- Harvard Division of Continuing Education

- DCE Theses and Dissertations

- Communities & Collections

- By Issue Date

- FAS Department

- Quick submit

- Waiver Generator

- DASH Stories

- Accessibility

- COVID-related Research

Terms of Use

- Privacy Policy

- By Collections

- By Departments

Machine Learning for Financial Market Forecasting

Citable link to this page

Collections.

- DCE Theses and Dissertations [1331]

Contact administrator regarding this item (to report mistakes or request changes)

Show Statistical Information

Now downloading ...

Los Angeles users can login to download this file.

Stock Market Prediction Using Machine Learning and Deep Learning

- Masters Thesis

- Ebrahimi, Amir

- Mohammad Pourhomayoun

- Navid Amini

- Los Angeles

- College of Engineering, Computer Science, and Technology

- Computer Science

- California State University, Los Angeles

- Computer science

- http://hdl.handle.net/20.500.12680/3197xs641

| Thumbnail | Title | Date Uploaded | Visibility | Actions |

|---|---|---|---|---|

| 2022-03-10 | Campus |

Items in ScholarWorks are protected by copyright, with all rights reserved, unless otherwise indicated.

Thesis Topics

General area of thesis supervision:.

Empirical Finance, Quantitative Finance, Risk Management, Parameter and Model Uncertainty, Forecasting

Open Topics:

Seminars (e.g. seminar in finance).

- COVID-19 and impacts on financial markets (moments/cross-sectional moments)

- Ambiguity/Parameter Uncertainty and Real Option Portfolios (Literature Review)

- Predicting Equity Risk Premia via Machine Learning this paper

- Factor Momentum: Does it exist in statistical factors?

- Uncertainty and Google searches Dzielinski, (2012)

- Predicting the equity premium with ambiguity, which measure performs best?

- Predicting stock returns with ambiguity vs measuring the current level of ambiguity from the markets

- Predicting the equity premium with cross-sectional moments using simple ML rather than OLS and auto-encoders rather than principal components.

- Turbulence before and after elections. Is there a relationship to the measure of political uncertainty of Kelly et al. (2016) ?

- Uncertainty and Volatility. Conduct a literature review.

Thesis (Mainly master thesis)

Please be aware, that I will only supervise theses, where the Research Proposal fulfills the following requirements:

- Either use exactly one of the topics given below, or

- Suggest a topic that is closely related to one of those given below. If so, the main paper to base your research on must have been published (or accepted for publication) in one of the Top Finance Journals (preferrably A+, but at least A in this ranking ).

- For the Research Pitch/Proposal I suggest to take a very close look at Robert Faff’s Webpage on pitching research , especially on the Finance examples.

Political Finance:

- Relationship between Populism and Financial Markets (Data available)

- The cost of populism (relate to corruption and economic freedom indices)

- Election Portfolios: Drivers of Betting Quotes and Stock Returns

- Based on data from this (conditionally accepted) AER paper see how financial markets did perform during this time

Innovative Finance - Machine Learning in Finance:

- Multivariate Predictability in Assets and Factors. Apply Machine Learning techniques to exploit linear and nonlinear predictability.

- Machine Learning in Asset Management. Clustering/Shrinking, Factor Models and the Covariance Matrix

- Optimal Portfolio Building using Machine Learning Techniques (investigate possible modifications of the loss function)

- Predicting the Equity Premium with Machine Learning and turbulence measures rather than anomaly returns (see this paper )

Innovative Finance - Cryptocurrencies:

- The predictability of cryptocurrency returns and the transfer/reference currency

- Delisting Bias in aggregate CC returns

- Machine learning and crypto currencies

- Efficient portfolio formation for crypto currencies

- Factor investing in crypto currencies

- A cryptocurrency turbulence index

Innovative Finance - Uncertainty (Parameter/Financial/Macro-Financial/Portfolio …):

- NEW: History-aware ambiguity measures: is there something turbulence can learn from probability uncertainty and vice-versa?

- NEW: Macro-Financial Uncertainty and the work of Rossi & Sekhposyan, 2017 and Rossi, Sekhposyan & Soupre, 2016 . Relate the various indices to each other. What measures what? How can we find out what the best measure of uncertainty is? (see also Bekaert et. al, 2022 )

- The term structure of uncertainty: Uncertainty (Unusualness/Turbulence) in good times, uncertainty in bad times and uncertainty about bad times. Investigate the term structure of uncertainty and its implications on (e.g.) asset prices.

- Within- and cross-country uncertainty (data available). What drives (international) asset prices?

- Higher (Co)Moment Uncertainty and Stock Returns: The case of the Covid-19 crash (also relate to coskewness risk)

- Follow Redl (2018) and link elections to macro/financial uncertainty

- Closely related: Check how much macroeconomic uncertainty/parameter uncertainty relate to the results of Pflueger, Siriwarda & Sunderam (2018): A Measure of Risk Appetite for the Macroeconomy

- Some more uncertainty: Replicate this paper using our Macro-Uncertainty Index

- Financial Turbulence and the Estimation of Tail Risk

Asset Pricing:

- What is the optimal number of portfolios to build for long-short factor premia? Is building portfolios the right way? A good starting point is this paper (ONLY FOR TOP STUDENTS)

- What is the optimal number of partitions (portfolios) for the calculation of cross-sectional predictors (e.g. cross-sectional volatility)? Which cross-section delivers the best predictor of the equity premium? (ONLY FOR TOP STUDENTS, I CAN PROVIDE DATA AND PARTS OF THE CODES). See also Walter et. al, 2022, Non-Standard Errors in Portfolio Sorts

- All about factor momentum and expected returns: Hanlin Yang (2020): Decomposing Factor Momentum . See also Eshani and Linainmaa (2019): The Inevitability of Momentum and Eshani and Linainmaa (2019): Factor Momentum and the Momentum Factor ) Gupta and Kelly (2019): Factor Momentum everywhere

- Factor Momentum: Factor Uncertainty and Factor Momentum Performance.

Asset Selection:

- Robust portfolios: Estimation & Empirics

Pension Finance

- Dollar-Cost Averaging vs Lump-Sum Investments in the context of market predictability (market timing) and life-cycle investments.

Theses Supervised:

- Performancevergleich und -entwicklung von aktiv und passiv gemanagten Schweizer Aktienfonds im Zeitraum von 2008 bis 2019 (BSc)

- Parameter Uncertainty and Equity Premium Prediction via Machine Learning Techniques (MSc)

- Factor Momentum Performance in Characteristics based Portfolios (MSc)

- Measurement and comparability of impact investing in asset management (MSc)

- Predicting stock returns in the presence of breaks by following the approach from Smith and Timmermann (2021): Evidence from the European market (MSc)

- Parameter Uncertainty and Portfolio Management (PhD Mentoring)

- Machine Learning in Financial Economics (PhD Mentoring)

- The Risk Premium of Critical Raw Materials - A Signal for Priority Needs in Realising the European Green Deal (MSc, A. Caroline White)

- Empirical asset pricing via Machine Learning: Evidence from the Cryptocurrency Market (MSc, A. Stefan Macanovic)

- Inflation-Hedged Portfolios within the European Stock Market (MSc, A. Fabian Köffel)

- Sub-portfolio Optimization (BSc, A. Jasminko Kulenovic)

- Stock Market Prediction With Long Short-Term Memory Recurrent Neural Networks (BSc, A. Elizabeth Sanyal)

- Robust Portfolio Optimization with Deep learning - Using past Forecast Errors to Improve Return Predictions (MSc, A. Markus Wabnig, best Master in Finance 2022)

- The EUR/CHF Exchange Rate and Euro Area Stress (MSc, A. Nicolas Tschütscher, best Master Thesis in Finance 2022)

- Incorporating ESG Score Changes in Portfolio Management via Deep Learning (MSc, A. Lukas Müller)

- Neural Network for KPI based Time Series Sales Forecasting (MSc, A. Niklas Leibinger)

- Optimal Portfolio Building using Deep Learning Techniques (MSc, A. Michael Metz)

- Economic Uncertainty Premia in U.S. Stock Markets during the COVID-19 Pandemic (MSc, A. Leo Pitscheneder)

- Cryptocurrency: Delisting Bias in the coinmarketcap database (BSc, A. Fabian Köffel)

- Multivariate Factor Forecasting and Smart Beta Investments (MSc, A. Dominik Brändle)

- Evaluating Dollar-Cost Averaging under the Aumann-Serrano Framework (MSc, A. Jonas Sterk)

- Impact of ESG exclusion on firms’ cost of capital (MSc, A. Fabian Müller)

- Sales Forecasting with Machine Learning (MSc, A. Johannes Gassner)

- Investors’ herding in the German equity options market: Evidence from the COVID-19 crisis (MSc, A. Dmytro Livshyts)

- “Long/Short” Momentum-Strategie am Kryptowährungsmarkt (BSc, A. Timothy Rist, best Bachelor Thesis in Business Administration 2020)

- Momentum meets Uncertainty (MSc, A. Dominik Kaiser, best Master Thesis in Finance 2020)

- Changes in Investor Attention and the Cross-Section of Stock Returns: Evidence from Thomson Reuters and Google Trends (MSc, A. Emanuel Broger)

- Künstliche Intelligenz und Anwendungsmöglichkeiten in der Vermögensberatung (MBA, A. Lukas Schäper)

- Stock Price Prediction for Portfolio Management Using Recurrent Neural Networks and Machine Learning (EMBA, A. Jensen Chang)

- Cross-Sectional Volatility and the Prediction of Factor Premia (MSc, A. Maibach, Runner-Up Finance Award)

- Multi-Factor Timing (MSc, B. Jäger, Winner of Finance Award, best Master Thesis in Business Science)

- Stock Age as Proxy for Uncertainty of Parameters (MSc, S. Sturzenegger)

- The Influence of News Coverage on Stock Returns – Evidence from European Markets (MSc, A. Person)

- Portfolio Optimization in a Cryptocurrency Environment: An Omega Optimization (BSc, D. Brändle, Runner-Up Finance Award)

- Liquid betting against beta revisited: Evidence from all over the world (MSc, L. Salcher)

- From IPO to Obsolete: Stock Age related investment strategies (MSc, P. Thoma)

- Eurex index dividend futures hedging (MSc, A. Spiegel)

- Predicting Equity Bear and Bull Markets: International Evidence (MSc, L. Liepert)

- The North Korea threat and its effect on global stock markets: The case of South Korea, Japan and the USA (BSc, M. Wabnig)

- Liquidity and the Polish Stock Market: Empirical Tests of Asset Pricing Models and Inclusion of Liquidity Factors (MSc, P. Ruzicka)

- Dynamic Asset Allocation Strategies and An Optimisation Framework: How Optimal is Optimised? (MSc, F. Balz)

- Prediction of the Monthly Sovereign Yield Spread Changes in EMU Countries from 2000 to 2016 using the Illiquidity Measure ‘Noise’ in Bond Prices (MSc, P. Heise)

- Using momentum to improve low-volatility strategies: Evidence from the US stock market (BSc, M. Amann)

- Terrorism and its effect on financial markets (MSc, S. Geiger)

- Prognose von Aktienrenditen - Eine empirische Forschung über die Vorhersagbarkeit der zukünftigen Renditen des Swiss Performance Index anhand von Renditen - Dispersionen (BSc, B. Jäger)

- Betting Against Beta (MSc, C. Lamprecht)

- Cross-Sectional and Option-Implied (Higher) Moments and the Predictability of Historical Volatility: US Study (MSc, O. Vukovic)

- The Relationship between Commodities and the Stock Market - Empirical Evidence for the Eurozone (MSc, P. Kain)

- The Effectiveness of Constant and Time-Varying Futures Optimal Hedge Ratios - Empirical Evidence from the European Stock Market (MSc, E. Panagakou)

Sebastian Stöckl

Assistant professor in financial economics (tenure-track).

My research interests include Financial and Economic Uncertainty as well as Empirical Asset Pricing.

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

200 Finance Dissertation Topics: Quick Ideas For Students

Finance dissertation topics are on-demand in the 21st century. But why is this so? It may perplex you how everyone is up and down looking for interesting, quality finance topics. However, the answer is simple: because fascinating finance dissertation topics can earn students bonus points.

We will delve into that in just a second. Your finance topic dictates the difficulty of the assignment you are going to handle. Landing on the right topic means that you will not have to toil as much as when you pick a highly complex topic. Does it make sense?

Let’s explore the nitty-gritty of finance dissertation papers before we get into mentioning the top-rated finance research topics list.

What Is A Finance Dissertation?

As the name goes, finance dissertation is a kind of writing that investigates a particular finance topic selected by the student. The topics range from the stock market, banking, and risk management to healthcare finance topics.

This dissertation provides the student with a degree of academic self-confidence and personal satisfaction in the finance field. Finance writing requires extensive research to create a persuasive paper in the end.

Writing Tips For Finance Dissertations

Are you uncertain concerning what you need to do to compose a top-notch finance dissertation? Worry no more! Our professional writers have put together some essential suggestions to kick you off. In the next few minutes, you will be in a position to create a perfect finance dissertation painstakingly:

- Narrow down your topic : Trim down your finance topic to a specific niche. It should focus on one region; either micro-finance, macro-finance, or internet banking.

- Verify your facts : Finance is a field that includes a lot of statistical data to be followed logically. Therefore, verify facts and figures with reliable sources before opting to use them in your paper.

- Write concisely : Unlike other papers with long narrative tales, you should encapsulate a finance paper into a tight, concise paper. The rule of ‘short is sweet’ technically applies here at great length.

- Arrange your data neatly : A paper that is stuffed with numerals and charts all over may turn down a reader at first sight. For an impressive finance thesis, know-how and when to use your data.

- Write simply : Avoid jargon that may confuse an ordinary reader. Where a need is for technical terms to be used, illustrate them with relatable examples. Simplicity is gold in a finance dissertation. So, use it well.

With these tips and tricks, you are all set to start writing your finance paper. We now advance to another crucial part that will make sure your finance paper is refined and at per with your institution’s academic standards.

General Structure of a Finance Dissertation

It is crucial to consult your supervisor regarding your dissertation’s research methodology, structure, style, and reasonable length. Depending on the guidance of your supervisor, the structure may vary. Nonetheless, as a general guide, ensure the following sections are part and parcel of your dissertation:

- Introduction: State the problem that you intend to address in your dissertation. It also includes a definition of key terms, the relevance of the topic and a summary of hypotheses.

- Theoretical and empirical literature, hypotheses development and contribution: It provides the theoretical framework of your study. The hypotheses are based on the literature review.

- Data and methodology: State the model (i.e. dependent and key independent variables) that you want to use the drawing on theoretical framework or economic argument that you may employ for your analysis. Define all control variables and describe the data used to test the hypothesis.

- Empirical results: Describe the results and mention whether they are consistent with the hypotheses and relate them with the existing evidence in the literature. You will also describe the statistical and practical/economic significance of your findings.

- Summary and conclusion: Summarize your research and state the general conclusion with relevant implications.

It is important to have all the dataset you want to use readily available before finalizing the topic. The dataset is essential for testing your hypotheses.

There are thousands of research topics for finance students available all over the internet and academic books. You only have to browse and lookup for the latest research or refer to past readings or course lectures.

Even though this exercise may look simple enough on the surface, it takes a lot of time to consider what makes for interesting finance topics adequately. Not all ideas you find will achieve the academic requirements that your supervisor expects from you.

Here is a list of freshly mint topics to use for numerous finance situations:

Impressive Healthcare Finance Topics

Healthcare involves more than just treating patients and administering injections. There are finance aspects that also come into play, including:

- Strategies for marketplace achievement in turbulent times: Medical staff marketing

- Effects of the employer executive compensation and benefits plan after the Tax Reform Act of 1986

- Improving profitability through accelerating philanthropic giving to healthcare systems

- Acceleration and effective information strategies for cash management in hospitals

- Finding the system’s solution to health care cost accounting

- How hospitals spend money from charitable organizations and donor funding

- Models of enhancing cost accounting efforts by improving existing information sources

- Strategies of increasing cash flow with a patient accounting review

- A systematic review of productivity, cost accounting, and information systems

- A study of the cost accounting strategies under the prospective payment system

- How to manage bad debt and charity care accounts in hospitals

- Achieving more value from managed care efforts in healthcare systems

- Strategies of achieving economies of scale through shared ancillary and support services

- Profitable ways of financing the acquisition of a health care enterprise

- Effects of mergers and acquisitions on private hospitals

- Measuring nursing costs with patient acuity data in hospitals

- Affordable treatment and care for long-term and terminal diseases

- Survey of the organization and structure of a hospital’s administration concerning financing

- Impact of culture and globalization on healthcare financing

- Discuss the necessity for universal health coverage in the United States

Finance Management Project Topics

If you are a finance management enthusiast, this section will impress you the most:

- The impact of corrupt bank managers on its sustainability

- How banks finance small and medium-scale enterprises

- Loan granting and its recovery problems on commercial banks

- An evaluation of credit management in the banking industry

- The role of microfinance banks in the alleviation of poverty in the US

- Comparative evaluation strategies in mergers and acquisitions

- How to plan and invest in the insurance sector and tax planning

- Impact of shareholders on decision-making processes on banks

- How diversity in banks affects management and leadership practices

- Credit management techniques that work for small scale enterprises

- Appraisal on the impact of effective credit management on the profitability of commercial banks

- The impact of quantitative tools of monetary policy on the performance of deposit of commercial banks

- Financial management practices in the insurance industry and risk management

- The role of the capital market in economic development

- Problems facing financial institutions to the growth of small scale business in the USA

- Why training and development of human resources is a critical factor in bank operations

- The impact of universal banking financial system on the credibility

- Security threats to effective management in banks

- The effect of fiscal and monetary policy in controlling unemployment

- The effects of financial leverage on company performance

Topics in Mathematics With Applications in Finance

Mathematics and finance correlate in several ways in that they borrow concepts from each other. Here are some of the mathematics concepts that apply to finance paper topics:

- Linear algebra

- Probability theory

- Stochastic processes

- Regression analysis

- Value at risk models

- Time series analysis

- Volatility modelling

- Regularized pricing and risk models

- Commodity models

- Portfolio theory

- Factor modelling

- Stochastic differential equations

- Ross recovery theorem

- Option, price, and probability duality

- Black-Scholes formula, Risk-neutral valuation

- Introduction to counterparty credit risk

- HJM model for interest rates and credit

- Quanto credit hedging

- Calculus in finance and its application

International Finance Topics

International finance research topics deal with a range of monetary exchanges between two or more nations. Below is a list of international research topics in finance for you to browse through and pick a relevant one:

- A study of the most important concepts in international finance

- How internal auditing enhances good corporate governance practice in an organization

- Factors that affect the capital structure of Go Public manufacturing companies

- A financial engineering perspective on the causes of large price changes

- Corporate governance and board of directors responsibilities

- An exploratory study on the management of support services in international organizations

- An accounting perspective of the need for theorizing corporation

- Impact of coronavirus on international trade relations

- Is business ethics attainable in the global market arena

- How exchange rates affect international trading

- The role of currency derivatives in shaping the global market

- How to improve international capital structure

- How to forecast exchange rates

- Ways of measuring exposure to exchange rates fluctuations

- How to hedge exposure to exchange rates fluctuations globally

- How foreign direct investment puts individual countries at risk

- How to stabilize international capital markets

- A study of shadow banking in the global environment

- A comparative analysis of Western markets and African markets

- Exploring the monetary funding opportunities by the International Monetary Fund

Corporate Finance Research Topics

These 20 topics have the potential to help you write an amazing corporate finance paper, provided you have the will to work hard on your paper:

- Short- and long-term investment needs for working capital trends

- Identifying proper capital structure models for a company

- How capital structure and an organization’s funding of its operations relate

- Corporate finance decision making in unstable stock markets

- The effect of firm size on financial decision making incorporates

- Compare and contrast the different internationally recognized corporate financial reporting standards

- Evaluate the emerging concept integrated reporting in corporate finance

- Managing transparency in corporate financial decisions

- How technological connectivity has helped in integrated financial management

- How different investment models contribute to the success of a corporate

- The essence of valuation of cash flows in financial and non-financial corporates

- Identify the prevalent financial innovations in the USA

- Ways in which governance influences corporate financial activities

- Impact of taxes on dividend policies in developed nations

- How corporate strategies related to corporate finance

- Implications of the global economic crisis in the backdrop of corporate finance concepts

- How information technology impact corporate relations among companies

- Evaluate the effectiveness of corporate financing tools and techniques

- How do FDI strategies compare in Europe and Asia?

- The role of transparency and liquidity in alternative corporate investments

Finance Debate Topics

These finance debate topics are formulated in keeping with emerging financial issues globally:

- Is China’s economy on the verge of ousting that of the US?

- Does the dynamic nature of the global market affect the financial alienations of countries?

- Is Foreign Direct Investment in retail sector good for the US?

- Is it possible to maintain stable oil prices in the world?

- Are multinational corporations good for the global economy?

- Does the country of origin matter in selling a product?

- Are financial companies misusing ethics in marketing?

- Why should consumer always be king in marketing messages?

- Does commercialization serve in the best interest of the consumer?

- Why should companies bother having a mission statement?

- Why should hospitals receive tax subsidies and levies on drugs?

- Is television the best medium for advertisement?

- Is the guarantor principle security or a myth?

- Compare and contrast market trends in capitalism versus Marxism states

- Does the name of a business have an impact on its development record?

- Is it the responsibility of the government to finance small-scale business enterprises?

- Does budgeting truly serve its purpose in a company?

- Why should agricultural imports be banned?

- Is advertising a waste of company resources?

- Why privatization will lead to less corruption in companies

Finance Topics For Presentation

Is your group or individual finance presentation giving you sleepless nights just because you do not have a topic? Worry no more!

- The role of diplomatic ties in enhancing financial relations between countries

- Should banks use force when recovering loans from long-term defaulters?

- Why mortgages are becoming difficult to repay among the middle class

- Ways of improving the skilled workforce in developing

- How technology creates income disparities among social classes

- The role of rational thinking in making financial decisions

- How much capital is necessary for a start-up?

- Are investments in betting firms good for young people?

- How co-operatives are important in promoting communism in a society

- Why should countries stop receiving foreign aids and depend on themselves?

- Compare and contrast the performance of private sectors over public sectors

- How frequent should reforms be conducted in companies?

- How globalization affects nationalism

- Theories of financial development that is still applicable today

- Should business people head the finance ministry of countries?

- The impact of the transport sector on revenue and tax collection

- The impact of space exploration on the country’s economy

- How regional blocs are impacting developing nations

- Factors contributing to the growth of online scams

- What is the impact of trade unions in promoting businesses?

Finance Research Topics For MBA

Here is our best list of top-rated MBA financial topics to write about in 2023, which will generate more passion for a debate:

- Evaluate the effect of the Global crisis to use the line of credit in maintaining cash flow

- Discuss options for investment in the shipping industry in the US

- Financial risk management in the maritime industry: A case study of the blue economy

- Analyze the various financial risk indicators

- Financial laws that prevent volatility in the financial market

- How the global recession has impacted domestic banking industries

- Discuss IMF’s initiatives in tackling internal inefficiency of new projects

- How the WTO is essential in the global financial market

- The link between corporate and capital structures

- Why is it important to have an individual investment?

- How to handle credit crisis in financial marketing

- Financial planning for salaried employee and strategies for tax savings

- A study on Cost And Costing Models in Companies

- A critical study on investment patterns and preferences of retail investors

- Risk portfolio and perception management of equity investors

- Is there room for improvement in electronic payment systems?

- Risks and opportunities of investments versus savings

- Impact of investor awareness towards commodities in the market

- Is taxation a selling tool for life insurance

- Impact of earnings per share

Public Finance Topics

These interesting finance topics may augur well with university students majoring in public finance:

- Financial assistance for businesses and workers during Coronavirus lockdowns

- Debt sustainability in developing countries

- How we can use public money to leverage private funds

- Analyze the use of public funds in developed versus developing countries

- The reliability of sovereign credit ratings for investors in government securities

- Propose a method of analysis on the cost-benefit ratio of any government project

- The role of entities in charge of financial intermediation

- The reciprocity and impact of tariff barriers

- Impact of the exempted goods prices on the trade deficit

- Investor penalties and its impact in the form of taxes and penalties

- Public government projects that use private funds

- Ways of measuring the cost of sustainability

- Maintaining economic growth to avoid a strong recession

- The impact of the declining income and consumption rates

- Effects of quarantine and forced suspension of economic activity

- Innovative means of limiting the scale of pandemic development

- The growing scale of the public debt of the public finance system

- A critical analysis of the epidemiological safety instruments used in countries

- The growing debt crisis of the state finance system

- How to permanently improve and increase the scale of anti-crisis socio-economic policy planning

Business Finance Topics

You can address the following business finance research papers topics for your next assignment:

- How organizations are raising and managing funds

- Analyze the planning, analysis, and control operations and responsibilities of the financial manager

- Why business managers should take advantage of the federal stimulus package

- Economical ways of negotiating for lower monthly bills

- Evaluate the best retirement plans for entrepreneurs

- Tax reform changes needed to spearhead businesses to the next level

- How politicians can help small businesses make it to the top

- Setting up life insurance policies from which you can sidestep the banks and loan yourself money

- Why every business manager should know about profit and loss statements, revenue by customers and more.

- Advantages of creating multiple corporations to business entrepreneurs

- Why good liquidity is a vital weapon in the face of a crisis

- Reasons why many people are declaring bankruptcy during the coronavirus pandemic

- Why you should closely examine the numbers before making any financial decisions

- Benefits of corporations to small scale business ventures

- How to start a business without money at hand

- Strategies for improving your company’s online presence

- Discuss the challenge of debt versus equity for small-scale businesses

- The impact of financial decisions on the profitability and the risk of a firm’s operations

- Striking a balance between risk and profitability

- Why taking the ratio of current assets to current liabilities is important to any business

You can use any of the hot topics mentioned above for your finance dissertation paper or opt for our thesis writing services. We have competitive finance dissertation writing experts ready to tackle your paper to the core.

Try us today!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Comment * Error message

Name * Error message

Email * Error message

Save my name, email, and website in this browser for the next time I comment.

As Putin continues killing civilians, bombing kindergartens, and threatening WWIII, Ukraine fights for the world's peaceful future.

Ukraine Live Updates

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

- Swedish House of Finance

- News & press

Master Thesis Award 2021: Empirical Analysis on the Swedish Stock Market

Mar. 09, 2022

The 2021 Swedish House of Finance Master’s Thesis Award goes to Jesper Andersson and Alexander Hübbert for their joint thesis: “Does the tick size regime on systematic internalisers improve market quality?”

We are thrilled to announce the 2021’s winners of the annual Swedish House of Finance Master’s Thesis Award, contributed by Nasdaq Nordic Foundation. Our warm congratulations to Jesper and Alexander from Stockholm University who co-authored a thesis on the Swedish Stock Market. This is the third year that the prize is awarded since its implementation in 2019. The aim is to stimulate the use of data on Nordic financial markets available at the Swedish House of Finance National Data Center .

Awarded research focuses on the Swedish Stock Market

The winner master’s thesis examined whether the tick size regime on systematic internalisers (SIs) during 2020 alters the market composition of trading venues and impacts the market quality at Nasdaq Stockholm. The students leveraged from the Swedish House of Finance’s National Data Center to access the Nasdaq HFT and Finbas database. The research results established that striving for an equivalent playing field for trading venues and SIs causes a negative spillover effect. In particular, the study identified that enforcing the MiFID II tick size regime on SIs causes a decrease in market quality for trading venues.

“We are very honoured to receive the 2021 Swedish House of Finance’s Master Thesis Award. The combination of databases provided us with necessary and valuable data to compute the liquidity measures needed to capture the effects on market quality changes at the Stockholm Stock Exchange for our 45 sample stocks. Big thanks to SHoF and the Nasdaq Nordic Foundation for the recognition of our work”

The students were supervised by Björn Hagströmer, Professor of Finance at Stockholm University, and collaborated with Erik Einerth, Senior Expert Capital & Derivatives Markets at Swedish Securities Markets Association.

Highlights from the jury

The winner thesis was selected by a jury committee formed by representatives from the Nasdaq Nordic Foundation, Stockholm School of Economics’ finance department, and financial firms who have an interest in financial data processing. According to the jury, Jesper’s and Alexander’s thesis study stands out for its level of maturity and potential to be published in an academic journal. The students have successfully developed the research topic into a “workable and testable hypothesis”.

“Jesper and Alexander do a fantastic job in “creating” the research idea together with an industry partner. They placed the topic in the correct academic context within relevant literature using appropriate statistical and econometric techniques to formulate and answer the hypothesis of interest.”

2021 Runner-up research: “Post-MiFID II: Dark Pool Bans and Regulatory Effects on Lit Market Quality”

We would like to also announce the runner-up paper for the 2021 Swedish House of Finance Master’s Thesis Award. The paper focus on the impacts of dark pools on lit market characteristics and is co-written by Hugo Hammar and Isak Djudja, from University of Gothenburg. They examined the first market-wide implementation of a dark pool ban on European securities, and used high-frequency data on Nordic equities, provided by the Swedish House of Finance’s National Data Center, to understand how suspending individual securities from dark pool trading affects the quality of its corresponding ‘lit’ markets.

“The data provided by the Swedish House of Finance has been truly instrumental in our research, forming the foundation of our quantitative analysis, and allowing us to investigate the true effects of dark pool bans on Nordic equity markets. We are genuinely thankful to have been able to explore such an important and interesting topic, which has implications for regulators and practitioners alike."

Hugo and Isak were supervised by Marcin Zamojski, Research Fellow in Financial and Time-Series Econometrics at University of Gothenburg.

About the Swedish House of Finance Master’s Thesis Award

The Swedish House of Finance Master’s Thesis Award is open for every MSc student at a Swedish college of university who have used Swedish Equity Data* available from the National Data Center of the Swedish House of Finance in their work. The total prize money for the award is SEK 50.000. The prize is awarded annually in order to stimulate students to work on topics related to financial economics by using data on Nordic financial markets.

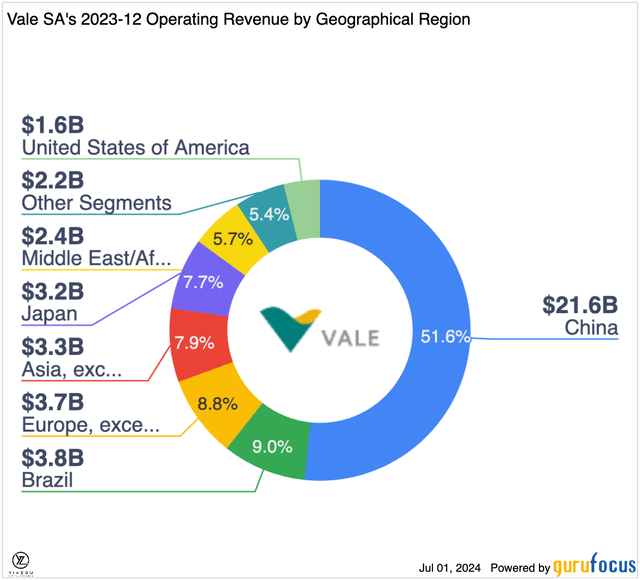

Why Vale Could Rebound

- VALE has plunged nearly 30% YTD due to falling iron ore prices, but its solid operational performance positions it well in the face of market fluctuations.

- Increased iron ore production suggests producers expect a rebound in prices and demand, hinting that Vale's stock may have found a bottom and could rebound with signs of recovery.

- Vale's investments in nickel and copper for the EV market, coupled with early signs of Chinese economic recovery, support its performance against iron ore price fluctuations.

- Vale's commitment to ESG initiatives enhances its market position, attracting socially responsible investors and reinforcing its long-term growth potential.

sdlgzps/E+ via Getty Images

Investment Thesis

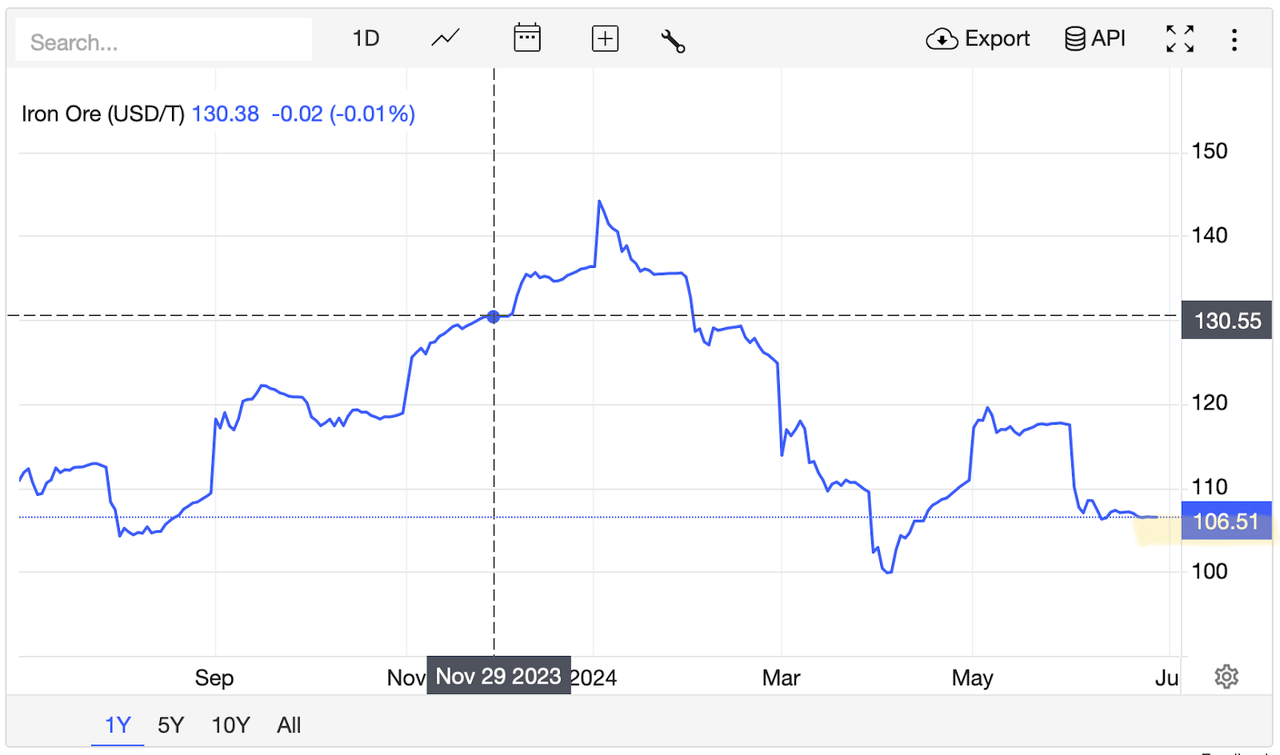

We expressed our optimistic view on Vale ( NYSE: VALE ) eight months ago. Since then, despite a short-lived upward movement, VALE has plunged nearly 30% YTD, tracking the decline in iron ore prices amid a seasonal break in Chinese demand . As a commodity-driven stock, Vale's earnings and stock performance remain highly correlated with iron ore prices, reflecting the market's volatility. Nevertheless, Vale has maintained solid operational and cost performance, effectively positioning itself to weather these fluctuations.

Despite the dropping demand in China, the increased iron ore production indicates that producers anticipate a rebound in iron ore prices and recovering demand in the foreseeable future. This optimism suggests that the stock might have found a bottom and priced in the pessimistic sentiment, setting the stage for a potential rebound with the first signs of recovery, particularly from China.

Lastly, Vale's nickel and copper investments will play an essential role in the growing EV market, enabling it to protect performance from fluctuations in iron ore prices. Meanwhile, the first signs of recovery in Chinese economic growth, fueled by government stimulus toward infrastructure-focused projects, may drive steel demand and, thus, iron ore prices.

tradingeconomics.com

Vale Reports Q1 2024 Growth in Iron Ore Production and Revenue Despite Profit Dip

For the first quarter of 2024, Vale reported a positive movement in iron ore production and revenue but decreased net profit. Iron ore manufacturing increased by 6% year-on-year (YoY) to 71 million tons , and the main drivers of this increase were enhanced operation at the S11D arm, better asset dependency programs, and more third-party purchases.

Pellet manufacturing also increased by 2% YoY up to 8.5 million tonnes. Even with a reduction in the average realized price of iron ore by 7.3%, the sales increased by 15%, reaching 63.8 million tonnes, though the prices of pellets increased by 5.8% YoY. However, compared to the Q4 2023, Q1 2024 saw decreased production and sales. Iron ore manufacturing fell by 20.8%, while pellet manufacturing dropped by 14%. Sales of iron ore and pellets reduced by 32.5% and 10.3%, respectively.

Copper production increased 22% YoY to 81.9 kt in Q1 2024, while nickel decreased 4% to 39.5 kt. For 2024, Vale estimates output of 38–42 million tons of pellets and iron ore production of 310–320 million tons. In the case of iron ore, Vale's output grew by 4.3% YoY in 2023 to reach 36.5 million tons of pellets—reflecting growth of 13.5% and 4.3%, respectively.

In contrast, iron ore sales decreased 1.5% year–over–year to 256.79 million tons, while pellet exports increased 8.1% to 35.8 million tons. In summary, Vale recorded strong growth in iron ore production and myriad revenues in the first quarter of 2024 despite a drop in net profit due to improved operations and strategic purchases.

Vale Reports 9% Dip in Q1 2024 Net Income Amid Strong Iron Ore Production and Strategic Advancements

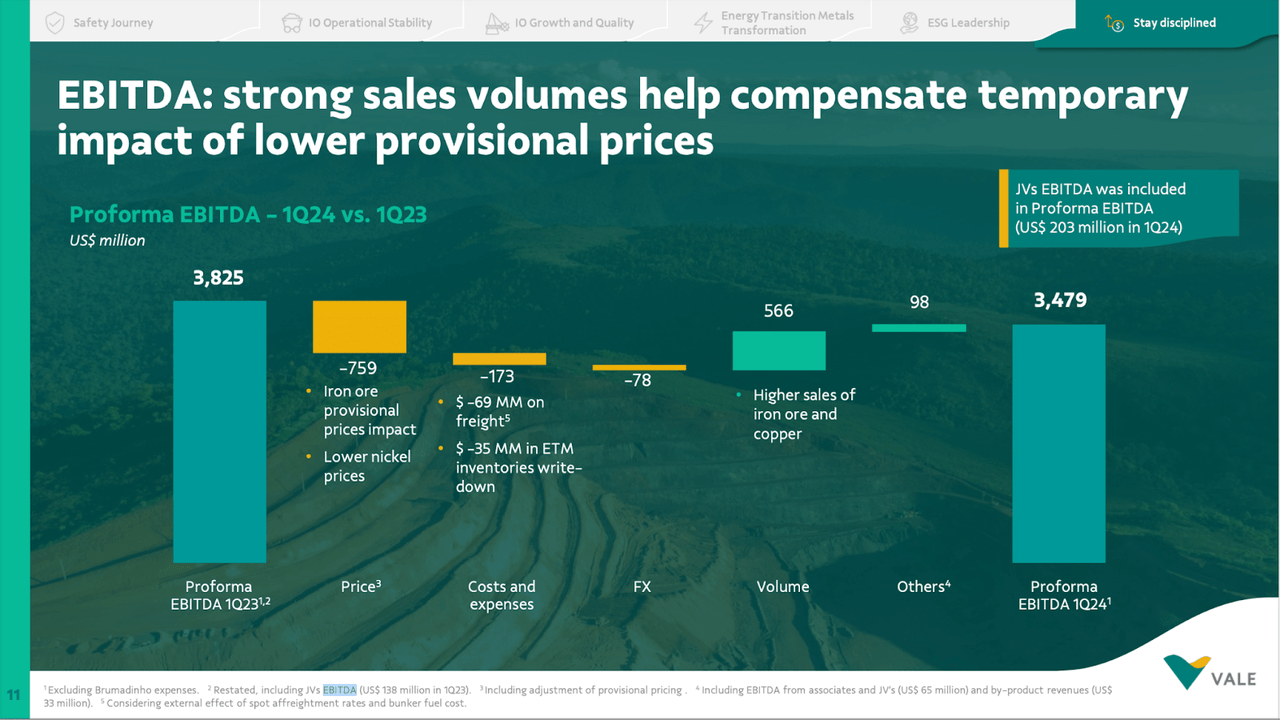

Vale reports 9% Drop in Q1 2024 Net Income Against Strong Iron Ore Production and Strategic Advancements Incorporated; on the financial front, Vale witnessed an ebb of 9% in net income attributable to shareholders, at $1.67 billion, against $1.83 billion registered in Q1 2023. Vale posted net operating revenues of $8.45 billion in the same quarter, charting well against its FY-before figure of $8.43 billion.

Q1 2024 EBITDA came in at $3.48 billion versus $3.82 billion in Q1 2023, while the adjusted EBITDA margin fell to 32% from 44% YoY. Capital expenditure increased 23% to US$1.39 billion in Q1 2024 from US$1.13 billion in Q1 2023. The average prices received for its essential commodities fell: nickel declined by 33%, copper dropped by 18%, and the sales volumes for both metals increased. According to Vale CEO Eduardo Bartolomeo, the company is off to an excellent start in 2024, driven by solid iron ore sales and production during the quarter; Q1 output is the strongest since 2019.

Progress in growth projects, improved performance at the Salobo complex, and ramping up of the Salobo 3 plant contributed to higher copper production and sales volumes. Bartolomeo also praised the Canadian nickel operations and highlighted Vale's success in Brazil, which uses all green power two years in advance.

Finally, despite a fall in net profit and mixed fortunes across various business segments, strong iron ore production at Vale, growth in sales, and progress in strategic projects will probably boost investor confidence. Therefore, if CapEx increases, signaling possible future growth, it may positively affect the share price in the short run.

China's Steel Slump: Implications for Vale

China's steel consumption is projected to decline by 1.7% in 2024, following a 3.3% decrease in 2023. This reduction is attributed to the ongoing real estate crisis and slowing infrastructure demand. Twelve debtor regions have been ordered to halt certain projects, further impacting steel demand. The Metallurgical Industry Planning and Research Institute (MPI) highlights these factors as key drivers of the downturn.

Chinese steel exports surged more than a third last year to their highest since 2016, at 90.26 million tons, despite falling domestic demand. Exports to the US dropped by 8.2%, but this did not impact exports that much; the major export destinations include Japan, South Korea, and the Middle East. Chinese steelmakers are targeting exports equal to last year's shipments, and estimates for 2024 are above 100 million tons.

Producers can increase production even when China demands to maintain or increase market share, since higher production makes companies remain competitive globally. Greater output also brings in economies of scale, which reduce the cost of production per unit and improve profitability. Besides, producers diversify markets to reduce dependence on any particular economy, like China, by entering other growing regions to spread the risk.

The other reason might be strategic stocking; businesses may stockpile the ore given future demand rebounds or commodity prices. This would undoubtedly give them leverage to benefit when the market turns around. There would probably be continued bearish pressure on iron ore prices amid weakened steel demand and growing port inventories in China.

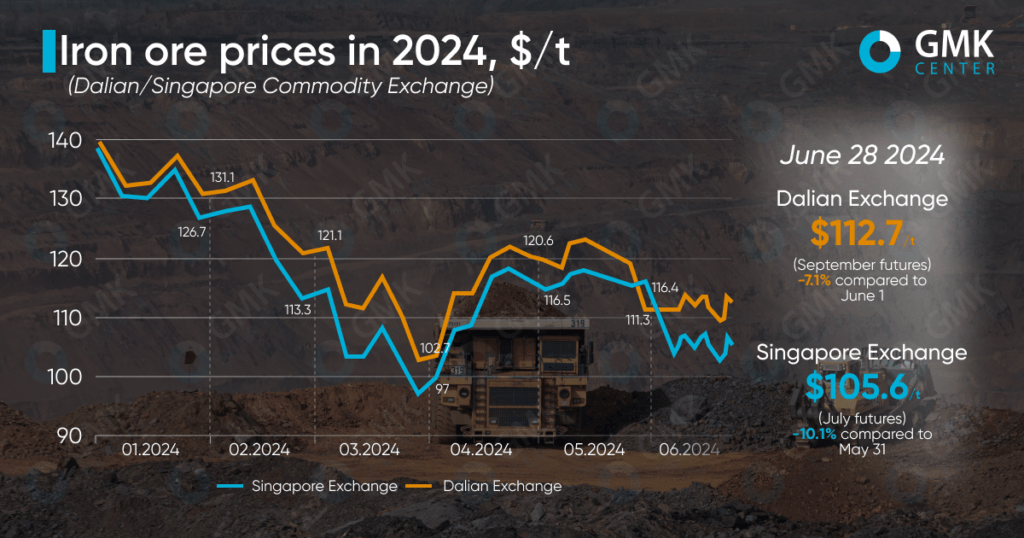

Iron ore futures suffered a massive decline in June, with Dalian falling 7.1% and Singapore falling 10.1%. Although the Chinese government's stimulus to the real estate market temporarily boosted prices, this failed to hold up prices. Seasonal drops in steel demand, poor construction weather, and probable controls on steel production in China are putting more stress on the market.

Finally, long-term forecasts remain gloomy despite some economic improvements and slight price increases at the end of June. HSBC says that, together with Capital Economics, it is projecting around $100/t in 2024—possibly further declines to $85/t at the end of the year—based on an oversupply and weak global steel demand environment.

Additionally, trade disputes are escalating, with 112 applications for anti-dumping and anti-subsidy measures against Chinese steel products in 2023. Further, Beijing may impose production restrictions, adding uncertainty to export prospects. The China Iron and Steel Association ("CISA") emphasizes the need for leading producers to align production with market demand to address the contradiction of strong supply potential and declining demand.

China, accounting for over half of Vale's revenue, significantly impacts the company's financial health through its steel demand. With China's steel consumption expected to drop, Vale faces reduced iron ore demand and lower prices, affecting its revenue and profitability. Despite increased iron ore and pellet production in Q1 2024, the decline in average realized prices and quarterly production poses challenges.

Despite recent stock volatility due to fluctuating iron ore prices and reduced Chinese demand, Vale maintains strong operational performance and strategic investments in nickel and copper. These investments are crucial for the growing EV market and help buffer the company against iron ore price shifts.

Further, Vale's commitment to ESG initiatives enhances its market position and appeals to socially responsible investors. With a promising start to 2024, Vale's increased iron ore and pellet production and revenue growth indicate robust fundamentals.

Lastly, the strategic partnerships, like the one with Caterpillar for decarbonization efforts, further bolster Vale's long-term growth potential. Given the lower valuation, Vale presents an attractive entry point for investors seeking to capture future upside potential amidst a recovering Chinese economy and ongoing global demand for cleaner energy solutions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About vale stock.

| Symbol | Last Price | % Chg |

|---|

More on VALE

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| VALE | - | - |

Trending Analysis

Trending news.

LIVE UPDATES

Stock Market News: Dow Gains

The s&p 500 and nasdaq were higher..

Last Updated:

7 hours ago

Chewy's Trading Could Become Divorced From Fundamentals

Denny Jacob, Dow Jones Newswires

(Michael Nagle/Bloomberg)

An expected fundamental recovery by Chewy later this year is at risk of being overshadowed by Keith Gill's stake, analysts at William Blair say in a research note.

The analysts believe the online pet retailer's 1Q results was thesis-affirming in that it showed a shift in focus away from active customers toward free cash flow, among other efforts.

Gill, the influential retail trader known by his online moniker "Roaring Kitty," disclosed a 6.6% stake in Chewy. The analysts note that they agree with Gill interest in the company, adding that Chewy remains their top pick.

But Gill's presence is sure to bring out speculative activity in the same spirit of GameStop and AMC Entertainment.

"It is worth planning for the potential of the stock to get divorced from fundamentals," the analysts say.

Chewy Inc. Cl A

CHWY (U.S.: NYSE)

GameStop Corp. Cl A

GME (U.S.: NYSE)

AMC Entertainment Holdings Inc. Cl A

AMC (U.S.: NYSE)

Advertisement - Scroll to Continue

- Cryptocurrencies

- Stock Picks

- Barron's Live

- Barron's Stock Screen

- Personal Finance

- Advisor Directory

Memberships

- Subscribe to Barron's

- Saved Articles

- Newsletters

- Video Center

Customer Service

- Customer Center

- The Wall Street Journal

- MarketWatch

- Investor's Business Daily

- Mansion Global

- Financial News London

For Business

- Corporate Subscriptions

For Education

- Investing in Education

For Advertisers

- Press & Media Inquiries

- Advertising

- Subscriber Benefits

- Manage Notifications

- Manage Alerts

About Barron's

- Live Events

IMAGES

VIDEO

COMMENTS

72%. Index price prediction 6 months - The baseline metrics for predicting the. 500) with six months of data showed good resultswith both Logistic R. gression (71% accuracy) and SVM (99.5% accuracy). In the case of stock prediction, high precisi. tock price correctly using BERT sentiment result.

Machine Learning for Financial Market Forecasting. Master's thesis, Harvard University Division of Continuing Education. Abstract Stock market forecasting continues to be an active area of research. In recent years machine learning algorithms have been applied to achieve better predictions. Using natural language processing (NLP), contextual ...

ABSTRACT. STOCK MARKET PREDICTIONS USING MACHINE LEARNING. In this thesis, an attempt is made to try and establish the impact of news articles and correlated. stocks on any one stock. Stock prices are dependent on many factors, some of which are common. for most stocks, and some are specific to a type of company.

stock market prediction is further facilitated by the availability of large-scale historic stock market information. As such information, e.g. on stock prices and volumes of stock trades, takes the form of time series, classical approaches to time series analysis are currently widespread within the investment industry (Clarke et al., 2001). This

A Comprehensive Review of Machine Learning Methods in Stock Market by Magdalena Spinu A thesis in partial fulfilment of the requirements for the degree of Master of Science (Information Systems and Technology) in the University of Michigan-Dearborn 2022 Master's Thesis Committee Assistant Professor Jin Lu, Chair

Masters Thesis Stock market prediction using machine learning. Stock market trading has gained popularity in today's world with the advancement in technology and social media. With the help of today's technology we can aim to predict the stock market for the future value of stocks. To make informed predictions, time series analysis is used by ...

MASTER THESIS "Analysis of the reaction patterns observed in the Dutch stock market, in response to shocks caused by the financial crisis" Erasmus School of Economics Department: Economics & Business Specialization: Financial Economics Name: Soultana Pitaraki Student number: 368550 Supervisor: Tong Wang

3.1 Predicting stock market declines. Predicting stock market declines and movements all together has long been a focal point of financial research and has inspired the development of various theories and models. This Chapter reviews the existing literature on methods and indicators used to predict market downturns.

This thesis focuses on two fields of machine learning in quantitative trading. The first field uses machine learning to forecast financial time series (Chapters 2 and 3), and then builds a ... prediction can be realized in a real stock market. Chapter 3 focuses on the application of Artificial Neural Networks (ANNs) in forecasting

Masters Thesis Stock Market Prediction Using Machine Learning and Deep Learning. Over the last century, the stock market has had several notable growths and declines. ... Prediction and analysis of financial markets, such as Stock Market prediction, have always been challenging for investors worldwide due to the non-linear nature of financial ...

Stock Market Prediction Through Sentiment Analysis of Social-Media and Financial Stock Data Using Machine Learning By Mohammad Al Ridhawi Thesis Submitted to the University of Ottawa in partial fulfillment of the requirements for the Master of Science in Data Transformation and Innovation School of Electrical Engineering and Computer Science

adequate stock selection criteria for these two paradigms, the thesis starts with a thorough explanation of the theory of financial markets. The classic financial market theory assumes a high degree of efficiency in the stock market. The EMH assumes that investors behavior on an aggregated level is rational and therefore leads to correct ...

Based on the GARCH-type models, the empirical results show that volatility of stock returns. stics of volatility clustering, leptoku. tic distribution and leverage effects overtime for. all the Africa equity markets. A weak relationship between volat. returns is also found in all the African equity markets studied.

Thesis (Mainly master thesis) Please be aware, ... Stock Market Prediction With Long Short-Term Memory Recurrent Neural Networks (BSc, A. Elizabeth Sanyal) Robust Portfolio Optimization with Deep learning - Using past Forecast Errors to Improve Return Predictions (MSc, A. Markus Wabnig, best Master in Finance 2022) ...

LIANG, YUZHUN, "STOCK MARKET FORECASTING BASED ON ARTIFICIAL INTELLIGENCE TECHNOLOGY" (2021). Electronic Theses, Projects, and Dissertations. 1324. https://scholarworks.lib.csusb.edu/etd/1324. This Thesis is brought to you for free and open access by the Ofice of Graduate Studies at CSUSB ScholarWorks.

The up/down classification predictions in this thesis achieved an accuracy of 70.3%. While this is a major improvement from the baseline of 50.1%, it is a significant difference compared to Bollen et al. (2011) that achieved 86.7%. The data gathered in the study is approximated to be roughly 9 850 000 tweets.

New York Stock Exchange (NYSE), between 2009 and 2021. The key findings of this thesis reveal that, on average, US technology IPOs were underpriced by 27.5 percent during the global post-financial crisis era. Determinants that are traditionally believed to influence underpricing, such as the average market returns, market volatility, and

This thesis consists of four self-contained papers related to the change of market structure and the quality of equity market. In Paper [I] we found, by using of a Flexible Dynamic Component Correlations (FDCC) model, that the creation of a common cross-border stock trading platform has increased the long-run trends in conditional correlations between foreign and domestic stock market returns.

The topics range from the stock market, banking, and risk management to healthcare finance topics. This dissertation provides the student with a degree of academic self-confidence and personal satisfaction in the finance field. Finance writing requires extensive research to create a persuasive paper in the end.

If you're just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you've come to the right place. ... and the subsequent performance of these IPOs in the stock market. A comparative analysis of different risk management strategies employed by investment banks;

Awarded research focuses on the Swedish Stock Market . The winner master's thesis examined whether the tick size regime on systematic internalisers (SIs) during 2020 alters the market composition of trading venues and impacts the market quality at Nasdaq Stockholm. The students leveraged from the Swedish House of Finance's National Data ...

Master Thesis Stock Market - Free download as PDF File (.pdf), Text File (.txt) or read online for free. Scribd is the world's largest social reading and publishing site.

Vale's investments in nickel and copper for the EV market, coupled with early signs of Chinese economic recovery. Find out more on VALE stock here.

The analysts believe the online pet retailer's 1Q results was thesis-affirming in that it showed a shift in focus away from active customers toward free cash flow, among other efforts.