it's worth your time to learn how to write the market analysis section of a business plan . While a robust market analysis can be a selling point for a generator rental and leasing business startup, weak market research is a sure giveaway for a business that hasn't invested adequate effort in planning.

Look Over Competitors

Well in advance of opening a generator rental and leasing business within your community, it's worthwhile to find out how many competitors you have. We've provided the link below to help you generate a list of competitors in your area. Simply enter your city, state and zip code to get a list of generator rental and leasing businesses in your town.

- Find Competing Generator Rental & Leasing Businesses

How are you going to successfully complete with existing firms? It's important that you never underestimate the competition.

Find Good Remote Business Advice

As part of your due diligence on opening a generator rental and leasing business, be sure to have a conversation with someone who is in the business. It's very unlikely that the local competition will talk to you. The last thing they want to do is help you to be a better competitor.

Fortunately, somebody who runs a generator rental and leasing business in a location that is not competitive to you may be willing to share their entrepreneurial wisdom with you, provided that you won't be directly competing with them. In that case, the business owner may be more than happy to discuss the industry with you. Our estimate is that you may have to contact many business owners to find one who is willing to share his wisdom with you.

What's the process for finding a generator rental and leasing business entrepreneur that lives outside of your area?

Here's one way to do it. Just use our link below, find somebody and call them.

- Find an Experienced Generator Rental & Leasing Business Entrepreneur

Getting Started in Generator Rental & Leasing Business Ownership

Would-be generator rental and leasing business business owners can either launch a new business or acquire an existing operation.

Startup generator rental and leasing businesses can be attractive because they allow the entrepreneur to have more control and greater influence. But financially, startups present significant challenges because lenders are typically hesitant to fund startup generator rental and leasing businesses.

Acquired generator rental and leasing businesses are known quantities - and are less risky for lenders. Buying a business means that you'll have access to a documented financial history, an established business model and other factors that are unknowns in a startup � and that makes the ownership opportunity less of a risk to both you and your generator rental and leasing business's key stakeholders.

Startup small business owners are under enormous pressure to achieve profitability quickly.

Franchised businesses present a viable alternative for startup entrepreneurs interested in minimizing investment risk. Although there are no guarantees, a proven franchise startup eliminates many of the obstacles startup owner face right out of the gate, significantly improving survival rates and profitability.

If fewer hassles and better visibility sound appealing, click on the below and check out our directory of generator rental and leasing business startup opportunities in your area.

- Rental Franchise Opportunities

More Startup Articles

These additional resources regarding starting a business may be of interest to you.

Questions to Ask Before Starting a Business

Share this article

Additional Resources for Entrepreneurs

Lists of Venture Capital and Private Equity Firms Franchise Opportunities Contributors Business Glossary

- Terms of Use

- Privacy Policy

- Franchise Directory

- Entrepreneurial Resources

- Small Business News

- Gaebler France

- Gaebler Mexico

- Gaebler Philippines

- Gaebler Czech Republic

- Gaebler Germany

- Gaebler China

Copyright © 2001-2024. Gaebler Ventures. All rights reserved.

How to Start an Equipment Rental Business: A Step-by-Step Guide

This article is your go-to guide for starting an equipment rental business , offering a step-by-step approach to navigate this venture. We packed our own insights after working with various rental businesses and helped them scale their operations.

We’ll go over on identifying the most profitable business idea, understanding your target market, and finding potential customers.

Moreover, it delves into selecting the right equipment, estimating your startup costs, and crafting a solid business plan.

Each section is tailored to provide you with the necessary tools and knowledge to set up a successful rental business, making it an invaluable resource for aspiring entrepreneurs in the rental industry.

6 Steps to Start a Rental Equipment Business in 2024

Starting a rental equipment business in 2024 requires a strategic approach and a deep understanding of the market. These six steps provide a comprehensive roadmap, from ideation to execution, ensuring you build a solid foundation for your entrepreneurial venture.

1. Identify Your Rental Business Idea

Pinpoint a niche in the rental market that aligns with both regional demands and your expertise. For example, if you're in a region with a robust fishing community, consider specializing in fishing kayaks and related equipment.

- Survey Local Residents: Conduct surveys within your community to gather direct feedback about what types of rental equipment are in demand. This can reveal insights into specific preferences, such as the popularity of tandem kayaks among couples or stand-up paddleboards for solo adventurers.

- Analyze Online Behavior: Utilize tools like Google Analytics to understand the interests of people visiting your website or searching for related activities in your area. For instance, a high number of searches for “mountain biking trails near me” could indicate a demand for mountain bikes.

- Study Competitors: Examine what your competitors are offering and to whom. If you notice a gap in the market - say, no one is catering to families with children - you can capitalize on this by offering child-friendly equipment like small kayaks or bikes with child seats.

2. Identify Your Target Market

Analyze demographic data and local trends to identify your ideal customer profile.

In-depth demographic analysis is integral to identifying your ideal customer profile for your equipment rental business.

Begin by examining local census data, focusing on age, income levels, and lifestyle preferences.

For instance, if your location boasts a significant population of young professionals with disposable income, gear your inventory towards adventure-centric equipment such as high-performance mountain bikes and jet skis.

To fine-tune your understanding, conduct surveys or focus groups with local residents. This hands-on approach can provide insights into specific equipment preferences, like the growing interest in electric bikes among eco-conscious consumers.

Additionally, attending local events or community gatherings can offer a direct view of the recreational interests prevalent in your area, guiding you to stock the most sought-after equipment.

3. Find Potential Customers

Start by analyzing online behavior using tools like Google Analytics and social media insights. This data can reveal where your target market spends their time online , what content resonates with them, and the best times to reach them.

Craft targeted advertising campaigns on platforms where your potential customers are most active.

For example, if data shows a high engagement rate on Instagram among your target demographic, focus on visually compelling content showcasing your inventory, like showcasing kayaks in scenic locations or highlighting the thrill of using your jet skis.

Partnering with local adventure clubs, tourism boards, and outdoor event organizers can also provide direct access to your target market.

These partnerships can be mutually beneficial; offering exclusive rental discounts to club members or event participants can drive business your way, while the clubs and events get to offer additional value to their members and attendees.

Implementing these focused tactics will help you efficiently reach and engage with potential customers, increasing the visibility and appeal of your equipment rental business.

4. Determine the Types of Equipment to Rent

When selecting equipment for your rental business, market research is pivotal. Assess the specific demands within your target market – for instance, if you're situated near urban areas with eco-aware consumers, consider adding solar-powered electric boats to your inventory.

This not only caters to environmental concerns but also differentiates your business in the competitive market.

Additionally, evaluate the popularity of various equipment types. Utilize tools like social media analytics to gauge interest in different outdoor activities, which can inform decisions about stocking stand-up paddleboards versus kayaks, for instance. This approach ensures your equipment rental business remains responsive to evolving consumer preferences.

Choosing the right equipment is just the beginning. For entrepreneurs eager to dive deeper into maximizing the profitability of your equipment rental business , it's vital to explore strategies that enhance your return on investment, from pricing models to customer retention techniques.

5. Estimate Startup Costs

A comprehensive financial plan is crucial for your equipment rental business. Begin by itemizing initial expenses such as the purchase of inventory – kayaks, jet skis, mountain bikes, and any specialized equipment like adaptive gear for individuals with disabilities.

Consider the costs of specialized transport vehicles for larger items like boats or jet skis. Include expenses for obtaining necessary permits and licenses, which may vary depending on your location and the type of equipment you're renting.

Also, factor in insurance costs to protect your business and inventory.

Lastly, allocate funds for marketing efforts to effectively launch and promote your business.

This detailed financial planning will help you secure funding, whether through loans, investors, or personal capital, and will guide your business towards profitability.

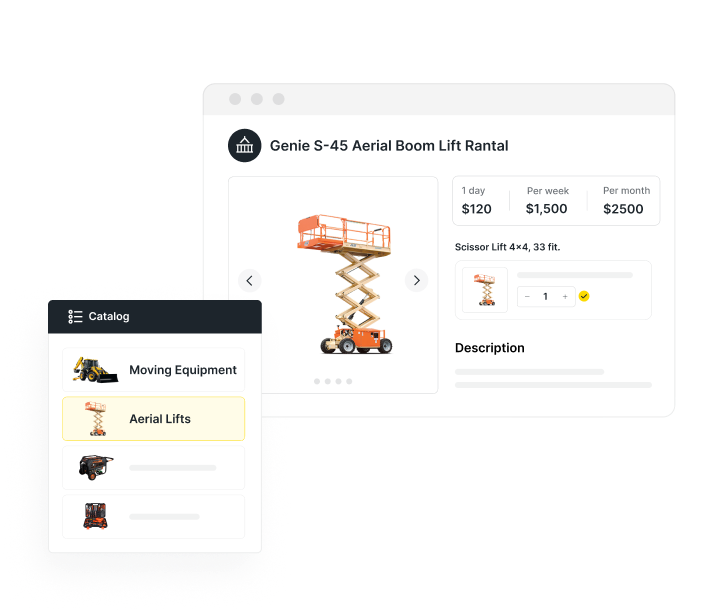

6. Create a Business Plan for Your Equipment Rental Company

Developing a business plan is a critical step for your equipment rental company. Start by integrating comprehensive market research to identify your target customers, their preferences, and spending habits. This research should guide your decisions on which types of equipment to stock, such as kayaks, bikes, or jet skis, and the quantity of each.

Include a competitive analysis to understand your market position relative to other rental businesses. Identify your unique selling points, whether it's superior equipment quality, specialized offerings like electric boats, or exceptional customer service.

Your financial strategy should detail all startup and operational costs, including the purchase of equipment, maintenance expenses, insurance, and marketing.

An integral part of your business plan revolves around strategizing your equipment rental pricing . Setting competitive yet profitable pricing is essential for attracting customers while ensuring your business's financial health, particularly in balancing peak and off-peak season demands.

Project your revenue streams, considering factors like seasonal demand variations for different types of equipment.

For example, demand for jet skis may peak in summer, while bikes might be more popular in spring and fall.

Tips to Start an Equipment Rental Business

Starting an equipment rental business requires strategic planning and savvy decision-making. The following tips are designed to guide you through key aspects of setting up and managing your rental business, ensuring both efficiency and profitability.

- Find the Best Deal for Your Equipment: Negotiate with suppliers for bulk pricing or seasonal discounts. Attend trade shows to connect with manufacturers offering innovative equipment that could give you an edge, like ultra-lightweight kayaks or advanced safety features in jet skis.

- Stock Up on the Best Inventory Available: Curate your inventory based on quality and unique selling points. For instance, offer high-end racing bikes with the latest gear systems for cycling enthusiasts.

- Don't Buy More, Buy Smarter: Invest in modular equipment that can serve multiple purposes. For example, kayaks with removable seats can be used for both solo and tandem experiences.

- Treat Your Equipment Right: Implement a rigorous maintenance protocol. Use the latest tools and technology for equipment diagnostics and repairs, ensuring each item is in peak condition for every rental.

- Stake Your Claim Online: Develop a sophisticated online presence with an emphasis on SEO and user experience. Showcase high-quality images and videos of your equipment in action, and feature customer testimonials highlighting unique experiences.

- Create Partnerships: Form strategic partnerships beyond the usual tourism circles. Consider collaborations with corporate entities for team-building retreats, offering group packages for your rental equipment.

- Find the Right Tools for Your Business: Utilize advanced rental management software that offers features like predictive analytics for inventory management, POS systems, and integrated customer relationship management tools.

- Decide on Your Online Booking Software: Select a booking system that offers flexibility and customization, like adjustable rental periods or add-on services. Ensure it has robust analytics to track customer behavior and preferences.

- Treat Your Customers Right: Implement a customer feedback system to continually improve your services. Offer loyalty programs or personalized rental suggestions based on previous preferences.

- Create a Waterproof Agreement: Design rental agreements that are comprehensive yet easy to understand. Include clauses specific to your equipment types, like damage protocols for high-tech gear or specific usage instructions for specialty bikes.

As you build your inventory, understanding the importance of digital inventory management becomes crucial. Effective inventory management not only streamlines operations but also ensures that your business can meet customer demand without overextending resources.

How to Calculate Your Startup Costs

Starting an equipment rental business, like renting out kayaks, boats, bikes, and jet skis, requires a clear understanding of the initial investment needed.

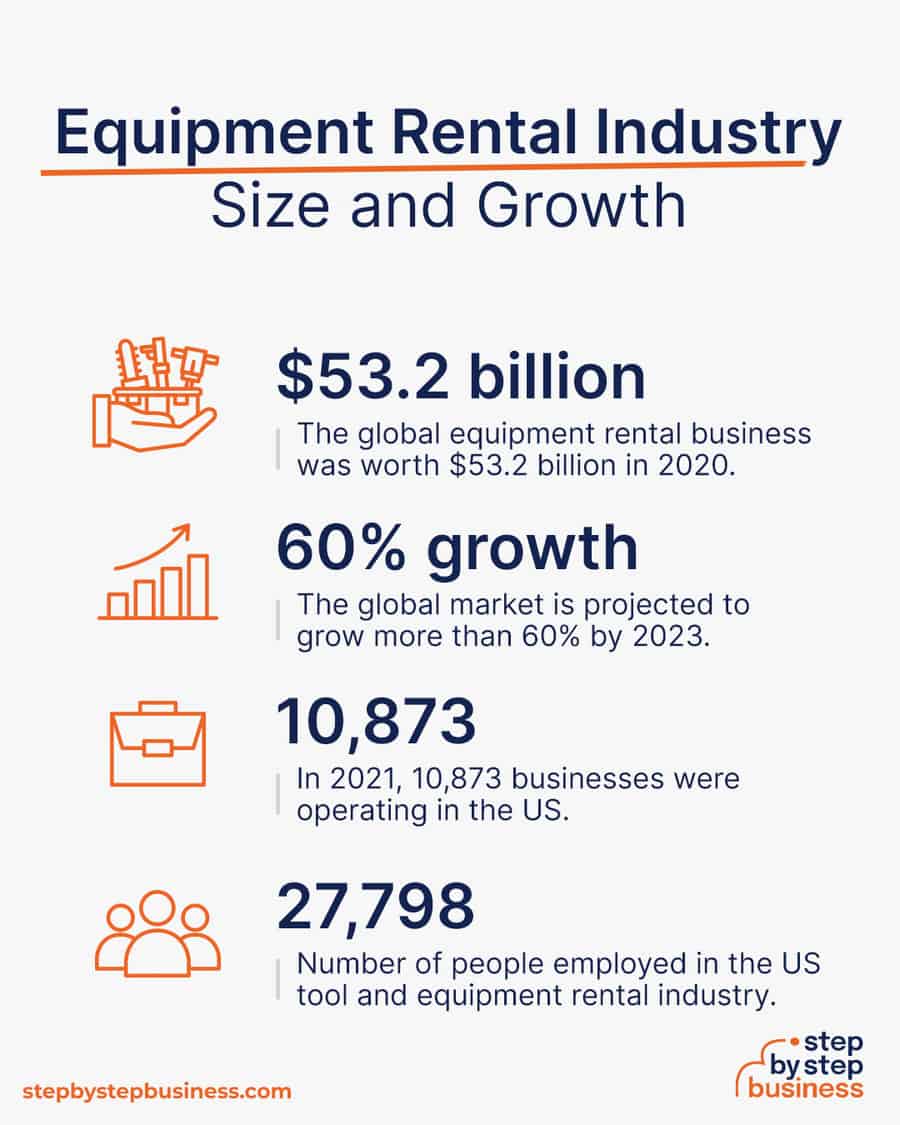

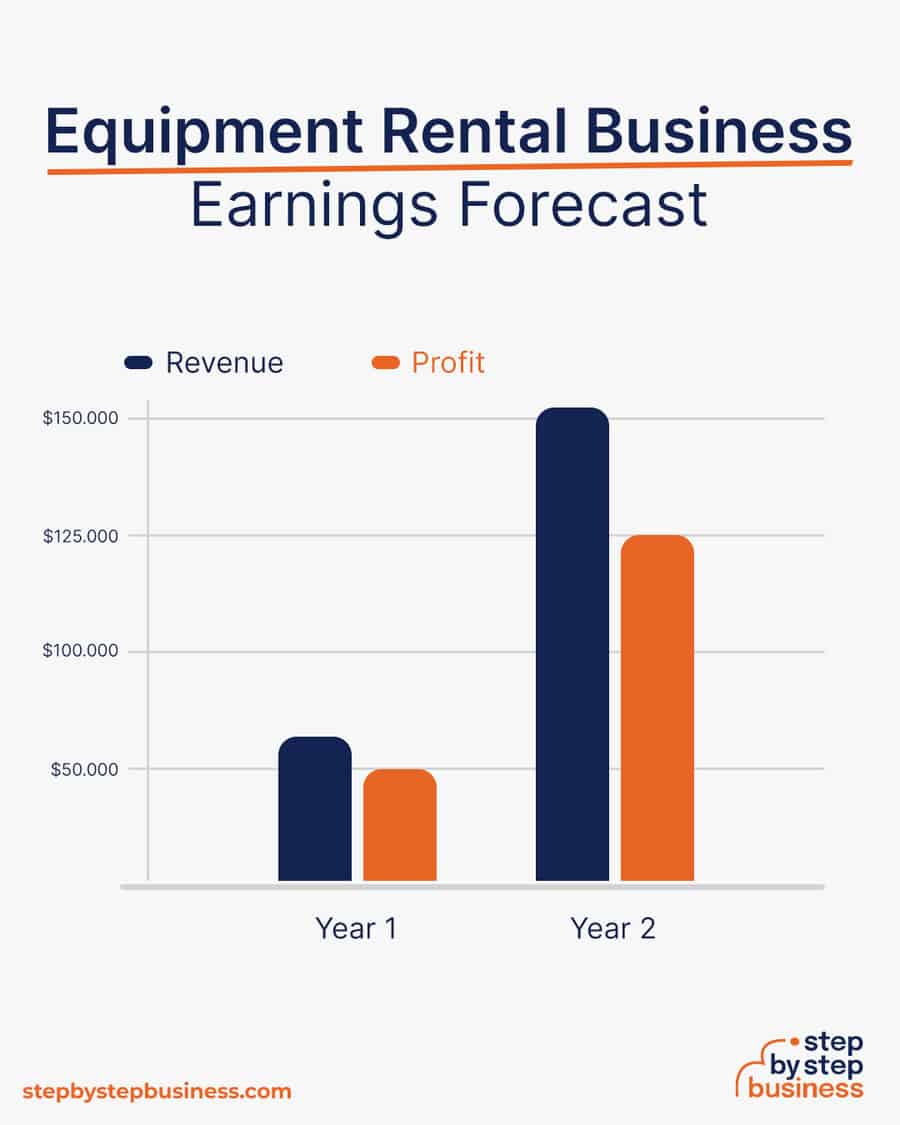

According to ProjectionHub's analysis of the equipment rental industry, the average annual revenue for all sole proprietorship equipment rental businesses in the U.S. was $168,007, with average annual expenses being $182,243, leading to an average net profit margin of -8%. *

Here's a breakdown of the startup costs you should consider, infused with expertise and actionable insights for rental business owners.

Equipment Rental Financial Model

These figures underline the importance of detailed financial projections and understanding the potential for net loss, especially due to large depreciation expenses which are a significant factor in the equipment rental business

Commercial and Industrial Equipment Rental Market: The Commercial and Industrial Equipment Rental industry report by Kentley Insights offers comprehensive data on industry size, growth, company dynamics, profitability, and financial benchmarks.

For instance, in 2023, the industry's sales were $47.3 billion, with an average sales per company of $9.5 million. The industry has experienced an annual growth rate of 7.3% over the past five years. Such reports can provide valuable insights for strategic planning and understanding the market dynamics of the equipment rental sector. *

Secure Necessary Financing: Calculate the total startup cost and plan your finance strategy. This could include loans, investors, or personal savings. Loan origination fees typically range from 0.5% to 1% of the loan amount.

Warehouse & Office (Deposit)

When leasing a warehouse or office space for a rental equipment business, costs vary based on location, size, and amenities. Prologis suggests the average base rental rate is around $0.85 per square foot per month, with an additional $0.25 per square foot per month for operating expenses, totaling an asking lease rate of $1.10 per square foot per month. *

Thomasnet * indicates that warehouse leasing costs depend on several factors, including the demand for smaller spaces in urban areas, which can drive up rental rates.

For a 1,000 square foot space, monthly costs could be approximately $1,100 or $13,200 annually, excluding the deposit. Thus, a deposit equivalent to the first and last month's rent could place your estimated total for warehouse and office space within the $10,000 - $20,000 range, aligning with your initial estimate. It's crucial to engage with landlords for a detailed understanding of all potential costs.

Renovation and Design Costs

For basic renovations and design of a rental business space like one for kayaks, boats, bikes, and jet skis, the budget range can vary widely based on several factors such as the quality of materials, labor costs, the extent of renovations, and the specific requirements of your business.

For example, electrical work alone can range significantly depending on the complexity of your needs, from as low as $10,000 to as high as $100,000 * for more extensive requirements.

Plumbing updates, particularly if adding or moving a bathroom, could cost between $3,000 to $6,000 or more *, depending on proximity to water and sewage lines. Flooring and ceiling updates might cost around $2.76 and $1.81 per square foot, respectively, while HVAC system updates could average about $2.61 per square foot or around $13,000 for a 5,000-square-foot space.

Given these variables, it's critical to get a clear understanding of your specific renovation needs and negotiate wisely with your landlord regarding the TI allowance.

Additionally, consulting with professionals like architects, interior designers, and contractors can provide a clearer and more detailed cost estimate tailored to your specific business needs.

Equipment Rental Insurance Costs

Insurance-Informed Decision: Obtaining comprehensive insurance is crucial. This includes general liability, property insurance, and specific insurance for rental equipment. Average costs for small business insurance range from $400 - $1,000 annually per policy. Expect to spend around $1,200 - $3,000 for the necessary coverage. *

Office Equipment & Security

It's also important to consider the ongoing costs of office supplies, which can average between $77 to $92 per employee per month for small businesses. This includes consumables like paper, ink, and other stationery items.*

For desktop computers, you can expect to pay between $400 for a basic model with limited storage space to $3,500 for a top-of-the-line desktop with a large hard drive. If you prefer Apple models, prices may range from $1,500 to $3,500, depending on the features required. Laptops offer more flexibility and can range from $300 for basic models to $3,000 for high-speed models with large storage capacity, with Apple laptops priced between $1,000 and $2,500. Tablets, which provide another level of portability and functionality, can cost between $200 and $1,200. *

Equipment Rental Fleet Maintenance Costs

Regularly Maintain and Service Equipment: Allocate funds for the ongoing maintenance of your rental fleet. This includes repairs, parts replacement, and servicing.

Setting aside about 10% of the initial cost of your equipment annually for maintenance aligns with industry guidelines for fleet management. This approach ensures your fleet remains in good condition, thereby reducing repair costs and maintaining your company's reputation. *

If your initial equipment costs are $50,000, budget around $5,000 annually for maintenance.

Key Takeaways

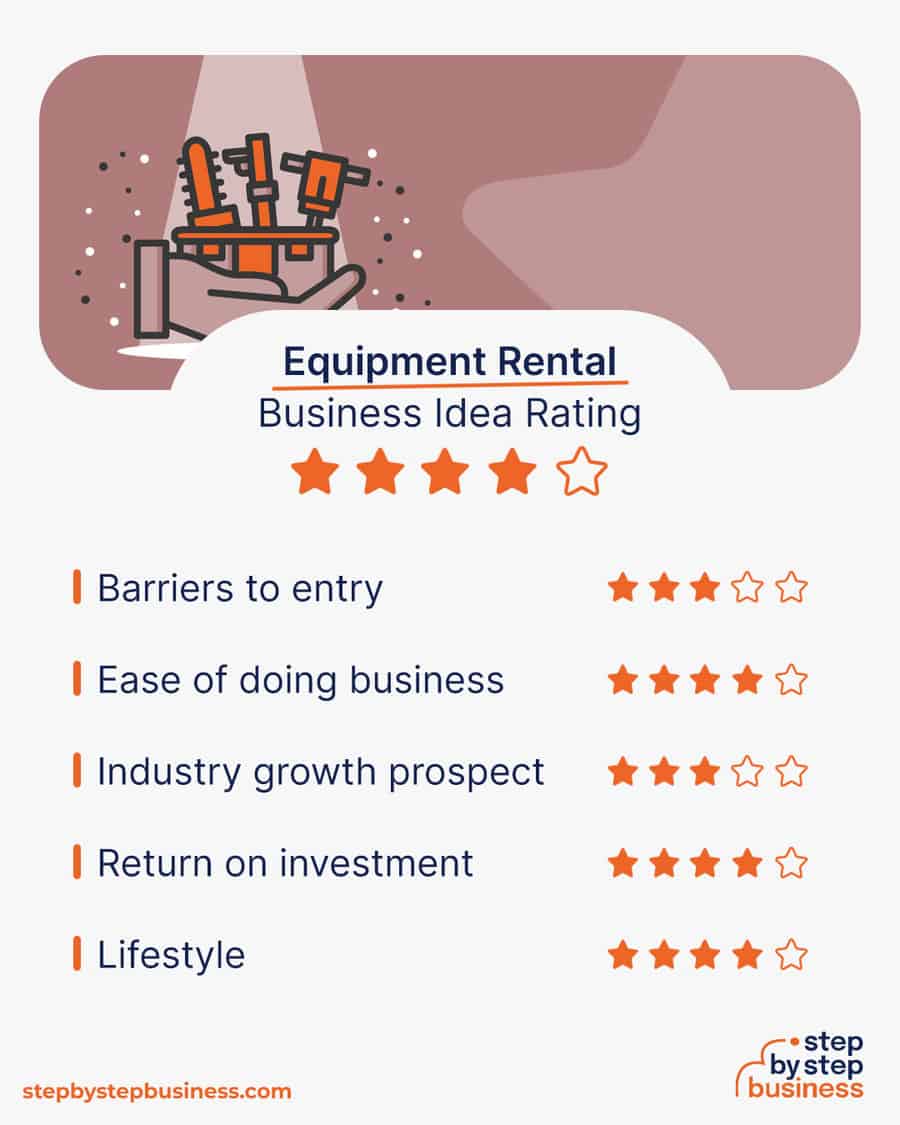

- Starting an equipment rental business involves a strategic approach, requiring steps from market research to execution, including identifying a niche, analyzing the target market, finding customers, selecting equipment, estimating costs, and creating a business plan.

- Estimated startup costs for an equipment rental business range from $27,700 to $56,000, covering expenses like market research, warehouse deposits, renovations, insurance, office equipment, and fleet maintenance.

- Profitability in the equipment rental business depends on factors like equipment type, market demand, and efficient management, with capital requirements varying based on equipment, location, and scale, and specific licenses or permits needed depending on the business location and equipment type.

Frequently Asked Questions

Is running an equipment rental business profitable.

Yes, running an equipment rental business can be profitable. The profitability largely depends on factors such as the type of equipment rented, market demand, location, and effective management. By offering in-demand equipment, maintaining high utilization rates, and managing operational costs efficiently, rental businesses can achieve significant profits.

How Much Capital is Needed to Start an Equipment Rental Business?

The capital required to start an equipment rental business varies depending on the type and quantity of equipment, location, and scale of the operation. On average, initial investments can range from $20,000 to $100,000. This includes costs for purchasing equipment, securing a location, initial marketing, and operational expenses.

Do I Need Special Licenses or Permits?

Yes, you will likely need special licenses or permits to operate an equipment rental business. The specific requirements depend on your location and the type of equipment you plan to rent. Common requirements include a general business license, safety and operation permits for certain types of equipment, and potentially special zoning permits for your rental facility. It's essential to check with local and state authorities to ensure compliance with all regulatory requirements.

Read about Dylan's Tours and how they became one of the largest operators in San Francisco

https://www.projectionhub.com/post/9-equipment-rental-industry-financial-statistics

https://www.marketresearch.com/Kentley-Insights-v4035/Commercial-Industrial-Equipment-Rental-Research-36009581/

https://sweeten.com/commercial-renovations/commercial-guide-retail-renovation-budget/

https://rentman.io/blog/equipment-rental-insurance

https://www.officeinteriors.ca/office-technology/what-does-office-equipment-cost/

https://www.business.org/finance/cost-management/much-computer-cost/

https://www.rermag.com/news-analysis/headline-news/article/20951948/fleet-management-101-fundamentals-to-maximizing-roi

Table of contents

Recommended Posts

Sign up to our newsletter..

Lorem ipsum dolor sit amet, consectetur adipiscing.

Want to learn more about Peek Pro? See it in action during our live demo

See related posts

How to Start an ATV Rental Business in 2024: Complete Guide

Top Recreational Equipment Rental KPIs and Metrics to Track

How to Start a Party Rental Business in 10 Steps

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Equipment Rental Sales Business Plan

Start your own equipment rental sales business plan

Equipment Rental

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

Equipment Rental, Inc. (ER) is a Breaux Bridge, Tennessee company that sells and rents heavy equipment such as dozers, backhoes, excavators, and trenchers as well as small home use and construction equipment such as tillers, augers, and chain saws.

ER has obtained the authorization to be a distributor for Hancor Pipe, Stone Equipment, Pro-Cut Diamond Products, Echo Lawn Care, Compact Excavators, and Skid Steer Loaders. The company is the only authorized distributor for the South-Tennessee area for Ramrod Equipment and Komatsu Forklifts.

ER has a world-class management team with direct knowledge of the industry, extensive research experience, and unique administrative skills. Its team includes Mr. David James and Mrs. Sally James. Having lived in Denton Parish for six years, and worked throughout the state, as well as parts of Texas, Mississippi, Alabama, and Georgia, President/CEO, Mr. James has compiled an extensive list of customers/potential customers, vendors, and contacts for equipment consignment.

The company plans to employ two people from the area, in positions within the shop. By employing local individuals, ER would be contributing toward the development of the area. Funds would remain in the area thereby boosting the economy and contributing to the community as a whole. Loyal customers help to expand the company’s business area by word-of-mouth and a pocketful of ER’s business cards.

A key component of the company’s strategy is to continue to add to its ever-increasing product line which currently includes homeowner equipment from Echo and Interstate Batteries, commercial, equipment from Ramrod, Compact S/I Technology, and industrial equipment from Komatsu.

The company is seeking a loan/credit line in the amount of $300,000 for the purpose of expanding the business. Expansion plans include the purchase of additional land and construction of a larger shop/service area, increase rental inventory, purchase of delivery truck, and the hiring of additional personnel including a mechanic and delivery driver. Projected revenues for Year 1 to Year 3 are $210,000, $420,000, and $840,000, respectively.

1.1 Mission

ER’s mission is to become THE exclusive full-service equipment rental, sales, and service company in upper and lower Denton Parish with the ability to service the surrounding parishes of Memphis, Knoxville, Grand Prairie, Plano, Garland, Irvine, and Riverside. Therefore the company’s strategy is to create a limited geographical niche for itself where there are no potential competitors.

ER’s vision is to continue to expand its service to other areas. The company’s coverage area is constantly increasing, as the areas are becoming aware of the company’s presence.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

ER began its operations on May 2, 1997 with little capital investment. The company combined 10 years of experience in the sales and rental field to generate a large customer base. After eight months of operations at the present facility, the company has increased its customer list by 100% and its vendor list by 75%. ER takes pride in having brought several new items to this area that were otherwise unknown, such as the spreader/grader and Ramrod products.

2.1 Company Ownership

ER was founded in Memphis, Tennessee in May 1997 to sell and rent heavy equipment, small home use machines, and construction equipment. The company was formed by Mr. David James and Mrs. Sally James. ER is a Tennessee S-Corporation, with principal offices located in Memphis, TN.

2.2 Locations and Facilities

The company has one office currently in Memphis, TN.

ER is located 1/2 mile from the Interstate (I-65) with easy access and a large turnaround area for larger vehicles used in pick up and delivery of equipment. ER is not inside any municipal jurisdiction which would restrict the type of business being conducted. The location also benefits from easy access to hotels (1/2 mile), banks (less than 1/4 mile), groceries (1/8 mile), repair shops (1/4 mile), service stations (1/8 mile), and a parts supply house (1/3 mile).

Currently, there are no environmental concerns, but the company hopes to be able to have a repair shop located on the premises at which time any environmental concerns will be seen to. ER’s current hours of operation are from 8:00 a.m. until 5:00 p.m. However, the company does receive after hours calls and provides assistance as needed. Work hours have sometimes extended from 5:00 a.m. to later than 6:00 p.m. as needed.

2.3 Past Performance

The following is the company’s past three years of performance since start-up.

| Past Performance | |||

| 1997 | 1998 | 1999 | |

| Sales | $49,000 | $57,000 | $100,000 |

| Gross Margin | $32,830 | $42,351 | $86,500 |

| Gross Margin % | 67.00% | 74.30% | 86.50% |

| Operating Expenses | $33,810 | $39,330 | $69,000 |

| Collection Period (days) | 0 | 0 | 0 |

| Inventory Turnover | 4.00 | 4.00 | 4.00 |

| Balance Sheet | |||

| 1997 | 1998 | 1999 | |

| Current Assets | |||

| Cash | $3,500 | $1,500 | $2,500 |

| Accounts Receivable | $6,000 | $7,000 | $9,000 |

| Inventory | $8,000 | $14,000 | $19,000 |

| Other Current Assets | $2,500 | $5,000 | $6,000 |

| Total Current Assets | $20,000 | $27,500 | $36,500 |

| Long-term Assets | |||

| Long-term Assets | $5,200 | $6,400 | $8,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $5,200 | $6,400 | $8,000 |

| Total Assets | $25,200 | $33,900 | $44,500 |

| Current Liabilities | |||

| Accounts Payable | $5,500 | $7,000 | $9,000 |

| Current Borrowing | $8,000 | $9,000 | $9,500 |

| Other Current Liabilities (interest free) | $4,000 | $3,400 | $3,700 |

| Total Current Liabilities | $17,500 | $19,400 | $22,200 |

| Long-term Liabilities | $10,000 | $12,000 | $10,000 |

| Total Liabilities | $27,500 | $31,400 | $32,200 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | ($2,300) | $2,500 | $12,300 |

| Earnings | $0 | $0 | $0 |

| Total Capital | ($2,300) | $2,500 | $12,300 |

| Total Capital and Liabilities | $25,200 | $33,900 | $44,500 |

| Other Inputs | |||

| Payment Days | 60 | 45 | 45 |

| Sales on Credit | $0 | $0 | $0 |

| Receivables Turnover | 0.00 | 0.00 | 0.00 |

2.4 Future Facilities

There is 1/2 – 1 acre of additional property directly to the north side and is available for the construction of a storage/equipment yard if necessary. Mr. James has worked with a steel building construction company and is able to purchase items to construct a building at cost or at a sufficient discount that it would not be necessary to use the greater portion of the loan for building needs. The estimated cost of building is expected to be between $10,000 and $13,500. ER has access to a main highway with concrete entrances to and from the property.

ER sells and rents heavy equipment such as dozers, backhoes, excavators, and trenchers, as well as small home use, and construction equipment such as tillers, augers, and chain saws. ER takes pride in having brought several new items to this area that were otherwise unknown, such as the spreader/grader and Ramrod products.

3.1 Product Summary

Interstate ER carries a range of Interstate equipment including:

- Megatron Plus – 72 month;

- Megatron – 60 month;

- Light truck and van (LTV);

- Interstate – 50 month;

- Extreme performance;

- Interstate – 50 month (imported cars);

- Special use – lawn and garden, etc.;

- Marine/RV – 12 volt;

- Commercial – Very HD 12 volt;

- Commercial – 6 volt;

- Commercial – 8 volt special duty.

Komatsu ER carries gasoline, diesel, LPG, and electric forklifts from Komatsu. The benefits of Komatsu products include:

- Low noise designs reduce operator fatigue;

- Non-asbestos brakes;

- Open mast designs for excellent visibility;

- Heavy-duty air filtration systems with high air intake for extended engine life;

- Easy access to mechanical components.

Ramrod ER carries a series of Ramrod Taskmaster products that are designed for any task. They include:

- The post hole auger (9″ and 12″) – can dig up to 60 holes in one hour;

- 32″ forks – mini fork lift;

- Leveller – for back landscaping;

- The trencher – the attachment of choice for digging trenches;

- Hay and mower fork – horse and cattle stall cleanup;

- Scattrack. ER carries a series of mini excavators and skid steer loaders with various attachments;

- Hydraulic breakers – for breaking concrete, rock, or other hard surfaces;

- Trenchers – for installing electric lines and underground cables;

- Pallet fork – for handling heavy palletized material;

- Grapples – for clean up of loose, bulky, or baled materials;

- Augers – for digging holes and wide trenches in tight areas;

- Angle blade – for grading;

- Mini excavator – for construction, landscaping, and utility applications;

- Trimmers and bushcutters and accessories;

- Tiller/Cultivator;

- Power blowers and accessories;

- Hedge clippers;

- Power pruners and accessories;

- Chain saws;

- Safety accessories.

3.1.1 Future Products

Stone ER anticipates carrying a series of Stone products including:

- WolfPac asphalt rollers;

- Rhino ride-on vibratory dirt rollers;

- Bulldog trench rollers;

- Hydroblend continuous mixers.

3.1.2 Product Support

ER is also listed on the bidder list for several states and receive bid packages by mail, fax, and email which is checked daily. The company is currently on the Atchafalaya Basin Development Committee mailing list and is working with the Henderson Area Committee.

Market Analysis Summary how to do a market analysis for your business plan.">

The company expects to participate in a variety of different industries, including commercial and residential construction and farm machinery. The following sections will describe the industries in which ER hopes to compete.

4.1 Target Market Segment Strategy

ER currently has customers in the industrial and commercial fields, petro-chemical plants, contractors, sub-contractors, oil fields, and municipalities, with expansion potential in other areas. The Market Analysis table below gives the total potential number of businesses that could rent or buy our equipment in the local area.

| Market Analysis | |||||||

| 2000 | 2001 | 2002 | 2003 | 2004 | |||

| Potential Customers | Growth | CAGR | |||||

| Petro-chemical clients | 1% | 5 | 5 | 5 | 5 | 5 | 0.00% |

| Contractors and subcontractors | 10% | 160 | 176 | 194 | 213 | 234 | 9.97% |

| Municipalities | 1% | 8 | 8 | 8 | 8 | 8 | 0.00% |

| Farmers | 3% | 127 | 131 | 135 | 139 | 143 | 3.01% |

| Industrial clients | 4% | 86 | 89 | 93 | 97 | 101 | 4.10% |

| Other | 2% | 40 | 41 | 42 | 43 | 44 | 2.41% |

| Total | 5.86% | 426 | 450 | 477 | 505 | 535 | 5.86% |

4.2 Market Growth

Most of ER’s client industries such as the petro-chemical and farm industries have flat or very slow growth because these are mature or declining industries. However, often times there are other factors that make them attractive in the long run. The farming industry is heavily subsidized by the government and many of the farms in the local area are small plots with less than 100 acres. This means that most are poorly capitalized and seasonally require heavy equipment for planting and harvesting. This makes for an excellent cash-cow type client.

The one industry that can be counted on to grow significantly for the short-term is the contractor/commercial construction industry. The housing boom of the past five years has produced annual growth rates ranging from 5-10%. In evaluating our total market we plan to concentrate on this industry as our primary target market.

4.3 Marketing

The overall marketing plan for ER’s products and services is based on the following fundamentals:

- The segment of the market(s) planned to reach.

- Distribution channels planned to be used to reach market segments: television, radio, sales associates, and mailings.

- Share of the market expected to capture over a fixed period of time.

Market Responsibilities ER is committed to an extensive promotional campaign. This will be done aggressively and on a broad scale. To accomplish initial sales goals, the company will require an extremely effective promotional campaign to accomplish two primary objectives:

- Attract quality sales/service personnel that have a desire to be successful.

- Attract customers that will constantly look to ER for their projects.

In addition, ER plans to advertise in magazines, newspapers, television, radio, and on billboards throughout the state.

Promotion In addition to standard advertisement practices, ER will gain considerable recognition through these additional promotional mediums:

- Press releases sent to major radio stations, newspapers, and magazines.

- Radio advertising on secondary stations.

- Incentives. As an extra incentive for customers and potential customers to ER’s name, the company plans to distribute coffee mugs, T-shirts, pens, and other advertising specialties with the company logo. This will be an ongoing program for the company, when appropriate and where it is identified as beneficial.

- Brochures. The objective of brochures is to portray ERs’ goals and products as an attractive functionality. It is also to show customers how to use the latest in technology as it relates to construction and building services. ER will develop three brochures: one to be used to promote sales, one to use to announce the product in a new market, and the other to recruit sales associates.

Investment in Advertising and Promotion For the first year of operation, advertising, and promotion is budgeted at a combined total of $14,000. A fixed amount of sales revenues will go toward the state ER advertisement campaign. On an ongoing basis, ER feels that it can budget advertising expenses at less than 10% of revenues to ER.

4.3.1 Pricing

Currently, ER maintains a commercial credit department for business customers with a 1% net 30-day limit. This loan will enable the company to establish its lending ability but will be structured so as not to hamper its ability to assist other customers (due on receipt with approved credit references). Most of ER’s customers choose to deal with their own financial sources, however ER does have several financial sources to choose from, thereby giving them references should it become necessary to do so.

The company offers competitive prices, which are subject to review when necessary. ER has done sufficient work in this area to know that it can place a markup on merchandise and still retain sufficient funds to be competitive. Knowledge of market and competitor prices gives ER the advantage of pricing in-line with competitors. ER suppliers have and will continue to supply products that enable the company to meet the customers price range.

Most companies have a 15-20% markup on their merchandise. Having worked for most of the larger companies in the area, Mr. James has an advantage of knowing which companies are firm with the prices and how much others will decrease their prices. Several companies do not have a working list of rental prices and change with the market thereby causing a delay of several hours or even days to allow for a check of existing rental rates.

At ER, pricing is derived from an American Rental Association (ARA) formula used to price sales and rental items in relation to cost and resale/use value.

4.3.2 Marketing Communications

The company’s promotional plan is diverse and includes a range of marketing communications:

- Trade shows. Company representatives will attend and participate in several trade shows, such as Lagcoe.

- Print advertising. The company’s print advertising program includes advertisements in the Denton Parish newspaper, church bulletin, Denton Economics 101 directory, and restaurant menus in Memphis and Denton Parish.

- Festivals. The company plans to take part in various local shows.

- Additional methods include:

- Yard signs – changed on a two week rotating schedule.

- Magnetic signs – for trucks.

- Business cards.

- Sponsoring baseball and soccer teams.

4.4 Industry Analysis

Industry Description (information provided by imarketinc.com)

Market size statistics – Industrial trucks and tractors Establishments primarily engaged in manufacturing industrial trucks, tractors, trailers, stackers (truck type), and related equipment used for handling materials on floors and paved surfaces in and around industrial and commercial plants, depots, docks, airports, and terminals.

| Estimated number of U.S. establishments | 1,004 |

| Total people employed in this industry | 37,854 |

| Total annual sales in this industry | $13,004 million |

| Average employees per establishment | 38 |

| Average sales per establishment | $16 million |

Market size statistics – Farm machinery and equipment Establishments primarily engaged in manufacturing farm machinery and equipment including soil preparation machinery, for use in the preparation and maintenance of the soil, planting and harvesting of the crop, preparing crops for market on the farm, or for use in performing other farm operations and processes.

| Estimated number of U.S. establishments | 2,594 |

| Total people employed in this industry | 79,978 |

| Total annual sales in this industry | $30,474 million |

| Average employees per establishment | 31 |

| Average sales per establishment | $13.3 million |

Market size statistics – Construction machinery Establishments primarily engaged in manufacturing heavy machinery and equipment, such as bulldozers, concrete mixers, cranes.

| Estimated number of U.S. establishments | 2,266 |

| Total people employed in this industry | 125,081 |

| Total annual sales in this industry | $58,196 million |

| Average employees per establishment | 57 |

| Average sales per establishment | $34.3 million |

4.4.1 Market Statistics

The market in ER’s area is very large with new construction being at an all-time high. ER is in need of inventory to be able to supply the local area and neighboring communities. The company has been able to sub-rent some equipment but would like to obtain certain items to put into its fleet thereby increasing profit margins. ER plans on offering a substantial line of equipment for rental and sales to meet customer needs as well as service for the equipment and those owned by others in the area.

The housing industry has proceeded at a red-hot pace for several years running. An all-time record was set in 1998, when 886,000 new-site single family homes were sold. That represented a 10% gain from the robust total of 804,000 homes sold in 1997, and an 8.1% rise from the prior record of 819,000 units in 1977. Single-family housing construction accounted for $47,539 million of the total $124,953 million generated in the industry.

Home sales were strengthened even further during most of 1999’s first 10 months. In that period, new single-family home sales increased by 4.8% on a year-to-year basis, to 791,000 units, according to the U.S. Department of Commerce. Through October 1999, seasonally adjusted sales had exceeded 800,000 on an annualized basis in every month since the start of 1998.

The record setting string of home sales since the second half of 1997 has forced builders to pick up the pace of their construction activity. During 1998, total starts increased by 9.7% to 1.62 million units. Starts for single family units moved up 12% for the year, and those of multi-family units were ahead by 1.5%. As an indication of building activity at year-end 1999, housing starts in November 1999 came in at a seasonally adjusted annual rate of 1.6 million units.

Market size statistics – Single-family housing construction General contractors primarily engaged in construction of single-family houses.

| Estimated number of U.S. establishments | 218,276 |

| Average people employed in this industry | 831,158 |

| Total annual sales in this industry | $124,953 million |

| Average employees per establishment | 4 |

| Average sales per establishment | $.6 million |

Market size statistics – Residential construction, nec General contractors primarily engaged in construction (including new work additions, alterations, remodeling, and repair) of residential buildings other than single-family houses. This includes hotels, motels, apartments, and multi-family homes.

| Estimated number of U.S. establishments | 25,201 |

| Total people employed in this industry | 114,523 |

| Total annual sales in this industry | $25,545 million |

| Average employees per establishment | 5 |

| Average sales per establishment | $1.1 million |

Market size statistics – Heavy construction, nec General and special trade contractors primarily engaged in the construction of heavy projects not elsewhere classified. This includes canal, drainage system, athletic and recreation facilities, land preparation, rock removal, waste water and sewage treatment plant, and trenching construction.

| Estimated number of U.S. establishments | 16,914 |

| Total people employed in this industry | 211,440 |

| Total annual sales in this industry | $50,637 million |

| Average employees per establishment | 13 |

| Average sales per establishment | $3.2 million |

Market size statistics – Bridge, tunnel, and elevated highway construction General contractors primarily engaged in the construction of bridges, viaducts, elevated highways, and pedestrian and railway tunnels.

| Estimated number of U.S. establishments | 1,414 |

| Total people employed in this industry | 43,889 |

| Total annual sales in this industry | $14,047 million |

| Average employees per establishment | 34 |

| Average sales per establishment | $12.9 million |

Market size statistics – Highway and street construction General and special trade contractors primarily engaged in the construction of roads, streets, alleys, public sidewalks, guardrails, parkways, and airports.

| Estimated number of U.S. establishments | 19,694 |

| Total people employed in this industry | 302,944 |

| Total annual sales in this industry | $66,045 million |

| Average employees per establishment | 16 |

| Average sales per establishment | $13.3 million |

Market size statistics – Nonresidential construction, nec General contractors primarily engaged in the construction (including new work additions, alterations, remodeling, and repair) of nonresidential buildings other than industrial buildings and warehouses. This includes commercial, institutional, religious, and amusement and recreational buildings.

| Estimated number of U.S. establishments | 44,505 |

| Total people employed in this industry | 540,550 |

| Total annual sales in this industry | $205,214 million |

| Average employees per establishment | 12 |

| Average sales per establishment | $4.9 million |

4.4.2 Competition and Buying Patterns

ER’s closest competitors are located in Memphis Parish. They include the following five companies:

- CBC Equipment;

- Northern Equipment;

- Jones Rental Service;

- Rental Service Center;

- Memphis Rental.

Being located in or near Memphis, they charge a drop off and/or pick up fee. ER can, in most cases, wave this fee which will allow the customer more funds to purchase/rent additional equipment.

Strategy and Implementation Summary

The company plans to rapidly develop marketing alliances with industry leaders and pursue new sales of homeowner, commercial, and industrial equipment. The market strategy is to capitalize on ER’s ever-increasing customer base and contacts by offering the latest products and personalized service.

The company’s goal in the next year is to obtain financing which will allow for expanding the shop/service area with up-to-date servicing equipment, hiring additional employees, and obtaining a delivery truck as well as rental and sales inventory for all aspects of the company’s customer base.

The company’s goal in the next two to five years is to hire additional employees, concentrate on customer service, and promote the company and the environment that has allowed for this increase in service by way of discounts and promotional specials that will benefit the company and the customer.

5.1 Competitive Edge

- Obtain financing. The company is currently working to obtain financing that will enable it to carry out its operations.

- Expansion. ER is currently in need of property for expansion and display, rental and sale, and to increase its product line. Storage is a constant problem without a building and additional land to met ER’s current needs.

- Purchase additional equipment. Most previous equipment purchases have been for resale/consignment, and the markup has not allowed for a great increase in supplies.

- Hire more employees. The company plans to employ two people from the area, in positions within the shop. They will be responsible for maintenance, repair, and delivery. This will enable Mr. and Mrs. James to focus on the core of the business.

- Increase advertising. The company is currently working to expand its advertising campaigns. The company has designed a tri-fold brochure that will make people in the area aware of its product offering and how it can meet their needs.

- Establish more alliances. ER has contacts with several companies with floor plans, which will enable the company to stock several of their items for resale. The company plans to purchase some of their products, leaving them to furnish the display equipment.

5.2 Marketing Strategy

The company has strategic alliances with the ARA. This alliance is valuable to ER because the company gets to air television ads, and they are valuable to the ally firms because they are promoting a local company and this helps in community development. ER plans to also form strategic alliances with Internet sites, area publications, and other equipment dealers.

Sales Forecast forecast sales .">

The following table and charts show the Projected Sales Forecast for Equipment Rental.

| Sales Forecast | |||

| 2000 | 2001 | 2002 | |

| Sales | |||

| Sales and Rentals | $210,000 | $420,000 | $840,000 |

| Other | $0 | $0 | $0 |

| Total Sales | $210,000 | $420,000 | $840,000 |

| Direct Cost of Sales | 2000 | 2001 | 2002 |

| Sales and Rentals | $31,500 | $60,000 | $150,000 |

| Other | $3,000 | $6,000 | $12,000 |

| Subtotal Direct Cost of Sales | $34,500 | $66,000 | $162,000 |

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

7.1 personnel plan.

ER’s management is highly experienced and qualified. Its key management team includes Mr. David James and Mrs. Sally James.

Jointly, they are responsible for processing quotes, arranging financing, as needed, scheduling invoices for pickup and delivery, and contract sales/rentals.

Descriptions of the management team and responsibilities are as follows.

Mr. David James. Mr. James has 10 years of marketing experience, 15 years rental/sales experience, and 15 years mechanical experience.

Mr. James makes all decisions concerning equipment purchases, as this is his area of expertise. Mr. James is in charge of obtaining all equipment for sales and rentals, completing contracts, working up quotes, setting up delivery of merchandise, arranging financing as needed, contacting customers, and verifying pickup and delivery.

Mrs. Sally L. James. Mrs. James has 10 years secretarial experience and 12 years accounts payable and receivable experience.

Mrs. James answers the phone, faxes, does all the computer work, files any monthly or quarterly tax forms, compiles correspondence as needed, accounts receivable, accounts payable, meets with a bookkeeper for end of year tax return, keeps all office needs running smoothly, filing, typing, copies, and is majority stock holder in the company (45%).

Future plans call for the hiring of a mechanic and shopman with hopes of adding a truck and delivery driver shortly there after from the area, with additional office/shop personnel to be added as needed.

On occasion part-time personnel will be used and job training provided through the area schools for those interested in this area of the job market.

| Personnel Plan | |||

| 2000 | 2001 | 2002 | |

| Sales/Rental Associate | $19,200 | $19,200 | $19,200 |

| Sales/Rental Associate | $19,200 | $19,200 | $19,200 |

| Sales/Rental Associate | $19,200 | $19,200 | $19,200 |

| Maintenance/Technician | $0 | $5,010 | $9,500 |

| Maintenance Technician | $0 | $0 | $6,000 |

| Total People | 5 | 6 | 7 |

| Total Payroll | $57,600 | $62,610 | $73,100 |

Financial Plan investor-ready personnel plan .">

ER was capitalized with $5,000 when it was formed in May 1997. A strong knowledge of the area and supply and demand needs led to the formation of the company. Most items purchased to this date (truck, trailer, computer, office supplies, envelopes, and stationery) have been financed through personal funds, and a $4,000 line of credit with Hibernia Bank.

ER’s first sales placed $5,145 into the business account, most of which was used to pay off initial purchases with the balance being used for office and truck expenses such as telephone bill, postage, and fuel. As of April 1, 2000, the truck has been paid in full along with several of the smaller home use items. The company has generated sales in the amount of $52,490 with cost being $38,870 and a profit of $13,620 (97-98 Income Tax Return).

Funding Requirements and Uses The company is seeking a loan/credit line in the amount of $300,000 for the purpose of expanding the business. Expansion plans include the purchase of additional land and construction of a larger shop/service area, increase rental inventory, and hiring of additional personnel including a mechanic and delivery driver. The table below provides a breakdown of the use of funds.

Use of Funds

| Purchase land 25′ X 175′ on the north side of existing building | $7,000 |

| Erect shop area 25′ X 32′ on land w/concrete slab, office area | $10,000 |

| Shop equipment | $14,000 |

| Rental inventory | $60,000 |

| Consolidate regions loan, Hibernia L. O. C., current equipment purchases Bosch electric breaker, 3.0 KW generator, shop items | $50,000 |

| Advertising | $7,000 |

| Balance for working capital, employee training, office equipment modernization, maintenance inventory (i.e.: oil, air, and hydraulic filters), unforeseen building/maintenance expense | $152,000 |

Shop equipment to include: air compressor, air tools and accessories, blow torch, welding machine and accessories, 1 1/2 ton chain hoist, oil/water separator, holding tank, assorted hand tools, washing vat, chain saw sharpener and repair accessories.

Rental inventory to include: Trash and diaphragm pumps 2 ea. 2″ and 3″, 3/4″ submersible pump and accessories, 3 hp. concrete vibrator, 2-48″ concrete power trowels, Case 580L or JD 310 Backhoe, small trailer and larger trailer, 1-ton Ford F350 or F450 Diesel delivery truck, air compressor, 90 lb. air hammer and accessories, rotovator for tractor, 1 push mower, 1 lawn tractor.

8.1 General Assumptions

The following table lists the general assumptions.

| General Assumptions | |||

| 2000 | 2001 | 2002 | |

| Plan Month | 1 | 2 | 3 |

| Current Interest Rate | 10.00% | 10.00% | 10.00% |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% |

| Tax Rate | 30.00% | 30.00% | 30.00% |

| Other | 0 | 0 | 0 |

8.2 Key Financial Indicators

The following chart shows the important benchmarks for Equipment Rental.

8.3 Break-even Analysis

The table and chart below contain the Break-even Analysis for Equipment Rental.

| Break-even Analysis | |

| Monthly Revenue Break-even | $13,981 |

| Assumptions: | |

| Average Percent Variable Cost | 16% |

| Estimated Monthly Fixed Cost | $11,684 |

8.4 Projected Profit and Loss

The Projected Profit and Loss can be seen in the following table and charts.

| Pro Forma Profit and Loss | |||

| 2000 | 2001 | 2002 | |

| Sales | $210,000 | $420,000 | $840,000 |

| Direct Cost of Sales | $34,500 | $66,000 | $162,000 |

| Other Production Expenses | $3,000 | $42,000 | $126,000 |

| Total Cost of Sales | $37,500 | $108,000 | $288,000 |

| Gross Margin | $172,500 | $312,000 | $552,000 |

| Gross Margin % | 82.14% | 74.29% | 65.71% |

| Expenses | |||

| Payroll | $57,600 | $62,610 | $73,100 |

| Sales and Marketing and Other Expenses | $14,000 | $31,000 | $82,598 |

| Depreciation | $0 | $0 | $0 |

| Supplies and equipment | $9,924 | $19,851 | $39,702 |

| Utilities | $1,602 | $2,403 | $3,604 |

| Telephone | $7,812 | $7,810 | $7,810 |

| Insurance | $14,448 | $21,688 | $32,533 |

| Repairs and Maintenance | $10,932 | $20,397 | $30,596 |

| Services | $2,832 | $2,833 | $2,833 |

| Rent | $12,420 | $12,420 | $12,420 |

| Payroll Taxes | $8,640 | $9,392 | $10,965 |

| Other | $0 | $0 | $0 |

| Total Operating Expenses | $140,210 | $190,404 | $296,161 |

| Profit Before Interest and Taxes | $32,290 | $121,597 | $255,839 |

| EBITDA | $32,290 | $121,597 | $255,839 |

| Interest Expense | $29,938 | $23,065 | $18,365 |

| Taxes Incurred | $706 | $29,559 | $71,242 |

| Net Profit | $1,646 | $68,972 | $166,232 |

| Net Profit/Sales | 0.78% | 16.42% | 19.79% |

8.5 Cash Flow

The following table and chart are the Projected Cash Flow figures for Equipment Rental.

| Pro Forma Cash Flow | |||

| 2000 | 2001 | 2002 | |

| Cash Received | |||

| Cash from Operations | |||

| Cash Sales | $42,000 | $84,000 | $168,000 |

| Cash from Receivables | $157,400 | $316,400 | $632,800 |

| Subtotal Cash from Operations | $199,400 | $400,400 | $800,800 |

| Additional Cash Received | |||

| Sales Tax, VAT, HST/GST Received | $0 | $0 | $0 |

| New Current Borrowing | $149,000 | $20,000 | $20,000 |

| New Other Liabilities (interest-free) | $0 | $0 | $0 |

| New Long-term Liabilities | $151,000 | $0 | $0 |

| Sales of Other Current Assets | $0 | $0 | $0 |

| Sales of Long-term Assets | $0 | $0 | $0 |

| New Investment Received | $0 | $0 | $0 |

| Subtotal Cash Received | $499,400 | $420,400 | $820,800 |

| Expenditures | 2000 | 2001 | 2002 |

| Expenditures from Operations | |||

| Cash Spending | $57,600 | $62,610 | $73,100 |

| Bill Payments | $134,408 | $274,735 | $580,262 |

| Subtotal Spent on Operations | $192,008 | $337,345 | $653,362 |

| Additional Cash Spent | |||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 |

| Principal Repayment of Current Borrowing | $45,248 | $30,000 | $60,000 |

| Other Liabilities Principal Repayment | $0 | $0 | $0 |

| Long-term Liabilities Principal Repayment | $29,100 | $19,000 | $25,000 |

| Purchase Other Current Assets | $58,000 | $2,000 | $22,000 |

| Purchase Long-term Assets | $91,000 | $4,000 | $9,000 |

| Dividends | $65,000 | $10,000 | $20,000 |

| Subtotal Cash Spent | $480,356 | $402,345 | $789,362 |

| Net Cash Flow | $19,044 | $18,055 | $31,438 |

| Cash Balance | $21,544 | $39,600 | $71,038 |

8.6 Projected Balance Sheet

ER’s projected balance sheets for 2000-2002.

| Pro Forma Balance Sheet | |||

| 2000 | 2001 | 2002 | |

| Assets | |||

| Current Assets | |||

| Cash | $21,544 | $39,600 | $71,038 |

| Accounts Receivable | $19,600 | $39,200 | $78,400 |

| Inventory | $2,000 | $3,826 | $9,391 |

| Other Current Assets | $64,000 | $66,000 | $88,000 |

| Total Current Assets | $107,144 | $148,626 | $246,829 |

| Long-term Assets | |||

| Long-term Assets | $99,000 | $103,000 | $112,000 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Long-term Assets | $99,000 | $103,000 | $112,000 |

| Total Assets | $206,144 | $251,626 | $358,829 |

| Liabilities and Capital | 2000 | 2001 | 2002 |

| Current Liabilities | |||

| Accounts Payable | $8,346 | $23,856 | $49,827 |

| Current Borrowing | $113,252 | $103,252 | $63,252 |

| Other Current Liabilities | $3,700 | $3,700 | $3,700 |

| Subtotal Current Liabilities | $125,298 | $130,808 | $116,779 |

| Long-term Liabilities | $131,900 | $112,900 | $87,900 |

| Total Liabilities | $257,198 | $243,708 | $204,679 |

| Paid-in Capital | $0 | $0 | $0 |

| Retained Earnings | ($52,700) | ($61,054) | ($12,082) |

| Earnings | $1,646 | $68,972 | $166,232 |

| Total Capital | ($51,054) | $7,918 | $154,150 |

| Total Liabilities and Capital | $206,144 | $251,626 | $358,829 |

| Net Worth | ($51,054) | $7,918 | $154,150 |

8.7 Business Ratios

Business ratios for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 7359, [Equipment Rental and Leasing, nec], are shown for comparison.

| Ratio Analysis | ||||

| 2000 | 2001 | 2002 | Industry Profile | |

| Sales Growth | 110.00% | 100.00% | 100.00% | 7.07% |

| Percent of Total Assets | ||||

| Accounts Receivable | 9.51% | 15.58% | 21.85% | 27.61% |

| Inventory | 0.97% | 1.52% | 2.62% | 3.96% |

| Other Current Assets | 31.05% | 26.23% | 24.52% | 44.65% |

| Total Current Assets | 51.98% | 59.07% | 68.79% | 76.22% |

| Long-term Assets | 48.02% | 40.93% | 31.21% | 23.78% |

| Total Assets | 100.00% | 100.00% | 100.00% | 100.00% |

| Current Liabilities | 60.78% | 51.98% | 32.54% | 33.47% |

| Long-term Liabilities | 63.98% | 44.87% | 24.50% | 16.23% |

| Total Liabilities | 124.77% | 96.85% | 57.04% | 49.70% |

| Net Worth | -24.77% | 3.15% | 42.96% | 50.30% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 82.14% | 74.29% | 65.71% | 100.00% |

| Selling, General & Administrative Expenses | 81.36% | 57.86% | 45.92% | 84.88% |

| Advertising Expenses | 3.33% | 5.71% | 6.90% | 1.01% |

| Profit Before Interest and Taxes | 15.38% | 28.95% | 30.46% | 1.94% |

| Main Ratios | ||||

| Current | 0.86 | 1.14 | 2.11 | 1.73 |

| Quick | 0.84 | 1.11 | 2.03 | 1.33 |

| Total Debt to Total Assets | 124.77% | 96.85% | 57.04% | 57.72% |

| Pre-tax Return on Net Worth | -4.61% | 1244.37% | 154.05% | 3.77% |

| Pre-tax Return on Assets | 1.14% | 39.16% | 66.18% | 8.92% |

| Additional Ratios | 2000 | 2001 | 2002 | |

| Net Profit Margin | 0.78% | 16.42% | 19.79% | n.a |

| Return on Equity | 0.00% | 871.06% | 107.84% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 8.57 | 8.57 | 8.57 | n.a |

| Collection Days | 59 | 32 | 32 | n.a |

| Inventory Turnover | 4.44 | 22.66 | 24.51 | n.a |

| Accounts Payable Turnover | 16.03 | 12.17 | 12.17 | n.a |

| Payment Days | 29 | 20 | 22 | n.a |

| Total Asset Turnover | 1.02 | 1.67 | 2.34 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.00 | 30.78 | 1.33 | n.a |

| Current Liab. to Liab. | 0.49 | 0.54 | 0.57 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | ($18,154) | $17,818 | $130,050 | n.a |

| Interest Coverage | 1.08 | 5.27 | 13.93 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.98 | 0.60 | 0.43 | n.a |

| Current Debt/Total Assets | 61% | 52% | 33% | n.a |

| Acid Test | 0.68 | 0.81 | 1.36 | n.a |

| Sales/Net Worth | 0.00 | 53.04 | 5.45 | n.a |

| Dividend Payout | 39.49 | 0.14 | 0.12 | n.a |

| Sales Forecast | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | |||||||||||||

| Sales and Rentals | 0% | $10,000 | $10,000 | $11,200 | $14,400 | $17,500 | $20,400 | $28,000 | $29,000 | $26,000 | $18,500 | $15,000 | $10,000 |

| Other | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Sales | $10,000 | $10,000 | $11,200 | $14,400 | $17,500 | $20,400 | $28,000 | $29,000 | $26,000 | $18,500 | $15,000 | $10,000 | |

| Direct Cost of Sales | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Sales and Rentals | $1,500 | $1,500 | $1,680 | $2,160 | $2,625 | $3,060 | $4,200 | $4,350 | $3,900 | $2,775 | $2,250 | $1,500 | |

| Other | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | $250 | |

| Subtotal Direct Cost of Sales | $1,750 | $1,750 | $1,930 | $2,410 | $2,875 | $3,310 | $4,450 | $4,600 | $4,150 | $3,025 | $2,500 | $1,750 | |

| Personnel Plan | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales/Rental Associate | 0% | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 |

| Sales/Rental Associate | 0% | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 |

| Sales/Rental Associate | 0% | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 | $1,600 |

| Maintenance/Technician | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Maintenance Technician | 0% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total People | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | 5 | |

| Total Payroll | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | |

| Pro Forma Profit and Loss | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Sales | $10,000 | $10,000 | $11,200 | $14,400 | $17,500 | $20,400 | $28,000 | $29,000 | $26,000 | $18,500 | $15,000 | $10,000 | |

| Direct Cost of Sales | $1,750 | $1,750 | $1,930 | $2,410 | $2,875 | $3,310 | $4,450 | $4,600 | $4,150 | $3,025 | $2,500 | $1,750 | |

| Other Production Expenses | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $1,000 | $750 | $500 | $750 | |

| Total Cost of Sales | $1,750 | $1,750 | $1,930 | $2,410 | $2,875 | $3,310 | $4,450 | $4,600 | $5,150 | $3,775 | $3,000 | $2,500 | |

| Gross Margin | $8,250 | $8,250 | $9,270 | $11,990 | $14,625 | $17,090 | $23,550 | $24,400 | $20,850 | $14,725 | $12,000 | $7,500 | |

| Gross Margin % | 82.50% | 82.50% | 82.77% | 83.26% | 83.57% | 83.77% | 84.11% | 84.14% | 80.19% | 79.59% | 80.00% | 75.00% | |

| Expenses | |||||||||||||

| Payroll | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | |

| Sales and Marketing and Other Expenses | $917 | $917 | $917 | $2,417 | $2,417 | $917 | $917 | $917 | $917 | $917 | $917 | $917 | |

| Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Supplies and equipment | $827 | $827 | $827 | $827 | $827 | $827 | $827 | $827 | $827 | $827 | $827 | $827 | |

| Utilities | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | $134 | |

| Telephone | $651 | $651 | $651 | $651 | $651 | $651 | $651 | $651 | $651 | $651 | $651 | $651 | |

| Insurance | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | $1,204 | |

| Repairs and Maintenance | $911 | $911 | $911 | $911 | $911 | $911 | $911 | $911 | $911 | $911 | $911 | $911 | |

| Services | $236 | $236 | $236 | $236 | $236 | $236 | $236 | $236 | $236 | $236 | $236 | $236 | |

| Rent | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | $1,035 | |

| Payroll Taxes | 15% | $720 | $720 | $720 | $720 | $720 | $720 | $720 | $720 | $720 | $720 | $720 | $720 |

| Other | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Total Operating Expenses | $11,434 | $11,434 | $11,434 | $12,934 | $12,934 | $11,434 | $11,434 | $11,434 | $11,434 | $11,434 | $11,434 | $11,434 | |

| Profit Before Interest and Taxes | ($3,184) | ($3,184) | ($2,164) | ($944) | $1,691 | $5,656 | $12,116 | $12,966 | $9,416 | $3,291 | $566 | ($3,934) | |

| EBITDA | ($3,184) | ($3,184) | ($2,164) | ($944) | $1,691 | $5,656 | $12,116 | $12,966 | $9,416 | $3,291 | $566 | ($3,934) | |

| Interest Expense | $2,663 | $2,663 | $2,663 | $2,643 | $2,623 | $2,604 | $2,584 | $2,565 | $2,442 | $2,296 | $2,151 | $2,043 | |

| Taxes Incurred | ($1,754) | ($1,754) | ($1,448) | ($1,076) | ($280) | $916 | $2,860 | $3,120 | $2,092 | $298 | ($476) | ($1,793) | |

| Net Profit | ($4,093) | ($4,093) | ($3,379) | ($2,511) | ($653) | $2,136 | $6,672 | $7,281 | $4,882 | $696 | ($1,110) | ($4,184) | |

| Net Profit/Sales | -40.93% | -40.93% | -30.17% | -17.44% | -3.73% | 10.47% | 23.83% | 25.11% | 18.78% | 3.76% | -7.40% | -41.84% | |

| Pro Forma Cash Flow | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Cash Received | |||||||||||||

| Cash from Operations | |||||||||||||

| Cash Sales | $2,000 | $2,000 | $2,240 | $2,880 | $3,500 | $4,080 | $5,600 | $5,800 | $5,200 | $3,700 | $3,000 | $2,000 | |

| Cash from Receivables | $4,500 | $4,767 | $8,000 | $8,032 | $9,045 | $11,603 | $14,077 | $16,523 | $22,427 | $23,120 | $20,600 | $14,707 | |

| Subtotal Cash from Operations | $6,500 | $6,767 | $10,240 | $10,912 | $12,545 | $15,683 | $19,677 | $22,323 | $27,627 | $26,820 | $23,600 | $16,707 | |

| Additional Cash Received | |||||||||||||

| Sales Tax, VAT, HST/GST Received | 0.00% | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| New Current Borrowing | $149,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Other Liabilities (interest-free) | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Long-term Liabilities | $151,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Other Current Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Sales of Long-term Assets | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| New Investment Received | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Subtotal Cash Received | $306,500 | $6,767 | $10,240 | $10,912 | $12,545 | $15,683 | $19,677 | $22,323 | $27,627 | $26,820 | $23,600 | $16,707 | |

| Expenditures | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Expenditures from Operations | |||||||||||||

| Cash Spending | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | $4,800 | |

| Bill Payments | $9,251 | $7,543 | $7,553 | $7,910 | $9,727 | $10,467 | $10,363 | $16,469 | $17,042 | $15,688 | $11,732 | $10,662 | |

| Subtotal Spent on Operations | $14,051 | $12,343 | $12,353 | $12,710 | $14,527 | $15,267 | $15,163 | $21,269 | $21,842 | $20,488 | $16,532 | $15,462 | |

| Additional Cash Spent | |||||||||||||

| Sales Tax, VAT, HST/GST Paid Out | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Principal Repayment of Current Borrowing | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $12,416 | $12,416 | $12,416 | $8,000 | |

| Other Liabilities Principal Repayment | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Long-term Liabilities Principal Repayment | $0 | $0 | $0 | $2,350 | $2,350 | $2,350 | $2,350 | $2,350 | $2,350 | $5,000 | $5,000 | $5,000 | |

| Purchase Other Current Assets | $10,000 | $12,000 | $25,000 | $4,000 | $7,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Purchase Long-term Assets | $0 | $30,000 | $27,000 | $34,000 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | |

| Dividends | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | $5,417 | |

| Subtotal Cash Spent | $29,468 | $59,759 | $69,770 | $58,477 | $29,294 | $23,034 | $22,930 | $29,036 | $42,025 | $43,320 | $39,365 | $33,879 | |

| Net Cash Flow | $277,032 | ($52,993) | ($59,530) | ($47,565) | ($16,748) | ($7,351) | ($3,253) | ($6,713) | ($14,398) | ($16,500) | ($15,765) | ($17,172) | |

| Cash Balance | $279,532 | $226,539 | $167,010 | $119,445 | $102,697 | $95,346 | $92,093 | $85,380 | $70,982 | $54,481 | $38,717 | $21,544 | |

| General Assumptions | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Plan Month | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | |

| Current Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Long-term Interest Rate | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | 10.00% | |

| Tax Rate | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | 30.00% | |

| Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Pro Forma Balance Sheet | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | ||

| Assets | Starting Balances | ||||||||||||

| Current Assets | |||||||||||||

| Cash | $2,500 | $279,532 | $226,539 | $167,010 | $119,445 | $102,697 | $95,346 | $92,093 | $85,380 | $70,982 | $54,481 | $38,717 | $21,544 |

| Accounts Receivable | $9,000 | $12,500 | $15,733 | $16,693 | $20,181 | $25,136 | $29,853 | $38,176 | $44,853 | $43,227 | $34,907 | $26,307 | $19,600 |

| Inventory | $19,000 | $17,250 | $15,500 | $13,570 | $11,160 | $8,285 | $4,975 | $4,895 | $5,060 | $4,565 | $3,328 | $2,750 | $2,000 |

| Other Current Assets | $6,000 | $16,000 | $28,000 | $53,000 | $57,000 | $64,000 | $64,000 | $64,000 | $64,000 | $64,000 | $64,000 | $64,000 | $64,000 |

| Total Current Assets | $36,500 | $325,282 | $285,773 | $250,273 | $207,786 | $200,118 | $194,174 | $199,164 | $199,293 | $182,773 | $156,716 | $131,773 | $107,144 |

| Long-term Assets | |||||||||||||

| Long-term Assets | $8,000 | $8,000 | $38,000 | $65,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 |

| Accumulated Depreciation | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Total Long-term Assets | $8,000 | $8,000 | $38,000 | $65,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 | $99,000 |

| Total Assets | $44,500 | $333,282 | $323,773 | $315,273 | $306,786 | $299,118 | $293,174 | $298,164 | $298,293 | $281,773 | $255,716 | $230,773 | $206,144 |

| Liabilities and Capital | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |

| Current Liabilities | |||||||||||||

| Accounts Payable | $9,000 | $7,291 | $7,291 | $7,587 | $9,378 | $10,128 | $9,815 | $15,900 | $16,515 | $15,296 | $11,374 | $10,375 | $8,346 |

| Current Borrowing | $9,500 | $158,500 | $158,500 | $158,500 | $158,500 | $158,500 | $158,500 | $158,500 | $158,500 | $146,084 | $133,668 | $121,252 | $113,252 |

| Other Current Liabilities | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 | $3,700 |

| Subtotal Current Liabilities | $22,200 | $169,491 | $169,491 | $169,787 | $171,578 | $172,328 | $172,015 | $178,100 | $178,715 | $165,080 | $148,742 | $135,327 | $125,298 |

| Long-term Liabilities | $10,000 | $161,000 | $161,000 | $161,000 | $158,650 | $156,300 | $153,950 | $151,600 | $149,250 | $146,900 | $141,900 | $136,900 | $131,900 |

| Total Liabilities | $32,200 | $330,491 | $330,491 | $330,787 | $330,228 | $328,628 | $325,965 | $329,700 | $327,965 | $311,980 | $290,642 | $272,227 | $257,198 |

| Paid-in Capital | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 | $0 |

| Retained Earnings | $12,300 | $6,883 | $1,467 | ($3,950) | ($9,367) | ($14,783) | ($20,200) | ($25,617) | ($31,033) | ($36,450) | ($41,867) | ($47,283) | ($52,700) |

| Earnings | $0 | ($4,093) | ($8,185) | ($11,564) | ($14,075) | ($14,728) | ($12,591) | ($5,919) | $1,362 | $6,244 | $6,940 | $5,830 | $1,646 |

| Total Capital | $12,300 | $2,791 | ($6,719) | ($15,514) | ($23,442) | ($29,511) | ($32,791) | ($31,536) | ($29,671) | ($30,206) | ($34,927) | ($41,453) | ($51,054) |

| Total Liabilities and Capital | $44,500 | $333,282 | $323,773 | $315,273 | $306,786 | $299,118 | $293,174 | $298,164 | $298,293 | $281,773 | $255,716 | $230,773 | $206,144 |