More From Forbes

Fundamentals of risk assessment: methods and tools used to assess business risks.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

CEO of Schwenk AG & Crisis Control Solutions LLC , a leading expert in risk and crisis management for the automotive industry.

In the intricate tapestry of the modern business landscape, every thread is intertwined with an element of risk. From startups navigating the treacherous waters of market entry to conglomerates expanding their global footprint, understanding and adeptly managing these risks has become a distinguishing factor between fleeting success and enduring resilience.

As the pace of innovation surges and the global marketplace transforms, the significance of comprehensive risk assessment is only magnified. As a top expert in risk and crisis management, I've served major clients as well as numerous smaller firms in Europe and the U.S. Here's my guide for businesses.

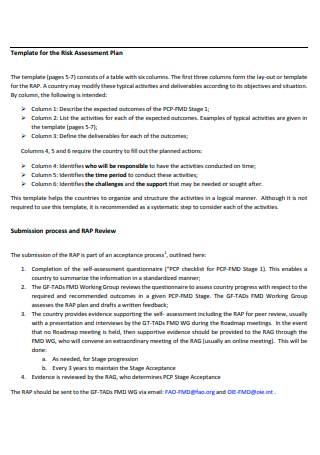

Key Components Of Risk Assessment

Risk assessment stands as a cornerstone in strategic business decision-making, demanding a structured and meticulous approach to ensure effectiveness.

1. Identify

At the heart of this process is the task of identifying risks. This involves recognizing and describing potential pitfalls that a business might face. Recognizing these risks early ensures that businesses can allocate resources and strategize aptly without being caught unprepared.

Best High-Yield Savings Accounts Of September 2023

Best 5% interest savings accounts of september 2023, 2. quantify.

Following the identification phase, businesses need to quantify the risks, gauging both their potential impact and likelihood.

Employ tools such as statistical models, analyses of historical data and simulated scenarios as they can all provide valuable insights in this dimension. It's through this quantification that businesses can discern which threats merit immediate attention and which can be set aside for later.

3. Prioritize

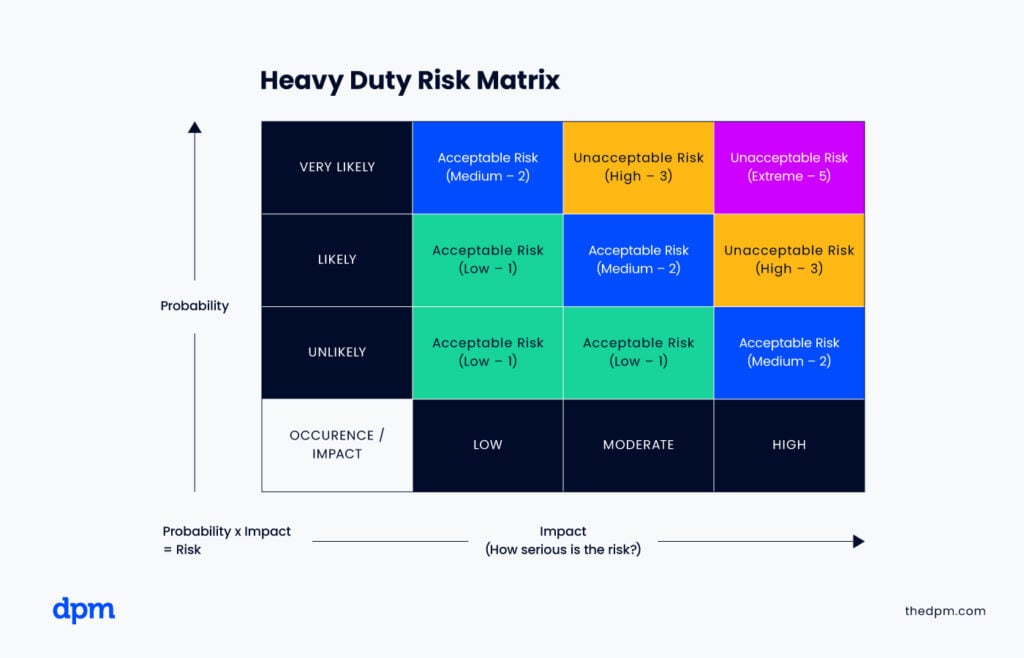

Once quantified, the next logical step is to prioritize these risks. Here, businesses rank and evaluate the identified risks, determining which should be addressed first based on their significance.

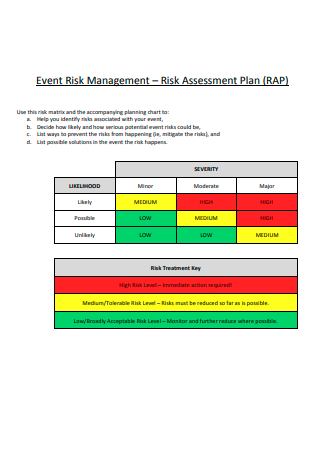

Instruments like risk matrices , which juxtapose the likelihood of a risk against its impact, play a crucial role in this assessment phase. Not every risk poses an immediate threat, and thus it's essential to ensure the most significant risks are addressed immediately, streamlining resources for maximum efficacy.

4. Evaluate

Subsequent to prioritization, a comprehensive evaluation of these risks is essential. This phase requires businesses to weigh the magnitude of each risk against their inherent risk appetite.

Compare industry benchmarks, past experiences or predetermined thresholds to decide the most appropriate way to address each threat. This step is pivotal in ensuring that risk management efforts are in harmony with a company's overarching objectives and risk tolerance levels.

5. Mitigate And Manage

Mitigating and managing risks forms the next stage. Strategic decisions come into play, determining how each identified risk should be addressed. Depending on the nature and magnitude of the risk, businesses might opt to transfer the risk through mechanisms like insurance, change their business processes to avoid it entirely, put in place safeguards to diminish its effect, or even accept it outright.

Effective risk management, in this regard, becomes a dual-edged sword; while it safeguards against potential adversities, it can also pave the way for opportunities, enabling growth and improvement.

6. Monitor And Review

Risks are inherently dynamic, fluctuating with time and circumstances. Regular audits, feedback mechanisms and even third-party reviews ensure that strategies employed remain effective and that emergent risks are identified promptly.

This continuous monitoring helps businesses stay nimble, adjusting their strategies to the evolving landscape of risks, better ensuring both survival and prosperity in an uncertain world.

Methods Of Risk Assessment

1. qualitative assessments.

The qualitative assessment is predominantly based on descriptive, nonnumerical data, and it shines in scenarios where garnering accurate numerical data is challenging. One of its significant advantages is its capacity to harness the power of expertise, intuition and experience to scrutinize risks.

There are several techniques under this umbrella. For instance, SWOT analysis delves into both the internal and external elements that might influence a project or business. It identifies the strengths, weaknesses, opportunities and threats.

The expert judgment method seeks insights from those with specialized expertise. Another technique, the Delphi method , orchestrates a structured dialogue among a panel of experts. This communication continues in multiple rounds until a consensus emerges.

2. Quantitative Assessments

The quantitative assessment employs numerical data. By leveraging statistical, financial or numerical analyses, it provides a more systematic and data-centric perspective on potential risks.

Techniques in this category include the Monte Carlo simulation , which uses an algorithm that hinges on constant random sampling to deduce numerical outcomes. Decision trees provide a visual representation of decisions and their possible results. Additionally, sensitivity analysis explores how varying values of one variable can influence another.

3. Additional Assessments

Scenario analysis empowers businesses by laying out an array of potential future situations. It aids in sketching the best-case, worst-case and the most-probable scenarios, enabling firms to visualize and weigh the potential risks and rewards.

Stress testing dives deep into analyzing potential vulnerabilities in any given system. It designs models that emulate challenging, often drastic conditions. A classic example of its application is in the financial realm , where banks deploy this method to unearth potential weak points in their financial statements.

The comparative risk assessment offers a comparative perspective. By juxtaposing potential risks against a benchmark or another risk, businesses can determine which threats deserve immediate attention, especially when resources are sparse and setting priorities becomes vital.

A hybrid method epitomizes adaptability. Realizing that no single technique can capture the entirety of risks, many entities interweave both qualitative and quantitative strategies. This amalgamated approach furnishes a richer, more detailed depiction of the risk environment surrounding a business.

Navigating Risk

To make an informed decision on which assessment method to employ, decision-makers should consider the nature of the risk, available data and desired depth of analysis.

Whether leaning toward qualitative methods that harness expertise and intuition or quantitative techniques that provide data-centric insights, the key is to choose a method (or combination thereof) that aligns with the specific context and objectives of the business, ensuring both its survival and prosperity amid uncertainties.

In essence, managing risk boils down to four strategies: avoiding it, mitigating its impact, transferring it, or simply accepting it. The chosen approach depends on the nature and magnitude of the risk in question.

Forbes Business Council is the foremost growth and networking organization for business owners and leaders. Do I qualify?

- Editorial Standards

- Reprints & Permissions

Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

Types of Risks in Business Planning

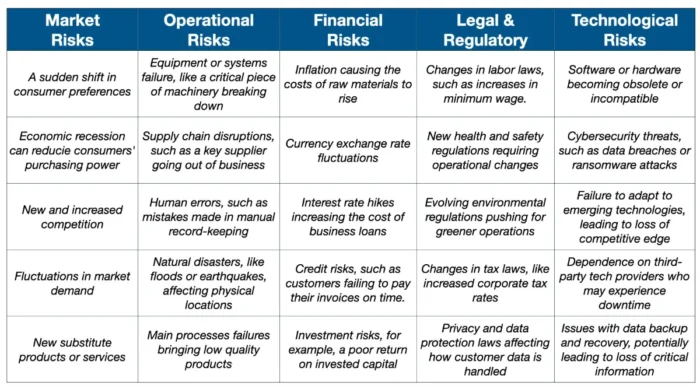

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

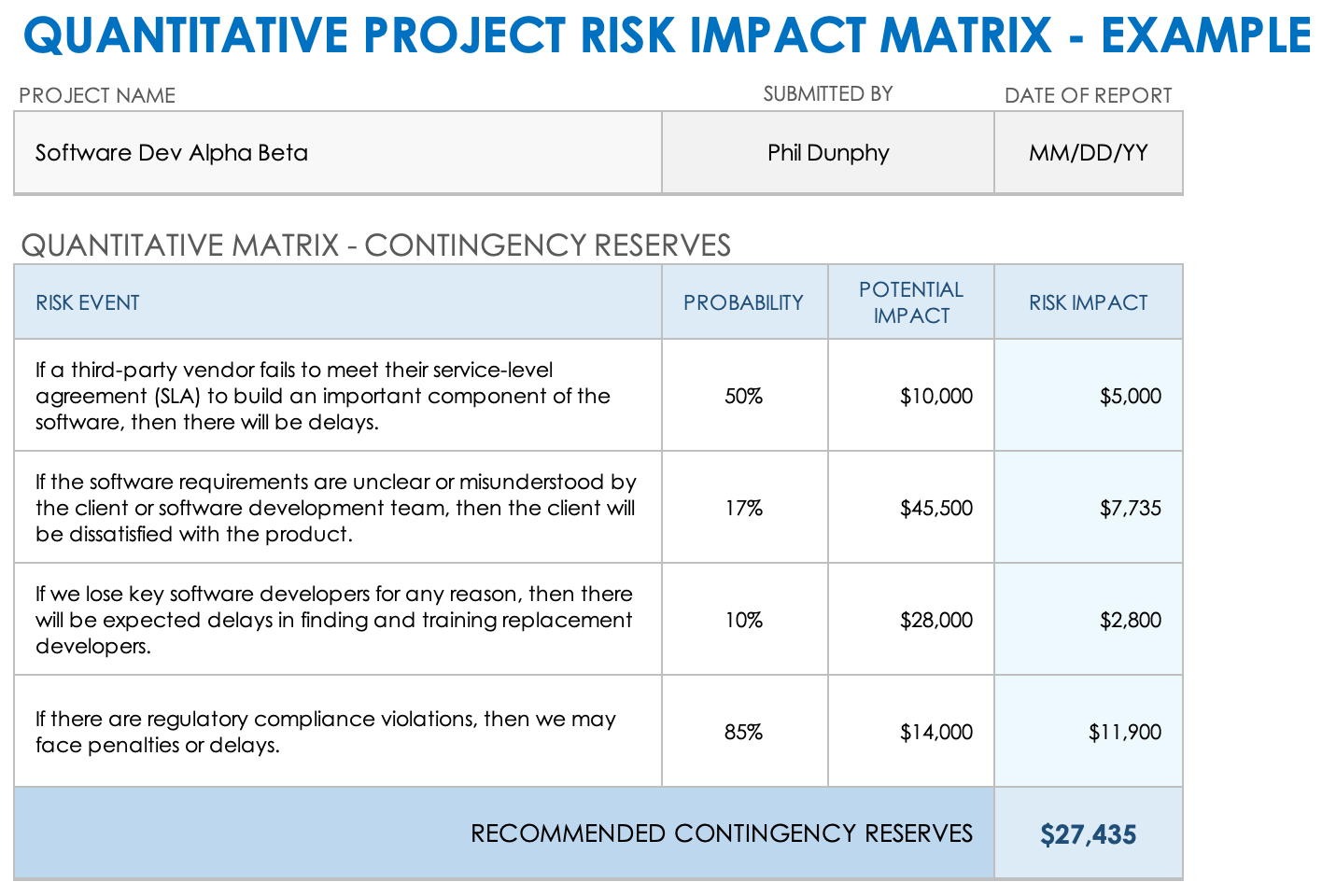

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

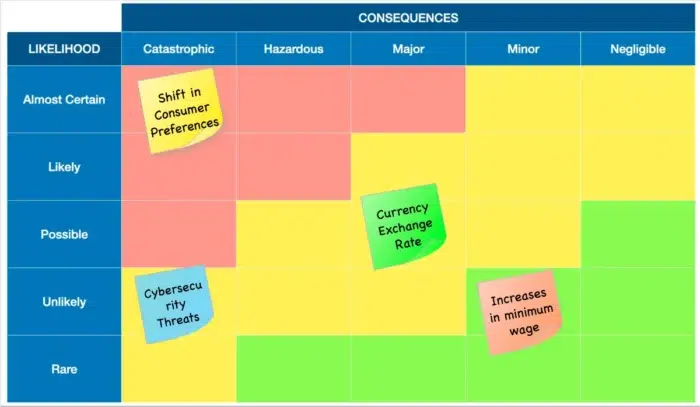

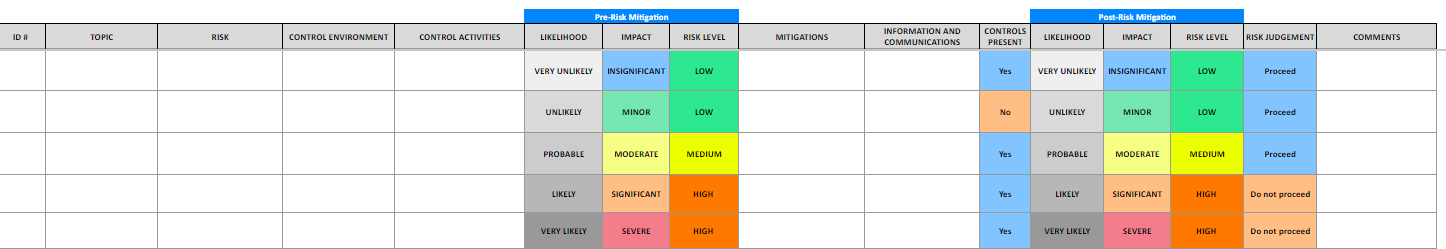

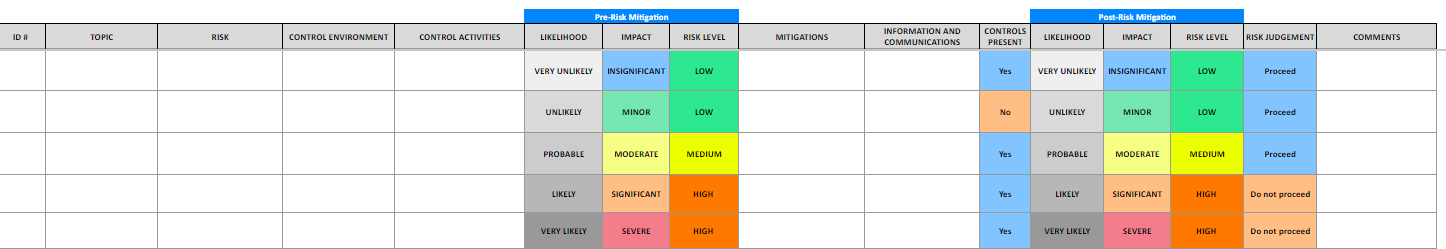

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

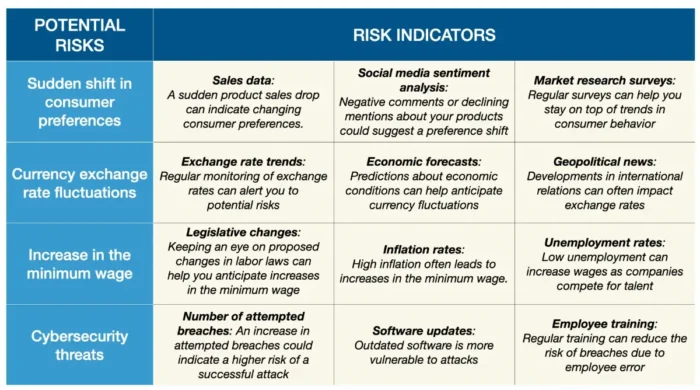

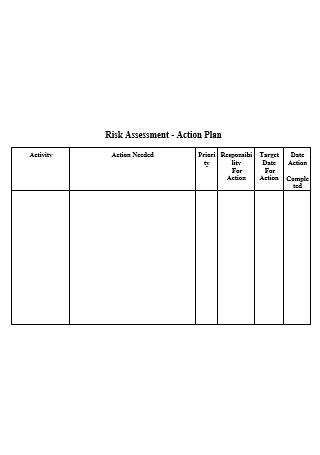

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

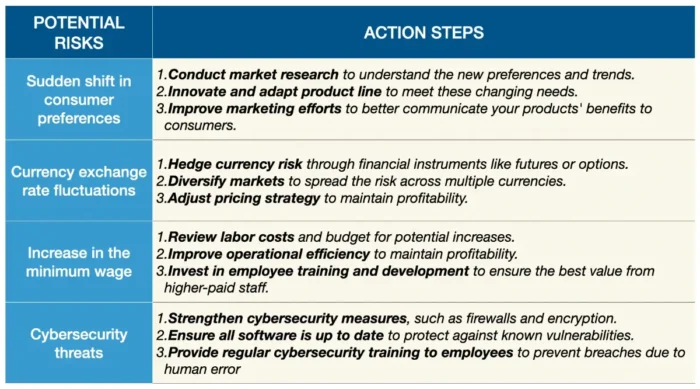

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

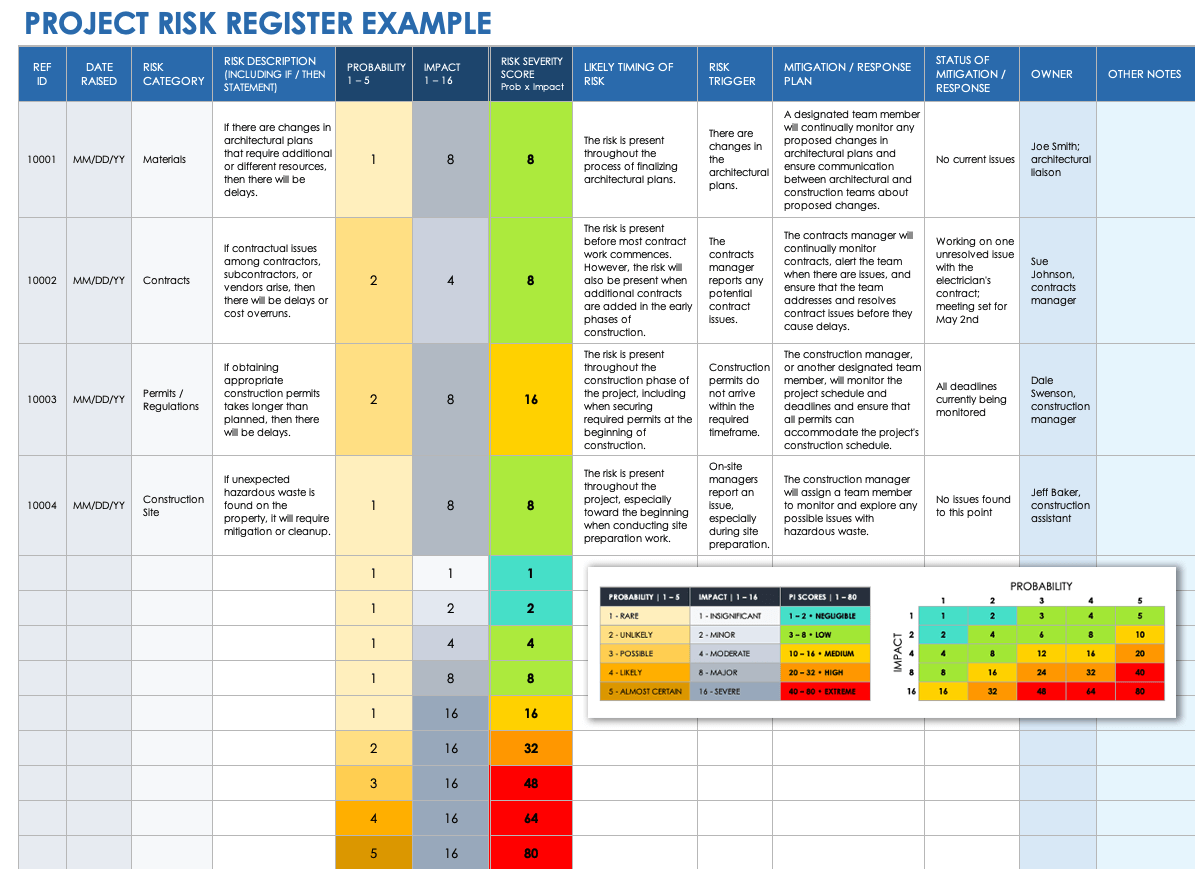

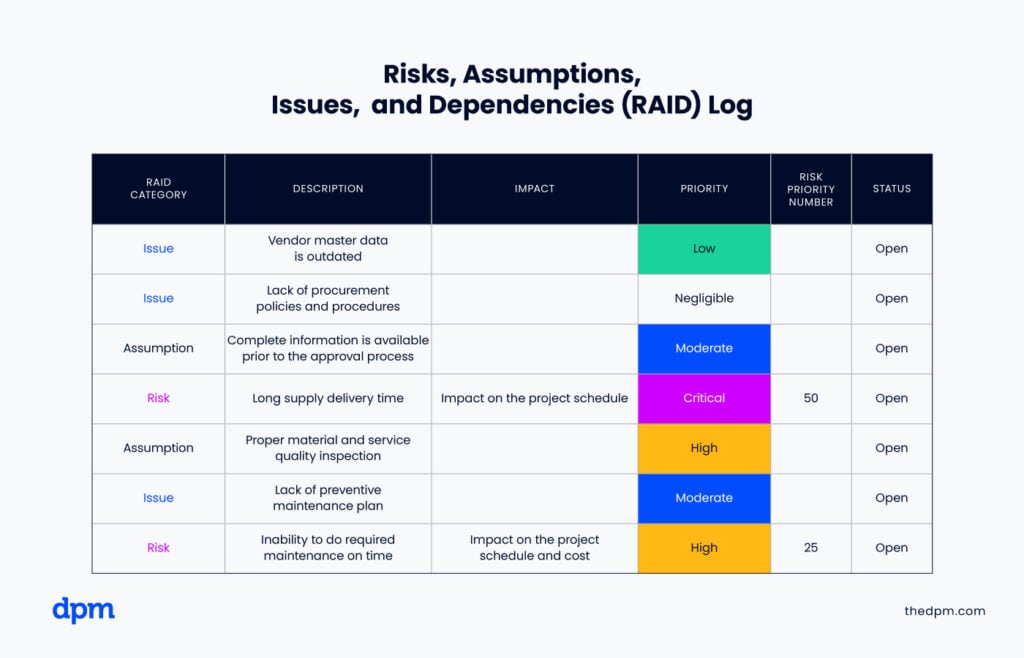

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

How to Write a Business Plan in 36 Steps

Risk Tolerance in Entrepreneurship: A Guide to Successful Business

Business Goals Questions to Develop SMART Goals

Risk Management Guide: Everything You Need to Know About Business Risk

Start typing and press enter to search.

Call Us (877) 968-7147 Login

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Conduct a Risk Analysis for Your Small Business

Small business owners take risks every day. But if you put too much at stake, your business bottom line could suffer. To make sure your decisions are sound, conduct a risk analysis for your small business.

What is a risk analysis in business?

A risk is a situation that can either have huge benefits or cause serious damage to a small business’s financial health. Sometimes a risk can result in the closure of a business. Before taking risks at your business, you should conduct a risk analysis.

A risk assessment for small business is a strategy that measures the potential outcomes of a risk. The assessment helps you make smart business decisions and avoid financial issues.

Jason Olsen, serial entrepreneur and founder of Studios 360, Prestman Auto, and Automobia, explained in his article :

The key is to not only use optimism for reasons to take action, but also to utilize risk factors you uncover to guide your decisions. Yes, you must have courage to bet on your ideas, but you must also have the ability to take a thoughtful, calculated approach. It’s nearly impossible to remove all risk in any scenario, but what’s important is to make sure these troublesome areas are always considered and understood.”

Internal vs. external risks

Usually, a risk is either internal or external. Internal risks occur inside of your operations, while external risks occur outside of your business.

Internal risks are often more specific to your business and easier to control than external risks. Examples of internal risks include:

- Financial risks

- Marketing risks

- Operational risks

- Workforce risks

Though you can project external risks, they are usually out of your control. You might need to take a reactive approach to managing external risks. These risks include:

- Changing economy

- New competitors

- Natural disasters

- Government regulations

- Consumer demand changes

How to do a risk assessment

There is no one way to assess business risk. The assessment is not 100% accurate when it comes to judging your level of risk. A small business risk analysis gives you a picture of the possible outcomes your business decisions could have. Use the following steps to do a financial risk assessment.

Step 1: Identify risks

The first step to managing business risks is to identify what situations pose a risk to your finances. Consider the damage a risk could have on your business. Then, think about your goals and the rewards that could come out of taking the risk. Depending on your business, location, and industry, risks will vary.

Step 2: Document risks

Once you have a list of potential business risks, define them in a document. Develop a process to weigh the effect of each risk. Look at how much damage the risk could potentially cause and how hard it would be to recover. Set up a scoring system for risks, from mild to severe.

Step 3: Appoint monitors

Identify individuals at your business who will keep an eye on and manage risks. The risk monitor might be you, a partner, or an employee. Decide how risks should be reported and handled. When you have procedures for risk management, issues can be taken care of smoothly.

Step 4: Determine controls

After understanding potential risks, figure out controls you can use to reduce them. Look at patterns over time to predict your income cycle. And, assess the impact risks have on your business. Look at the significance of a risk as well as its likelihood of occurring at your business.

Step 5: Review periodically

Your business risk assessment is not a one-time commitment. Review risk management processes annually to see how you handle risks. Also, look out for new risks that might not have been relevant in the previous assessment.

Use a risk ratio to gauge risk

A risk ratio shows the relationship between your business’s debts and equity. Business debt creates risk. By comparing debt, or leverage, to equity, you get a better understanding of your business’s level of risk. This can help you set more targeted business debt management goals.

Debt-to-equity ratio

There are different kinds of financial leverage ratios. One common leverage ratio formula is the debt-to-equity ratio . For this ratio, divide your total debt by your total equity. Business equity is equal to your assets minus liabilities and shows your ownership in the business.

Debt-to-Equity Ratio = Total Debt / Total Equity

For example, you have $30,000 in debt and $15,000 in equity.

$30,000 / $15,000 = 2 times or 200%

This means for every dollar you have, you owe two dollars to creditors.

By finding the debt-to-equity ratio, you can see how much capital comes from debt. The more debt you have compared to equity, the bigger your risk level.

Purpose of risk assessments

Risk assessments are an important part of running your business. You can use your business risk assessment for making decisions and financing your business .

A simple risk analysis will help you avoid hazards that could damage your finances. The assessment informs you about the steps you need to take to protect your business. You can see what situations you need to address and avoid.

Beyond internal use, a financial risk assessment can help you prepare to talk with lenders. These individuals want to know your business’s level of risk before giving you money. They look at the likelihood of your business growing and how likely you are to pay back the loan.

Need help keeping track of your business debts, income, and expenses? Patriot’s online accounting software is easy to use and made for the non-accountant. We offer free, USA-based support. Try it for free today.

This article is updated from its original publication date of May 9, 2017.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Business risk assessment: what it is & why you need it

Updated 20 June 2024 • 6 min read

What is a business risk assessment?

A business risk assessment helps you identify, analyse and prioritise risks. Businesses use risk assessments to:

minimise or eliminate risks

protect against potential threats

improve decision-making.

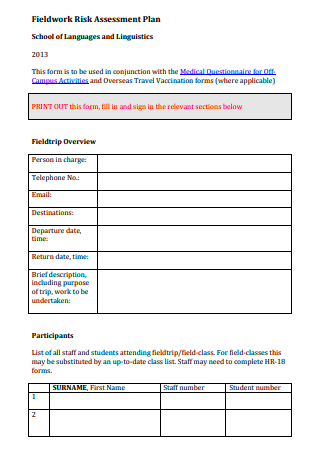

Risk assessment for business plan

When you’re putting together a business plan , it’s important to include a business risk assessment. Completing this section helps business owners to:

understand what risks they face

develop strategies for minimising or eliminating those risks

allocate resources effectively to manage risks

monitor and review risks on an ongoing basis.

This means that the business owner has a documented strategy in place to handle when things can — and do — go wrong. This gives them better control over the business and its trajectory, while also giving potential investors assurance that the business is well managed and their investment is sound.

The different types of risks businesses face

While it may be difficult to catalogue every risk a business may face, you can do a risk assessment based on types of risk. These categories may include:

Hazard-based

These are risks from dangerous workplace situations that could cause harm to people, property or the environment. Examples include fires, floods and chemical spills.

Opportunity-based

This risk comes from choosing one opportunity over another. When you dedicate your resources to one opportunity, there’s always the chance that a better one will come along or the current one won’t go as planned. Examples include investing in a new product line or moving to a new location.

Uncertainty-based

This risk is present when the outcome of a situation is uncertain. Examples of business risks include legal action, damage from natural disasters, and the loss of important customers or suppliers.

Operational

This type of risk comes from the day-to-day running of your business. Examples of operational risk may include equipment failure, employee error or theft.

Reputational

A risk to your business' reputation can include negative media coverage, product recalls and data breaches.

Cyber security

Cyber security is a risk for all businesses, including small and medium-sized organisations. Any data loss, leak or compromise can cost a business severely — both financially and in reputational damage.

How to do a business risk assessment (plus template and example)

1. identify the different types of risks for your business..

To identify the risks to your business, consider what could go wrong and why that might happen. Consider holding brainstorming sessions with your employees or reviewing past incidents to get started.

2. Assess the likelihood and potential impact of each type of risk.

You’ll want to decide the likelihood and potential impact of each type of risk. For example, the risk may be unlikely to occur through to very likely to occur. Likewise, the impact of the risk may be negligible through to severe. Doing this assessment will help you decide what to prioritise and where to allocate resources.

3. Prioritise the risks and develop strategies for mitigating them.

Once you’ve identified and assessed your risks, you’ll need to develop strategies to mitigate them and lessen their potential negative impact. This could involve taking out adequate business insurance or putting business continuity plans in place.

Business risk assessment template

The Australian Taxation Office (ATO) has developed a business risk assessment template that you can use for your risk assessment.

The template includes questions to help you identify and assess risks.

Business risk assessment example

If you own a small business, you might not think you need to worry about conducting risk assessments. But all businesses can face risks that could significantly affect their operations. Consider the following example:

You own a small retail business with one store. Your primary source of income is from selling products online, but you also have a small number of customers who visit your store in person.

A customer tells you they see a mouse in your store. This is a reputational risk, as it could damage your business’ reputation if word gets out. It’s also an operational risk if it leads to damaged inventory.

In this case, you'd need to assess the likelihood of that risk and the potential damage it could do to your business reputation or operations. Based on this assessment, you can decide how best to deal with the risk.

This is just one example of the innumerable risks businesses can face. Conducting a thorough business risk assessment prepares you for just about anything that comes your way.

Tips for mitigating risk in your business

Risk is part of life — it can’t always be avoided, but there are strategies you can put in place to mitigate its impacts. Consider the following:

Have adequate insurance coverage to help mitigate the financial impact of risks such as fire, theft or liability.

Develop contingency plans so that you can continue operating if an incident, such as a natural disaster or power outage, occurs.

Implement risk management processes and procedures. This could involve anything from regular risk assessments to employee training on identifying and dealing with potential risks.

Regularly monitor and review risks and make sure you have effective mitigation strategies in place.

Maintain good relationships with suppliers and customers. This can help to minimise the impact of risks such as supply chain disruptions. Also, ask for feedback on their experience with your products or services, so you can identify potential risks before they become major problems.

Have strong internal financial controls and IT security measures.

Stay up to date on changes in laws and regulations. This will help you avoid compliance-related issues, including risks specific to your industry and general risks all businesses face.

Disclaimer: This is general advice not meant to replace professional guidance. When seeking out someone to help advise you on business decisions, find somebody with the accreditations to assist you.

Minimise your IT risk with MYOB

With MYOB’s business management platform , you can look after your finances, invoices , payroll and more, while maintaining compliance and data security at all times. Our cloud-based software is scalable and affordable, catering for sole traders through to mid-sized enterprises . With MYOB, your IT is future fit — so you have one less thing to worry about.

Sign up today and try FREE for 30 days .

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

Related Guides

How to define key performance indicators (kpis) for employees arrow right, how to perform a business gap analysis arrow right, business expenses guide for smbs arrow right.

Contact us on 0208 290 4560

- Business insurance

- How to Write a...

How to Write a Risk Assessment: Templates & Examples

Dec 15, 2021

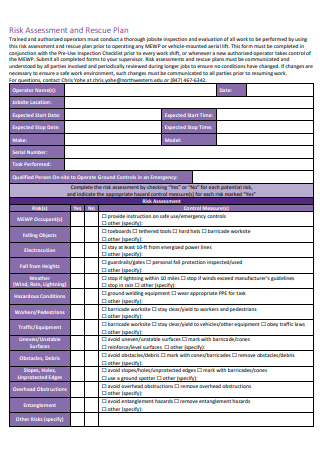

Does your business have to carry out risk assessments?

Yes, is the short answer. The Health and Safety Executive (HSE) state that as an employer, you’re required by law to protect your employees, and others, from harm.

The Management of Health and Safety at Work Regulations 1999 sets a minimum requirement that businesses must

- identify what could cause injury or illness in your business (hazards)

- decide how likely it is that someone could be harmed and how seriously (the risk)

- take action to eliminate the hazard, or if this isn’t possible, control the risk

To meet your duty of care, you will need to carry out and document a risk assessment.

Find out if the rules apply to you if you are self-employed .

Whilst not necessarily required by law, it also makes sense to carry out risk assessments linked to the running of your business. Knowing the possible risks that could threaten your businesses survival puts you in the best possible position to deal with them should they arise.

How to write a risk assessment

If you’ve not written a risk assessment before, it can seem like a daunting task. But it doesn’t need to be. The HSE suggest taking a 5-step approach to writing a risk assessment.

- Identify hazards

Hazards can be thought of as things in the workplace which may cause harm. Take a walk around your workplace and identify things which have the potential cause harm – this could be things which could injure, or things which could pose a long-term threat to health– manual handling, loud noise, or workplace stress for example.

When it comes to hazards think about working practices, processes, substances, and activities which could cause harm. And when identifying the hazards, think about how they could cause harm to employees, contractors, visitors, or members of the public.

- Assess the risks

Once you have identified your risks, then think about the likelihood of them happening and how serious it would be if they did.

The HSE recommends thinking about:

- who might be harmed and how

- what you’re already doing to control the risks

- what further action you need to take to control the risks

- who needs to carry out the action

- when the action is needed by

- Control the risks

Think about the steps you need to take to control the risks that you have identified.

The best possible outcome is that you can put controls in place which totally remove the identified risk. However, in many cases this just isn’t possible. So, you will need to think about the controls you can put in place to minimise the risks and the likelihood it will create harm.

Once you have identified the controls you need, put them into practice

- Record your findings

If you employ 5 or more people, then you must document the findings of your risk assessment.

You’ll need to include

- the hazards (things that may cause harm)

- what you are doing to control the risks

The HSE have created a risk assessment template to help you record your findings. And a quick Google search for ‘risk assessment template’ brings back multiple other template options which you may find useful and will mean you do not need to start from scratch.

- Review the controls

A risk assessment should not be thought of as a one time, box ticking exercise. It is important to that you review it on a regular basis. Make sure the controls you have identified remain appropriate and actually work in controlling the risks.

If anything changes in the way that you work (new staff, new processes, new premises etc) then make sure that you make a new assessment of the risks and work through the process listed above again.

COVID-19 is a good example of a new risk, requiring businesses to carry out COVID-19 specific risk assessments .

What type of risk assessment may your business need to carry out?

The obvious risk assessment that a business will need to carry out, and the one required by law referenced above, is linked to health and safety. Remember, you have a legal duty to protect your employees, and others, from harm

But there are also other risks which your business may face on a day-to-day basis, closely linked to your business success and survival.

So, you may need to carry out other risk assessments in areas such as:

- business continuity

- cyber security

- data security

You should be able to use the 5 principles above as a basis to writing any type of risk assessment.

Why your business should take risk seriously

Businesses face many risks in today’s environment. You just have to think of the shock which COVID-19 bought to the business world. And whilst it is one that we could not have foreseen, not giving enough time and effort to thinking about the risks your business faces and how you will respond if they should arise is a major risk to your business in itself.

At Anthony Jones we always say businesses should avoid falling into the trap of thinking ‘we would just….’ when it comes to risk management. The use of the word ‘just’ implies a level of simplicity in overcoming potential issues. But without prior thought, it is highly unlikely that you will have the answers to issues which may present themselves.

You also need to think about risk management when it comes to your insurance. Insurers are becoming increasingly selective, and we are seeing more requests for risk management information from insurers. They want to see how your business manages risk and how you are able to present this back can have a bearing on your ability to obtain the right insurance at the best possible price.

At Anthony Jones we focus on the areas of risk management with all of our clients. We work in partnership with Cardinus , a global risk and safety partner, to support our focus in this area. We can work with you to help you understand your business and attitude to risk and identify insurance covers which can offer protection. Get in touch with us on 020 8290 9080 or email us at [email protected] to discuss any of your business insurance requirements.

Get a Quote

You can call us during normal office hours, Monday to Friday, 9am to 5pm. Outside of office hours you can either email us or leave an answerphone message and we promise to get back to you the next working day.

General enquiries: 020 8290 4560 [email protected]

Sign up for news

Business Insurance Business Interruption Insurance Commercial Vehicle Insurance Cyber Insurance Fleet Management High Net Worth Insurance Intellectual Property Insurance Life & Critical Illness Cover Personal Insurance Transport & Logistics Vaping Insurance

Risk Management 101: Process, Examples, Strategies

Emily Villanueva

August 16, 2023

Effective risk management takes a proactive and preventative stance to risk, aiming to identify and then determine the appropriate response to the business and facilitate better decision-making. Many approaches to risk management focus on risk reduction, but it’s important to remember that risk management practices can also be applied to opportunities, assisting the organization with determining if that possibility is right for it.

Risk management as a discipline has evolved to the point that there are now common subsets and branches of risk management programs, from enterprise risk management (ERM) , to cybersecurity risk management, to operational risk management (ORM) , to supply chain risk management (SCRM) . With this evolution, standards organizations around the world, like the US’s National Institute of Standards and Technology (NIST) and the International Standards Organization (ISO) have developed and released their own best practice frameworks and guidance for businesses to apply to their risk management plan.

Companies that adopt and continuously improve their risk management programs can reap the benefits of improved decision-making, a higher probability of reaching goals and business objectives, and an augmented security posture. But, with risks proliferating and the many types of risks that face businesses today, how can an organization establish and optimize its risk management processes? This article will walk you through the fundamentals of risk management and offer some thoughts on how you can apply it to your organization.

What Are Risks?

We’ve been talking about risk management and how it has evolved, but it’s important to clearly define the concept of risk. Simply put, risks are the things that could go wrong with a given initiative, function, process, project, and so on. There are potential risks everywhere — when you get out of bed, there’s a risk that you’ll stub your toe and fall over, potentially injuring yourself (and your pride). Traveling often involves taking on some risks, like the chance that your plane will be delayed or your car runs out of gas and leave you stranded. Nevertheless, we choose to take on those risks, and may benefit from doing so.

Companies should think about risk in a similar way, not seeking simply to avoid risks, but to integrate risk considerations into day-to-day decision-making.

- What are the opportunities available to us?

- What could be gained from those opportunities?

- What is the business’s risk tolerance or risk appetite – that is, how much risk is the company willing to take on?

- How will this relate to or affect the organization’s goals and objectives?

- Are these opportunities aligned with business goals and objectives?

With that in mind, conversations about risks can progress by asking, “What could go wrong?” or “What if?” Within the business environment, identifying risks starts with key stakeholders and management, who first define the organization’s objectives. Then, with a risk management program in place, those objectives can be scrutinized for the risks associated with achieving them. Although many organizations focus their risk analysis around financial risks and risks that can affect a business’s bottom line, there are many types of risks that can affect an organization’s operations, reputation, or other areas.

Remember that risks are hypotheticals — they haven’t occurred or been “realized” yet. When we talk about the impact of risks, we’re always discussing the potential impact. Once a risk has been realized, it usually turns into an incident, problem, or issue that the company must address through their contingency plans and policies. Therefore, many risk management activities focus on risk avoidance, risk mitigation, or risk prevention.

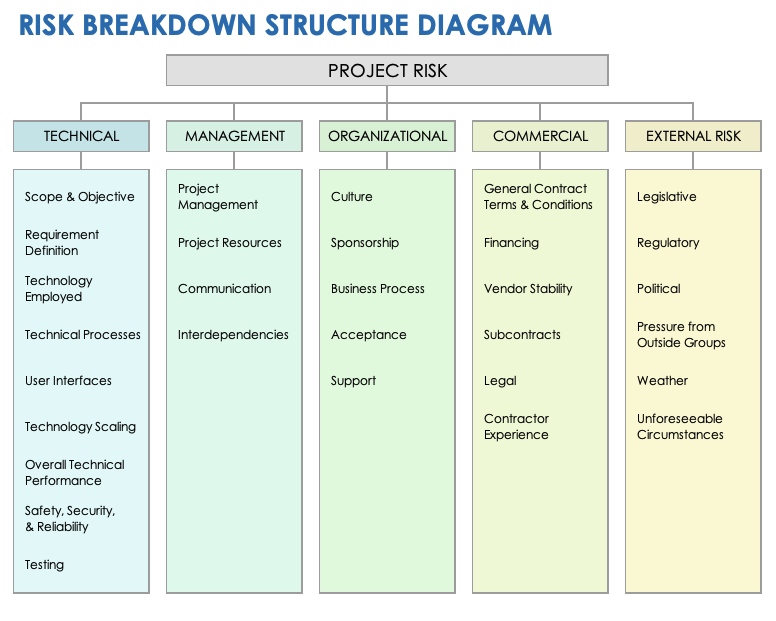

What Different Types of Risks Are There?

There’s a vast landscape of potential risks that face modern organizations. Targeted risk management practices like ORM and SCRM have risen to address emerging areas of risk, with those disciplines focused on mitigating risks associated with operations and the supply chain. Specific risk management strategies designed to address new risks and existing risks have emerged from these facets of risk management, providing organizations and risk professionals with action plans and contingency plans tailored to unique problems and issues.

Common types of risks include: strategic, compliance, financial, operational, reputational, security, and quality risks.

Strategic Risk

Strategic risks are those risks that could have a potential impact on a company’s strategic objectives, business plan, and/or strategy. Adjustments to business objectives and strategy have a trickle-down effect to almost every function in the organization. Some events that could cause strategic risks to be realized are: major technological changes in the company, like switching to a new tech stack; large layoffs or reductions-in-force (RIFs); changes in leadership; competitive pressure; and legal changes.

Compliance Risk

Compliance risks materialize from regulatory and compliance requirements that businesses are subject to, like Sarbanes-Oxley for publicly-traded US companies, or GDPR for companies that handle personal information from the EU. The consequence or impact of noncompliance is generally a fine from the governing body of that regulation. These types of risks are realized when the organization does not maintain compliance with regulatory requirements, whether those requirements are environmental, financial, security-specific, or related to labor and civil laws.

Financial Risk

Financial risks are fairly self-explanatory — they have the possibility of affecting an organization’s profits. These types of risks often receive significant attention due to the potential impact on a company’s bottom line. Financial risks can be realized in many circumstances, like performing a financial transaction, compiling financial statements, developing new partnerships, or making new deals.

Operational Risk

Risks to operations, or operational risks, have the potential to disrupt daily operations involved with running a business. Needless to say, this can be a problematic scenario for organizations with employees unable to do their jobs, and with product delivery possibly delayed. Operational risks can materialize from internal or external sources — employee conduct, retention, technology failures, natural disasters, supply chain breakdowns — and many more.

Reputational Risk

Reputational risks are an interesting category. These risks look at a company’s standing in the public and in the media and identify what could impact its reputation. The advent of social media changed the reputation game quite a bit, giving consumers direct access to brands and businesses. Consumers and investors too are becoming more conscious about the companies they do business with and their impact on the environment, society, and civil rights. Reputational risks are realized when a company receives bad press or experiences a successful cyber attack or security breach; or any situation that causes the public to lose trust in an organization.

Security Risk

Security risks have to do with possible threats to your organization’s physical premises, as well as information systems security. Security breaches, data leaks, and other successful types of cyber attacks threaten the majority of businesses operating today. Security risks have become an area of risk that companies can’t ignore, and must safeguard against.

Quality Risk

Quality risks are specifically associated with the products or services that a company provides. Producing low-quality goods or services can cause an organization to lose customers, ultimately affecting revenue. These risks are realized when product quality drops for any reason — whether that’s technology changes, outages, employee errors, or supply chain disruptions.

Steps in the Risk Management Process

The six risk management process steps that we’ve outlined below will give you and your organization a starting point to implement or improve your risk management practices. In order, the risk management steps are:

- Risk identification

- Risk analysis or assessment

- Controls implementation

- Resource and budget allocation

- Risk mitigation

- Risk monitoring, reviewing, and reporting

If this is your organization’s first time setting up a risk management program, consider having a formal risk assessment completed by an experienced third party, with the goal of producing a risk register and prioritized recommendations on what activities to focus on first. Annual (or more frequent) risk assessments are usually required when pursuing compliance and security certifications, making them a valuable investment.

Step 1: Risk Identification

The first step in the risk management process is risk identification. This step takes into account the organization’s overarching goals and objectives, ideally through conversations with management and leadership. Identifying risks to company goals involves asking, “What could go wrong?” with the plans and activities aimed at meeting those goals. As an organization moves from macro-level risks to more specific function and process-related risks, risk teams should collaborate with critical stakeholders and process owners, gaining their insight into the risks that they foresee.

As risks are identified, they should be captured in formal documentation — most organizations do this through a risk register, which is a database of risks, risk owners, mitigation plans, and risk scores.

Step 2: Risk Analysis or Assessment

Analyzing risks, or assessing risks, involves looking at the likelihood that a risk will be realized, and the potential impact that risk would have on the organization if that risk were realized. By quantifying these on a three- or five-point scale, risk prioritization becomes simpler. Multiplying the risk’s likelihood score with the risk’s impact score generates the risk’s overall risk score. This value can then be compared to other risks for prioritization purposes.

The likelihood that a risk will be realized asks the risk assessor to consider how probable it would be for a risk to actually occur. Lower scores indicate less chances that the risk will materialize. Higher scores indicate more chances that the risk will occur.

Likelihood, on a 5×5 risk matrix, is broken out into:

- Highly Unlikely

- Highly Likely

The potential impact of a risk, should it be realized, asks the risk assessor to consider how the business would be affected if that risk occurred. Lower scores signal less impact to the organization, while higher scores indicate more significant impacts to the company.

Impact, on a 5×5 risk matrix, is broken out into:

- Negligible Impact

- Moderate Impact

- High Impact

- Catastrophic Impact

Risk assessment matrices help visualize the relationship between likelihood and impact, serving as a valuable tool in risk professionals’ arsenals.

Organizations can choose whether to employ a 5×5 risk matrix, as shown above, or a 3×3 risk matrix, which breaks likelihood, impact, and aggregate risk scores into low, moderate, and high categories.

Step 3: Controls Assessment and Implementation

Once risks have been identified and analyzed, controls that address or partially address those risks should be mapped. Any risks that don’t have associated controls, or that have controls that are inadequate to mitigate the risk, should have controls designed and implemented to do so.

Step 4: Resource and Budget Allocation

This step, the resource and budget allocation step, doesn’t get included in a lot of content about risk management. However, many businesses find themselves in a position where they have limited resources and funds to dedicate to risk management and remediation. Developing and implementing new controls and control processes is timely and costly; there’s usually a learning curve for employees to get used to changes in their workflow.

Using the risk register and corresponding risk scores, management can more easily allocate resources and budget to priority areas, with cost-effectiveness in mind. Each year, leadership should re-evaluate their resource allocation as part of annual risk lifecycle practices.

Step 5: Risk Mitigation

The risk mitigation step of risk management involves both coming up with the action plan for handling open risks, and then executing on that action plan. Mitigating risks successfully takes buy-in from various stakeholders. Due to the various types of risks that exist, each action plan may look vastly different between risks.

For example, vulnerabilities present in information systems pose a risk to data security and could result in a data breach. The action plan for mitigating this risk might involve automatically installing security patches for IT systems as soon as they are released and approved by the IT infrastructure manager. Another identified risk could be the possibility of cyber attacks resulting in data exfiltration or a security breach. The organization might decide that establishing security controls is not enough to mitigate that threat, and thus contract with an insurance company to cover off on cyber incidents. Two related security risks; two very different mitigation strategies.

One more note on risk mitigation — there are four generally accepted “treatment” strategies for risks. These four treatments are:

- Risk Acceptance: Risk thresholds are within acceptable tolerance, and the organization chooses to accept this risk.

- Risk Transfer : The organization chooses to transfer the risk or part of the risk to a third party provider or insurance company.

- Risk Avoidance : The organization chooses not to move forward with that risk and avoids incurring it.

- Risk Mitigation : The organization establishes an action plan for reducing or limiting risk to acceptable levels.

If an organization is not opting to mitigate a risk, and instead chooses to accept, transfer, or avoid the risk, these details should still be captured in the risk register, as they may need to be revisited in future risk management cycles.

Step 6: Risk Monitoring, Reviewing, and Reporting

The last step in the risk management lifecycle is monitoring risks, reviewing the organization’s risk posture, and reporting on risk management activities. Risks should be monitored on a regular basis to detect any changes to risk scoring, mitigation plans, or owners. Regular risk assessments can help organizations continue to monitor their risk posture. Having a risk committee or similar committee meet on a regular basis, such as quarterly, integrates risk management activities into scheduled operations, and ensures that risks undergo continuous monitoring. These committee meetings also provide a mechanism for reporting risk management matters to senior management and the board, as well as affected stakeholders.

As an organization reviews and monitors its risks and mitigation efforts, it should apply any lessons learned and use past experiences to improve future risk management plans.

Examples of Risk Management Strategies

Depending on your company’s industry, the types of risks it faces, and its objectives, you may need to employ many different risk management strategies to adequately handle the possibilities that your organization encounters.

Some examples of risk management strategies include leveraging existing frameworks and best practices, minimum viable product (MVP) development, contingency planning, root cause analysis and lessons learned, built-in buffers, risk-reward analysis, and third-party risk assessments.

Leverage Existing Frameworks and Best Practices

Risk management professionals need not go it alone. There are several standards organizations and committees that have developed risk management frameworks, guidance, and approaches that business teams can leverage and adapt for their own company.

Some of the more popular risk management frameworks out there include:

- ISO 31000 Family : The International Standards Organization’s guidance on risk management.

- NIST Risk Management Framework (RMF) : The National Institute of Standards and Technology has released risk management guidance compatible with their Cybersecurity Framework (CSF).

- COSO Enterprise Risk Management (ERM) : The Committee of Sponsoring Organizations’ enterprise risk management guidance.

Minimum Viable Product (MVP) Development

This approach to product development involves developing core features and delivering those to the customer, then assessing response and adjusting development accordingly. Taking an MVP path reduces the likelihood of financial and project risks, like excessive spend or project delays by simplifying the product and decreasing development time.

Contingency Planning

Developing contingency plans for significant incidents and disaster events are a great way for businesses to prepare for worst-case scenarios. These plans should account for response and recovery. Contingency plans specific to physical sites or systems help mitigate the risk of employee injury and outages.

Root Cause Analysis and Lessons Learned

Sometimes, experience is the best teacher. When an incident occurs or a risk is realized, risk management processes should include some kind of root cause analysis that provides insights into what can be done better next time. These lessons learned, integrated with risk management practices, can streamline and optimize response to similar risks or incidents.

Built-In Buffers

Applicable to discrete projects, building in buffers in the form of time, resources, and funds can be another viable strategy to mitigate risks. As you may know, projects can get derailed very easily, going out of scope, over budget, or past the timeline. Whether a project team can successfully navigate project risks spells the success or failure of the project. By building in some buffers, project teams can set expectations appropriately and account for the possibility that project risks may come to fruition.

Risk-Reward Analysis

In a risk-reward analysis, companies and project teams weigh the possibility of something going wrong with the potential benefits of an opportunity or initiative. This analysis can be done by looking at historical data, doing research about the opportunity, and drawing on lessons learned. Sometimes the risk of an initiative outweighs the reward; sometimes the potential reward outweighs the risk. At other times, it’s unclear whether the risk is worth the potential reward or not. Still, a simple risk-reward analysis can keep organizations from bad investments and bad deals.

Third-Party Risk Assessments

Another strategy teams can employ as part of their risk management plan is to conduct periodic third-party risk assessments. In this method, a company would contract with a third party experienced in conducting risk assessments, and have them perform one (or more) for the organization. Third-party risk assessments can be immensely helpful for the new risk management team or for a mature risk management team that wants a new perspective on their program.

Generally, third-party risk assessments result in a report of risks, findings, and recommendations. In some cases, a third-party provider may also be able to help draft or provide input into your risk register. As external resources, third-party risk assessors can bring their experience and opinions to your organization, leading to insights and discoveries that may not have been found without an independent set of eyes.

Components of an Effective Risk Management Plan

An effective risk management plan has buy-in from leadership and key stakeholders; applies the risk management steps; has good documentation; and is actionable. Buy-in from management often determines whether a risk management function is successful or not, since risk management requires resources to conduct risk assessments, risk identification, risk mitigation, and so on. Without leadership buy-in, risk management teams may end up just going through the motions without the ability to make an impact. Risk management plans should be integrated into organizational strategy, and without stakeholder buy-in, that typically does not happen.

Applying the risk management methodology is another key component of an effective plan. That means following the six steps outlined above should be incorporated into a company’s risk management lifecycle. Identifying and analyzing risks, establishing controls, allocating resources, conducting mitigation, and monitoring and reporting on findings form the foundations of good risk management.

Good documentation is another cornerstone of effective risk management. Without a risk register recording all of a company’s identified risks and accompanying scores and mitigation strategies, there would be little for a risk team to act on. Maintaining and updating the risk register should be a priority for the risk team — risk management software can help here, providing users with a dashboard and collaboration mechanism.

Last but not least, an effective risk management plan needs to be actionable. Any activities that need to be completed for mitigating risks or establishing controls, should be feasible for the organization and allocated resources. An organization can come up with the best possible, best practice risk management plan, but find it completely unactionable because they don’t have the capabilities, technology, funds, and/or personnel to do so. It’s all well and good to recommend that cybersecurity risks be mitigated by setting up a 24/7 continuous monitoring Security Operations Center (SOC), but if your company only has one IT person on staff, that may not be a feasible action plan.

Executing on an effective risk management plan necessitates having the right people, processes, and technology in place. Sometimes the challenges involved with running a good risk management program are mundane — such as disconnects in communication, poor version control, and multiple risk registers floating around. Risk management software can provide your organization with a unified view of the company’s risks, a repository for storing and updating key documentation like a risk register, and a space to collaborate virtually with colleagues to check on risk mitigation efforts or coordinate on risk assessments. Get started building your ideal risk management plan today!

Emily Villanueva, MBA, is a Senior Manager of Product Solutions at AuditBoard. Emily joined AuditBoard from Grant Thornton, where she provided consulting services specializing in SOX compliance, internal audit, and risk management. She also spent 5 years in the insurance industry specializing in SOX/ICFR, internal audits, and operational compliance. Connect with Emily on LinkedIn .

Related Articles

A guide to business risk assessment

No business venture is entirely without risk. However, conducting a company risk assessment offers one way to identify potential hazards and mitigate them. Keep reading to learn more about what’s involved in business risk assessment.

What is risk analysis in business?

Apart from this type of business decision, there are also wider risks such as natural disasters which must also be accounted for. By identifying these problems, both large and small, a company can conduct a business analysis risk assessment and prepare for all eventualities. The goal of risk analysis in business is to assess potential outcomes, and ultimately make smarter business decisions.

Benefits of performing a company risk assessment

There are plentiful benefits to business risk analysis, including the following:

Avoid overly risky decisions that could damage your bottom line

Identify steps needed to protect your business from external damages

Pull together information needed to speak with lenders about financing

Create an action plan to respond quickly to adverse situations

Reduce recovery time after a natural disaster, legal damages, or security threat

Types of risk in business

There are both internal and external risks to consider when performing a business risk assessment. Internal risks occur as part of your business’s operations, while external risks involve outside incidents that impact your finances.

Generally, inside risks are easier to mitigate. These include factors like marketing, workforce, or operational risks.

By contrast, external risks might be out of your company’s immediate control. As a result, you’ll need to prepare for their effects on your business. Examples of external risks include things like natural disasters, changes to government regulations, new competitors, or changing economic conditions.

How to perform a business risk assessment

To create your own business analysis risk assessment and accompanying strategy, follow these steps:

1. Identify likely hazards.

The first step in any company risk assessment is to outline which hazards your company is most likely to face. This will vary according to your business’s size, typical operations, geographical location, and industry. Think about which situations would pose the greatest threat to your finances.

2. Identify at-risk assets.

The next step is to think about the assets that would be most at-risk from the hazards you’ve written down. For example, if there was a change to government regulations impacting your mechanical processes, this would mainly cause risk to your business’s operations. Risks could also impact your finances, properties, employees, customers, or brand reputation.

3. Document risks.

No business risk analysis is complete without fully documenting the identified risks, at-risk assets, and potential harms. Define these categories in a document, developing an internal process to give each type of risk a weight. It’s helpful to create your own scoring system ranging from mild to severe for each identified risk.

4. Analyze the impacts.

After documenting and scoring your risks, weigh these impacts with a thorough analysis of harm. For example, if you’re analyzing the impact of a cyber-attack, you should think about the specific damages that would occur. This could include compromised customer details, harm to your company’s reputation, leaking of sensitive company information, and draining of bank accounts.

5. Create a mitigation strategy.

Once you’ve analyzed the potential impacts of a risk, the next step is to create a mitigation strategy. In the example of the cyber-attack, this could include strengthening your online security platforms. Designate individuals at the business to implement these mitigation actions and manage risks. Create new flows for reporting and handling each risk.

6. Perform regular risk reviews.

Finally, remember that business risk assessment is an ongoing process. You will need to determine controls used to reduce risks, analyzing patterns over time to predict and document future financial outcomes. Review these processes annually to verify that they’re still working – and identify new risks.

We can help

GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments .

Over 85,000 businesses use GoCardless to get paid on time. Learn more about how you can improve payment processing at your business today.

Interested in automating the way you get paid? GoCardless can help

Try a better way to collect payments, with GoCardless. It's free to get started.

Try a better way to collect payments

What is business risk?